Economic concerns are a forefront, but are fears easing for 2023?

Argentina needed stable to falling bunker prices

Analysts are always looking to find what is driving things and what are the outcomes. As a side issue, the following analysis perhaps shows why our market can take some credit for the Argentinian footballing success.

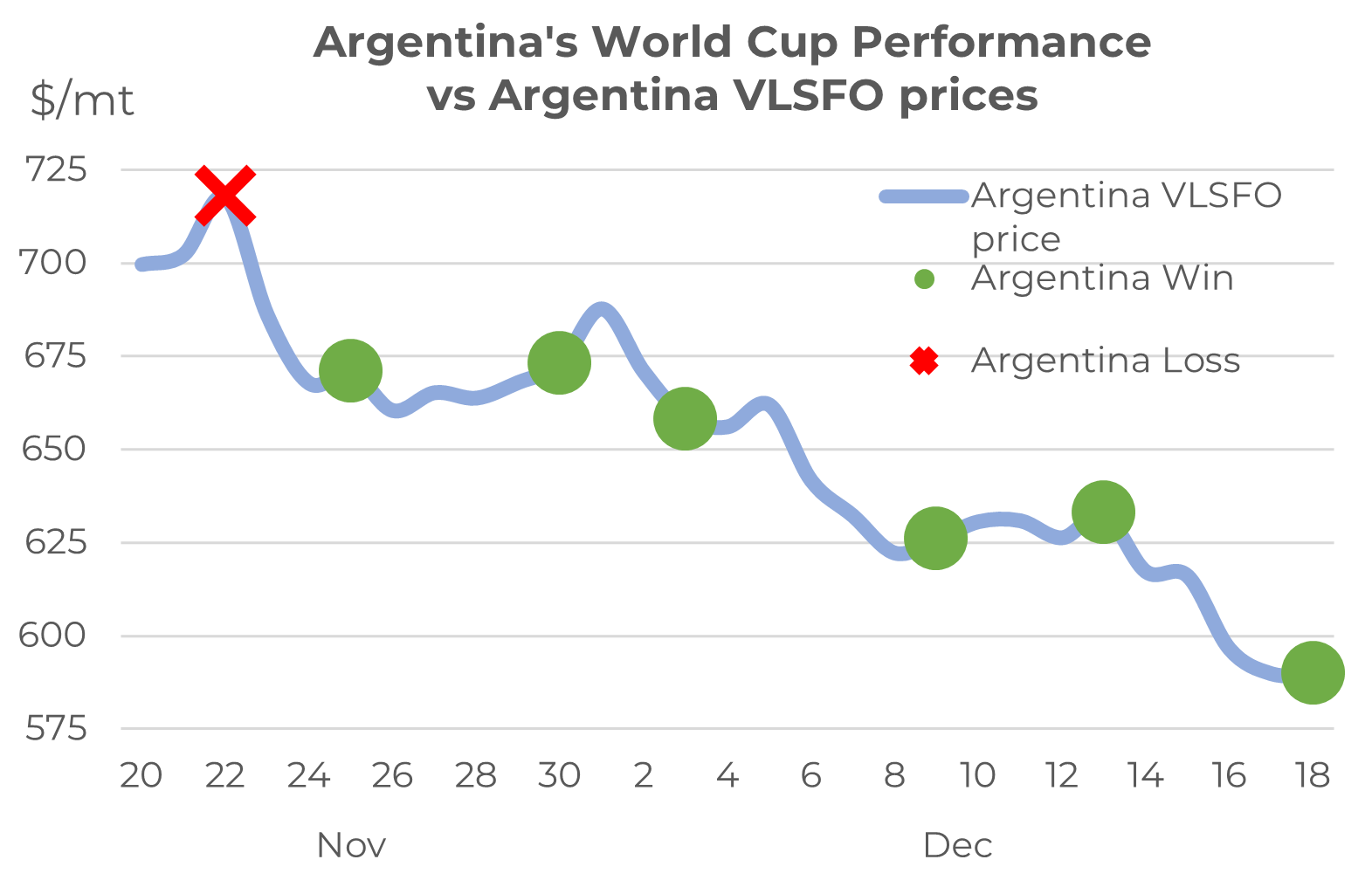

The World Cup started on 20th November and in those early days Argentinian VLSFO prices were rising. In this rising market, on 22nd November, Argentina lost 2-1 to Saudi Arabia in one of the ‘shocks’ of the tournament! After this, Argentina VLSFO prices reversed and fell sharply and with it the team performance turned around with a 2-0 win against Mexico on 26th November. Prices were then broadly stable to the next match on the 30th and Argentina won 2-0 against Poland; luckily for Argentina the match wasn’t played the next day, when Argentina VLSFO prices rose to another peak and Argentina would have lost.

