Bunker Quality Trends Report 2024

June 11, 2024

In the fourth bi-annual report from Integr8 Fuels, bunker quality and claims manager Chris Turner advises shipowners and bunker buyers on how they can improve their buying processes and performance. Tapping into the world’s biggest bunker fuel quality sample database, Turner reveals the most pressing quality issues the industry is up against.

These include:

- Red Sea closure affecting VLSFO compliance for vessels rerouting around Africa

- Global VLSFO compliance suffers as suppliers stretch barges to cash in on rising HSFO demand, driven by increasing scrubber numbers

- Two-thirds of fuels are still sold with obsolete (pre-2017) specifications. Can the new ISO specs finally shake up old school practices?

- Profit margin-motivated blenders push more HSFOs over ISO limits

- VLSFO sulphur off specs worsening in the ARA and partly driven by high- to low sulphur barge switching

- The supply landscape as it relates to availability, off-specification trends and problematic parameters

- Biofuel quality and distribution

- Geographical variances and “hot spots”

Published June 2024

What is OPEC+ going to do in June (and the rest of this year)? It will be an important issue for us in bunkers!

May 22, 2024

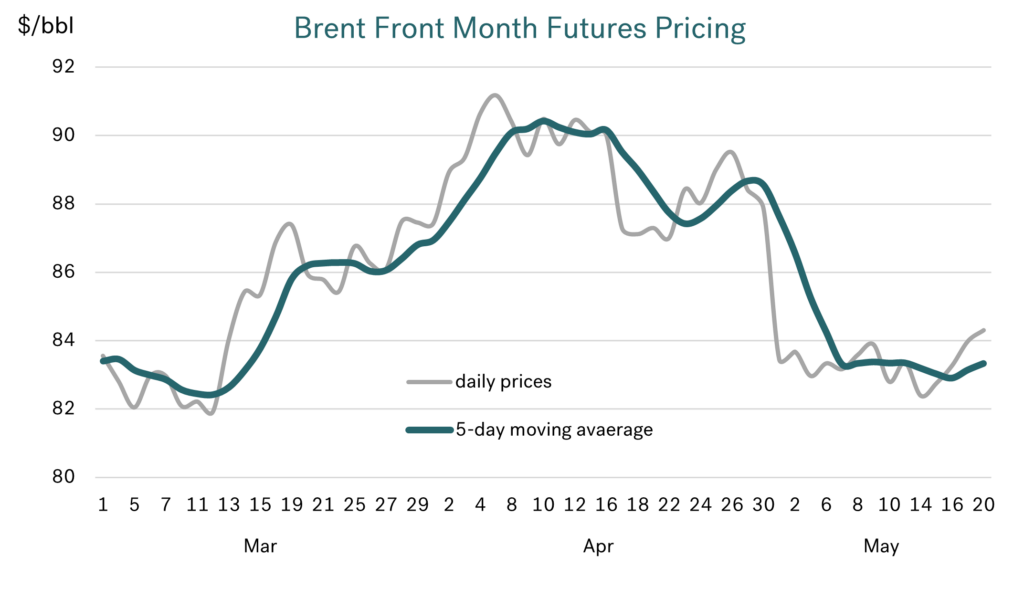

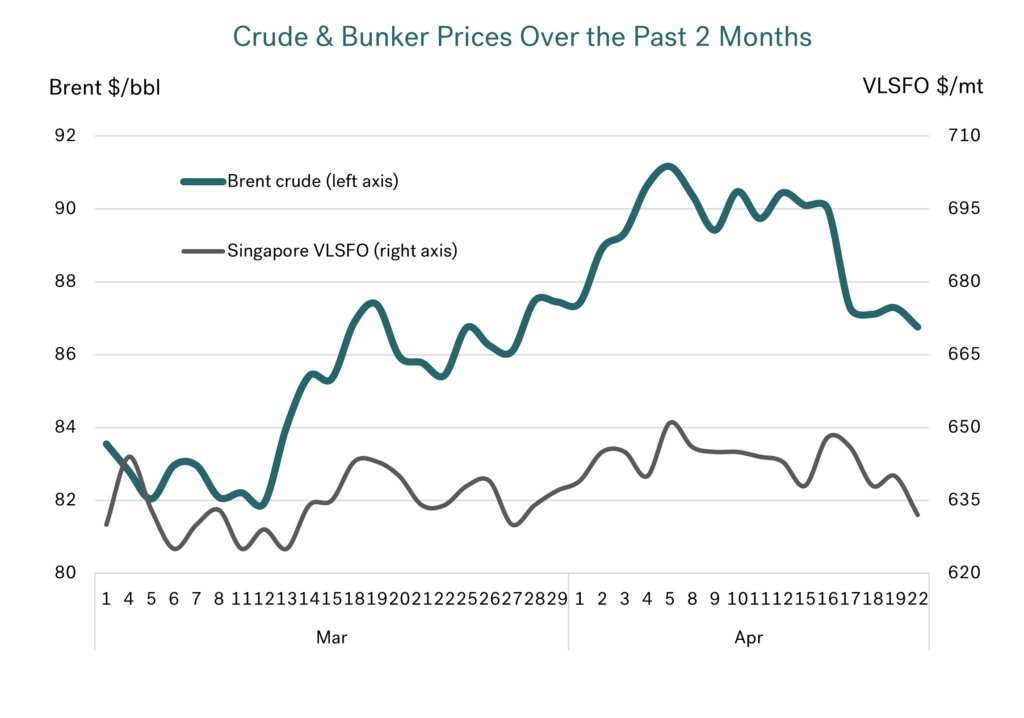

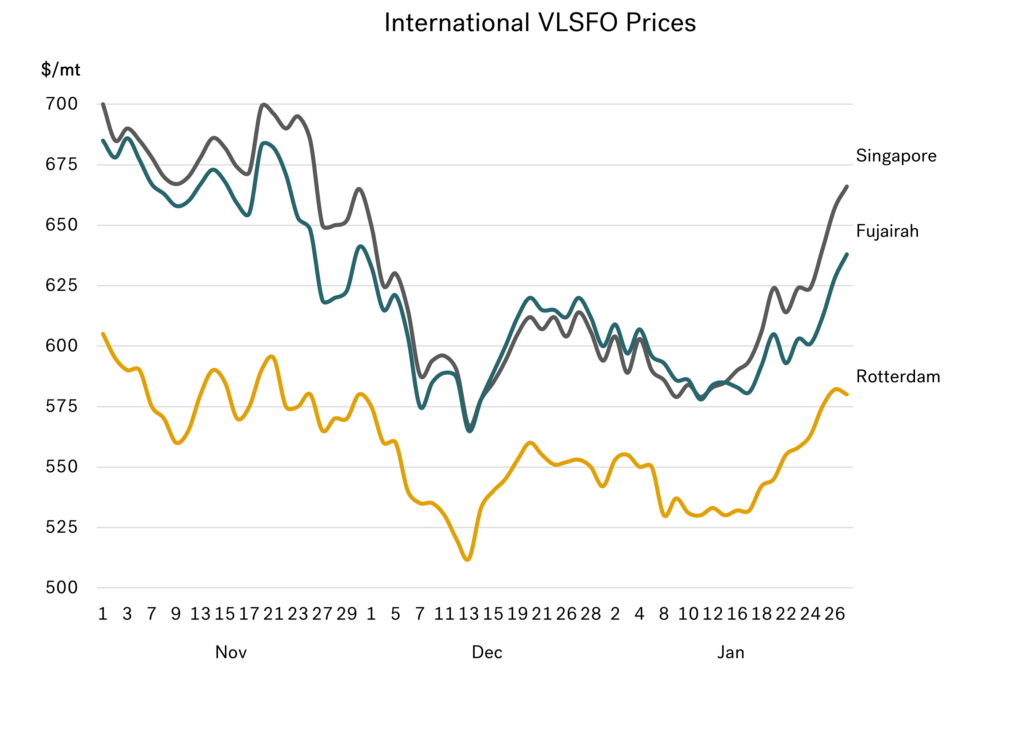

Bunker prices are at their lowest for three months

Although VLSFO has been in a relatively narrow price range, prices are now at their lowest for more than 3 months. The sharp drop in oil prices at the start of this month has meant Singapore and Fujairah VLSFO prices are down by $20/mt since end April, with Rotterdam VLSFO down by $30/mt.

General concerns about future economic growth, a perceived greater chance of a truce in the Israel/Gaza conflict, weaker oil demand (especially in Europe) and rising oil stock levels have all contributed to this bearish sentiment and led prices down.

Source: Integr8 Fuels

Source: Integr8 Fuels

Lower crude prices mean OPEC+ has tough decisions to take

The drop in crude prices has meant Brent has fallen from $90+ levels, back down to the low $80s, and is why OPEC+ is facing a significant dilemma at their upcoming June 1st meeting.

Source: Integr8 Fuels

Source: Integr8 Fuels

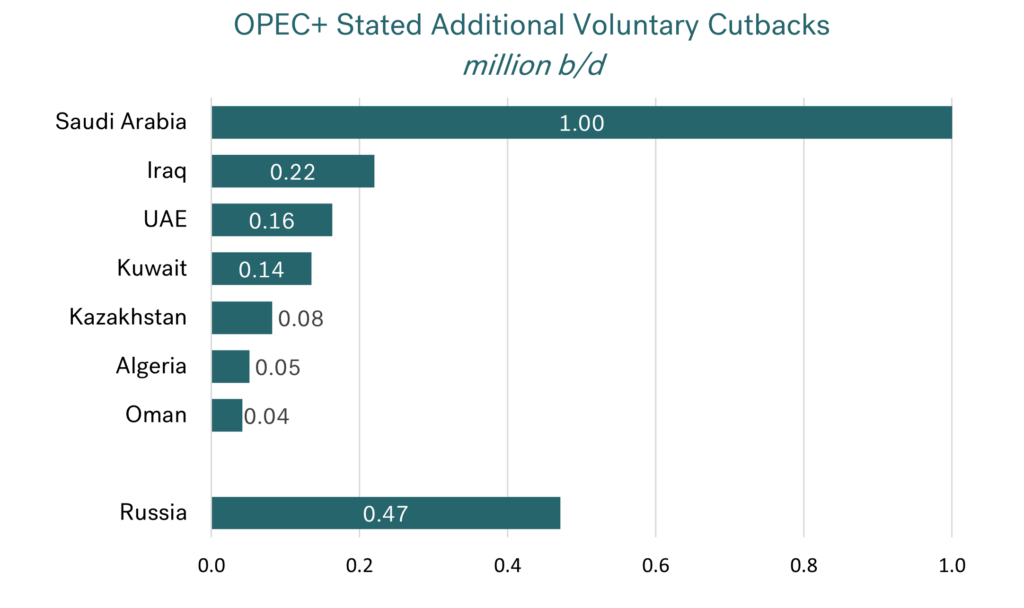

The big questions for OPEC+ surround their production cutbacks, where there are three key aspects:

- First, the main cutbacks from all OPEC+ countries that amount to around 3.7 million b/d. These have been extended a number of times and are now scheduled to run until the end of this year, and so perhaps will not be a primary focus just yet.

- The main issue now surrounds a limited number of OPEC+ countries that have made additional voluntary cutbacks totalling 2.2 million b/d. These were implemented in July 2023 and have been extended through to the end of the second quarter this year.

- Finally, the extent of continued over-production by some countries. In April, the main ‘over-producers’ were Iraq (at 0.24 million b/d), UAE (0.24 million b/d), Kazakhstan (0.13 million b/d) and Russia (0.20 million b/d)

The immediate dilemma for OPEC+ is: what do those countries making the additional voluntary cutbacks do? The quote from OPEC in early March was that from end June “these voluntary cuts will be returned gradually subject to market conditions”. Will they do this?

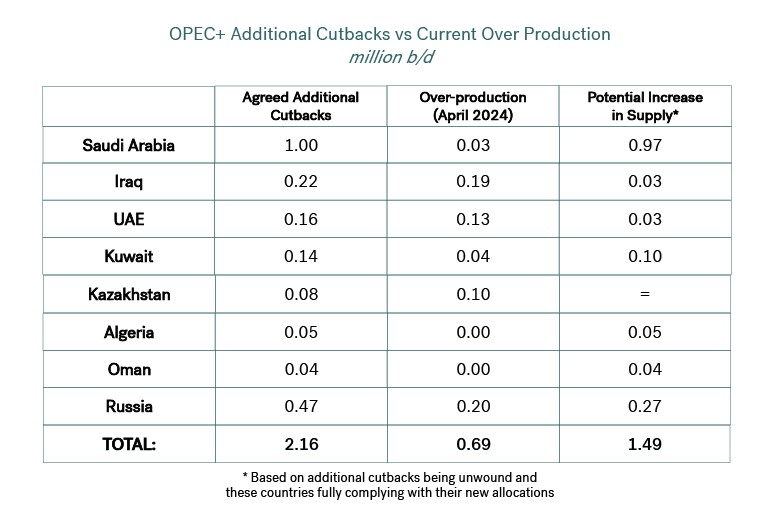

Which countries are we talking about?

Of the eight countries involved in the additional 2.2 million b/d cutbacks, Saudi Arabia is by far the biggest, and most likely to drive the decision to extend or unwind this part of the agreement.

Source: Integr8 Fuels

Source: Integr8 Fuels

On paper, Russia also has a significant role, but this is ‘clouded’ by the fact that the crude cutbacks are split between production for the domestic market and those for export. It is only the export volumes that matter to the fundamentals and sentiment in international oil markets.

