Bunker prices were high last month; they are even higher today. What is driving prices & how quickly can

they fall?

September 28, 2023

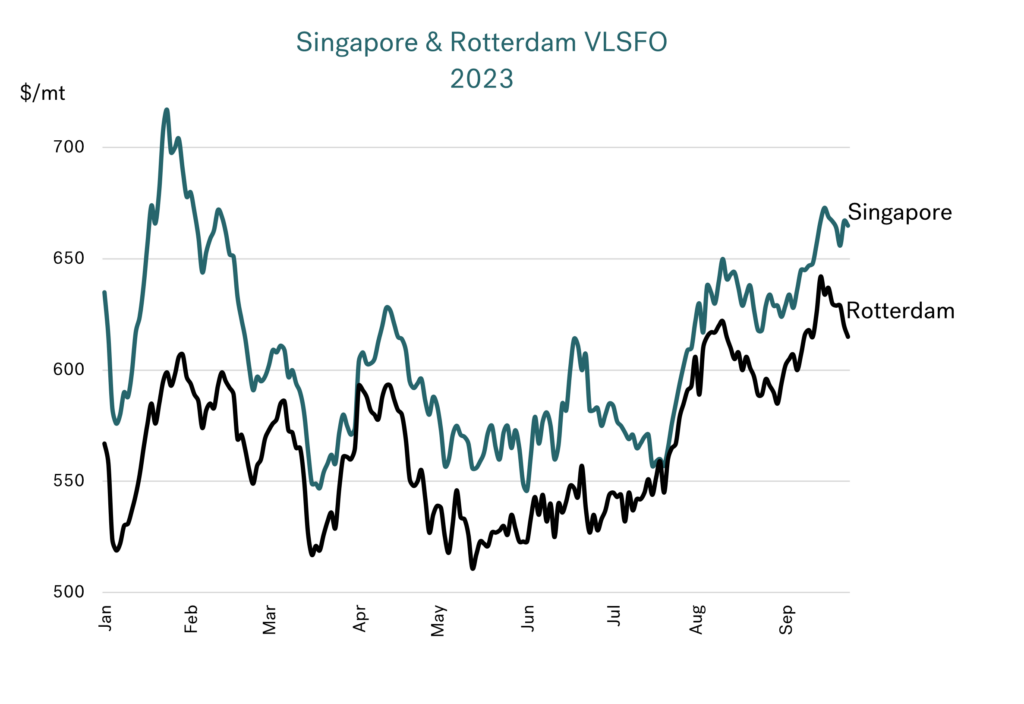

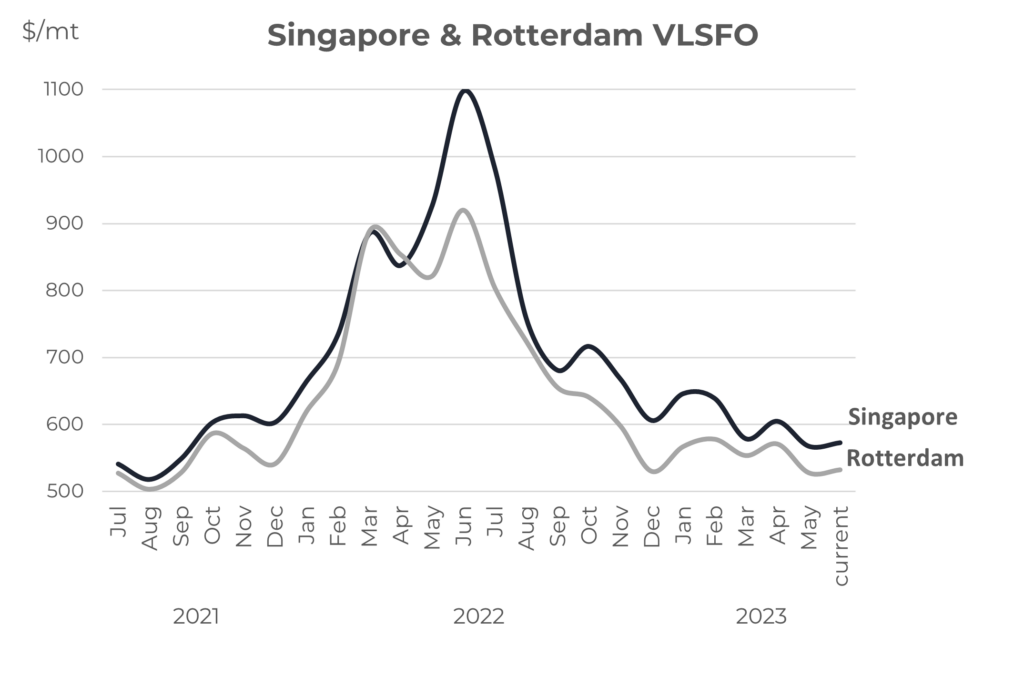

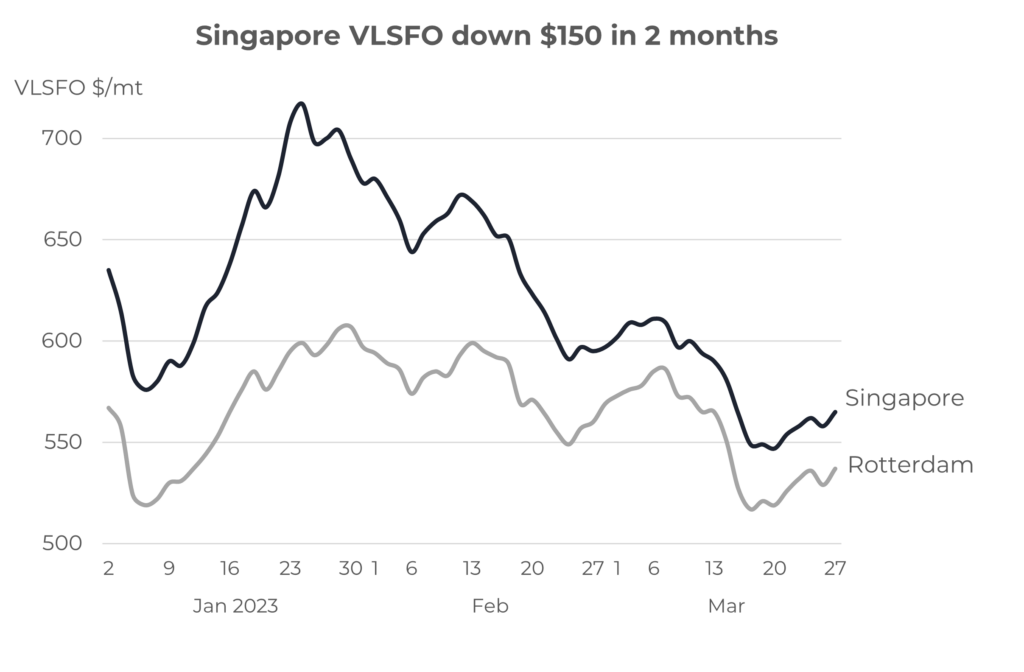

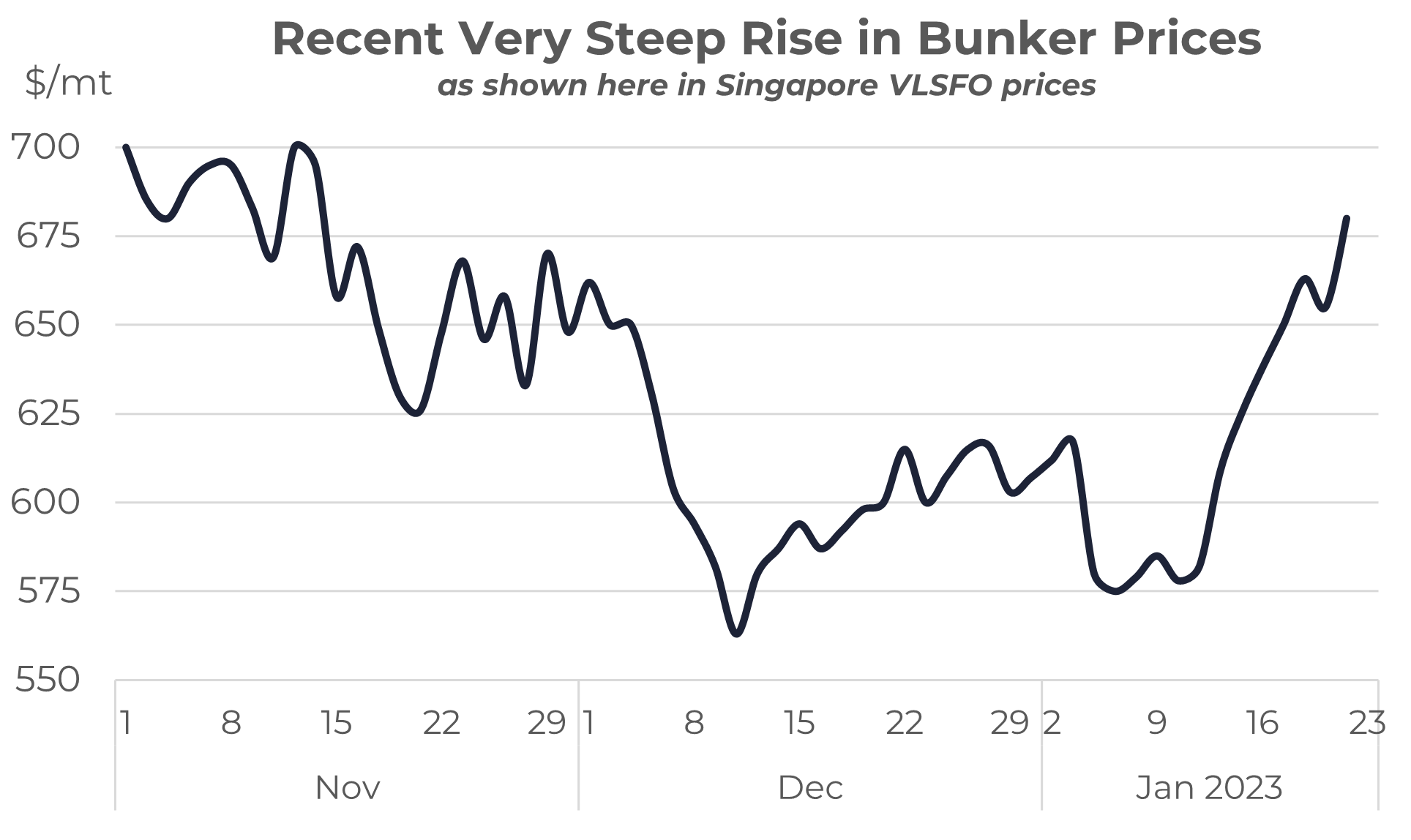

VLSFO prices have been on another rise

A month ago, we wrote about high bunker prices which were based on two key factors: Tightness in most product markets; And additional oil production cutbacks by Saudi Arabia. Now, bunker prices are even higher.

Brent has moved above $90/bbl, with Singapore VLSFO above $660/mt and close to peak levels seen at the start of this year. Rotterdam VLSFO has been trading at around $615-635/mt, its highest so far this year. More recently Rotterdam prices have eased slightly but they are still above this year’s previous peaks, and Singapore prices remain at high levels.

Source: Integr8 Fuels

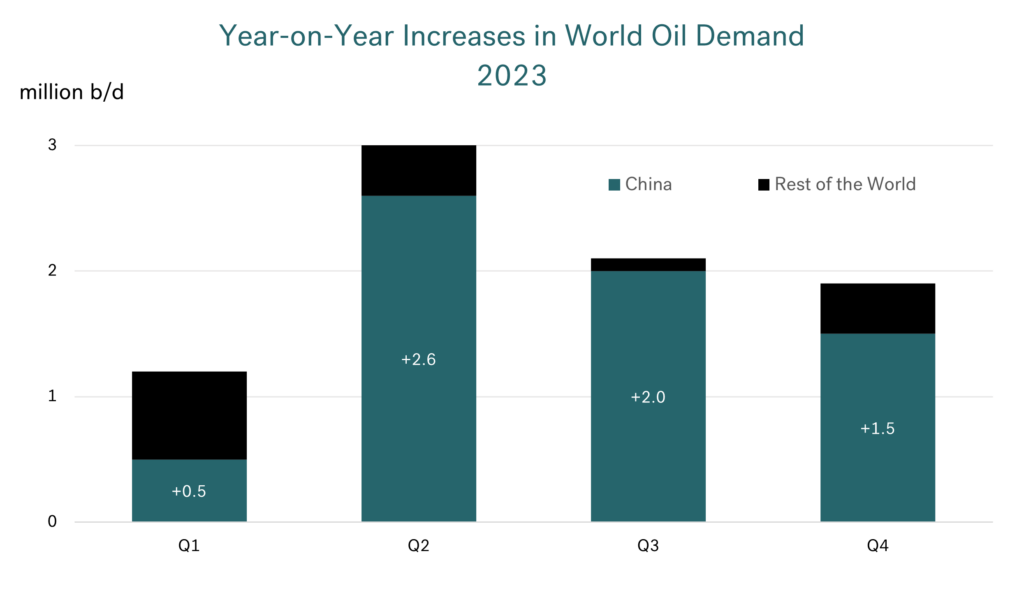

Much tighter fundamentals are behind the price hike

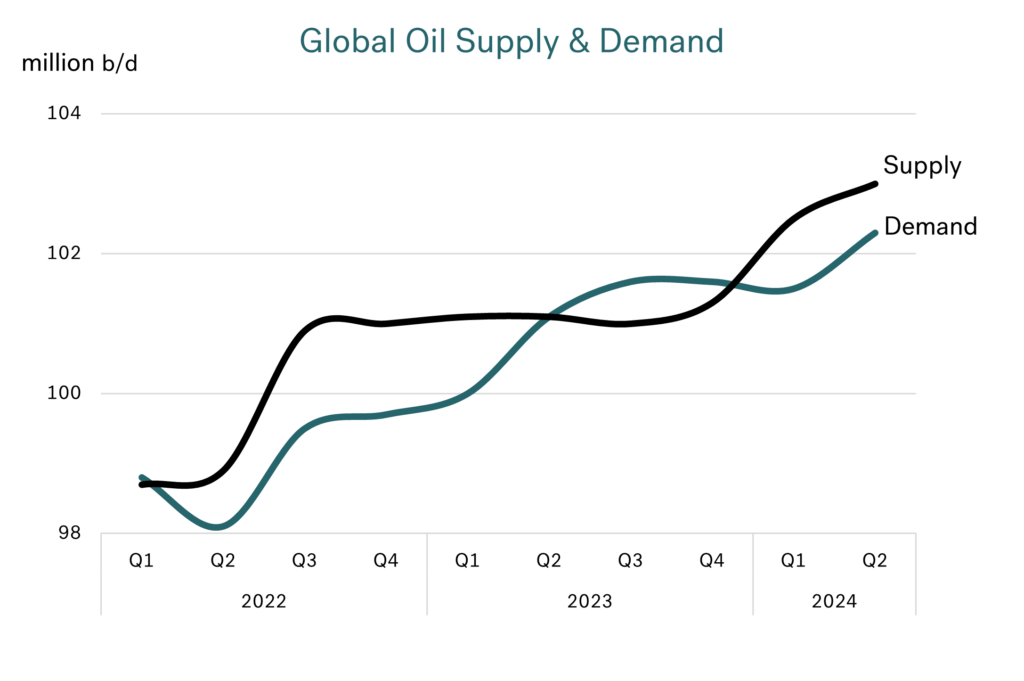

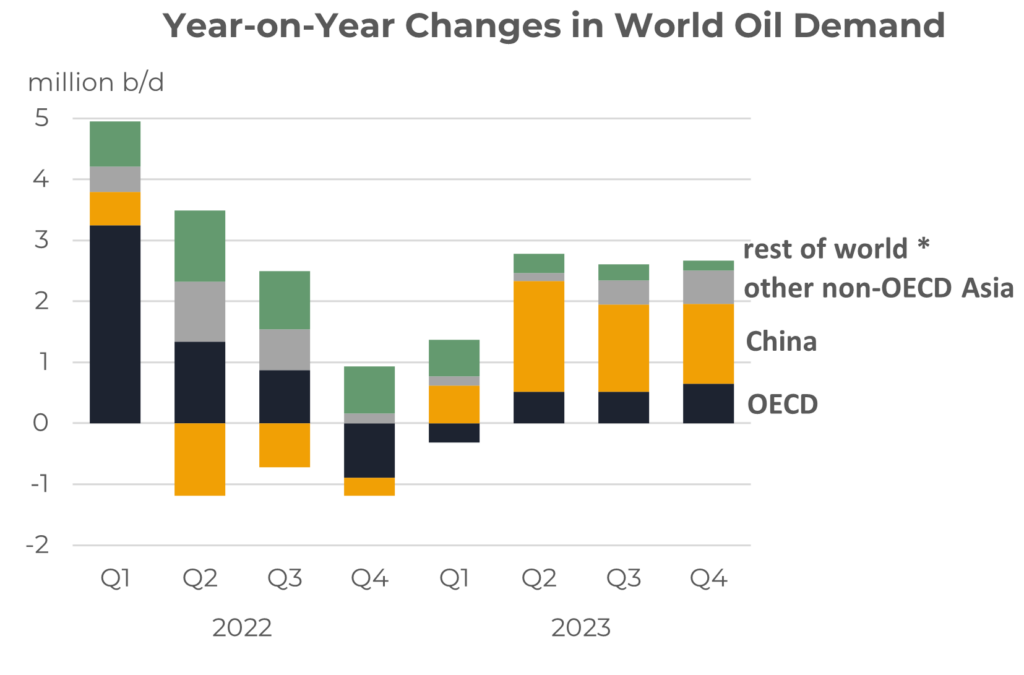

On a very short-term basis, the market can see dramatic price shifts, but it is normally the fundamentals that drive price direction over a period of weeks and months. We are now in a strong fundamental period, with year-on-year growth in global oil demand at 3 million b/d in Q2 this year and projected at 2 million b/d in Q3 and Q4. The key factor here is growth is almost entirely centred on China.

