The IEA’s latest long term energy report & what it could mean for the bunker industry

Background to the IEA study

The IEA has just released its annual World Energy Outlook and for the first time it shows total demand for fossil fuels going into decline within the next few years in all of three of their forecast scenarios. The shift in outlook comes with the current energy crisis, high prices and the question of energy security, all principally triggered by the Russian invasion of Ukraine, but also prompted by under-investment in recent years.

The IEA study is based on three scenarios:

- Stated Policies, where the future outlook for demand across all energy sectors is based on current stated government and corporate policies to reduce emissions and that these are achieved. Here total oil demand would start to fall in the mid-2030s, but this would still mean a rise in global average temperatures of 2.5oC by 2100 (way above the 1.5oC by 2050)

- Announced Pledges, where policies that have been announced are actually enacted and fulfilled. This is the case where it is easy to say something, but far more difficult to implement it! Here total oil demand would start to decline in the next few years, with a temperature rise of 1.7oC by 2100;

- Net Zero by 2050, where new, and far more aggressive policies will be adopted to achieve net zero emissions by 2050, and temperature targets of a 1.5oC rise by 2050 are achieved. In this case oil demand will decline from now on.

In the step from case to case, the outlook is of more rapid government strategies to quicken the pace towards ‘more sustainable and secure energy systems’. The central theme here is renewable energy supported by nuclear power, with huge investments in existing technologies and the search for new technologies.

In this report we focus on what these views could mean for the bunker sector, in terms of prices and, importantly, the fuel mix. It is worth noting that hydrogen-based fuels get a big mention in the study.

What is the outlook for oil and bunker prices?

