If refinery throughput is back up towards record highs, why are refinery margins and bunker prices so high?

Refinery throughput is finally back to 2019 levels, however…

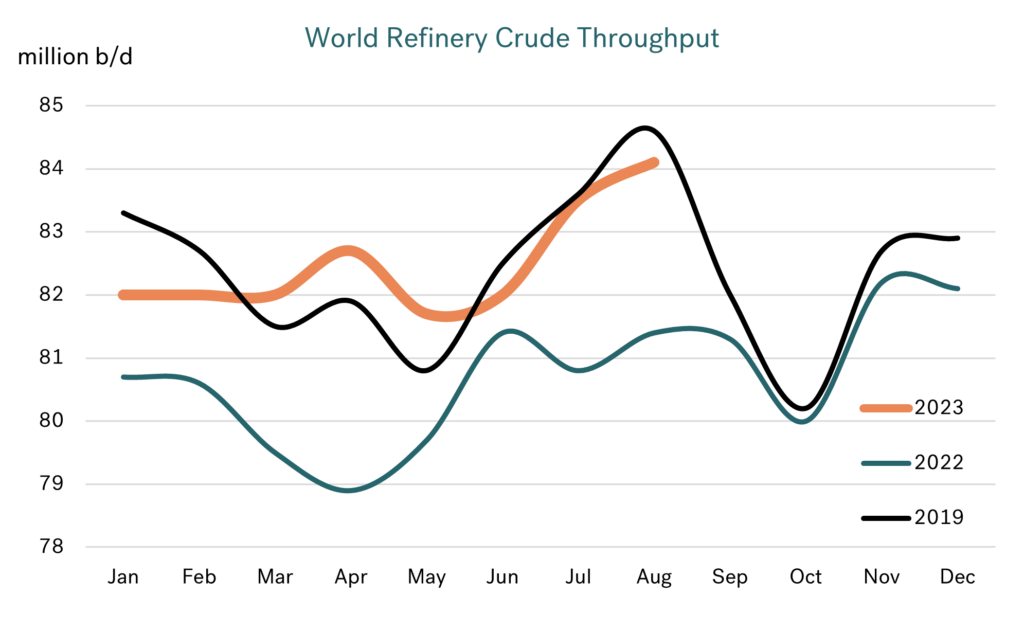

Over the past six months worldwide refinery crude throughputs have finally returned to their pre-pandemic, 2019 levels. The extent of this rise in clearly shown in the graph below, with estimated August crude throughputs at 84 million b/d and around 2.5 million b/d higher than 12 months ago. On the face of it this looks good for product availabilities.

Source: EIA

Contradictory position of high refinery runs and high refinery margins

Despite this surge in throughputs to near record highs, most product markets are extremely tight, including those covering the bunker market. The industry is being led by rising demand, with stock levels generally remaining at the low end of historic ranges. This means gasoline is strong, middle distillates are strong, and HSFO is extremely strong. The only product showing weakness is naphtha, which is at the very lighter end of the barrel and some of the reasons for this will become apparent in this report.

