A look at the fundamentals and what analysts say for prices next year

VLSFO prices are tracking crude, so just follow crude!

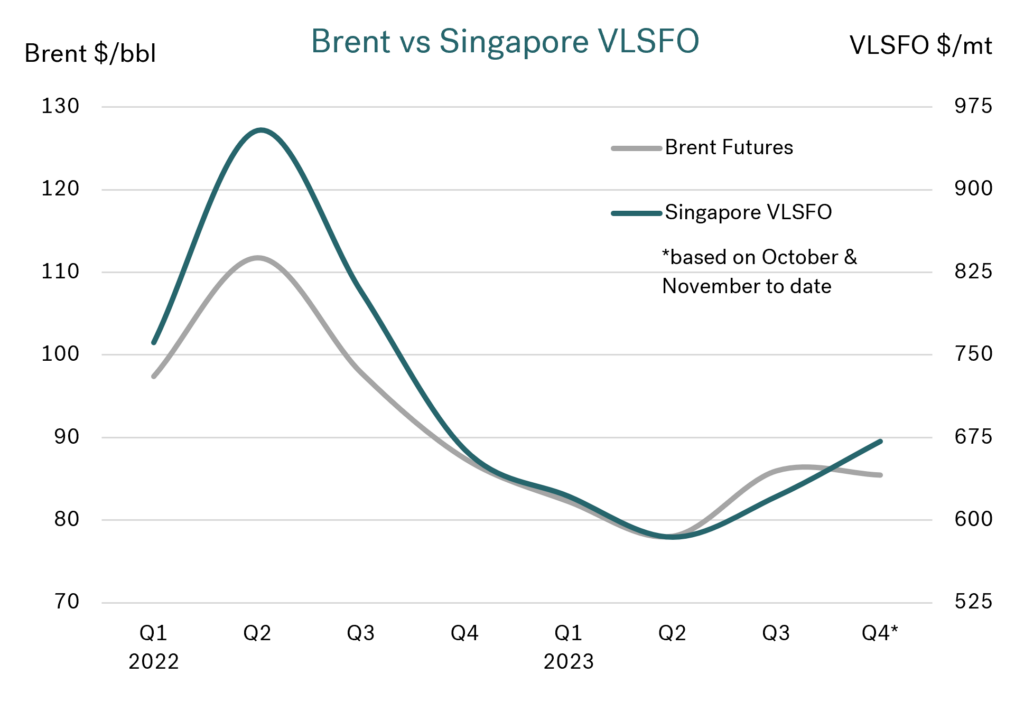

A month ago, we illustrated how movements in VLSFO prices very closely tracked changes in Brent crude on a short-term basis. Here we are extending the analysis back to 2022 and using it as the starting point to look at what analysts are saying about the fundamentals for next year and where this could take Brent and VLSFO prices in 2024.

Source: Integr8 Fuels

Back in Q2 and Q3 last year there was an extreme price premium for VLSFO over crude, but this was when products markets were exceptionally tight and refining margins at historic highs. Since then, VLSFO pricing has closely tracked Brent crude, with quarterly average prices for Brent in the $80-90/bbl range and Singapore VLSFO $600-675/mt.

Current expectations are that there will be sufficient product supplies going forward and that VLSFO will continue to follow movements in crude oil prices. Now comes the difficult part, what are the analysts saying for the fundamentals and crude prices next year?