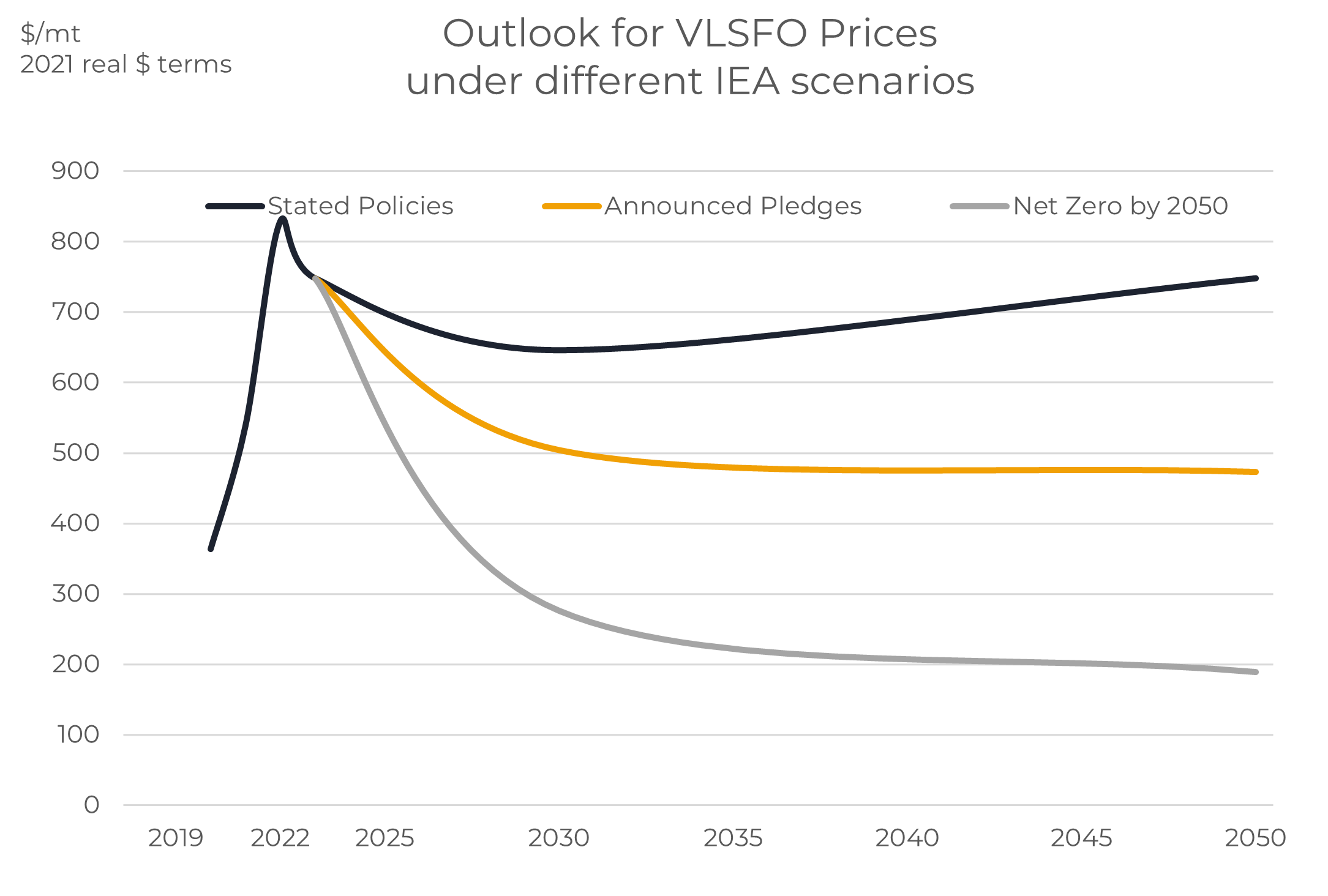

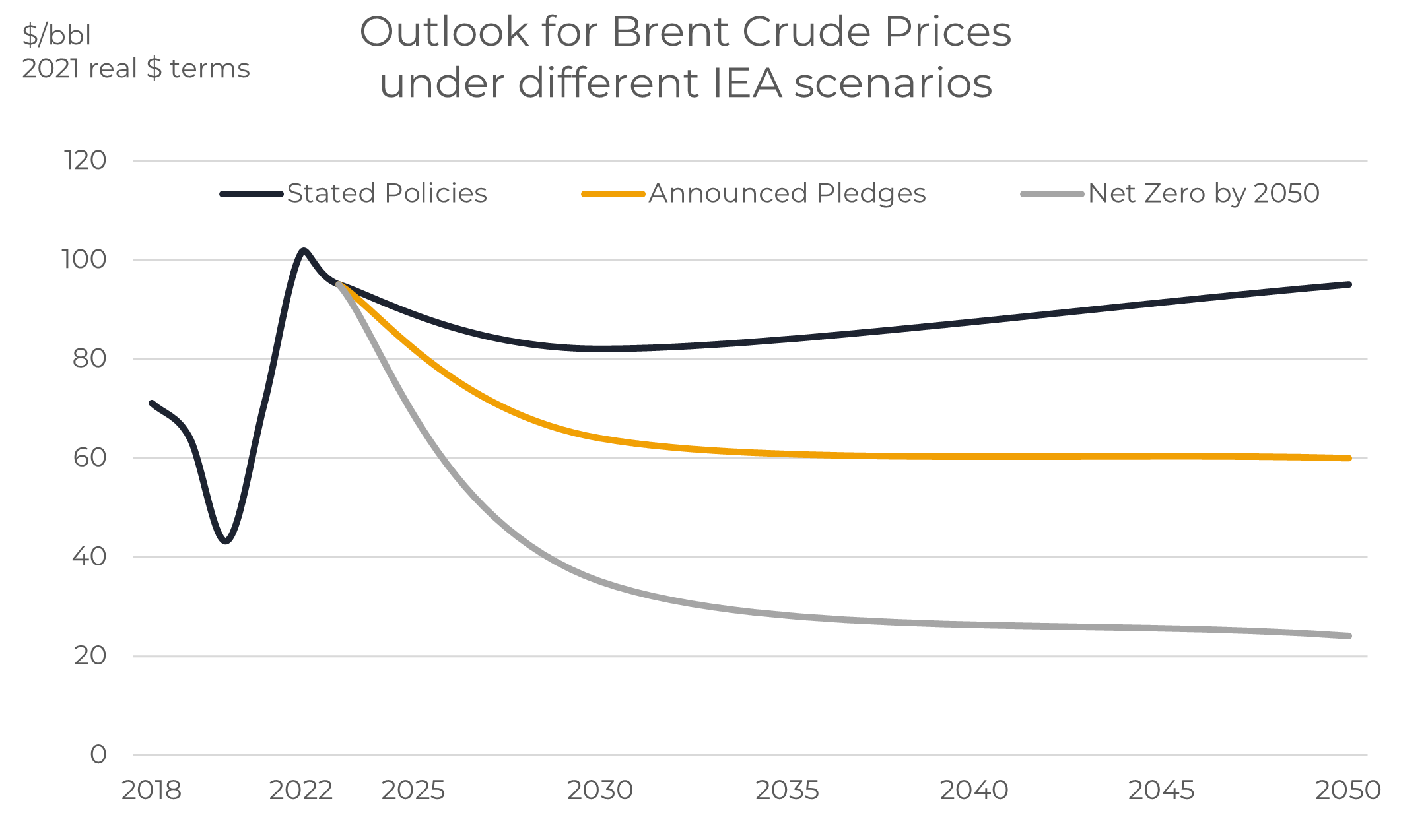

The IEA’s forecast is based on trends, but they do recognise the high degree of volatility in pricing at different times. However, the extent of their scenarios does show a very broad range in pricing, with the ‘current course’ under the Stated Policies case taking crude prices (in real terms) only slightly lower than recent levels and remaining in the $80-95/bbl range for Brent.

