Sentiment and prices have shifted into reverse; Will it last?

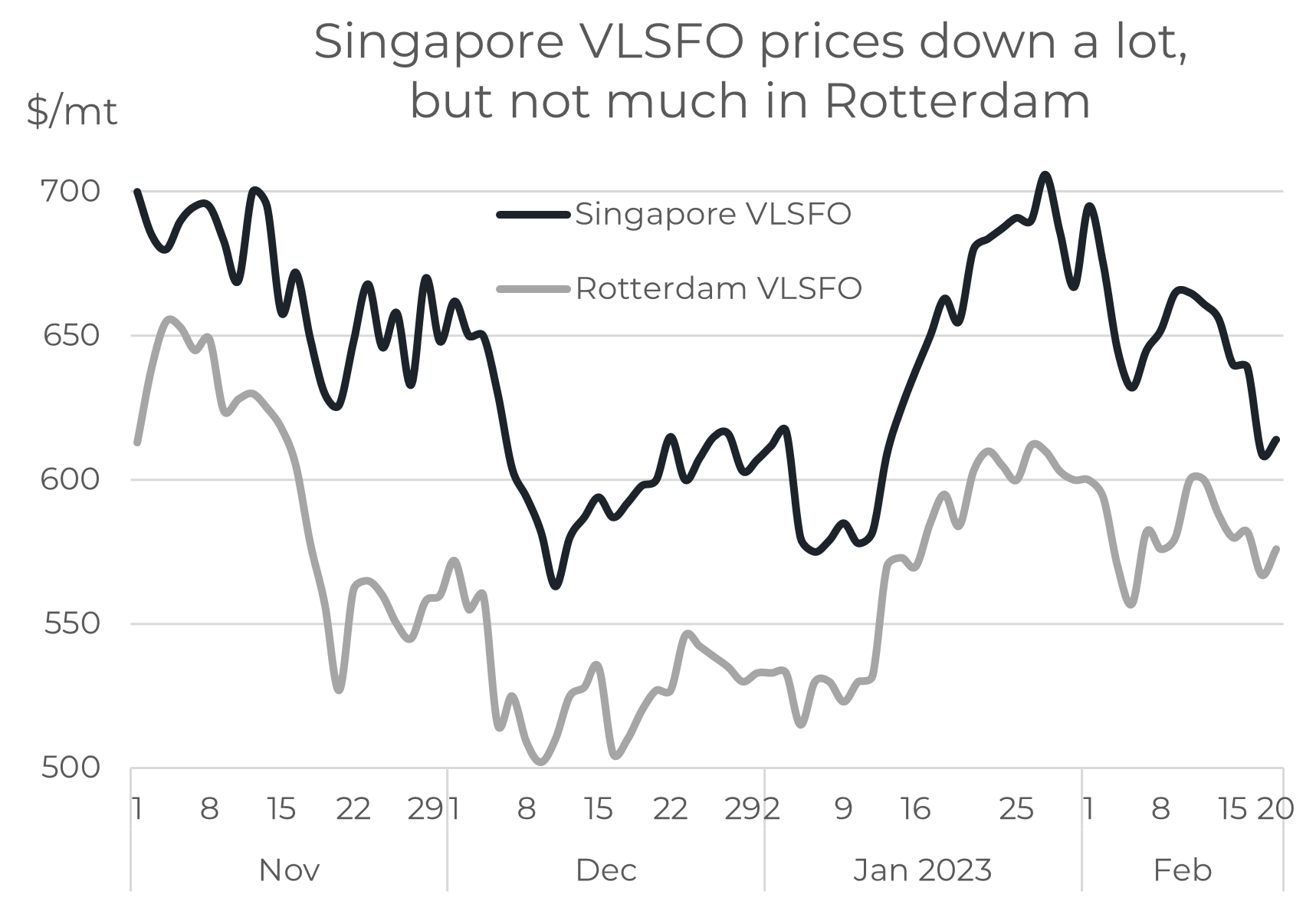

Singapore VLSFO up in January and back down in February!

It’s clear that sentiment and price direction can change ‘in the blink of an eye’, and that’s what’s happened this month. Singapore VLSFO prices rose by some $130/mt in January; so far in February they are back down by around $100/mt. It means Singapore VLSFO is not much higher than at the start of the year.

