One story to push prices higher; Now a number of stories to bring them back down

May 11, 2023

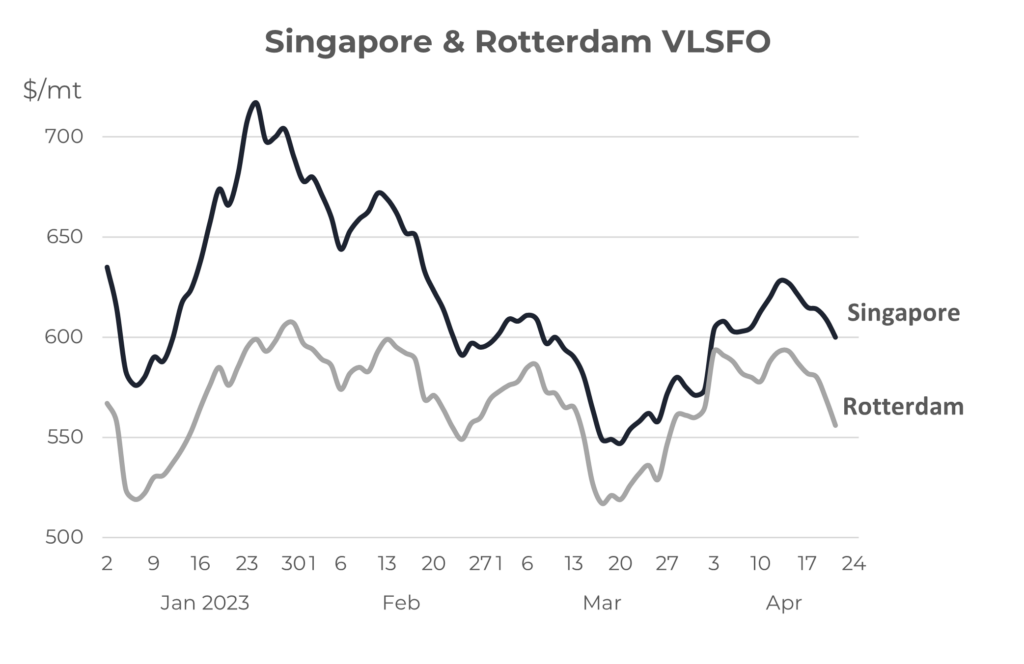

This time last month we wrote about the experts’ view that although prices had been falling for two months, their underlying outlook was still largely bullish. They were right, but perhaps for the wrong reasons; VLSFO was up around $75/mt (15%) over the last week of March and in to the first two weeks of April.

Source: Integr8 Fuels

OPEC+ cutbacks drove prices higher; not increases in oil demand

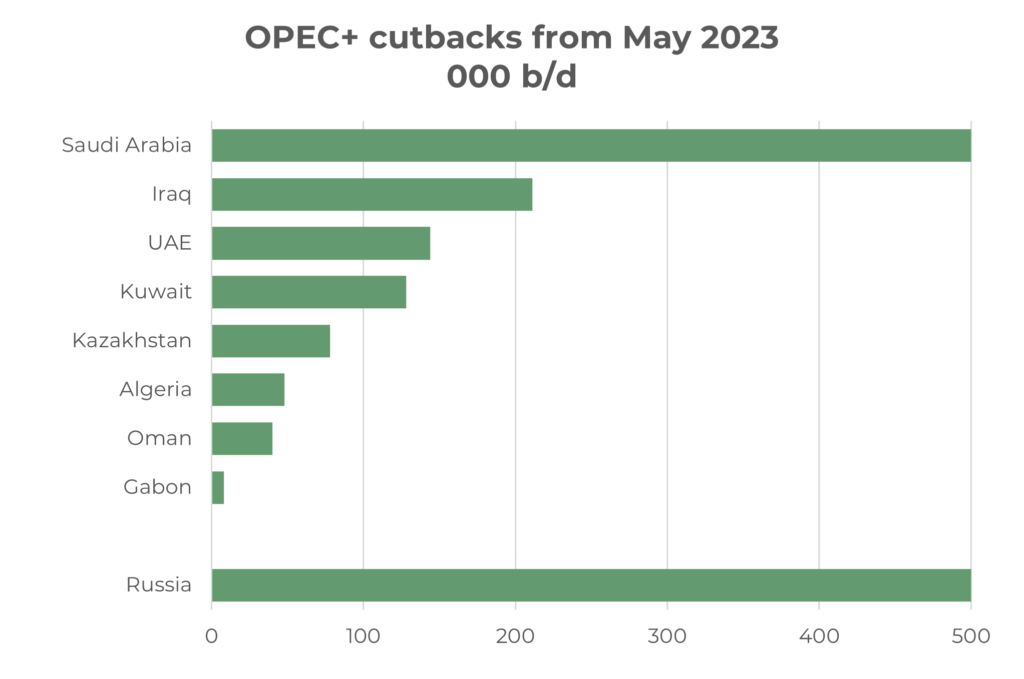

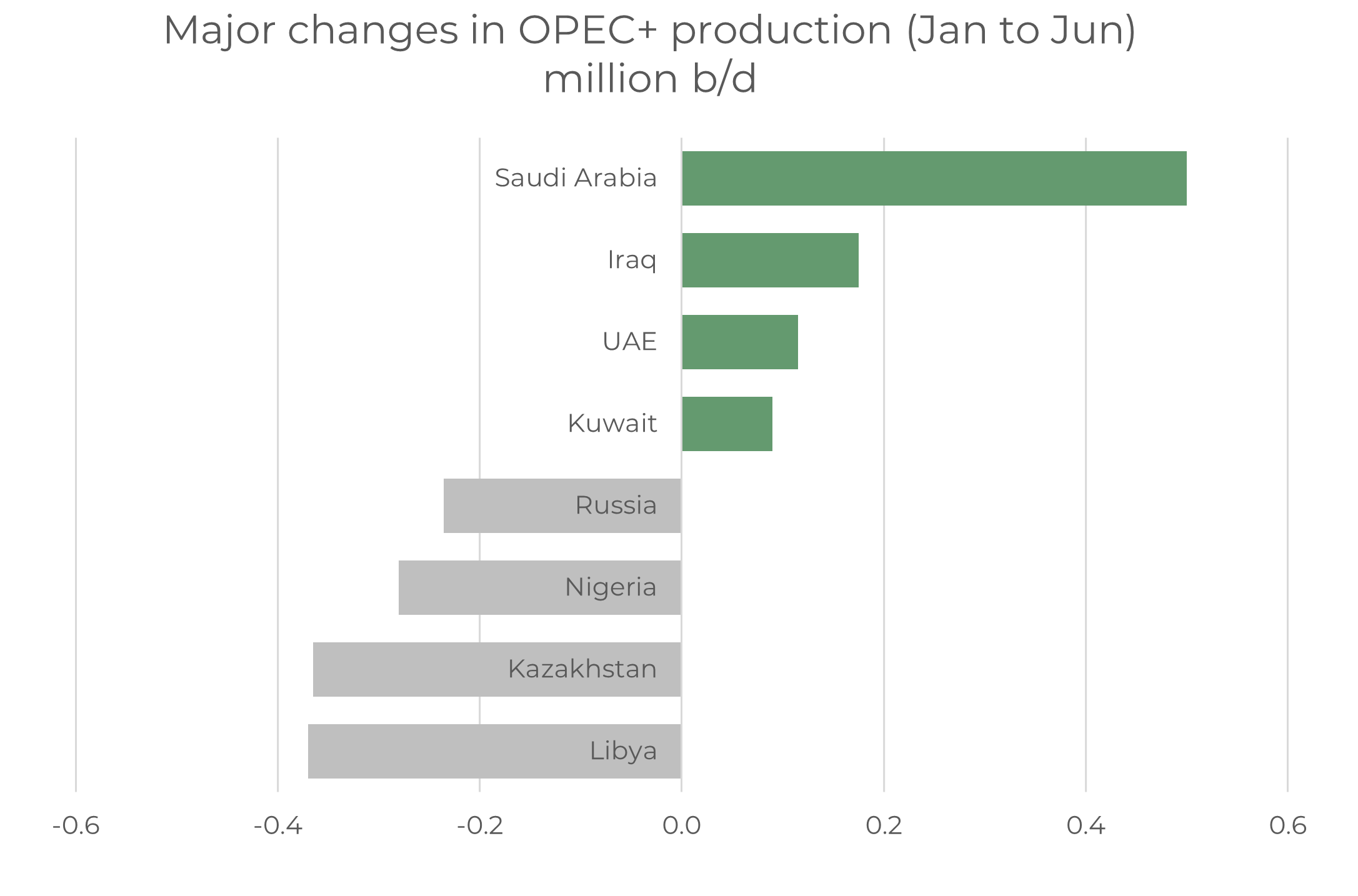

Expectations of prices moving higher have generally been based on forecasts of stronger economic activity in China and some other Asian countries, with this pulling up global oil demand. However, the main trigger to the recent price hike was the “precautionary measure” taken by some of the OPEC+ members, to make voluntary cuts in oil production amounting to 1.2 million b/d.

Source: Integr8 Fuels

This is on top of an announcement by Russia to cut its production by 0.5 million b/d. The impact of Russian statements like this are always questioned and more importantly, what does it mean for exports. If they maintain exports for revenue and cut supplies to domestic markets, it makes no difference at all to the oil balance and price projections.

When prices have been ‘under threat’ OPEC has often made cuts

It is definitely worth understanding OPEC strategy, as this can have a major impact on prices, and there could well be increasing pressures on them to cut output again. One of key issues for the enlarged OPEC+ group is that production in many countries is already below their announced quota levels. This means that any agreed cutbacks by these members is meaningless in terms of impact on oil supplies. As with the latest announcement, it does therefore fall to the ‘big’ Middle East producers to set strategy and shifts in production, and of these Saudi Arabia is the principal player.

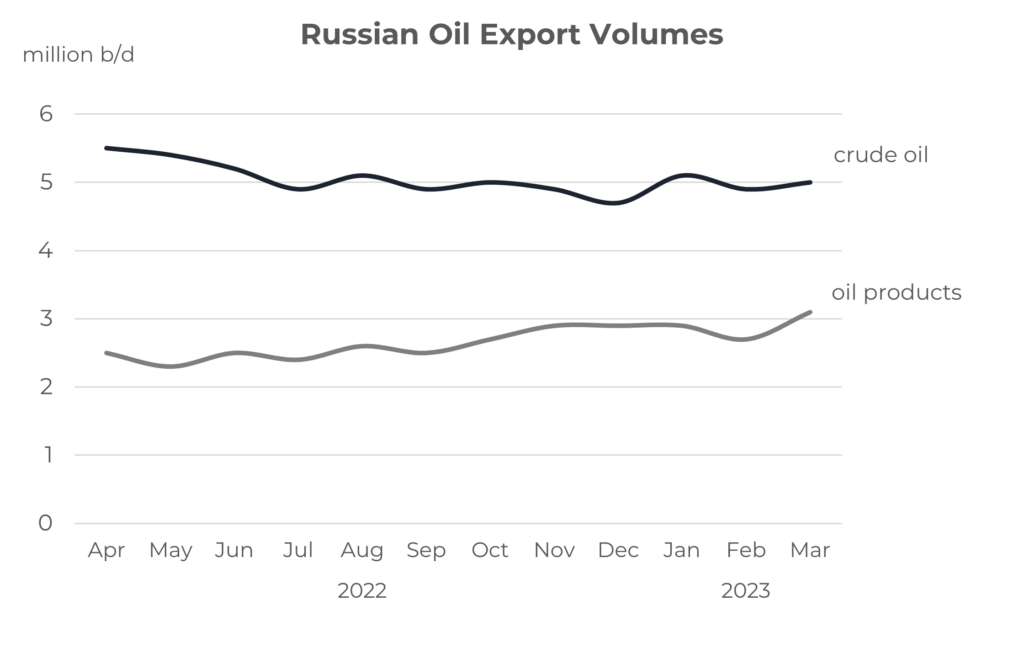

Russian exports stay the same; just going to different places

The dilemma for these Middle East producers is illustrated in the following two graphs. On the face of it, the first doesn’t appear to be very interesting, with two near straight lines. But what this does show is perhaps surprising, in that Russian crude exports have been maintained at around 5 million b/d throughout the past year. This is even with the political fallout from the war, and after the December 2022 EU ban on crude imports and the G7 imposed $60/bbl price cap on crude exports.

Source: Integr8 Fuels

On the products side, Russian export volumes are higher than a year ago.

Russia needs oil revenues

There is no doubt that Russian oil export revenues are down sharply since the start of the war, but perversely, oil revenues were boosted because of the war and the resulting surge in oil prices.

Today, maintaining oil export volumes (even under the G7 price cap), is still a way of Russia generating significant national revenue. To put this in context, Russian oil revenues were estimated at around $12 billion in March; this compares with average monthly revenues of around $15 billion in 2021. Perhaps not that big a fall in light of the political squeeze being imposed on Russia.

The challenge for the Middle East

The dilemma for the Middle East oil producers has been that Russia has been able to maintain oil export volumes, but has lost their biggest market outlet of Europe; down by 2.7 million b/d, from 3.5 million b/d in April 2022 to only 0.8 million b/d in March 2023. This has meant a swing of some 2-3 million b/d of Russian oil from Atlantic markets to Asian markets.

The known big gain has been in exports to India, which are up by 1 million b/d, but a lot of the 2 million b/d increase in other and unknown destinations is believed to be in the East.

Source: Integr8 Fuels

Middle East oil producers have responded

So, now there is a huge challenge for Middle East producers, and Saudi in particular. There has been the push from West to East on Russian crude sales and at the same time the G7 price cap has meant fob price discounts of $35-40/bbl on Urals sales to these Asian customers. Unfortunately, it’s not an easy, straight swap for Middle East exporters to fill to gap in Europe left by the loss of Russian crude, as the European refining sector is not as capable of running so much heavy and high sulphur crudes. Put simply, for the Middle East OPEC countries it is either discount to compete in Asia or cut production to defend prices. They are unlikely to compete; at the end of the day, it is all about national revenues and these are much better defended by supporting prices though ‘limited’ production cutbacks rather than aggressive pricing to maintain production.

For every action there is a reaction

The war in Ukraine has triggered EU and US embargoes on Russian oil imports. Russia has sought to maintain oil exports to generate revenues and the only way to do this has been to sell more oil to Asian customers and at discounted prices. The war in Ukraine has triggered EU and US embargoes on Russian oil imports. Russia has sought to maintain oil exports to generate revenues and the only way to do this has been to sell more oil to Asian customers and at discounted prices. Middle East producers have felt the ramifications of increased competition in Asian markets and also looked to support prices by cutting production. Higher oil prices are likely to add to global inflationary pressures and higher inflation is then likely to create a government/central bank response by raising interest rates. This can then dent future oil demand growth and potentially put a more bearish sentiment on oil prices.

As always, the impact of an action or story only tends to lasts for so long, and then another story comes along. The announcement of cuts in OPEC+ production pushed prices higher for almost two weeks. But now the news stories are more on the bearish side. Current product markets are generally well supplied and refinery margins are typically falling (apart from Asian jet fuel). Economic forecasts continue to be revised downwards, with the IMF recently lowering their outlook for growth and with it, their outlook for oil prices. So, after the $7/bbl hike in Brent front month futures following the announced OPEC+ production cuts, prices have now fallen back by around $6/bbl and close to their earlier levels.

Sitting on the fence?

People are still talking about a tighter fundamental market in the second half of this year, but this is based on growth in the Chinese and Asian markets. For now, the sentiment and stories definitely feel more to the bearish side of things.

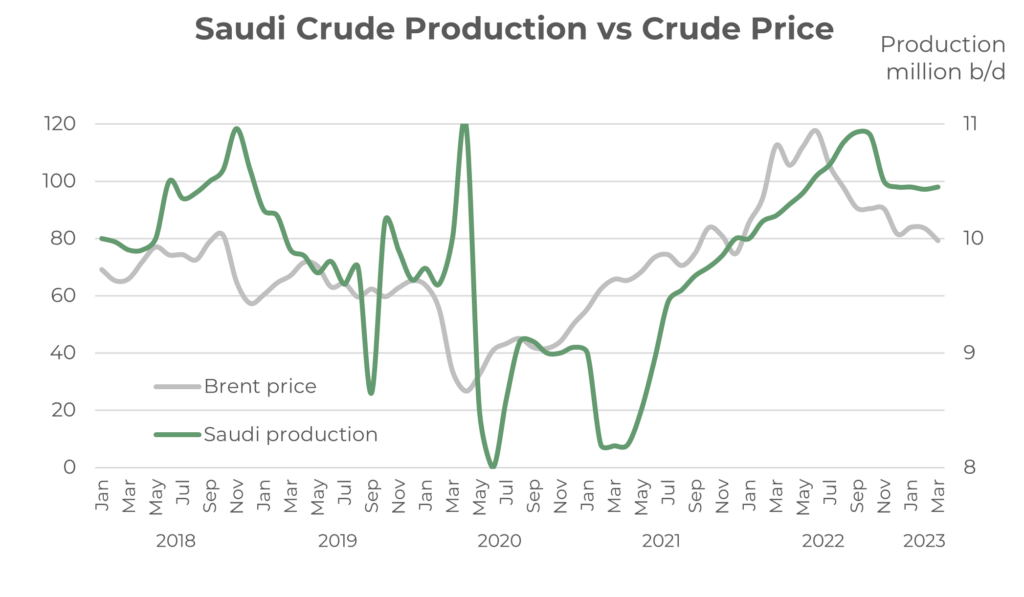

In terms of managing oil supply in the short term, Saudi Arabia is the main player. As shown in the graph below, they have been prepared to cut production when prices are ‘low’, and of course around the time of covid shutdowns. Before this, when Brent prices fell to around $60/bbl (which is equivalent to around $475/mt for Singapore VLSFO), Saudi cut output to as low as 9.5 million b/d; they are currently moving from a 10.5 to 10.0 million b/d target. On this basis Saudi Arabia could make further cuts to those already announced.

Source: Integr8 Fuels

Hence, understanding and watching OPEC+ (and Saudi Arabia in particular) is an important part of our market. We have to see if they are prepared to cut production again if expectations of economic growth fail and Brent prices fall towards $60/bbl.

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Bunker prices: Let’s listen to what experts have to say

March 28, 2023

Don’t trust the experts?

In these more macro reports, we tend to look at oil industry fundamentals and try to get a steer on where bunker prices are going. There is no doubt that over the past few months the industry has generally reflected a more bullish outlook for prices. BUT prices have fallen!

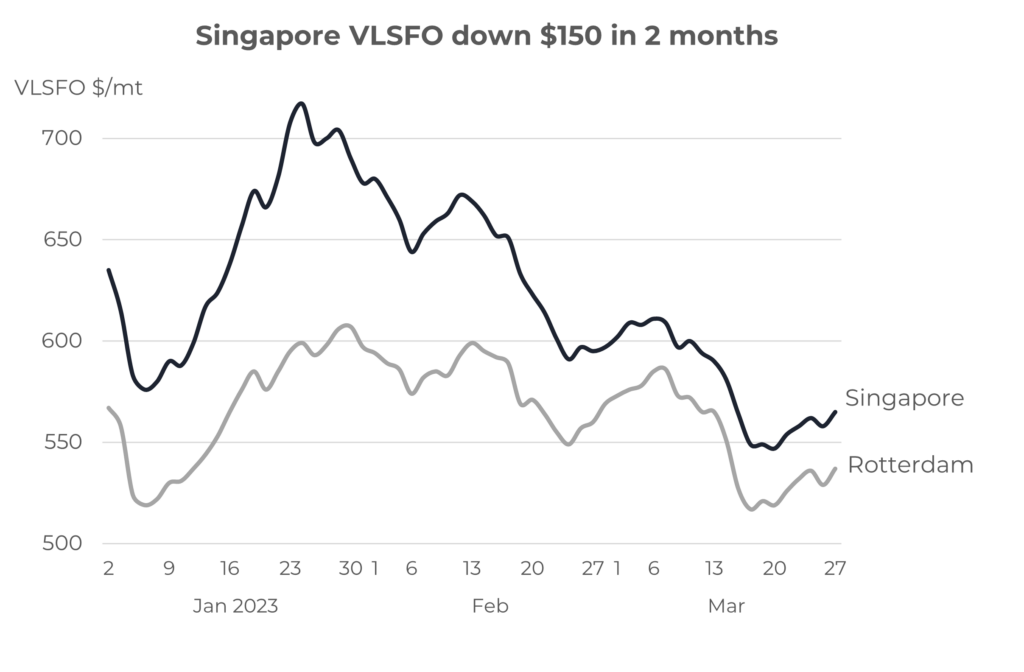

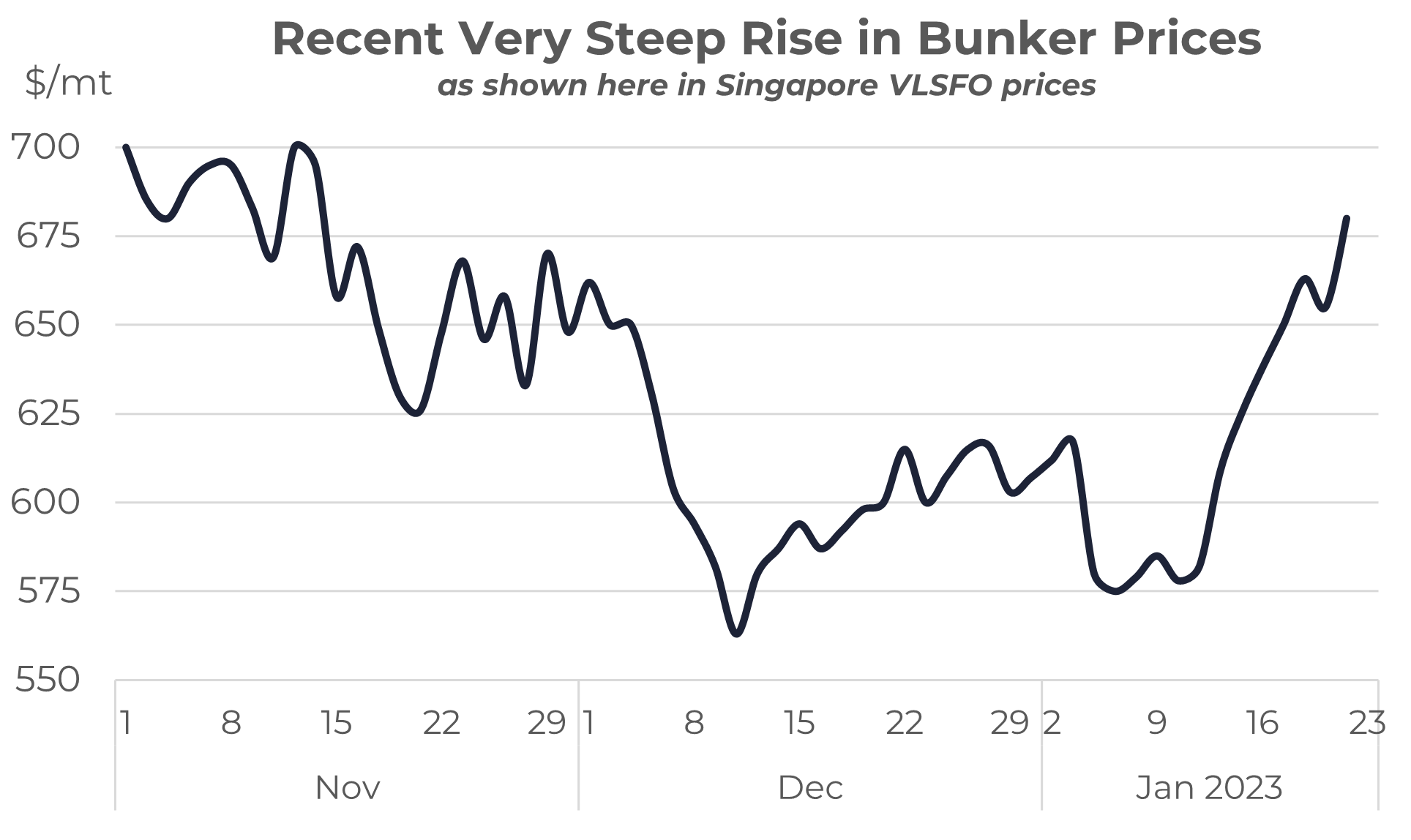

In February there were signs of short-term weakness in Asian and European oil markets and this led prices down. In March prices have fallen again. So, there has generally been a bullish view of pricing and yet Singapore VLSFO price are down by almost $150/mt (minus 20%)!

