Bunker market shifts focus to supply concerns – Will this last?

Crude prices are higher, especially for light/sweet fuel grades

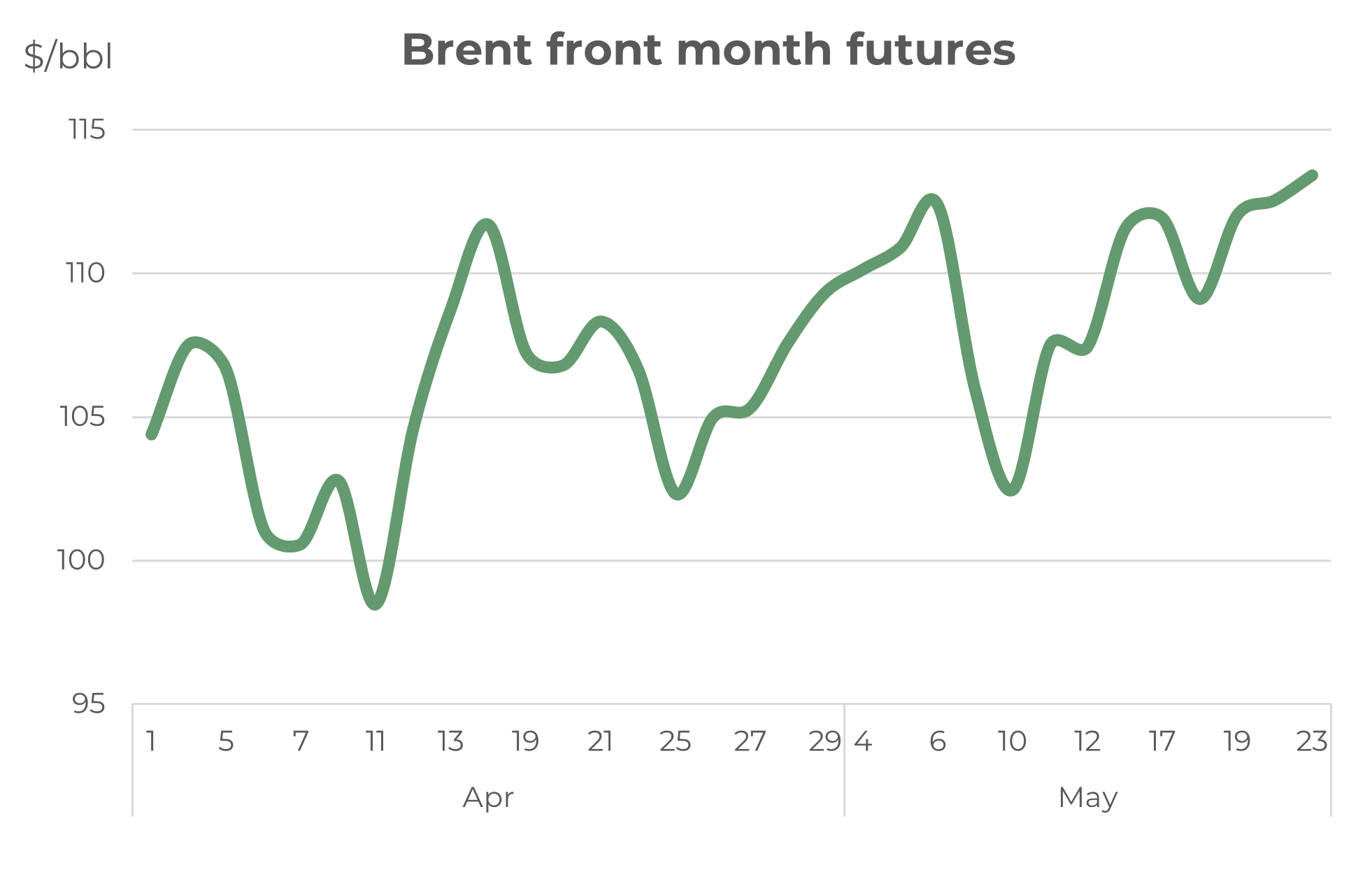

A month ago, Brent futures were around $105/bbl and there were real concerns about inflation, much slower economic growth and downwards revisions to oil demand. Despite these bearish signals, Brent futures are almost $10/bbl higher than a month ago, at close to $115/bbl!