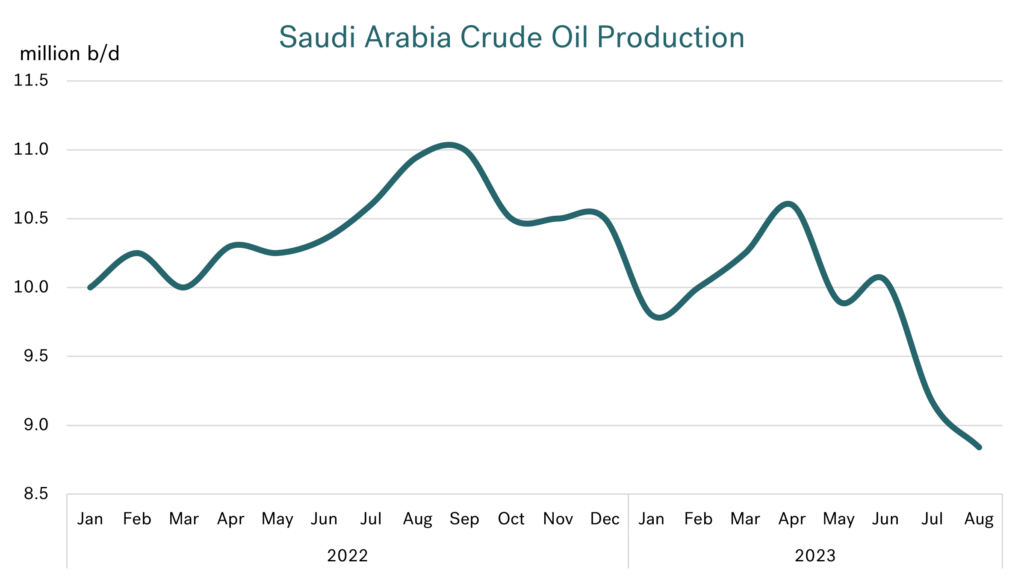

At the same time there are huge constraints in oil supply, with the additional 1 million b/d voluntary cut made by Saudi Arabia, starting in July. In fact, part of the recent price hike is that Saudi Arabia has recently committed to extending these additional cuts through to the end of this year. Additionally, the September 21st announcement by Russia which banned all diesel and gasoline exports to support their own domestic market and, we can see clear reasons why oil prices have taken another leap higher over the past month.

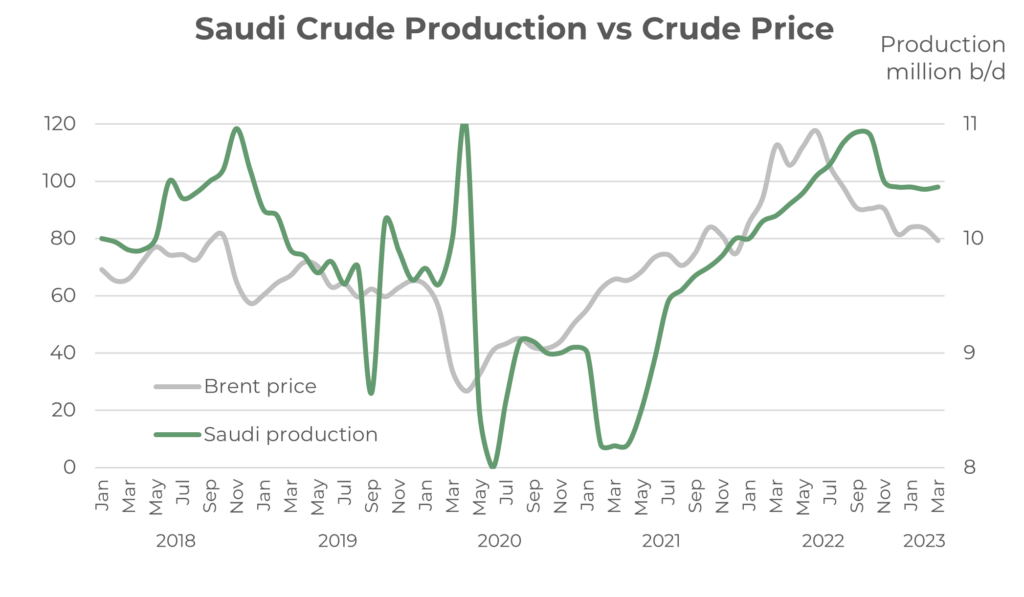

On the supply side, it is what’s happening to Saudi oil production

Saudi Arabia’s stated policy is aimed at supporting a market with less volatility, and more sustainable and predictable outcomes. As part of this strategy, the country had reduced crude output by 0.5 million b/d in line with the overall OPEC+ agreement, and then made a further 1 million b/d cut over the second half of this year. The net result is that Saudi crude production has fallen sharply over the past few months and is currently some 1.5 million b/d lower than average 2022 levels (8.9 million b/d in August vs an average of 10.4 million b/d last year). This lower level of output is expected to be maintained through to the end of the year.

Source: Integr8 Fuels

Source: Integr8 Fuels

Looking at alternative crude supplies, US production crude production is near record highs and higher oil prices has incentivised even greater investment in US shale oil. However, the problem here is Saudi cuts are instantaneous and any rise in US shale production from new investment takes months. Hence, current signals are for a potential tightness in supply over the rest of this year, before an expected 1 million b/d hike in January as Saudi crude output climbs back towards 10 million b/d.

On the demand side it is all about China, China, China

Fundamentals on the demand side also point to higher oil prices. As mentioned, increases in global oil demand are running at 2-3 million b/d (year-on-year), and these are big numbers. However, they are almost entirely based on what is happening in China; product demand developments elsewhere are minimal, and even falling in Europe and projected to start falling in the US next year

The reason for current very high year-on-year growth rates in China is that the country was still largely in lockdown through 2022, and the easing has only taken place this year. This is much later than almost all other countries worldwide, where the post-pandemic ‘boom’ took place in 2022, not 2023. Therefore, it is more-or-less China alone that is driving up oil demand this year.

Source: Integr8 Fuels

Clearly there is a risk of weaker demand than forecast in many countries but if we are looking for a big price impact from the demand side, then it is more likely to be stories about China that are going to drive prices up or down.

Market tightness in Q3 & Q4, but potentially changing going into 2024

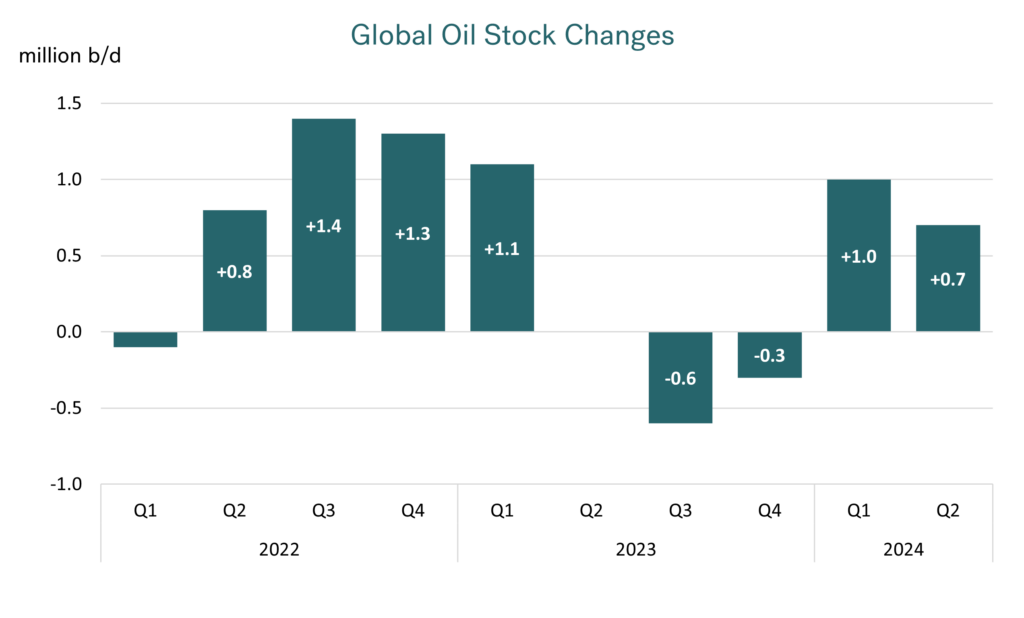

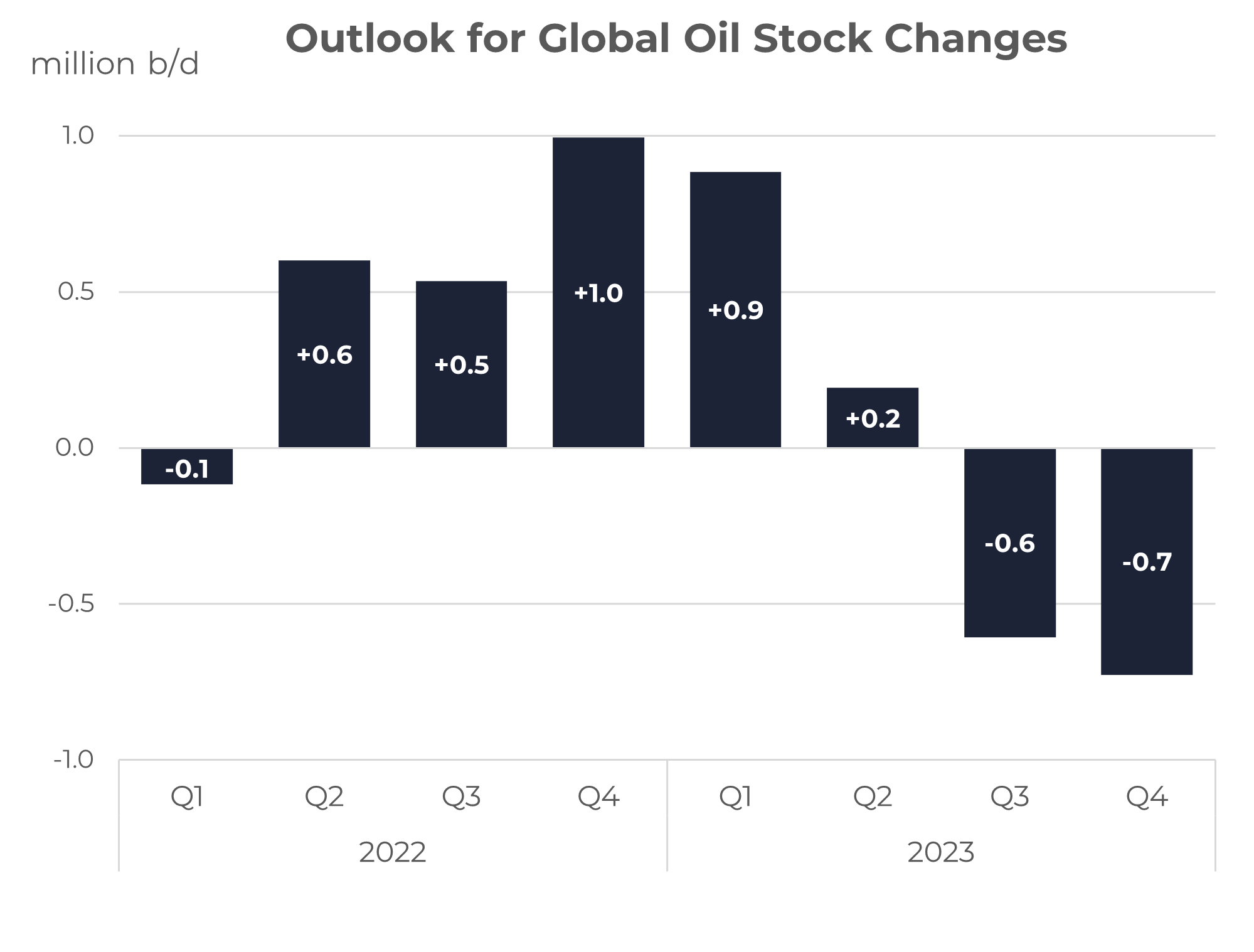

Bringing together these more extreme developments in supply and demand, the graph below illustrates global fundamentals on a quarterly basis. The key for us is that global oil supply exceeded demand through most of 2022 and in the first quarter of this year, resulting in an ongoing global stock build. However, we have just been through a turning point, where demand is exceeding supply in Q3 this year and this is expected to be repeated in Q4, leading to stock draws.

Source: Integr8 Fuels

It is not until the start of next year that we see a reversal and another turning point is envisaged. It is at this stage; Saudi Arabia says it will lift its voluntary 1 million b/d cutbacks. At the same time year-on-year growth in oil demand is expected to ease back to around 1 million b/d. So, at the start of next year oil supply is projected to exceed demand once again, reverting us back to a world of stock builds.

Summarising by looking at the global stock build/stock draw positions, we can see the exceptional times we are currently in; Having moved to a position of stock draws in Q3 and projected for Q4 this year. In addition, the tightness in global stocks lies with oil products, and not crude oil. This has been driven by high product demand and exacerbated by several unplanned refinery outages this year.

Source: Integr8 Fuels

Going into next year the position looks like reversing again, going back to a fundamental global stock build.

What’s next?

Given the fundamentals, these developments explain the wave of price rises we have seen in September.

Looking ahead over the rest of this year and into 2024, on the demand side China is the main story. Of course, Chinese demand could be higher than currently projected, in which case Brent crude could easily pass the $100/bbl ‘barrier’, along with Singapore VLSFO going above $700/mt. However, the chatter at the moment is about weakness in the Chinese economy. If this translates to lower oil demand, then it will be a sign ‘to sell’, and prices for us all would come down. This is clearly the story to watch on the demand side.

The supply side seems more predictable – When Saudi Arabia announces the additional cutbacks will be eased (or there are strong indications of this), then oil prices are likely to fall. A reversal of the Russian ban on diesel and gasoline exports could also have a bearish impact.

Timing is everything in all these developments, and the extent of any fall in prices may still be dependent on how tight oil product stocks are at the time and what stocks look like doing in the near term.

Being precise on price movements is difficult, but we know prices never wait for the fundamentals to be borne out; Markets react on news, changes, and psychology. If the fundamentals do play out as shown in this report, then prices are more likely to fall before the end of the year, in anticipation of weaker fundamentals going into 2024. Let’s see what happens….

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

If refinery throughput is back up towards record highs, why are refinery margins and bunker prices so high?

August 23, 2023

Refinery throughput is finally back to 2019 levels, however…

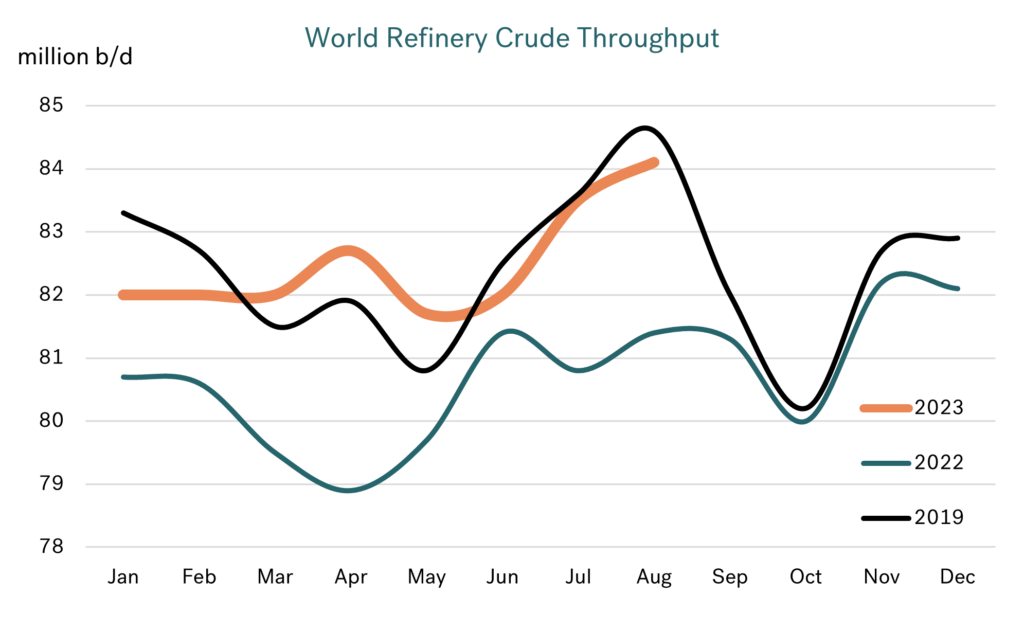

Over the past six months worldwide refinery crude throughputs have finally returned to their pre-pandemic, 2019 levels. The extent of this rise in clearly shown in the graph below, with estimated August crude throughputs at 84 million b/d and around 2.5 million b/d higher than 12 months ago. On the face of it this looks good for product availabilities.

