Fuel Switch Snapshot: LNG sharply up in bunker hubs

Singapore B24-VLSFO falls to wider discount to LNG

Below-average gas stocks support Rotterdam’s LNG

Rotterdam biofuel price shoots up on rising POME costs

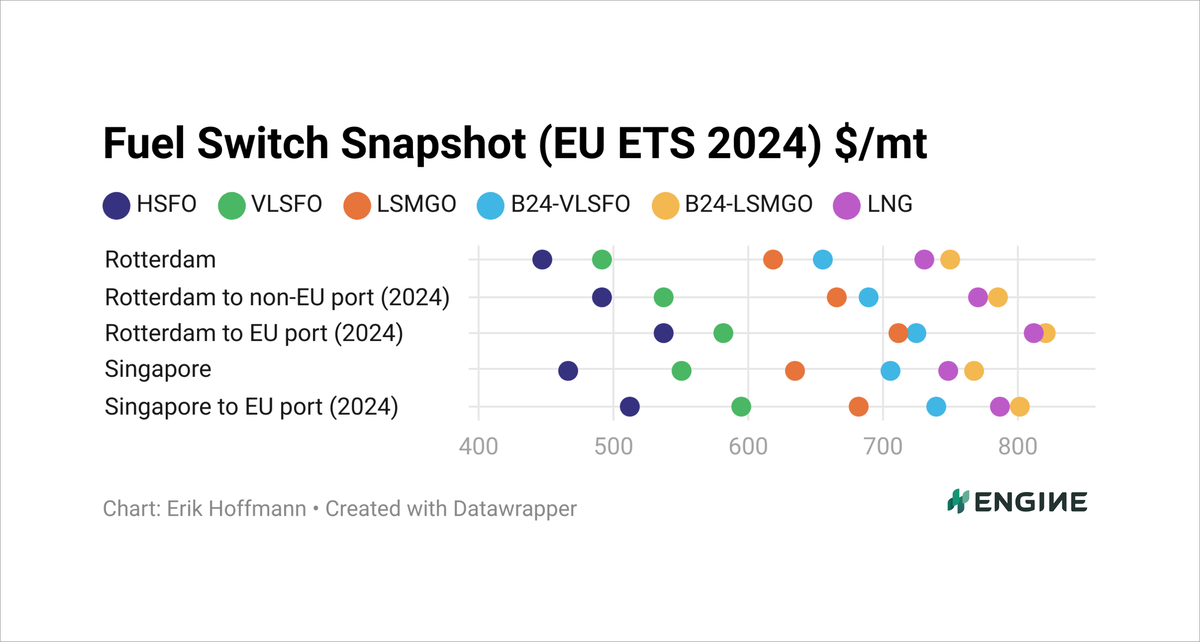

CHART: The dots represent bunker fuel prices adjusted for calorific contents to become VLSFO-equivalents, and with various estimated levels of EU ETS costs in 2024 excluded (Rotterdam) and included (Rotterdam to non-EU port and Rotterdam to EU port). ENGINE, PRIMA Markets, NYMEX

CHART: The dots represent bunker fuel prices adjusted for calorific contents to become VLSFO-equivalents, and with various estimated levels of EU ETS costs in 2024 excluded (Rotterdam) and included (Rotterdam to non-EU port and Rotterdam to EU port). ENGINE, PRIMA Markets, NYMEX

B24-VLSFO UCOME has fallen by $6/mt less than pure VLSFO in Singapore in the past week, and is now at a premium of around $155/mt.

B24-VLSFO UCOME has fallen sharply against LNG in Singapore, to widen a $15/mt discount last week to a $43/mt discount now. That has come amid a $14/mt LNG price gain on the back of stronger gas demand in Asia, while B24-VLSFO UCOME has shed $13/mt under pressure from a falling VLSFO price.

In Rotterdam, the price of B24-VLSFO HBE has shot up from a $116/mt premium over pure VLSFO a week ago, to a $163/mt premium now.

Rotterdam’s B24-VLSFO HBE has gone up to a wide $76/mt discount to LNG in the port. Even B24-LSMGO HBE has moved into a competitive range of $10-20/mt of LNG, depending on whether estimated EU Allowance (EUA) costs have been added. Based on default emission factors in the EU ETS regulation, shipowner need fewer EUAs to cover the emissions of B24 blends than LNG.

VLSFO

VLSFO prices have dropped by $19/mt in Singapore and $24/mt in Rotterdam amid a $3.33/bbl ($24/mt) decline in front-month ICE Brent values.

Availability of VLSFO remains tight in Singapore, where 10 days of lead time is recommended. Some suppliers can accommodate prompt deliveries, typically at a higher price.

Prompt HSFO and VLSFO availability remains tight in Rotterdam and across the wider ARA hub. Lead times of 5-7 days are advised for VLSFO. The ARA’s independently held fuel oil stocks have been drawn by 2% so far this month compared to October, according to Insights Global data.

Biofuels

Singapore’s B24-VLSFO UCOME price has dropped by a significant $13/mt in the past week, closely tracking a $19/mt decline in the underlying ENGINE conventional VLSFO price. Meanwhile, the port’s B24-LSMGO UCOME price has seen a smaller decrease of $6/mt.

Rotterdam’s B24-VLSFO HBE and B24-LSMGO HBE prices have risen by $22-24/mt in the past week. These gains have been supported by an increase in the price of palm oil mill effluent methyl ester (POMEME).

PRIMA assessed the POMEME price in the ARA at $1,463/mt on Friday, up by a massive $71/mt in the past week. POMEME is one of the most popular advanced biofuel feedstocks, and POMEME-based biofuels qualify for advanced biofuel rebates through the Dutch HBE system.

LNG

Singapore's LNG bunker price has gained by $14/mt in the past week, tracking gains in the NYMEX Japan/Korea Marker (JKM) contract. This uptick reflects heightened competition, with Asian buyers facing pressure as European buyers rush to secure flexible LNG cargo contracts.

Rotterdam's LNG bunker price has surged $38/mt higher. The upward trend reflects a corresponding increase in the underlying Dutch TTF Natural Gas contract.

Europe's gas storage currently stands at 85%, slightly below the five-year average of 88%.

Adding to the tension is the potential cessation of Russian piped gas via Ukraine by year-end, sparking worries over supply stability. While a balanced market is expected by the end of the 2024-2025 heating season, challenges remain for summer 2025 storage refills.

By Erik Hoffmann, Nithin Chandran and Debarati Bhattacharjee

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.