Source: Integr8 Fuels

One outcome of this is maybe, ‘don’t trust the experts, what do they know?’. This is certainly an approach some politicians have adopted in recent years! Another view is that we are in a market where not only do fundamentals count, but ‘unforecastable’ global events, politics and psychology play major roles (as an analyst, I’m going for this view!).

A lot of (non-oil) people influence bunker prices

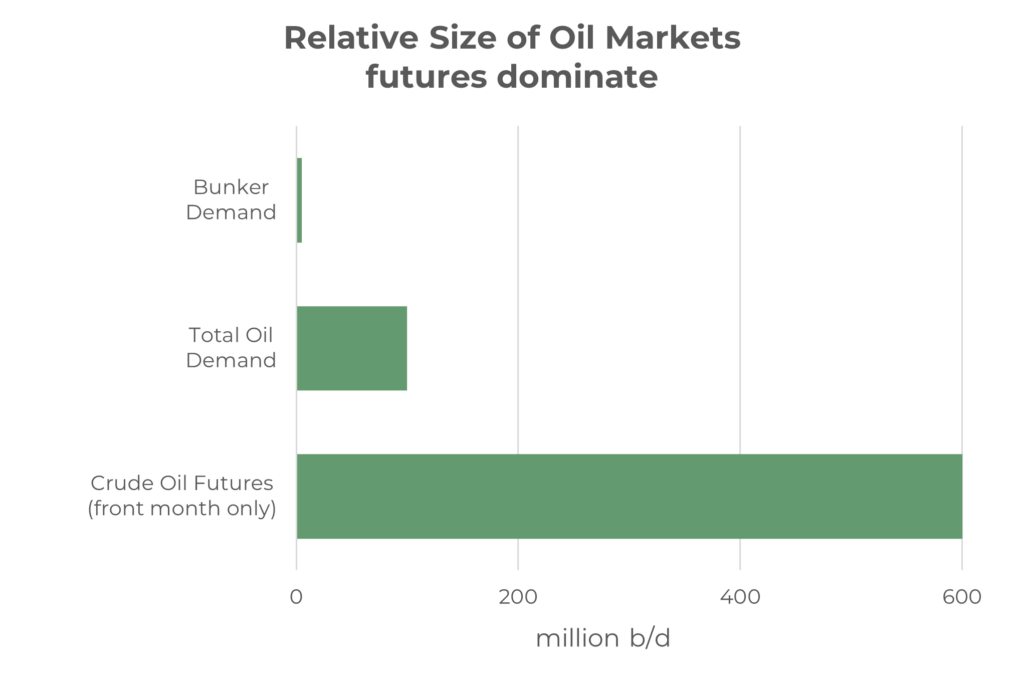

In the bunker market, our prices are driven by crude oil, and this is freely, easily and widely traded in international futures markets; they set our benchmarks.

To put this in perspective, the size of the bunker market is around 5 million b/d, the total oil market is around 100 million b/d, and the average combined size of the two main crude futures markets is estimated at around 600 million b/d on front month contracts alone (this excludes trades on outer months and options etc).

Source: Integr8 Fuels

At times of a global shock, crude futures trading can easily double. So, when anything happens in the world it can have an instant impact on crude futures prices, which in turn means an immediate hit on the prices we pay for bunkers.

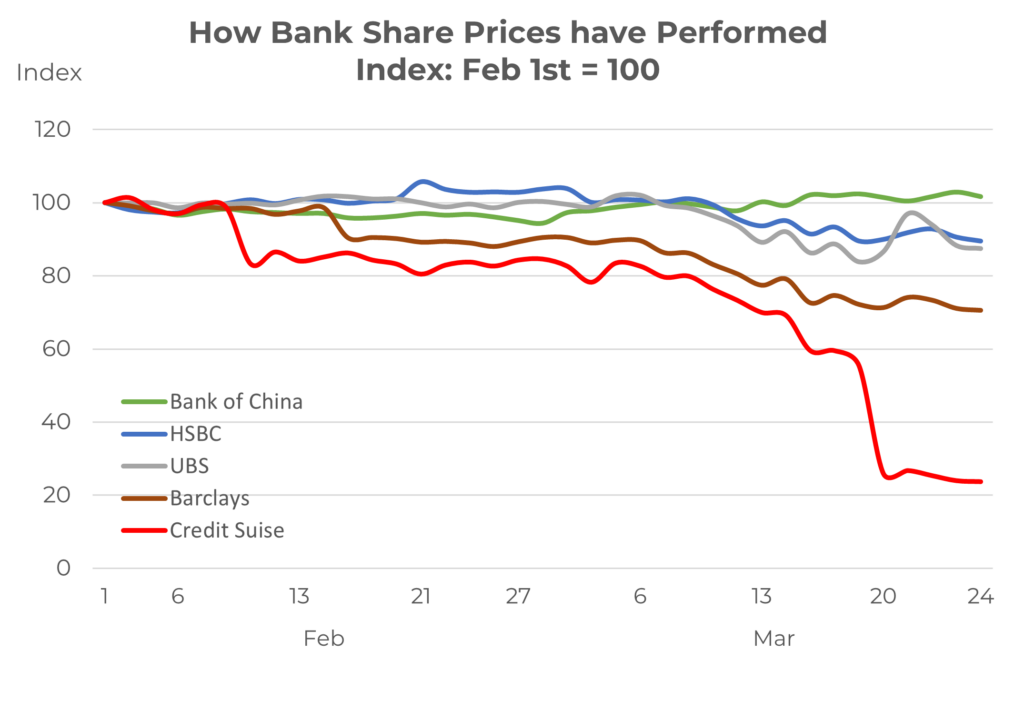

A crisis in confidence in the banking sector means lower bunker prices

Source: Integr8 Fuels

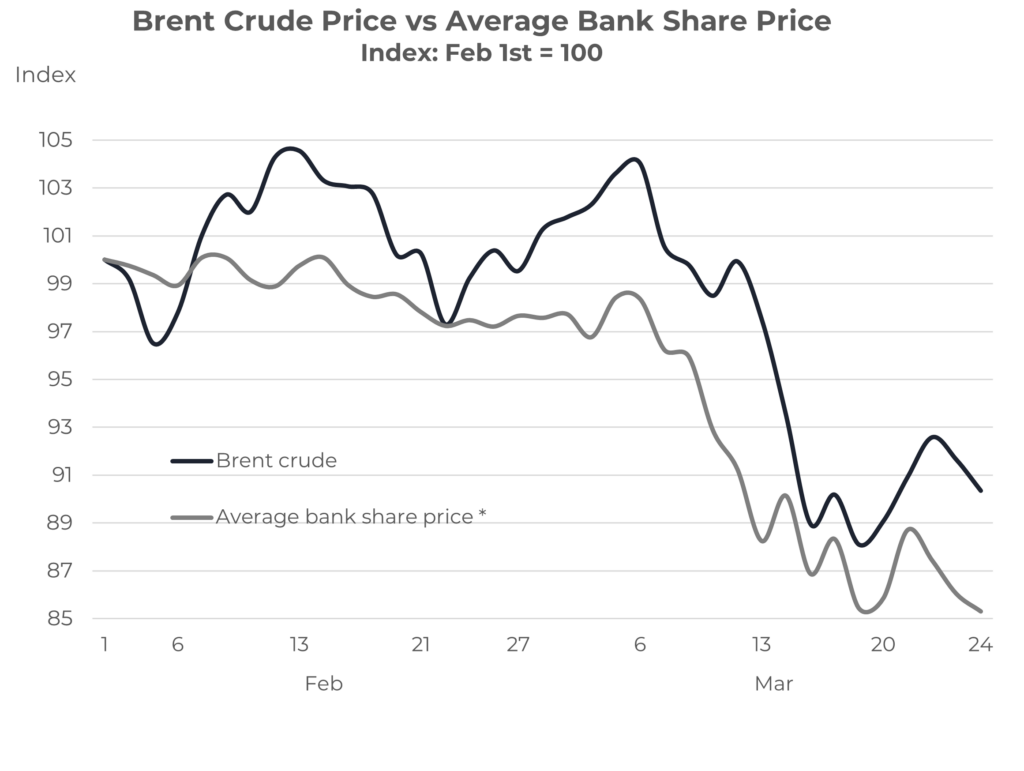

These developments clearly put a focus on other banking institutions from around the 9th March onwards. Looking at eight major international banks (excluding Credit Suisse), the average share price fell by around 10% between the 10th and 20th March. There is a 1-2 day lag in oil prices, but the banking woes clearly hit crude prices on the futures markets over this period.

Source: Integr8 Fuels

From these share price movements, it is clear the banking community (and so also us) are ‘not out of the woods’ yet, although oil prices have bounced back from their lows.

What are the expects saying now?

So, we have seen short-term weakness in the oil markets in February, and a crisis of confidence in the banking sector in March. These overtook the bullish views that were in the oil markets at the start of the year. But what are the expects saying now?

Well, those bullish economic pointers of China and Asia, plus constraints on OPEC+ production still remain and are being talked about.

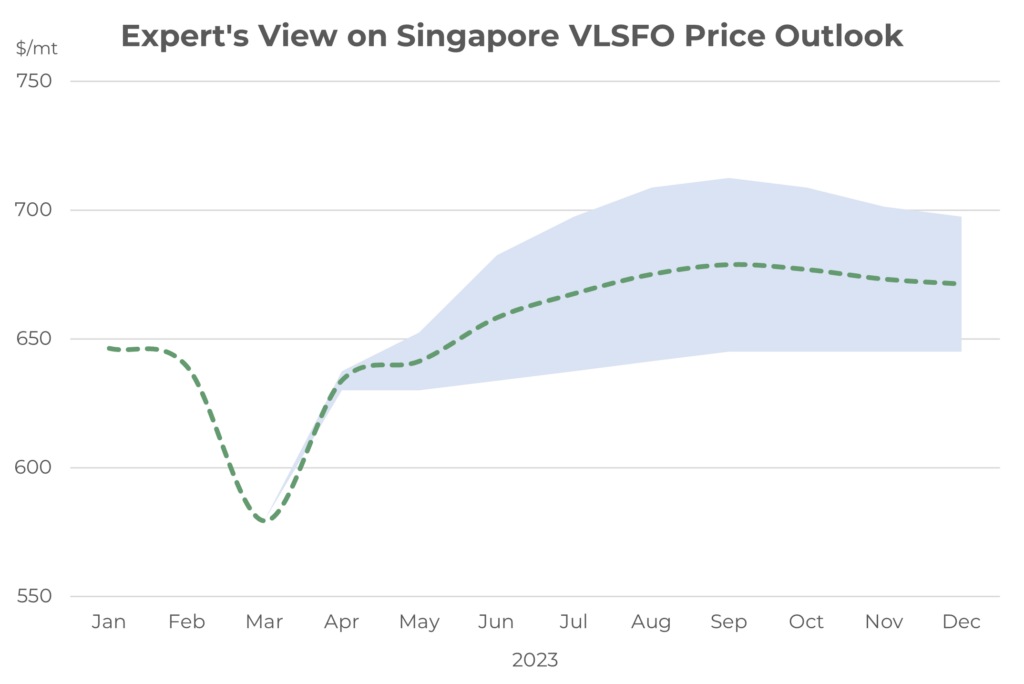

Perhaps the first signal has come from the FT Commodities Global Summit, taking place just last week in Switzerland. As a broad outcome from this, crude oil prices are forecast to hit somewhere between $80-140/bbl this year; this would imply Singapore VLSFO reaching a point between $600-1,000/mt over the next 9 months

I can hear the comments now: “These experts have a very, very wide range of price views.”; “What use is forecast with a $400/mt range?”; “They have already got it wrong so far this year!”.

There will be a lot more views than these three, and some may be unprintable. But it’s worth listening to what they say, as long as we know the reasoning behind their views.

Firstly, the consensus is that prices will rise from current levels. The experts are coming back to their fundamental views and these are generally bullish. The main one here is probably China and their expectations that domestic demand is already on the rise and this is enough to tighten global supply & demand balances. Indications from the big trading companies are that Chinese road and air travel are already back to, or above 2019 levels, and this can only fuel these more bullish views.

It’s human nature to find supporting evidence to reinforce views, and here the bolt-on arguments are:

- A rise of oil demand in Asian economies;

- No signs of the OPEC+ group (particularly Saudi Arabia) raising production against higher levels of demand;

- US oil production cannot increase rapidly or by enough to take the sting out of the market.

These are generally the same market fundamentals that the experts talked about in January and February, and these still form their basis for prices hitting higher levels this year; it’s just that some curved balls have intervened in

the meantime.

The bottom line: What does this mean for bunker prices?

Although the headline news on forecasts show such a wide range, most commentators are gravitating towards Brent prices in the $90-95/bbl range for this year. Also, the recent trend is for most analysts to revise down their forecasts by around $5-7/bbl, including Goldman Sachs and Barclays. This means Goldman Sachs is now at $85/bbl for Brent this year, which is not that much higher than end March prices and very close to what we saw in January and February.

Taking these latest, indicative views from the experts implies Singapore VLSFO prices moving back up to around $650/mt and trading in the $650-700/mt range for the rest of the year; Not as concerning as headline news of $140/bbl Brent and $1,000/mt VLSFO.

Source: Integr8 Fuels

Where are the next ‘curved balls’ to prove the experts wrong?

The pandemic, the war in Ukraine and the uncertainty in the banking arena are just three recent events that were largely unforecastable; the first pushing prices significantly lower, the next pushing prices higher and the last taking around $50/mt off the Singapore VLSFO price.

Current hot topics involve the politics between China, Russia and the US and these always have the potential to change prices drastically. Also, any outcome in the war in Ukraine will shift oil prices. However, at this stage the biggest risks to the experts’ views come from recession or another economic crisis, which seem closer now than for many years; if it happens, oil demand will be hit and prices will definitely fall.

One other potential curved ball that has just come into view is China potentially brokering a deal to re-establish diplomatic ties between Saudi Arabia and Iran. The process is underway and the first phase is to reopen embassies in each other’s country within the next two months. Upcoming diplomatic talks are planned and there are even (unconfirmed) suggestions of the Iranian President going to Saudi Arabia to meet the King at some stage.

Obviously, it is unclear how far things will go, but in the first instance, any resolution between the two counties is more likely to lead to lower oil prices, rather than higher. However, that then leaves the political fallout from the situation and China brokering such a deal; where does this leave the US and how would they respond?

There are a lot of unknows here, and any oil expert looking at forecasting oil prices is not going to be able to factor-in these into any price forecast they make.

So, for us looking at bunker prices, let’s take a steer from the experts, make sure we know why they are saying what they are saying, and keep an open mind to world events and what these may do to prices in our market. Easy…..

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Sentiment and prices have shifted into reverse; Will it last?

February 22, 2023

Singapore VLSFO up in January and back down in February!

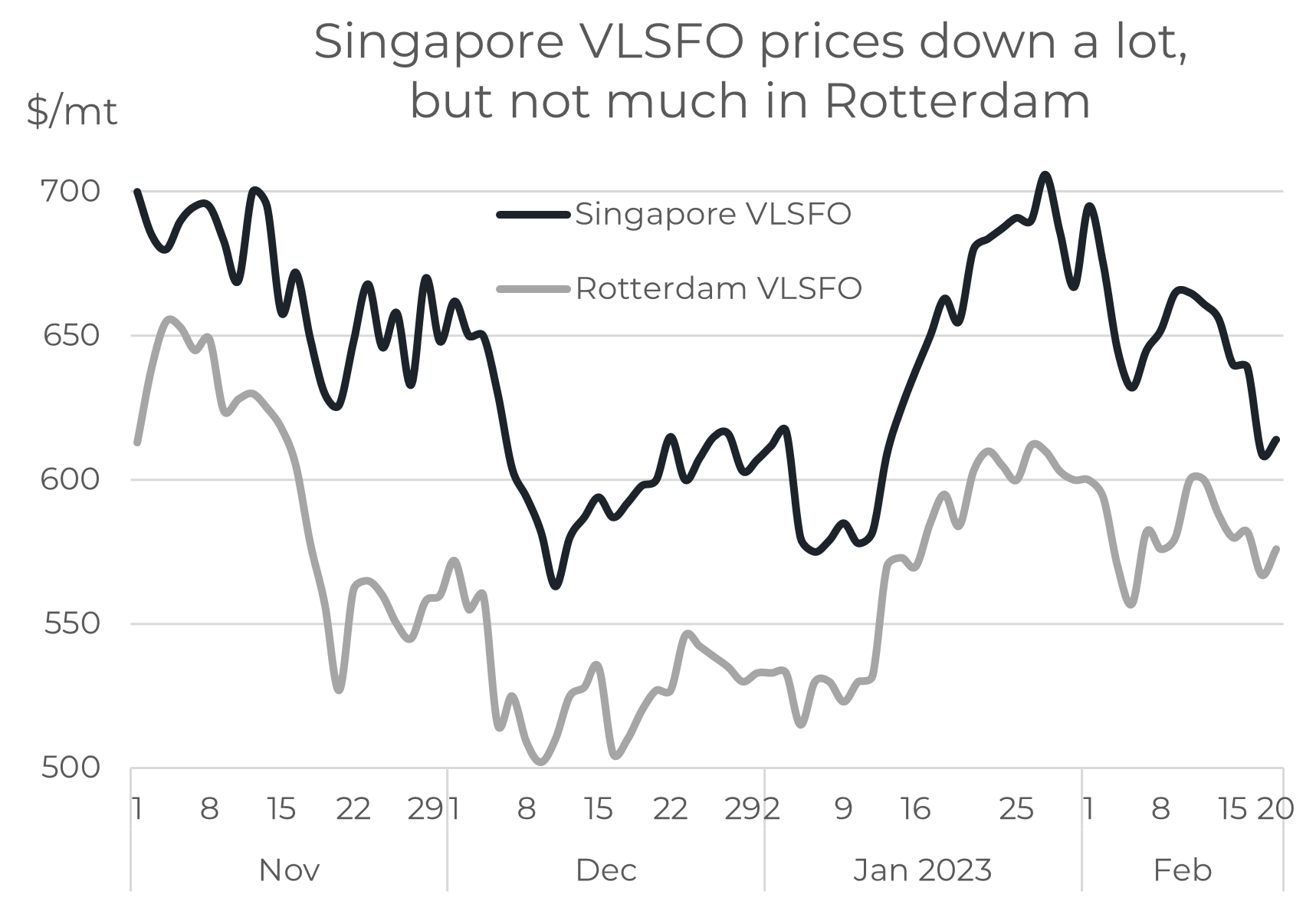

It’s clear that sentiment and price direction can change ‘in the blink of an eye’, and that’s what’s happened this month. Singapore VLSFO prices rose by some $130/mt in January; so far in February they are back down by around $100/mt. It means Singapore VLSFO is not much higher than at the start of the year.