Source: EIA

Contradictory position of high refinery runs and high refinery margins

Despite this surge in throughputs to near record highs, most product markets are extremely tight, including those covering the bunker market. The industry is being led by rising demand, with stock levels generally remaining at the low end of historic ranges. This means gasoline is strong, middle distillates are strong, and HSFO is extremely strong. The only product showing weakness is naphtha, which is at the very lighter end of the barrel and some of the reasons for this will become apparent in this report.

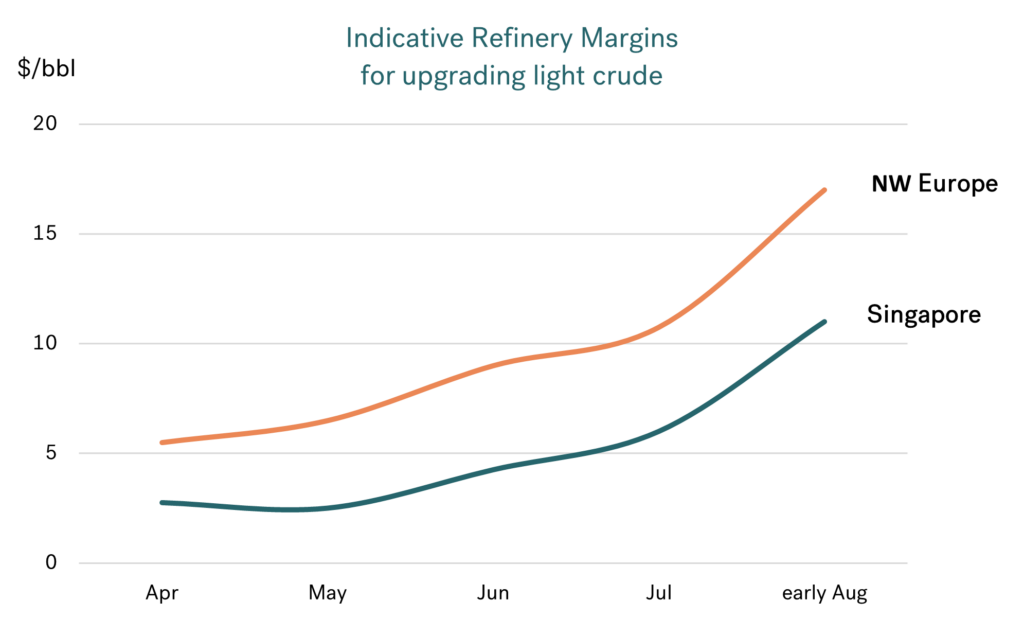

This tightness in most product markets is pushing refinery margins much higher and having the knock-on effect of higher bunker prices. The graph below illustrates recent indicative upgrading margins for lighter crude in two key bunkering centers.

Source: Eikon

Source: Eikon

Although not back to the extreme highs around the middle of last year, these margins are strong; up by around $10/bbl, and some 3-4 times greater than back in April. A reasonable conclusion may be that these much bigger margins would drive seasonal refinery crude throughputs considerably higher in both regions, however…

Where is the growth in world refining crude throughput?

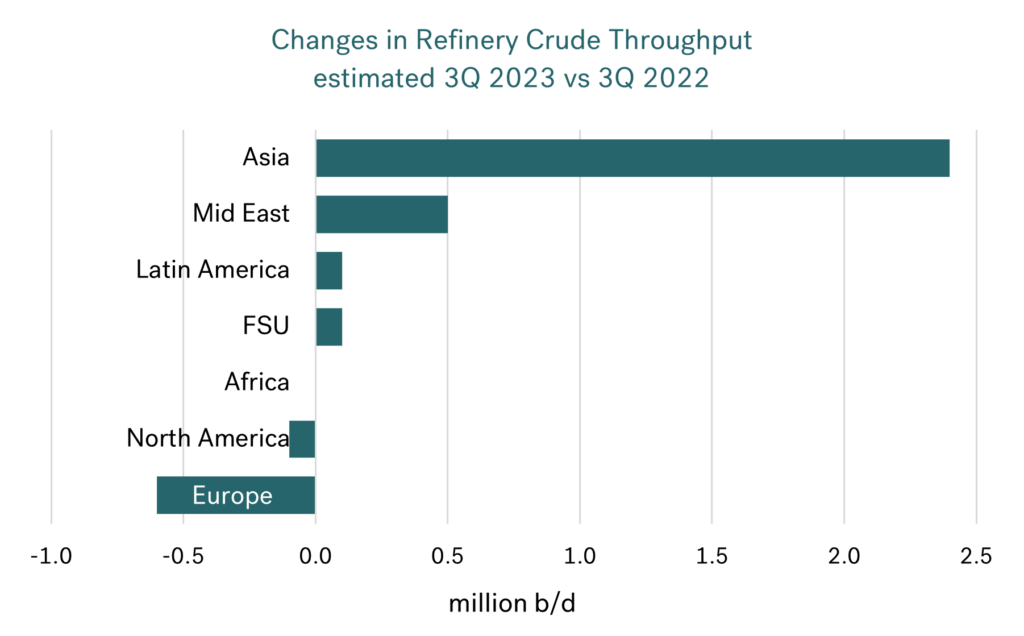

As expected, the major gain in refinery throughput has been in Asia, and almost all of this has been in China. New capacity and stronger demand in China have led to an estimated 2 million b/d increase in throughput over the past 12 months.

Similarly, Middle East crude throughputs are also up, again with new capacity coming on stream in Kuwait and Saudi Arabia supporting the increase. Operations in Africa and North America look to be largely unchanged seasonally from last year, with the US EIA suggesting a slight reduction in US crude throughputs.

However, Europe is the outlier, where refinery operations here look to be much lower than 12 months ago, with a drop of more than 0.5 million b/d in crude throughput! This is despite strong refining margins and an apparent attraction to run more crude.

Source: EIA

Why is European refinery throughput down on last year?

The first thing to say is that there have been refinery capacity closures in Europe, but this does not fully explain the drop in throughputs at a time of high margins.

There is typically some operational flexibility in the refining system to shift the type of products supplied, but this is usually very limited. At the same time, most refineries are designed to process specific types of crude, and as a generalisation this tends to be more towards medium and heavier grades.

This is the case in Europe, where the infrastructure is generally designed for medium and heavier crude grades and yet the industry:

- Has ‘lost’ access to Russian (medium) crude because of the ban in place;

- Has seen a reduction in Middle East (heavy) crude imports with the cutbacks in production in that region, which have been even more severe with further cuts by Saudi Arabia in July.

These ‘losses’ have been filled by importing more US crude and running more North Sea grades. However, these ‘new’ crude are much lighter the Russian and Middle East grades they are replacing and as a result European refiners have hit limitations in processing crude.

Ordinarily in these circumstances European refiners may have bought in feedstocks to fill upgrading units, but this has been too challenging with the ban on the Russian feedstock trade to Europe. All-round, the European refining industry is being squeezed and the net result is that crude distillation runs have had to be cut. Therefore, there is an inability in Europe to supply the market with exactly what it needs, even though refining margins are strong!

What does this all mean for bunker prices?

The importance of all of this to us in the bunker market is that pricing for low sulphur fuel oil and VLSFO blending components is relatively strong. However, the upwards pressures in HSFO markets, especially in Europe, are even greater. The enforced shift to a lighter crude slate in the European refining sector has pushed European HSFO margins to a 30 year high!

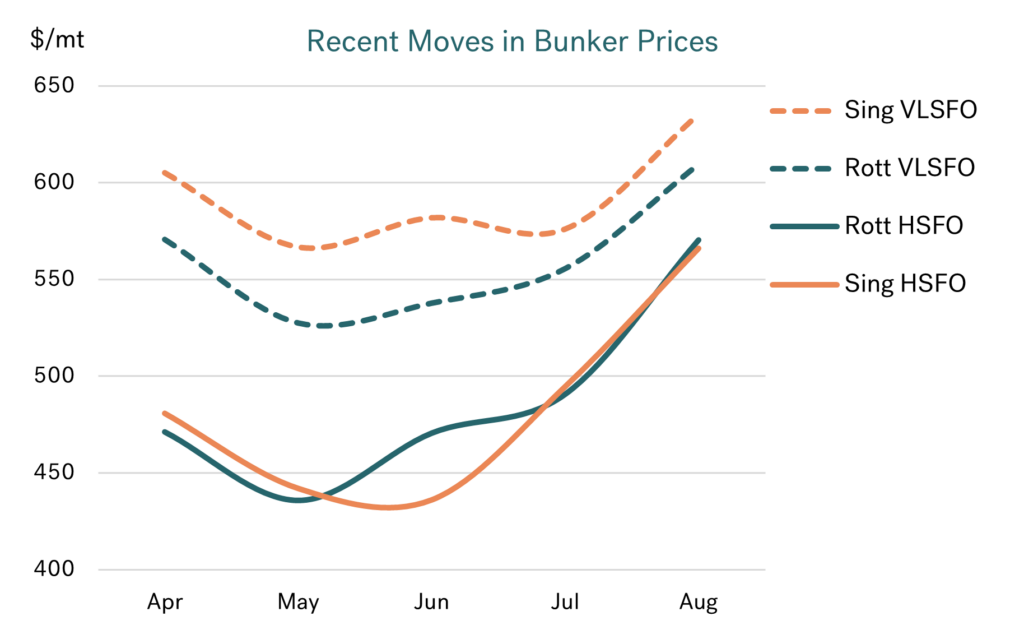

The graph below illustrates recent developments for VLSFO and HSFO prices in Singapore and Rotterdam, with all prices dipping between May/June but rising since then.

Source: Integr8 Fuels

So far in August, in both regions, average VLSFO prices are around $55/mt higher than in July. Also, whilst Singapore VLSFO prices remain above Rotterdam, this differential has narrowed to only $20-25/mt, showing bigger price increases in the European bunker market.

However, the biggest price increases from July to August have been for HSFO, which are up by $80/mt in Rotterdam and $72/mt in Singapore. Again, the pricing pressures have been greater in Europe, and with this Rotterdam HSFO prices are now at a slight premium to Singapore, which compares with an historic average discount of around $15/mt.

What are the signposts going forward?

Clearly movements in crude prices will have an ‘over-arching’ impact on product pricing across the barrel, and so for prices in our market.

But looking more specifically, the cutbacks in OPEC+ have centred on heavier supplies from the Middle East and so had a global impact on the HSFO market. This has been further exacerbated with Saudi Arabia implementing an additional cutback of close to 1 million b/d in July, and this has now been extended at least through to September. So there does not appear to be any near-term ‘relief’ to the tight global HSFO market conditions. At the same time, it is very difficult (if not impossible) to see the European ban on Russian crude, products and feedstocks being revoked anytime soon. This, along with the OPEC+ cuts, would indicate a continued greater tightness in the European HSFO market.

Let’s see where this takes us over the coming months.

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

The price is right; but what is happening to VLSFO in Singapore?

July 26, 2023

A big push up on crude oil prices to 3-month highs

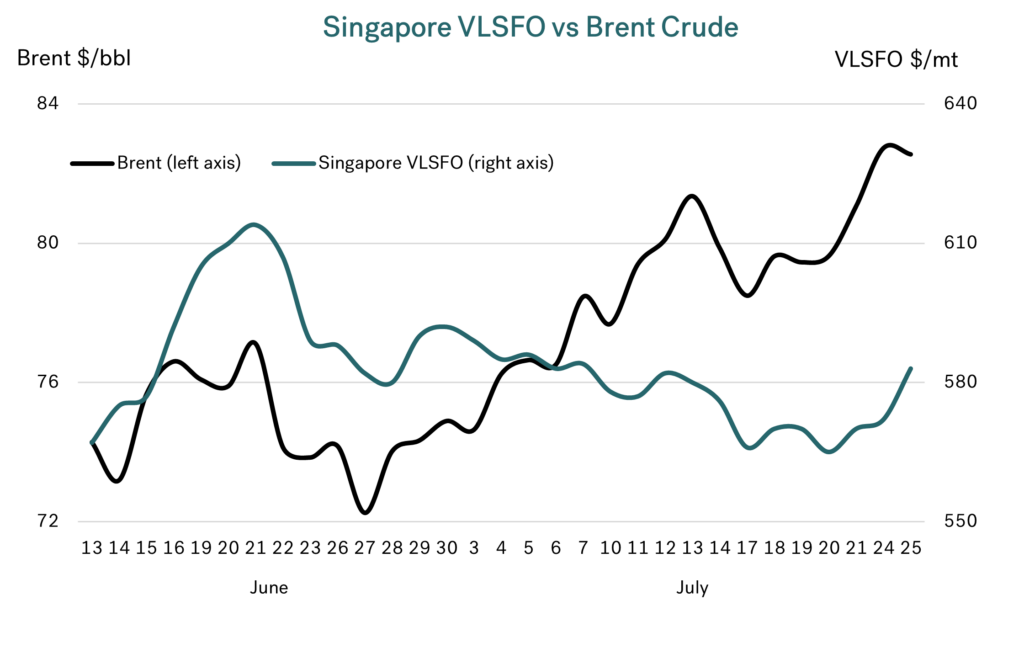

Oil prices have seen a strong hike over the past month, with Brent front month futures up by around $10/bbl, to $82/bbl. This is the highest price we have seen for 3 months and has revived the talk and forecasts of higher prices in the second half of this year.

Source: Integr8 Fuels

At the same time, heavier, more sour crude grades have strengthened by even more. We are now at a point where Oman is priced at around $1.50/bbl above Brent, when over the first half of this year it averaged a more typical $1.50/bbl below Brent. All of these moves have a heavy influence on bunker prices.

Forecasters have been talking about a price rise for some time

Since the start of this year we have been writing about how forecasters saw a potential rise in oil prices in the second half of the year. These views have been based on combined expectations of strength in oil demand coming from China and constraints in oil supply with cutbacks from OPEC+ (principally Saudi Arabia). Chinese oil demand has risen sharply and is now well above pre-pandemic levels (although there are concerns about the extent of future growth). At the same time OPEC+ has cut production, and these two developments together have pushed crude prices higher.

Crude prices usually drive product prices (although the reverse can also be true) and price direction is typically reflected across the barrel. There are obviously nuances between products, with different drivers impacting different sectors. However, a strong upward price for crude is usually a strong upward price for products.

What about HSFO bunker prices?

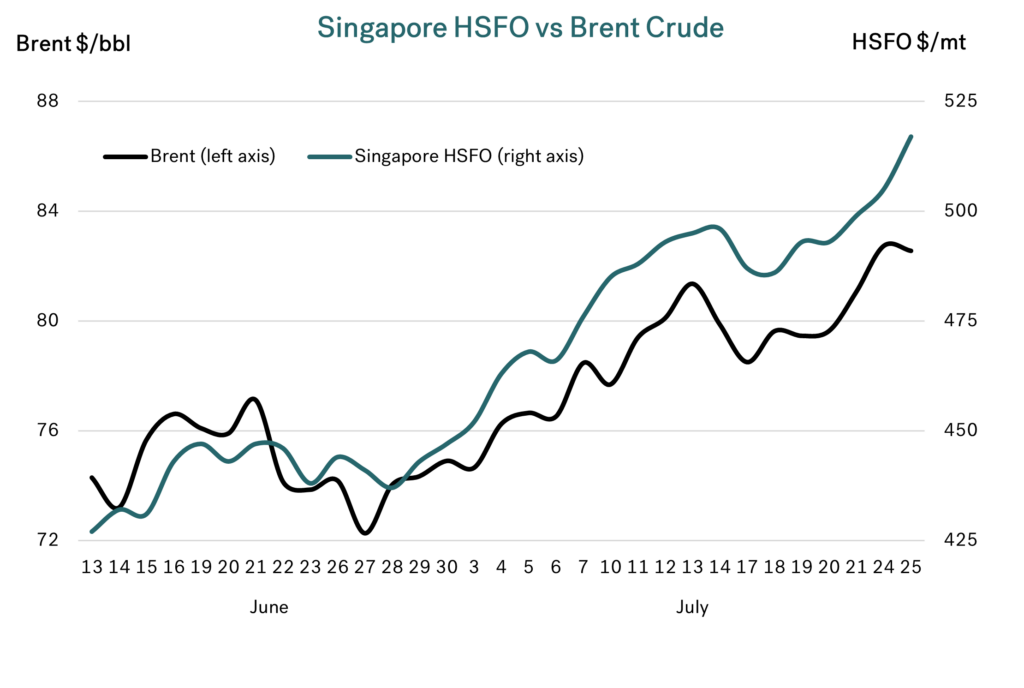

Looking first at Singapore HSFO prices, developments over the past month have been as expected given the rise in crude prices and the moves by OPEC+ (and Saudi Arabia in particular) to cut oil production. Singapore HSFO quotes moved higher as crude prices moved up. However, there has also been a further impact on this market, with fewer HSFO cargoes moving from the Middle East to Asia because of strong local demand for power generation in the Middle East.

