Prices have changed quickly; Here’s what we are looking at

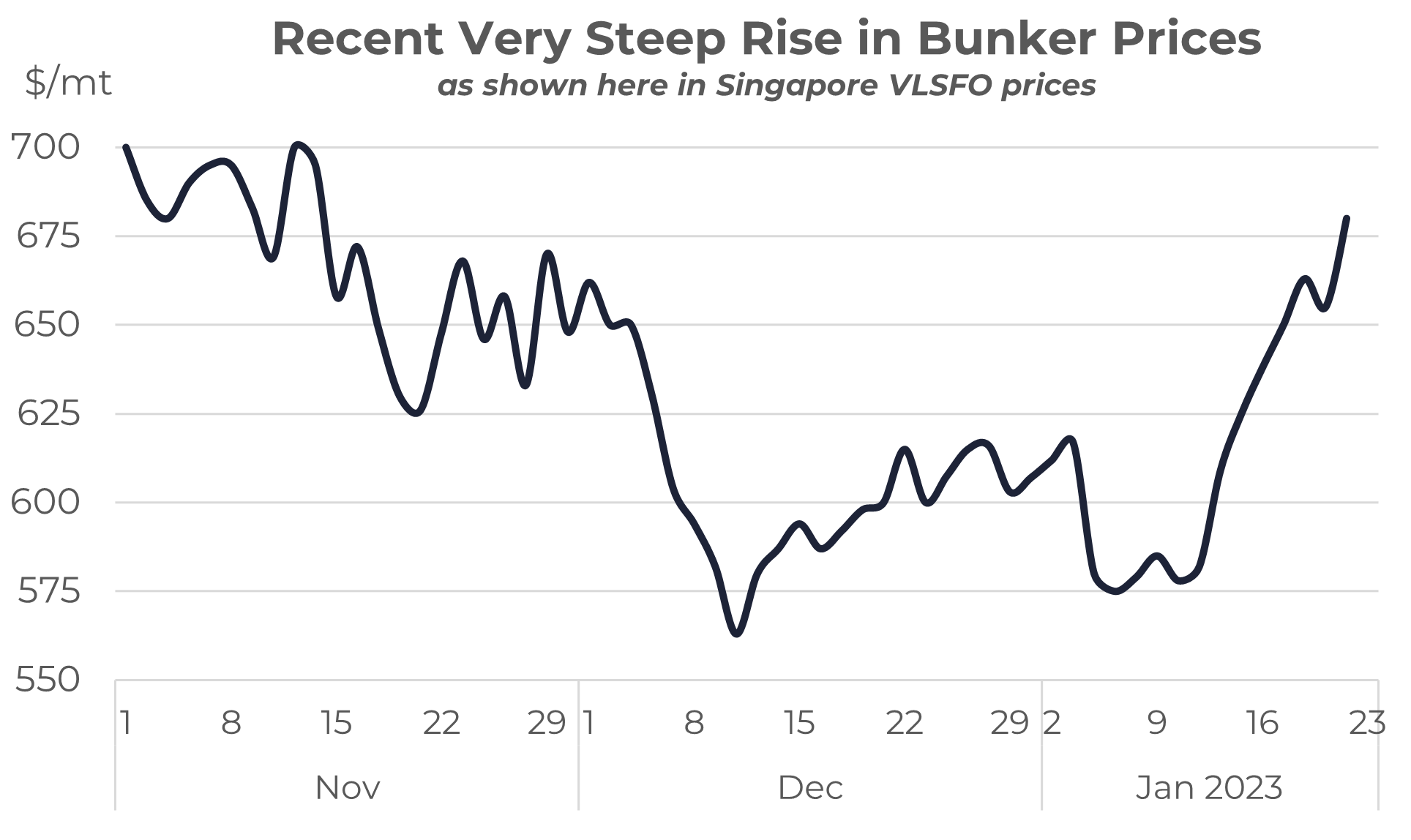

The bullish sentiment has kicked-in; Singapore VLSFO is up $100/mt

In our report at the end of December we highlighted a change in sentiment towards a more bullish bunker price view. This was centred on IEA analysis and changes in their forecasts towards a stronger than anticipated growth in global oil demand for this year.

It is only early days, but after an initial dip in prices at the start of the year, Singapore VLSFO has risen by $100/mt (plus 17%) over the past 2 weeks.

Source: Integr8 Fuels

This isn’t only in Singapore; Fujairah VLSFO is up $80/mt, with Rotterdam and Houston both up by $90/mt. These price rises are largely following the movements in crude prices, with Brent up by $10/bbl (14%) over the same period.

