Bunker prices: Let’s listen to what experts have to say

Don’t trust the experts?

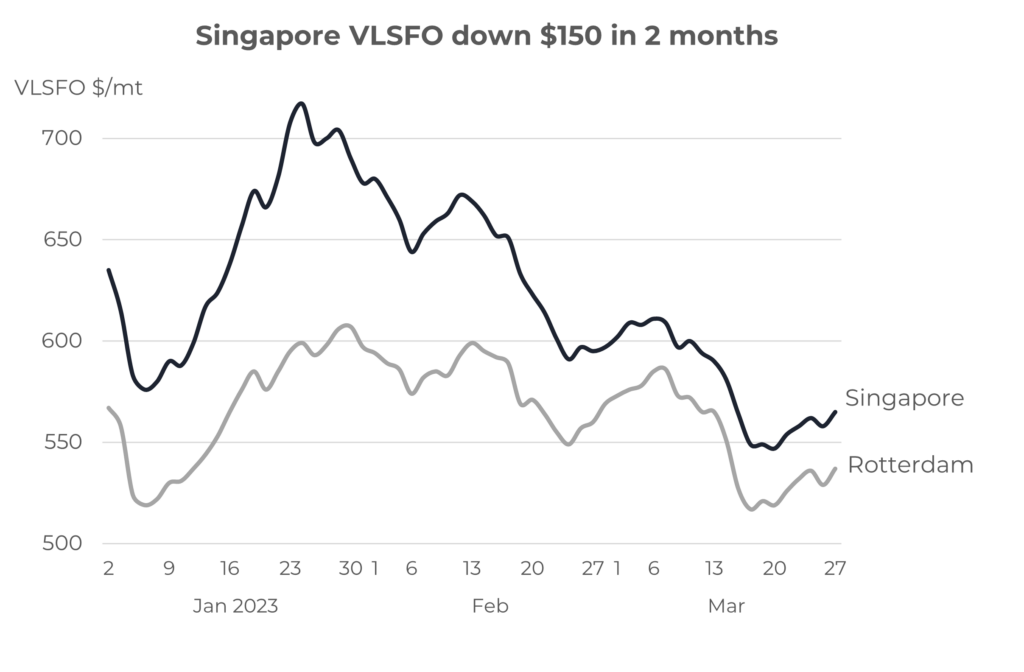

In these more macro reports, we tend to look at oil industry fundamentals and try to get a steer on where bunker prices are going. There is no doubt that over the past few months the industry has generally reflected a more bullish outlook for prices. BUT prices have fallen!

In February there were signs of short-term weakness in Asian and European oil markets and this led prices down. In March prices have fallen again. So, there has generally been a bullish view of pricing and yet Singapore VLSFO price are down by almost $150/mt (minus 20%)!

Source: Integr8 Fuels

One outcome of this is maybe, ‘don’t trust the experts, what do they know?’. This is certainly an approach some politicians have adopted in recent years! Another view is that we are in a market where not only do fundamentals count, but ‘unforecastable’ global events, politics and psychology play major roles (as an analyst, I’m going for this view!).