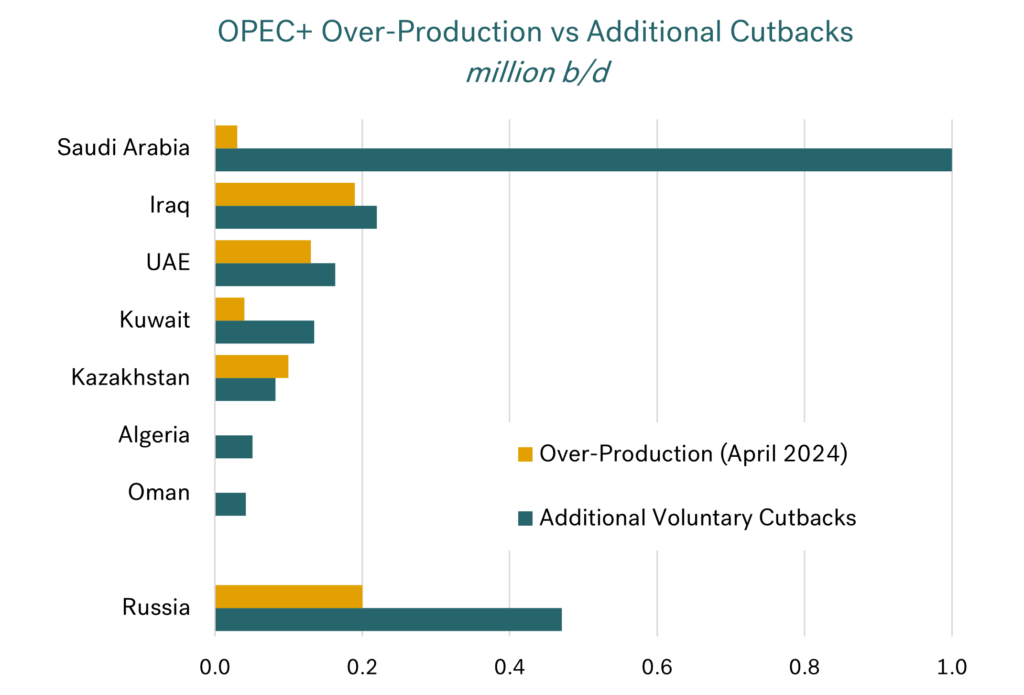

Not all eight countries will have an impact

Outside of Saudi Arabia, and possibly Russia, there may be little impact from the unwinding this ‘additional’ agreement. Even if it does go ahead, it is possible that there will be very little (if any) change in production from six of the eight member countries involved.

The reasoning here is that in the broader OPEC+ agreement covering all countries, the four members that are producing substantially more than their allocation (Iraq, UAE, Kazakhstan, and Russia) are also included in the eight members that make up this additional 2.2 million b/d cutback.

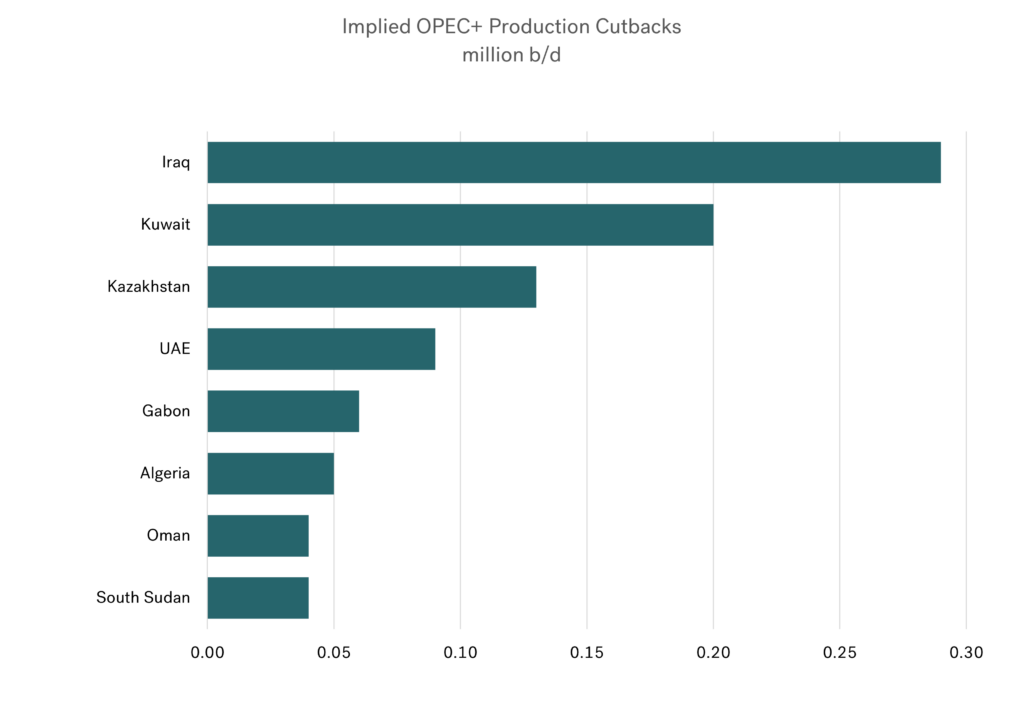

The graph below illustrates the extent of over-production versus the agreed additional cutbacks made by each of the eight countries involved.

Source: Integr8 Fuels

Source: Integr8 Fuels

For instance, Iraq is currently producing around 0.19 million b/d more than its 4.00 million b/d allocation. If the additional cutbacks are removed, then Iraq’s new allocation will rise to 4.22 million b/d. This is virtually in-line with their current production. So, for Iraq, it could be that they just maintain current production levels as the additional cutbacks are unwound. This would mean they automatically fall into line as a ‘good’ member, adhering to their new, higher allocation; AND there will be no increases in world oil supply!

It is exactly the same for UAE and Kazakhstan; their output levels can just continue at current levels, and they will also ‘fall into line’ with their new allocation as the additional cutbacks are unwound.

After this, Algeria and Oman are relatively small players in volume terms, and so will have limited impact. It does mean that Saudi Arabia and Russia will be the main protagonists.

So, what will happen if the additional cutbacks are unwound in Q3?

Based on the scenario above, which is credible, if the additional cuts are removed then Saudi Arabia is highly likely to ramp up production by 1 million b/d, and Kuwait potentially by 0.1 million b/d.

That then leaves Russia, which is highly uncertain given it may not have capacity to raise output, and if it has, whether this would go to their domestic market, or into the international market.

The table below indicates what the agreed additional cutbacks are, compared with the latest levels of over-production. Assuming the agreement is unwound and each country abides by its new production allocation, the final column shows the potential gain in oil supply.

Source: Integr8 Fuels

Either way, it looks like a removal of the additional OPEC+ cuts would result in an extra 1.0-1.2 million b/d to world oil supply (outside of Russia), and not the full 2.2 million b/d headline figure.

What signal would an ‘unwinding’ send to the market?

The IEA and the US EIA put the call on OPEC+ remaining more-or less flat through the rest of this year, and also flat to a potential slight decline next year (highlighted in our report April 24th). This implies any unwinding of the OPEC+ additional cuts would be a bearish signal to the market this year (and even in 2025!).

However, market analysis by OPEC contradicts this, and shows a much stronger growth in oil demand for 2024 and 2025 than other organisations. In their latest report, OPEC indicates the call on OPEC+ increasing by around 0.8 million b/d over the remainder of this year, and another 0.9 million b/d between end 2024 and end 2025. On their basis there is room for OPEC+ to start unwinding the additional cutbacks from end June and there would be only a small material change to the fundamental oil balance.

It is likely to come down to Saudi policy

Although an announcement could be made at any time, the market focus will be on the run-up to the June 1st OPEC+ meeting.

If the group decides to extend the additional cuts again, then this is more likely to be seen ‘price neutral’.

For most, an unwinding is likely to be seen as a bearish signal. In this case, bunker prices would fall. There are also further implications for us in bunkers, as almost all the crude supply gains would be heavy/sour grades from the Middle East, and so have a potential impact on the VLSFO/HSFO spread.

Is there a ‘curved ball’, where OPEC+ make more cuts? We can only keep an eye on OPEC+ and Saudi Arabia ahead of the June meeting (and for the rest of this year and next!).

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Is it time to worry when all the analysts are in agreement?

April 24, 2024

Brent can’t stay above $90/bbl for very long!

For a number of months, we have pointed towards ‘weak’ fundamentals in the oil market and the counter effects of high geopolitical risks, with a net outcome of only limited movements in price.

In the past month we have seen the geopolitical risks escalate again, with Iran now also involved in military operations. Brent futures did move up in response, from around $86/bbl to just above $91/bbl (it’s highest for 6 months). But this is only a gain of some $5/bbl, which doesn’t seem very much given military actions between Israel and Iran. To emphasise the limited ‘price concerns’ in these conditions, Brent futures have now fallen back to their earlier levels!

Source: Integr8 Fuels

Source: Integr8 Fuels

If, given the circumstances, crude price movements over the past month can be considered ‘muted’, then shifts in bunker prices have been ‘non-existent’ The graph above shows daily Brent futures prices alongside Singapore VLSFO, on comparable scales. In bunkers we haven’t seen the full extent of movements in crude futures prices, and looking at the daily Singapore VLSFO quotes, we haven’t seen a major uptick, and current prices are actually $2/mt lower than a month ago!

More for OPEC+ to do?

It is clear the market is currently ‘relaxed’ on oil supply; crude oil prices did move up on these actions and tensions, but they didn’t ‘want’ to go much higher, and they ‘wanted’ to come down pretty quickly. Looking further ahead, through to the end of next year, all the supply pointers suggest there will be more than enough oil to satisfy world needs. In fact, now it looks like the OPEC+ group will need to continue to extend their agreed and voluntary production cutbacks beyond June, and well into next year, to try to maintain prices around current levels.

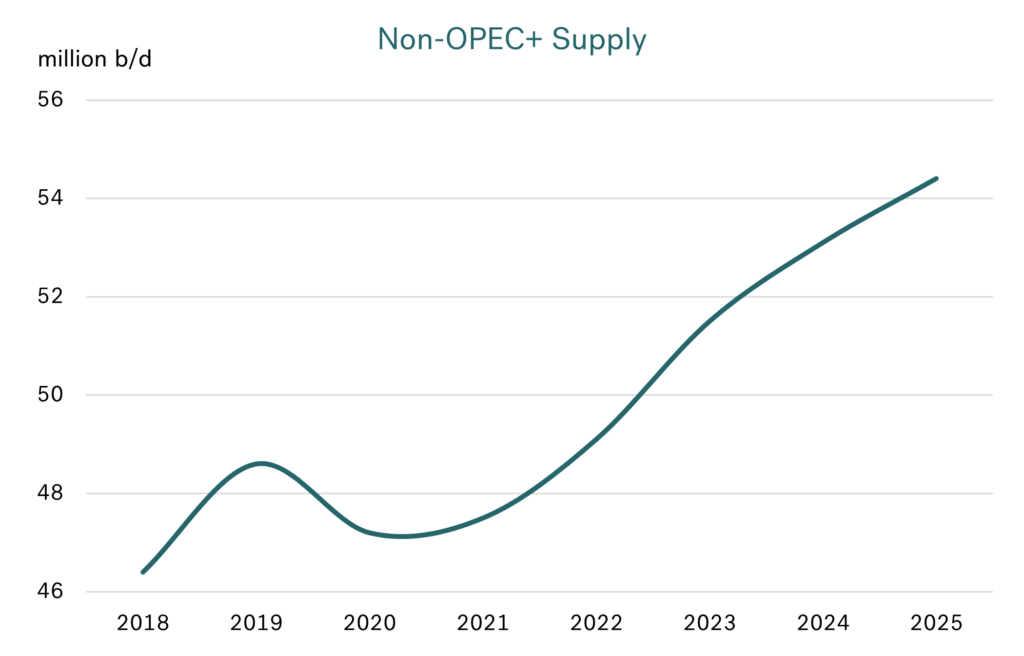

Gains in non-OPEC+ production give confidence to the market and concerns to OPEC+

Work and investment in non-OPEC+ production certainly waned during covid, meaning depletion rates at existing fields were higher and new oil developments lower. Hence non-OPEC+ supply fell during 2020/21, then only showed a modest gain in 2022, and started to pick up in 2023.

But that has now all changed. Renewed capital commitments to existing oil and new projects suggest non-OPEC+ output will rise from 51.5 million b/d last year 54.5 million b/d by 2025. The ‘big hitters’ in this gain will be the US (shale and Gulf of Mexico oil), Brazil, Guyana, Canada, and Norway.

