Geopolitics have a huge bearing on our market, but something different is happening in HSFO bunker pricing.

We are in a global, geopolitical market

It is often said that the more dramatic movements in oil prices are usually driven by world events, and that the bunker market is no different to any other part of the crude and products markets.

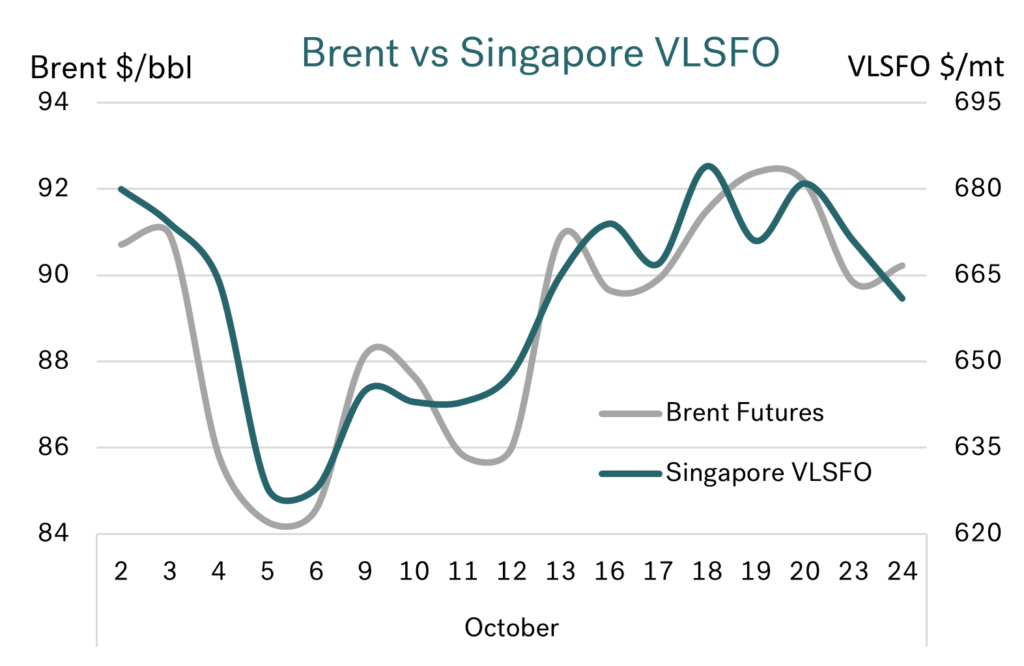

This is exactly what has happened in October. Crude prices were falling in the first week of the month on the back of weaker economic indications for China and Europe. Even though Saudi Arabia and Russia stated they would maintain their voluntary production cutbacks through to the end of the year, this had little impact on the market and oil prices continued their bearish slide.

Over this first week of October Brent futures were down $7/bbl, Singapore VLSFO down $50/mt and Rotterdam VLSFO down by almost $40/mt.

Shortly thereafter, the extreme events in the Middle East took hold. Oil prices rebounded with the news, wiping out the declines seen in the previous week; Brent futures moved back up to the low $90s, Singapore VLSFO returned to around $680/mt, and Rotterdam VLSFO hit $625/mt.

These “down and up” price developments and the close relationship between Brent crude and VLSFO are shown clearly in the chart below.

Source: Integr8 Fuels

Prices have eased at the time of writing, as people wait to see where the Middle East conflict goes and weaker economic indicators out of Europe come to the forefront.