In addition, there is the prospect of a fall in high sulphur supplies with further cutbacks in Middle East crude production, which are predominantly heavier and higher sulphur grades. The net result has been an even greater increase in Singapore HSFO prices than in the crude market, and this is clearly shown in the chart below, with the left and right axes scaled the same.

Source: Integr8 Fuels

The current HSFO bunker market in Rotterdam is also broadly in line with crude, although there has been a difference in the timing of price rises.

Has VLSFO in Singapore moved in the same way?

This is the focus of the report, and the simple answer is “NO”. In the second half of June, Singapore VLSFO prices rose and fell in line with Brent. However, since the start of July there has been a dramatic divergence in these prices. Singapore VLSFO has gone in the opposite direction to crude and HSFO and has actually fallen! This is contrary to usual expectations, but as the mantra says:

“The price is the price!”

The graph below shows these developments, again with the left and right axes scaled the same.

Source: Integr8 Fuels

The main reason for this Singapore VLSFO price ‘divergence’ is put down to an excess of low sulphur fuel oil in the region. This has come about with the West-East arb being open more recently and so several low sulphur fuel oil cargoes moving from NW Europe to Singapore. On top of this, there is an additional and ongoing low sulphur supply from Kuwait’s relatively new Al-Zour refinery.

This surge in low sulphur supply has been met with limited buying, and as a consequence sellers have been pricing very aggressively on the low side to try to clear this build-up of volumes. Hence, Singapore VLSFO prices have fallen, in sharp contrast to strong rises in crude and HSFO pricing.

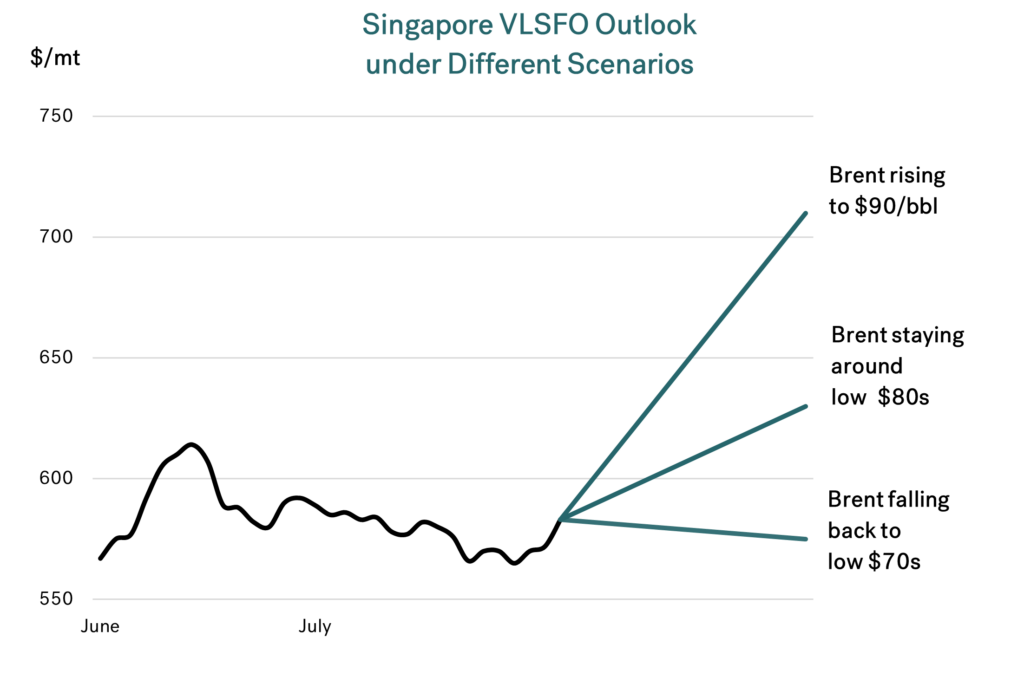

What does this mean for Singapore VLSFO pricing in the near term?

These price ‘divergences’ happen, but they are generally temporary, and price relationships do move back towards ‘the norm’ over a period of time. The ‘rebalancing’ will take place with the West-East arb closing and so reducing incoming supplies to Singapore. At the same time, buying interest will pick up, especially if buyers perceive a tighter market and higher prices on the horizon.

This can all happen over a brief period (weeks not months), and there are a number of scenarios that can play out here, including:

1. Brent crude stabilising in the low $80s

In this case Singapore VLSFO prices are likely to catch up with the recent hike in crude prices, and we could see Singapore VLSFO rise by around $50/mt from recent levels, to somewhere around $630/mt.

2. Brent crude falling back to the low $70s

Timings may not be the same as movements in the Singapore VLSFO market, but the main point is we would not expect Singapore VLSFO prices to be significantly lower even if Brent crude does return to the low $70s.

3. Brent crude continuing to rise (to say around $90/bbl)

Here we would not only see Singapore VLSFO prices rise to reflect the recent rise in Brent to $80/bbl, but then see additional bunker price gains as crude takes another step up. Picking $90/bbl as an arbitrary crude number, this would imply Singapore VLSFO rising by more than $100/mt from current levels, to around $700/mt.

Source: Integr8 Fuels

In two of these three cases it suggests Singapore VLSFO prices will rise; it will take a reverse in Brent prices to the low $70s to hold Singapore VLSFO around $580/mt. For VLSFO prices to fall significantly below these levels is likely to need Brent crude to drop into the $60s, which is not what the current OPEC+ strategy is working towards.

As always, forecasting is never straight forward, but having a framework to hang things on and then looking for key indicators can give us a better steer as to where Singapore VLSFO is likely to go.

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

The IEA has just published its 5-year outlook; What does it mean for the bunker market?

June 28, 2023

Overview

The IEA has just published its annual medium-term outlook for the oil industry. This looks five years ahead and covers the fundamental aspects of the industry, from demand and supply to refining and trade, plus a view on the outlook for Brent crude oil prices.

In this report, we analyse the key features of the oil market (which will set the underlying price for oil) and specific issues for the bunker sector, including pricing pressures in our sector and the potential overall size of our market; will it continue to grow?

What are the prospects for oil demand in the next 5 years?

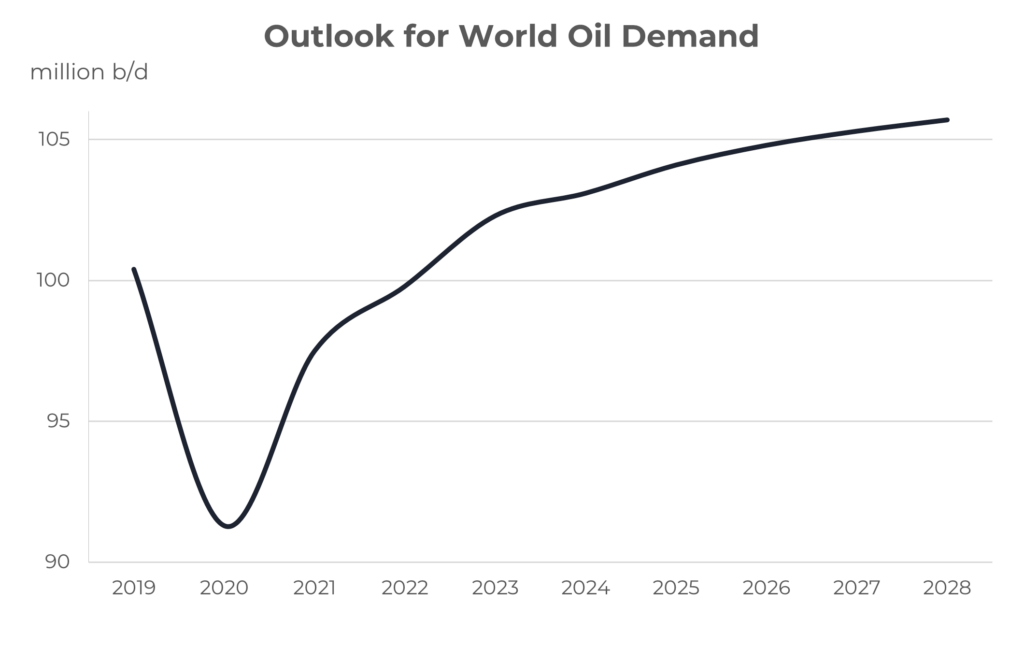

The first thing to say is that the IEA sees oil demand continuing to grow throughout the period, but the rate of growth is forecast to slow considerably.

Source: Integr8 Fuels

We are clearly still in the post-pandemic ‘return to normal’, but we are almost there; it is probably only international air travel from China that has to be ‘normalised’, and that will come soon. In this context, world oil demand is forecast to rise by 2.4 million b/d this year. Next year demand is forecast to rise by 0.8 million b/d, and is then projected to slow to only 0.4 million b/d growth by 2028. This slowdown in demand growth is principally down to energy transition to electric vehicles (EVs), with one in seven new car sales last year being EVs. This is only increasing and also being driven by China. However, greater efficiencies in the combustion engine are also a significant contributing factor.

Driving, air travel and shipping activity are all forecast to continue rising, but EVs and more efficient engines mean any increase in oil demand is much lower than otherwise expected. Efficiency is a key word across most sectors, with government backed strategies targeting net zero emissions by 2050. We are clearly involved ourselves through the IMO’s drive to reduce greenhouse gas emissions through the Energy Efficiency Design Index (EEDI) on new ships.

So, by 2028 there is still growth in oil demand, but only just and the writing is on the wall for peak oil demand to be reached sometime soon after this, and then go in to decline.

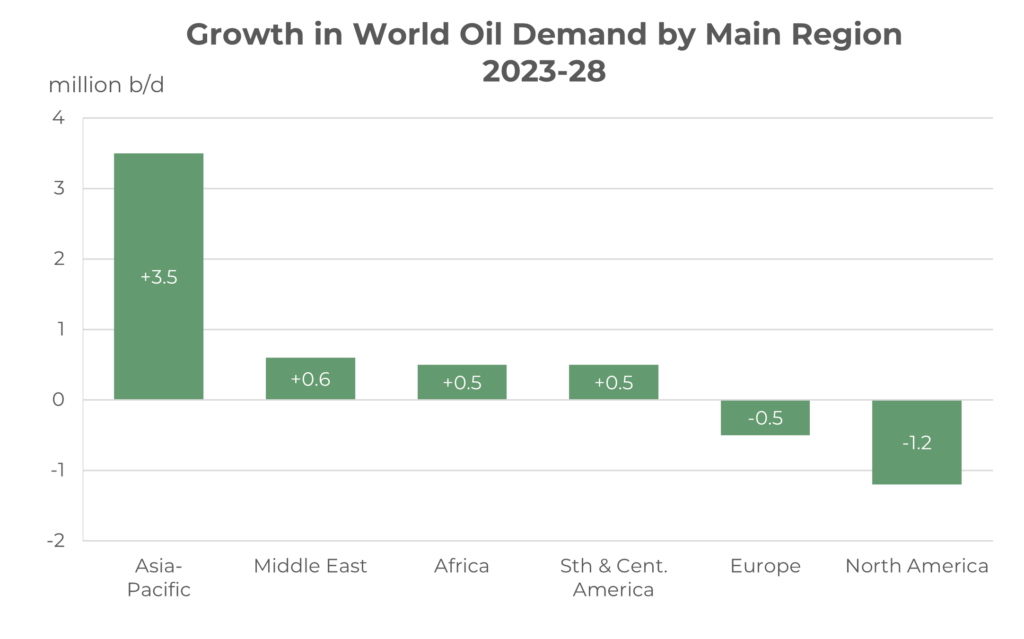

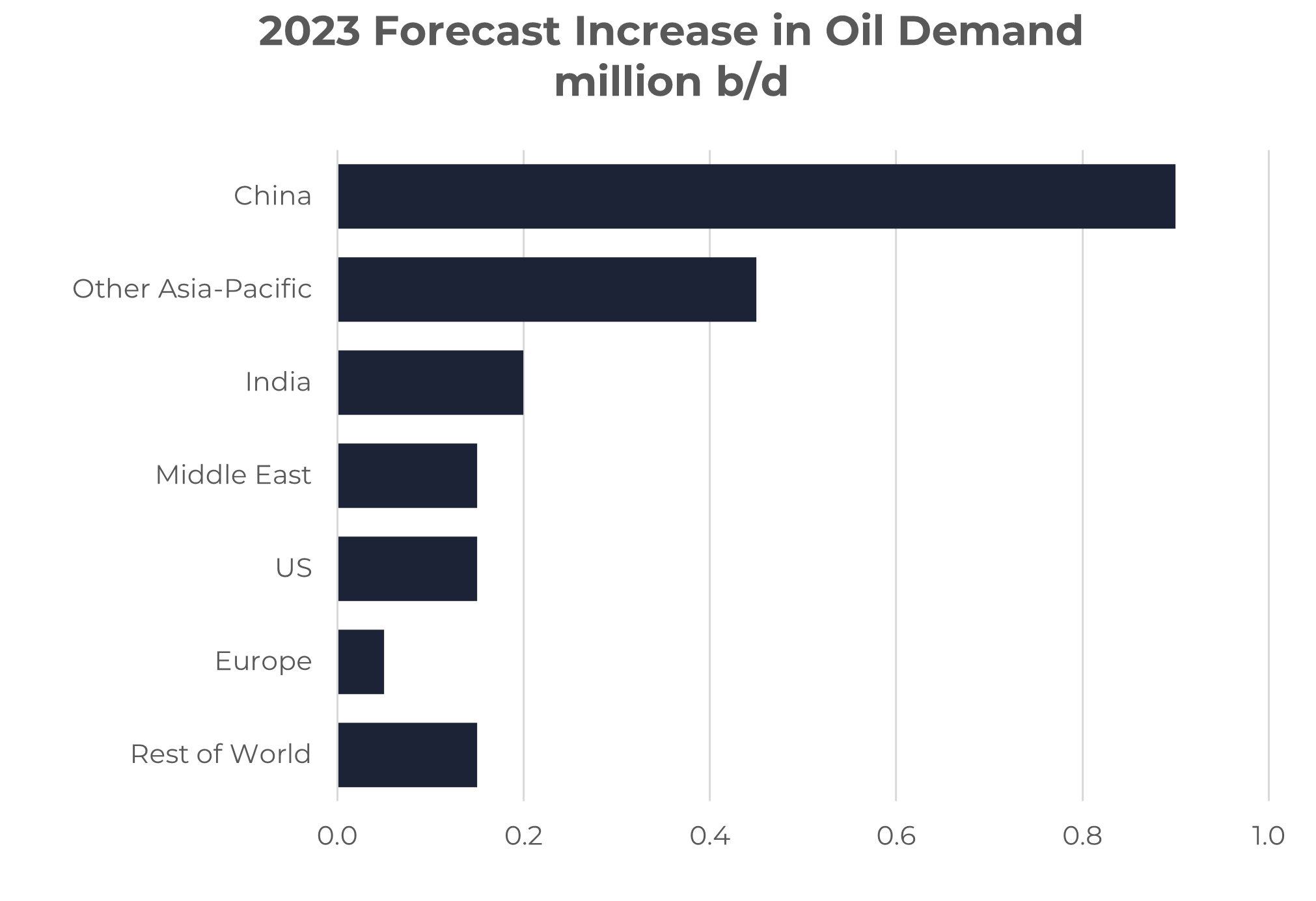

Asia is the focus for demand growth

Simply put, growth in oil demand over the next five years is centered on Asia. China alone accounts for 1.5 million b/d of the growth, followed by India, at 0.8 million b/d; each of these countries is greater than any other entire region.

Source: Integr8 Fuels

It is shifts in the advanced economies of the US and Europe where demand for oil is falling.

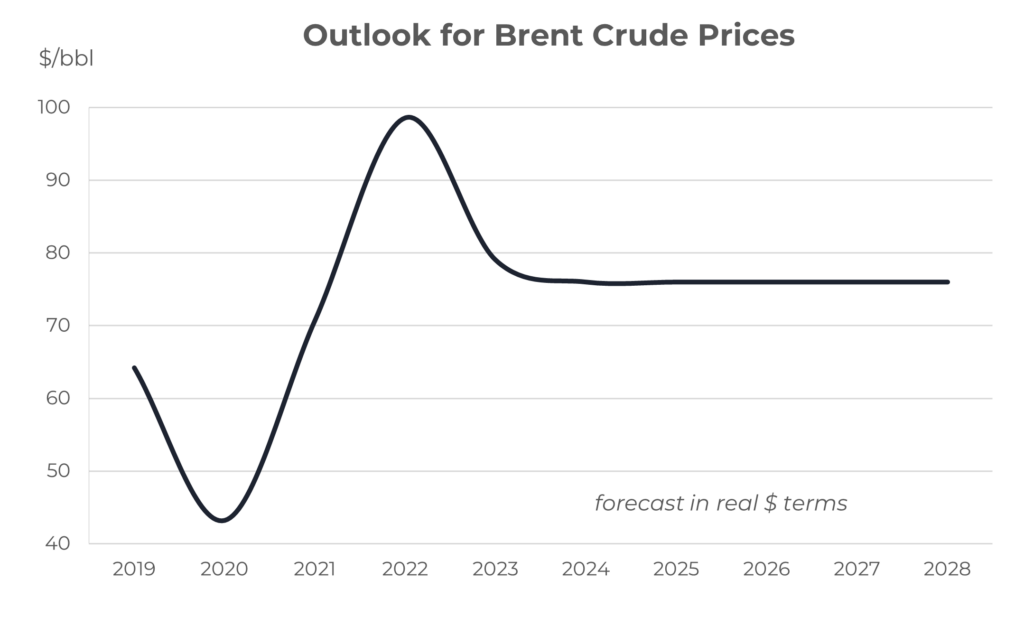

Will oil supply be able to match oil demand?

