Global Market Update 25 Dec 2024

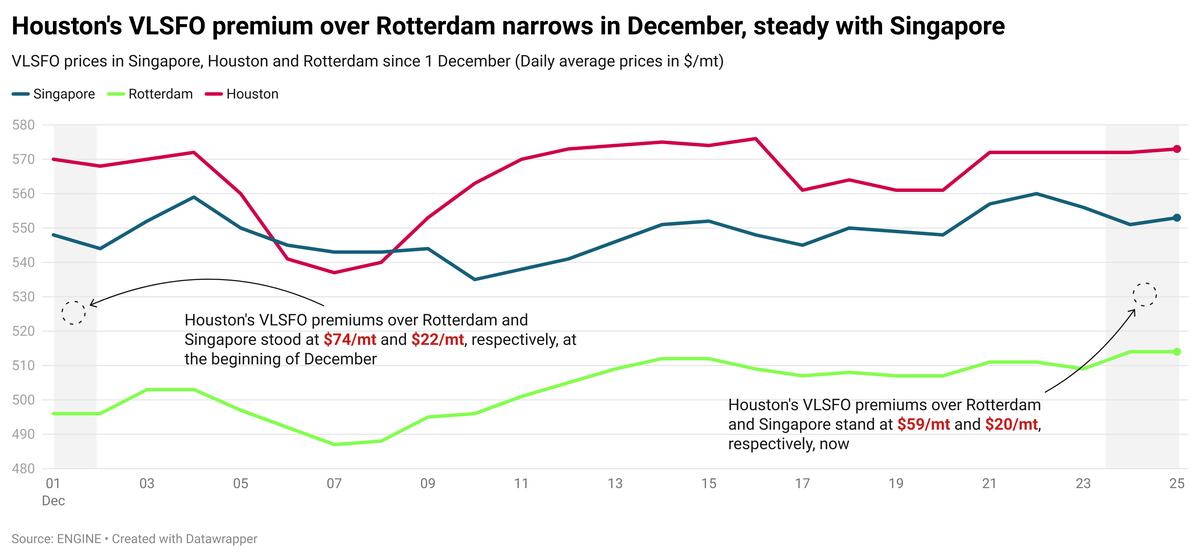

VLSFO prices across global ports have been mostly rangebound, and prompt availability of all grades is tight in Fujairah.

Changes on the day to 09.00 GMT today:

- VLSFO prices up in Gibraltar ($5/mt), Singapore ($3/mt), Fujairah ($2/mt) and Houston ($1/mt), and unchanged in Rotterdam

- LSMGO prices up in Houston ($8/mt), Gibraltar ($7/mt), Rotterdam, Fujairah ($2/mt) and Singapore ($1/mt)

- HSFO380 prices up in Gibraltar ($12/mt), Fujairah ($6/mt), Singapore ($3/mt) and Rotterdam ($2/mt), and down in Houston ($4/mt)

VLSFO availability in Singapore remains tight, with lead times of nine days, nearly unchanged from last week. Some suppliers can offer deliveries within four days but at higher prices. HSFO supply is constrained, with lead times ranging from 10-18 days, while LSMGO lead times remain steady at 4-9 days.

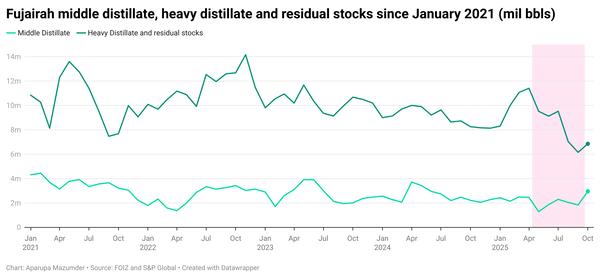

In Fujairah, fuel availability also remains tight, with lead times for all grades steady at 5-7 days, consistent with last week.

Gibraltar’s HSFO price has increased the most compared to other regional bunker benchmarks. As a result, the port’s HSFO premium over Rotterdam has widened by $10/mt, to $34/mt now.

Prompt HSFO availability is good in Gibraltar compared to Rotterdam, where lead times of 5-7 days are advised. Gibraltar is forecast to experience strong wind gusts of up to 24 knots today, which could escalate to 27 knots tomorrow. Rought weather conditions could disrupt smooth bunker deliveries.

Houston's LSMGO price gain has continued to be steeper than that of its VLSFO. Prompt availability is tight across all grades in Houston. Some suppliers need 7-9 days for VLSFO and LSMGO deliveries, while HSFO could require more than nine days.

The US Gulf Coast is currently experiencing the fog season. Heavy fog and reduced visibility could disrupt bunkering operations in Houston throughout the week. This may also impede vessel movement in the Houston Ship Channel, causing potential congestion and bunker delays.

Brent

The ICE Brent Futures market is closed for trading today on account of Christmas. Front-month ICE Brent closed at $73.58/bbl on Tuesday, which is $0.42/bbl higher than the price was at 09.00 GMT on Tuesday.

Upward pressure:

Brent crude’s price settled on a high note yesterday on the back of emerging market confidence in US oil demand growth, supported by strong economic data.

The US gross domestic product (GDP), a key indicator of demand growth and consumer spending activity, grew by an annualised rate of 3.1% in the third quarter of this year, higher than the initial estimate of 2.8%, the US Commerce Department’s Bureau of Economic Analysis (BEA) reported last week.

The upward revision has shown resilience in the country's economic growth in the third quarter of this year, as it was better than previously estimated.

The news comes as global financial markets brace for former US President Donald Trump to take office on 20 January.

“As we catapult into 2025… markets are teetering on the edge of optimism and uncertainty, with the spotlight blazing on Donald Trump's anticipated return to the White House,” SPI Asset Management’s managing partner Stephen Innes said.

Downward pressure:

Oil demand growth in China – the world's second-largest consumer, remains the biggest concern in the oil market now, according to analysts.

Oil demand in China will peak around 2027, with expected oil consumptions of about 750 million mt and 770 million mt in 2024 and 2025, Chinese state-owned oil company Sinopec has projected.

Even though Chinese officials have pledged to roll out new economic stimulus packages in 2025, oil market analysts remain cautious, with fewer expectations of a major boost to oil demand.

“Supply and demand is now starting to matter; as we have less of the first and more of the latter,” Price Futures Group’s senior market analyst Phil Flynn remarked.

By Tuhin Roy, Manjula Nair and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.