Crude price direction is usually a very good guide for VLSFO

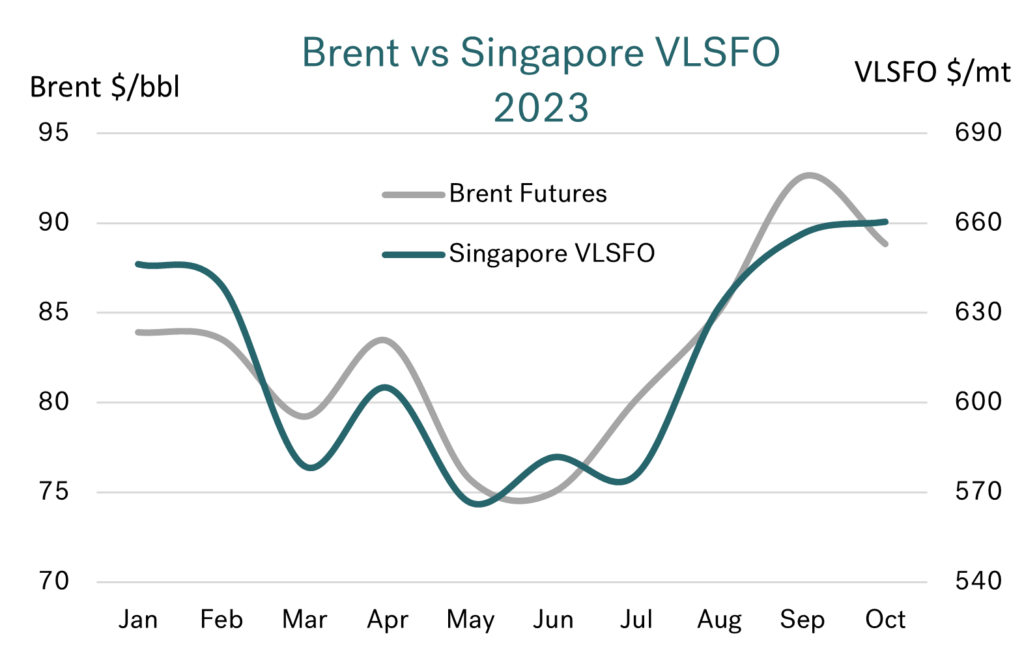

Putting some longer-term context into the Singapore VLSFO versus Brent relationship, the chart below illustrates monthly average price developments for these two commodities so far this year. It shows their very strong correlation and the range in pricing. When Brent crude was around $75/bbl, Singapore VLSFO was close to $575/mt. With recent crude prices rising to their highest levels so far this year and Brent in the low $90s, so monthly average Singapore VLSFO prices are at $660/mt and almost $100/mt above their mid-year lows.

Source: Integr8 Fuels

Source: Integr8 Fuels

In the near term, a lot of the movement in crude oil prices will be linked to what is happening in the Middle East, and so VLSFO price direction will be derived from these events. However, there are still nuances within the bunker market that we continue to monitor, not least the differences between VLSFO and HSFO.

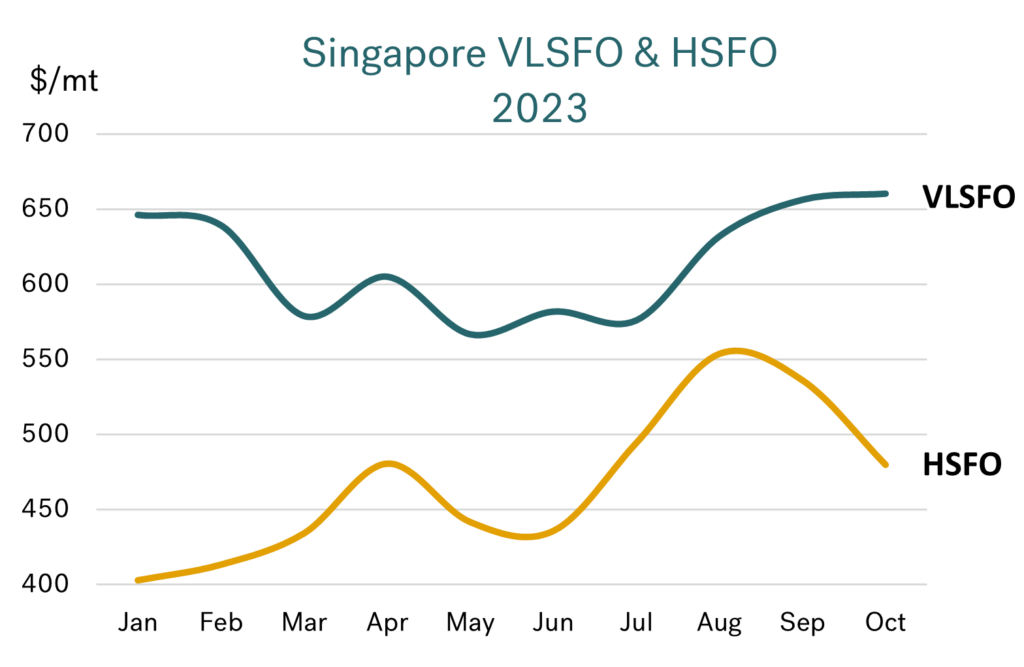

In complete contrast to VLSFO, average prices for HSFO have fallen!