Source: Integr8 Fuels

Low stock and product supply are the primary issue

Clearly something in the market is more significant than these bearish factors, and that is on the supply side. Oil product supply is tight and stock levels low, centred on lighter products such as middle distillates and gasoline. This in turn has supported incredibly high refinery margins. At the same time, despite calls from the US, OPEC has made no significant move to raise crude production, and in fact output from some OPEC+ countries has actually fallen.

These supply developments have been more than enough to reverse what was a market focus on bearish economic factors to a market focus on the current squeeze on product supply.

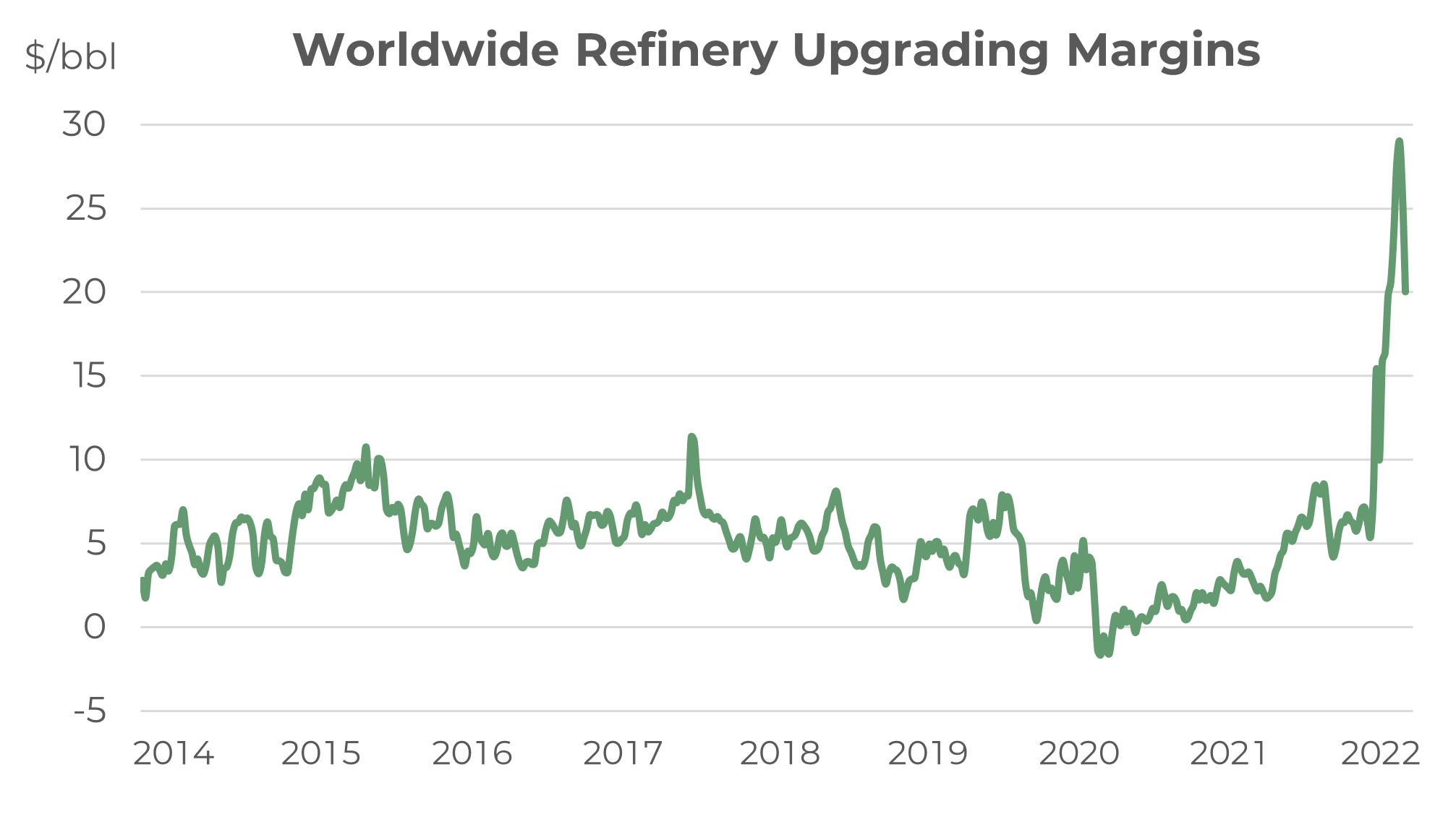

Extraordinary refinery margins are the tell-tale sign

The current extremely tight position in the products markets is clearly represented in the graph below. This shows a long-run indication of average refinery upgrading margins and just how high they are today.

Source: Integr8 Fuels

Source: Integr8 Fuels

Average refining upgrading margins increased to close to $30/bbl two weeks ago, with:

- strong demand in Europe (partly replacing Russian supplies) and a period of refinery maintenance;

- gasoline demand picking up in the US against a low stocks position;

- a strong pull on Middle East product exports going east and west;

- strong gasoline and gasoil buying in the east, also against a low stocks position.