Source: Integr8 Fuels

If there is a shift towards a more environmentally sensitive case, such as the Announced Pledges, then the IEA sees prices lower, at $60-65/bbl in real terms; still not massively dissimilar to historic prices.

At this stage any shift towards Net Zero policies by 2050 seems to be a huge hurdle and perhaps unlikely, but the implications for oil prices would be clear and very low. In the IEA’s scenario this would take Brent prices down to $35/bbl by 2030 and only $25/bbl by 2050 (again in 2021 real terms).

Keeping VLSFO prices inline with crude price developments under each scenario would imply VLSFO in the $650-750/mt range (real 2021 $) in the first case and $450-500/mt in the second case. It is only in the highly unlikely third case that VLSFO prices would fall to around $200/mt by 2050, and as we outline later, this would be a very different market, with oil as a bunker fuel being squeezed out of the market.

Source: Integr8 Fuels

Source: Integr8 Fuels

The Stated Policy case more-or-less means ‘business as usual’ for us

In the IEA’s first, and ‘least intrusive’ Stated Policies scenario, coal demand falls, natural gas demand hits a plateau around 2030 and for us in the oil sector, total oil demand continues to rise for at least another 10 years. It is only in the mid-2030s that oil demand starts to fall, and this is mainly with the expansion in the electric car fleet.

The IEA does separate out shipping as one of those industries that is heavily dependent on oil to meet its needs, and in the Stated Policies case the mainstay of bunkering is likely to stay with oil, even with potential growth in oil demand in our sector.

In fact, the IEA sees three areas where oil demand will continue to rise beyond 2030, namely aviation, petrochemicals and shipping. The decline in total oil demand comes as the gains in these three industries are more than offset by declining demand for gasoline and diesel with the expansion in the electric vehicle (EV) fleet.

As a backdrop, although the level of new oil discoveries in 2021 was at its lowest for more than 80 years, the IEA underlines that there are sufficient oil resources globally to meet the medium term rise in oil demand. However, with campaign groups in some non-OPEC countries already challenging government strategies on oil investments, the focus of new production is likely to be in the Middle East.

This is unlikely to mean a shortage of oil available to the global markets generally, or us in bunkers, but it is likely to mean a growing dependence on Middle East crude oil supplies to fuel the industry.

What do the other IEA cases mean for the bunker industry?

In the Announced pledges case, demand for oil bunkering is forecast to fall, perhaps by around 25% by 2050. Hence not a collapse in the oil bunkering market, but no doubt a smaller market and a shift towards alternative fuels

However, at the other end of the spectrum, the Net Zero case would demand a radical shift in the bunkering industry. In this case, the IEA indicate our sector reducing CO2 emissions from 840 million tons today to 110 million tons by 2050 and see a dramatic move towards ammonia and other hydrogen-based fuels, along with biofuels. They recognise the 20-35 year life spans of ships, although they also mention the possible retro-fitting of vessels to burn hydrogen-based fuels, as well as commenting on wind kites and rotor sails as having a role.