Source: Integr8 Fuels

VLSFO price movements in Rotterdam have been less volatile than in Singapore, and unlike Singapore, prices have remained much higher than in early January. This is mainly down to Europe’s close proximity to the war in Ukraine and the EU bans on Russian oil imports.

Why the change in sentiment?

Throughout January, markets were increasingly bullish on the back of:

- Stronger economic and demand prospects in China and other Asian economies;

- The start of the EU ban on Russian product imports from 5th February;

- a potential tightness in the oil market over the second half of this year.

However, at the start of February there was a much shorter-term focus on what was a weakening market structure. Asian markets were not as tight as expected, partly as more diesel exports came from China.

The European market was also not as tight as expected, with a surge in Russian product imports ahead of the EU ban and substantial long-haul distillate imports coming in to replace the lack of future Russian products. The EU ban on Russian products is seen as shifting trade patterns to longer haul destinations in the East, rather than a total loss of the Russian export market (similar to what has happened with the EU ban on Russian crude starting last year).

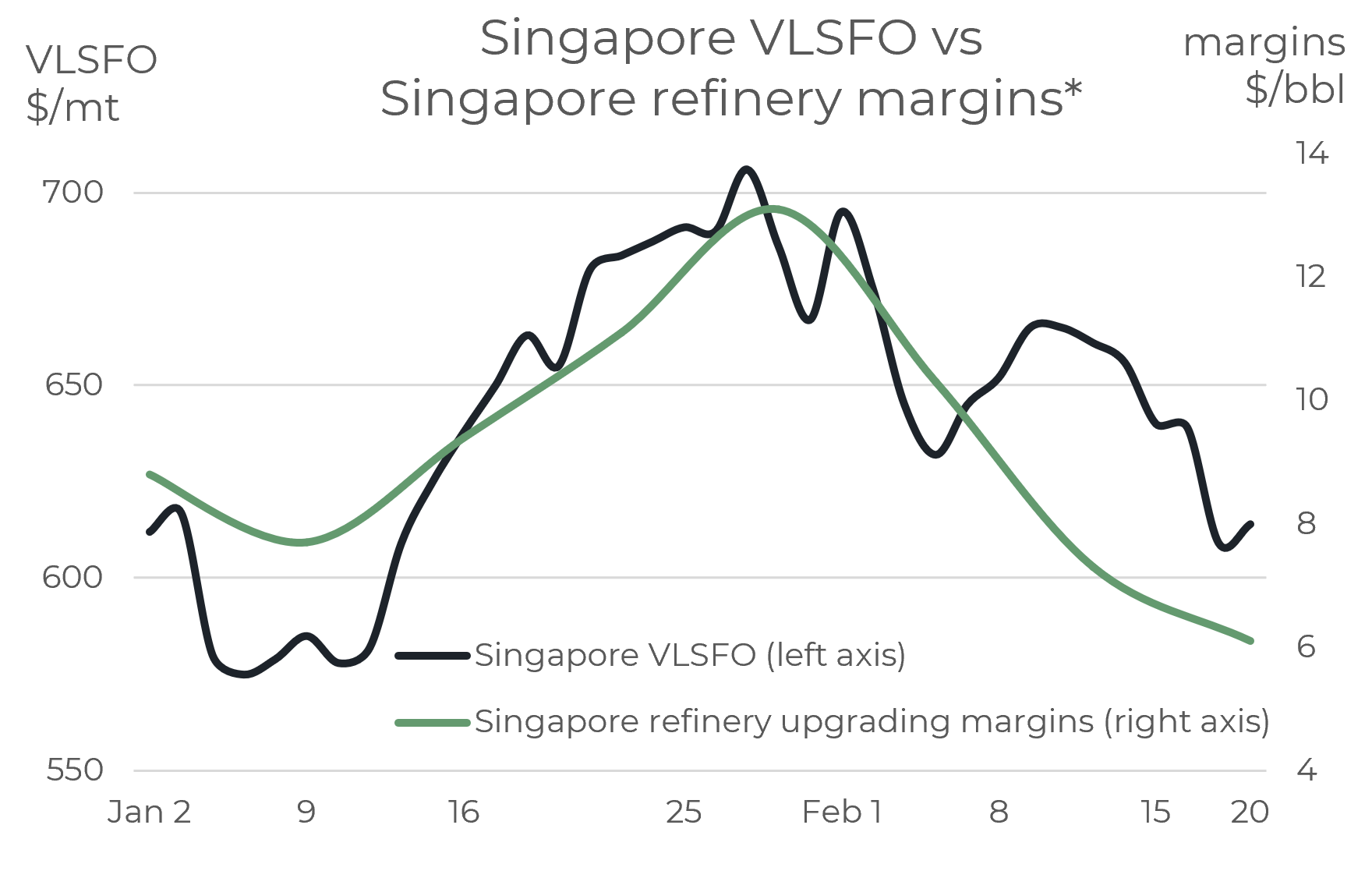

All of these bearish developments filtered through to weaker prices and refinery margins, which have been much lower so far in February than in January. Margins have been a clear, measurable market signal of weakening conditions, which is illustrated in the graph below for Singapore VLSFO and local refinery margins.

Source: Integr8 Fuels

Source: Integr8 Fuels

What about the ‘previous’ bullish factors?

