Europe & Africa Market Update 26 Dec 2024

Regional bunker benchmarks have mostly gained with Brent, and adverse weather may disrupt bunkering in Gibraltar today.

Changes on the day to 09.00 GMT today:

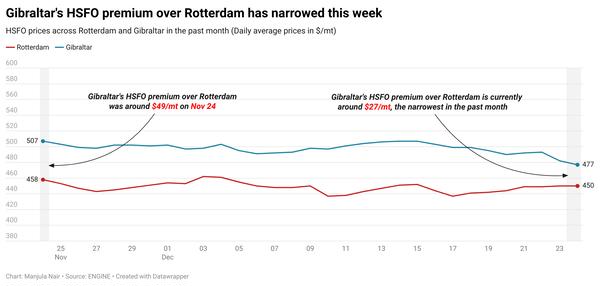

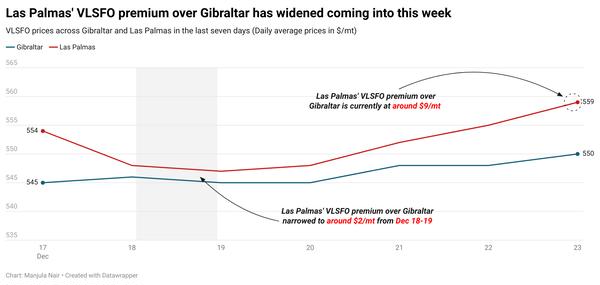

- VLSFO prices up in Rotterdam ($2/mt) and Gibraltar ($1/mt), and down in Durban ($7/mt)

- LSMGO prices up in Rotterdam and Gibraltar ($2/mt)

- HSFO prices up in Gibraltar ($3/mt), and down in Rotterdam ($1/mt)

HSFO supply in the ARA remains tight for very prompt delivery dates. A trader recommends lead times of 5-7 days for optimal coverage. VLSFO and LSMGO availability is normal in Rotterdam and the wider ARA hub, with suppliers offering prompt delivery dates. Lead times of 3-5 days are advised for both grades in the ARA hub.

The Gibraltar Port Authority has put out a strong wind warning today. The port area is witnessing wind gusts of up to 30 knots and waves close to two meters. Bad weather is forecast to continue until Saturday, with strong wind gusts of up to 25 knots predicted for Friday. This may cause prolonged delays for bunkering in Gibraltar.

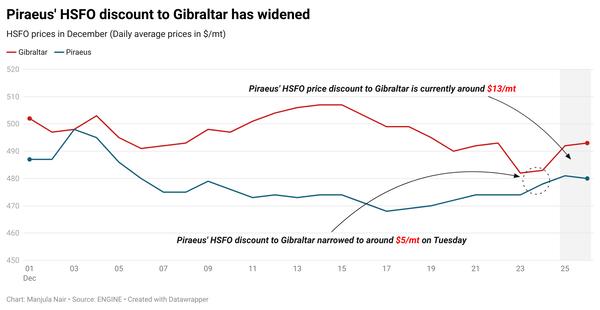

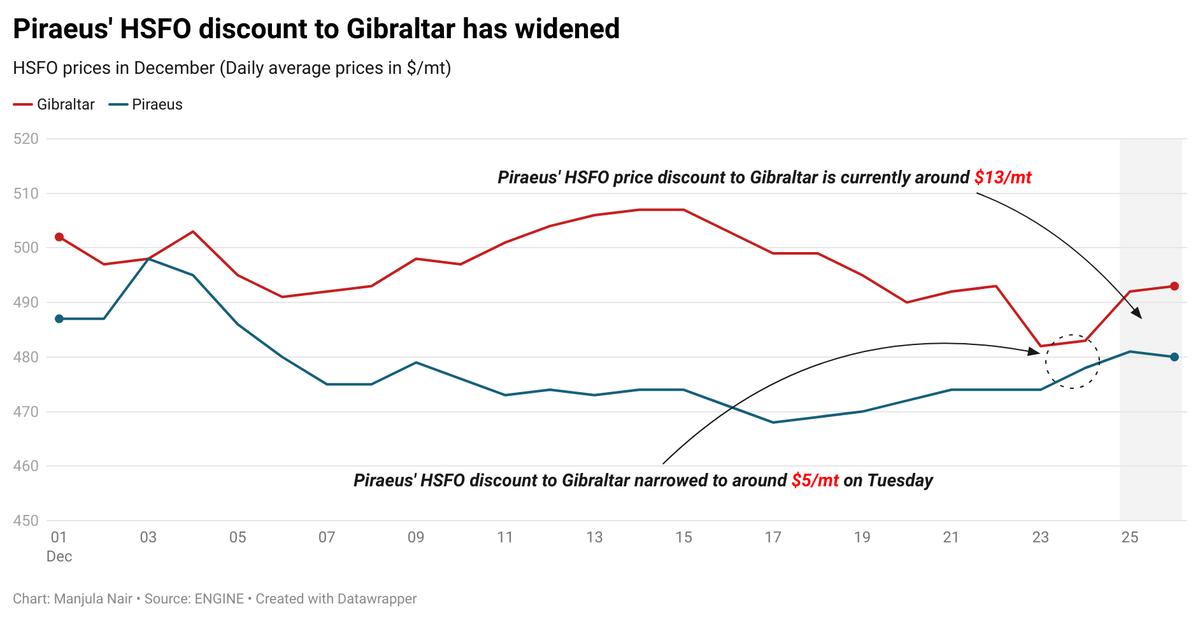

Bunker supply is also good in the Greek port of Piraeus, where suppliers are able to supply grades for prompt delivery dates, a trader said. Piraeus’ HSFO discount to Gibraltar has widened to $13/mt, which is much higher compared to $5/mt seen earlier this week.

Brent

The front-month ICE Brent contract has risen $0.72/bbl from Tuesday, to trade at $73.88/bbl at 09.00 GMT.

Upward pressure:

Oil prices rose on optimism about additional fiscal stimulus in China, the world's largest oil importer.

China plans to enhance fiscal support for consumption next year by increasing pensions, medical insurance subsidies, and expanding trade-in programs for consumer goods, according to a finance ministry announcement reported by Reuters.

China's trade-in programs for consumer goods refer to a series of measures to boost domestic sales.

Expectations of a decline in US crude inventories also supported Brent futures, analysts said.

Downward pressure:

Libya's National Oil Corporation (NOC) announced on Wednesday that the country's average crude production in 2024 surpassed its target of approximately 1.4 million b/d, Reuters reported. This exerted some downward pressure on Brent futures.

By Manjula Nair and Tuhin Roy

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.