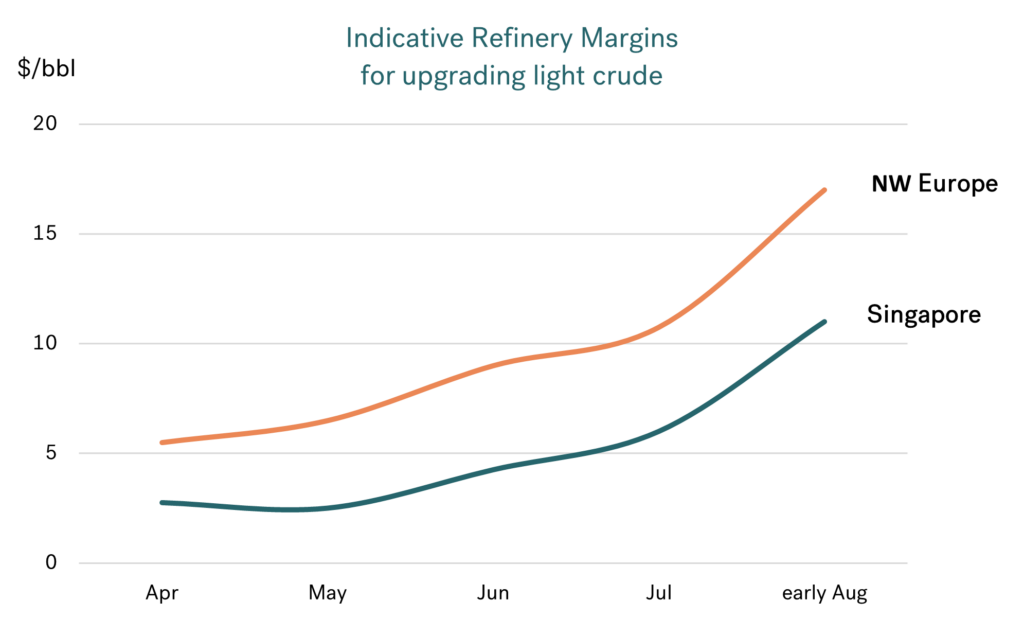

This tightness in most product markets is pushing refinery margins much higher and having the knock-on effect of higher bunker prices. The graph below illustrates recent indicative upgrading margins for lighter crude in two key bunkering centers.

Source: Eikon

Source: Eikon

Although not back to the extreme highs around the middle of last year, these margins are strong; up by around $10/bbl, and some 3-4 times greater than back in April. A reasonable conclusion may be that these much bigger margins would drive seasonal refinery crude throughputs considerably higher in both regions, however…

Where is the growth in world refining crude throughput?

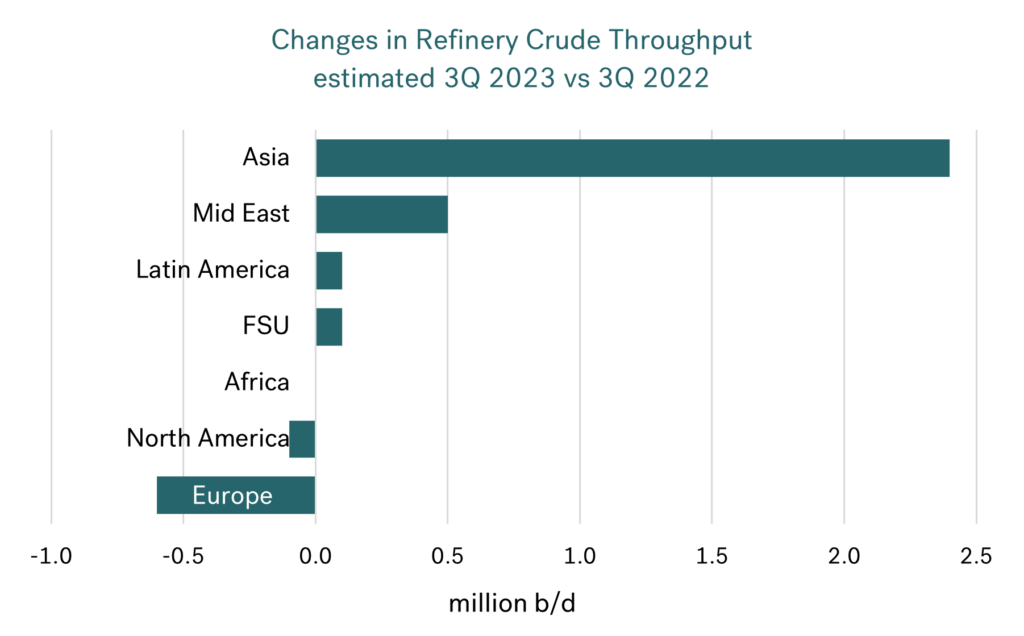

As expected, the major gain in refinery throughput has been in Asia, and almost all of this has been in China. New capacity and stronger demand in China have led to an estimated 2 million b/d increase in throughput over the past 12 months.

Similarly, Middle East crude throughputs are also up, again with new capacity coming on stream in Kuwait and Saudi Arabia supporting the increase. Operations in Africa and North America look to be largely unchanged seasonally from last year, with the US EIA suggesting a slight reduction in US crude throughputs.

However, Europe is the outlier, where refinery operations here look to be much lower than 12 months ago, with a drop of more than 0.5 million b/d in crude throughput! This is despite strong refining margins and an apparent attraction to run more crude.

Source: EIA

Why is European refinery throughput down on last year?

The first thing to say is that there have been refinery capacity closures in Europe, but this does not fully explain the drop in throughputs at a time of high margins.

There is typically some operational flexibility in the refining system to shift the type of products supplied, but this is usually very limited. At the same time, most refineries are designed to process specific types of crude, and as a generalisation this tends to be more towards medium and heavier grades.

This is the case in Europe, where the infrastructure is generally designed for medium and heavier crude grades and yet the industry:

- Has ‘lost’ access to Russian (medium) crude because of the ban in place;

- Has seen a reduction in Middle East (heavy) crude imports with the cutbacks in production in that region, which have been even more severe with further cuts by Saudi Arabia in July.