The key here is strong gasoline and middle distillate demand against low stocks positions, and this has created a spike in refinery margins nothing like we have seen in recent years. Although current margins are still exceptionally high, with an average indication around $20/bbl, they have turned a corner and are declining. In Europe, product stocks have started to rise (albeit slowly) and significant volumes from the Middle East and India are heading in this direction (as a further indicator, product tanker earnings are also at high levels, unlike earnings in the crude tanker sector). In the US, gasoline remains strong, but middle distillates have eased, bringing down refinery margins. Looking ahead, US gasoline could also ease as more Europe exports arrive on the US east coast.

In Asia there is a mixture, with refinery outages supporting gasoline margins however, middle distillates are easing similar to other markets. The ‘curved ball’ is China and what happens next. Indications are that refinery runs and product exports have been low, but exports could rise as domestic oil demand continues to be hit by big city lockdowns. However, lockdowns are expected to ease, and Shanghai is likely to ease restrictions during June. Chinese oil demand will pick up as a result; but what will be the extent of refinery runs and product exports as lockdowns ease?

Overall, refinery margins have been extraordinarily high and reflect the tightness in the products markets and prices; they are still extremely high in historical terms, but they are falling.

The pressure has been on products, hence the surge in refinery margins, but crude supply has also been constrained. Clearly Russian production and exports have been hit by the international responses to the invasion of Ukraine, and Russian output down by around 1 million b/d over the past few months.