Source: Integr8 Fuels

Source: Integr8 Fuels

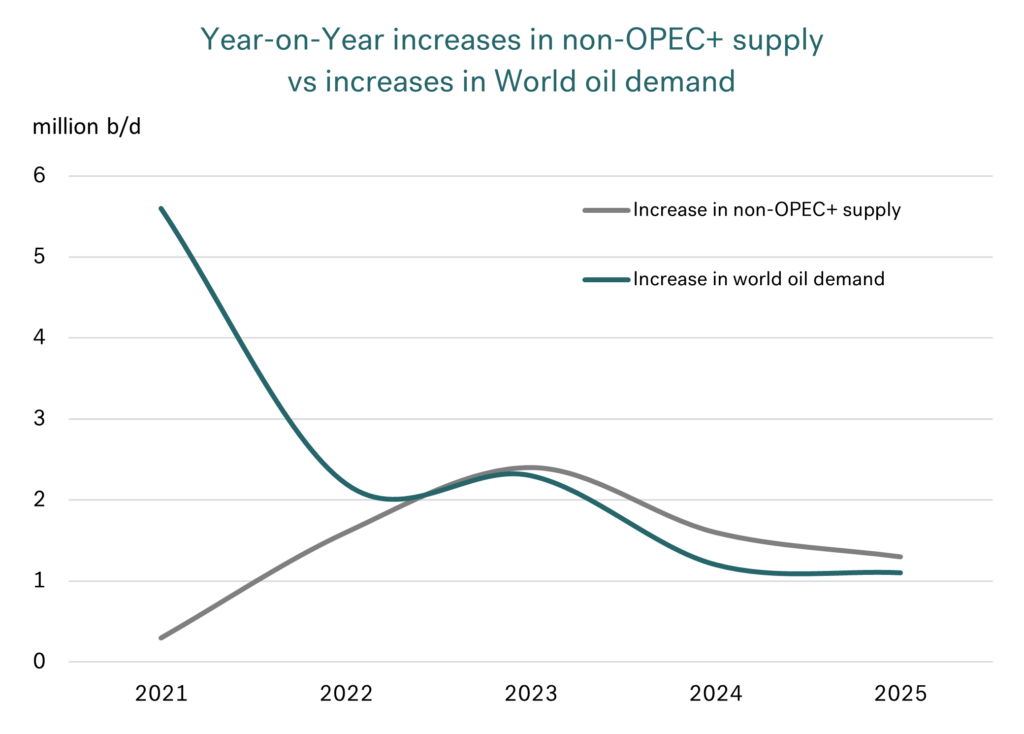

This 3 million b/d supply gain in non-OPEC+ over the 2 years to 2025 is expected to be in line with, or even slightly greater than increases in World oil demand. This means the world has shifted dramatically from 2021/22, when we were coming out of COVID and heavily reliant on OPEC+ raising output to meet the post-pandemic rebound in oil demand.

Source: Integr8 Fuels

Source: Integr8 Fuels

Last year was the turning point, where non-OPEC+ output started to ramp up and OPEC+ made agreed and voluntary production cutbacks to support oil prices (with Brent in the $80s).

These OPEC+ cutbacks have been reviewed and extended a number of times. Also, a few OPEC+ countries are producing above their target levels, and there is pressure on these to cutback. However, given the expansion in non-OPEC+ supply, if the OPEC+ cartel want to keep prices anywhere close to current levels it looks like they will have to keep rolling over the current cutbacks well into next year (the next OPEC+ meeting is scheduled for early June).

OPEC+ restraint means more spare production capacity in the world

With the cutbacks and restraint in OPEC+ production, it means there is a close to 6 million b/d spare oil production capacity in the system. Apart from the covid period, this is historically, a high level. Almost all of this spare capacity lies in four countries in the Middle East; Saudi Arabia holding 3.2 million b/d, the UAE 1.1 million b/d, with Kuwait and Iran each reportedly at around 0.5 million b/d. Russia also has reported spare capacity of around 0.4 million b/d, but in current circumstances this is likely to be seen as more-or-less irrelevant.

There is a very modest gain in OPEC+ production capacity expected next year, and so spare capacity could be even higher in 2025. Given the expansion of non-OPEC+ production and the large-scale spare capacity in the Middle East, plus how recent disruptions have been overcome, it is no surprise the market is ‘comfortable’ on supply.

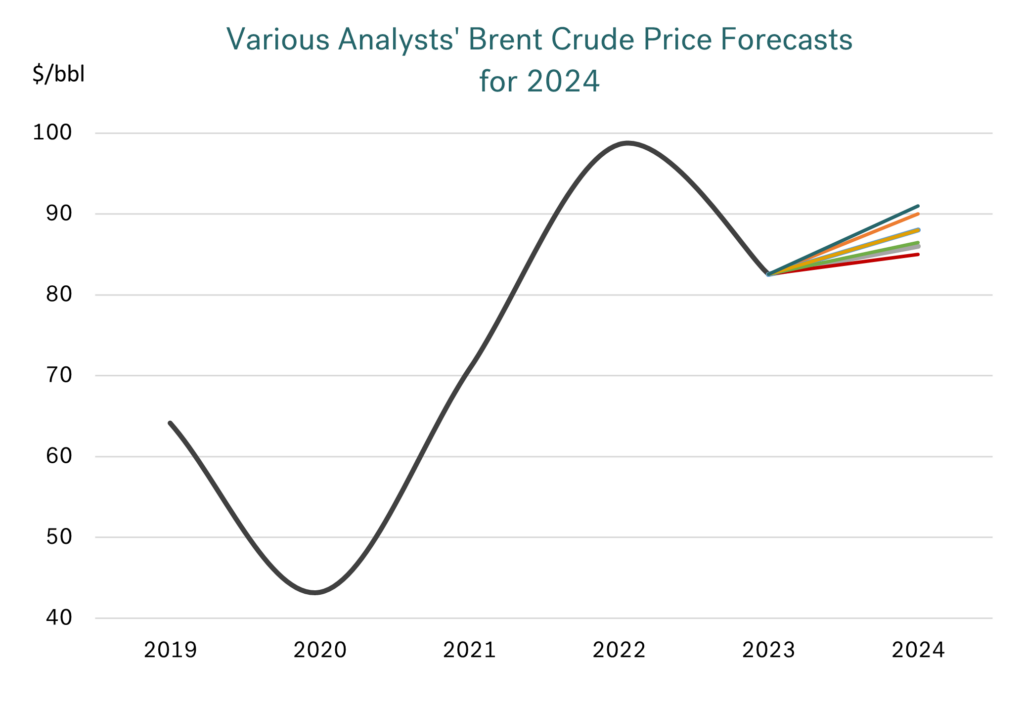

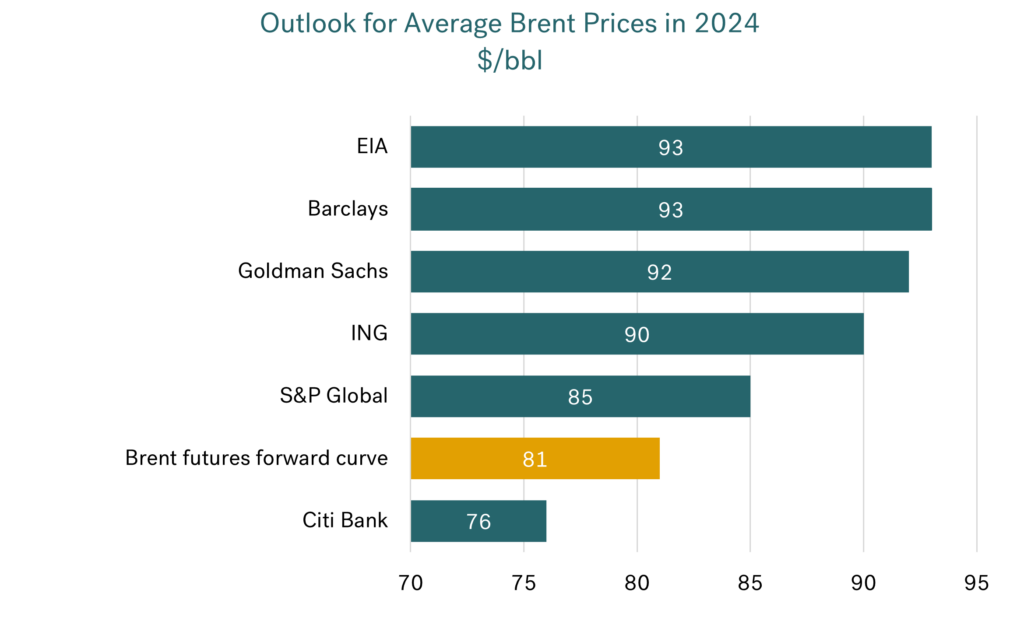

Analysts converging on their price forecasts.

Given how the market has responded over the last year to what in the past would have been considered extreme ‘high risk’ geopolitical and military events, it is not surprising that analysts have ‘put a lid’ on their oil price forecasts for this year, typically at $90/bbl for Brent. The range of forecasts is now very narrow, with almost everyone in the $85-90/bbl as an average for Brent this year. A few have put a slightly higher number of up to $94/bbl for the third quarter average, based on some more positive economic indicators coming out. But in comparison to other times, there is not that much of a difference between analysts’ price views.

Source: Integr8 Fuels

Source: Integr8 Fuels

Is it time to be worried when everyone is in agreement?

Going forward, IF the geopolitical risks are even greater than we have seen (and they have already been extreme!), OR OPEC+ is prepared to make even further production cutbacks, then prices would likely rise and stay well above $90/bbl. BUT, if the situation in the Middle East becomes more settled, then, given the fundamentals, prices are more likely to fall.

So far this year, Brent front month futures has averaged $83.30/bbl. From a perspective here and what we have seen so far this year, it is surprising that none of these analysts looking at average 2024 Brent prices have put a figure lower than last year’s average of $82.50/bbl.

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Dual-fuel vessels owners should consider e-LNG to make the most of emissions compliance

April 11, 2024

Dual-fuel vessel owners should look to liquefied e-methane as a drop-in bunker fuel to make the most out of emission compliance, argue Jonathan Gaylor of Integr8 Fuels and Maximilian Matheis of TURN2X.

We already know that fossil LNG-fuelled vessels will pay less to comply with the EU’s Emissions Trading System (EU ETS) than vessels fuelled with conventional high sulphur fuel oil (HSFO), very low sulphur fuel (VLSFO) and low sulphur marine gasoil (LSMGO) because LNG has a lower carbon factor. Many of these LNG-fuelled vessels will also be compliant with FuelEU Maritime (FEUM) greenhouse gas (GHG) intensity reduction targets until 2030, 2035 and 2040, depending on their engine type and methane slip. Dual-fuel vessels have recently benefitted from low fossil LNG prices, which have rendered it a more attractively priced bunker fuel option to VLSFO, LSMGO (Rotterdam and Singapore) and HSFO (Rotterdam).

Liquefied e-methane, or e-LNG, is almost five times more expensive than fossil LNG, but because you need so little of it per vessel to meet FEUM targets for 2030-2039, it will not add much to the total price of a blend of fossil LNG and e-LNG. Any compliance surplus from extra e-LNG consumption will be added on top of a neutral compliance balance and averaged out across your fleet or pool, or it can be banked for future years.

Incoming LNG Glut

After the LNG bunker market was shaken by Russia’s invasion of Ukraine and skyward prices, it now faces a period of oversupply, low prices and soon a doubling of the global LNG-fuelled fleet. Massive fossil LNG production and export growth from the US and Qatar is set to put LNG in a prime position to continue to trade at discounts to conventional VLSFO and LSMGO prices. Fresh output boosts from Malaysia, Australia and others also form part of a wave of new supply. So, if fossil LNG prices keep at sustained discounts to conventional fuels going forward, these discounts can be used to cover a higher price paid for e-LNG, which can be used to meet more and more stringent GHG reduction targets.

Mass Balancing and Virtual Liquefaction

And you do not necessarily need to blend e-LNG into fossil LNG physically. The LNG industry is increasingly becoming familiar with mass balancing and virtual liquefaction – accounting techniques that remove the need to move physical e-LNG molecules out to every ship and other end-users. A shipowner can order a certain amount of e-LNG in its LNG blend but will actually receive pure fossil LNG in its ship’s fuel tank. The shipowner will pay for, say 1% e-LNG, which will be produced and distributed to another end user that has paid for fossil LNG and would otherwise have consumed only fossil LNG. More e-LNG will be consumed on the balance as a result and costs can be cut in its distribution and liquefaction, which can be done virtually and boost the competitiveness of e-LNG.

Price Edge on Liquid Bunker Fuel Blends

Integr8 Fuels estimates that 2% used cooking oil methyl ester (UCOME) blended with 98% VLSFO is priced around $610/mt with current price levels in the ARA. If you blend e-LNG into the fossil LNG, the e-part will count twice towards FEUM targets towards 2033 because it qualifies as a renewable fuel of non-biological origin (RFNBO) if it has GHG savings of more than 70%. Say you blend in 1% e-LNG with 99% fossil LNG, then that e-LNG component would count as 2% RFNBO and be priced around $480/mt. These prices have been adjusted for calorific contents to make them VLSFO-equivalents in terms of energy. In other words, e-LNG blends are about $130/mt more cost efficient than biofuel blends when you compare energy for energy with 1-2% shares of renewables.

Taking the RFNBO argument a bit further, running just one vessel on 100% e-LNG can cover the FEUM compliance of 44 other similar vessels running on VLSFO between 2025-2029, according to a recent report by the Mærsk Mc-Kinney Møller Center for Zero Carbon Shipping. This is because the e-LNG vessel generates a massive compliance surplus that can be averaged out across a fleet of conventionally fuelled vessels or a pool of vessels. Your compliance surplus can therefore be sold to other shipowners through pooling with them. It can also allow you to lower your EU ETS exposure and help improve your Carbon Intensity Indicator (CII).