Source: Integr8 Fuels

VLSFO price movements in Rotterdam have been less volatile than in Singapore, and unlike Singapore, prices have remained much higher than in early January. This is mainly down to Europe’s close proximity to the war in Ukraine and the EU bans on Russian oil imports.

Why the change in sentiment?

Throughout January, markets were increasingly bullish on the back of:

- Stronger economic and demand prospects in China and other Asian economies;

- The start of the EU ban on Russian product imports from 5th February;

- a potential tightness in the oil market over the second half of this year.

However, at the start of February there was a much shorter-term focus on what was a weakening market structure. Asian markets were not as tight as expected, partly as more diesel exports came from China.

The European market was also not as tight as expected, with a surge in Russian product imports ahead of the EU ban and substantial long-haul distillate imports coming in to replace the lack of future Russian products. The EU ban on Russian products is seen as shifting trade patterns to longer haul destinations in the East, rather than a total loss of the Russian export market (similar to what has happened with the EU ban on Russian crude starting last year).

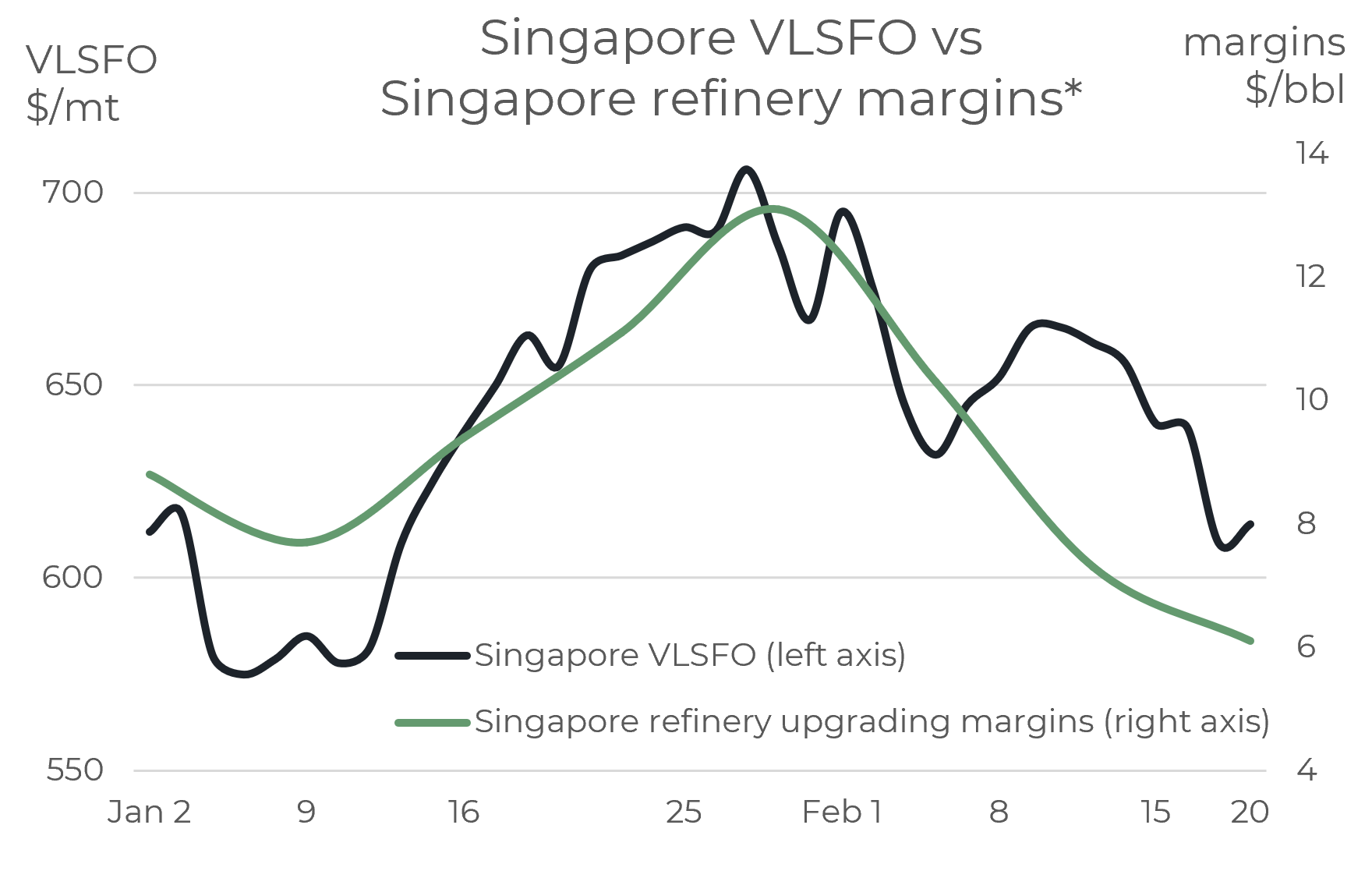

All of these bearish developments filtered through to weaker prices and refinery margins, which have been much lower so far in February than in January. Margins have been a clear, measurable market signal of weakening conditions, which is illustrated in the graph below for Singapore VLSFO and local refinery margins.

Source: Integr8 Fuels

Source: Integr8 Fuels

What about the ‘previous’ bullish factors?

It’s not that the economic prospects in China and Asia have disappeared, or analysts no longer see a potential tightening in oil market fundamentals over the second half of the year. It’s that as we moved into February, oil stocks rose and refinery margins fell. There are also a couple of other bearish factors that have been picked up on, such as possible tighter monetary policy in the US and the strong US dollar hitting buyers using other ‘local’ currencies. It is all this that turned the market around in late January/early February.

The obvious market question then is…

How long will it remain bearish, and what factors to look out for?

The age-old mantra of ‘the market tells you everything’ usually works, and we have gone through this month where most product balances are weakening.

Published data on refinery margins and oil stock levels are really useful to keep watching to see if there is a change. It may be difficult to change sentiment on just one week’s data, but as we have seen this month, turning points usually happen when the market focusses on a few ‘contributing factors’ all pointing in the same direction.

Here is where developments in China and its economy will be a prime focus. The key elements for us are what is happening to Chinese crude buying, refinery throughputs, product exports and how oil demand is performing. All four of these are inter-linked, but the headline focus will be oil demand. If there is strong confidence in Chinese demand rising in line with many forecasts, and this coincides with data signals such rising refinery margins and lower stock levels, then the market is likely to reverse once again, to a bullish trajectory. If however, Chinese oil demand is seen as faltering, then this is highly likely to mean a continued bearish oil market all round.

China is obviously a key player in market sentiment and a main driver in any change. Today there are conflicting signals being discussed, with ‘bullish’ indicators from government stimulus packages and infrastructure projects, but against this are ‘bearish’ signs of low disposable incomes and savings. This is where analysts will keep a close eye.

What about an increase in oil production to bring down prices?

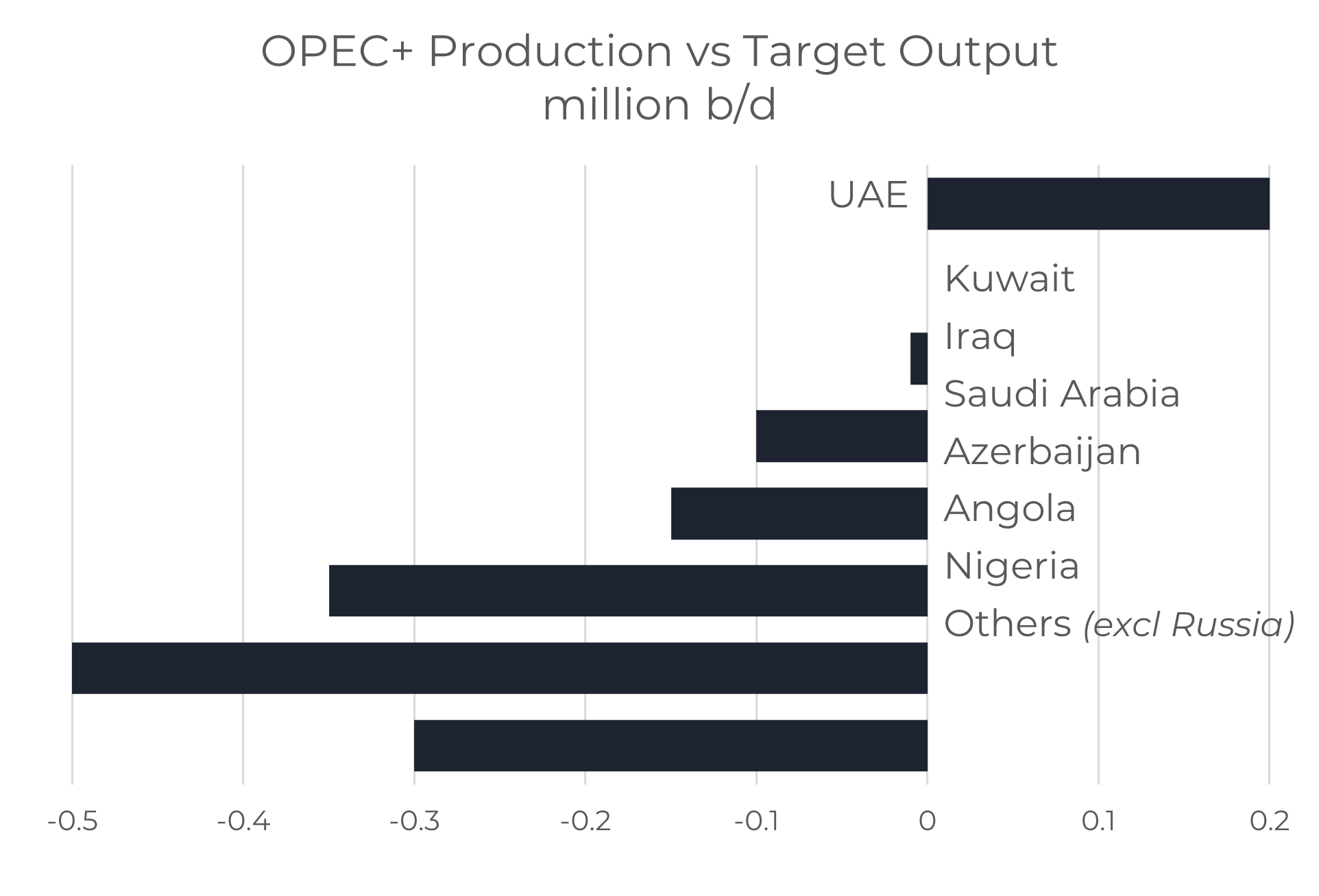

Apart from Chinese oil demand, another fundamental factor worth looking at and understanding is crude oil supply. OPEC+ is the only group/country that has spare production capacity and so can increase output rapidly. However, given all the volatility in oil prices, the OPEC+ group has stood firm in its strategy of not increasing target allocations for the group. Part of this is because of a ‘lack’ of upstream spending in recent years means many of the member countries cannot even reach their current targets.

The UAE is the only country currently producing substantially more than its allocated volumes. Almost all other countries are below target, with Azerbaijan around 150,000 b/d lower, Angola 350,000 b/d lower and Nigeria 500,000 b/d lower. The signs are clear that most OPEC+ countries could not raise output even if the cartel decided to increase allocations.

Source: Integr8 Fuels

Although Saudi Arabia is currently producing less than its target, it is one of very few countries that have spare capacity and so are able to increase production relatively quickly. The main players with this spare capacity are all in the Middle East:

Estimated Spare Capacity

Saudi Arabia 1.7 – 2.0 million b/d

UAE 0.8 – 1.0 million b/d

Iraq 0.2 – 0.3 million b/d

Kuwait 0.1 – 0 .2 million b/d

Total 2.8 – 3.5 million b/d

There is also spare capacity in Russia and Iran, but the situation in Russia is highly uncertain (to say the least) and any changes in Iran would take a huge political shift to lift ‘nuclear’ sanctions and reopen the country.

So, for those OPEC+ countries currently maximising their oil production, it is not in their interests to agree to an increase in the cartel’s production allocations and bring oil prices down. However, even though Middle East countries do have the ability to raise output and reduce oil prices, it is also not really in their economic interests to do so. These economies are highly dependent on oil revenues to support their economies and so need a minimum revenue, which tends to come at a ‘higher’ oil price. To raise output would likely see a drop in revenues; if you raise production by 5% the price is likely to fall by 10% or more!

The next scheduled OPEC+ meeting is on 4th June. Now no one expects the group to increase production and in fact, the talk is of possible production cuts.

Conclusion: It’s China, China, China?

From where we stand today, the Chinese economy looks like the best indicator for either a continued bearish sentiment or another reversal towards a bullish view on prices. Then comes the supporting roles of things like refinery margins and oil stocks (easy to see and worth watching). These things will tell us an awful lot about market sentiment and where prices are going.

But, because we are in a global industry, where politics can play a huge role in our markets, we can also never ignore the big stage of what is happening in the Ukraine war, Russia, China and the US.

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Prices have changed quickly; Here’s what we are looking at

January 25, 2023

The bullish sentiment has kicked-in; Singapore VLSFO is up $100/mt

In our report at the end of December we highlighted a change in sentiment towards a more bullish bunker price view. This was centred on IEA analysis and changes in their forecasts towards a stronger than anticipated growth in global oil demand for this year.

It is only early days, but after an initial dip in prices at the start of the year, Singapore VLSFO has risen by $100/mt (plus 17%) over the past 2 weeks.

Source: Integr8 Fuels

This isn’t only in Singapore; Fujairah VLSFO is up $80/mt, with Rotterdam and Houston both up by $90/mt. These price rises are largely following the movements in crude prices, with Brent up by $10/bbl (14%) over the same period.

Why the shift?

It is the change in sentiment that has propelled oil and bunker prices higher, and the main reasons for this change are:

- stronger economic and demand prospects in China (with relaxations in the previous very tight covid restrictions);

- ongoing growth in India and other Asian economies;

- a potential tightness in the oil market over the second half of this year.

Early signals in China have been bullish, with indications of Sinopec and Unipec increasing their crude buying. This has supported the more positive outlook for China and reinforces a ‘higher price’ view.

Economic sentiment will steer oil prices up (or down)

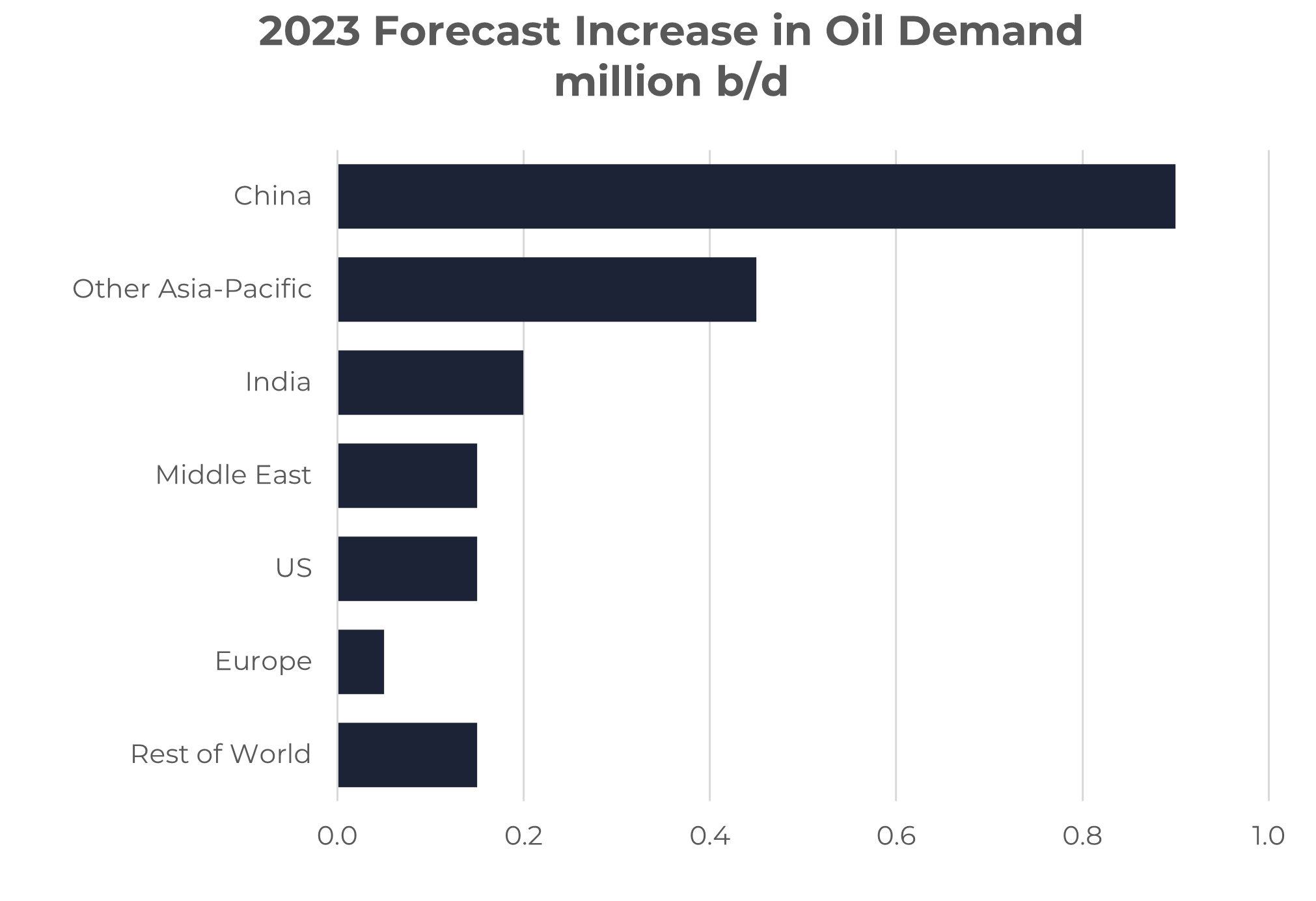

The ‘bigger picture’ economic developments are likely to be the main drivers behind price direction. The graph below illustrates forecast growth in oil demand this year by region. It is very clear that the current bullish sentiment in the oil market hinges on the expected gains in demand in China specifically, and Asia-Pacific generally, with only limited impacts elsewhere in the world.

Source: Integr8 Fuels

Source: Integr8 Fuels

At the same time, if OPEC+ maintain their current constrained production strategy, then oil markets could tighten considerably over the second half of this year; hence the more bullish sentiment and stronger price outlook for 2023.

The EU ban on Russian product imports is about to kick-in

As always, other fundamental and political developments emerge and impact on price. The main one at the moment is the impending EU ban on Russian product imports, which is also bullish for prices.

The start date for the EU ban is February 5th, with the G7 export price cap also starting on the same day. This means that Russian cargoes bound for the EU that are loaded before the 5th Feb and discharged by 1st April are allowed, but after this what happens?

The spotlight for us in bunkers will be on Russian diesel/gasoil, which will impact on VLSFO pricing. At the moment there is a surge in Russian diesel/gasoil exports to Europe, ahead of the February 5th start date. As we move through February and March the implications for supply, price and trade patterns should become clearer; will the overall volume of Russian diesel/gasoil exports fall; will new trades to Asia become established; what will be the impact on European and global diesel prices?

These developments will create price movements around what is still likely to be the main price driver, the economy.

Other product developments to watch

Another factor to watch is the jet market. Almost half the forecast growth in world oil demand this year is expected to be for jet fuel, and again this will impact on VLSFO pricing.

On the supply side, Middle East product volumes and exports should be boosted with the Q2 start-up of KPC’s second crude unit (of three) at its new 615,000 b/d Al-Zour refinery. In addition, the new 140,000 b/d Karbala refinery in Iraq is scheduled to start-up over Q2/Q3 this year, again adding to Middle East product supplies and exports. However, these gains in Middle East product supply alone are not enough to cover potential losses in Russian exports and the increases in world oil demand.

Bullish oil prices hinge on economic “success”

Coming back to the economy, the outlook for this year is uncertain (as always), but reducing inflation is a core target for most central banks and governments. The general view is that inflation will peak and then ease over the course of this year, but it will still take another 2-3 years to get back to targets of around 2.5%. Also, views are that any recession will be relatively short-lived.

So, the consensus view is ‘a rocky road ahead, but we will get through this and there is light at the end of the tunnel’.

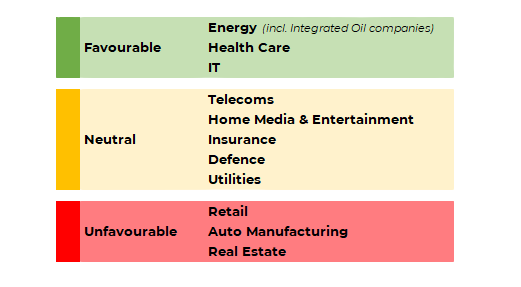

Investors are looking where to put money – it could be the energy sector

Oil is a global commodity with easy access for anyone to trade on its futures markets (primarily WTI and Brent futures). ‘Speculative’ money coming into and out of these futures markets can have a huge bearing on oil prices and sentiment, which in turn have a direct impact on bunker prices in our market.

When it comes to energy, many investment analysts tend to focus on the long-term direction and strategies towards 2050. However, some do look at the near-term investment opportunities in the oil sector and to illustrate what some are thinking, the following diagram maps out the preferences of an international investment company on what to and what not to invest in the short term for 2023; and at the energy industry is at the top!

Source: Integr8 Fuels

They see commodities in general, and the oil sector in particular, in a new ‘bull super-cycle’. This comes from limitations in supply and a focus on a strong second half of the year. In this sense, the energy sector becomes more attractive for someone to put money to work, through equities and through oil futures markets. This in turn pushes oil and bunker prices higher (admittedly, when the ‘speculators’ find something better and take their money out of oil futures then oil prices can fall!).