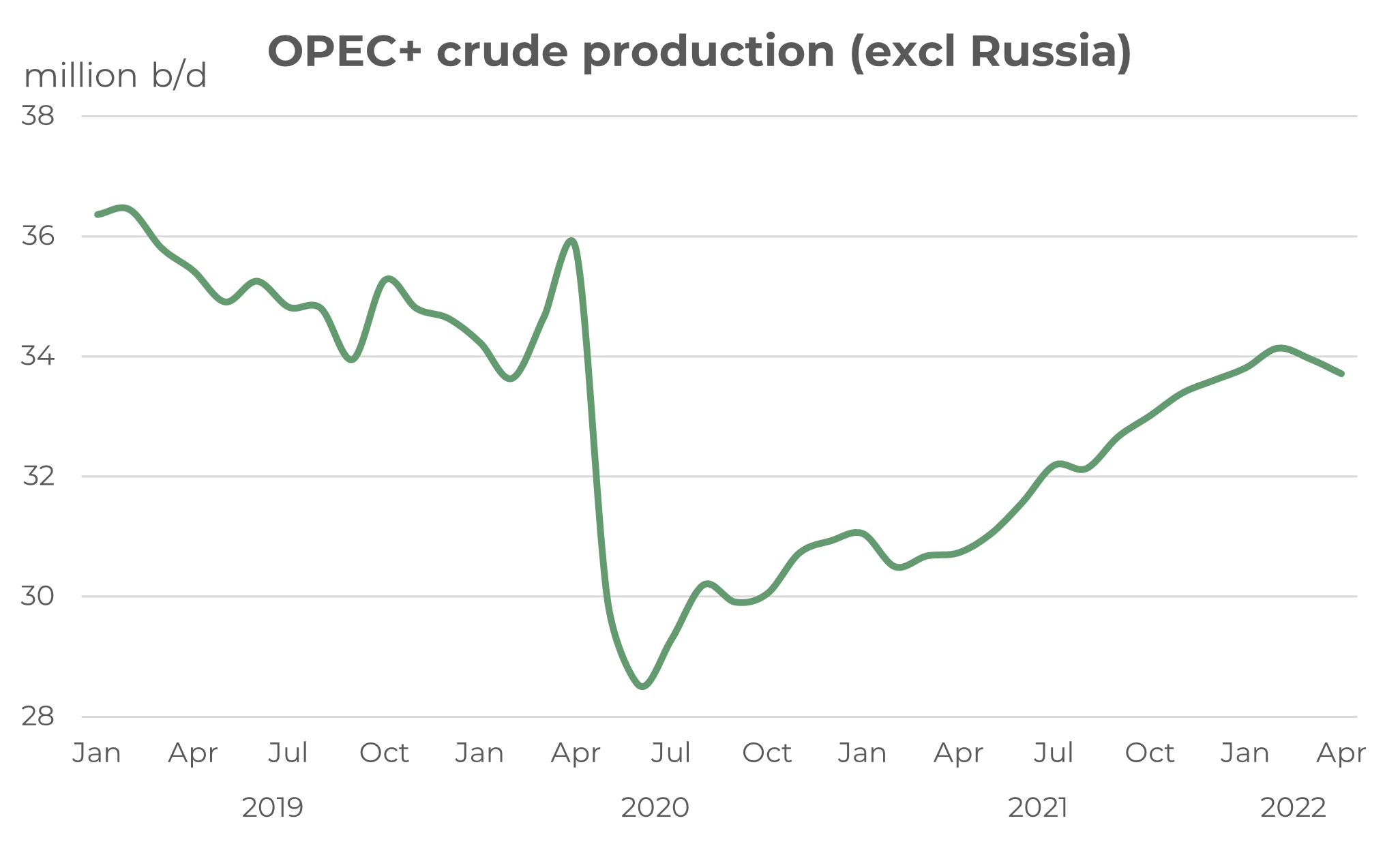

Crude supplies are also an issue – even outside Russia

Russia is part of the OPEC+ group and so the loss here has affected the overall production from the group. However, combined crude production from all the other OPEC+ countries has actually fallen by around 0.5 million b/d since the Russian invasion. This has created a ‘double whammy’ in terms of crude supply constraints over the past couple of months.