FEUM Here to Stay

When we consider not just e-LNG on its own, but in blends with attractively priced fossil LNG, it becomes a more attractive proposition to dual-fuel vessel owners. This will lead to further investments into this space and continue to reduce costs. It is important to note that FEUM is a long-term regulation that can enable shipowners to be confident about signing the long-term agreements that are necessary for e-LNG projects to get through the final investment decision stage. Since these projects will have strong commercial underpinnings, they are more robust. As an e-LNG supplier or project developer, you need long term contracts to underwrite power purchasing agreements for these types of fuels. FEUM creates predictability through being an offtake enabler. This long-term focus does not generally align with the nature of the bunker market – which tends to favour spot deals – but FEUM is poised to help bridge that gap.

How It’s Made

E-LNG is an electricity-based fuel where green hydrogen is one of its two major components. The process of splitting water into hydrogen and oxygen through electrolysis is dependent on renewable electricity generation, so access to competitively priced electricity is key. E-methane is e-LNG in gas form and has no upstream emissions because it is synthesised at plants that combine green hydrogen from renewable electricity with biogenic CO2. The green hydrogen allows renewable electricity to be stored off the grid and without a need for batteries. This green hydrogen is subsequently reacted with captured biogenic CO2 and liquefied into e-LNG.

All of these processes are comparatively CAPEX- and OPEX-intense, but e-methane start-up TURN2X is actively working on lowering the levelised costs for e-LNG to become an even more competitive drop-in fuel. A shared characteristic of all electricity based

fuels (i.e. e-LNG, e-ammonia and e-methanol) are the conversion losses, especially within the electrolysis. The conversion loss from methanation – which TURN2X uses to produce e-methane – is significantly smaller. Further increasing the efficiency of electrolysis will therefore become an important lever to reduce the energy conversion losses going forward.

The Case For E-LNG

It is almost impossible to electrify largescale ocean-going ships and there is not yet technological readiness for hydrogen fuelled vessels – which is why we need to move one step further with the molecules toward hydrogen derivatives such as e-LNG.

TURN2X recently launched its first commercial e-methane plant in Spain’s Miajadas. The location was chosen for its abundant solar energy potential, and because the electricity grid in this region in Spain is already suffering from congestion at certain times during the day, it has become harder for renewable electricity projects to come online. The company is creating an off-grid opportunity to bring in renewables projects while finding another way of transporting it out of Spain – and sees the pan-European gas grid as the largest battery that we currently have.

Munich-based TURN2X is now looking to the maritime sector for long-term contract customers, and because FEUM does not have an end date, it can help underpin growing renewables demand in decades to come. This can, in turn, enable TURN2X to develop even more competitive and scalable solar PV projects on-site for affordable green electricity and further reduce the price of critical CAPEX components such as the electrolyser stacks and the proprietary methanation technology. Maritime is one outlet for TURN2X, which has teamed up with Integr8 Fuels to reach a wide network of fossil LNG-fuelled vessels with e-LNG. Existing bunker infrastructure used to deliver fossil LNG can just as well be used to deliver e-LNG.

Jonathan Gaylor

Integr8 Fuels

jonathan.g@integr8fuels.com

Maximilian Matheis

TURN2X

max@turn2x.com

For more information about Integr8’s energy procurement offering, visit our bunker trading services page.

Stable prices at the moment, but wider VLSFO/ HSFO spread going forward?

March 20, 2024

A lot of market risk and uncertainty, but no movement in prices!

Something rare has happened in the bunker market over the past 40 days – VLSFO prices have remained near unchanged! Prices in Singapore have moved within a very narrow $27/mt range ($619-646/mt); you have to go back to 2021 to see when the last 40-day trading range was at this level. More often we have seen these trading ranges close to $100/mt and at times it has been $200-300/mt (admittedly at higher absolute prices).

The 40-day trading range in Fujairah and Rotterdam is similarly low (at $30 and 32/mt). So, looking at recent price movements we could say nothing is happening in the market and bunker buying is ‘easy’. But far from it, you only have to look at the front pages to know there is a lot of risk and uncertainty in the market, especially surrounding various events in the Middle East, along with developments in Russia and Ukraine.

Source: Integr8 Fuels

Source: Integr8 Fuels

Nothing lasts forever

We are in one of those very strange periods, where the political and war risks are high, but oil fundamentals going forward look weak (even though OPEC+ has just extended its cutbacks again through to mid-year). It seems the bearish side is perfectly counter-balancing the bullish side and so nothing is moving. It isn’t the case that buying bunkers is ‘easy’ – there is still a lot going on behind the scenes to keep prices this flat! And one thing we do know is ‘something will change…’.

Change: What could this mean for the VLSFO/HSFO price differential

In our report a month ago we highlighted a potential tightness in the middle distillate part of the barrel and how this could lead to relatively high VLSFO pricing as we go through this year. Here we take the discussion one step further, looking at implications for the VLSFO/HSFO price spread (and so the economic attractiveness of scrubber fitted vessels).

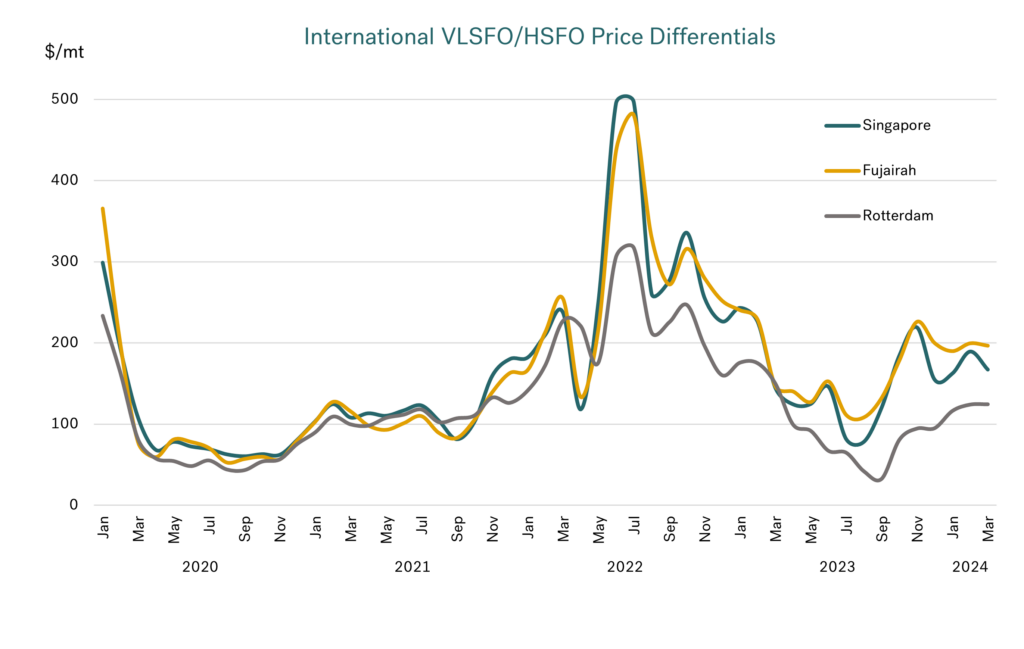

Where are we currently with the VLSFO/HSFO spread?

The VLSFO/HSFO spread has moved wildly since the legislation kicked-in at the start of 2020. The market rush and wide spreads at end 2019/early 2020 were quickly replaced by spreads of only $50-75/mt as COVID hit everything.

In 2022, we did see an extreme spike as most industrial sectors moved into ‘growth-mode’, at a time when refining was tight AND Russia had invaded Ukraine. This pushed oil prices and spreads to extreme levels, including the VLSFO/HSFO spread out as far as $500/mt East of Suez and $300/mt in Europe.

Source: Integr8 Fuels

Source: Integr8 Fuels

Between mid-2022 and mid-2023, markets became more balanced and oil prices fell sharply. Differentials would tend to narrow as prices fall, but the VLSFO/HSFO spread collapsed to only $50-100/mt; cuts in heavy/sour crude production from OPEC+ and European sanctions on Russian crude and product exports meant greater support to HSFO pricing than VLSFO.

Now things have changed again. Over the past 6 months we have seen this far greater strength in middle distillates than in HSFO, with the net result the VLSFO/HSFO price spread has moved back out to $175-200/mt East of Suez and $125/mt in NW Europe.

Is the spread likely to continue to widen?

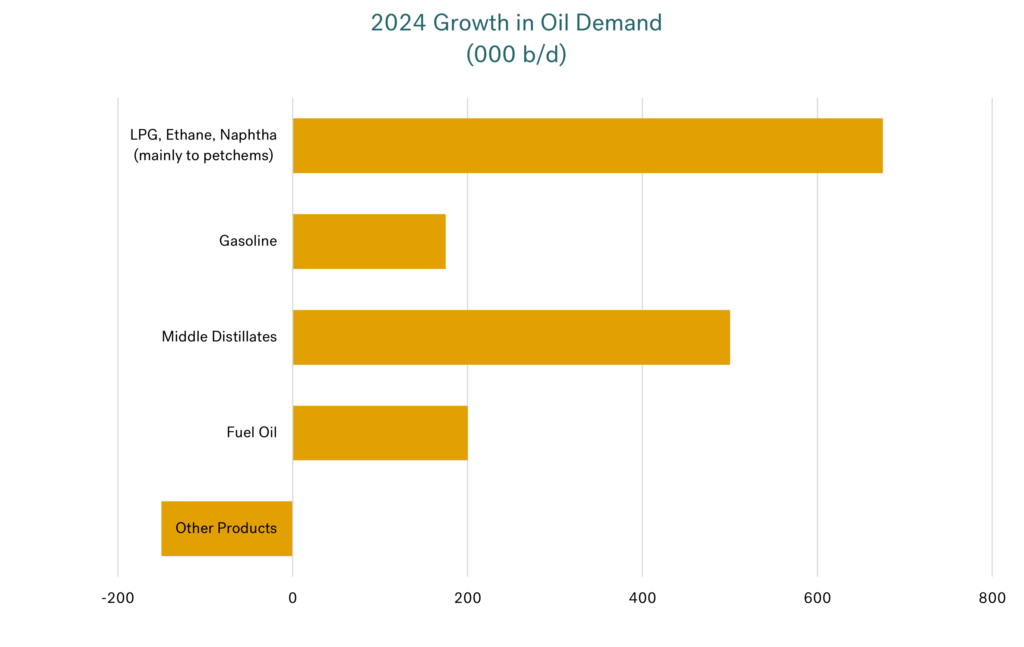

Looking at the bigger picture, growth in world oil demand this year is definitely centered on lighter end and middle distillate products.

Source: Integr8 Fuels

Source: Integr8 Fuels

There is a general shift in the oil industry towards petrochemicals, so, demand for LPG, ethane and naphtha are growth markets. In contrast, growth in demand for gasoline is low and at a turning point; the expansion in electric vehicle numbers in Europe, the US and China will mean gains in these regions will be minimal at best.

However, focusing on the VLSFO/HSFO spread this year, we need to look more closely at the middle distillates and fuel oil markets.

In absolute terms, middle distillate demand is the second biggest growth area this year, with gains evenly split between jet/kero and diesel/gasoil. Jet demand is generally increasing, with most regions now back to, or above their pre-pandemic levels. However, international airline travel in Asia is still below 2019 levels, and so a continued rebound here would give a further boost to jet demand. Also, even small positive developments in the economy will raise diesel/gasoil demand. The added factor to this is that middle distillate stock levels are very tight; so, prices here are likely to be ‘well supported’. With VLSFO pricing closely linked to middle distillates, it would mean VLSFO prices are also well supported.

There is forecast growth in fuel oil demand this year, but in absolute terms it is far lower than for middle distillates and lighter products. So, looking at the demand side, the inference is towards stronger relative pricing for VLSFO than HSFO and therefore a widening of the VLSFO/HSFO spread.

The supply side and refining

We have already seen severe bottlenecks in the refining industry, leading to much stronger margins and wider product price spreads. With demand now focussed on the lighter and middle parts of the barrel, there is little refiners can do in the short term other than to process more and more lighter crudes.

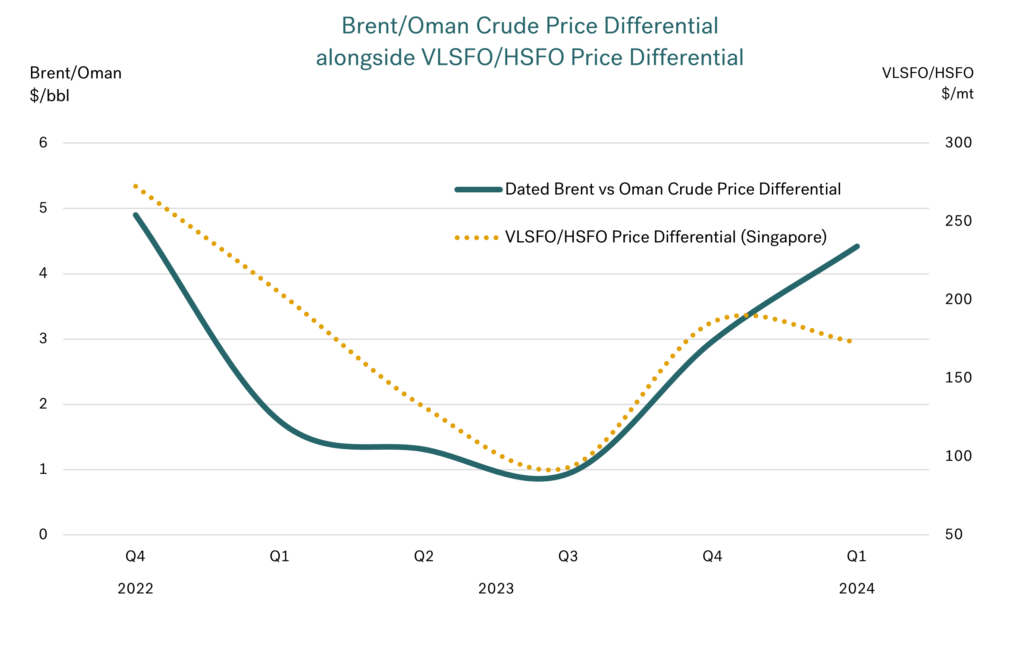

There are gains in production of these lighter crudes, but clearly not enough. The graph below shows the price spread between light/sweet and heavy/sour crudes (using dated Brent and Oman crudes as references) and then superimposing the Singapore VLSFO/HSFO differential.