Strong sentiment & strong fundamentals?

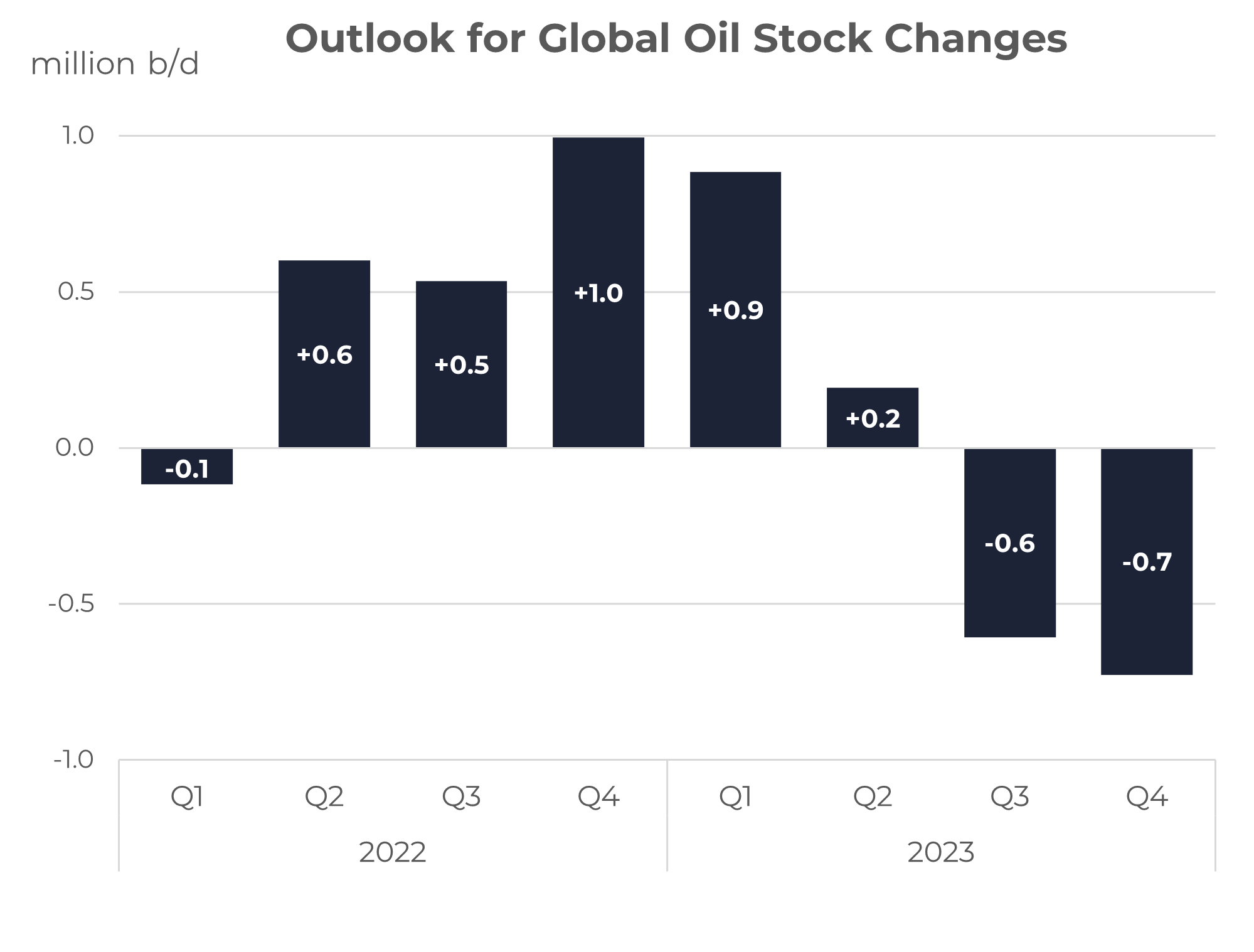

Bringing the supply and demand fundamentals together and looking at a number of analysts, the chart below illustrates an average of the historical and forecast global oil stock changes. The clear pointers here are that we saw global oil stock-builds through most of last year. With this oil prices fell; Brent futures were down from $110/bbl in Q2 2022 to the low $80s in December.

Source: Integr8 Fuels

Source: Integr8 Fuels

Taking an average of current forecasts indicates another stock-build this quarter, but for the market to be near balanced in Q2 and then potentially tighten significantly in the second half of this year with forecasts of relatively large stock-draws.

There is every reason for today’s bullish sentiment

It is invariably the case that the fundamentals win out, and on this basis oil prices would be expected to rise. We are looking at this, the oil industry is looking at this and certain investment analysts are also looking at the same picture. Again, from where we stand today the sentiment appears bullish and bunker prices would be expected to rise further.

The main factors underpinning this view (and to keep watching) are:

- the strength of oil demand in Asia this year;

- that economic forecasters get it right that we are not going to fall into a global recession;

- what OPEC+ does, but at the moment they are holding firm on a more constrained supply strategy, which again is bullish.

Let’s keep watching to see if everything pans out as expected!

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Economic concerns are a forefront, but are fears easing for 2023?

December 21, 2022

Argentina needed stable to falling bunker prices

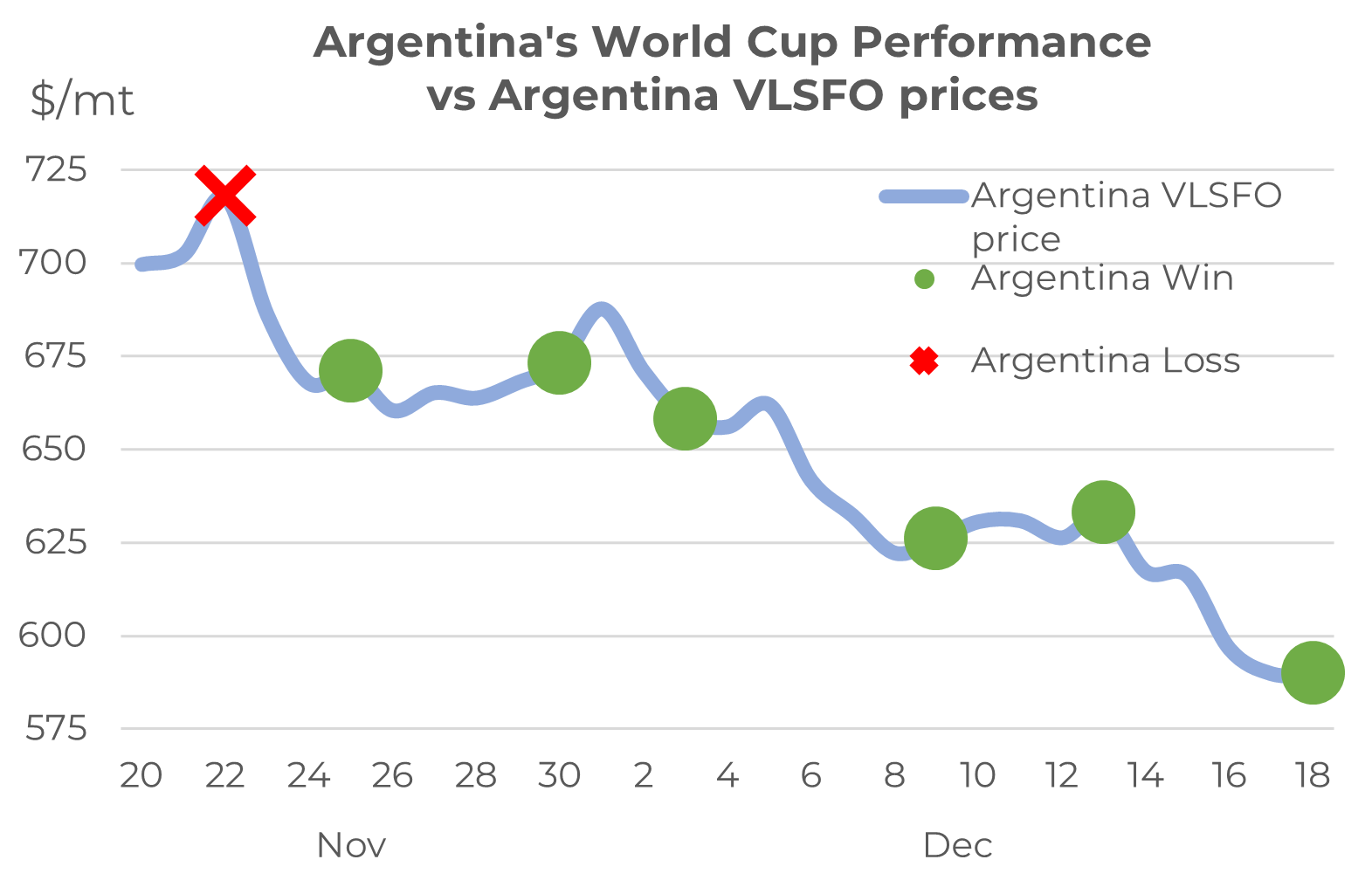

Analysts are always looking to find what is driving things and what are the outcomes. As a side issue, the following analysis perhaps shows why our market can take some credit for the Argentinian footballing success.

The World Cup started on 20th November and in those early days Argentinian VLSFO prices were rising. In this rising market, on 22nd November, Argentina lost 2-1 to Saudi Arabia in one of the ‘shocks’ of the tournament! After this, Argentina VLSFO prices reversed and fell sharply and with it the team performance turned around with a 2-0 win against Mexico on 26th November. Prices were then broadly stable to the next match on the 30th and Argentina won 2-0 against Poland; luckily for Argentina the match wasn’t played the next day, when Argentina VLSFO prices rose to another peak and Argentina would have lost.

Prices then fell again and again, and there were two wins on the trot. The semi-final was on the 13th December and there must have been some concern in Argentina as local VLSFO prices edged up a bit, but not enough to affect a win.

Source: Integr8 Fuels

And then, in the 5-day run-up to the final, Argentina VLSFO prices fell sharply again, by another $43/mt. The final analysis is clear, Argentinian VLSFO prices were down a lot in the run-up to the final and so Argentina were always going to win.

It will be interesting to see how many international football managers start looking at their local bunker prices at the next World Cup!

Crude & VLSFO prices are now at their lowest this year

Back to ‘more regular’ analysis. Since the start of this year the concerns on global economic performance have been major headlines in all business. For us in the bunker market we have been continually looking at the prospects of lower prices, and finally we now have the lowest prices of the year!

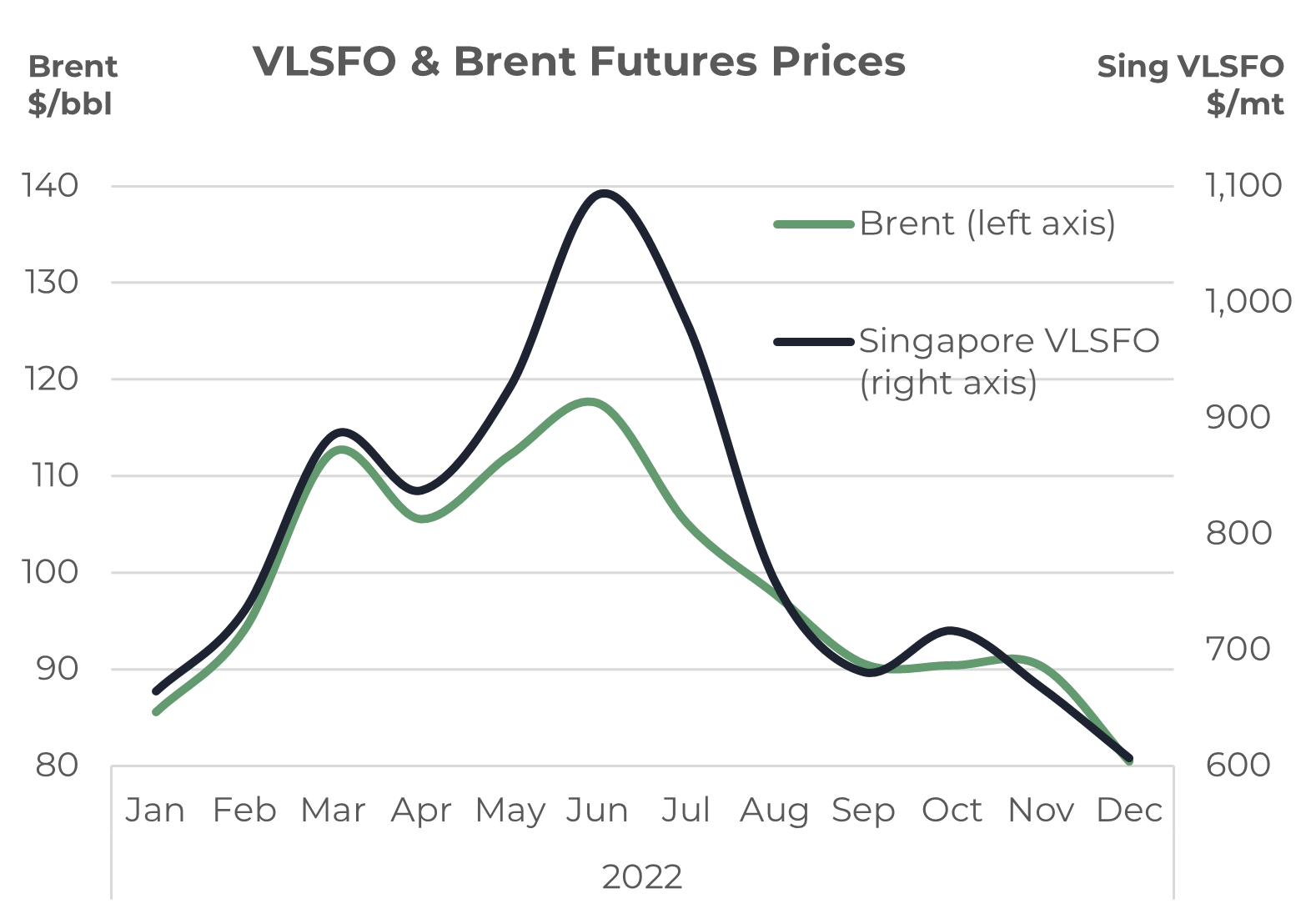

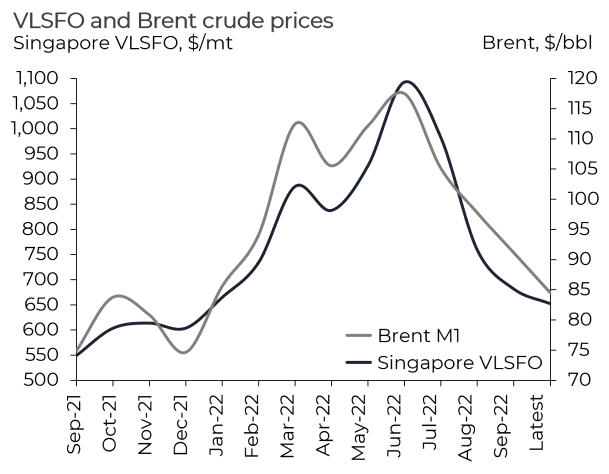

There are a number of reasons why VLSFO had not hit this low point earlier. The extreme tightness in jet, distillate and gasoline around mid-year led to record high refinery margins and was probably the biggest supporting factor for VLSFO prices. The graph below shows the mid-year VLSFO price spike and its strong premium to crude at the time.

Source: Integr8 Fuels

Since mid-year, crude has been on the slide and VLSFO has dropped by even more, to fall back into line with crude.

Over the past month we have seen another fall, with Brent futures down $14/bbl and Singapore VLSFO $85/mt lower. This has left the December average to date at $80/bbl for Brent front month futures and $600/mt for Singapore VLSFO. All the pointers show the gloomy economic picture has finally filtered through to oil and bunker prices.

Are prices going to continue falling, or are changes in the wind?

Now we are here, is the picture for 2023 just as gloomy on the economic front and are there pointers for a further drop in bunker prices? If you asked this question a couple of months ago, the answer was probably “yes”. But today there seems to be a hint towards a turning point.

Oil demand looks stronger than we thought

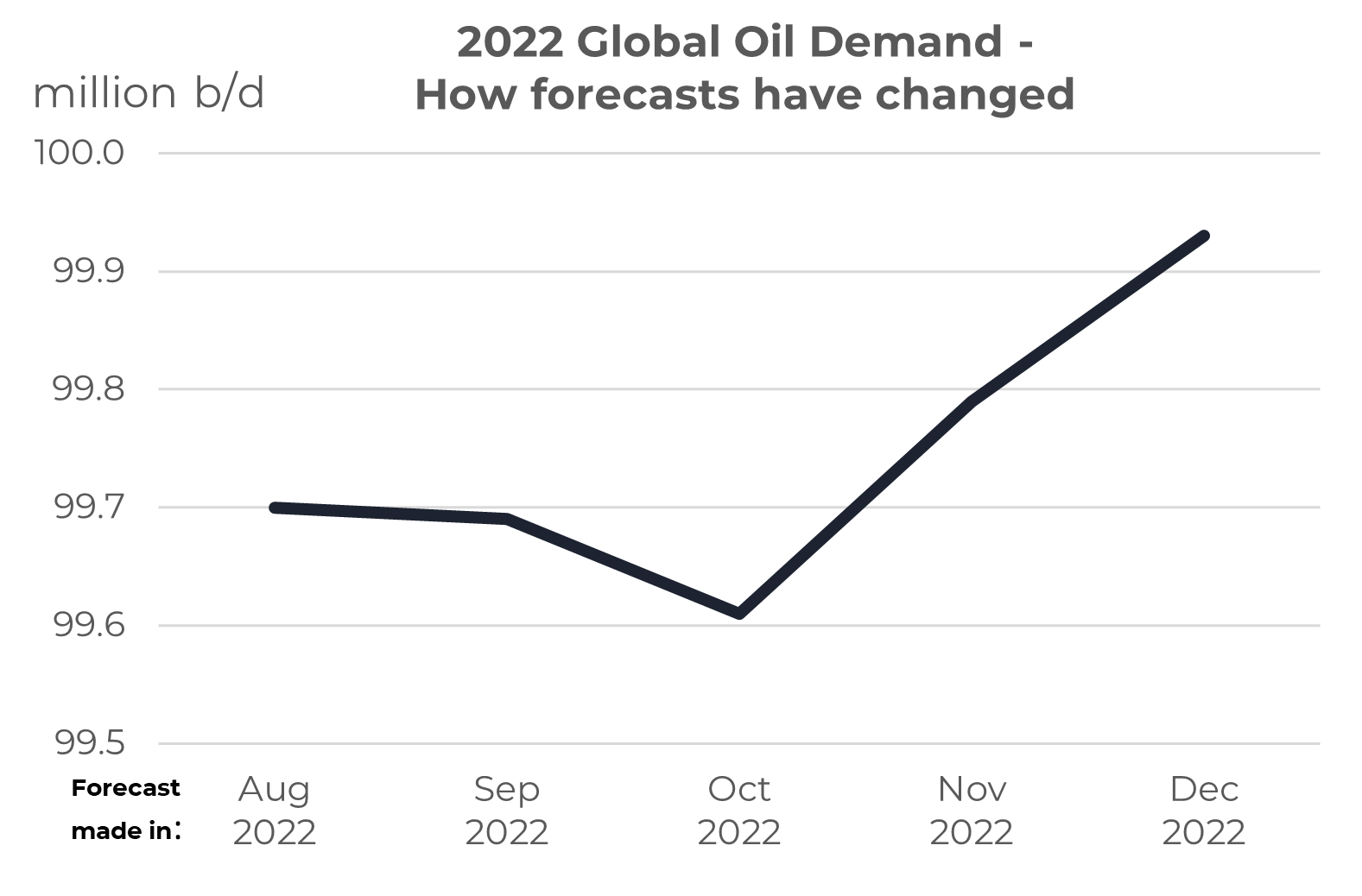

The IEA is a key reference in measuring and reporting on global oil demand. It was no surprise that in their September and October monthly reports the forecast for 2022 oil demand was being downgraded; down from an annual average of 99.7 million b/d to 99.6 million b/d. However, in their November and December reports they have made major upwards revisions to the demand figure for 2022, now up to 99.9 million b/d.

Source: Integr8 Fuels

Something has made the IEA more optimistic than they were for oil demand this year. It seems demand in China and India is more positive than previously assessed, with the Middle East also stronger than anticipated (not just because of activity around the World Cup). The main product focus here is gasoil, where demand is rising despite ‘high’ consumer prices. The key drivers have been: industrial activity has been higher than expected and the switching from natural gas to gasoil has exceeded previous expectations.

However, demand in the OECD is nowhere near as strong, especially Europe. A more positive spin can be put on the US, with latest US economic data better than expected and the inflation rate on a downwards trend, but it is still at 7%.