These ‘losses’ have been filled by importing more US crude and running more North Sea grades. However, these ‘new’ crude are much lighter the Russian and Middle East grades they are replacing and as a result European refiners have hit limitations in processing crude.

Ordinarily in these circumstances European refiners may have bought in feedstocks to fill upgrading units, but this has been too challenging with the ban on the Russian feedstock trade to Europe. All-round, the European refining industry is being squeezed and the net result is that crude distillation runs have had to be cut. Therefore, there is an inability in Europe to supply the market with exactly what it needs, even though refining margins are strong!

What does this all mean for bunker prices?

The importance of all of this to us in the bunker market is that pricing for low sulphur fuel oil and VLSFO blending components is relatively strong. However, the upwards pressures in HSFO markets, especially in Europe, are even greater. The enforced shift to a lighter crude slate in the European refining sector has pushed European HSFO margins to a 30 year high!

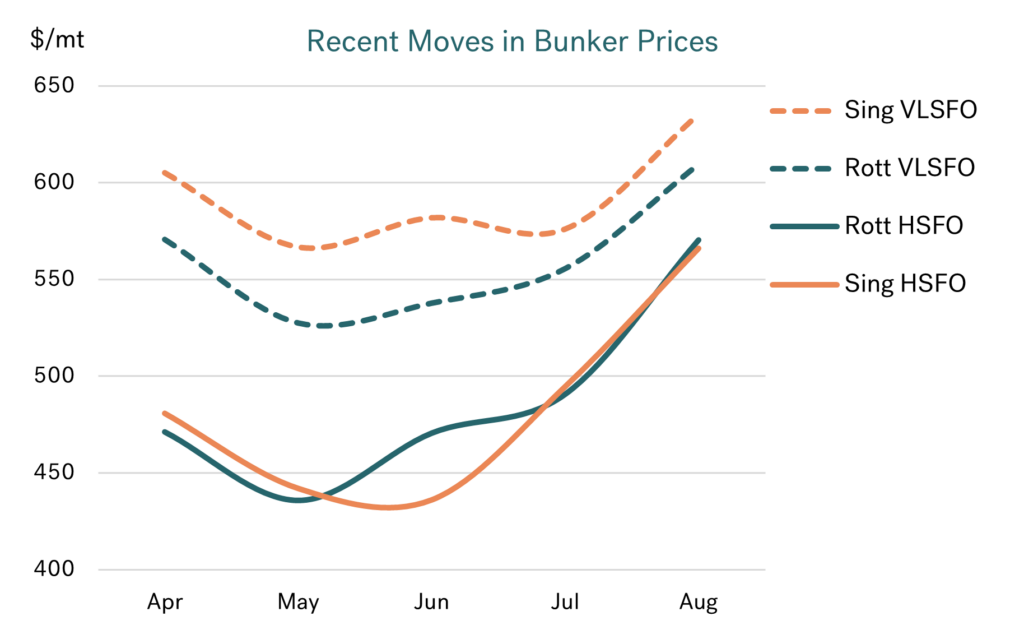

The graph below illustrates recent developments for VLSFO and HSFO prices in Singapore and Rotterdam, with all prices dipping between May/June but rising since then.

Source: Integr8 Fuels

So far in August, in both regions, average VLSFO prices are around $55/mt higher than in July. Also, whilst Singapore VLSFO prices remain above Rotterdam, this differential has narrowed to only $20-25/mt, showing bigger price increases in the European bunker market.

However, the biggest price increases from July to August have been for HSFO, which are up by $80/mt in Rotterdam and $72/mt in Singapore. Again, the pricing pressures have been greater in Europe, and with this Rotterdam HSFO prices are now at a slight premium to Singapore, which compares with an historic average discount of around $15/mt.

What are the signposts going forward?

Clearly movements in crude prices will have an ‘over-arching’ impact on product pricing across the barrel, and so for prices in our market.

But looking more specifically, the cutbacks in OPEC+ have centred on heavier supplies from the Middle East and so had a global impact on the HSFO market. This has been further exacerbated with Saudi Arabia implementing an additional cutback of close to 1 million b/d in July, and this has now been extended at least through to September. So there does not appear to be any near-term ‘relief’ to the tight global HSFO market conditions. At the same time, it is very difficult (if not impossible) to see the European ban on Russian crude, products and feedstocks being revoked anytime soon. This, along with the OPEC+ cuts, would indicate a continued greater tightness in the European HSFO market.

Let’s see where this takes us over the coming months.

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Contact our Experts

With 65+ traders in 13 offices around the world, our team is available 24/7 to support you in your energy procurement needs.