Different analysts equals different demand outlooks

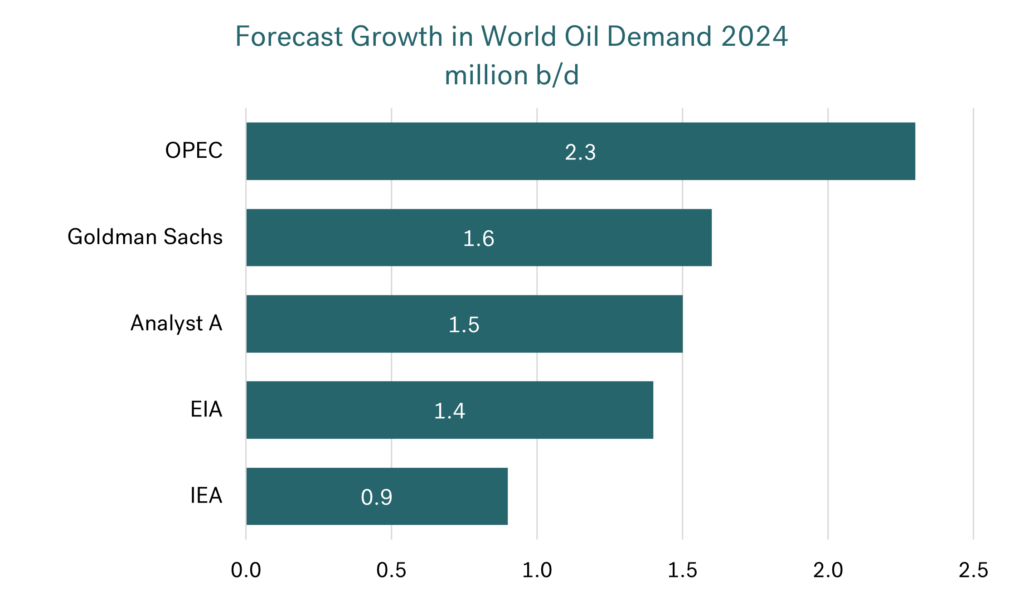

A month ago, Brent prices were in the $90s, with fears about the Middle East driving prices up. Today, Brent is in the low $80s and the general talk on oil prices again centres on the fundamentals. Looking at what various analysts are saying, the first thing to note is there are widely differing views for next year. Usually forecasts of growth in world oil demand tend to converge around the same levels, but this isn’t the case today. Some analysts are looking at a ‘typical’ underlying increase in demand of around 1.4-1.5 million b/d next year. However, there are more extreme cases being put forward, with OPEC the most bullish and indicating a very strong demand increase of 2.3 million b/d and suggesting the current negative sentiment is exaggerated. At the other end of the spectrum, the IEA is far more conservative with a growth projection around 0.9 million b/d for 2024.

Source: Integr8 Fuels

Source: Integr8 Fuels

These differences in demand not only have an impact on the fundamentals for the oil market, but also a forceful influence on market psychology. It would seem a ‘typical’ increase of 1.4-1.5 million b/d is more price neutral, but confirmation of a lower demand increase is likely to send more bearish tremors through the market.

The most important single aspect of demand next year is what happens in China. Here forecast increases range from around 0.4 million b/d up to 0.7 million b/d growth. By definition, signs of weaker economic prospects in China are likely to damage demand and send oil prices lower!

However, another factor will be what happens in the US and Europe. Here the focus will be on the shift towards electric vehicles (EVs) and the potential declines in oil demand in these regions. The IEA is currently indicating total US oil demand falling by 0.2 million b/d next year, and Europe down by 0.1 million b/d. OPEC is forecasting continued increases in US and European oil demand next year (each up by 0.1 million b/d), and the US EIA is showing US oil demand up by 0.2 million b/d and Europe down by 0.1 million b/d.

This ‘mixed bag’ of forecasts for the US and Europe does have an impact on the overall growth in world oil demand next year and will impact on sentiment. It will also set the scene for how quickly oil demand in the OECD countries can be reversed through switching to EVs.

Oil supply highly dependent on Saudi Arabia and OPEC+ policy

Since July, Saudi Arabia has made an additional, voluntary production cutback of 1 million b/d, which has been extended to the end of this year. However, with current more bearish talk, there have been some market suggestions and hints that Saudi Arabia will make a further extension of this cutback, through to the first or second quarter of next year (but nothing official has yet been announced).

Other suggestions are that the OPEC+ group will make further cutbacks at its upcoming meeting on 26th November. However, with many members not able to reach their current quota allocation, any reduction in quotas will have to be closely inspected against current production levels, to assess any real impact on world oil supplies.

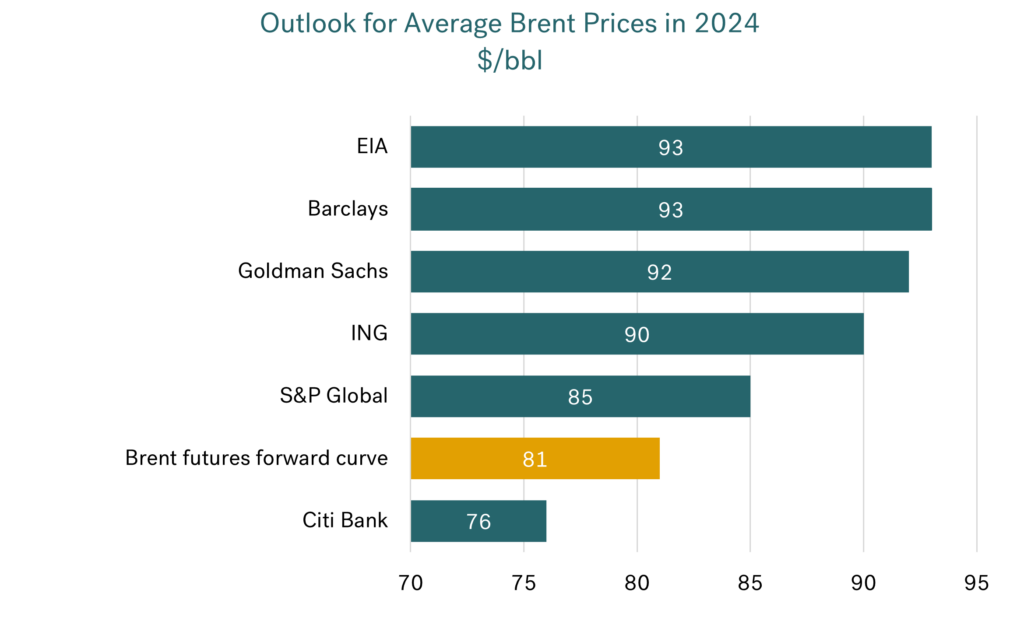

Most price forecasts for 2024 are higher than today!