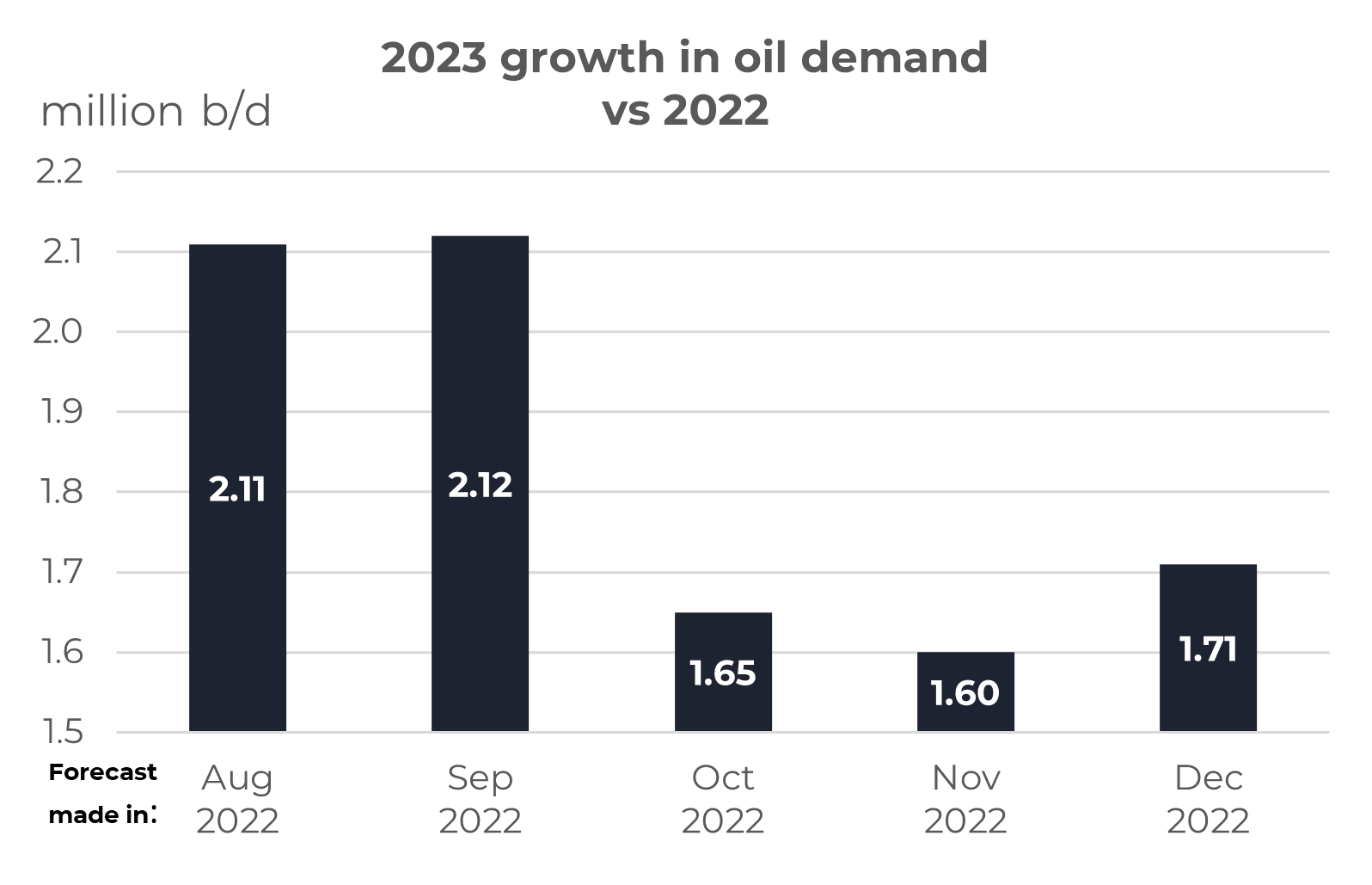

Oil demand forecasts for next year are being revised upwards

This more ‘bullish’ view on non-OECD oil demand has been carried through into next year, with the IEA revising up its forecasts for overall oil demand growth in 2023. Forecasts made by the IEA in August and September indicated growth in global oil demand for 2023 at 2.1 million b/d. The turning point in their forecast came in October, when this was revised down to growth of only 1.65 million b/d. In November they made a further adjustment down. However, in their latest report from last week, the forecast increase in demand next year has been revised upwards. The revision maybe small, but it is a reversal of what they have been saying for the past two months.

Source: Integr8 Fuels

Source: Integr8 Fuels

There are a number of contributing factors for this ‘more upbeat’ view. The better than expected recent non-OECD demand data is a starting point, but the easing in what has been a very strict Chinese covid lockdown strategy could release a lot of demand. Also, increases in jet fuel demand are expected to remain very high, with pent up demand still to be fulfilled. Also, any opening up of Chinese travel could give added impetus to the jet market.

The bottom line is that Indian growth in oil demand has been particularly strong in recent months, supported by government interventions to fix domestic fuel prices. But China is likely to take-over the position of leading growth market next year, especially with easing in COVID restrictions.

There are a number of more bullish price signals for next year

So, we have:

- Oil demand looking stronger than previously expected;

- OPEC+ apparently maintaining its position to cut and then hold production throughout 2023;

- Current supply issues surrounding Russian crude exports with the EU import ban and G7 price cap, which could be repeated in February when the EU product ban kicks in;

- No quick ramp up of US shale oil production, even though shale companies have been accused of being “un-American” with their more limited investment plans.

It’s a ‘bit cautious’ at this stage, and of course there are still potential bearish price factors such as greater economic weakness, tightening domestic policies in China, any reversal of OPEC+ strategy and of course an ending of the war in Ukraine. But based on all the factors outlined in this report, it is worth quoting the IEA when they say “another price rally cannot be ruled out”.

It is clear there is always something new for analysts to look at, whether it’s the intricacies and changes in the oil market potentially pushing oil and bunker prices back up next year, or the driving factors behind an Argentina victory at the World Cup. Let’s meet again next year to see how our market unfolds.

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

VLSFO prices are falling and HSFO is holding relatively firm; what is happening?

November 24, 2022

Background

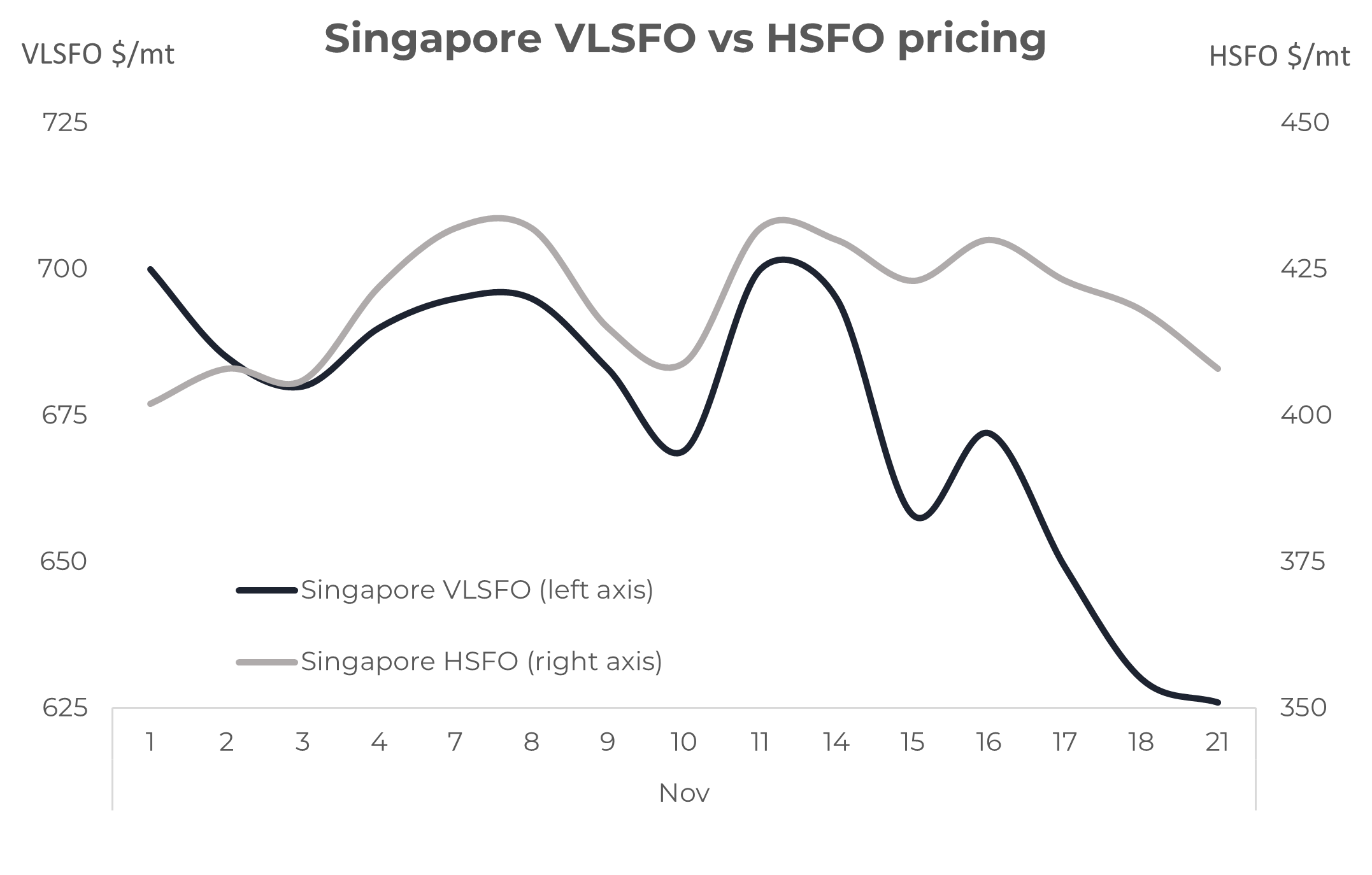

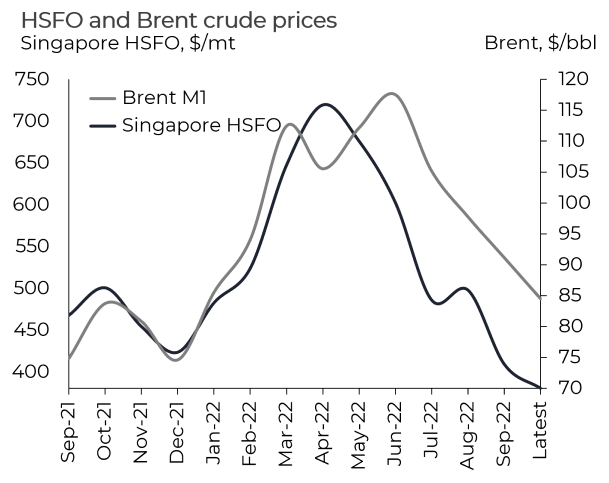

In the past couple of weeks we have seen VLSFO prices fall by around $75/mt in Singapore (down 10%), but at the same time HSFO prices have remained within a $20 range. The story is the same in Rotterdam, where the VLSFO price fall is slightly bigger than Singapore. In this report we look at what is driving these VLSFO and HSFO price movements and where things could go in the near term.

Source: Integr8 Fuels

The graph above shows Singapore delivered prices since the start of November, with HSFO remaining around $410-430/mt (right axis), versus VLSFO falling from close to $700/mt to around $625/mt (left axis) over the same period. Looking at this short-term snapshot does give us pricing developments in what is obviously a highly dynamic and fast paced bunker business. But to get some indication of where we are going, we have to take a step back, put current moves into perspective, and then pick out the key drivers that could affect our market going forward.

Is it VLSFO weakening or HSFO strengthening that is driving these price moves?

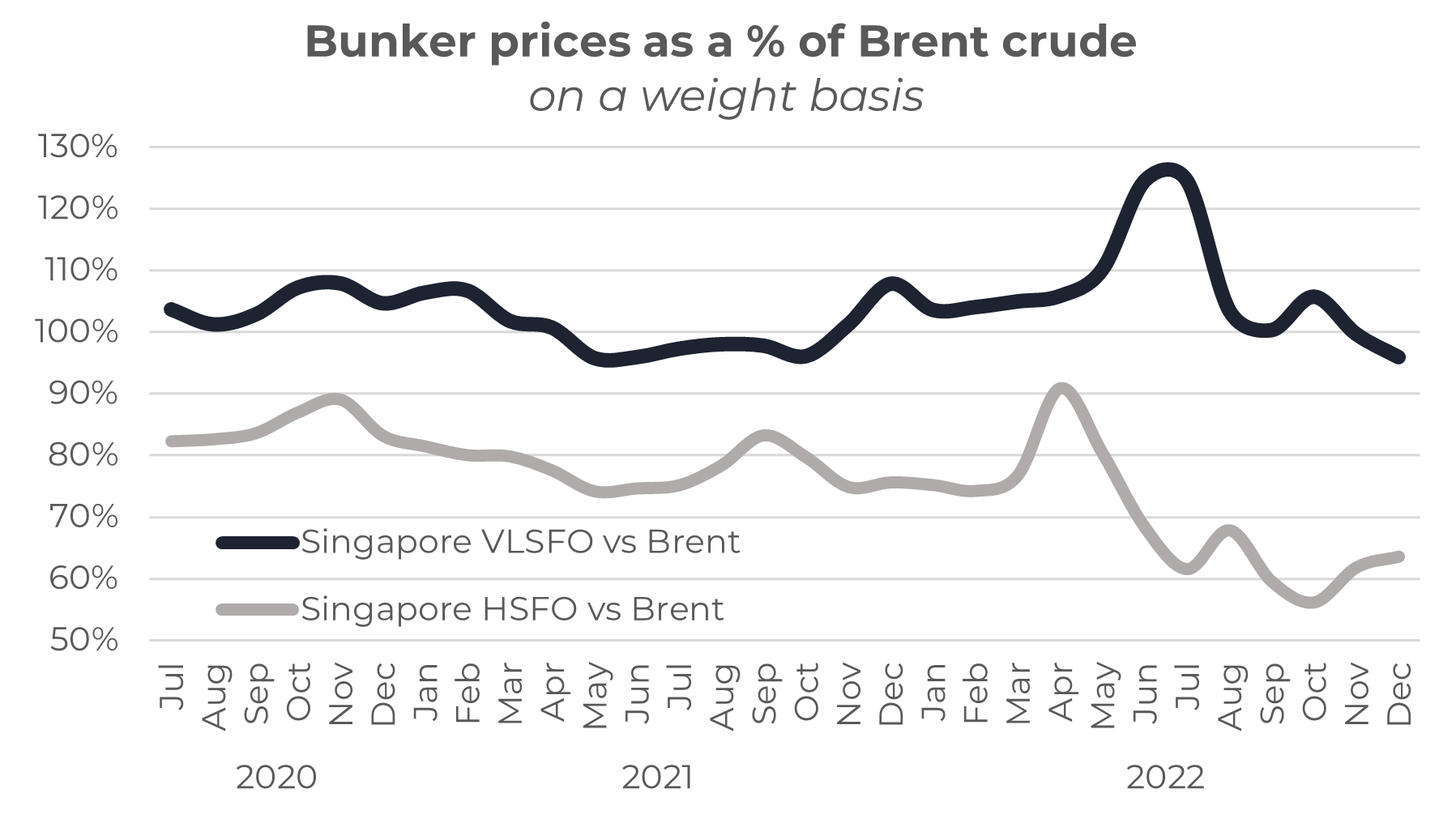

The answer (conveniently) is ‘a bit of both’. Around mid-year, VLSFO was extraordinarily strong relative to crude oil and has now ‘fallen back into line’, whereas HSFO was extremely weak and is now regaining some of those earlier ‘loses’.

Between mid-2020 and early 2022 (i.e. after VLSFO supply and pricing had settled and before the Russian invasion of Ukraine) Singapore VLSFO pricing was around 95-105% of Brent crude. Around the middle of this year VLSFO strengthened to 125% of Brent, on the back of extreme tightness in the middle distillate and gasoline markets. Since then, most oil markets (apart from diesel and jet) have weakened considerably, in line with global economic pressures. On the back of this VLSFO prices have also fallen from their extreme highs, and have now ‘reverted back to normal’, albeit to around 96% of crude and towards the bottom of the historic range.

Source: Integr8 Fuels

At the same time, HSFO pricing fell from a long-run basis of around 75-85% of crude to a low of only some 60% of crude at mid-year. This relative low for HSFO came as refiners ramped up throughputs and production on the back of historic high margins for jet, diesel and gasoline. Higher refinery throughputs of course led to increased supplies of fuel oil (as a by-product), generating a ‘surplus’.

For the main part, the strength in refining has eased, throughputs are down and with it HSFO pricing is also reverting back to trend; i.e. strengthening relative to crude. However, HSFO pricing is still relatively low, at only 65% of crude.

If pricing does revert back to around historic norms, then going forward we could expect VLSFO to largely track movements in the crude oil price, but given where HSFO is today, we would expect a further relative strengthening in high sulphur bunker prices relative to Brent crude.

Do market indicators suggest VLSFO and HSFO prices are reverting back to historic norms?

Taking what looks like the easier part of the question first and looking at HSFO, the answer is ‘yes’. On the HSFO supply side, there is no expectation of extreme hikes in refinery throughputs. At the same time, OPEC+ has agreed cutbacks in crude production and these are most likely to fall on Middle East producers, which tend to be the heavier, higher sulphur grades. There is then the issues surrounding the December 5th ban on Russian crude imports into the EU and UK, which could have a big impact on pricing and trade flows. The G7 pricing cap for Russian exports may have little impact itself, as Russian prices are already heavily discounted and countries that will take Russian volumes are likely to work outside this remit.

Near-term signs on the demand side are also towards a strengthening HSFO position. As we go into the northern hemisphere winter there is the potential for some power generating companies to switch from high priced natural gas to fuel oil as a feedstock. If this happens it would again tighten the HSFO bunker market. So yes, HSFO prices could continue to strengthen relative to crude over the coming months.

It’s a more difficult area looking at VLSFO. Prices here are already at the low end relative to crude. Diesel and jet refinery margins are very strong at the moment, and even though these may ease, there could be enough in these markets to support VLSFO pricing; in contrast, gasoline margins are extremely weak.

Also, the ban on Russian product exports to the EU and UK kicks in from 5th February, and like the crude export ban next month, it could create uncertainty, plus distortions in price and trade flows. If anything, this is likely to push the relative price of VLSFO higher in the first quarter of next year, and potentially oil prices higher overall. At the same time, it is likely to see more Russian fuel oil going to Asia, lowering the relative price of HSFO in Singapore.

Therefore, we could see HSFO prices strengthening a bit more relative to VLSFO over the next couple of months. But, as we come out of the northern hemisphere winter any upwards pressure on HSFO could ease, and at the same time seasonal strengthening on transportation fuels (gasoline, diesel and jet) could see VLSFO prices rising relative to HSFO.

What this could mean for the VLSFO/HSFO spread

Pulling this together and looking at the implications for the VLSFO/HSFO spread. Through the ‘covid times’ of 2020/21, the spread was extremely narrow, at only $100/mt. The extreme market conditions in mid-2022 saw this spread widen to $300/mt in Rotterdam, and a massive $500/mt in Singapore. These times have changed, and based on the pointers outlined above in this report, the spread is now down to around $200/mt.

Source: Integr8 Fuels

As always, we need to track bigger picture developments in the oil markets, and here there are a number of key factors going on, including the global economy and its impact on overall oil demand; what is happening in China; the fall out from the EU/UK ban on Russian imports and what OPEC does.

But taking the focus of this report, the conclusions are that the VLSFO/HSFO spread may continue to narrow a bit further over the next 2-3 months, but then could widen again as we move through Q1 next year and into Q2.

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

The IEA’s latest long term energy report & what it could mean for the bunker industry

November 1, 2022

Background to the IEA study

The IEA has just released its annual World Energy Outlook and for the first time it shows total demand for fossil fuels going into decline within the next few years in all of three of their forecast scenarios. The shift in outlook comes with the current energy crisis, high prices and the question of energy security, all principally triggered by the Russian invasion of Ukraine, but also prompted by under-investment in recent years.

The IEA study is based on three scenarios:

- Stated Policies, where the future outlook for demand across all energy sectors is based on current stated government and corporate policies to reduce emissions and that these are achieved. Here total oil demand would start to fall in the mid-2030s, but this would still mean a rise in global average temperatures of 2.5oC by 2100 (way above the 1.5oC by 2050)

- Announced Pledges, where policies that have been announced are actually enacted and fulfilled. This is the case where it is easy to say something, but far more difficult to implement it! Here total oil demand would start to decline in the next few years, with a temperature rise of 1.7oC by 2100;

- Net Zero by 2050, where new, and far more aggressive policies will be adopted to achieve net zero emissions by 2050, and temperature targets of a 1.5oC rise by 2050 are achieved. In this case oil demand will decline from now on.

In the step from case to case, the outlook is of more rapid government strategies to quicken the pace towards ‘more sustainable and secure energy systems’. The central theme here is renewable energy supported by nuclear power, with huge investments in existing technologies and the search for new technologies.

In this report we focus on what these views could mean for the bunker sector, in terms of prices and, importantly, the fuel mix. It is worth noting that hydrogen-based fuels get a big mention in the study.

What is the outlook for oil and bunker prices?