Why the shift?

It is the change in sentiment that has propelled oil and bunker prices higher, and the main reasons for this change are:

- stronger economic and demand prospects in China (with relaxations in the previous very tight covid restrictions);

- ongoing growth in India and other Asian economies;

- a potential tightness in the oil market over the second half of this year.

Early signals in China have been bullish, with indications of Sinopec and Unipec increasing their crude buying. This has supported the more positive outlook for China and reinforces a ‘higher price’ view.

Economic sentiment will steer oil prices up (or down)

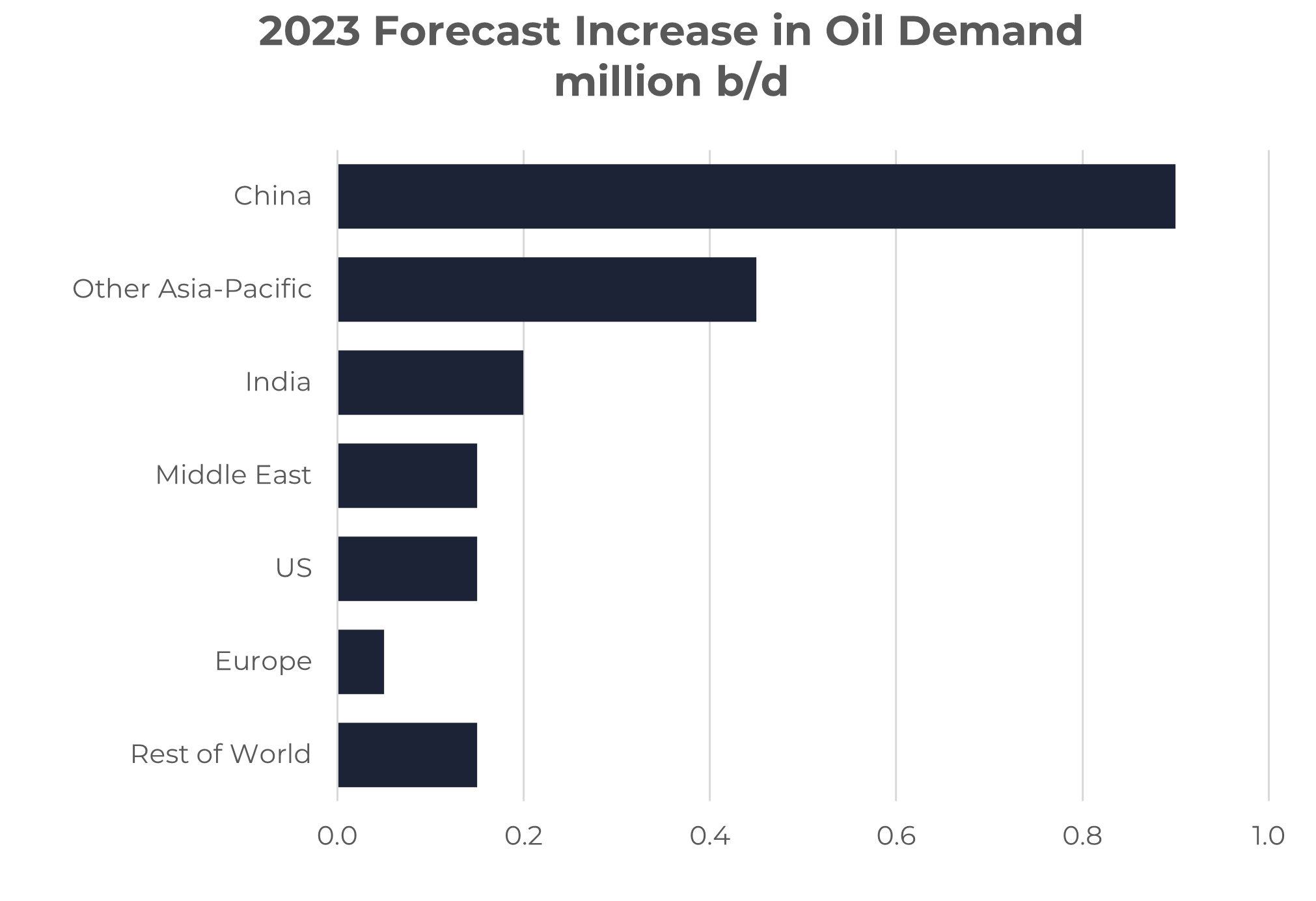

The ‘bigger picture’ economic developments are likely to be the main drivers behind price direction. The graph below illustrates forecast growth in oil demand this year by region. It is very clear that the current bullish sentiment in the oil market hinges on the expected gains in demand in China specifically, and Asia-Pacific generally, with only limited impacts elsewhere in the world.