The IEA does include a detailed analysis of future oil supply, with the bottom line that there is enough new oil to meet the expected gains in demand. The key players in additional oil production are the US, Brazil and Guyana in the non-OPEC+ countries, and Saudi Arabia, UAE and Iraq in the OPEC+ countries.

As a base forecast, the IEA envisages spare oil production capacity at close to 4 million b/d throughout the period. This implies no major price hikes in their 5-year outlook, and an underlying Brent price around $76/bbl (in real $ terms) and close to current levels.

Source: Integr8 Fuels

A straight-line forecast may be concerning, but their starting point is that there will be adequate supplies to meet demand. However, there are always major caveats, with the economy a huge variable, OPEC+ strategy a key player and political events potentially damning everything; but you have to start somewhere, and these ‘events’ are largely unforecastable.

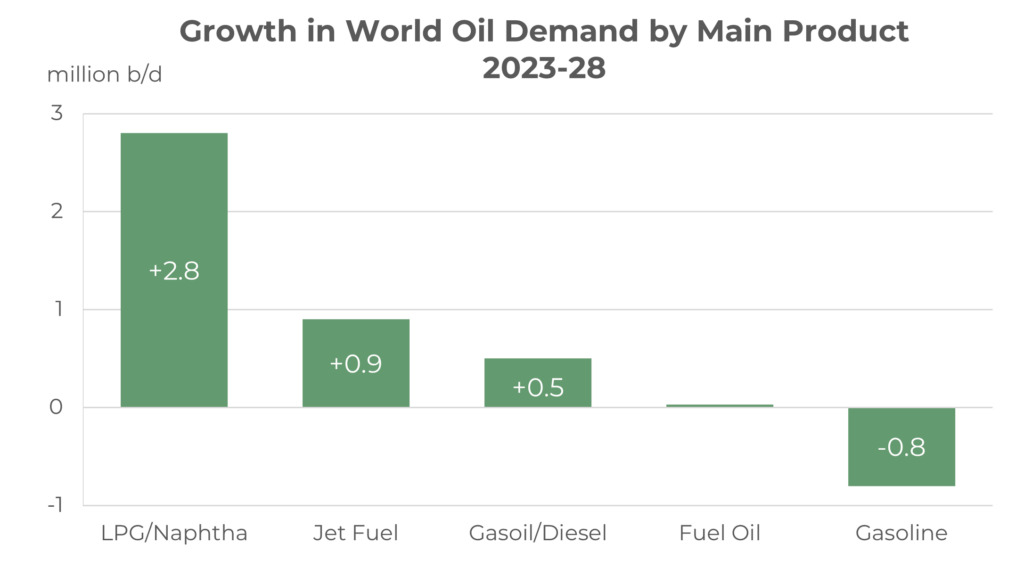

What are the products in demand?

There is always a lot going on in the oil sector, but the backdrop to the IEA’s 5-year forecast is strong growth in demand for petrochemicals (LPG and naphtha) and jet fuel, but declines in the demand for gasoline from now on and declining demand for road transport in general towards the end of the period. Interestingly, the IEA sees demand for bunkers continuing to rise (see below). The magnitude of these changes is clearly seen in the graph below.

Source: Integr8 Fuels

The growth in jet fuel demand (and the smaller gains in gasoil) are crucial features for us in bunkers, as these will have a direct impact on refining balances, leading to pressures on VLSFO supply and pricing.

The nuance for us may not be the absolute price of crude but potential constraints in the refining industry leading to a squeeze on middle distillate supplies and prices. This would push the relative price of VLSFO higher versus crude.

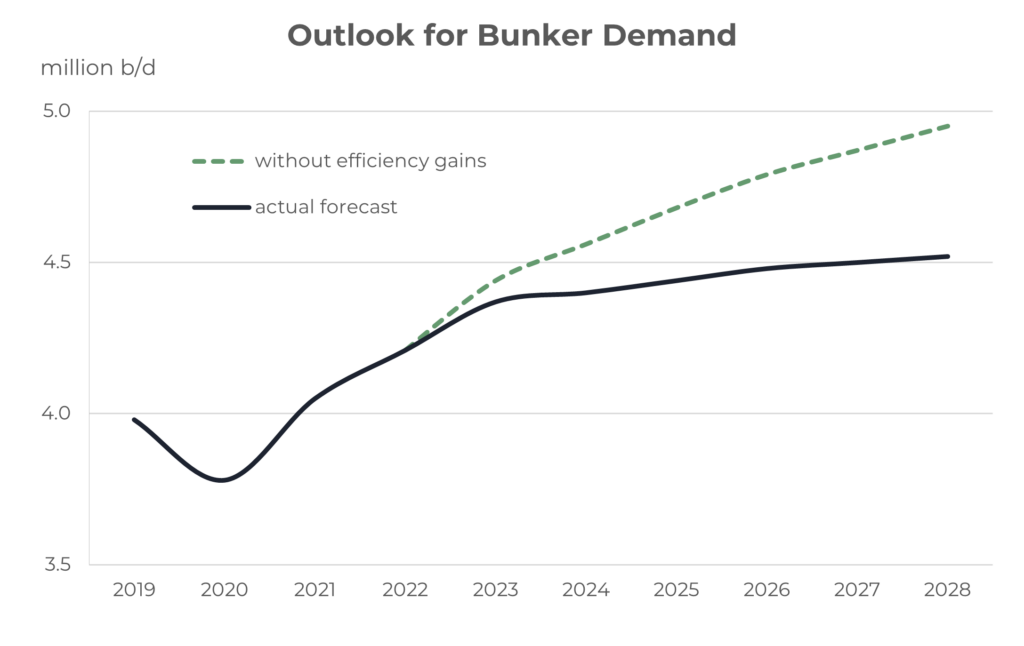

What about the size of the bunker market?

The IEA forecast seaborn trade to increase by 2-3% p.a. over the next 5 years. Ordinarily this would give a strong push on the overall size of our market, up from around 4.4 million b/d this year to around 4.9 million b/d by 2028.

However, like everywhere else, we know there is a huge drive towards greater efficiencies in our industry as part of the commitment towards ‘net zero’. With phases 1 and 2 of the EEDI kicking in during 2015 and 2020, and phase 3 starting in 2025, the shipping fleet is increasingly more efficient. The net result is bunker demand is forecast to rise not by 0.5 million b/d, but by around 0.1 million b/d by 2028. Nonetheless, the size of our market is likely to be relatively stable over the next 5 years (unlike the gasoline market and road diesel markets, which are in decline).

Source: Integr8 Fuels

Source: Integr8 Fuels

What is the outcome for us?

So, for us in the bunker market looking at it day-to-day, or week to week, it is positive, and we may actually see a very slight increase in the amount of activity taking place over the next 5 years. For those planners in our business, we are potentially looking at a ‘decent’ market size in the next 5 years.

Beyond 5 years it is more difficult, with the fleet becoming more efficient over time and talk of alternative fuels. Add to this the likelihood of more environmental legislation and the potential for new technologies (as we have seen in the car sector), and the longer-term bunker market is certainly an interesting one. Based on the latest IEA report, the bunker market looks pretty robust in terms of volumes and, at least as a base case, we are looking at annual average Singapore VLSFO prices at around $600-650/mt over the next 5 years. As always, let’s see what happens!

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Singapore VLSFO at its lowest price in 20 months; what’s next?

May 29, 2023

We have the lowest bunker prices in almost two years

For a number of months we have been ‘banging on’ about the analysts’ view of stronger oil fundamentals and higher prices, versus the reality of declining oil prices, and so lower bunker costs in our sector.

We are now at a point where monthly average Singapore and Rotterdam VLSFO prices are below their levels just prior to the Russian invasion of Ukraine, and at their lowest for 20 months. In fact, Singapore VLSFO prices have almost halved from their peak just 11 months ago.

Source: Integr8 Fuels

Can bunker prices go lower?

As we have seen over the past three years, forecasting prices can be a difficult challenge, especially in our area, which has been heavily influenced by a pandemic, let alone politics and war. So, the answer is: yes, prices can continue to slide.

Over the past 3-4 months market sentiment has strayed away from those bullish analytical forecasts and centred on some very worrying global economic developments. But we may now be at a ‘breathing space’ in the market, and if nothing else major happens like even higher inflation rates, significant hikes in bank rates or banks collapsing, then the industry may come back to look at what the analysts are saying. They haven’t really changed their fundamental views, and so if this does happen, then there will be a generally more bullish sentiment coming through.

Oil production could remain near unchanged through the next 6 months

In our report a month ago, we focused on oil production and how this is likely to be constrained over the rest of this year if key OPEC+ countries abide by their commitments to cut around 1.2 million b/d of supply (watch OPEC+ was the mantra). Forecast gains in non-OPEC+ production are similar to the planned OPEC+ cutbacks, and so on this basis oil supply would be relatively flat through the rest of this year.

After OPEC+, it comes down to demand

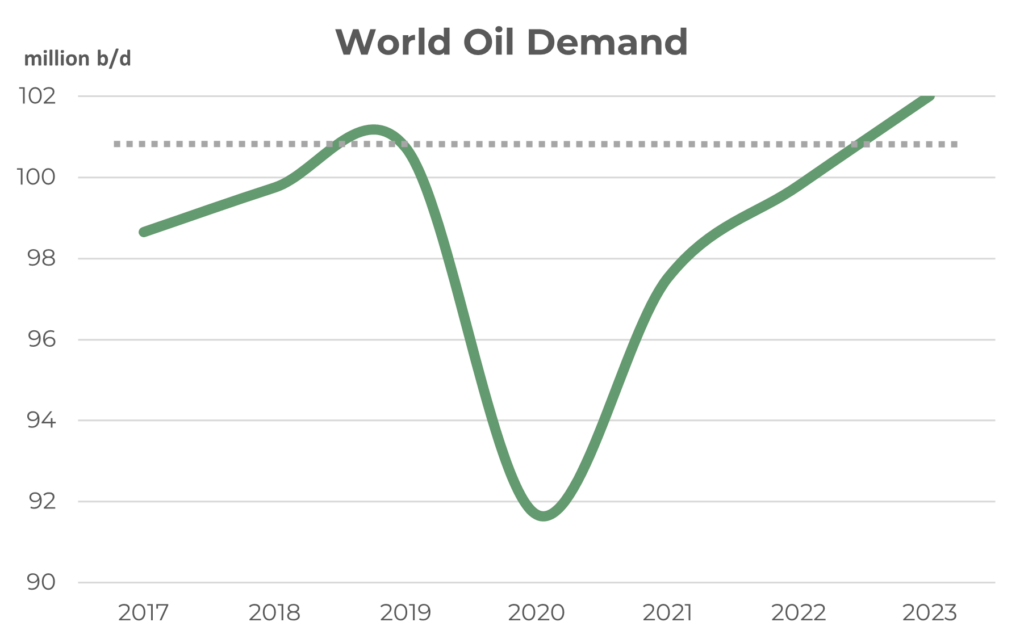

In this report we are focusing on oil demand. Current forecasts are that global oil demand will hit an all-time high this year, at an annual average of 102 million b/d. This is up 2 million b/d on last year and surpasses the pre-pandemic high of close to 101 million b/d seen in 2019.

Source: Integr8 Fuels

For all the talk of electrification in the auto sector, and anti-oil protests, global demand for oil is still rising, and is projected to continue rising for another 10 years or more. Electric vehicles will one day dominate and total oil demand will fall, it’s just that this is likely to be into the 2030s at the earliest.

The focus on demand definitely lies with China

Coming back to more recent developments and the demand outlook for the rest of this year. The graph below illustrates year-on-year changes in oil demand by main region. The two main points here are that through the earlier parts of last year it was the OECD countries that were coming out of lockdown and driving increases in global oil demand (with China maintaining strict lockdowns). Now growth in OECD countries has stalled to only minimal levels and it is China that is the focus and powerhouse of new growth, with lockdowns finally removed and the economy ‘getting back into gear’.

Source: Integr8 Fuels

This story on Chinese oil demand is gaining momentum, with latest (March) data indicating an all-time high at 16 million b/d (this compares with the US at 20 million b/d, and the two countries combined, accounting for 35% of world oil consumption). Domestic air travel has also ‘taken off’, and is also back to pre-pandemic levels. Most analysts are indicating continued growth in these transport sectors, with a boom in international air travel on the cards for the second half of this year (at the moment international air travel is only around 70% of its pre-pandemic level).

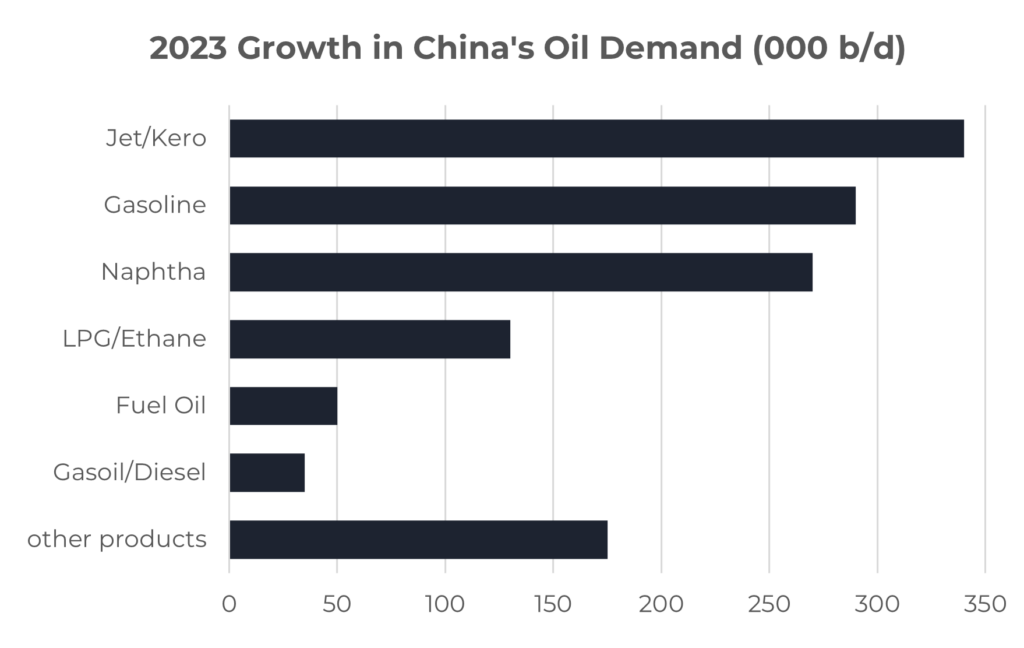

The graph below illustrates the forecast year-on-year growth in Chinese oil demand for this year by product, and clearly shows the emphasis on the air and road transport fuels of jet and gasoline. It is obviously that analysts looking at a strong growth in global oil demand this year are ‘pinning their hopes’ on these two products in China.

Source: Integr8 Fuels

Growth in naphtha demand in China is also very strong, with the major expansion in domestic petrochemical capacity.

In contrast, gasoil demand in China appears to be weak and this is a major concern because gasoil tends to be a ‘backbone’ to industrial activity. This does have further ramifications beyond the Chinese domestic market, as it is likely to limit any increase in exports and international trade. It also means a widening gap between levels of personal spending and industrial activity within China. However, the gains in travel are expected to far outweigh any limitations in the industrial sector.

Will market sentiment shift back to reflect what analysts are saying?

The IEA, Goldman Sachs, OPEC and the US EIA are some of the groups forecasting a tighter fundamental oil balance as we go through the rest of this year. There are some others that are less optimistic about China’s prospects and have greater concerns over economies in the OECD, but at the moment these seem to be in a minority.

It goes without saying that if there are heightened war or global political issues, then bunker prices are more likely to rise than fall. But summarising here, the fundamental outlook lies with the announced cuts in oil production from a few OPEC+ countries, along with the demand issues laid out in this report; in particular what is going to happen to oil demand in China. If no big, economic stories hit the headlines, and the sentiment shifts back to what various analysts are saying, then jet and gasoline demand in China will be a cornerstone in their thinking and oil prices over the rest of this year, including for us in bunkers.

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Bunker Quality Trends Report 2023

May 24, 2023

Analysing data from 60 million metric tons of supply, Integr8 Fuels’ latest bi-annual report reveals several regional and parametric trends with regards to fuel quality and consistency, including;

- VLSFO obtained in ARA is approximately 14 times more likely to have Sulphur levels exceeding 0.50% than Singapore, although with careful buying we can avoid this risk.

- The epicentre for hidden losses associated with Density remains in one of Southeast Asia’s most popular ports.

- There are continued challenges of non-homogenous VLSFO blends in the industry.