Source: Integr8 Fuels

Source: Integr8 Fuels

The differential between the two crudes was squeezed to only $1/bbl through the first three quarters of 2023. This stemmed from the Russian situation and the agreed and voluntary cuts in OPEC+ production, which were dominant factors at the time and effectively lent support to fuel oil pricing.

But, even though OPEC+ has maintained their cuts and even extended them through to end June, the focus now is on refiners making more middle distillates. This has pushed demand for lighter crudes much higher, and with it this crude price differential is now back out and has averaged $4.50/bbl so far this year.

A wider VLSFO/HSFO price differential?

Given everything on the demand side and the limitations in the refining industry, it seems the pressure is on for a wider VLSFO/HSFO spread.

As an additional note, OPEC+ has managed the market and monthly average Brent futures prices have mostly remained in the $80-90/bbl for the past 18 months. As and when OPEC+ unwind these agreed and voluntary cutbacks, it will reintroduce more heavy/sour crude grades to the market and could put a further downwards pressure on HSFO prices.

The conclusion is that the VLSFO/HSFO differential could widen further this year, and if OPEC+ unwind any of their cutbacks the differential could be even bigger.

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

European VLSFO prices are worth watching

February 21, 2024

Recent uptick in oil prices; but for temporary reasons

There are mixed signals driving the absolute price of oil at the moment, with a slightly more bullish push over the past two weeks. But, to put it in context, this recent uptick followed a sharp drop in prices at the end of January and into the first few days of February, when Brent crude fell from $82/bbl to $77/bbl. The ‘bullish’ push in the past two weeks has only brought Brent back to $82/bbl.

Looking at very low sulphur fuel oil (VLSFO) prices in Singapore and Fujairah, these have traded in a narrow $25/mt range so far this month and are still lower than their end January levels (and $35-40/mt lower than average November prices). This is not the case in Rotterdam.

Source: Integr8 Fuels

Source: Integr8 Fuels

Behind these price movements there have been some temporary bullish factors in the oil industry so far this year. Arctic weather conditions in North America shut in around 0.9 million b/d of oil production and halted around 1.7 million b/d refinery operations. At the same time, there have been planned, heavy maintenance programs in the Atlantic Basin refining industry running through January and into February. This again has restricted product availabilities and led to lower stock levels. But these are temporary issues!

On the bearish side, in recent reports we have focused on the weak prospects for oil demand this year, and this is still in play, especially when you look at the International Energy Agency’s (IEA) latest forecast for 2024. Also, gains in non-OPEC production look as though they will be high this year, and the recent cuts in OPEC+ production have been limited to only 0.2-0.3 million b/d from December levels. Therefore, the fundamentals for this year would indicate a ‘lid’ on prices. This, plus the ability of the industry to work around the attacks on Red Sea shipping, has so far superseded the heightened political events and risks in the Middle East region.

European VLSFO prices are ‘more exposed’

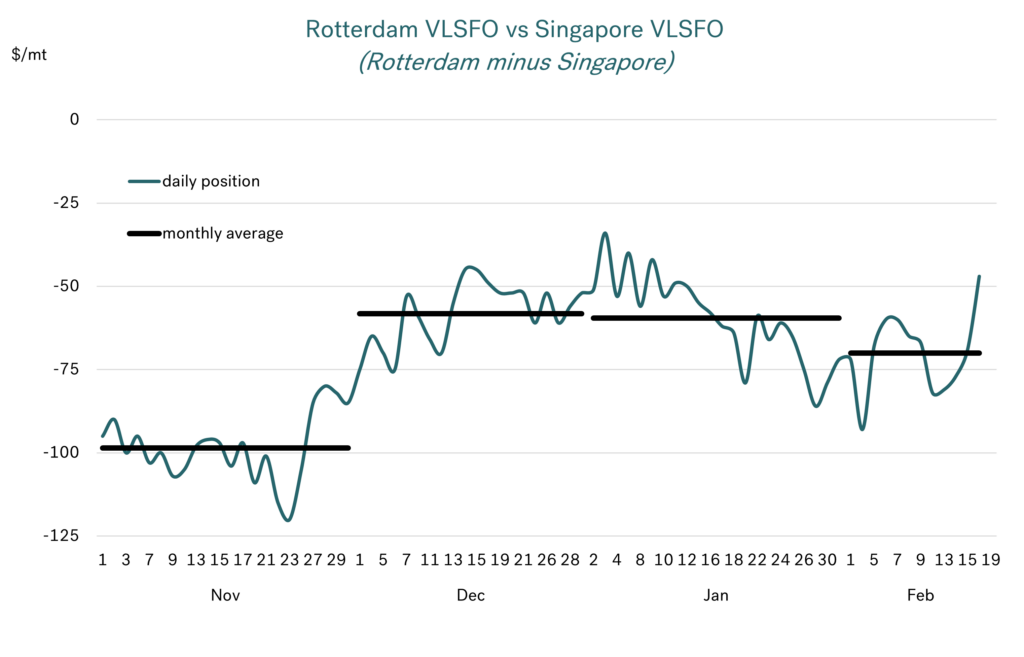

From the chart above, Rotterdam VLSFO prices have risen more steeply than in Singapore and Fujairah over the past two weeks. Rotterdam VLSFO prices are around $50/mt higher than in early February, and unlike the other major bunkering hubs, Rotterdam prices are higher than we have seen so far this year, and some $10/mt above their November average.

Back in November, Rotterdam VLSFO was priced at around $580/mt and Singapore at around $680/mt, i.e. a differential of $100/mt. Between then and now Singapore prices have fallen by $40, but Rotterdam prices have gone in the opposite direction and are around $10 higher. The net result is that the differential between the two markets has narrowed from $100- to $50/mt.

Source: Integr8 Fuels

Source: Integr8 Fuels

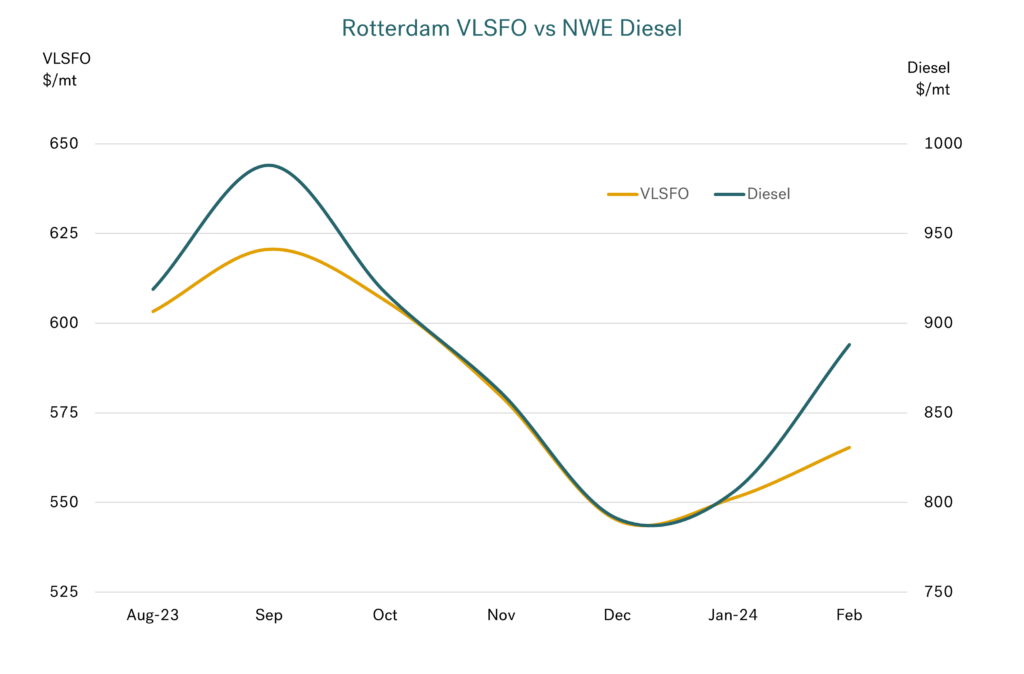

VLSFO pricing related to middle distillate pricing

The nature of VLSFO means supply and price movements are closely related to what is happening in other products. The chart below shows the close relationship between Rotterdam VLSFO and NW European diesel prices.

Source: Integr8 Fuels

Source: Integr8 Fuels

The European VLSFO market looks like it will only get tighter

Europe is naturally short in the middle distillates of jet, diesel, and gasoil and so highly dependent on imports. The European sector had already been under pressure since the embargo on Russian supplies. However, the situation has tightened even further with the attacks on shipping in the Red Sea. These latest developments have hit diesel and jet shipments from the Middle East and India to Europe, with a leap in freight costs, longer voyage times via the Cape of Good Hope and tighter market conditions in Europe.

This loss of these supplies from east to west has partly been made up by an increase in diesel exports from the US to Europe. However, this may be short-lived as US refinery turnarounds in the first quarter cut availabilities and potentially limit diesel exports. Hence, European diesel (and so VLSFO) prices are likely to rise relative to VLSFO markets elsewhere in the world. To compound this even more, Ukraine drone attacks on Russian refineries may have affected operations and so diesel exports from the country. Although this will not have a direct impact on the European diesel position, there is an indirect consequence, with other buyers of Russian products left short and having to source supplies from elsewhere, which will be in direct competition with European buyers.

Add to this a number of major European refineries going into turnaround in the north and Med regions, and the market is potentially even tighter!

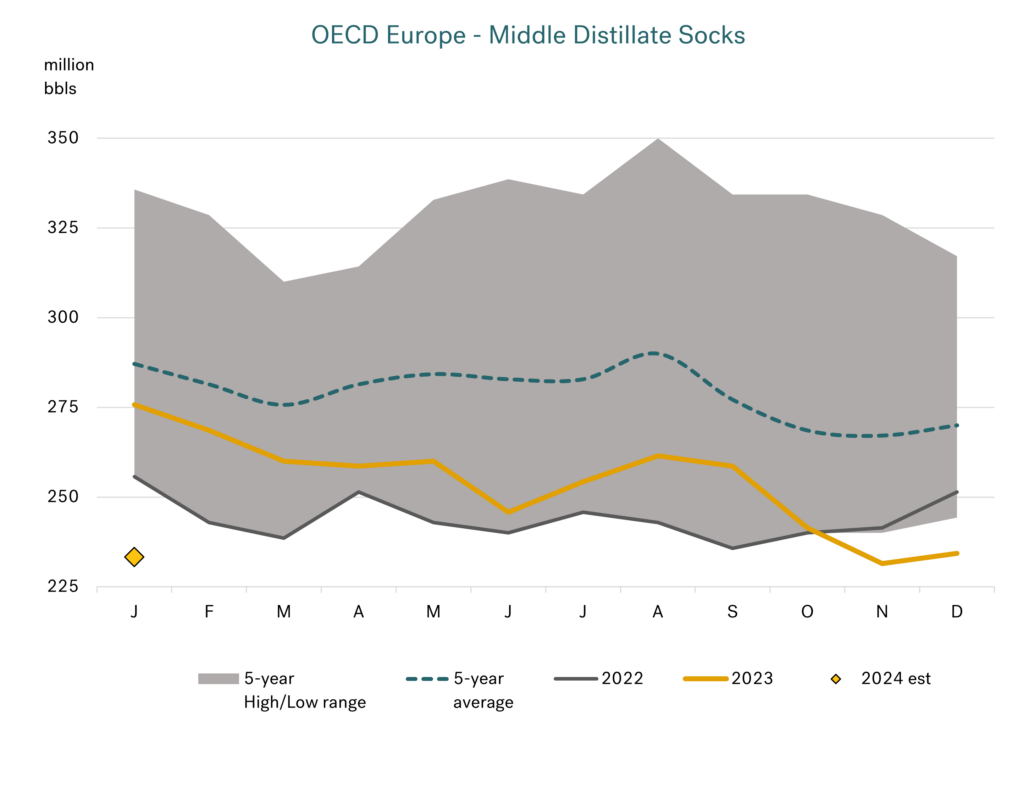

If this isn’t enough, then there is a further layer to add to the argument; and that is the current exceptionally low distillate stock levels in Europe. The graph below shows the five year high/low range for middle distillate stocks in Europe, and that for the past two years stocks have been well below their five year average. More importantly, over the past three months stocks have been below their previous five year lows, and this is at a stage when we expect the market to tighten even further.

Source: Integr8 Fuels

Source: Integr8 Fuels

Whatever happens, Rotterdam VLSFO prices are likely to be relatively high

All else being equal (it never is!), the fundamentals point towards a more bearish oil market, but with this relative strengthening in European VLSFO prices.