The medium-term focus to 2030 is on electric vehicles; not shipping

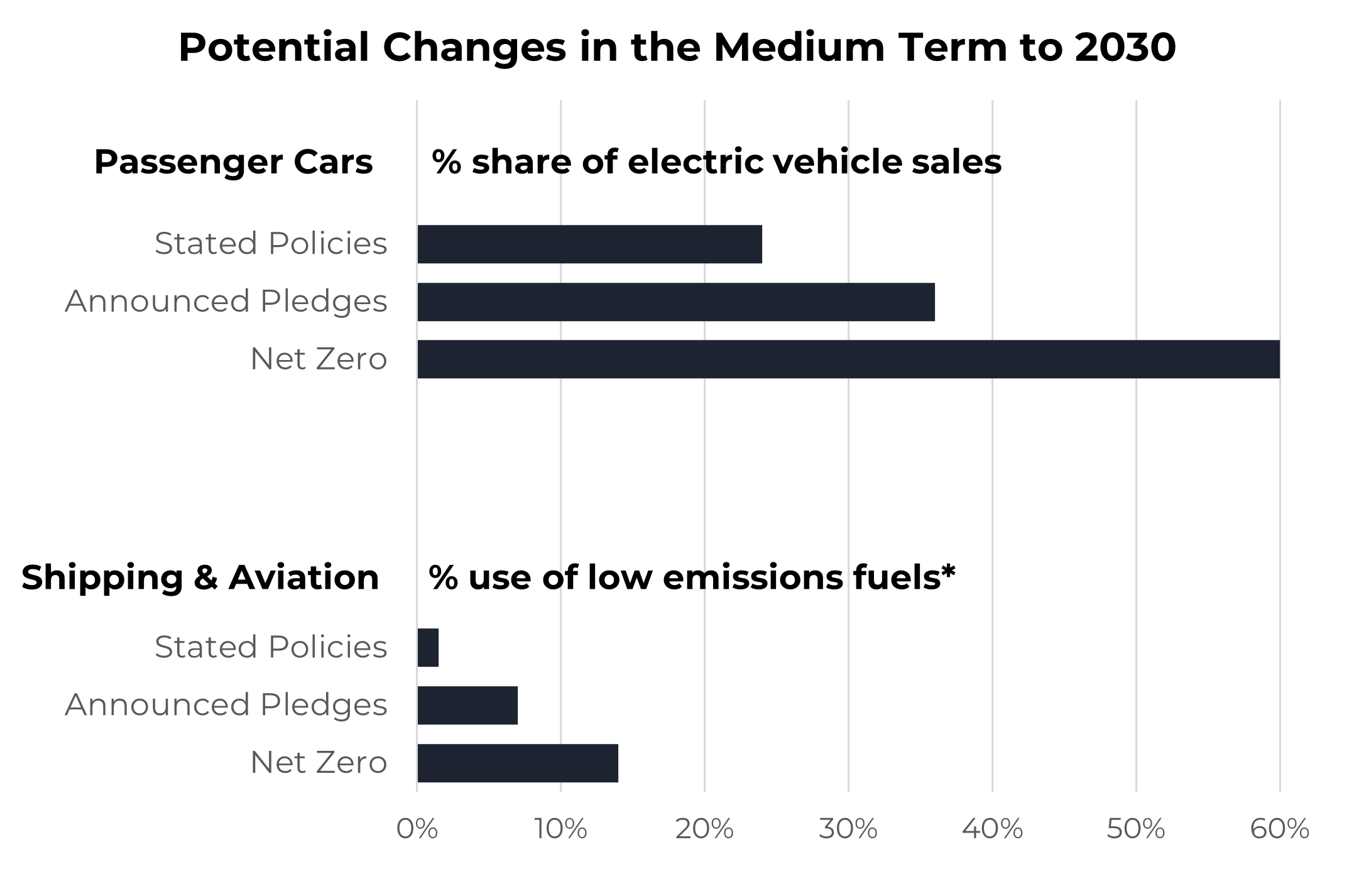

As already mentioned, the majority of the push towards lowering emissions in the medium term to 2030 is focused on the transition from gasoline and diesel passenger cars to electric vehicles. The graph below illustrates percentage of new car sales in 2030 under each of the three IEA scenarios, with around 25% of new car sales being electric even under the Stated Policies case. This rises to 35% in the Announced Policies case, and around 60% in the far more unlikely Net Zero case.

Source: Integr8 Fuels

This compares with minimal shifts in the shipping and aviation sectors by 2030, with only 1-2% of demand met by ‘low emission’ fuels in the first case, rising to only 5-6% in the more aggressive Announced Policies case. We could say our day-to-day market is unlikely to change that much in the next 5-10 years.

However, things will change at some stage!

In the Stated Policies case, it could be that oil remains by far the dominant fuel in the bunker industry through to 2050. However, if you believe we are only likely to be in a world where more environmental legislation is coming, then things in our sector will definitely change.

In this instance, in the longer term to 2050 (and beyond), the use of hydrogen based, low emission fuels such as ammonia and methanol are seen as strong potential alternatives to oil in combustion engines in the shipping and aviation sectors.

The IEA does outline the need to find cheaper ways of producing these low emission fuels to make them successful, and no doubt companies are, or will be, looking at technologies to achieve this. There are already projects outlined to support such moves, including the largest power generating company in Japan issuing a tender for the supply of 5,000 b/d low emissions ammonia as a replacement for coal use by 2027.