The report provides an in-depth assessment of key trends across all commercial fuel grades and key ports, answering questions such as, how likely am I to be faced with an off-specification situation, what are the most problematic parameters, which ports pose the highest risk, and what steps should I take when faced with a claim?

Topics covered include:

- The supply landscape relating to availability and specifications

- Off-specification trends and problematic parameters

- Geographical variances and “hot spots”

- ISO 8217:2017 and the headwinds continuing to mute demand

- MARPOL & SOLAS compliance challenges

- The risk of non-homogenous VLSFO blends and the impact to the end user

- Hidden losses that are often not considered when purchasing

- Statistically, what quality time bar is suitable for the bunkering location?

One story to push prices higher; Now a number of stories to bring them back down

May 11, 2023

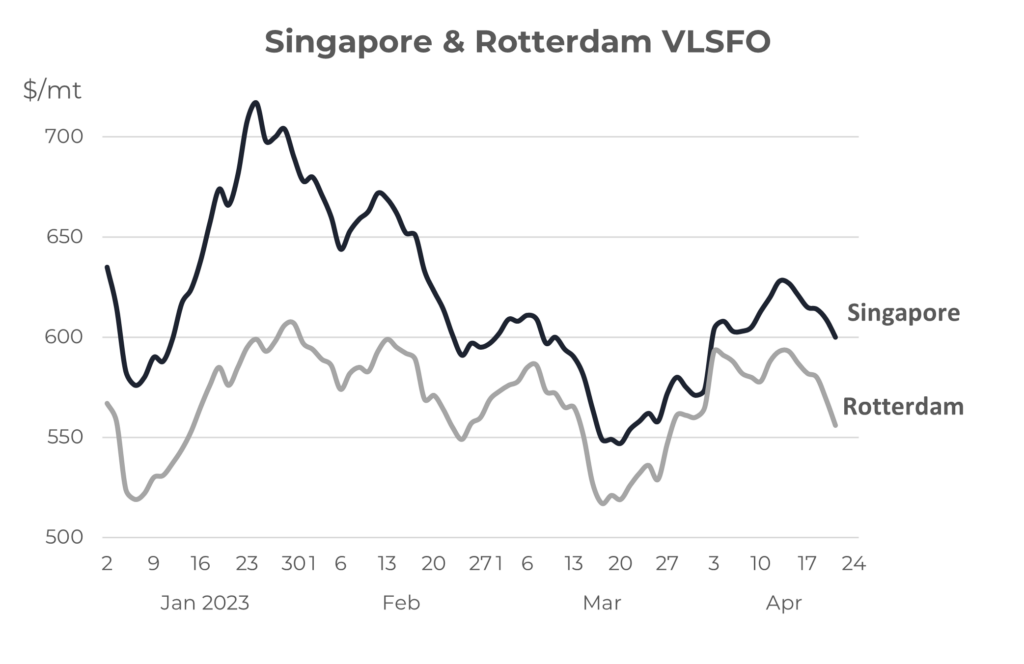

This time last month we wrote about the experts’ view that although prices had been falling for two months, their underlying outlook was still largely bullish. They were right, but perhaps for the wrong reasons; VLSFO was up around $75/mt (15%) over the last week of March and in to the first two weeks of April.

Source: Integr8 Fuels

OPEC+ cutbacks drove prices higher; not increases in oil demand

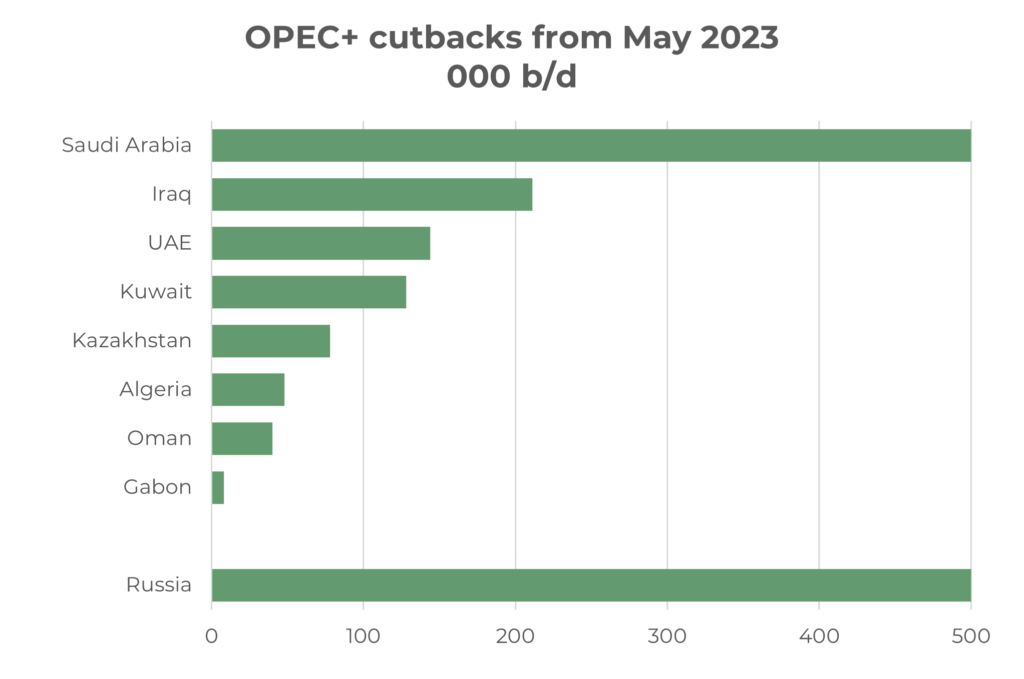

Expectations of prices moving higher have generally been based on forecasts of stronger economic activity in China and some other Asian countries, with this pulling up global oil demand. However, the main trigger to the recent price hike was the “precautionary measure” taken by some of the OPEC+ members, to make voluntary cuts in oil production amounting to 1.2 million b/d.

Source: Integr8 Fuels

This is on top of an announcement by Russia to cut its production by 0.5 million b/d. The impact of Russian statements like this are always questioned and more importantly, what does it mean for exports. If they maintain exports for revenue and cut supplies to domestic markets, it makes no difference at all to the oil balance and price projections.

When prices have been ‘under threat’ OPEC has often made cuts

It is definitely worth understanding OPEC strategy, as this can have a major impact on prices, and there could well be increasing pressures on them to cut output again. One of key issues for the enlarged OPEC+ group is that production in many countries is already below their announced quota levels. This means that any agreed cutbacks by these members is meaningless in terms of impact on oil supplies. As with the latest announcement, it does therefore fall to the ‘big’ Middle East producers to set strategy and shifts in production, and of these Saudi Arabia is the principal player.

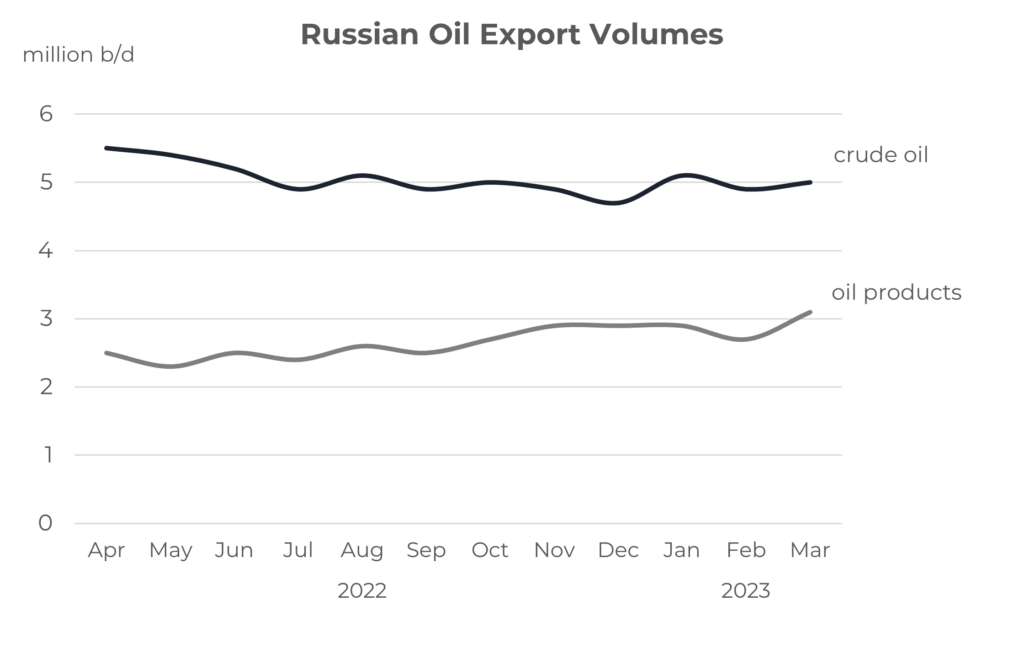

Russian exports stay the same; just going to different places

The dilemma for these Middle East producers is illustrated in the following two graphs. On the face of it, the first doesn’t appear to be very interesting, with two near straight lines. But what this does show is perhaps surprising, in that Russian crude exports have been maintained at around 5 million b/d throughout the past year. This is even with the political fallout from the war, and after the December 2022 EU ban on crude imports and the G7 imposed $60/bbl price cap on crude exports.

Source: Integr8 Fuels

On the products side, Russian export volumes are higher than a year ago.

Russia needs oil revenues

There is no doubt that Russian oil export revenues are down sharply since the start of the war, but perversely, oil revenues were boosted because of the war and the resulting surge in oil prices.

Today, maintaining oil export volumes (even under the G7 price cap), is still a way of Russia generating significant national revenue. To put this in context, Russian oil revenues were estimated at around $12 billion in March; this compares with average monthly revenues of around $15 billion in 2021. Perhaps not that big a fall in light of the political squeeze being imposed on Russia.

The challenge for the Middle East

The dilemma for the Middle East oil producers has been that Russia has been able to maintain oil export volumes, but has lost their biggest market outlet of Europe; down by 2.7 million b/d, from 3.5 million b/d in April 2022 to only 0.8 million b/d in March 2023. This has meant a swing of some 2-3 million b/d of Russian oil from Atlantic markets to Asian markets.

The known big gain has been in exports to India, which are up by 1 million b/d, but a lot of the 2 million b/d increase in other and unknown destinations is believed to be in the East.

Source: Integr8 Fuels

Middle East oil producers have responded

So, now there is a huge challenge for Middle East producers, and Saudi in particular. There has been the push from West to East on Russian crude sales and at the same time the G7 price cap has meant fob price discounts of $35-40/bbl on Urals sales to these Asian customers. Unfortunately, it’s not an easy, straight swap for Middle East exporters to fill to gap in Europe left by the loss of Russian crude, as the European refining sector is not as capable of running so much heavy and high sulphur crudes. Put simply, for the Middle East OPEC countries it is either discount to compete in Asia or cut production to defend prices. They are unlikely to compete; at the end of the day, it is all about national revenues and these are much better defended by supporting prices though ‘limited’ production cutbacks rather than aggressive pricing to maintain production.

For every action there is a reaction

The war in Ukraine has triggered EU and US embargoes on Russian oil imports. Russia has sought to maintain oil exports to generate revenues and the only way to do this has been to sell more oil to Asian customers and at discounted prices. The war in Ukraine has triggered EU and US embargoes on Russian oil imports. Russia has sought to maintain oil exports to generate revenues and the only way to do this has been to sell more oil to Asian customers and at discounted prices. Middle East producers have felt the ramifications of increased competition in Asian markets and also looked to support prices by cutting production. Higher oil prices are likely to add to global inflationary pressures and higher inflation is then likely to create a government/central bank response by raising interest rates. This can then dent future oil demand growth and potentially put a more bearish sentiment on oil prices.

As always, the impact of an action or story only tends to lasts for so long, and then another story comes along. The announcement of cuts in OPEC+ production pushed prices higher for almost two weeks. But now the news stories are more on the bearish side. Current product markets are generally well supplied and refinery margins are typically falling (apart from Asian jet fuel). Economic forecasts continue to be revised downwards, with the IMF recently lowering their outlook for growth and with it, their outlook for oil prices. So, after the $7/bbl hike in Brent front month futures following the announced OPEC+ production cuts, prices have now fallen back by around $6/bbl and close to their earlier levels.

Sitting on the fence?

People are still talking about a tighter fundamental market in the second half of this year, but this is based on growth in the Chinese and Asian markets. For now, the sentiment and stories definitely feel more to the bearish side of things.

In terms of managing oil supply in the short term, Saudi Arabia is the main player. As shown in the graph below, they have been prepared to cut production when prices are ‘low’, and of course around the time of covid shutdowns. Before this, when Brent prices fell to around $60/bbl (which is equivalent to around $475/mt for Singapore VLSFO), Saudi cut output to as low as 9.5 million b/d; they are currently moving from a 10.5 to 10.0 million b/d target. On this basis Saudi Arabia could make further cuts to those already announced.

Source: Integr8 Fuels

Hence, understanding and watching OPEC+ (and Saudi Arabia in particular) is an important part of our market. We have to see if they are prepared to cut production again if expectations of economic growth fail and Brent prices fall towards $60/bbl.

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Bunker prices: Let’s listen to what experts have to say

March 28, 2023

Don’t trust the experts?

In these more macro reports, we tend to look at oil industry fundamentals and try to get a steer on where bunker prices are going. There is no doubt that over the past few months the industry has generally reflected a more bullish outlook for prices. BUT prices have fallen!

In February there were signs of short-term weakness in Asian and European oil markets and this led prices down. In March prices have fallen again. So, there has generally been a bullish view of pricing and yet Singapore VLSFO price are down by almost $150/mt (minus 20%)!

Source: Integr8 Fuels

One outcome of this is maybe, ‘don’t trust the experts, what do they know?’. This is certainly an approach some politicians have adopted in recent years! Another view is that we are in a market where not only do fundamentals count, but ‘unforecastable’ global events, politics and psychology play major roles (as an analyst, I’m going for this view!).

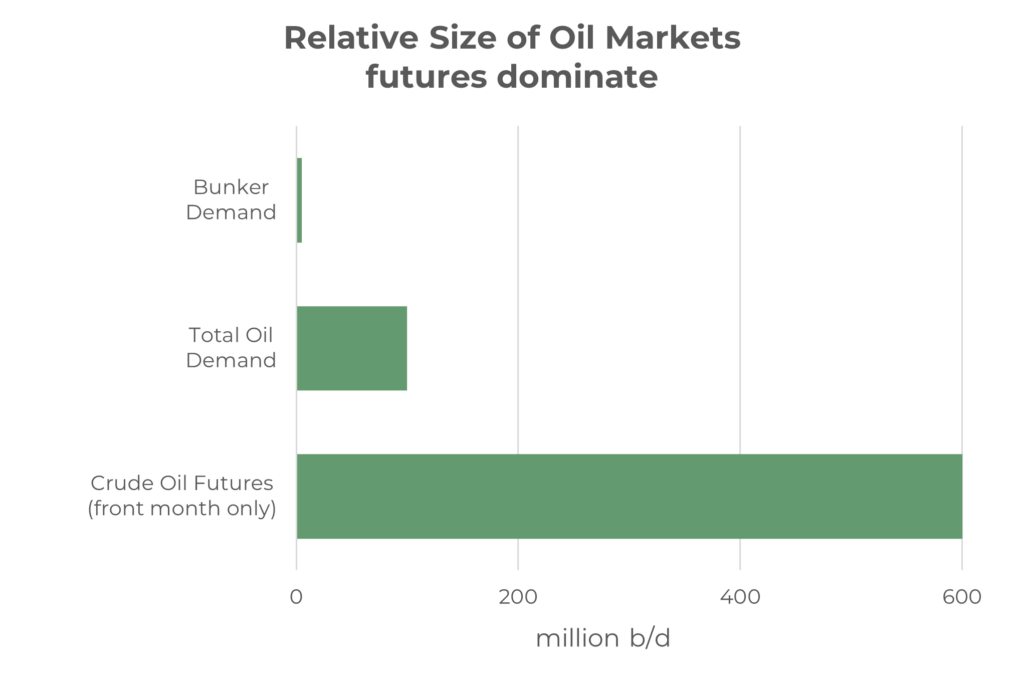

A lot of (non-oil) people influence bunker prices

In the bunker market, our prices are driven by crude oil, and this is freely, easily and widely traded in international futures markets; they set our benchmarks.

To put this in perspective, the size of the bunker market is around 5 million b/d, the total oil market is around 100 million b/d, and the average combined size of the two main crude futures markets is estimated at around 600 million b/d on front month contracts alone (this excludes trades on outer months and options etc).

Source: Integr8 Fuels

At times of a global shock, crude futures trading can easily double. So, when anything happens in the world it can have an instant impact on crude futures prices, which in turn means an immediate hit on the prices we pay for bunkers.

