Bunker prices look like they are falling – Bearish signals in sight

VLSFO Prices Under Threat

After the Russian invasion of Ukraine and the sharp price spike in early March, VLSFO has eased back and moved within the $800-900/mt range for more than a month. However, at the start of this week prices took a $40/mt dive to the low of the recent range; there are a lot of bearish news stories in the market and prices look vulnerable for another fall.

Within these price movements it is still worth noting that, unlike the historical norm, Rotterdam VLSFO prices have remained at or above Singapore quotes throughout this period. VLSFO pricing could continue this way, with more extreme pressures on Europe because of its closer proximity to the Russian market.

Source: Integr8 Fuels

What is happening to Singapore HSFO?

Whereas the rise and falls in Rotterdam and Singapore VLSFO prices have largely tracked each other over the past couple of months, and are currently both around 25% ($200/mt) below their peak, this is definitely not the case in the HSFO market. Rotterdam HSFO prices have eased more-or-less the same as international VLSFO prices, and are around 20% below their recent peak. BUT the Singapore HSFO bunker market has followed its own trajectory, and prices last week were even higher than the early March peak at the time around the Russian invasion.

Source: Integr8 Fuels

Source: Integr8 Fuels

There are a number of reasons why Singapore HSFO prices have taken this divergent upwards move, including bunker contamination issues. However, there are key fundamental drivers pushing this extreme pricing. The loss of Russian supplies has left western markets tight on high sulphur material, which has drastically cut the ‘normal’ flow of these volumes from west to east. In addition, more high sulphur Middle East fuel has been ‘pulled west’ to make up the Russian shortfall, rather than typically going east. This again has tightened the Asian HSFO markets. This is likely to be a continuing feature of the market, with no obvious near-term return of Russian oil supplies to western markets.

In addition to these potentially longer-term east/west fundamental changes, very high natural gas prices can make fuel oil a more attractive alternative into power generation in some Asian countries, such as Pakistan and Bangladesh. Because of this, these countries are already buying HSFO and there could be a higher seasonal demand for fuel oil in the coming months to meet summer cooling demand, again adding to the squeeze in the Asian high sulphur market.

The net result is that the VLSFO/HSFO price spread has remained relatively wide in the west, at around $200/mt in Rotterdam, but has slid to only $100/mt in Singapore. The economics for scrubbers are clearly much stronger in the west than in the east.

Source: Integr8 Fuels

Although any contamination issues are likely to be resolved, the numerous fundamental drivers could keep Singapore HSFO quotes relatively high for some time, even in a falling market.

Economic slowdown will threaten oil demand and impact bunker prices

As the war in Ukraine continues, so the world’s financial markets are focused on high prices, inflation, much slower economic growth (and even talk of recession). All of these ‘bigger picture’ developments will clearly have a major impact on oil markets and what happens to bunker prices.

In our sector we have seen the sharp rise in prices because of the Russian invasion of Ukraine and subsequent embargoes and sanctions on Russia. In other markets, such as natural gas, the price hikes have been far greater, and numerous other commodity prices are also significantly higher. All these developments and fears are driving inflation rates to levels not seen for around 40 years; annual European inflation was at 8% in 1984 and the US in 1981/82. The obvious response is for interest rates to rise, which in turn is a threat to economic growth and future demand. The latest IMF report has already indicated a global slowdown based on the impacts of war and cuts in goods supplied from China because of the covid lockdowns.

In the same way, analysts are already lowering their expectations for future oil demand on the back of these war related and Chinese lockdown developments. Until now crude prices have generally held up, despite concerns on the Chinese lockdowns and downward revisions to economies and oil demand. This has been predominantly due to supply concerns going forward, including the current loss of Libyan crude exports because of domestic protests.

The supply concerns are still there, with more buyers refusing to take Russian oil, and Germany stating that it will stop all its 0.4 million b/d Russian crude imports by the end of this year. Some traders are also reducing or stopping Russian oil purchases. These developments may be considered price supportive, but signs at the start of this week suggest the focus is shifting more towards the Chinese lockdowns in the shorter-term and the looming economic issues in the longer term.