Source: Integr8 Fuels

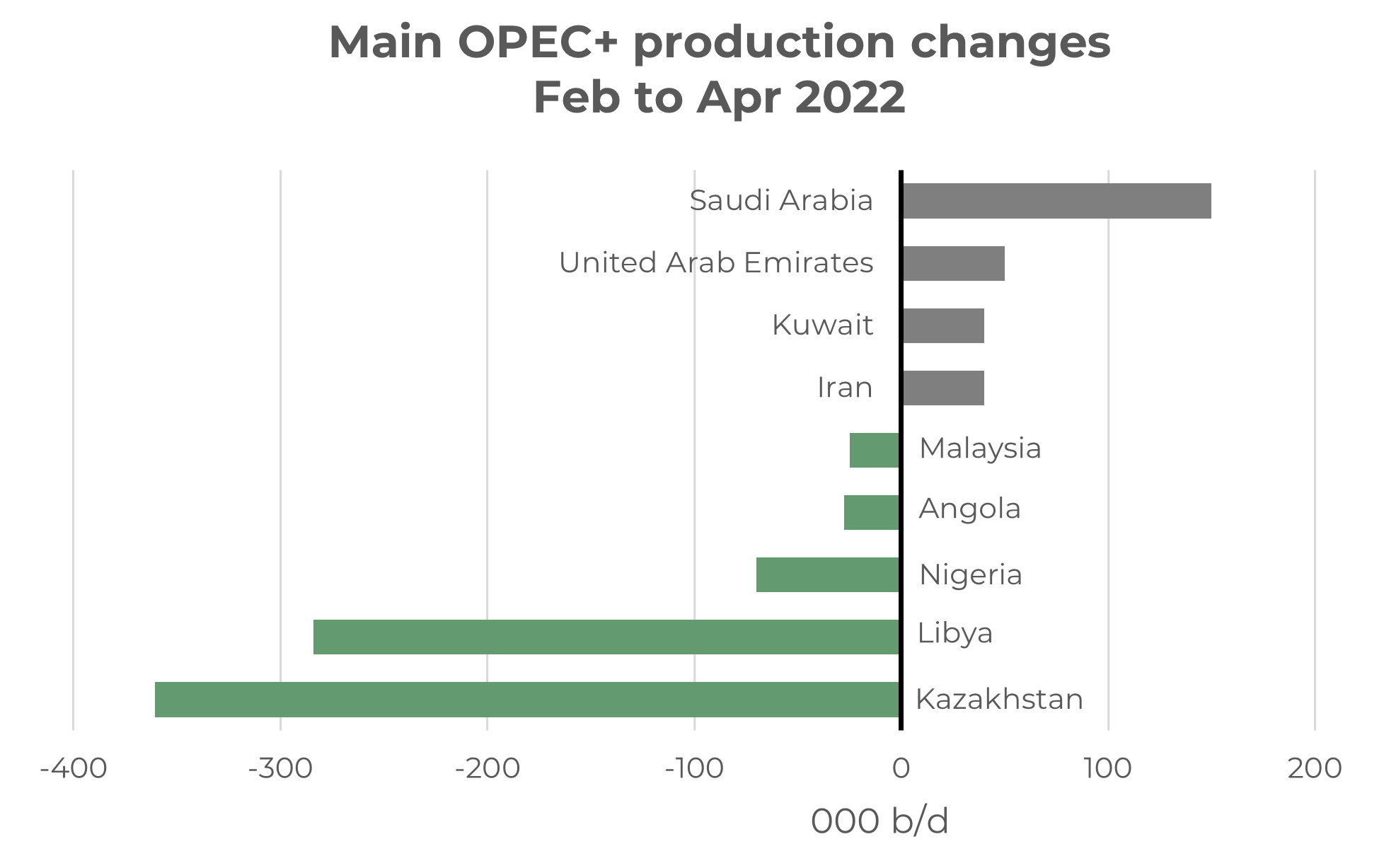

The reduction in OPEC+ crude output is not a group strategy, but a consequence of production losses in some countries and muted increase is supplies from those countries with spare capacity; namely Saudi Arabia, UAE and Kuwait. The US has made calls for OPEC to raise production in the wake of high prices, but the three ‘spare production’ countries have only increased output by 0.25 million b/d over the past couple of months; against a drop of almost 1 million b/d from Russia.

The situation has then been hugely compounded by production losses in other OPEC+ countries, specifically Kazakhstan, Libya, Nigeria, Angola and Malaysia. The w loss from these countries has amounted to 0.75 million b/d since February. Hence the overall 0.5 million b/d fall in output from the OPEC+ group outside Russia since February.

Source: Integr8 Fuels

Source: Integr8 Fuels

The other very significant development here is that all the production gains are in countries typically producing heavy, sour crudes, whilst all the losses are in countries producing lighter, sweet crudes. This has only exacerbated the pressures and prices on the gasoline and distillate markets. However, at the same time it has also weakened the relative pricing for high sulphur fuel oil.