A lot of (non-oil) people influence bunker prices

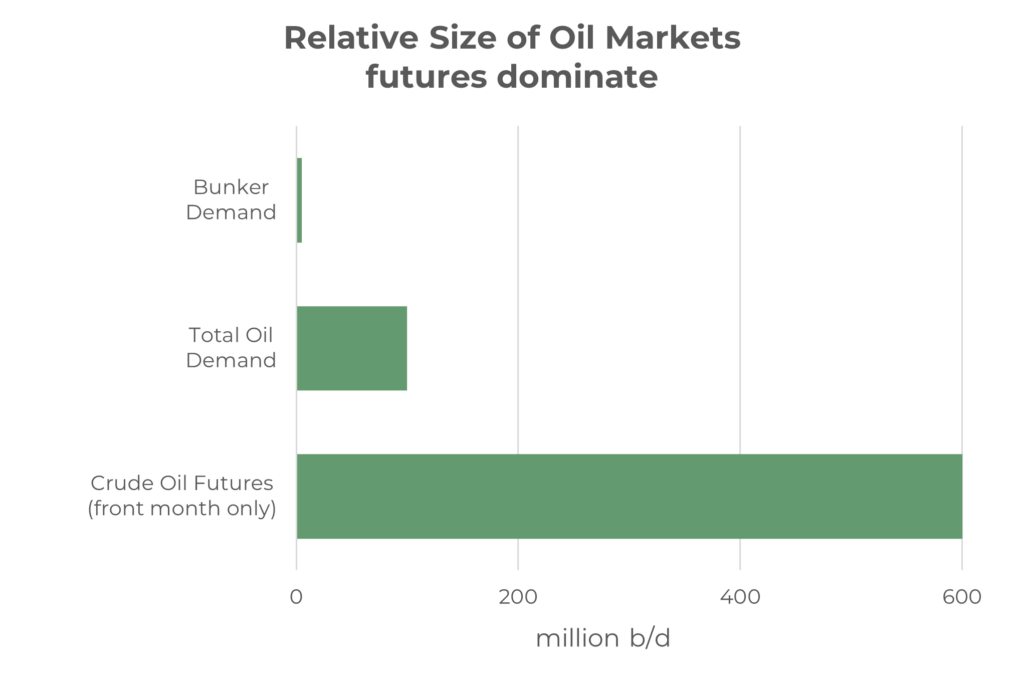

In the bunker market, our prices are driven by crude oil, and this is freely, easily and widely traded in international futures markets; they set our benchmarks.

To put this in perspective, the size of the bunker market is around 5 million b/d, the total oil market is around 100 million b/d, and the average combined size of the two main crude futures markets is estimated at around 600 million b/d on front month contracts alone (this excludes trades on outer months and options etc).

Source: Integr8 Fuels

At times of a global shock, crude futures trading can easily double. So, when anything happens in the world it can have an instant impact on crude futures prices, which in turn means an immediate hit on the prices we pay for bunkers.