Beyond the fundamentals, the geopolitical risks at the moment clearly lie in the Israel/Gaza position and developments surrounding Iran. But there are also a number of elections this year that will contribute to more uncertainty, not least in the US.

However, as things pan out, the European distillate market does look tight going forward and this would mean relatively higher VLSFO prices in Rotterdam, and Europe generally.

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

What does the refining industry tell us about VLSFO for this year?

January 31, 2024

Bunker prices had been falling, even with more attacks on Red Sea shipping

Bearish fundamentals and sentiment played out between mid-December and mid-January, with VLSFO prices on a downward slide. This was despite geopolitical tensions surrounding Houthi attacks on shipping in the Red Sea and the first US/UK air attack on Houthi targets on January 11th.

Source: Integr8 Fuels

Source: Integr8 Fuels

Something has changed, and prices are on the rise

However, over the past two weeks prices have increased, and are now back to early December levels. The main reasons behind the turning point have been:

- Stronger than expected economic growth in the US;

- More positive indications for growth in Chinese oil demand;

- Tighter product balances (because of disruptions to trade as ships re-route via the Cape of Good Hope and away from the Red Sea/Suez Canal*);

- Short-term crude production and refinery outages in the US because of cold weather.

*The main impact on oil markets so far on ships re-routing has been on diesel and jet trade from the Middle East/West Coast of India to Europe, and the naphtha and fuel oil trade from Europe to

It is these fundamental developments that have led prices higher, rather than a direct response to Houthi attacks. As a result, Rotterdam and Fujairah VLSFO prices are up by around $50/mt over the past two weeks, and Singapore VLSFO up by $80/mt.

The greater geopolitical risk now is any increased tensions/conflict between the US and Iran.

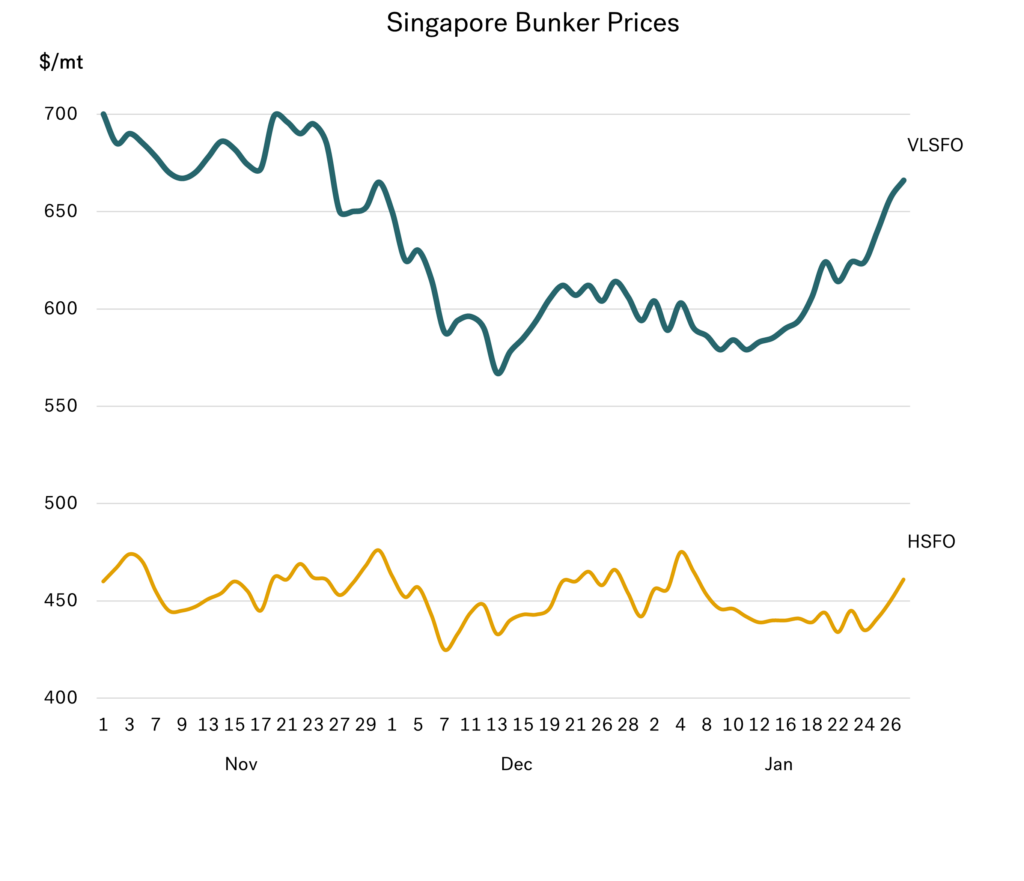

HSFO prices near ‘unchanged’

The same cannot be said for HSFO prices, which have only increased by around $20/mt in Rotterdam and Singapore over the past two weeks. An increase in heavy crude trade from the Middle East to Europe and a large-scale rise in HSFO exports from Kuwait to Asia has weakened the relative position of HSFO, in contrast to other products, including VLSFO. These price movements are shown in the graph below, with the net result that the Singapore VLSFO/HSFO spread has widened again to more than $200/mt (from $145/mt two weeks ago). This spread was last above $200/mt in late November.

Source: Integr8 Fuels

Source: Integr8 Fuels

Refinery crude throughputs will reach a record-high this year

Some of the price elements involved in today’s market are related to what is happening in the refining sector, and these influences are likely to be a continual feature this year.

Firstly, there have been a number of unplanned refinery outages, plus refinery maintenance programs are already higher than ‘normal’. Higher maintenance is expected to be a feature this year. This is because we have just been through two years of ‘light maintenance’ as margins have been so good; this year will be the time to ‘catch-up’.

Despite more maintenance, refinery crude throughput is still expected to hit a record high this year. New start-ups in Nigeria, China and Mexico, plus expansions and increased runs in the Middle East and India, will drive new capacity and throughputs much higher. These dynamics will have a significant impact on trade flows and volumes, and if the Red Sea/Suez Canal continues to be a ‘no-go’ zone, then disruptions and higher bunker demand may also be a continued feature of the market.

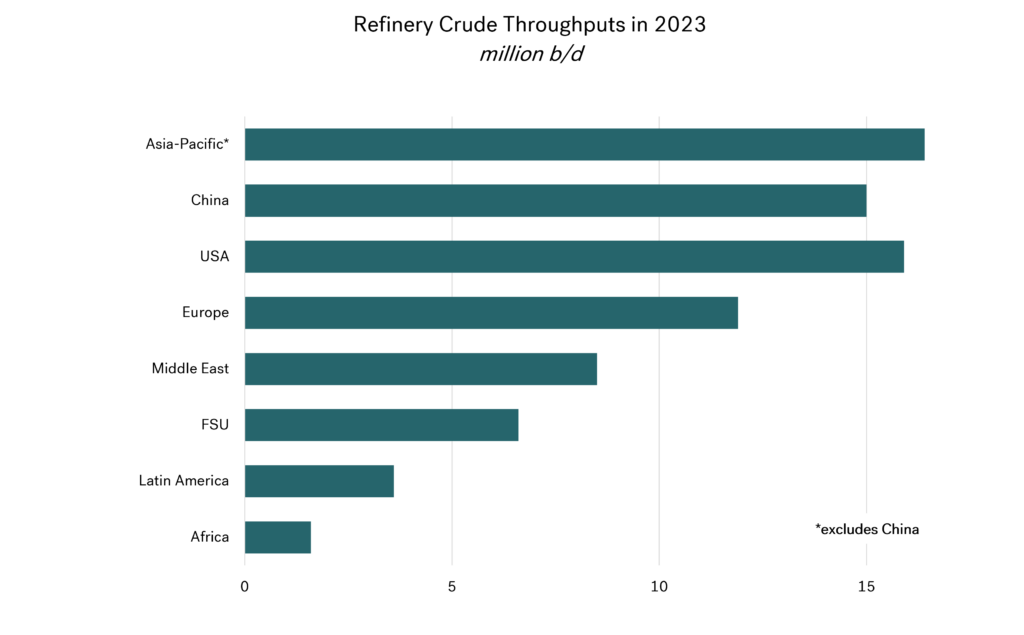

How big are the regional refining sectors?

Putting some context on what is happening in each region, last year China’s refinery crude throughput averaged around 15 million b/d, with the rest of Asia-Pacific at a similar level. This puts refinery crude throughput in Asia-Pacific at 31 million b/d, and way above any other area.

Source: Integr8 Fuels

Source: Integr8 Fuels

Crude throughput in the US was close to 16 million b/d, and then volumes scale back to 12 million b/d in Europe, 6.5 million b/d in the FSU, down to only 1.6 million b/d in Africa.

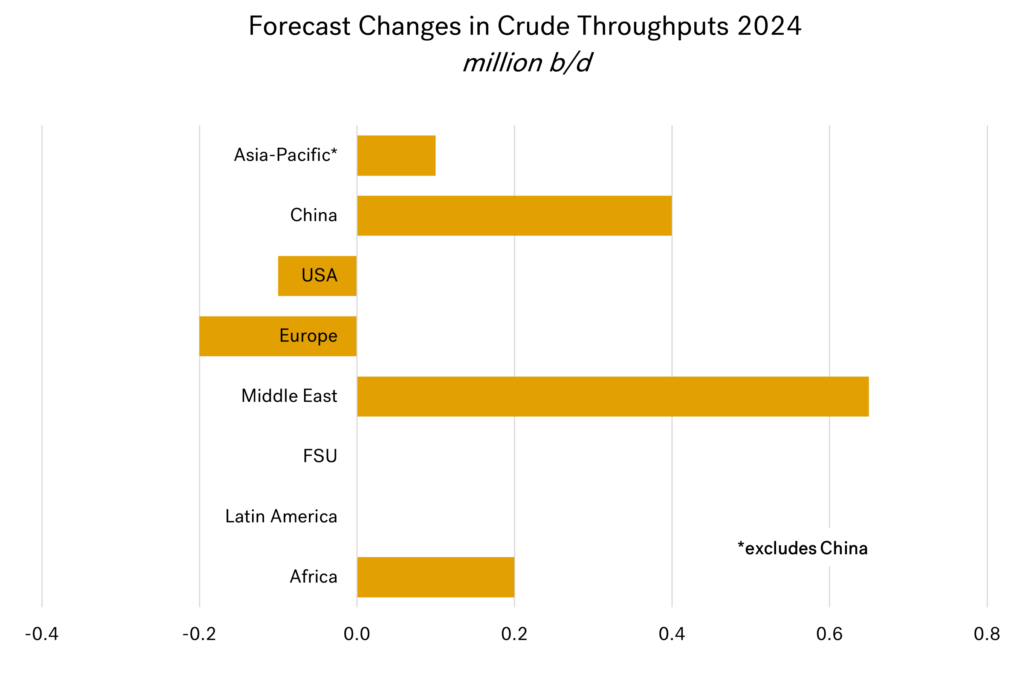

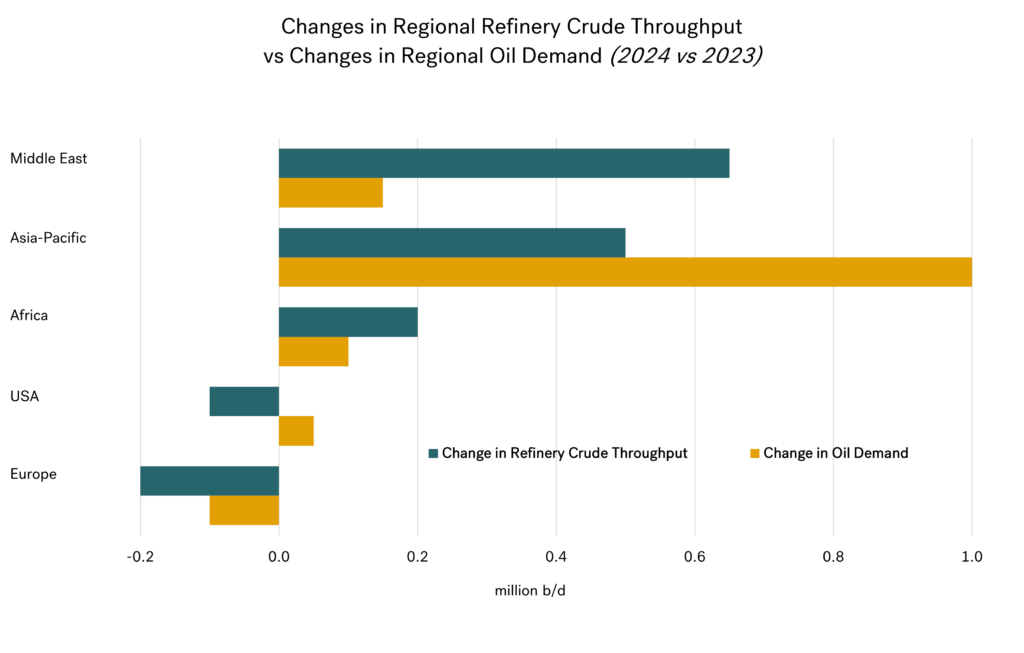

Where are the big throughput gains going to happen this year?

Firstly, the biggest increase in throughput this year is going to be in the Middle East, with gains in Kuwait, Saudi Arabia, Oman and Bahrain amounting to close to 0.7 million b/d more than 2023 levels (almost 8% higher).

Throughput in China is forecast to rise by around 0.4 million b/d, with the new 0.4 million b/d Yulong refinery expected to start up later this year and higher throughputs elsewhere. However, unlike other big refining centres, China has central control of crude imports and product exports, so there is always an upside and downside risk to throughput forecasts here.