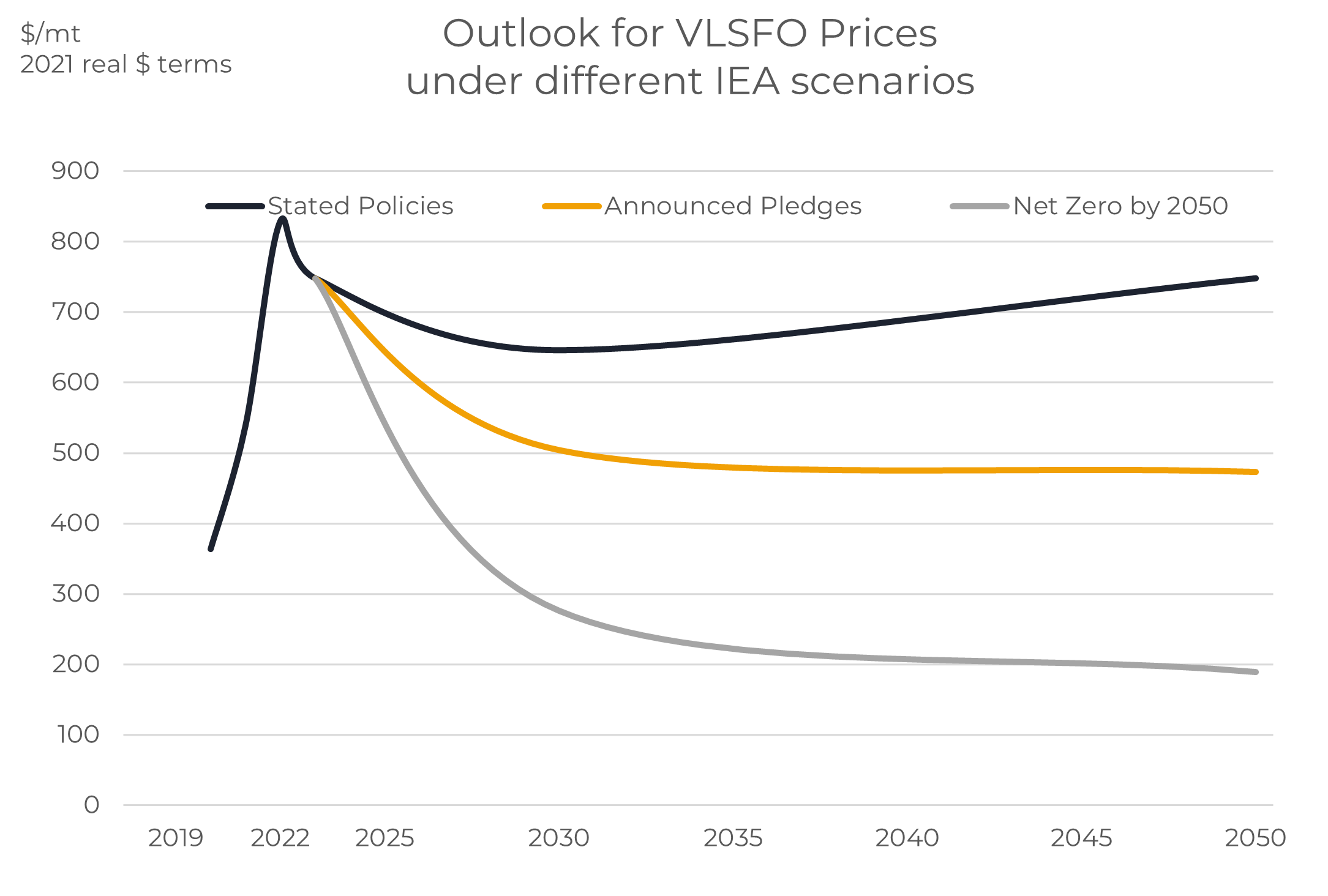

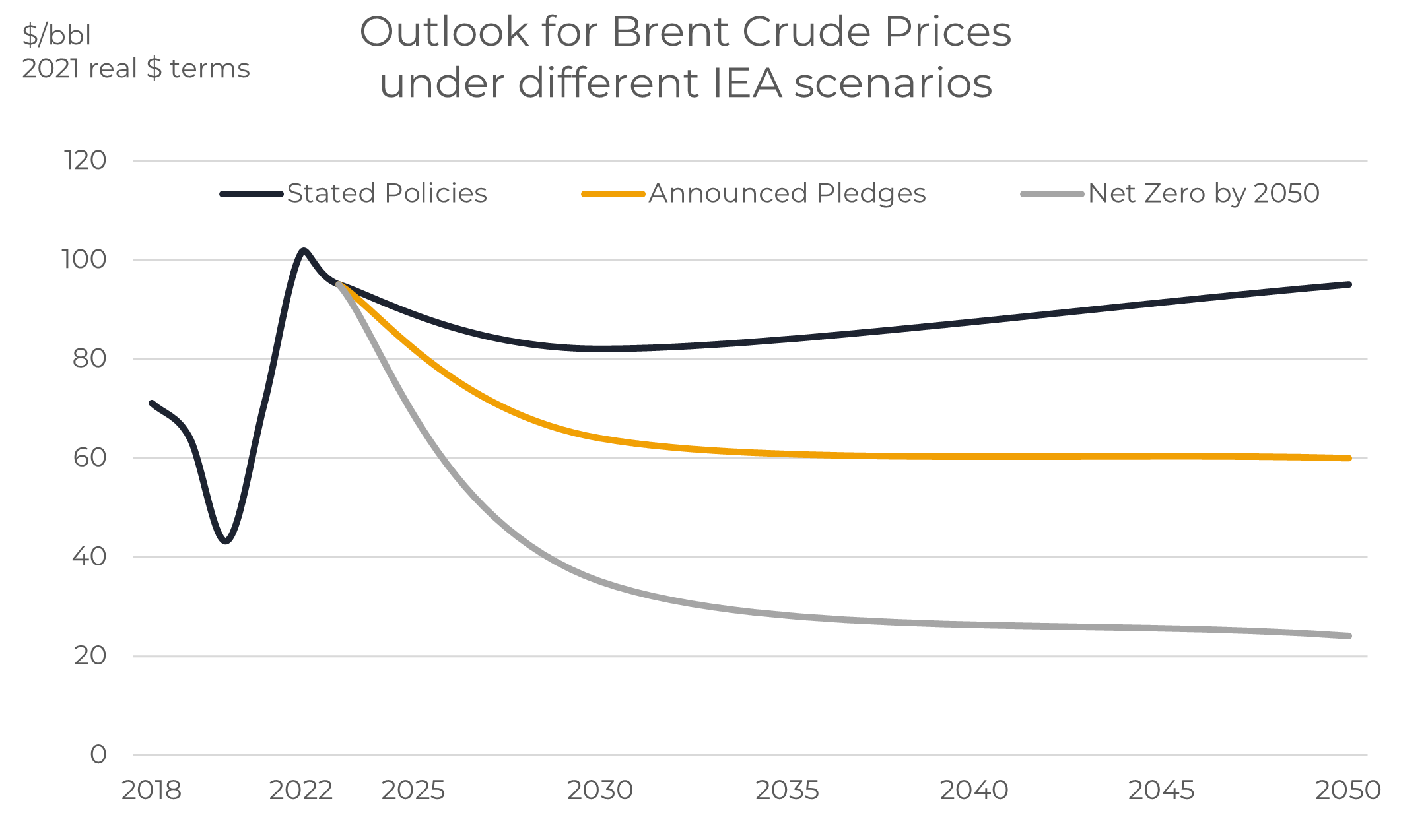

The IEA’s forecast is based on trends, but they do recognise the high degree of volatility in pricing at different times. However, the extent of their scenarios does show a very broad range in pricing, with the ‘current course’ under the Stated Policies case taking crude prices (in real terms) only slightly lower than recent levels and remaining in the $80-95/bbl range for Brent.

Source: Integr8 Fuels

If there is a shift towards a more environmentally sensitive case, such as the Announced Pledges, then the IEA sees prices lower, at $60-65/bbl in real terms; still not massively dissimilar to historic prices.

At this stage any shift towards Net Zero policies by 2050 seems to be a huge hurdle and perhaps unlikely, but the implications for oil prices would be clear and very low. In the IEA’s scenario this would take Brent prices down to $35/bbl by 2030 and only $25/bbl by 2050 (again in 2021 real terms).

Keeping VLSFO prices inline with crude price developments under each scenario would imply VLSFO in the $650-750/mt range (real 2021 $) in the first case and $450-500/mt in the second case. It is only in the highly unlikely third case that VLSFO prices would fall to around $200/mt by 2050, and as we outline later, this would be a very different market, with oil as a bunker fuel being squeezed out of the market.

Source: Integr8 Fuels

Source: Integr8 Fuels

The Stated Policy case more-or-less means ‘business as usual’ for us

In the IEA’s first, and ‘least intrusive’ Stated Policies scenario, coal demand falls, natural gas demand hits a plateau around 2030 and for us in the oil sector, total oil demand continues to rise for at least another 10 years. It is only in the mid-2030s that oil demand starts to fall, and this is mainly with the expansion in the electric car fleet.

The IEA does separate out shipping as one of those industries that is heavily dependent on oil to meet its needs, and in the Stated Policies case the mainstay of bunkering is likely to stay with oil, even with potential growth in oil demand in our sector.

In fact, the IEA sees three areas where oil demand will continue to rise beyond 2030, namely aviation, petrochemicals and shipping. The decline in total oil demand comes as the gains in these three industries are more than offset by declining demand for gasoline and diesel with the expansion in the electric vehicle (EV) fleet.

As a backdrop, although the level of new oil discoveries in 2021 was at its lowest for more than 80 years, the IEA underlines that there are sufficient oil resources globally to meet the medium term rise in oil demand. However, with campaign groups in some non-OPEC countries already challenging government strategies on oil investments, the focus of new production is likely to be in the Middle East.

This is unlikely to mean a shortage of oil available to the global markets generally, or us in bunkers, but it is likely to mean a growing dependence on Middle East crude oil supplies to fuel the industry.

What do the other IEA cases mean for the bunker industry?

In the Announced pledges case, demand for oil bunkering is forecast to fall, perhaps by around 25% by 2050. Hence not a collapse in the oil bunkering market, but no doubt a smaller market and a shift towards alternative fuels

However, at the other end of the spectrum, the Net Zero case would demand a radical shift in the bunkering industry. In this case, the IEA indicate our sector reducing CO2 emissions from 840 million tons today to 110 million tons by 2050 and see a dramatic move towards ammonia and other hydrogen-based fuels, along with biofuels. They recognise the 20-35 year life spans of ships, although they also mention the possible retro-fitting of vessels to burn hydrogen-based fuels, as well as commenting on wind kites and rotor sails as having a role.

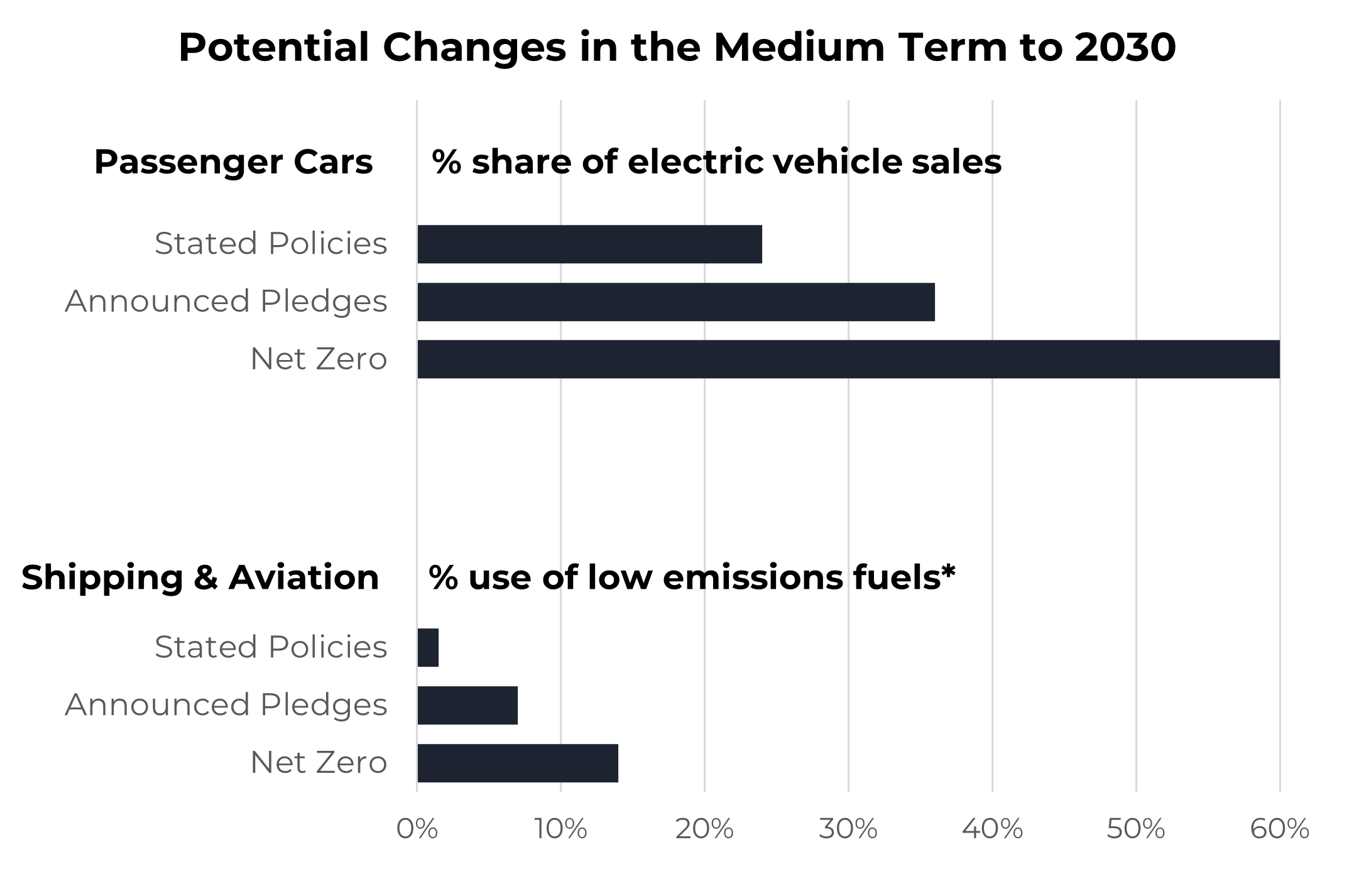

The medium-term focus to 2030 is on electric vehicles; not shipping

As already mentioned, the majority of the push towards lowering emissions in the medium term to 2030 is focused on the transition from gasoline and diesel passenger cars to electric vehicles. The graph below illustrates percentage of new car sales in 2030 under each of the three IEA scenarios, with around 25% of new car sales being electric even under the Stated Policies case. This rises to 35% in the Announced Policies case, and around 60% in the far more unlikely Net Zero case.

Source: Integr8 Fuels

This compares with minimal shifts in the shipping and aviation sectors by 2030, with only 1-2% of demand met by ‘low emission’ fuels in the first case, rising to only 5-6% in the more aggressive Announced Policies case. We could say our day-to-day market is unlikely to change that much in the next 5-10 years.

However, things will change at some stage!

In the Stated Policies case, it could be that oil remains by far the dominant fuel in the bunker industry through to 2050. However, if you believe we are only likely to be in a world where more environmental legislation is coming, then things in our sector will definitely change.

In this instance, in the longer term to 2050 (and beyond), the use of hydrogen based, low emission fuels such as ammonia and methanol are seen as strong potential alternatives to oil in combustion engines in the shipping and aviation sectors.

The IEA does outline the need to find cheaper ways of producing these low emission fuels to make them successful, and no doubt companies are, or will be, looking at technologies to achieve this. There are already projects outlined to support such moves, including the largest power generating company in Japan issuing a tender for the supply of 5,000 b/d low emissions ammonia as a replacement for coal use by 2027.

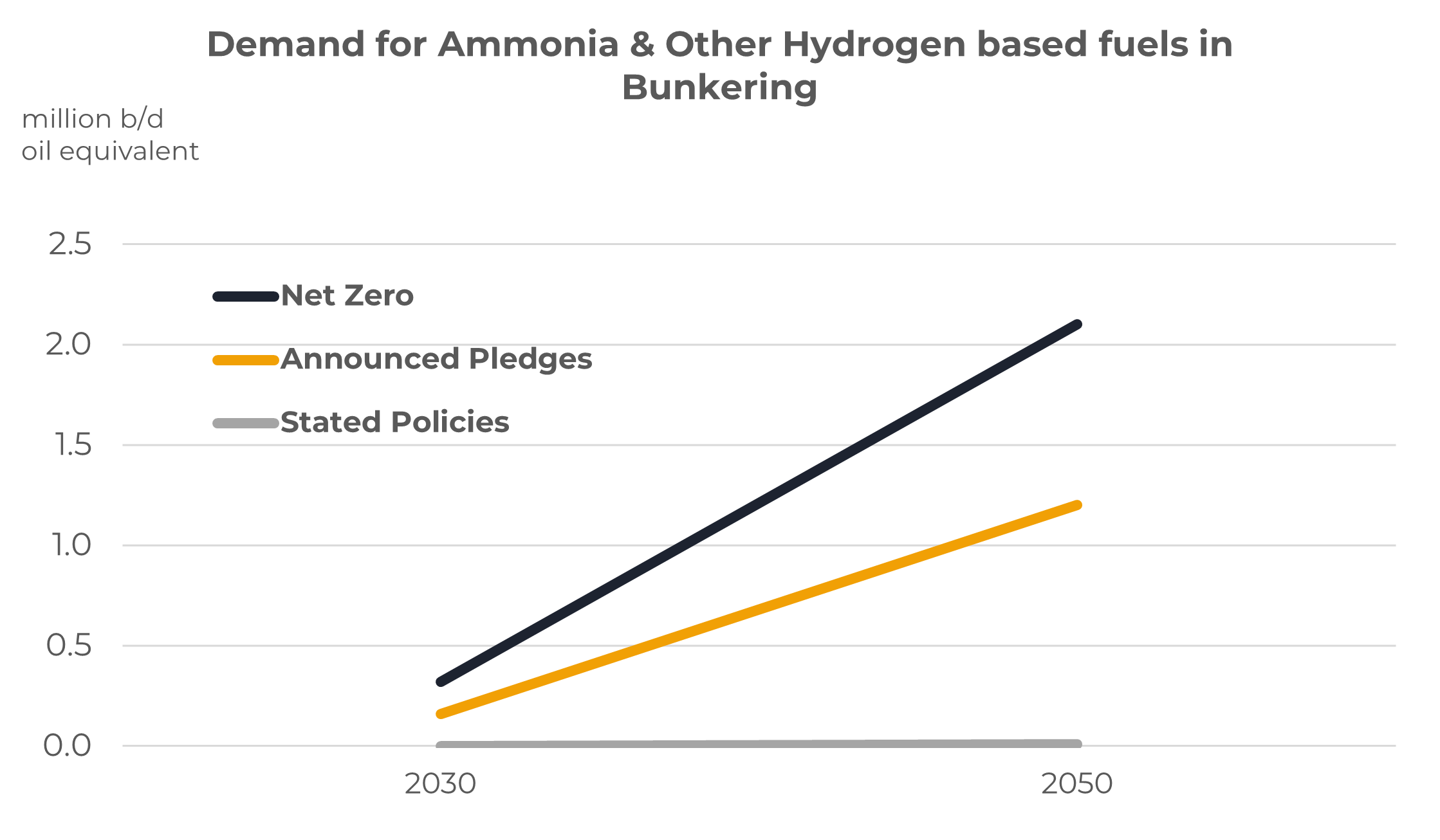

The chart below illustrates the IEA’s views on ammonia and other hydrogen-based fuels (such as methanol) in the shipping sector. This illustrates negligible levels in the Stated Policies case, BUT if we move more towards the Announced Pledges case then these ‘new’ fuels could account more than 1 million b/d (oil equivalent) of the market, which will be close to 25% of all sales.

Source: Integr8 Fuels

In the Net Zero scenario the ‘new fuels’ would account for around 50% of the market by 2050. In both cases the trend is clearly established; a move away from oil and one towards low emissions alternatives.

In all of this the timings outlined in studies may be ‘ambitious’, but given the pressures that were on the IMO to make the shift from high sulphur to low sulphur fuels in what was initially seen as a tight timeframe, we should not under-estimate any potential policy changes at the IMO, even with all of the issues, costs, infrastructure requirements and supplies. It’s likely to be when, not if!

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Bunker prices down again; is there more to come?

September 30, 2022

“It’s the economy…..”

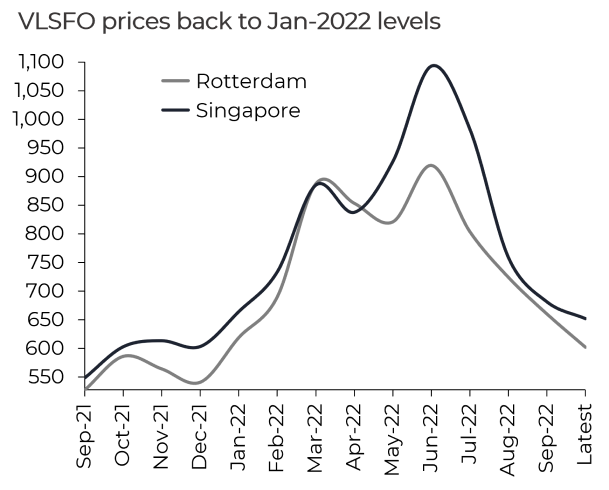

VLSFO prices are now back to levels at the start of this year. After all the extremes of this year, centring on the Russian invasion of Ukraine and mid-year tightness in the products markets, the hot topic has now come back round to the global economy; it always does. It’s an occasion to re-use a slogan from the 1992 US election; “It’s the economy, stupid”.

Source: Integr8 Fuels

Crude prices down and VLSFO down even more

Brent crude futures prices are also back to where they were in January this year, in the low $80s. Looking back over the past 12 months, the graph below shows that VLSFO prices tracked crude upwards through to May, with the war in Ukraine pulling underlying prices much higher. However around mid-year, VLSFO prices surged well above the more stable crude oil market. This followed extreme tightness across the diesel, gasoil, jet and gasoline markets (refinery margins at the time hit record highs).

Source: Integr8 Fuels

Source: Integr8 Fuels

The sharp fall in crude prices of around $40/bbl since mid-year has been mainly driven by economic concerns, with much lower global economic growth and downwards revisions to future oil demand. There have been some other contributing factors, such as government releases of strategic oil reserves and a greater confidence in world oil supplies. However, it is now fears about the global economy that are heightened and taking centre stage, overtaking concerns about the fallout from the Russian invasion of Ukraine and tightness in oil product supplies.