A crisis in confidence in the banking sector means lower bunker prices

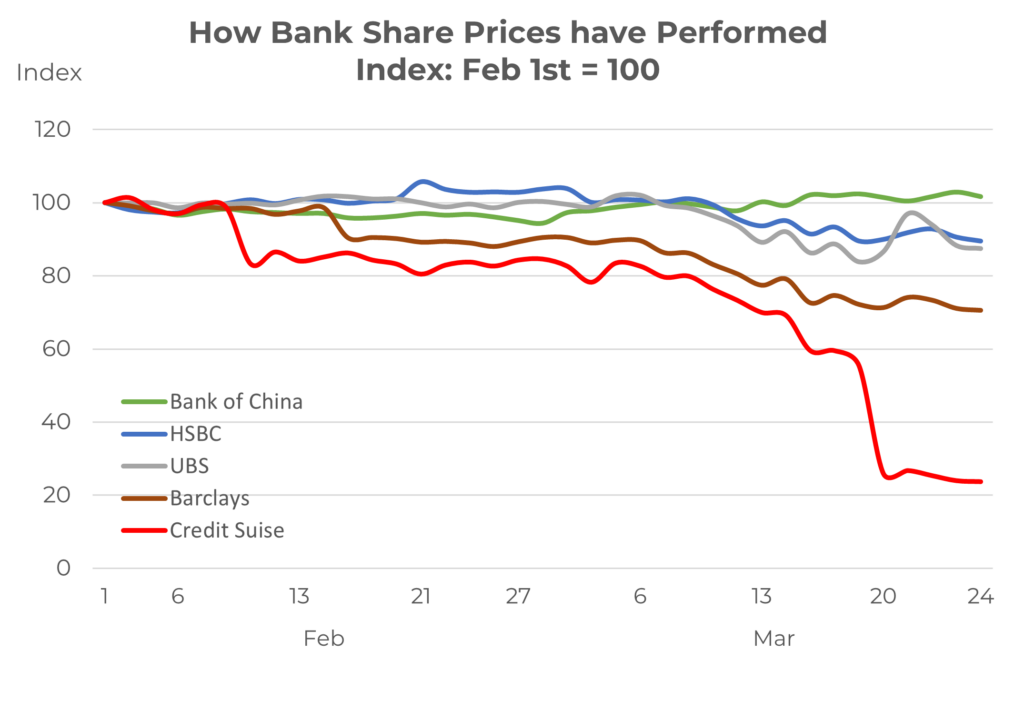

Source: Integr8 Fuels

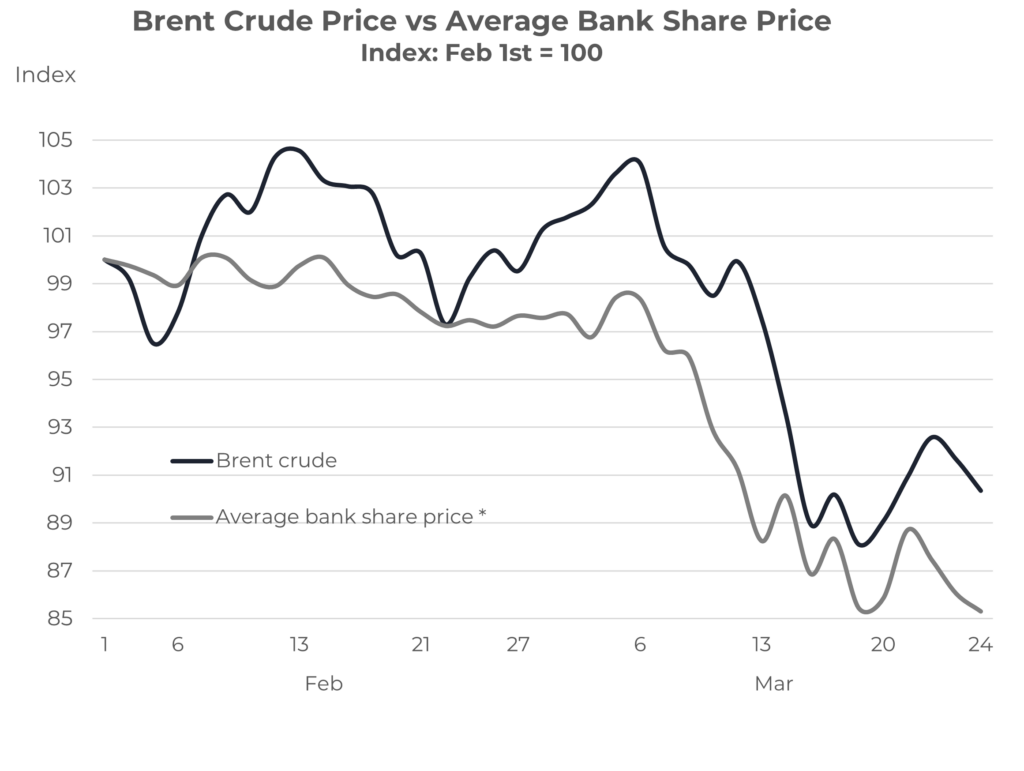

These developments clearly put a focus on other banking institutions from around the 9th March onwards. Looking at eight major international banks (excluding Credit Suisse), the average share price fell by around 10% between the 10th and 20th March. There is a 1-2 day lag in oil prices, but the banking woes clearly hit crude prices on the futures markets over this period.

Source: Integr8 Fuels

From these share price movements, it is clear the banking community (and so also us) are ‘not out of the woods’ yet, although oil prices have bounced back from their lows.

What are the expects saying now?

So, we have seen short-term weakness in the oil markets in February, and a crisis of confidence in the banking sector in March. These overtook the bullish views that were in the oil markets at the start of the year. But what are the expects saying now?

Well, those bullish economic pointers of China and Asia, plus constraints on OPEC+ production still remain and are being talked about.

Perhaps the first signal has come from the FT Commodities Global Summit, taking place just last week in Switzerland. As a broad outcome from this, crude oil prices are forecast to hit somewhere between $80-140/bbl this year; this would imply Singapore VLSFO reaching a point between $600-1,000/mt over the next 9 months

I can hear the comments now: “These experts have a very, very wide range of price views.”; “What use is forecast with a $400/mt range?”; “They have already got it wrong so far this year!”.

There will be a lot more views than these three, and some may be unprintable. But it’s worth listening to what they say, as long as we know the reasoning behind their views.

Firstly, the consensus is that prices will rise from current levels. The experts are coming back to their fundamental views and these are generally bullish. The main one here is probably China and their expectations that domestic demand is already on the rise and this is enough to tighten global supply & demand balances. Indications from the big trading companies are that Chinese road and air travel are already back to, or above 2019 levels, and this can only fuel these more bullish views.

It’s human nature to find supporting evidence to reinforce views, and here the bolt-on arguments are:

- A rise of oil demand in Asian economies;

- No signs of the OPEC+ group (particularly Saudi Arabia) raising production against higher levels of demand;

- US oil production cannot increase rapidly or by enough to take the sting out of the market.

These are generally the same market fundamentals that the experts talked about in January and February, and these still form their basis for prices hitting higher levels this year; it’s just that some curved balls have intervened in

the meantime.

The bottom line: What does this mean for bunker prices?

