Global Fuel Availability Outlook 25 Dec 2024

LSMGO availability is dry in Durban

VLSFO and HSFO availability is tight in Singapore

Prompt availability is tight in Houston

PHOTO: A container terminal at the Port of New York. Getty Images

PHOTO: A container terminal at the Port of New York. Getty Images

Europe & Africa

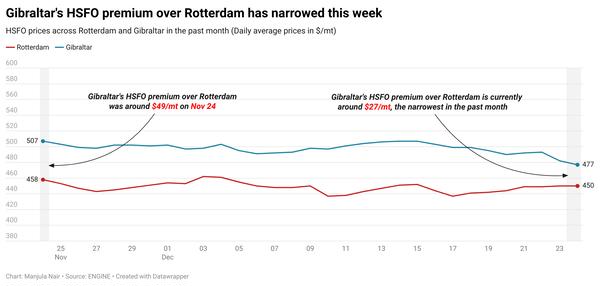

HSFO supply in the ARA is still tight for very prompt delivery dates. A trader recommends lead times of 5-7 days for optimal coverage.

Availability of both VLSFO and LSMGO is normal in Rotterdam and the wider ARA hub, with suppliers able to offer prompt delivery dates. Lead times of 3-5 days are advised for both grades in the ARA hub.

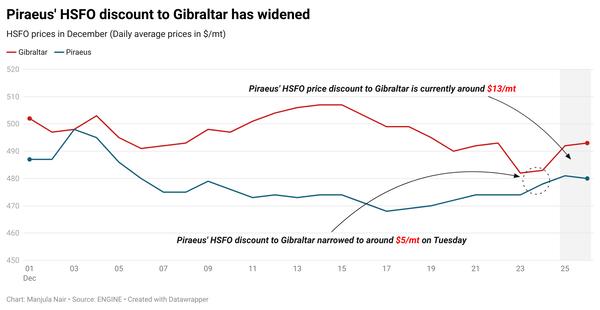

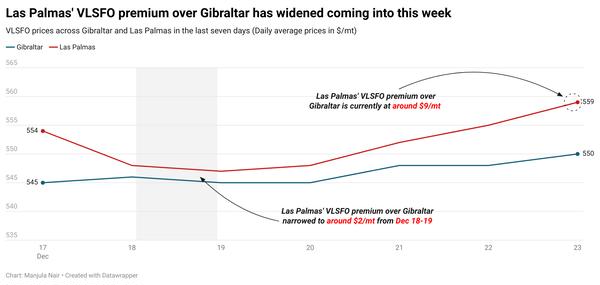

Gibraltar has good bunker availability across all three grades, with recommended lead times of 3-5 days consistent with last week. Rough weather may trigger bunkering disruptions in Gibraltar on Wednesday with wind gusts up to 24 knots forecast in the port area, which will escalate to 27 knots on Thursday.

The Spanish port of Barcelona is experiencing some tightness for very prompt dates for all grades. Lead times have been consistent since last week with traders advising 5-7 days.

The Canary Islands’ port of Las Palmas continues to grapple with tight availability for prompt delivery. Recommended lead times range between 5-7 days, a trader said.

Prompt availability is good in Turkey’s Istanbul, with some suppliers able to offer grades within a day, a trader said. Bunker supply is also good in the Greek port of Piraeus, where prompt delivery dates are being offered.

Meanwhile, LSMGO is dry in the South African port of Durban, a trader said. Strong wind gusts of up to 29 knots are forecast in Durban on Friday, which may impact bunkering.

In Mauritius Port Louis, prompt availability is good across all grades, a trader told ENGINE.

East of Suez

VLSFO availability in Singapore remains tight with a standard lead time of 10 days, though expedited deliveries within four days are possible at higher prices. HSFO lead times range from 9-15 days, while LSMGO is steady at 3-7 days. In Malaysia's Port Klang, VLSFO and LSMGO are abundant with prompt small-quantity deliveries available, but HSFO remains limited.

In East Asia, Zhoushan has strong VLSFO supplies with lead times of 4-6 days and improved HSFO lead times of 3-5 days. LSMGO lead times have risen to 4-6 days. Northern China ports of Dalian and Qingdao have ample VLSFO and LSMGO, but Qingdao faces limited HSFO, and Tianjin has tight supply across all grades. Shanghai has ample LSMGO, but VLSFO and HSFO are constrained. Taiwanese ports’ availability across grades is stable, with Kaohsiung seeing tighter LSMGO supply due to barge maintenance from 26 December.

In southern South Korean ports, VLSFO and LSMGO lead times range from 3-11 days, while 6-11 days are recommended for western ports. This marks an increase from last week’s lead times of 4-9 days for both grades across the country. In Japan, fuel availability remains tight across all major ports, including Tokyo, Chiba, Yokohama, Kawasaki, Osaka, Kobe, Sakai, Nagoya, Yokkaichi, Mizushima, and Oita.

In South Asia, several Indian ports struggle with constrained supplies, while the Sri Lankan ports of Colombo and Hambantota maintain good availability.

The Middle East sees tight supplies in Fujairah and Khor Fakkan, with Djibouti facing severe shortages. Omani ports and Jeddah have ample LSMGO, though VLSFO is limited in Jeddah.

Americas

Prompt availability is tight across all grades in Houston. Some suppliers need 7-9 days for VLSFO and LSMGO deliveries, while HSFO require more than nine days.

On the West Coast, prompt VLSFO and LSMGO availability is tight in Los Angeles and Long Beach, with expected lead times of at least eight days, a source says. The situation is expected to get better at the onset of the new year.

A moderate to high risk of fog and reduced visibility is forecast near Galveston this week. This could halt vessel traffic in the Houston Ship Channel and may result in congestion and delays.

Bunker deliveries in Argentina’s Zona Comun are expected to face delays due to weather-related disruptions.

By Tuhin Roy, Manjula Nair and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.