Source: Integr8 Fuels

Source: Integr8 Fuels

At the same time, if OPEC+ maintain their current constrained production strategy, then oil markets could tighten considerably over the second half of this year; hence the more bullish sentiment and stronger price outlook for 2023.

The EU ban on Russian product imports is about to kick-in

As always, other fundamental and political developments emerge and impact on price. The main one at the moment is the impending EU ban on Russian product imports, which is also bullish for prices.

The start date for the EU ban is February 5th, with the G7 export price cap also starting on the same day. This means that Russian cargoes bound for the EU that are loaded before the 5th Feb and discharged by 1st April are allowed, but after this what happens?

The spotlight for us in bunkers will be on Russian diesel/gasoil, which will impact on VLSFO pricing. At the moment there is a surge in Russian diesel/gasoil exports to Europe, ahead of the February 5th start date. As we move through February and March the implications for supply, price and trade patterns should become clearer; will the overall volume of Russian diesel/gasoil exports fall; will new trades to Asia become established; what will be the impact on European and global diesel prices?

These developments will create price movements around what is still likely to be the main price driver, the economy.

Other product developments to watch

Another factor to watch is the jet market. Almost half the forecast growth in world oil demand this year is expected to be for jet fuel, and again this will impact on VLSFO pricing.

On the supply side, Middle East product volumes and exports should be boosted with the Q2 start-up of KPC’s second crude unit (of three) at its new 615,000 b/d Al-Zour refinery. In addition, the new 140,000 b/d Karbala refinery in Iraq is scheduled to start-up over Q2/Q3 this year, again adding to Middle East product supplies and exports. However, these gains in Middle East product supply alone are not enough to cover potential losses in Russian exports and the increases in world oil demand.

Bullish oil prices hinge on economic “success”

Coming back to the economy, the outlook for this year is uncertain (as always), but reducing inflation is a core target for most central banks and governments. The general view is that inflation will peak and then ease over the course of this year, but it will still take another 2-3 years to get back to targets of around 2.5%. Also, views are that any recession will be relatively short-lived.

So, the consensus view is ‘a rocky road ahead, but we will get through this and there is light at the end of the tunnel’.

Investors are looking where to put money – it could be the energy sector

Oil is a global commodity with easy access for anyone to trade on its futures markets (primarily WTI and Brent futures). ‘Speculative’ money coming into and out of these futures markets can have a huge bearing on oil prices and sentiment, which in turn have a direct impact on bunker prices in our market.

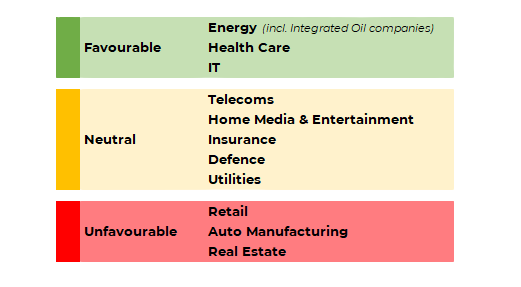

When it comes to energy, many investment analysts tend to focus on the long-term direction and strategies towards 2050. However, some do look at the near-term investment opportunities in the oil sector and to illustrate what some are thinking, the following diagram maps out the preferences of an international investment company on what to and what not to invest in the short term for 2023; and at the energy industry is at the top!

Source: Integr8 Fuels

They see commodities in general, and the oil sector in particular, in a new ‘bull super-cycle’. This comes from limitations in supply and a focus on a strong second half of the year. In this sense, the energy sector becomes more attractive for someone to put money to work, through equities and through oil futures markets. This in turn pushes oil and bunker prices higher (admittedly, when the ‘speculators’ find something better and take their money out of oil futures then oil prices can fall!).

Strong sentiment & strong fundamentals?