Taking the ‘mid-case’ view on growth in world oil demand at 1.4-1.5 million b/d, the price forecasts appear to incorporate a Saudi extension of their voluntary cutback into 2024, and possibly even further cutbacks by OPEC+ collectively; the numbers don’t stack up if Saudi Arabia adds 1 million b/d to production at the start of next year.

Source: Integr8 Fuels

Citi Bank is the only analyst here with a ‘lower than current’ price prediction for next year. The bank has been typically known as a more bearish forecaster of oil prices and that is clearly the case here. However, if Saudi Arabia and OPEC+ don’t make moves to lower output going into 2024, then the Citi Bank view is highly credible.

What does this mean for VLSFO prices next year?

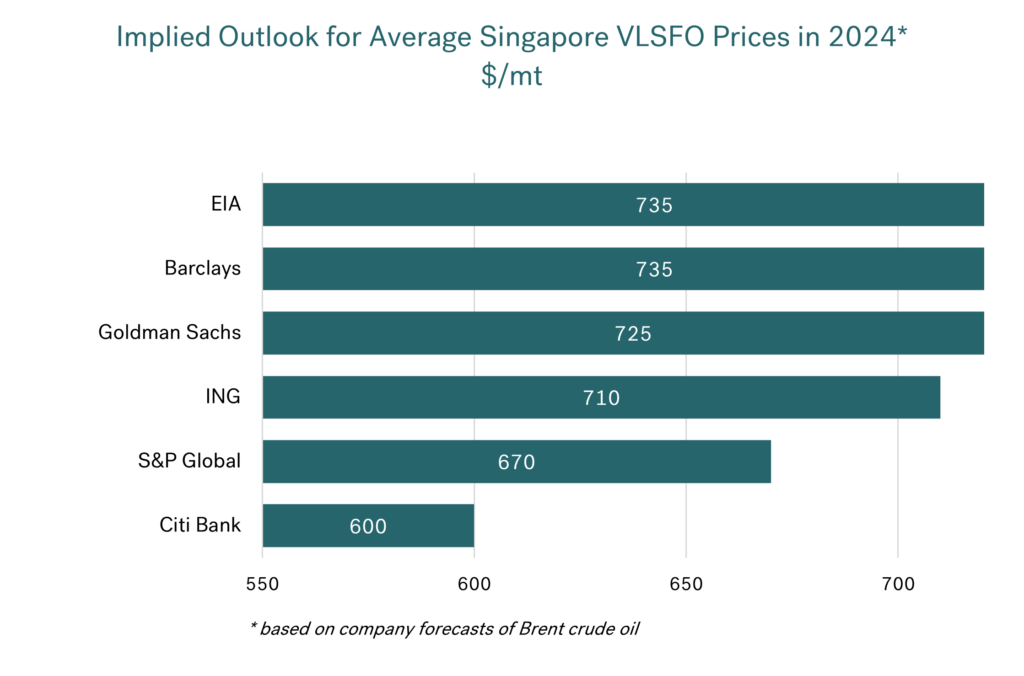

Taking the straight relationship between VLSFO prices and Brent crude prices that we have seen since Q4 last year, and extending this through 2024, the following chart illustrates the implied average pricing for Singapore VLSFO based on the company predictions for Brent crude. Again, most are above today’s levels, with Citi Bank considerably lower at around $600/mt.

Source: Integr8 Fuels

Source: Integr8 Fuels

Wrapping up

The bottom line is there is an increasing pressure in the market towards lower oil prices. However, many analysts are betting on Saudi Arabia responding to these pressures and extending (or even increasing) their additional voluntary 1 million b/d cutback beyond December and into next year.

An announcement is expected at the OPEC+ meeting on 26th November. If they do extend, then in the short term, prices are likely to be at least maintained in the $80s for Brent and Singapore

VLSFO somewhere close to $700; if they don’t, then we should be looking at lower Brent crude prices and so lower bunker prices. For the very short term, all eyes are on Saudi Arabia and its willingness to continue ‘carrying the can’ supporting higher oil prices.

But there is a long way to go, even before we get to 2024. For next year’s outlook people will also

be looking at oil demand in China, coupled with the potential declines in oil demand in the US

and Europe.

These supply and demand stories are likely to be very persuasive arguments in oil and bunker price direction. Geopolitics aside, at the moment the fundamentals for next year still look more bearish than bullish.

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.