Bunker prices down again; is there more to come?

“It’s the economy…..”

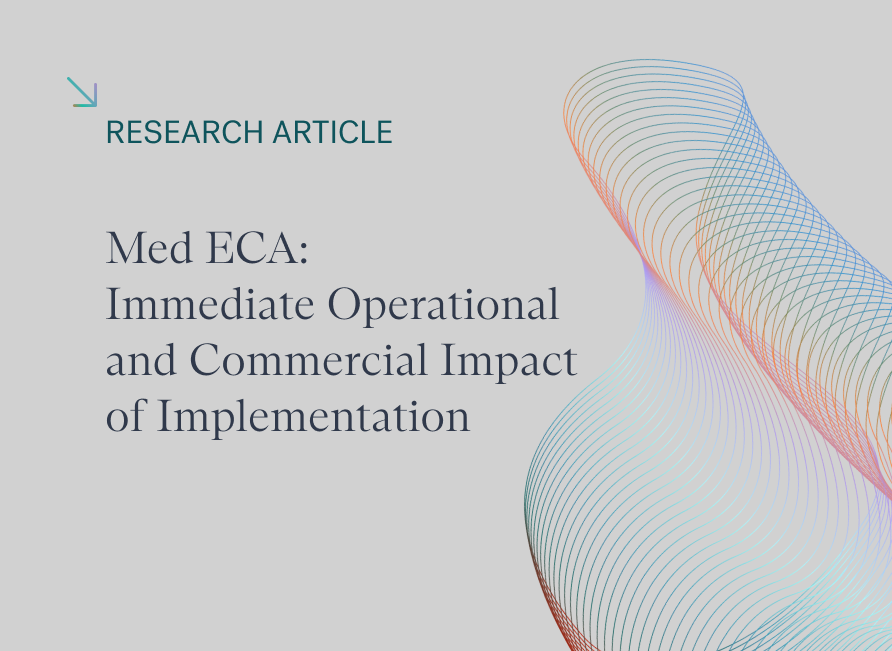

VLSFO prices are now back to levels at the start of this year. After all the extremes of this year, centring on the Russian invasion of Ukraine and mid-year tightness in the products markets, the hot topic has now come back round to the global economy; it always does. It’s an occasion to re-use a slogan from the 1992 US election; “It’s the economy, stupid”.

Source: Integr8 Fuels

Crude prices down and VLSFO down even more

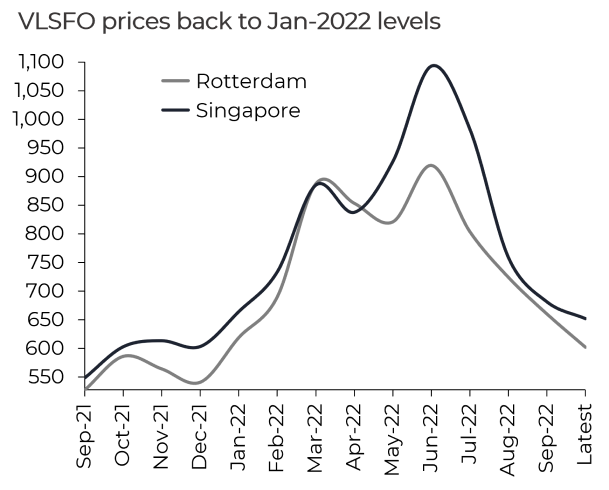

Brent crude futures prices are also back to where they were in January this year, in the low $80s. Looking back over the past 12 months, the graph below shows that VLSFO prices tracked crude upwards through to May, with the war in Ukraine pulling underlying prices much higher. However around mid-year, VLSFO prices surged well above the more stable crude oil market. This followed extreme tightness across the diesel, gasoil, jet and gasoline markets (refinery margins at the time hit record highs).

Source: Integr8 Fuels

Source: Integr8 Fuels

The sharp fall in crude prices of around $40/bbl since mid-year has been mainly driven by economic concerns, with much lower global economic growth and downwards revisions to future oil demand. There have been some other contributing factors, such as government releases of strategic oil reserves and a greater confidence in world oil supplies. However, it is now fears about the global economy that are heightened and taking centre stage, overtaking concerns about the fallout from the Russian invasion of Ukraine and tightness in oil product supplies.

It is now clear to see that not only has the underlying price of crude fallen back, but that the extreme tightness in products has gone. With this, Singapore VLSFO prices have fallen by a massive $450/mt (40%) since mid-year, and are now back in line with crude price movements.

Other factors worth keeping an eye on

At least for the near-term, crude price movements are likely to determine where VLSFO prices go, and the signs for the crude market are weak. This follows the trajectory of a collapsing economic outlook and constant talk about weakness across almost all markets, including the oil sector.

There are a few other aspects to keep an eye on, such as dynamics in the Chinese market potentially pushing more gasoline exports into the region, which could lead to lower Singapore VLSFO prices. But in contrast, gasoil/heating oil prospects are relatively strong going into the northern hemisphere winter, and this could be even greater with the switching from natural gas to oil in the power generating sector. However, the potential downs based on gasoline, or ups based on gasoil/diesel are only likely to be price sensitivities around what is happening to crude, and again, this looks weak at the moment.

What about HSFO?