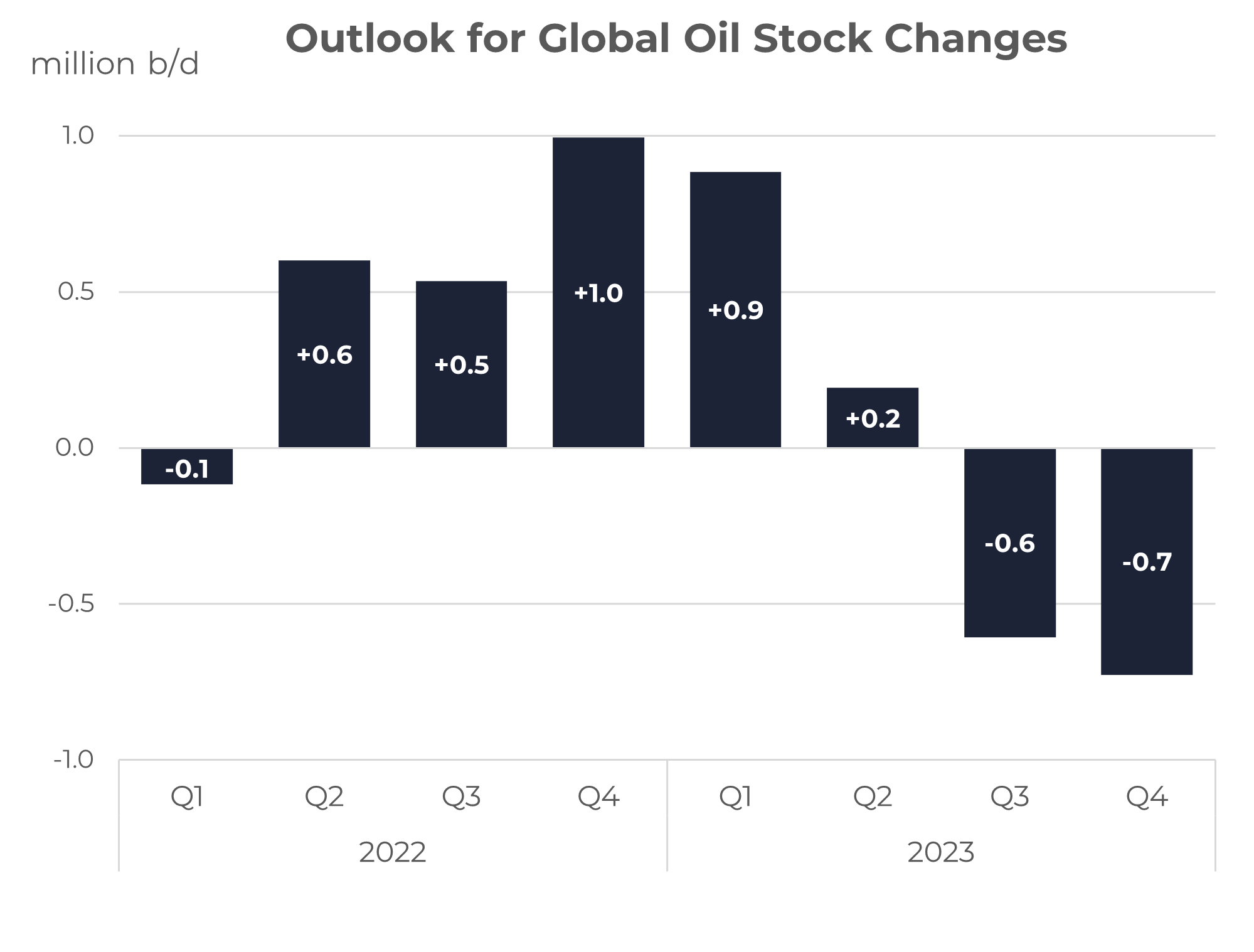

Bringing the supply and demand fundamentals together and looking at a number of analysts, the chart below illustrates an average of the historical and forecast global oil stock changes. The clear pointers here are that we saw global oil stock-builds through most of last year. With this oil prices fell; Brent futures were down from $110/bbl in Q2 2022 to the low $80s in December.

Source: Integr8 Fuels

Source: Integr8 Fuels

Taking an average of current forecasts indicates another stock-build this quarter, but for the market to be near balanced in Q2 and then potentially tighten significantly in the second half of this year with forecasts of relatively large stock-draws.

There is every reason for today’s bullish sentiment

It is invariably the case that the fundamentals win out, and on this basis oil prices would be expected to rise. We are looking at this, the oil industry is looking at this and certain investment analysts are also looking at the same picture. Again, from where we stand today the sentiment appears bullish and bunker prices would be expected to rise further.

The main factors underpinning this view (and to keep watching) are:

- the strength of oil demand in Asia this year;

- that economic forecasters get it right that we are not going to fall into a global recession;

- what OPEC+ does, but at the moment they are holding firm on a more constrained supply strategy, which again is bullish.

Let’s keep watching to see if everything pans out as expected!

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.