Prices then fell again and again, and there were two wins on the trot. The semi-final was on the 13th December and there must have been some concern in Argentina as local VLSFO prices edged up a bit, but not enough to affect a win.

Source: Integr8 Fuels

And then, in the 5-day run-up to the final, Argentina VLSFO prices fell sharply again, by another $43/mt. The final analysis is clear, Argentinian VLSFO prices were down a lot in the run-up to the final and so Argentina were always going to win.

It will be interesting to see how many international football managers start looking at their local bunker prices at the next World Cup!

Crude & VLSFO prices are now at their lowest this year

Back to ‘more regular’ analysis. Since the start of this year the concerns on global economic performance have been major headlines in all business. For us in the bunker market we have been continually looking at the prospects of lower prices, and finally we now have the lowest prices of the year!

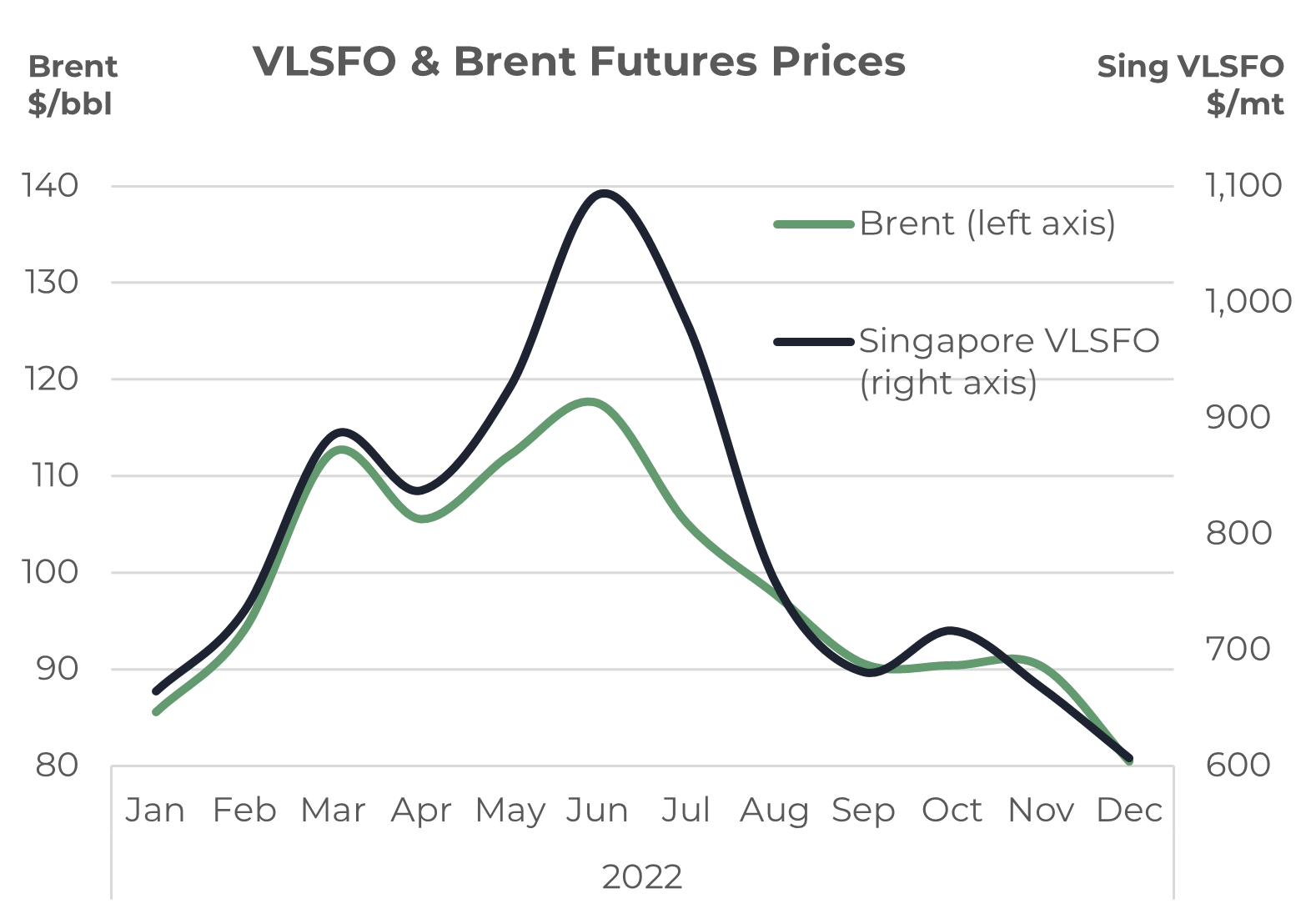

There are a number of reasons why VLSFO had not hit this low point earlier. The extreme tightness in jet, distillate and gasoline around mid-year led to record high refinery margins and was probably the biggest supporting factor for VLSFO prices. The graph below shows the mid-year VLSFO price spike and its strong premium to crude at the time.

Source: Integr8 Fuels

Since mid-year, crude has been on the slide and VLSFO has dropped by even more, to fall back into line with crude.

Over the past month we have seen another fall, with Brent futures down $14/bbl and Singapore VLSFO $85/mt lower. This has left the December average to date at $80/bbl for Brent front month futures and $600/mt for Singapore VLSFO. All the pointers show the gloomy economic picture has finally filtered through to oil and bunker prices.

Are prices going to continue falling, or are changes in the wind?

Now we are here, is the picture for 2023 just as gloomy on the economic front and are there pointers for a further drop in bunker prices? If you asked this question a couple of months ago, the answer was probably “yes”. But today there seems to be a hint towards a turning point.