It’s not that the economic prospects in China and Asia have disappeared, or analysts no longer see a potential tightening in oil market fundamentals over the second half of the year. It’s that as we moved into February, oil stocks rose and refinery margins fell. There are also a couple of other bearish factors that have been picked up on, such as possible tighter monetary policy in the US and the strong US dollar hitting buyers using other ‘local’ currencies. It is all this that turned the market around in late January/early February.

The obvious market question then is…

How long will it remain bearish, and what factors to look out for?

The age-old mantra of ‘the market tells you everything’ usually works, and we have gone through this month where most product balances are weakening.

Published data on refinery margins and oil stock levels are really useful to keep watching to see if there is a change. It may be difficult to change sentiment on just one week’s data, but as we have seen this month, turning points usually happen when the market focusses on a few ‘contributing factors’ all pointing in the same direction.

Here is where developments in China and its economy will be a prime focus. The key elements for us are what is happening to Chinese crude buying, refinery throughputs, product exports and how oil demand is performing. All four of these are inter-linked, but the headline focus will be oil demand. If there is strong confidence in Chinese demand rising in line with many forecasts, and this coincides with data signals such rising refinery margins and lower stock levels, then the market is likely to reverse once again, to a bullish trajectory. If however, Chinese oil demand is seen as faltering, then this is highly likely to mean a continued bearish oil market all round.

China is obviously a key player in market sentiment and a main driver in any change. Today there are conflicting signals being discussed, with ‘bullish’ indicators from government stimulus packages and infrastructure projects, but against this are ‘bearish’ signs of low disposable incomes and savings. This is where analysts will keep a close eye.

What about an increase in oil production to bring down prices?