Taking into account increases elsewhere, total crude throughputs in Asia-Pacific are projected to rise by some 0.5 million b/d this year (plus 2%).

Source: Integr8 Fuels

Source: Integr8 Fuels

There is a potential increase in African throughput, but this all hinges on the massive 650,000 b/d Dangote project in Nigeria. Like some other refinery projects, the start date has been pushed back numerous times. However, there are reports of crude oil moving into the site, which implies testing and commissioning of some units. Current expectations are for a start-up later this year, but this is one to watch closely as it will have significant implications for trade flows, potentially backing out gasoline from Europe to West Africa.

After this, the bigger story is possible declines in European and US refinery operations. Higher refinery maintenance programs and current outages in the US because of cold weather will impact throughputs. However, there are also ongoing threats of closures in both regions, and an extended period of weaker margins could trigger these.

Implications for product trade and VLSFO pricing

Bringing together increases in regional refinery throughputs and measuring these against regional increases in oil demand does offer a clear direction on trade flows and potential shifts in relative VLSFO pricing.

Two main pointers become clear. One is the increase in refinery runs in the Middle East this year will far exceed the gain in ‘local’ oil demand; runs up 0.65 million b/d and demand up 0.15 million b/d implies a rise of 0.5 million b/d in product exports.

At the same time, although refinery runs in Asia-Pacific are forecast to increase by 0.5 million b/d this year, oil demand is expected to be 1.0 million b/d higher. The implication is product imports into Asia need to increase by a net 0.5 million b/d this year.

Although the net imports into Asia match the forecast increase in Middle East exports, it doesn’t mean all incremental Middle East product exports will go east. Different products will have different surplus and deficit positions in all regions, so Middle East volumes will be pulled east and west; however, a bigger proportion of incremental Middle East exports are likely to go east.

Source: Integr8 Fuels

Source: Integr8 Fuels

As mentioned, the balance in Africa is highly dependent on the Dangote refinery project, but an increase in refinery throughput greater than the increase in regional demand would mean less product imports into the region and potentially product exports out.

Finally, oil demand in the OECD is ‘under threat’ and is at, or close to decline. At the same time, refinery operations in Europe and the US could also fall. It is then a question of which falls further, oil demand or refinery throughputs?

Based on this analysis, there could be an increase in demand for diesel and jet imports into Europe, which would have to be ‘pulled in’ from the Middle East/India. This is long haul trade, which could be made even longer if the situation in the Red Sea is not resolved.

In the US, the position is less clear, as both demand and refinery operations could go either way this year, although in the longer run both are expected to decline.

More product trade from the Middle East pulled east and west

Looking at the net product trade positions in the main bunkering centres of Singapore and Rotterdam, it seems both regions are going to need increased imports and that most of these volumes will have to come from the Middle East. This has implications for trade, delays, bunker demand, but importantly for us it implies no obvious oversupply or relative weakness in VLSFO pricing in either bunkering centre in 2024.

VLSFO is likely to trade at an increasing premium to crude oil in 2024. Watch crude, and then add a bit more!

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Prices still look like falling, even after OPEC+ announce a 2.2 million b/d cut.

December 21, 2023

Oil prices are down, but Singapore VLSFO is DOWN.

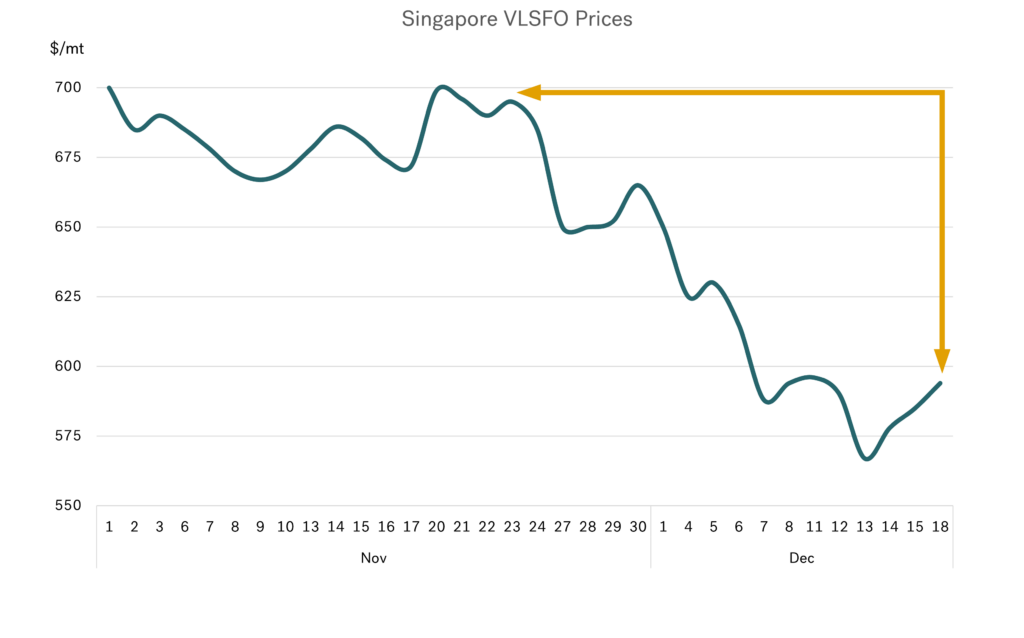

A month ago, we wrote about the oil fundamentals looking more bearish and that OPEC+ may cut production at their end November meeting to counter these views and support oil prices. Well, OPEC+ did come up with an agreement to cut output by 2.2 million b/d, but oil prices still fell!

From the lead-up to the OPEC+ meeting to now, Brent crude is down by around $6/bbl, and Rotterdam VLSFO is down by around $50/mt. However, with tightness in the Singapore VLSFO market unwinding at the same time, bunker prices here have fallen by a massive $100/mt over the past four weeks (15%). All this is certainly welcome news for bunker buyers, but also shows the bearish nature of the market at the moment.

Source: Integr8 Fuels

Source: Integr8 Fuels

There are always three reasons for market moves!

The three key features why we are seeing much lower oil prices and the big drop in bunker prices are:

- There are more bearish signals for growth in world oil demand, predominantly because of weak global economic prospects and the knock-on effects.

- Increases in non-OPEC oil production are much bigger than most people expected, especially in the US, but also with output ramping up in Brazil and Guyana.

- Actual production cutbacks from OPEC+ will be much lower than the headline 2.2 million b/d figure that came out of the end November meeting, and could be even less than 0.5 million b/d.

Again, it is these fundamental features that are currently driving the market, and the fundamentals look weak.

US production has hit record highs – and it means lower oil prices

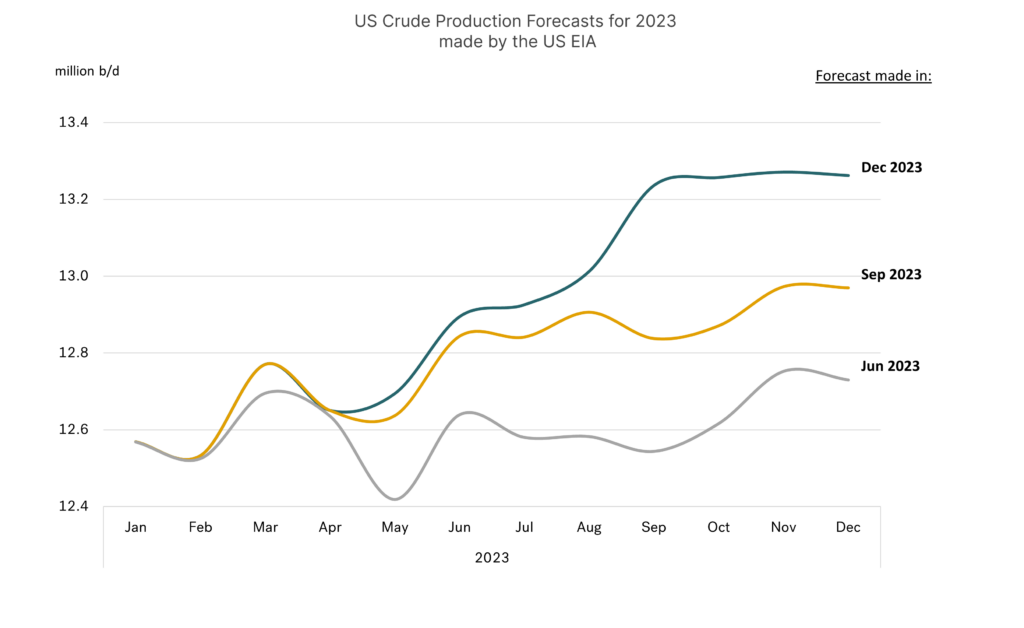

Until recently the main talk in the US shale sector was of limited new investments, constraints on equipment and labour, and a general slowdown in developments. Just six months ago the view was very much that US crude production was going to remain flat. Now the market is booming!

This turnaround in US shale output has come with gains in operating efficiencies and higher productivity at the wells. These moves have been far greater than people envisaged and have driven US oil output to a record high level. In the latest estimates by the US Energy Information Administration (EIA), December crude output is at close to 13.3 million b/d; three months ago, their December estimate was 13.0 million b/d and only 6 months ago it was at 12.7 million b/d.

Source: EIA

Source: EIA

So, over the past 6 months, the OPEC+ group has cut production by around 0.8 million b/d, but the US has seen an ‘unexpected’ increase of 0.6 million b/d. This has been a ‘surprise’ to the market, an additional challenge to OPEC+ and a blessing to those looking for lower bunker prices.

The challenge for OPEC+ to ‘manage the market’ is huge

Given the weaker prospects for growth in oil demand next year, and production gains in certain non-OPEC countries, the challenges facing the OPEC+ group going into their recent meeting were immense. The headline number of a 2.2 million b/d production cut by the group was, on the face of it, very impressive. However, it wasn’t enough to maintain prices you don’t have to dig very deep to see there are some optics in this figure.

Within these figures, Saudi Arabia has agreed again to extend its voluntary cutback of an additional 1 million b/d into the first quarter of next year. Before the OPEC+ meeting, the plan was for Saudi to end this voluntary arrangement at the end of this year. So, this is one of those cases where the ‘reduction’ is from ‘what would have otherwise happened’, not from current production levels.

In a similar development, Russia has announced that it will also rollover its 0.3 million b/d cut in crude/product exports into Q1 2024 and add a further 0.2 million b/d cut to this from January i.e. a theoretical cutback of 0.5 million b/d.

So, 1.3 million b/d of the announced 2.2 million b/d OPEC+ cutback comes from extending the Saudi and Russian voluntary cuts into Q1; it is not a cut from current production levels! There is a planned additional 0.2 million b/d cut from Russia, but there are questions about this.

Therefore, this only leaves an implied 0.7 million b/d actual cut in OPEC+ output from the start of next year. However, there is another twist, as some time ago it was agreed that the quota for the UAE will be increased by 0.2 million b/d from the start of 2024. This means the actual agreed OPEC+ cut from current levels is only 0.5 million b/d, and full adherence to this is questionable.

Based on the new quotas and that some OPEC+ members are producing more than their existing allocation, the chart below illustrates the countries that need to cut production and by how much to ‘fall in line’ with the new agreement starting in January.

Source: Integr8 Fuels

Focus is likely to be on the four biggest countries here, and a general view is that not all of these will be fully compliant. Also, the existing agreement excludes Iran and Venezuela, where there are potential increases in production. This means OPEC+ will be doing very well if they can reduce current production by even as much as 0.5 million b/d, despite the headline news of a 2.2 million b/d cutback.

The market still looks bearish

In summarising these reports, geopolitics are always the great unknown. But, based on the prospects for oil demand, increases in non-OPEC production and as we have outlined here, the reality/challenges to OPEC+, the market still looks bearish. The fundamentals are still pointing towards lower bunker prices.

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Integr8 achieves ISCC EU certification to trade sustainable biofuels and help shipowners prove compliance.

December 19, 2023

Integr8 achieves ISCC EU certification to trade sustainable biofuels and help shipowners prove compliance with environmental regulations.

Integr8 Fuels has today announced they have been awarded certification from the International Sustainability and Carbon Certification (ISCC) scheme for the trading of biofuels. The news comes in advance of a raft of regulations from the EU designed to reduce greenhouse gas (GHG) emissions from shipping, which are due to come into effect in 2024 and 2025.

In order for shipowners to reduce their emissions exposure towards environmental regulations like the EU Emissions Trading System (EU ETS) and FuelEU Maritime, they will need to show that the low carbon fuels they consume are sustainable and meet the criteria defined in the EU’s Renewable Energy Directive (RED II).

As conventional ship engines can run on biofuels, they can have an edge over alternatives like LNG, which requires specialised engines. For biofuel suppliers, however, this market power comes with great responsibility. Biofuel suppliers and operators will have to provide a Proof of Sustainability (PoS) or similar documentation to verify the sustainability of feedstock and energy inputs.

ISCC is a global certification system that sets standards for sustainable production, sourcing and trade of all kinds of bio-based feedstocks and biofuels. A PoS follows a fuel batch throughout its whole supply chain with GHG estimates.

Integr8’s Bunker Quality and Claims Manager, Chris Turner, asserts why certification and documentation of this nature will be paramount in the evolving alternative fuels regime.