Oil demand looks stronger than we thought

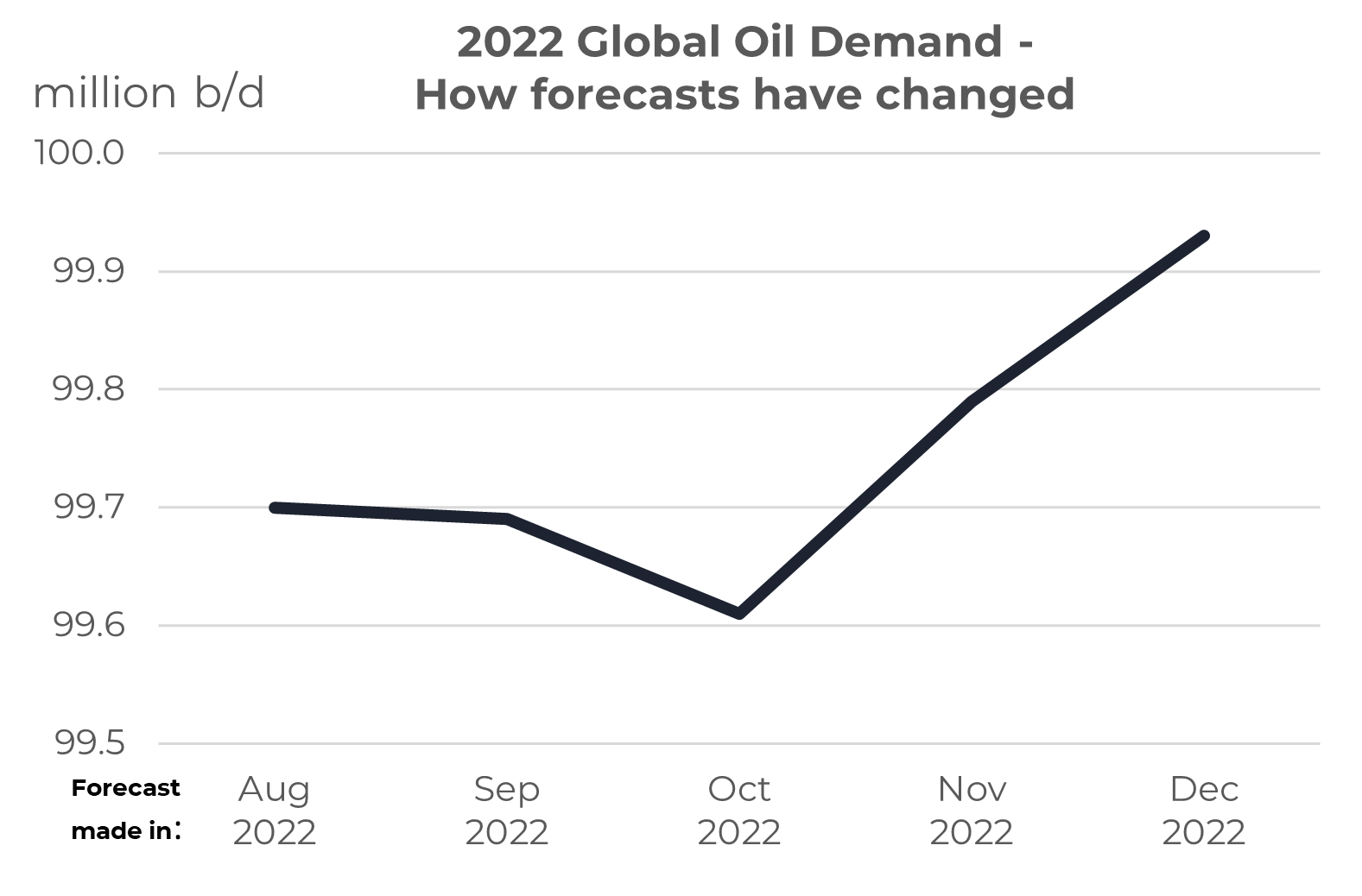

The IEA is a key reference in measuring and reporting on global oil demand. It was no surprise that in their September and October monthly reports the forecast for 2022 oil demand was being downgraded; down from an annual average of 99.7 million b/d to 99.6 million b/d. However, in their November and December reports they have made major upwards revisions to the demand figure for 2022, now up to 99.9 million b/d.

Source: Integr8 Fuels

Something has made the IEA more optimistic than they were for oil demand this year. It seems demand in China and India is more positive than previously assessed, with the Middle East also stronger than anticipated (not just because of activity around the World Cup). The main product focus here is gasoil, where demand is rising despite ‘high’ consumer prices. The key drivers have been: industrial activity has been higher than expected and the switching from natural gas to gasoil has exceeded previous expectations.

However, demand in the OECD is nowhere near as strong, especially Europe. A more positive spin can be put on the US, with latest US economic data better than expected and the inflation rate on a downwards trend, but it is still at 7%.