Although the headline news on forecasts show such a wide range, most commentators are gravitating towards Brent prices in the $90-95/bbl range for this year. Also, the recent trend is for most analysts to revise down their forecasts by around $5-7/bbl, including Goldman Sachs and Barclays. This means Goldman Sachs is now at $85/bbl for Brent this year, which is not that much higher than end March prices and very close to what we saw in January and February.

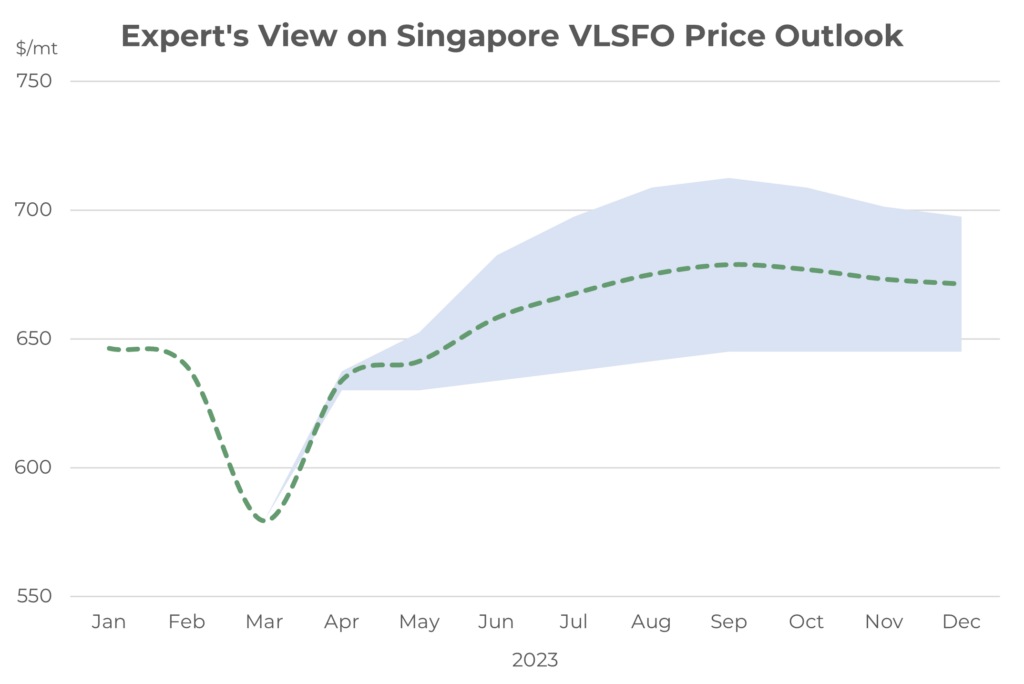

Taking these latest, indicative views from the experts implies Singapore VLSFO prices moving back up to around $650/mt and trading in the $650-700/mt range for the rest of the year; Not as concerning as headline news of $140/bbl Brent and $1,000/mt VLSFO.

Source: Integr8 Fuels

Where are the next ‘curved balls’ to prove the experts wrong?

The pandemic, the war in Ukraine and the uncertainty in the banking arena are just three recent events that were largely unforecastable; the first pushing prices significantly lower, the next pushing prices higher and the last taking around $50/mt off the Singapore VLSFO price.

Current hot topics involve the politics between China, Russia and the US and these always have the potential to change prices drastically. Also, any outcome in the war in Ukraine will shift oil prices. However, at this stage the biggest risks to the experts’ views come from recession or another economic crisis, which seem closer now than for many years; if it happens, oil demand will be hit and prices will definitely fall.

One other potential curved ball that has just come into view is China potentially brokering a deal to re-establish diplomatic ties between Saudi Arabia and Iran. The process is underway and the first phase is to reopen embassies in each other’s country within the next two months. Upcoming diplomatic talks are planned and there are even (unconfirmed) suggestions of the Iranian President going to Saudi Arabia to meet the King at some stage.

Obviously, it is unclear how far things will go, but in the first instance, any resolution between the two counties is more likely to lead to lower oil prices, rather than higher. However, that then leaves the political fallout from the situation and China brokering such a deal; where does this leave the US and how would they respond?

There are a lot of unknows here, and any oil expert looking at forecasting oil prices is not going to be able to factor-in these into any price forecast they make.

So, for us looking at bunker prices, let’s take a steer from the experts, make sure we know why they are saying what they are saying, and keep an open mind to world events and what these may do to prices in our market. Easy…..

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.