Unlike VLSFO prices closely tracking crude and moving higher over recent months, there has been a turning point in the HSFO market and prices have actually fallen. Whereas monthly average Singapore VLSFO prices are now $30/mt higher than in August, Singapore HSFO prices are $70/mt lower!

Source: Integr8 Fuels

VLSFO and HSFO go in different directions

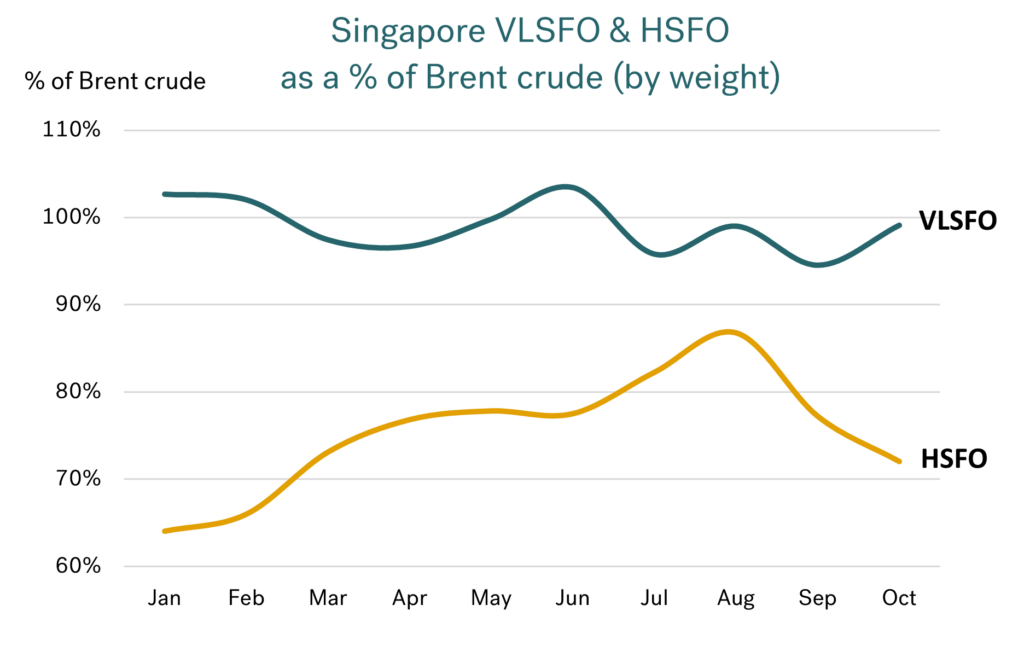

From the initial analysis, Singapore VLSFO closely tracks crude, so it is no surprise that the price relationship between these two are consistent. In fact, Singapore VLSFO is priced at close to 100% of Brent (on a weight basis) and this year has only varied within a very narrow range of 95-103%. If you go back three years, the relationship has been consistently tight and VLSFO has been within the 95-108% range of Brent in all but three months.

Source: Integr8 Fuels

This is in complete contrast to HSFO pricing versus crude. Taking Singapore HSFO as a benchmark, its percentage of Brent shifted from around 65% at the start of the year to close to 80% by mid-year. It is no surprise that the HSFO/Brent relationship strengthened even further in July and August to close to 90%, as Saudi Arabia and Russia made additional, voluntary cuts in crude production/exports totalling 1.5 million b/d (all of which are medium and heavy grades). Consequently, HSFO supply was always going to be squeezed and its relative price likely to rise.

With statements that the Saudi (and Russian) production cuts would run through to the end of this year, it might have been the case that HSFO prices would continue to be supported, at least going into the fourth quarter. This hasn’t happened, and HSFO prices have already fallen sharply despite the Saudi Arabia and Russia strategy and heightened geopolitical risks in the Middle East.

Why has HSFO fallen relative to Brent?

HSFO pricing was always expected to weaken versus Brent, not least in anticipation of the rise in Saudi and Russian crude exports from January. However, the shift has been ‘early’ and the key trigger for the turnaround has centred on the Middle East and a recent substantial increase in HSFO exports.

HSFO is used in a number of power-generating plants in the Middle East and demand is high in the region during the summer months to meet air conditioning demand. As temperatures eased in October, ‘local’ demand for HSFO fell back. Consequently, HSFO exports from the UAE moved from virtually nothing in September, to indications of around 3 million bbls going to Singapore in the middle two weeks of October. On this basis we could expect the seasonal pattern of continued HSFO exports from the UAE until power-generating demand increases again Q2 next year.