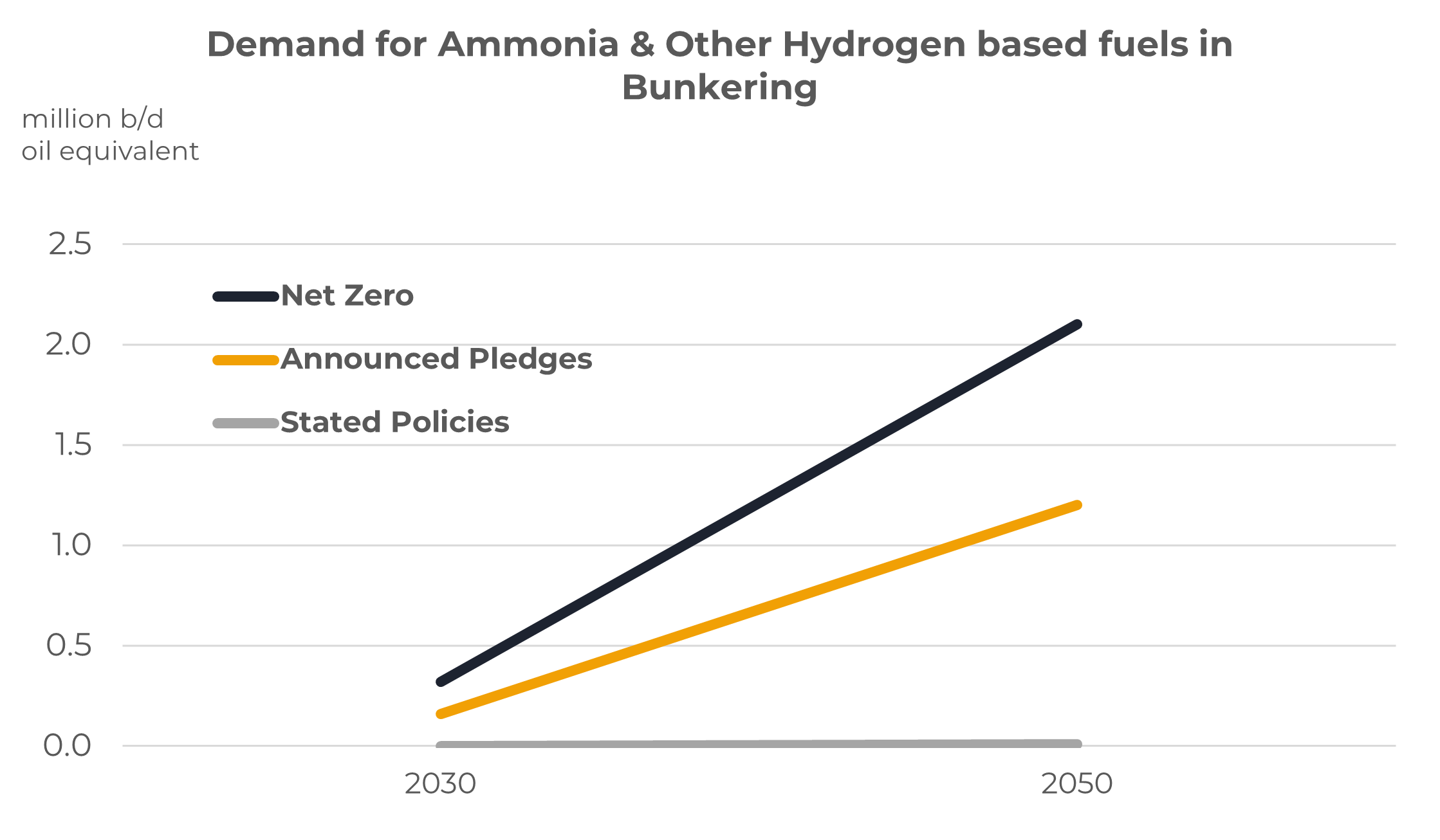

The chart below illustrates the IEA’s views on ammonia and other hydrogen-based fuels (such as methanol) in the shipping sector. This illustrates negligible levels in the Stated Policies case, BUT if we move more towards the Announced Pledges case then these ‘new’ fuels could account more than 1 million b/d (oil equivalent) of the market, which will be close to 25% of all sales.

Source: Integr8 Fuels

In the Net Zero scenario the ‘new fuels’ would account for around 50% of the market by 2050. In both cases the trend is clearly established; a move away from oil and one towards low emissions alternatives.

In all of this the timings outlined in studies may be ‘ambitious’, but given the pressures that were on the IMO to make the shift from high sulphur to low sulphur fuels in what was initially seen as a tight timeframe, we should not under-estimate any potential policy changes at the IMO, even with all of the issues, costs, infrastructure requirements and supplies. It’s likely to be when, not if!

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.