It is now clear to see that not only has the underlying price of crude fallen back, but that the extreme tightness in products has gone. With this, Singapore VLSFO prices have fallen by a massive $450/mt (40%) since mid-year, and are now back in line with crude price movements.

Other factors worth keeping an eye on

At least for the near-term, crude price movements are likely to determine where VLSFO prices go, and the signs for the crude market are weak. This follows the trajectory of a collapsing economic outlook and constant talk about weakness across almost all markets, including the oil sector.

There are a few other aspects to keep an eye on, such as dynamics in the Chinese market potentially pushing more gasoline exports into the region, which could lead to lower Singapore VLSFO prices. But in contrast, gasoil/heating oil prospects are relatively strong going into the northern hemisphere winter, and this could be even greater with the switching from natural gas to oil in the power generating sector. However, the potential downs based on gasoline, or ups based on gasoil/diesel are only likely to be price sensitivities around what is happening to crude, and again, this looks weak at the moment.

What about HSFO?

The subject of switching from natural gas to oil in power generation brings this neatly into the HSFO market and future prospects. It is a given that there will be switching into oil, just the volumes that are in question. In terms of additional oil products going into power, this will be for fuel oil and gasoil. The fuel oil element will have a direct impact on the HSFO bunker market and so we are keen to keep watching this.

Looking at the HSFO market over the past 12 months, like VLSFO, HSFO prices tracked crude upwards through to the earlier part of the year and had a minor surge in April. However, HSFO prices never saw the huge relative rise that VLSFO underwent around mid-year, which was driven by the extreme tightness in lighter end products.

Source: Integr8 Fuels

Since April (through the northern hemisphere summer) HSFO prices have fallen faster than crude and Singapore HSFO prices are now at their lowest since August last year. There will be the same underlying downwards pressures on HSFO prices if crude does continue to fall. However, it is highly likely that HSFO will strengthen relative to crude as we move through the winter period, especially if there is an early cold snap in Asia. This is because there is the greatest flexibility to switch from natural gas to oil in the Asian power sector.

It’s still all about the economy

In summary, there are mixed signals for VLSFO prices relative to crude, depending on weaker gasoline or stronger gasoil/diesel. HSFO prices are likely to rise relative to crude as we go through the northern hemisphere winter on the back of a seasonal rise in fuel oil demand and potential additional requirements into power generation. However, the big question is still ‘what happens in the global economies and how this will impact on crude prices?’; this will determine where bunker prices go.

Looking at what the World Bank is saying

It is very difficult to find a positive economic outlook out there (unless you listen to some government rhetoric!). Talk is of much higher inflation and lower growth rates than we have seen for many years, across all the big economies. Central banks/governments are already shifting policies towards raising base rates and expectations are that these could hit 4-6% in an attempt to manage inflation and economic pressures; this after years when rates remained close to 0.5%.

The World Bank has just published a report titled ‘Is a Global Recession Imminent?’ and although it may be one of the more pessimistic views, it is also one of the most recent reports. The report looks at prospects over the next two years and has used an economic model of previous recessions to compare with the current economic position and developments. They have outlined three scenarios and the bottom line is:

Scenario 1: Current monetary policies will not be enough;

Scenario 2: additional fiscal measures could halt a recession, but we would still be in a sharp

downturn, with inflation remaining ‘high’;

Scenario 3: it’s a ‘doomsday’ scenario.

However you look at it, this is not a good economic outlook and would suggest a strong likelihood of economic weakness and for us in the bunker sector, lower bunker prices.

The World Bank does indicate that policy makers will have to follow a very narrow path to avoid recession. This includes managing supply and demand factors, balancing price stability and managing debt, as well as even being prepared to reverse policies that are aimed at supporting growth!

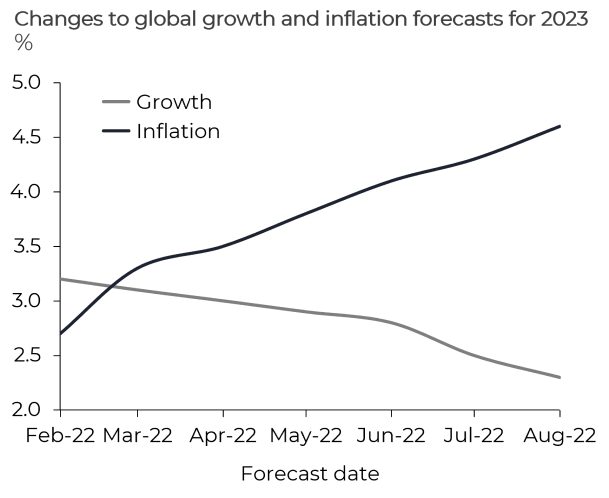

A picture to show the change in economic sentiment

Rounding off with a picture, the graph below is from the World Bank’s report and it illustrates how perception of the global economy has changed so much this year. Back in February this year (just 7 months ago), global growth projections for 2023 were at 3.2% and higher than inflation, at 2.7%. Latest indicators (from August) put 2023 forecast growth at 2.3%, and inflation well above this at 4.6%.

Source: Integr8 Fuels

It’s now over to governments and central banks

The tone of this report is towards a gloomy economic outlook, and one which would imply lower oil and bunker prices. As we have already seen this year, situations can change quickly, but at the moment the global economy is the main talking point and it doesn’t look good.

Steve Christy, Research Contributor

E: steve.christy@integr8fuels.com

It is worth looking beyond the bunker market for price direction

August 26, 2022

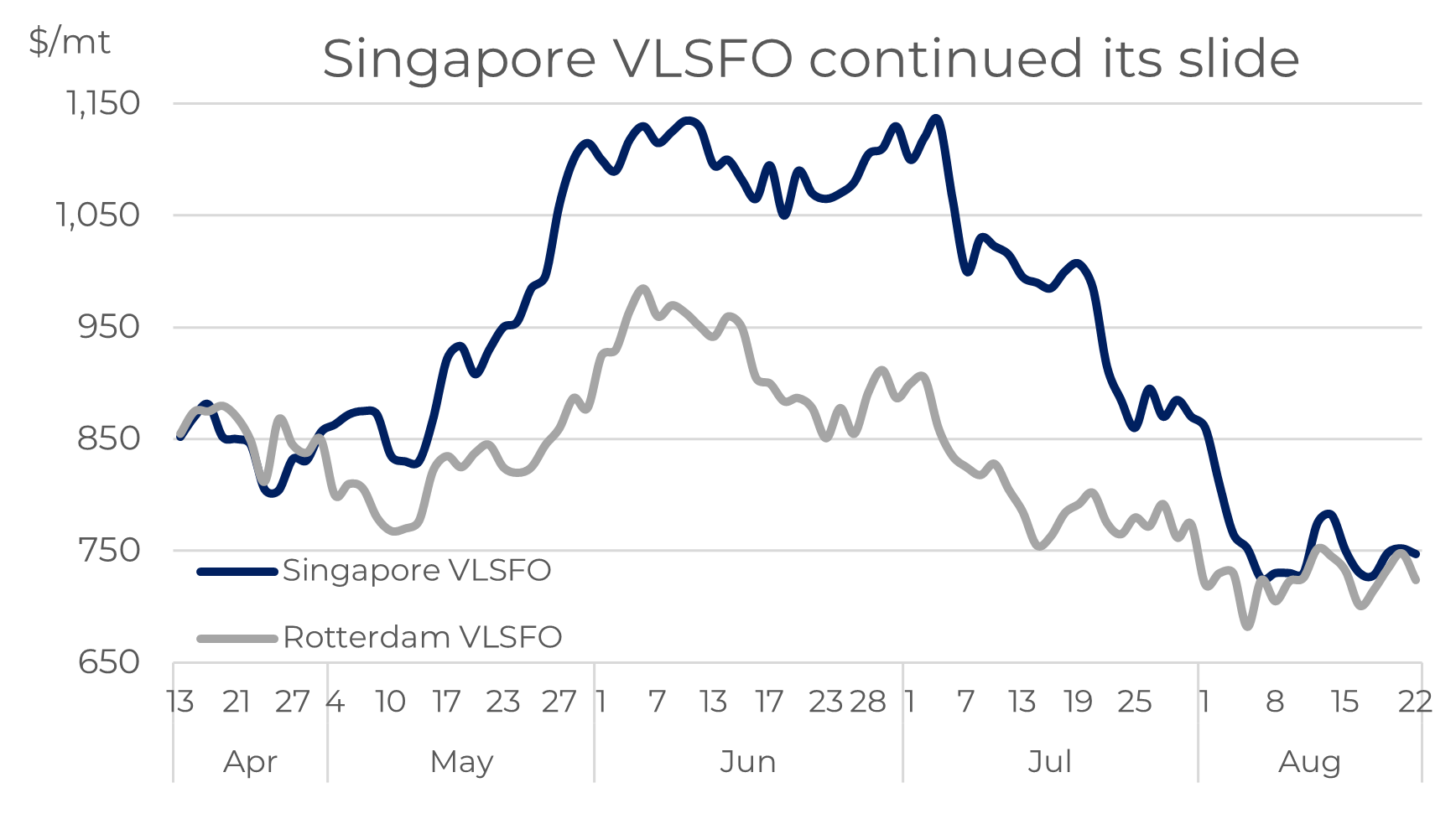

VLSFO prices have continued to slide, but the outlook is very murky

VLSFO prices in Singapore are down even further to around $750/mt and also back in line with prices elsewhere, such as in Rotterdam. But when you look for a steer on the price outlook, the picture becomes pretty murky.

Source: Integr8 Fuels

Everyone is looking at sky-high natural gas prices

This is one of those occasions when it is worth looking at the much bigger picture beyond bunkers and even beyond the oil industry, and at the moment there is a huge focus on natural gas from governments, industry and consumers.

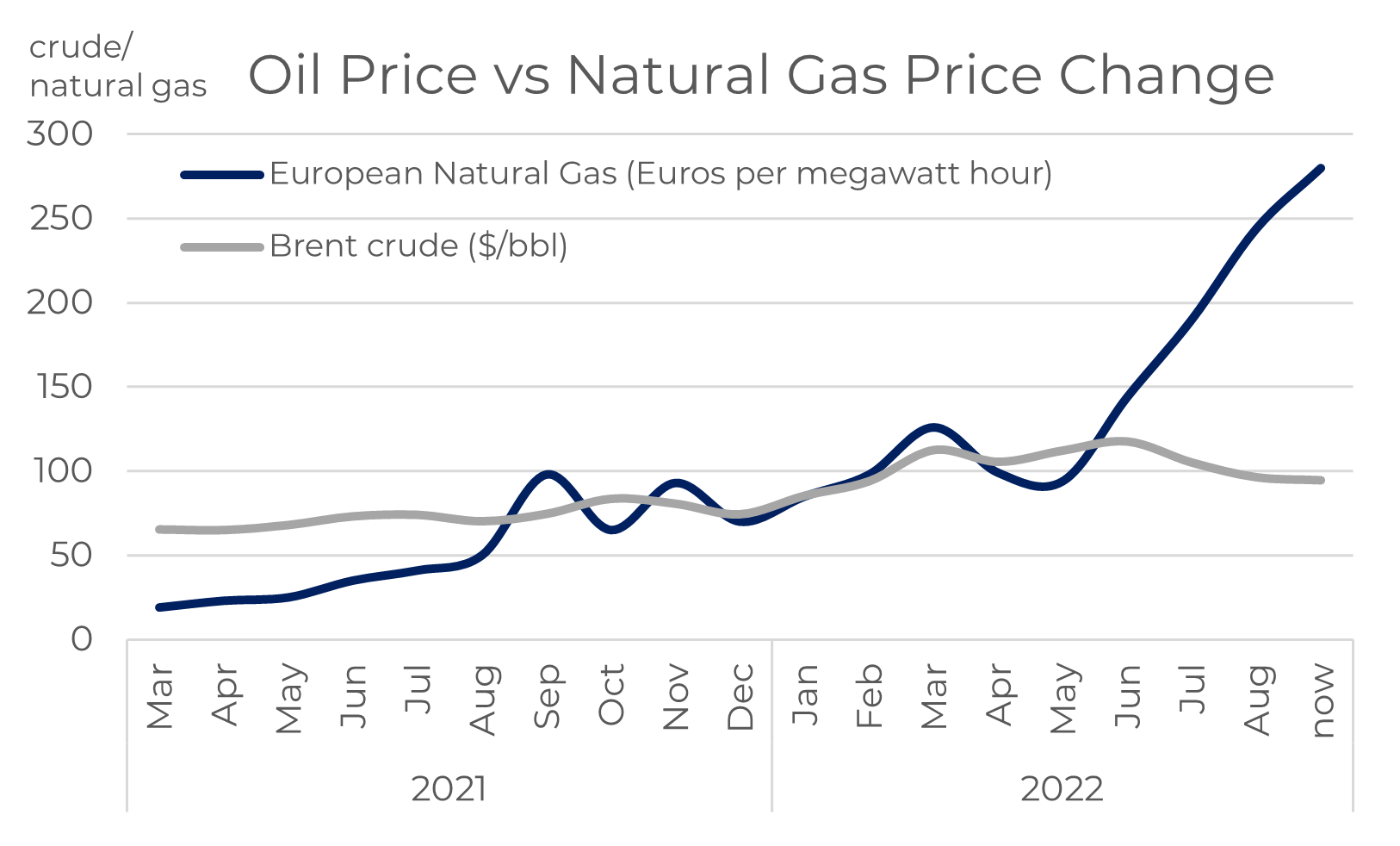

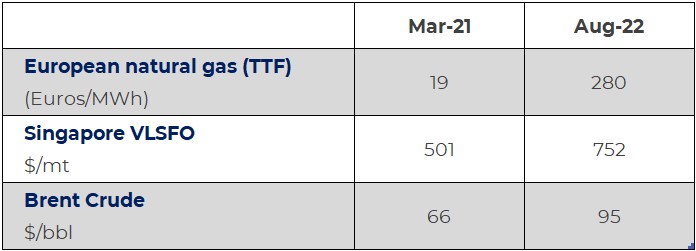

To put this in context, current Brent crude oil prices are around 45% higher than 18 months ago; Singapore VLSFO is slightly higher, at 50% more, but the benchmark European natural gas price (TTF) is 1,500% more! We have seen what we believe as huge volatility in bunker prices, but this is nothing compared to what is happening in natural gas markets.

Source: Integr8 Fuels

Source: Integr8 Fuels

Source: Integr8 Fuels

Source: Integr8 Fuels

This is one of the political fallouts from the Russian invasion of Ukraine, and has created a nervousness around many commodity markets and prices, but especially natural gas. Russia supplies around 40% of Europe’s gas needs and so Europe has a direct vulnerability. In late July Russia said it would limit natural gas supplies to Europe, which led to a price surge and then just a few days ago Russia announced an unscheduled 3-day shutdown of the main gas pipeline from Russia into Europe (Nord Stream 1) and European natural gas prices went up a further 20%.

But this isn’t just a European issue; with Europe taking increasing volumes of US LNG supplies, this leaves less for other international markets, and so the supply and price impact is global.

Across the board, energy costs are significantly higher and a major contributor to inflationary pressures, but natural gas is something else and it is no surprise that this is having a devastating impact on government policy, industrial costs and consumer concerns and responses.

The economic fallout suggests lower oil & bunker prices

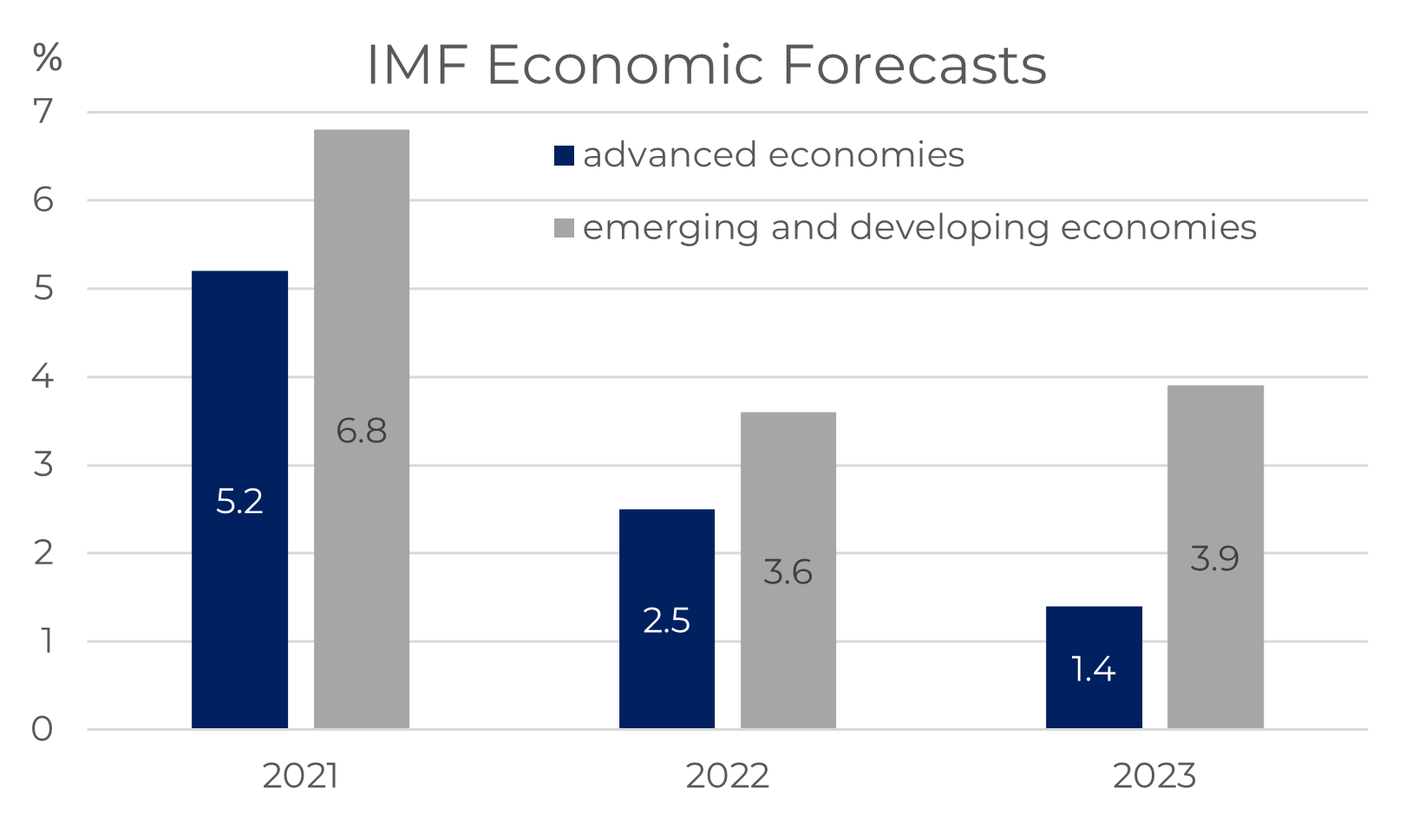

The economic threat from these high energy prices is well documented, with all the major economic forecasters tending to raise their projections for inflation and interest rates and revise down their projections for growth. At the same time, they are saying there are still major risks to the downside. The latest projections from the IMF show the declining position and the most extreme pressures on the advanced economies of Europe and the US.

Source: Integr8 Fuels

There is already a major effect, with crude and oil product prices down and Singapore VLSFO prices dropping by $250/mt over the past month.

On the one hand these pressures would typically lead to weaker global oil demand and potentially even lower bunker prices. However, this may not be the case.

No easy sign of a steep rise in oil production to take prices lower

OPEC has re-affirmed its position that it is not going to hike oil production, with the new secretary-general (from Kuwait) making public statements that current high prices are because of external influences and that OPEC is already “doing its part”.

The latest EIA forecast for US crude production shows output going up by 0.9 million b/d over the next 12 months, but this is a gradual and relatively modest rise in the global context. There are also questions about the ability to source labour and equipment in the shale oil sector to support this rise. So, there is no quick fix from higher US production.

The one possibility for a production hike is if there is a successful conclusion to the US/Iranian nuclear deal and a lifting of Iranian sanctions. Oil prices will fall on the news and we could see a subsequent increase in crude output of around 1 million b/d over 6 months or so. There is often talk of an agreement on the horizon, but this is one where we just have to wait and see.

Therefore, without an Iranian deal, it is unlikely that we will see a sudden surge in crude production, which would lead to a further drop in oil and bunker prices, at least on a short-term basis.

We may think oil demand will be weaker, but no!

The other aspect that could reduce oil and bunker prices is weaker growth in oil demand. The bottom line for most consumers in current circumstances is to attempt to limit consumption. In the oil industry all the economic pointers would suggest consumer responses to use less oil, and signs are already there about people driving less because of the hike in gasoline prices. BUT despite this, the IEA has just raised its forecast growth in global oil demand by 0.4 million b/d for this year. This is because with natural gas prices at such high levels, industries are looking to switch from natural gas to oil where possible.

Although nowadays there is not a huge ability for commercial, industrial or power companies to switch from natural gas to oil, at the margin this does have an impact, and in winter the developments are likely to be even more pronounced.