In addition to this seasonal shift, there has also been a structural change in HSFO exports from Kuwait. Like the UAE, Kuwait has been burning HSFO in its power generating sector, with supplies coming from their domestic refineries as well as imported volumes. However, with the phased introduction of the massive, 615,000 b/d Al Zour refinery from late last year, it was always planned that the country would switch to using lower sulphur fuel oil as part of its Environmental Fuel Project (EFP). This is now in place and the agreement is for Al Zour to supply up to 225,000 b/d of low-sulphur material to the Kuwait Ministry of Electricity as part of their cleaner energy program.

This has therefore ‘freed-up’ Kuwaiti HSFO for export and also removed them as a buyer of HSFO from the international market on a permanent basis. These ‘additional’ HSFO volumes are moving to Asia and are another contributing factor to a weakening HSFO price.

It all means a widening VLSFO – HSFO price differential

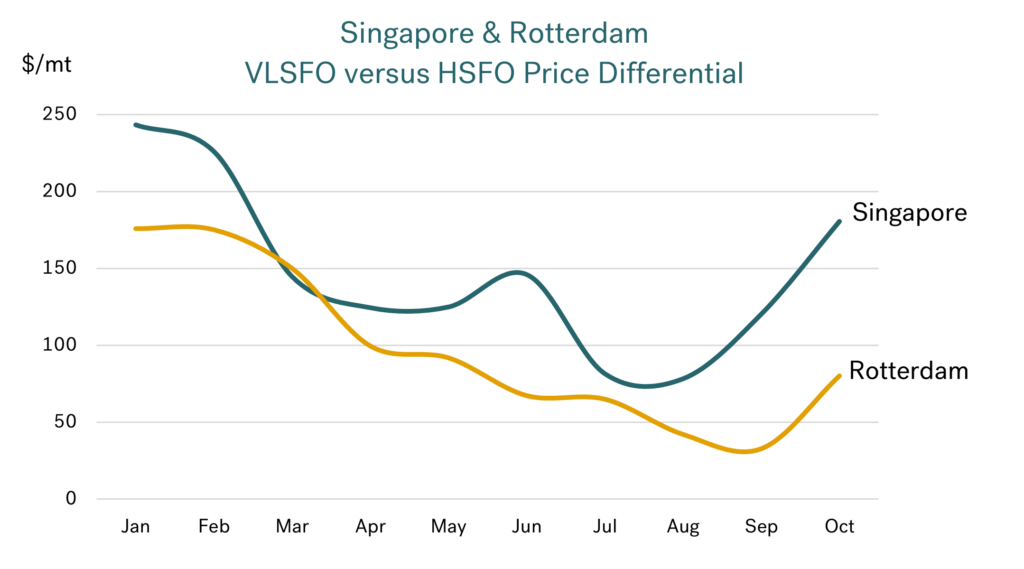

Looking at the VLSFO and HSFO markets, it is clear the price spread between the two products has widened. With ‘incremental’ HSFO volumes available in the Middle East and moving into Singapore, the widening has been greater in these two bunker regions.

This has meant the VLSFO – HSFO spread in Singapore has shifted from an extreme low of only $80/mt in July and August to an average of $180/mt in October. This is still not back to levels seen at the start of this year, but the advantages for scrubber-fitted ships are clearly far better than they have been since March.

Source: Integr8 Fuels

The price spread in Fujairah is very close to the Singapore differential, at around $175/mt in October. However, since the Russian invasion of Ukraine and the resulting ban on Russian products entering Europe (halting a substantial flow of HSFO), the VLSFO – HSFO price spread in Europe has typically been far smaller than in the Middle East and Asia. So, although the spread in Europe has widened, in Rotterdam it has only moved out to $80/mt in October, $100/mt less than in Singapore!

What next?

With the shifts in the HSFO pricing and additional heavier crudes expected to enter the market from the start of next year as Saudi Arabia and Russia remove their voluntary production cutbacks, we can expect ongoing relative downwards pressures on HSFO prices. In the near term, it remains to see what the geopolitical risk is on crude prices, which in turn will largely determine VLSFO pricing. Now the VLSFO – HSFO spread is far more attractive for owners of scrubber-fitted ships in the Middle East and Asia.

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.