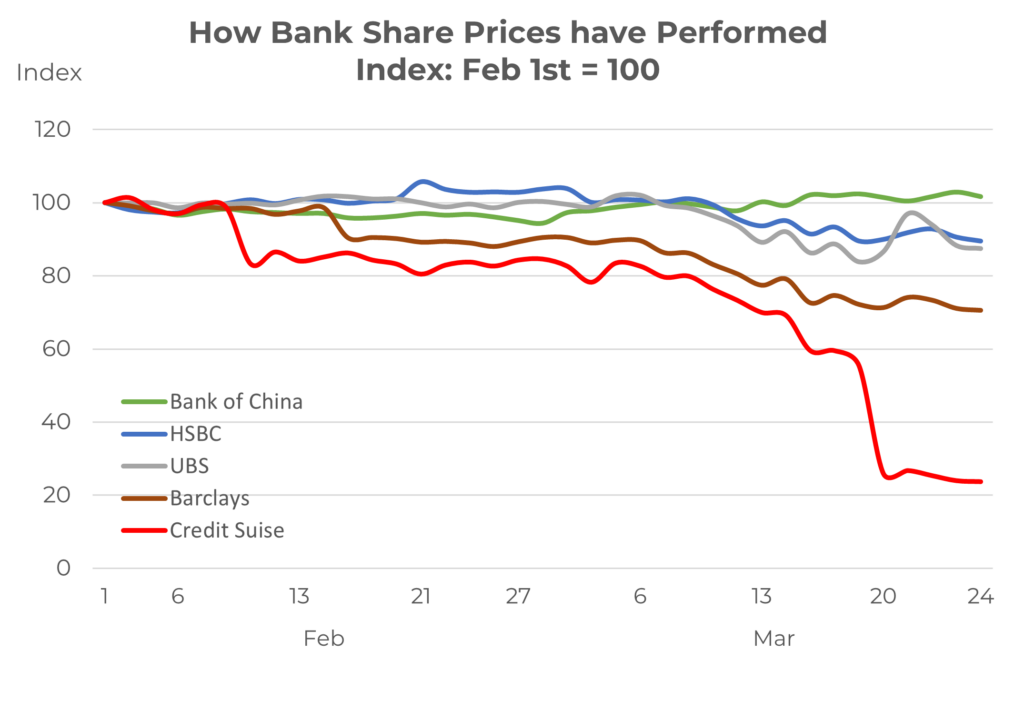

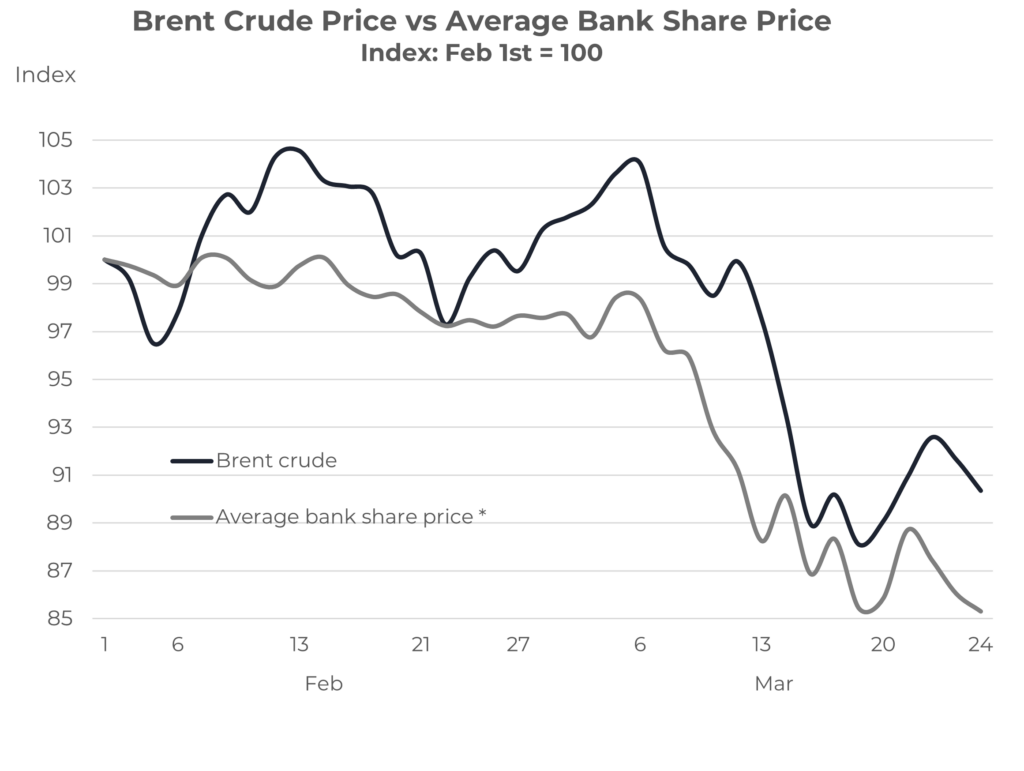

A crisis in confidence in the banking sector means lower bunker prices

Source: Integr8 Fuels

These developments clearly put a focus on other banking institutions from around the 9th March onwards. Looking at eight major international banks (excluding Credit Suisse), the average share price fell by around 10% between the 10th and 20th March. There is a 1-2 day lag in oil prices, but the banking woes clearly hit crude prices on the futures markets over this period.

Source: Integr8 Fuels

From these share price movements, it is clear the banking community (and so also us) are ‘not out of the woods’ yet, although oil prices have bounced back from their lows.

What are the expects saying now?

So, we have seen short-term weakness in the oil markets in February, and a crisis of confidence in the banking sector in March. These overtook the bullish views that were in the oil markets at the start of the year. But what are the expects saying now?

Well, those bullish economic pointers of China and Asia, plus constraints on OPEC+ production still remain and are being talked about.

Perhaps the first signal has come from the FT Commodities Global Summit, taking place just last week in Switzerland. As a broad outcome from this, crude oil prices are forecast to hit somewhere between $80-140/bbl this year; this would imply Singapore VLSFO reaching a point between $600-1,000/mt over the next 9 months

I can hear the comments now: “These experts have a very, very wide range of price views.”; “What use is forecast with a $400/mt range?”; “They have already got it wrong so far this year!”.

There will be a lot more views than these three, and some may be unprintable. But it’s worth listening to what they say, as long as we know the reasoning behind their views.

Firstly, the consensus is that prices will rise from current levels. The experts are coming back to their fundamental views and these are generally bullish. The main one here is probably China and their expectations that domestic demand is already on the rise and this is enough to tighten global supply & demand balances. Indications from the big trading companies are that Chinese road and air travel are already back to, or above 2019 levels, and this can only fuel these more bullish views.

It’s human nature to find supporting evidence to reinforce views, and here the bolt-on arguments are:

- A rise of oil demand in Asian economies;

- No signs of the OPEC+ group (particularly Saudi Arabia) raising production against higher levels of demand;

- US oil production cannot increase rapidly or by enough to take the sting out of the market.

These are generally the same market fundamentals that the experts talked about in January and February, and these still form their basis for prices hitting higher levels this year; it’s just that some curved balls have intervened in

the meantime.

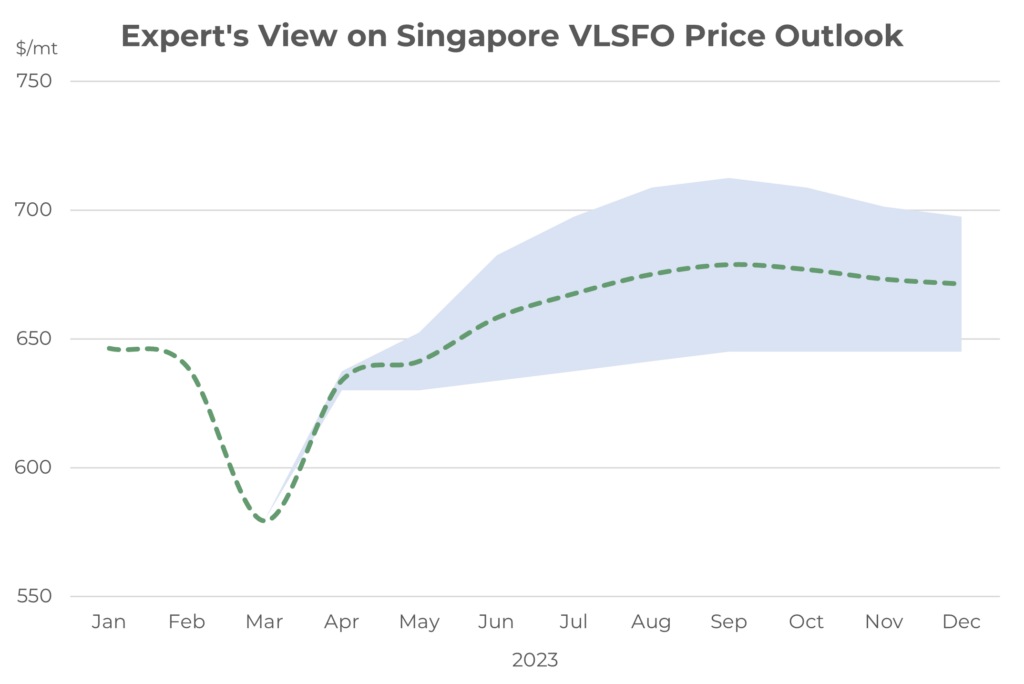

The bottom line: What does this mean for bunker prices?

Although the headline news on forecasts show such a wide range, most commentators are gravitating towards Brent prices in the $90-95/bbl range for this year. Also, the recent trend is for most analysts to revise down their forecasts by around $5-7/bbl, including Goldman Sachs and Barclays. This means Goldman Sachs is now at $85/bbl for Brent this year, which is not that much higher than end March prices and very close to what we saw in January and February.

Taking these latest, indicative views from the experts implies Singapore VLSFO prices moving back up to around $650/mt and trading in the $650-700/mt range for the rest of the year; Not as concerning as headline news of $140/bbl Brent and $1,000/mt VLSFO.

Source: Integr8 Fuels

Where are the next ‘curved balls’ to prove the experts wrong?

The pandemic, the war in Ukraine and the uncertainty in the banking arena are just three recent events that were largely unforecastable; the first pushing prices significantly lower, the next pushing prices higher and the last taking around $50/mt off the Singapore VLSFO price.

Current hot topics involve the politics between China, Russia and the US and these always have the potential to change prices drastically. Also, any outcome in the war in Ukraine will shift oil prices. However, at this stage the biggest risks to the experts’ views come from recession or another economic crisis, which seem closer now than for many years; if it happens, oil demand will be hit and prices will definitely fall.

One other potential curved ball that has just come into view is China potentially brokering a deal to re-establish diplomatic ties between Saudi Arabia and Iran. The process is underway and the first phase is to reopen embassies in each other’s country within the next two months. Upcoming diplomatic talks are planned and there are even (unconfirmed) suggestions of the Iranian President going to Saudi Arabia to meet the King at some stage.

Obviously, it is unclear how far things will go, but in the first instance, any resolution between the two counties is more likely to lead to lower oil prices, rather than higher. However, that then leaves the political fallout from the situation and China brokering such a deal; where does this leave the US and how would they respond?

There are a lot of unknows here, and any oil expert looking at forecasting oil prices is not going to be able to factor-in these into any price forecast they make.

So, for us looking at bunker prices, let’s take a steer from the experts, make sure we know why they are saying what they are saying, and keep an open mind to world events and what these may do to prices in our market. Easy…..

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Sentiment and prices have shifted into reverse; Will it last?

February 22, 2023

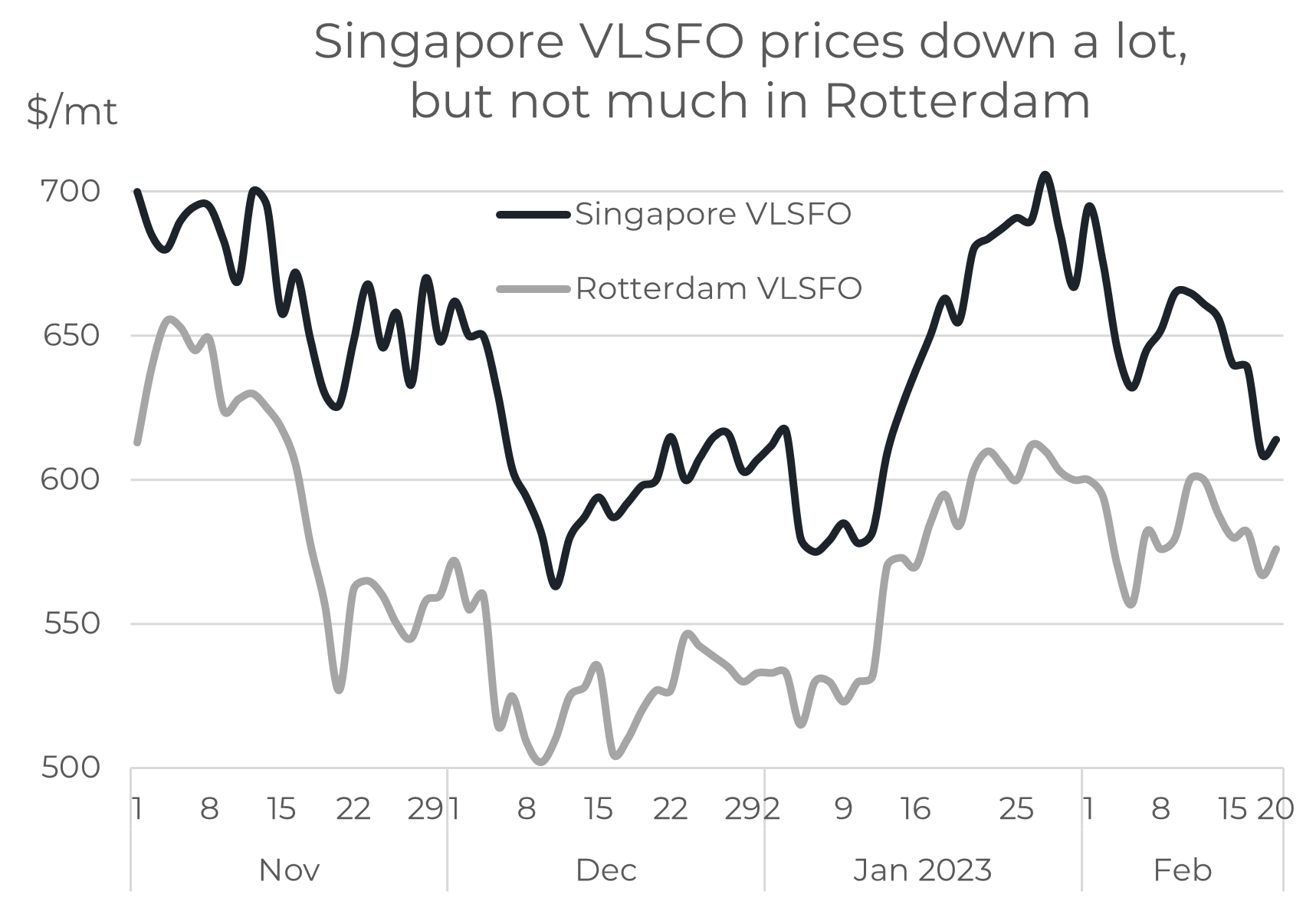

Singapore VLSFO up in January and back down in February!

It’s clear that sentiment and price direction can change ‘in the blink of an eye’, and that’s what’s happened this month. Singapore VLSFO prices rose by some $130/mt in January; so far in February they are back down by around $100/mt. It means Singapore VLSFO is not much higher than at the start of the year.

Source: Integr8 Fuels

VLSFO price movements in Rotterdam have been less volatile than in Singapore, and unlike Singapore, prices have remained much higher than in early January. This is mainly down to Europe’s close proximity to the war in Ukraine and the EU bans on Russian oil imports.

Why the change in sentiment?

Throughout January, markets were increasingly bullish on the back of:

- Stronger economic and demand prospects in China and other Asian economies;

- The start of the EU ban on Russian product imports from 5th February;

- a potential tightness in the oil market over the second half of this year.

However, at the start of February there was a much shorter-term focus on what was a weakening market structure. Asian markets were not as tight as expected, partly as more diesel exports came from China.

The European market was also not as tight as expected, with a surge in Russian product imports ahead of the EU ban and substantial long-haul distillate imports coming in to replace the lack of future Russian products. The EU ban on Russian products is seen as shifting trade patterns to longer haul destinations in the East, rather than a total loss of the Russian export market (similar to what has happened with the EU ban on Russian crude starting last year).