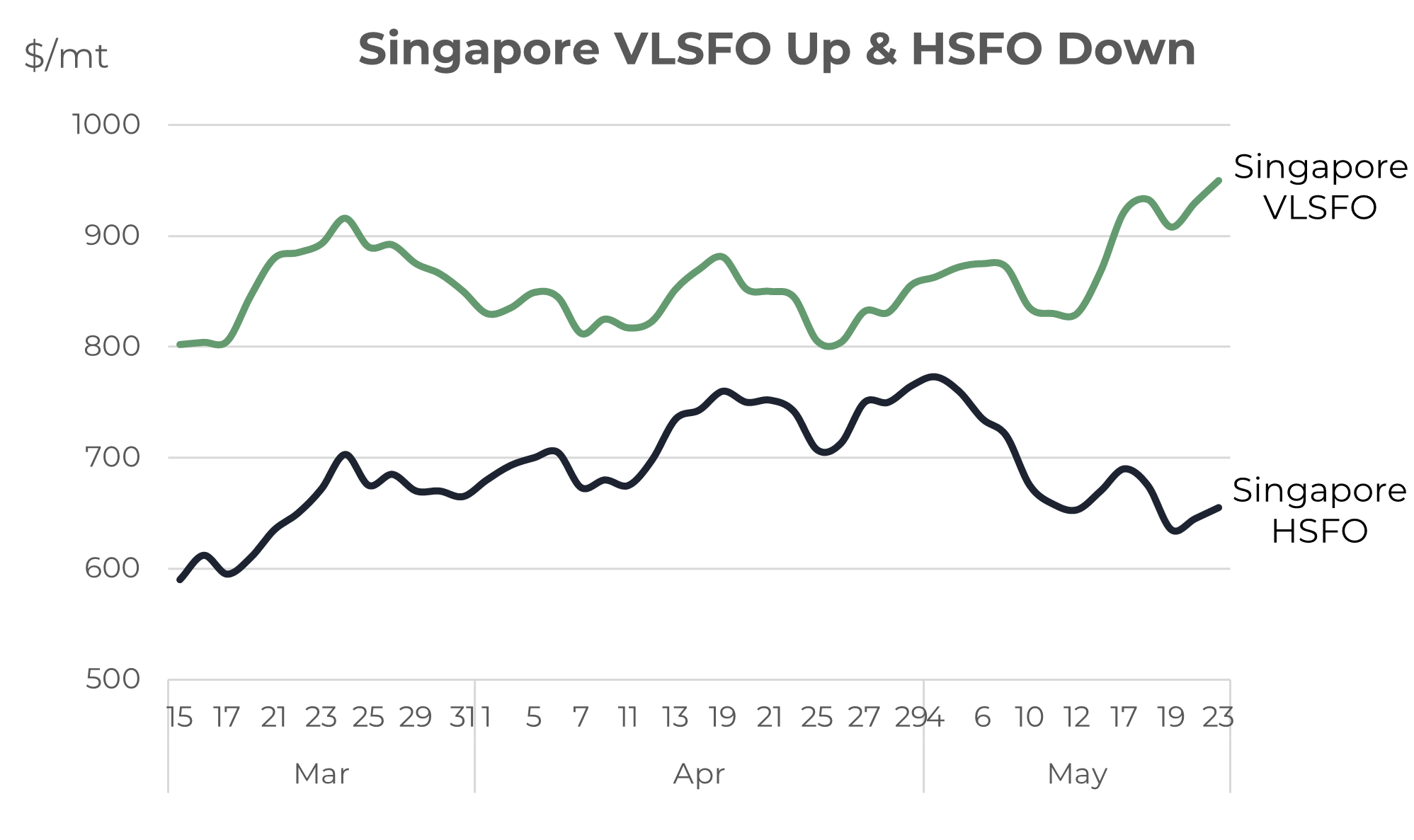

The bunker market in Singapore has seen extreme price moves

These dynamics have hit the Singapore market, with VLSFO prices up on the back of market developments and also driven higher because an anticipated drop in imports. Conversely, Singapore HSFO prices fell as imports are forecast to rise, not least with Russian volumes finding their way east rather than west.

Source: Integr8 Fuels

Source: Integr8 Fuels

The net result is that the Singapore VLSFO/HSFO price differential has widened enormously over recent weeks, from only $80/mt at the end of April to more than $300/mt currently (and now much wider than the $160/mt spread in Rotterdam).

Monitoring refining margins

Summarising, the gasoline and middle distillate markets have led oil prices higher over recent weeks and although refinery margins are still very high, they are falling. These developments have taken the wind out of the bearish economic factors as a main market focus. There are always a lot of factors that influence prices and price direction and the bearish issues haven’t gone away. However, at the moment tightness in products is still the main price support and watching refining margins may well be a good place to focus in the next few weeks to see if this is maintained

or not.

Steve Christy, Research Contributor

E: steve.christy@integr8fuels.com

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.