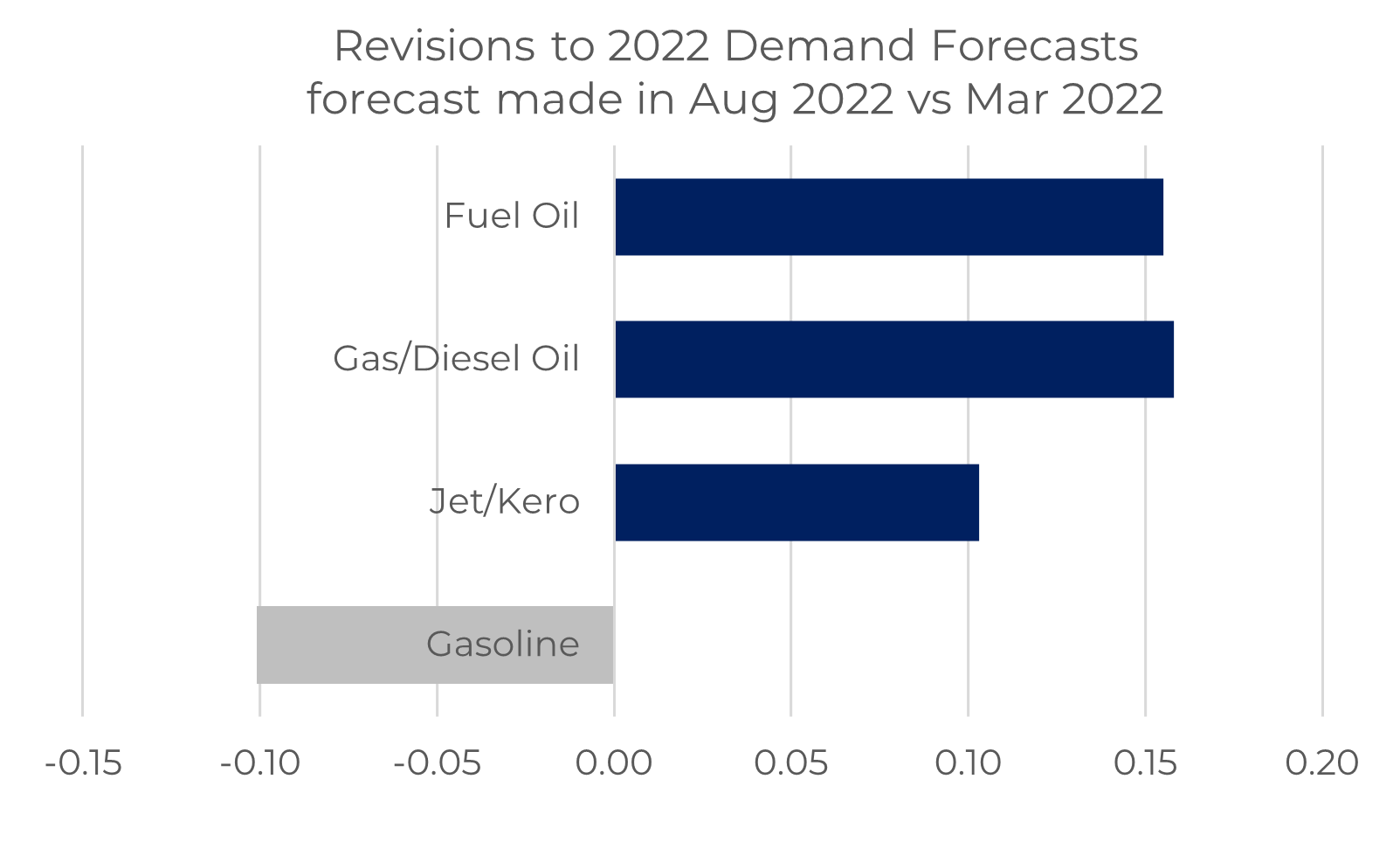

Some European industries are already moving towards heating oil as a replacement for natural gas and in the northern hemisphere winter we can expect higher demand for fuel oil into the power generation sector, especially in some Asian countries. Current forward curves would indicate these conditions continuing through to end 2023 (although forward curves can change quickly).

On the back of exceptionally high natural gas prices and the switching process, the IEA has raised its forecast demand for fuel oil this year by 150,000 b/d and gas/diesel oil by 160,000 b/d since their March outlook. At the same time, they have raised their outlook for jet demand on increased air travel and downgraded their views on gasoline demand in response to higher prices.

Source: Integr8 Fuels

High natural gas prices mean a support to bunker prices

Extra oil demand from this switching is split around 50:50 between heating oil and fuel oil and so likely to prop up bunker prices; additional heating oil demand will have an indirect impact on VLSFO availabilities and pricing, and additional fuel oil into power generation will have a direct impact on the HSFO market.

Therefore, in the near term there appears to be conflicting issues surrounding oil and bunker price direction, with ‘conventional’ demand forecasts under downwards threat, but demand from switching from natural gas to oil potentially outweighing this and lifting oil demand forecasts.

In conclusion, a lot of the headline news may suggest bunker prices falling, but when you scratch below the surface it may not be so obvious.

Given all of this, Russian natural gas exports to Europe could be something to watch as a price indicator for bunkers.

Steve Christy, Research Contributor

E: steve.christy@integr8fuels.com

What is the best indicator for bunker price direction?

August 2, 2022

VLSFO prices finally fall – down $270/mt in Singapore

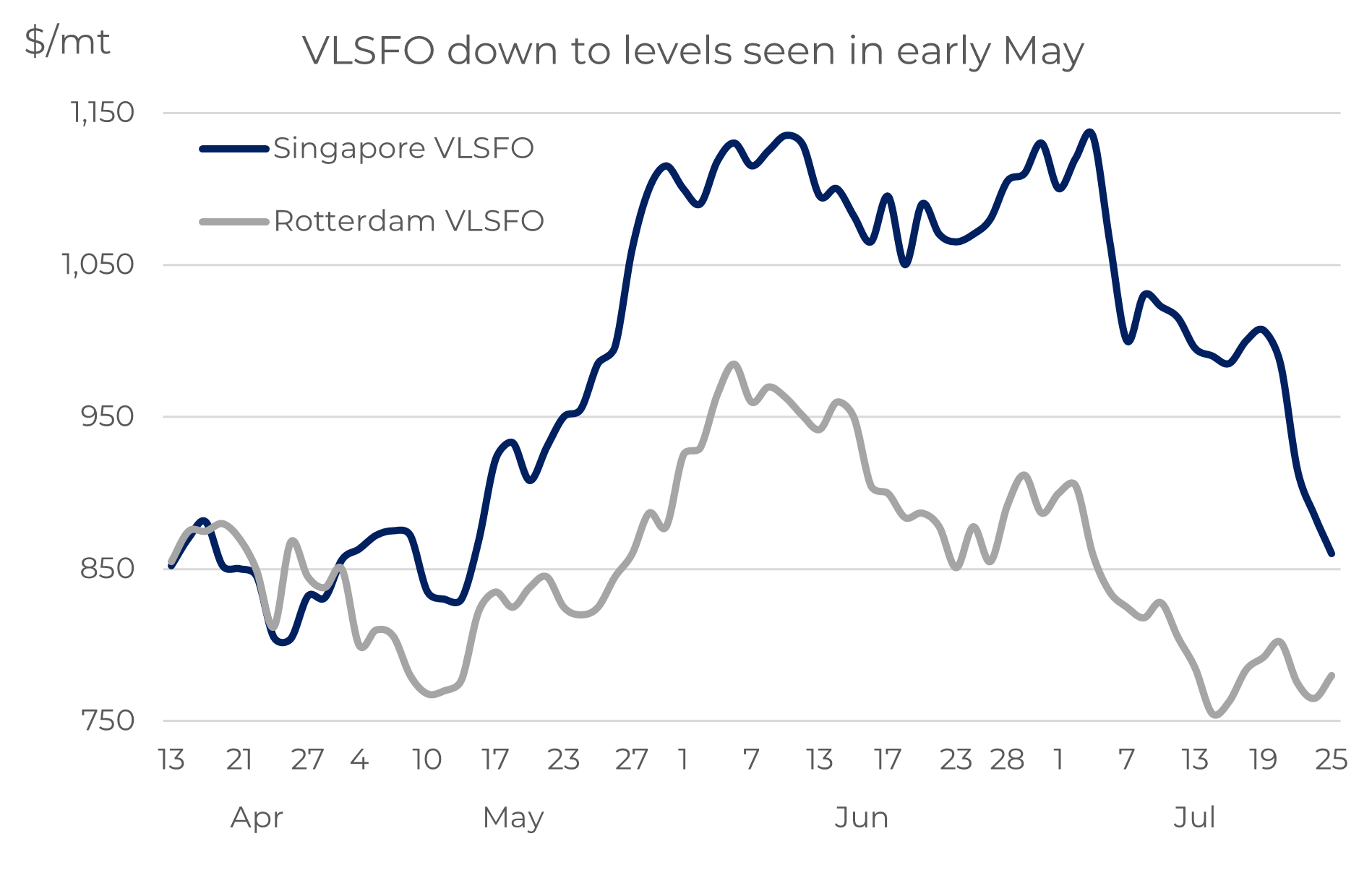

After almost 2 months of Singapore VLSFO prices being above $1,000/mt, we have finally seen an easing in the market. There have been two sharp price drops this month and Singapore VLSFO is now back to around $860/mt; still historically high, but at least similar to levels in early May.

Source: Integr8 Fuels

VLSFO prices have also fallen in Rotterdam, but with prices already significantly lower than Singapore, the drop was not by as much. So far this month Rotterdam prices are down by around $100/mt to $780. It does mean the difference in VLSFO between the two locations has narrowed massively from around $250/mt to $80/mt currently, but this compares with an average differential of only $25/mt last year; there is still a bigger than usual difference between Rotterdam and Singapore VLSFO prices.

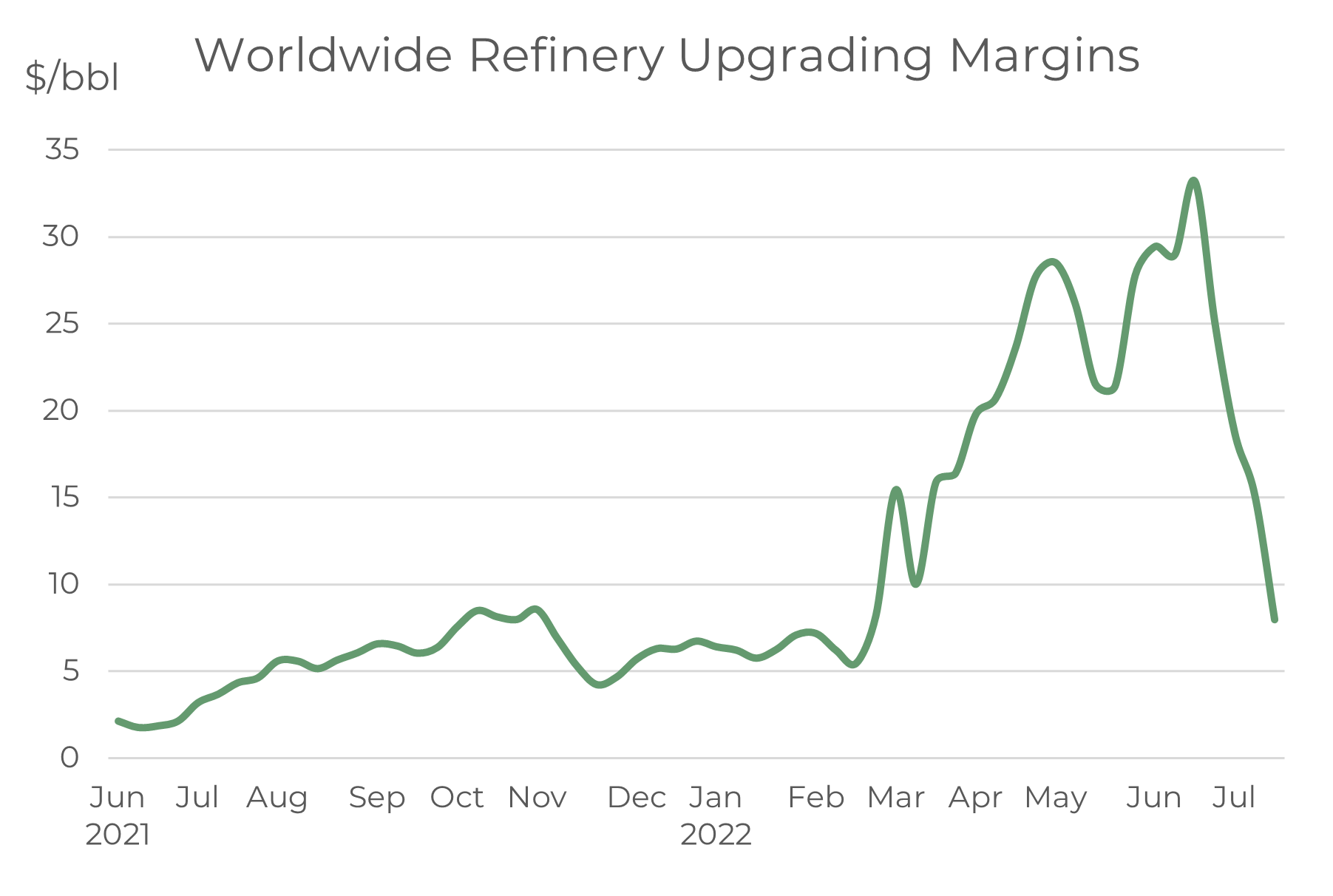

Global refinery margins are down massively

Over the past couple of months, we have focused on refinery margins as a marker of the strength in products markets and ultimately a key indicator for bunker price movements. In May and June refinery margins moved to record highs, driven by extreme tightness in gasoline, diesel and jet markets around the world. However, these margins have collapsed over the past 2-3 weeks, mainly because of far greater weakness in gasoline and diesel markets in most parts of the world (jet margins are lower but the falls have not generally been to the same extent).

Source: Integr8 Fuels

Source: Integr8 Fuels

Gasoline in the US has weakened significantly with a loss in demand from $5/gallon prices (high by US standards, but not necessarily in other parts of the world). This in turn has closed the arb on European gasoline moving transatlantic and so eased any tightness in the European market. In Asia, gasoline margins have fallen from record highs to their lowest in the past 12 months, as higher exports from China and Malaysia ease the supply concerns.

VLSFO prices have followed this exact same trend in margins, at a time when crude oil prices have generally been around $105-115/bbl.

The ‘refinery margins indicator’ reflects the heavy support for VLSFO prices in May/June, and clearly demonstrates the diminishing support for VLSFO over the past few weeks. However, with margins moving back towards more historical norms, it is now time to shift focus towards other indicators to get some feel of where bunker prices could go in the near term.

What is the next good indicator for bunker prices?

The concerns about economic threats, inflation, interest rates and even recession have ebbed and flowed. For us looking at short-term oil and bunker prices, these concerns have taken a back seat for the past 2 months; but with support for products and margins easing, talk about economic uncertainty and the negative outlook for oil demand is now likely to re-emerge.

The other ‘big picture’ feature that will affect bunker prices in the short-term is crude oil production and if OPEC+ increase output, as requested by the US.

These two factors cover both sides of the supply/demand fundamentals; possible downwards revisions to oil demand because of a weaker economic outlook and potential increases in crude oil supplies.

Will it be higher oil production that leads to lower bunker prices?

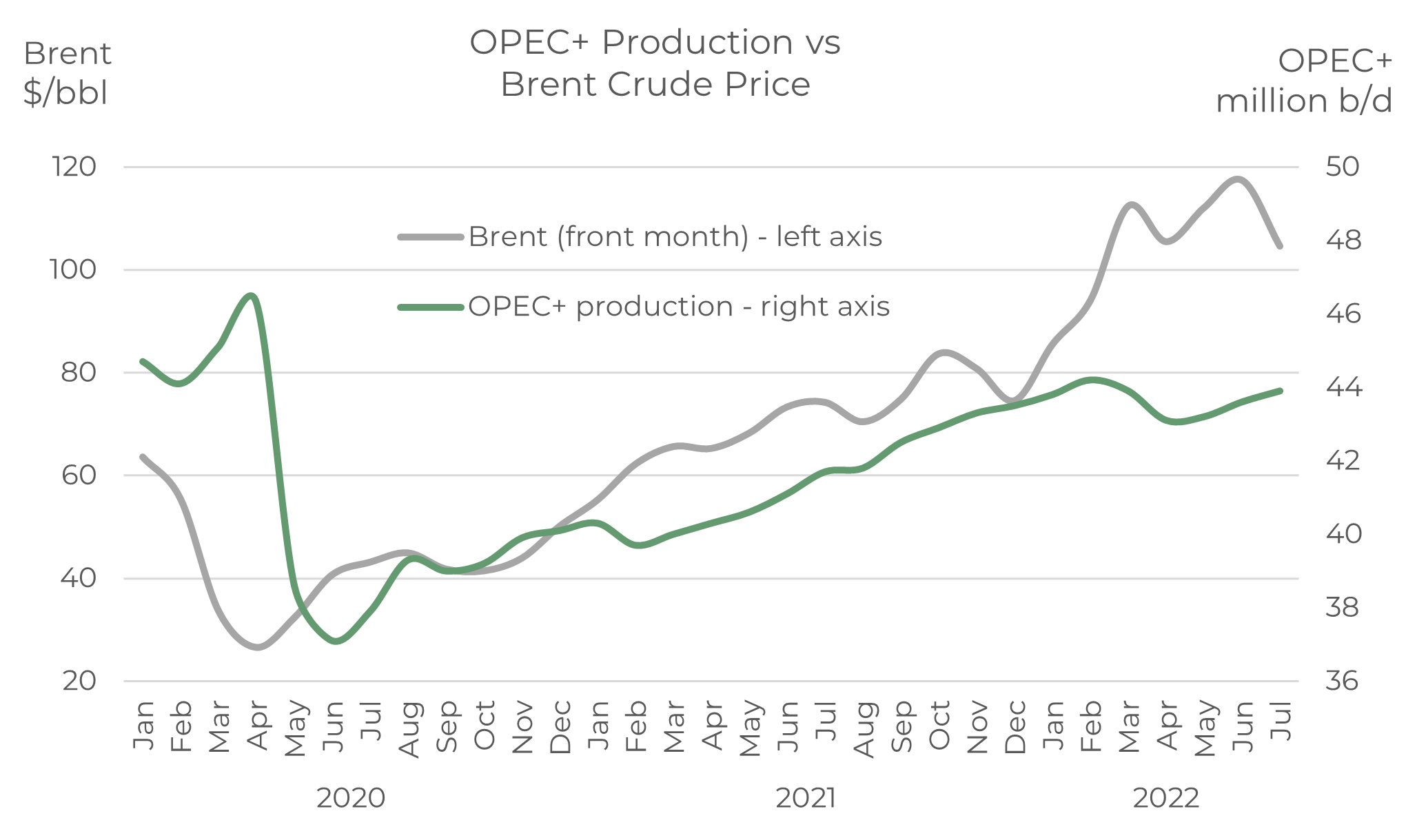

Historically OPEC manages the marginal barrel of oil supply and has generally responded to sharp movements in oil prices; increasing output when prices are ‘too high’ and cutting production when prices are ‘too low’. The extremes of the covid situation clearly show this strategy in the graph below, with Brent prices falling from the low $60s to the low $20s at the start of the pandemic and the expanded group of OPEC+ slashing output by 8 million b/d (almost 20%).

Once the pandemic started to ease, leading to oil demand and prices rising, so OPEC+ raised production back towards earlier levels. This all continued on the ‘usual’ strategy through to earlier this year and just before the invasion of Ukraine.

Source: Integr8 Fuels

However, since the Russian/Ukraine conflict started in February, Brent prices have risen from $85/bbl to around $105-115/bbl and OPEC+ production has not increased at all. There was actually a dip in output in March/April, but this was largely due to the loss of Russian production. However, even excluding Russia, production from the rest of the OPEC+ group has not increased at all since the invasion.

There is a lot going on at a country level within the OPEC+ group. Libyan output is currently around 0.3 million b/d lower than in January because of political tensions and protests, although it looks as though it is now increasing. Kazakhstan crude output is also down by around 0.3 million b/d, with problems surrounding exports passing through Russia and loading at Russian terminals; Kazakh crudes have been renamed in order to ease this. Output from Nigeria has also fallen by 0.3 million b/d.

There are also problems in many OPEC+ countries, where insufficient E&P spending has meant production capacity is below their allocated quotas.

This means most countries in the OPEC+ group do not have the capacity to raise output, even if quotas are increased. It is left to the few OPEC+ countries that do have spare capacity to set the strategy; namely Saudi Arabia, UAE, Kuwait and possibly Iraq. In all of these Saudi Arabia is by far the most influential.

Over recent months these ‘spare capacity’ countries have increased output by around 0.9 million b/d, but this only compensates for losses in output elsewhere within OPEC+.

Source: Integr8 Fuels

So, excluding Russia, current OPEC+ production is the same as it was back in January, and oil prices are some $20-25/bbl higher.

The US has made numerous calls for OPEC+ to raise production in response to prices going above $100/bbl. President Biden even made a trip to Saudi Arabia two weeks ago, but the calls appear to have come up with nothing in terms of a Saudi response to increase output; and it is Saudi Arabia that is likely to be the decision maker for OPEC+ strategy.

Not refinery margins; Not likely oil production. Is it the economy?

So, all the indications are that refinery margins have run their course to historic highs and now back towards historic norms, so these are no longer the most useful indicator for bunker price direction.

In terms of a production increase to reduce oil prices, Saudi Arabia is the linchpin here and the one to watch, but it currently shows no signs of hiking output; there will be increases in US shale production, but these will be gradual.

Outside of this, the next thing to watch is sentiment and direction in the economy. Bearish signals here may be the only thing that takes down oil and bunker prices in the near term. Lower prices are what a lot of people want, but this probably isn’t the best way to get them!

Steve Christy, Research Contributor

E: steve.christy@integr8fuels.com

Download this article as a PDF »