Oil demand forecasts for next year are being revised upwards

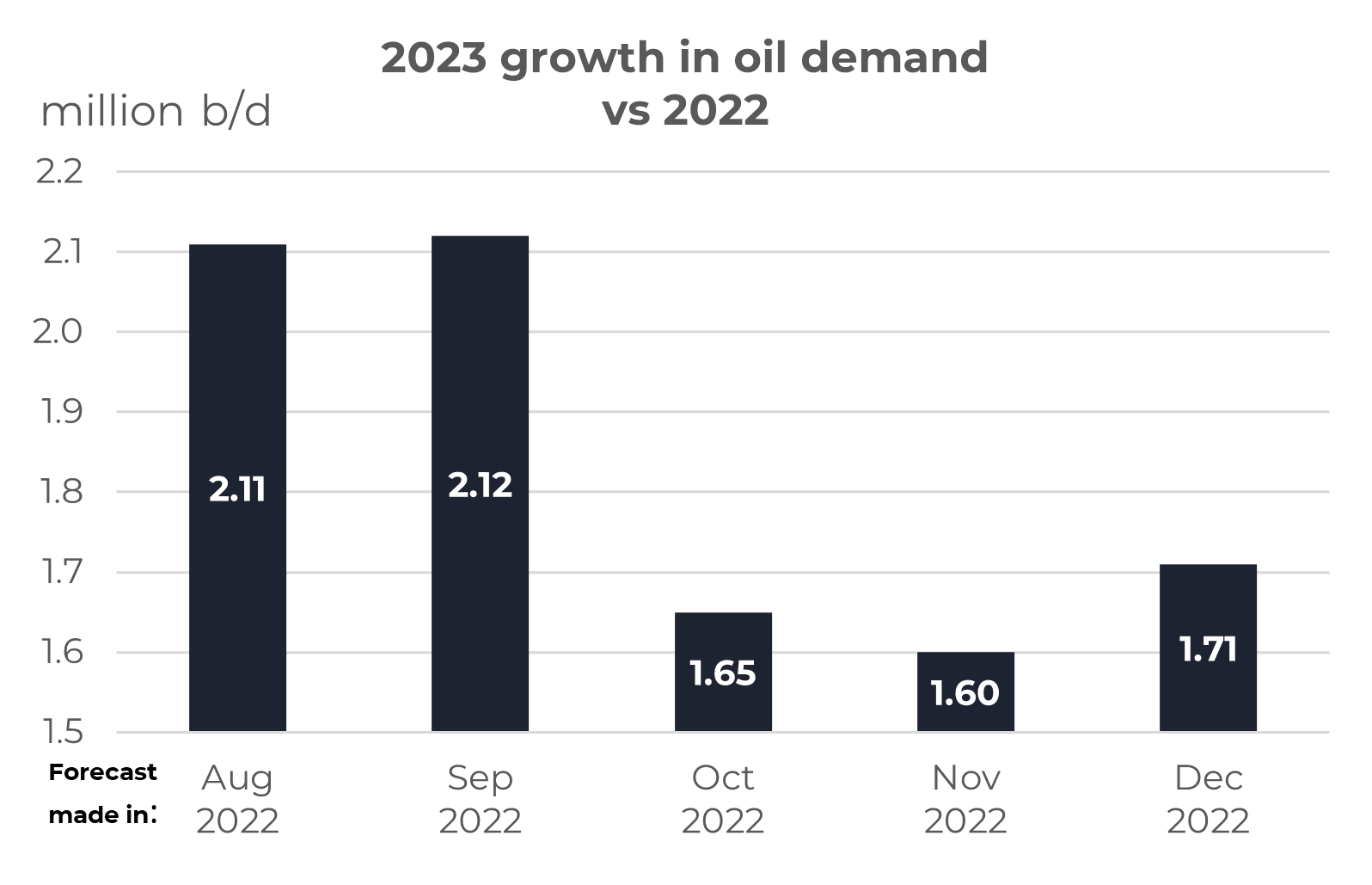

This more ‘bullish’ view on non-OECD oil demand has been carried through into next year, with the IEA revising up its forecasts for overall oil demand growth in 2023. Forecasts made by the IEA in August and September indicated growth in global oil demand for 2023 at 2.1 million b/d. The turning point in their forecast came in October, when this was revised down to growth of only 1.65 million b/d. In November they made a further adjustment down. However, in their latest report from last week, the forecast increase in demand next year has been revised upwards. The revision maybe small, but it is a reversal of what they have been saying for the past two months.

Source: Integr8 Fuels

Source: Integr8 Fuels

There are a number of contributing factors for this ‘more upbeat’ view. The better than expected recent non-OECD demand data is a starting point, but the easing in what has been a very strict Chinese covid lockdown strategy could release a lot of demand. Also, increases in jet fuel demand are expected to remain very high, with pent up demand still to be fulfilled. Also, any opening up of Chinese travel could give added impetus to the jet market.

The bottom line is that Indian growth in oil demand has been particularly strong in recent months, supported by government interventions to fix domestic fuel prices. But China is likely to take-over the position of leading growth market next year, especially with easing in COVID restrictions.

There are a number of more bullish price signals for next year

So, we have:

- Oil demand looking stronger than previously expected;

- OPEC+ apparently maintaining its position to cut and then hold production throughout 2023;

- Current supply issues surrounding Russian crude exports with the EU import ban and G7 price cap, which could be repeated in February when the EU product ban kicks in;

- No quick ramp up of US shale oil production, even though shale companies have been accused of being “un-American” with their more limited investment plans.

It’s a ‘bit cautious’ at this stage, and of course there are still potential bearish price factors such as greater economic weakness, tightening domestic policies in China, any reversal of OPEC+ strategy and of course an ending of the war in Ukraine. But based on all the factors outlined in this report, it is worth quoting the IEA when they say “another price rally cannot be ruled out”.

It is clear there is always something new for analysts to look at, whether it’s the intricacies and changes in the oil market potentially pushing oil and bunker prices back up next year, or the driving factors behind an Argentina victory at the World Cup. Let’s meet again next year to see how our market unfolds.

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.