The subject of switching from natural gas to oil in power generation brings this neatly into the HSFO market and future prospects. It is a given that there will be switching into oil, just the volumes that are in question. In terms of additional oil products going into power, this will be for fuel oil and gasoil. The fuel oil element will have a direct impact on the HSFO bunker market and so we are keen to keep watching this.

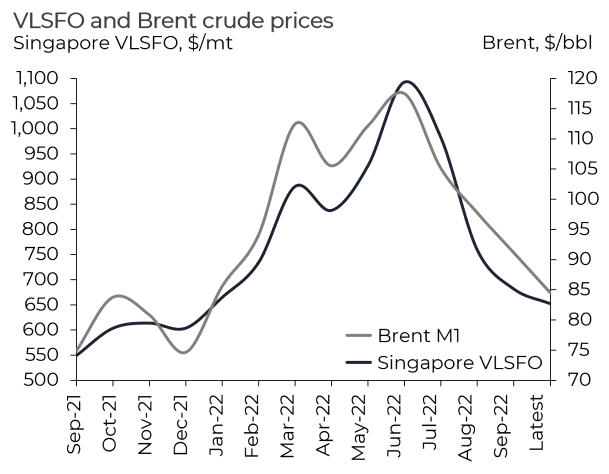

Looking at the HSFO market over the past 12 months, like VLSFO, HSFO prices tracked crude upwards through to the earlier part of the year and had a minor surge in April. However, HSFO prices never saw the huge relative rise that VLSFO underwent around mid-year, which was driven by the extreme tightness in lighter end products.

Source: Integr8 Fuels

Since April (through the northern hemisphere summer) HSFO prices have fallen faster than crude and Singapore HSFO prices are now at their lowest since August last year. There will be the same underlying downwards pressures on HSFO prices if crude does continue to fall. However, it is highly likely that HSFO will strengthen relative to crude as we move through the winter period, especially if there is an early cold snap in Asia. This is because there is the greatest flexibility to switch from natural gas to oil in the Asian power sector.

It’s still all about the economy

In summary, there are mixed signals for VLSFO prices relative to crude, depending on weaker gasoline or stronger gasoil/diesel. HSFO prices are likely to rise relative to crude as we go through the northern hemisphere winter on the back of a seasonal rise in fuel oil demand and potential additional requirements into power generation. However, the big question is still ‘what happens in the global economies and how this will impact on crude prices?’; this will determine where bunker prices go.

Looking at what the World Bank is saying

It is very difficult to find a positive economic outlook out there (unless you listen to some government rhetoric!). Talk is of much higher inflation and lower growth rates than we have seen for many years, across all the big economies. Central banks/governments are already shifting policies towards raising base rates and expectations are that these could hit 4-6% in an attempt to manage inflation and economic pressures; this after years when rates remained close to 0.5%.

The World Bank has just published a report titled ‘Is a Global Recession Imminent?’ and although it may be one of the more pessimistic views, it is also one of the most recent reports. The report looks at prospects over the next two years and has used an economic model of previous recessions to compare with the current economic position and developments. They have outlined three scenarios and the bottom line is:

Scenario 1: Current monetary policies will not be enough;

Scenario 2: additional fiscal measures could halt a recession, but we would still be in a sharp

downturn, with inflation remaining ‘high’;

Scenario 3: it’s a ‘doomsday’ scenario.

However you look at it, this is not a good economic outlook and would suggest a strong likelihood of economic weakness and for us in the bunker sector, lower bunker prices.

The World Bank does indicate that policy makers will have to follow a very narrow path to avoid recession. This includes managing supply and demand factors, balancing price stability and managing debt, as well as even being prepared to reverse policies that are aimed at supporting growth!

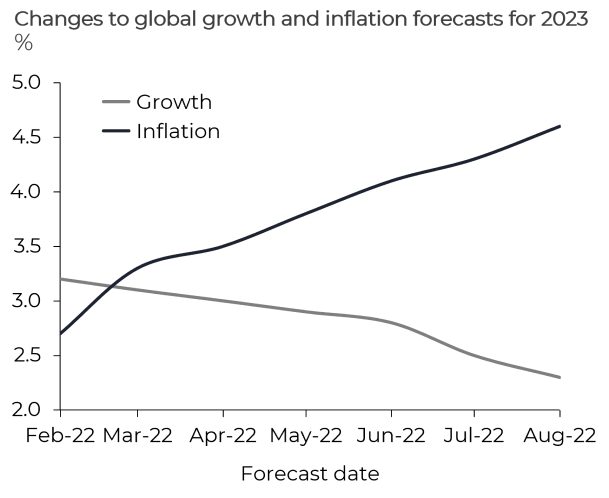

A picture to show the change in economic sentiment

Rounding off with a picture, the graph below is from the World Bank’s report and it illustrates how perception of the global economy has changed so much this year. Back in February this year (just 7 months ago), global growth projections for 2023 were at 3.2% and higher than inflation, at 2.7%. Latest indicators (from August) put 2023 forecast growth at 2.3%, and inflation well above this at 4.6%.

Source: Integr8 Fuels

It’s now over to governments and central banks

The tone of this report is towards a gloomy economic outlook, and one which would imply lower oil and bunker prices. As we have already seen this year, situations can change quickly, but at the moment the global economy is the main talking point and it doesn’t look good.

Steve Christy, Research Contributor

E: steve.christy@integr8fuels.com

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.