“Shipowners are turning to alternative fuels with significantly lower emissions than fossil fuels to trim the greenhouse gas emissions from their vessels. Alternative fuel suppliers must show that the bio-components in their fuels are sustainable and provide proof of that to their customers.

With ISCC EU certification, we are demonstrating our capability and commitment to trading biofuels that have been produced by ethical and sustainable practices, and importantly, we can provide the Proof of Sustainability that clients need to verify this with regulators. It provides an additional layer of trust and reassurance for our customers.

Without this documentation, then the biofuels, which are generally bought at premiums to conventional fuels, would not be counted in any emissions saving, counting the same as mineral fuels.”

Ultimately, the benefit of requiring documentation is twofold:

“Not only will certification ensure we are making meaningful strides towards decarbonising the industry, but it will also bring enhanced transparency and accountability to a historically opaque sector. I am hopeful that we will emerge a better and more professional industry as a result,” Chris explains.

Integr8’s ISCC EU certificate will enable the international bunker trading firm to pass on PoS for liquid and gaseous biofuels, including fatty acid methyl ester (FAME), hydrotreated vegetable oil (HVO) and liquefied biomethane (LBM).

Press Contact: Angela Freeth

Email: angela.f@integr8fuels.com

Tel: +44 (0) 207 467 5877

To see how we can assist you with your fuel procurement requirements, visit our Contact Us page.

A look at the fundamentals and what analysts say for prices next year

November 22, 2023

VLSFO prices are tracking crude, so just follow crude!

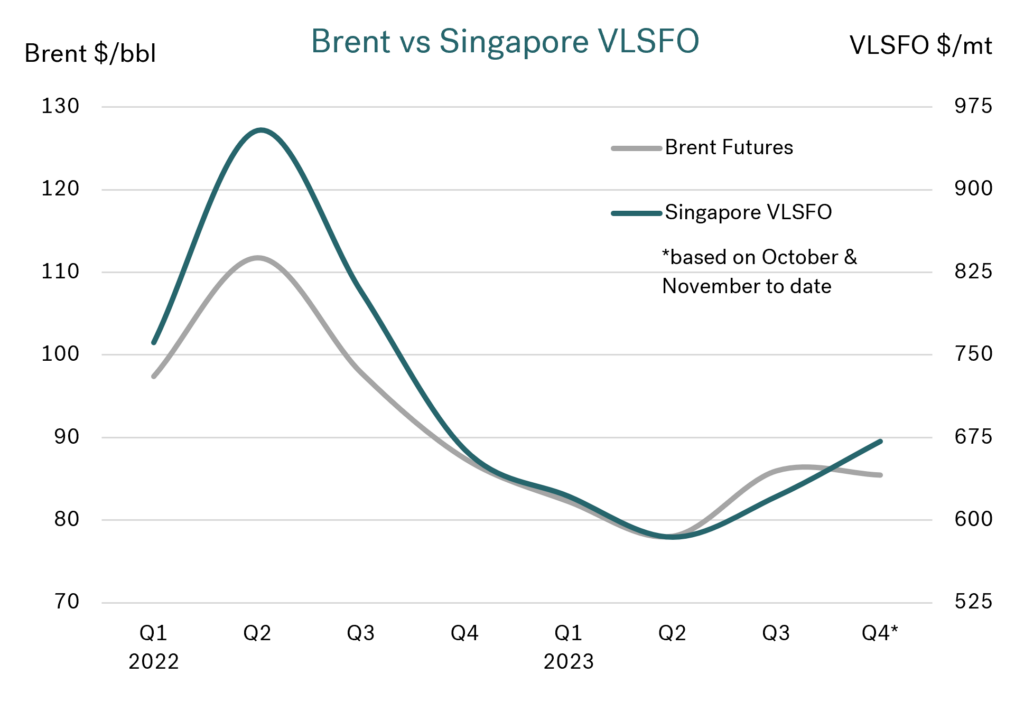

A month ago, we illustrated how movements in VLSFO prices very closely tracked changes in Brent crude on a short-term basis. Here we are extending the analysis back to 2022 and using it as the starting point to look at what analysts are saying about the fundamentals for next year and where this could take Brent and VLSFO prices in 2024.

Source: Integr8 Fuels

Back in Q2 and Q3 last year there was an extreme price premium for VLSFO over crude, but this was when products markets were exceptionally tight and refining margins at historic highs. Since then, VLSFO pricing has closely tracked Brent crude, with quarterly average prices for Brent in the $80-90/bbl range and Singapore VLSFO $600-675/mt.

Current expectations are that there will be sufficient product supplies going forward and that VLSFO will continue to follow movements in crude oil prices. Now comes the difficult part, what are the analysts saying for the fundamentals and crude prices next year?

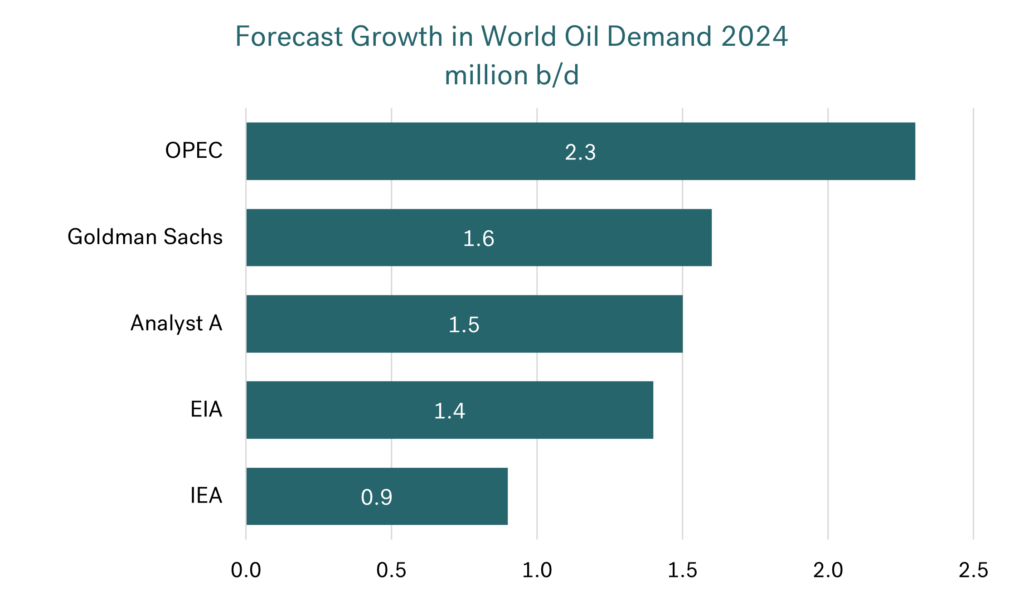

Different analysts equals different demand outlooks

A month ago, Brent prices were in the $90s, with fears about the Middle East driving prices up. Today, Brent is in the low $80s and the general talk on oil prices again centres on the fundamentals. Looking at what various analysts are saying, the first thing to note is there are widely differing views for next year. Usually forecasts of growth in world oil demand tend to converge around the same levels, but this isn’t the case today. Some analysts are looking at a ‘typical’ underlying increase in demand of around 1.4-1.5 million b/d next year. However, there are more extreme cases being put forward, with OPEC the most bullish and indicating a very strong demand increase of 2.3 million b/d and suggesting the current negative sentiment is exaggerated. At the other end of the spectrum, the IEA is far more conservative with a growth projection around 0.9 million b/d for 2024.

Source: Integr8 Fuels

Source: Integr8 Fuels

These differences in demand not only have an impact on the fundamentals for the oil market, but also a forceful influence on market psychology. It would seem a ‘typical’ increase of 1.4-1.5 million b/d is more price neutral, but confirmation of a lower demand increase is likely to send more bearish tremors through the market.

The most important single aspect of demand next year is what happens in China. Here forecast increases range from around 0.4 million b/d up to 0.7 million b/d growth. By definition, signs of weaker economic prospects in China are likely to damage demand and send oil prices lower!

However, another factor will be what happens in the US and Europe. Here the focus will be on the shift towards electric vehicles (EVs) and the potential declines in oil demand in these regions. The IEA is currently indicating total US oil demand falling by 0.2 million b/d next year, and Europe down by 0.1 million b/d. OPEC is forecasting continued increases in US and European oil demand next year (each up by 0.1 million b/d), and the US EIA is showing US oil demand up by 0.2 million b/d and Europe down by 0.1 million b/d.

This ‘mixed bag’ of forecasts for the US and Europe does have an impact on the overall growth in world oil demand next year and will impact on sentiment. It will also set the scene for how quickly oil demand in the OECD countries can be reversed through switching to EVs.

Oil supply highly dependent on Saudi Arabia and OPEC+ policy

Since July, Saudi Arabia has made an additional, voluntary production cutback of 1 million b/d, which has been extended to the end of this year. However, with current more bearish talk, there have been some market suggestions and hints that Saudi Arabia will make a further extension of this cutback, through to the first or second quarter of next year (but nothing official has yet been announced).

Other suggestions are that the OPEC+ group will make further cutbacks at its upcoming meeting on 26th November. However, with many members not able to reach their current quota allocation, any reduction in quotas will have to be closely inspected against current production levels, to assess any real impact on world oil supplies.

Most price forecasts for 2024 are higher than today!

Taking the ‘mid-case’ view on growth in world oil demand at 1.4-1.5 million b/d, the price forecasts appear to incorporate a Saudi extension of their voluntary cutback into 2024, and possibly even further cutbacks by OPEC+ collectively; the numbers don’t stack up if Saudi Arabia adds 1 million b/d to production at the start of next year.

Source: Integr8 Fuels

Citi Bank is the only analyst here with a ‘lower than current’ price prediction for next year. The bank has been typically known as a more bearish forecaster of oil prices and that is clearly the case here. However, if Saudi Arabia and OPEC+ don’t make moves to lower output going into 2024, then the Citi Bank view is highly credible.

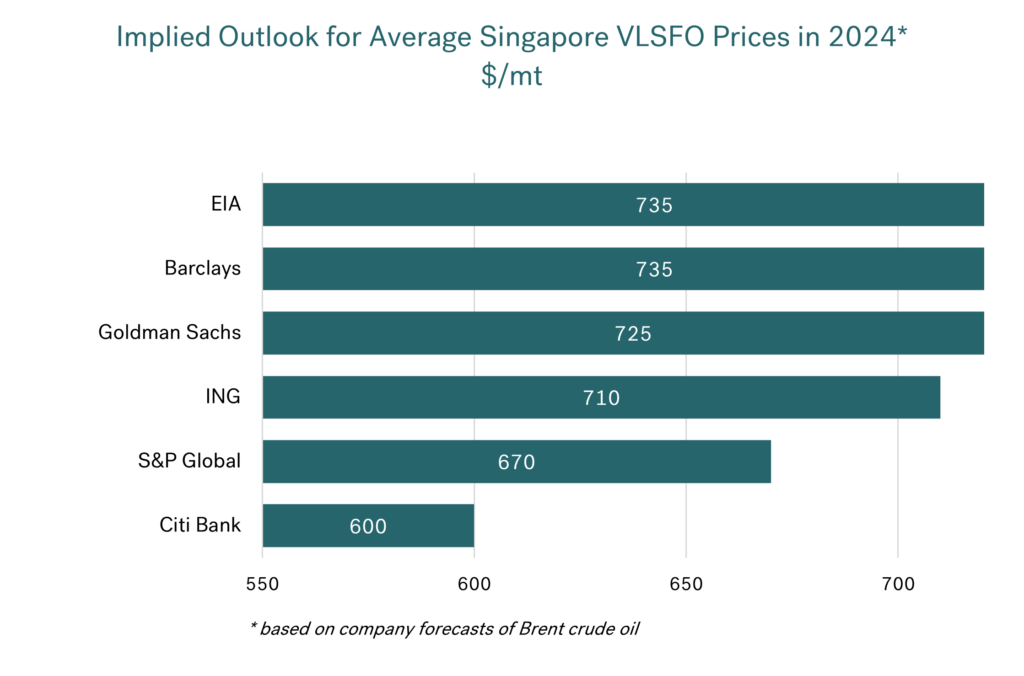

What does this mean for VLSFO prices next year?

Taking the straight relationship between VLSFO prices and Brent crude prices that we have seen since Q4 last year, and extending this through 2024, the following chart illustrates the implied average pricing for Singapore VLSFO based on the company predictions for Brent crude. Again, most are above today’s levels, with Citi Bank considerably lower at around $600/mt.

Source: Integr8 Fuels

Source: Integr8 Fuels

Wrapping up

The bottom line is there is an increasing pressure in the market towards lower oil prices. However, many analysts are betting on Saudi Arabia responding to these pressures and extending (or even increasing) their additional voluntary 1 million b/d cutback beyond December and into next year.

An announcement is expected at the OPEC+ meeting on 26th November. If they do extend, then in the short term, prices are likely to be at least maintained in the $80s for Brent and Singapore

VLSFO somewhere close to $700; if they don’t, then we should be looking at lower Brent crude prices and so lower bunker prices. For the very short term, all eyes are on Saudi Arabia and its willingness to continue ‘carrying the can’ supporting higher oil prices.

But there is a long way to go, even before we get to 2024. For next year’s outlook people will also

be looking at oil demand in China, coupled with the potential declines in oil demand in the US

and Europe.

These supply and demand stories are likely to be very persuasive arguments in oil and bunker price direction. Geopolitics aside, at the moment the fundamentals for next year still look more bearish than bullish.

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com