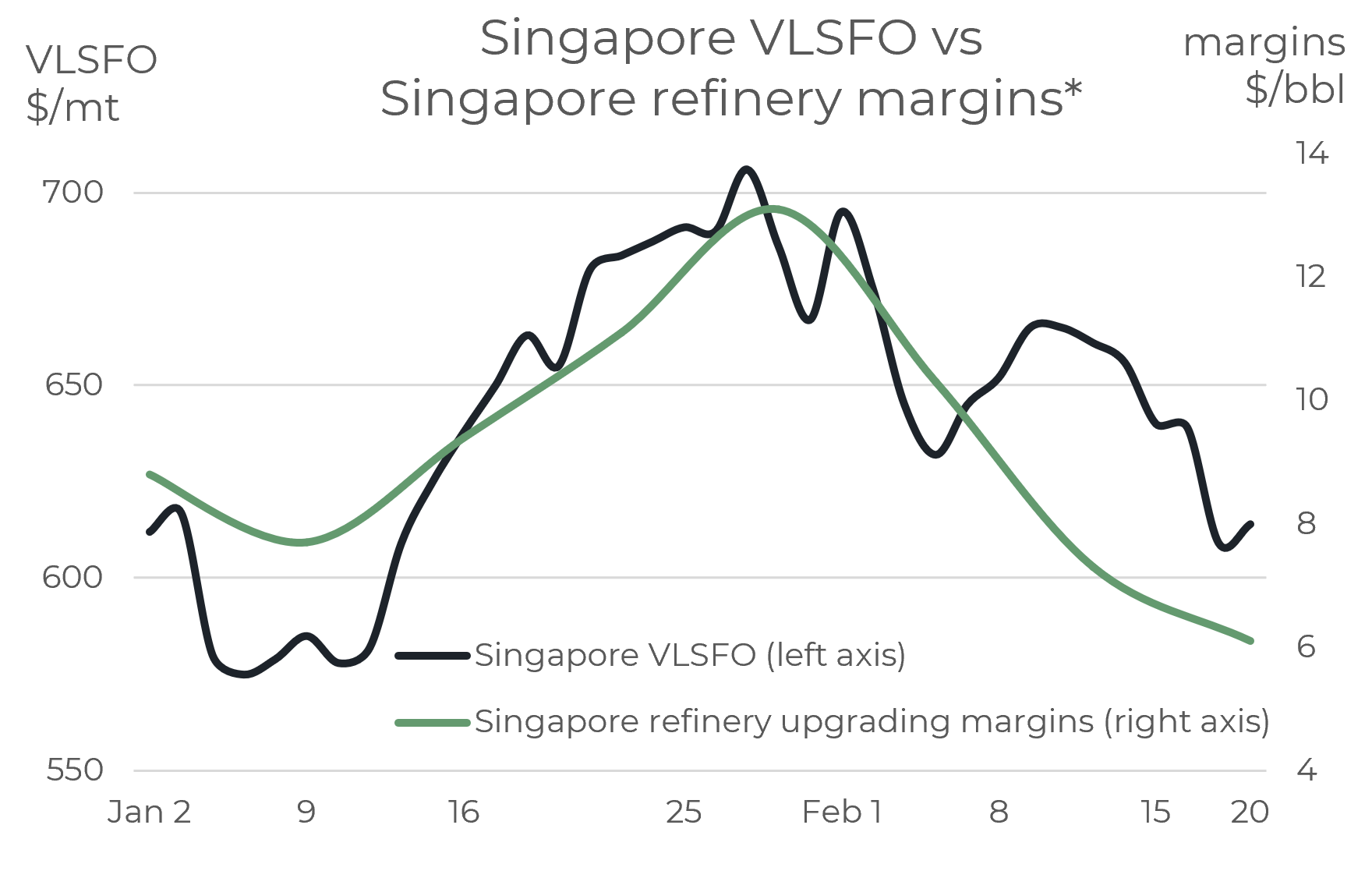

All of these bearish developments filtered through to weaker prices and refinery margins, which have been much lower so far in February than in January. Margins have been a clear, measurable market signal of weakening conditions, which is illustrated in the graph below for Singapore VLSFO and local refinery margins.

Source: Integr8 Fuels

Source: Integr8 Fuels

What about the ‘previous’ bullish factors?

It’s not that the economic prospects in China and Asia have disappeared, or analysts no longer see a potential tightening in oil market fundamentals over the second half of the year. It’s that as we moved into February, oil stocks rose and refinery margins fell. There are also a couple of other bearish factors that have been picked up on, such as possible tighter monetary policy in the US and the strong US dollar hitting buyers using other ‘local’ currencies. It is all this that turned the market around in late January/early February.

The obvious market question then is…

How long will it remain bearish, and what factors to look out for?

The age-old mantra of ‘the market tells you everything’ usually works, and we have gone through this month where most product balances are weakening.

Published data on refinery margins and oil stock levels are really useful to keep watching to see if there is a change. It may be difficult to change sentiment on just one week’s data, but as we have seen this month, turning points usually happen when the market focusses on a few ‘contributing factors’ all pointing in the same direction.

Here is where developments in China and its economy will be a prime focus. The key elements for us are what is happening to Chinese crude buying, refinery throughputs, product exports and how oil demand is performing. All four of these are inter-linked, but the headline focus will be oil demand. If there is strong confidence in Chinese demand rising in line with many forecasts, and this coincides with data signals such rising refinery margins and lower stock levels, then the market is likely to reverse once again, to a bullish trajectory. If however, Chinese oil demand is seen as faltering, then this is highly likely to mean a continued bearish oil market all round.

China is obviously a key player in market sentiment and a main driver in any change. Today there are conflicting signals being discussed, with ‘bullish’ indicators from government stimulus packages and infrastructure projects, but against this are ‘bearish’ signs of low disposable incomes and savings. This is where analysts will keep a close eye.

What about an increase in oil production to bring down prices?

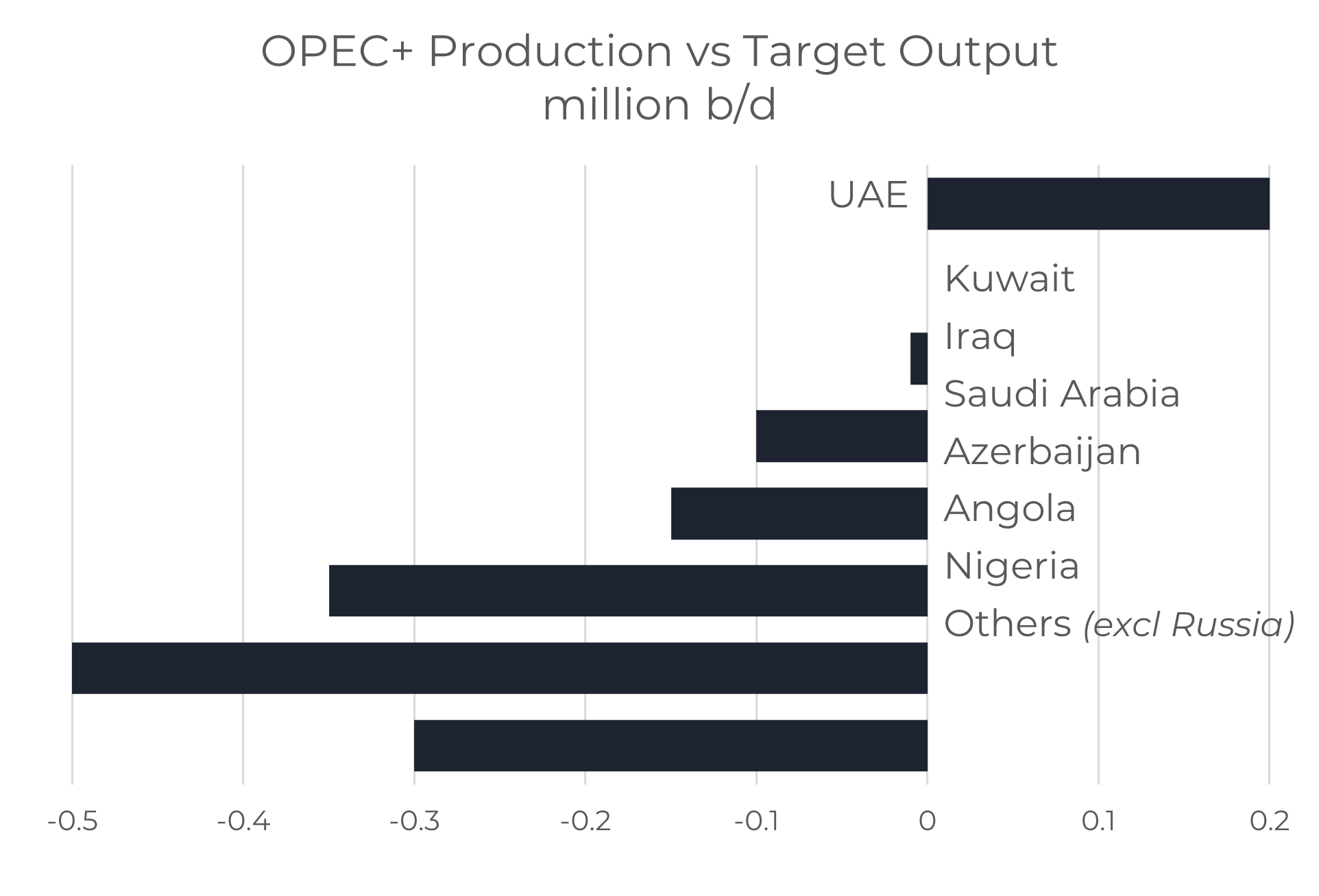

Apart from Chinese oil demand, another fundamental factor worth looking at and understanding is crude oil supply. OPEC+ is the only group/country that has spare production capacity and so can increase output rapidly. However, given all the volatility in oil prices, the OPEC+ group has stood firm in its strategy of not increasing target allocations for the group. Part of this is because of a ‘lack’ of upstream spending in recent years means many of the member countries cannot even reach their current targets.

The UAE is the only country currently producing substantially more than its allocated volumes. Almost all other countries are below target, with Azerbaijan around 150,000 b/d lower, Angola 350,000 b/d lower and Nigeria 500,000 b/d lower. The signs are clear that most OPEC+ countries could not raise output even if the cartel decided to increase allocations.

Source: Integr8 Fuels

Although Saudi Arabia is currently producing less than its target, it is one of very few countries that have spare capacity and so are able to increase production relatively quickly. The main players with this spare capacity are all in the Middle East:

Estimated Spare Capacity

Saudi Arabia 1.7 – 2.0 million b/d

UAE 0.8 – 1.0 million b/d

Iraq 0.2 – 0.3 million b/d

Kuwait 0.1 – 0 .2 million b/d

Total 2.8 – 3.5 million b/d

There is also spare capacity in Russia and Iran, but the situation in Russia is highly uncertain (to say the least) and any changes in Iran would take a huge political shift to lift ‘nuclear’ sanctions and reopen the country.

So, for those OPEC+ countries currently maximising their oil production, it is not in their interests to agree to an increase in the cartel’s production allocations and bring oil prices down. However, even though Middle East countries do have the ability to raise output and reduce oil prices, it is also not really in their economic interests to do so. These economies are highly dependent on oil revenues to support their economies and so need a minimum revenue, which tends to come at a ‘higher’ oil price. To raise output would likely see a drop in revenues; if you raise production by 5% the price is likely to fall by 10% or more!

The next scheduled OPEC+ meeting is on 4th June. Now no one expects the group to increase production and in fact, the talk is of possible production cuts.

Conclusion: It’s China, China, China?

From where we stand today, the Chinese economy looks like the best indicator for either a continued bearish sentiment or another reversal towards a bullish view on prices. Then comes the supporting roles of things like refinery margins and oil stocks (easy to see and worth watching). These things will tell us an awful lot about market sentiment and where prices are going.

But, because we are in a global industry, where politics can play a huge role in our markets, we can also never ignore the big stage of what is happening in the Ukraine war, Russia, China and the US.

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Prices have changed quickly; Here’s what we are looking at

January 25, 2023

The bullish sentiment has kicked-in; Singapore VLSFO is up $100/mt

In our report at the end of December we highlighted a change in sentiment towards a more bullish bunker price view. This was centred on IEA analysis and changes in their forecasts towards a stronger than anticipated growth in global oil demand for this year.

It is only early days, but after an initial dip in prices at the start of the year, Singapore VLSFO has risen by $100/mt (plus 17%) over the past 2 weeks.

Source: Integr8 Fuels

This isn’t only in Singapore; Fujairah VLSFO is up $80/mt, with Rotterdam and Houston both up by $90/mt. These price rises are largely following the movements in crude prices, with Brent up by $10/bbl (14%) over the same period.

Why the shift?

It is the change in sentiment that has propelled oil and bunker prices higher, and the main reasons for this change are:

- stronger economic and demand prospects in China (with relaxations in the previous very tight covid restrictions);

- ongoing growth in India and other Asian economies;

- a potential tightness in the oil market over the second half of this year.

Early signals in China have been bullish, with indications of Sinopec and Unipec increasing their crude buying. This has supported the more positive outlook for China and reinforces a ‘higher price’ view.

Economic sentiment will steer oil prices up (or down)

The ‘bigger picture’ economic developments are likely to be the main drivers behind price direction. The graph below illustrates forecast growth in oil demand this year by region. It is very clear that the current bullish sentiment in the oil market hinges on the expected gains in demand in China specifically, and Asia-Pacific generally, with only limited impacts elsewhere in the world.

Source: Integr8 Fuels

Source: Integr8 Fuels

At the same time, if OPEC+ maintain their current constrained production strategy, then oil markets could tighten considerably over the second half of this year; hence the more bullish sentiment and stronger price outlook for 2023.

The EU ban on Russian product imports is about to kick-in

As always, other fundamental and political developments emerge and impact on price. The main one at the moment is the impending EU ban on Russian product imports, which is also bullish for prices.

The start date for the EU ban is February 5th, with the G7 export price cap also starting on the same day. This means that Russian cargoes bound for the EU that are loaded before the 5th Feb and discharged by 1st April are allowed, but after this what happens?

The spotlight for us in bunkers will be on Russian diesel/gasoil, which will impact on VLSFO pricing. At the moment there is a surge in Russian diesel/gasoil exports to Europe, ahead of the February 5th start date. As we move through February and March the implications for supply, price and trade patterns should become clearer; will the overall volume of Russian diesel/gasoil exports fall; will new trades to Asia become established; what will be the impact on European and global diesel prices?

These developments will create price movements around what is still likely to be the main price driver, the economy.

Other product developments to watch

Another factor to watch is the jet market. Almost half the forecast growth in world oil demand this year is expected to be for jet fuel, and again this will impact on VLSFO pricing.

On the supply side, Middle East product volumes and exports should be boosted with the Q2 start-up of KPC’s second crude unit (of three) at its new 615,000 b/d Al-Zour refinery. In addition, the new 140,000 b/d Karbala refinery in Iraq is scheduled to start-up over Q2/Q3 this year, again adding to Middle East product supplies and exports. However, these gains in Middle East product supply alone are not enough to cover potential losses in Russian exports and the increases in world oil demand.

Bullish oil prices hinge on economic “success”

Coming back to the economy, the outlook for this year is uncertain (as always), but reducing inflation is a core target for most central banks and governments. The general view is that inflation will peak and then ease over the course of this year, but it will still take another 2-3 years to get back to targets of around 2.5%. Also, views are that any recession will be relatively short-lived.

So, the consensus view is ‘a rocky road ahead, but we will get through this and there is light at the end of the tunnel’.

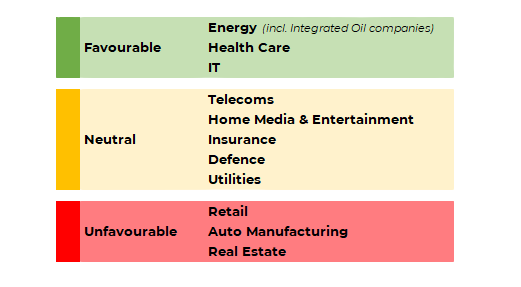

Investors are looking where to put money – it could be the energy sector

Oil is a global commodity with easy access for anyone to trade on its futures markets (primarily WTI and Brent futures). ‘Speculative’ money coming into and out of these futures markets can have a huge bearing on oil prices and sentiment, which in turn have a direct impact on bunker prices in our market.

When it comes to energy, many investment analysts tend to focus on the long-term direction and strategies towards 2050. However, some do look at the near-term investment opportunities in the oil sector and to illustrate what some are thinking, the following diagram maps out the preferences of an international investment company on what to and what not to invest in the short term for 2023; and at the energy industry is at the top!

Source: Integr8 Fuels

They see commodities in general, and the oil sector in particular, in a new ‘bull super-cycle’. This comes from limitations in supply and a focus on a strong second half of the year. In this sense, the energy sector becomes more attractive for someone to put money to work, through equities and through oil futures markets. This in turn pushes oil and bunker prices higher (admittedly, when the ‘speculators’ find something better and take their money out of oil futures then oil prices can fall!).

Strong sentiment & strong fundamentals?

Bringing the supply and demand fundamentals together and looking at a number of analysts, the chart below illustrates an average of the historical and forecast global oil stock changes. The clear pointers here are that we saw global oil stock-builds through most of last year. With this oil prices fell; Brent futures were down from $110/bbl in Q2 2022 to the low $80s in December.

Source: Integr8 Fuels

Source: Integr8 Fuels

Taking an average of current forecasts indicates another stock-build this quarter, but for the market to be near balanced in Q2 and then potentially tighten significantly in the second half of this year with forecasts of relatively large stock-draws.

There is every reason for today’s bullish sentiment

It is invariably the case that the fundamentals win out, and on this basis oil prices would be expected to rise. We are looking at this, the oil industry is looking at this and certain investment analysts are also looking at the same picture. Again, from where we stand today the sentiment appears bullish and bunker prices would be expected to rise further.

The main factors underpinning this view (and to keep watching) are:

- the strength of oil demand in Asia this year;

- that economic forecasters get it right that we are not going to fall into a global recession;

- what OPEC+ does, but at the moment they are holding firm on a more constrained supply strategy, which again is bullish.

Let’s keep watching to see if everything pans out as expected!

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com