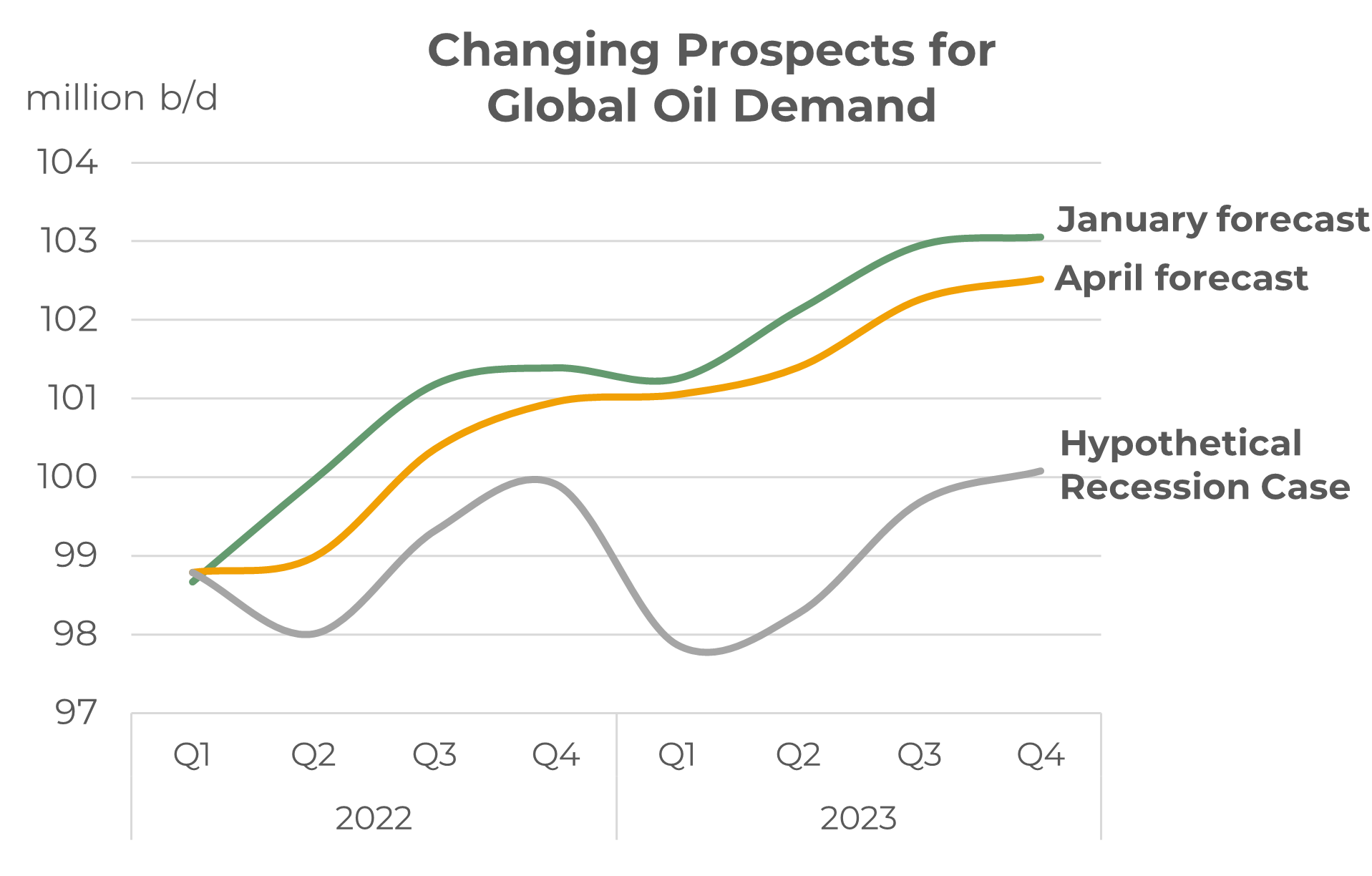

The graph below illustrates the general direction in global oil demand forecasts, with latest analyst reports indicating future demand around 0.6 million b/d lower than their January forecasts. This, in its self may not be too much, but ‘the storm clouds are brewing’, and there will be more talk and more analysis on the economic fallout of the war.

Source: Integr8 Fuels

Source: Integr8 Fuels

This is now the main concern for the market over 2022/23, and where-as the talk of recession may be premature, the conditions do at least warrant looking at such a case. Clearly the impact on oil demand over the next 2 years (and demand across all sectors) will be a function of how economies perform and what counter policies are put in place. However, a hypothetical recession case is shown in the graph above and it indicates a broad levelling off in demand with season fluctuations. Although the biggest demand falls in this case would be seen on gasoil/diesel and gasoline, the bunker market is not immune.

In summary, there will be more and more talk and reports about economic threats and if there is nothing to counter these stories, then oil prices are likely to come under more downwards pressure.

Steve Christy, Research Contributor

E: steve.christy@integr8fuels.com

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.