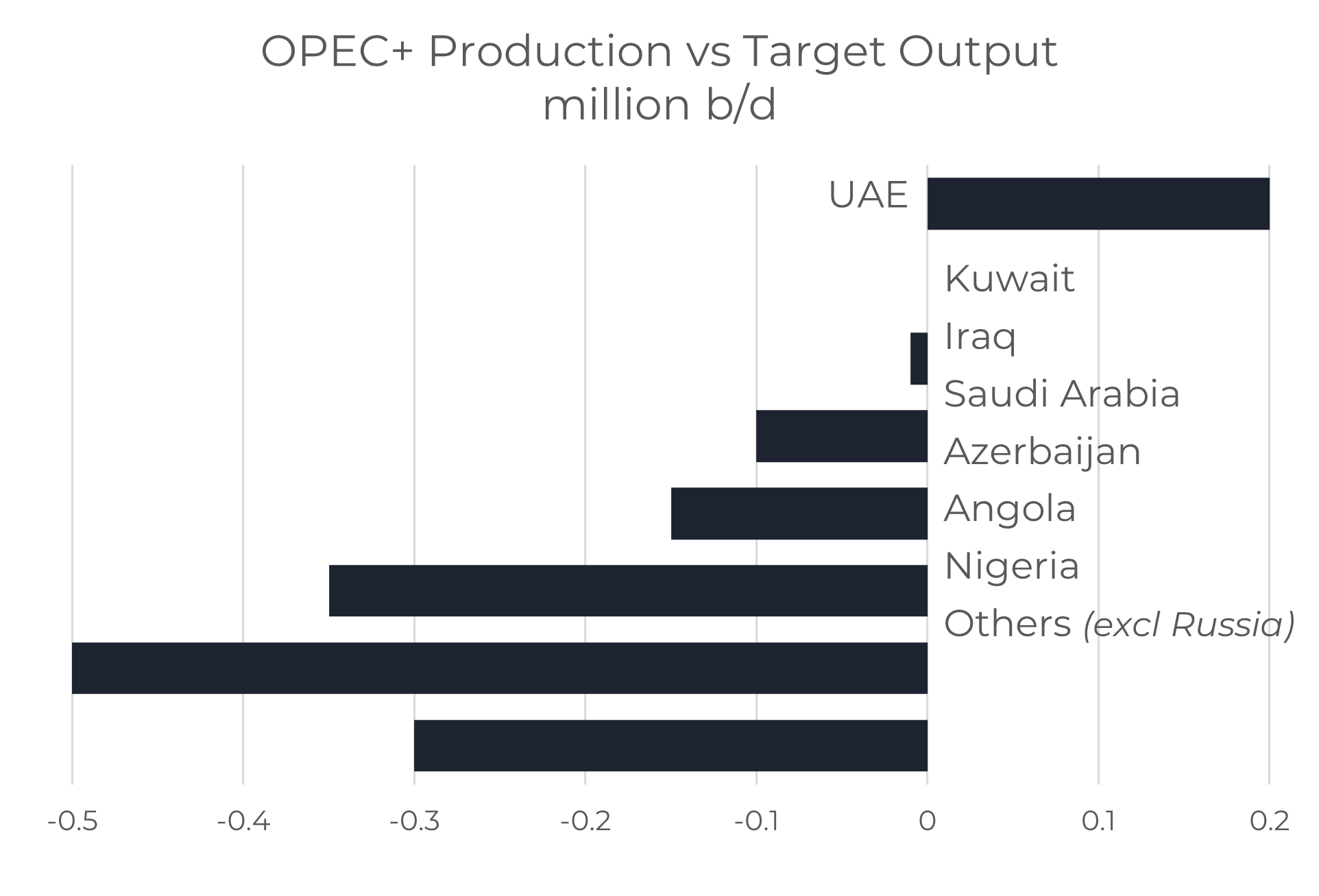

Apart from Chinese oil demand, another fundamental factor worth looking at and understanding is crude oil supply. OPEC+ is the only group/country that has spare production capacity and so can increase output rapidly. However, given all the volatility in oil prices, the OPEC+ group has stood firm in its strategy of not increasing target allocations for the group. Part of this is because of a ‘lack’ of upstream spending in recent years means many of the member countries cannot even reach their current targets.

The UAE is the only country currently producing substantially more than its allocated volumes. Almost all other countries are below target, with Azerbaijan around 150,000 b/d lower, Angola 350,000 b/d lower and Nigeria 500,000 b/d lower. The signs are clear that most OPEC+ countries could not raise output even if the cartel decided to increase allocations.

Source: Integr8 Fuels

Although Saudi Arabia is currently producing less than its target, it is one of very few countries that have spare capacity and so are able to increase production relatively quickly. The main players with this spare capacity are all in the Middle East:

Estimated Spare Capacity

Saudi Arabia 1.7 – 2.0 million b/d

UAE 0.8 – 1.0 million b/d

Iraq 0.2 – 0.3 million b/d

Kuwait 0.1 – 0 .2 million b/d

Total 2.8 – 3.5 million b/d

There is also spare capacity in Russia and Iran, but the situation in Russia is highly uncertain (to say the least) and any changes in Iran would take a huge political shift to lift ‘nuclear’ sanctions and reopen the country.

So, for those OPEC+ countries currently maximising their oil production, it is not in their interests to agree to an increase in the cartel’s production allocations and bring oil prices down. However, even though Middle East countries do have the ability to raise output and reduce oil prices, it is also not really in their economic interests to do so. These economies are highly dependent on oil revenues to support their economies and so need a minimum revenue, which tends to come at a ‘higher’ oil price. To raise output would likely see a drop in revenues; if you raise production by 5% the price is likely to fall by 10% or more!

The next scheduled OPEC+ meeting is on 4th June. Now no one expects the group to increase production and in fact, the talk is of possible production cuts.

Conclusion: It’s China, China, China?

From where we stand today, the Chinese economy looks like the best indicator for either a continued bearish sentiment or another reversal towards a bullish view on prices. Then comes the supporting roles of things like refinery margins and oil stocks (easy to see and worth watching). These things will tell us an awful lot about market sentiment and where prices are going.

But, because we are in a global industry, where politics can play a huge role in our markets, we can also never ignore the big stage of what is happening in the Ukraine war, Russia, China and the US.

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.