Bunker prices have remained in a narrow range for the past 3 months; When will this change?

October 30, 2020

Since our Integr8 notes and podcasts in late August we have taken a far more cautious approach on potential near-term gains in bunker prices. As we have (too) often outlined, absolute prices in our markets are driven by what is happening in the overall oil market, with some variations as relative crude and product prices shift.

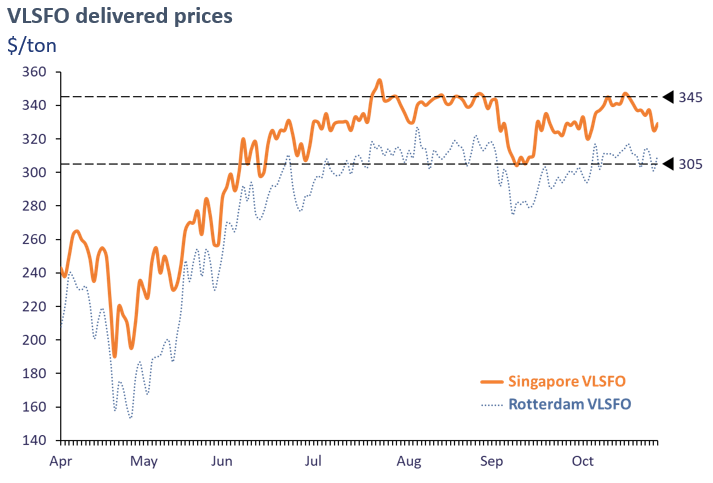

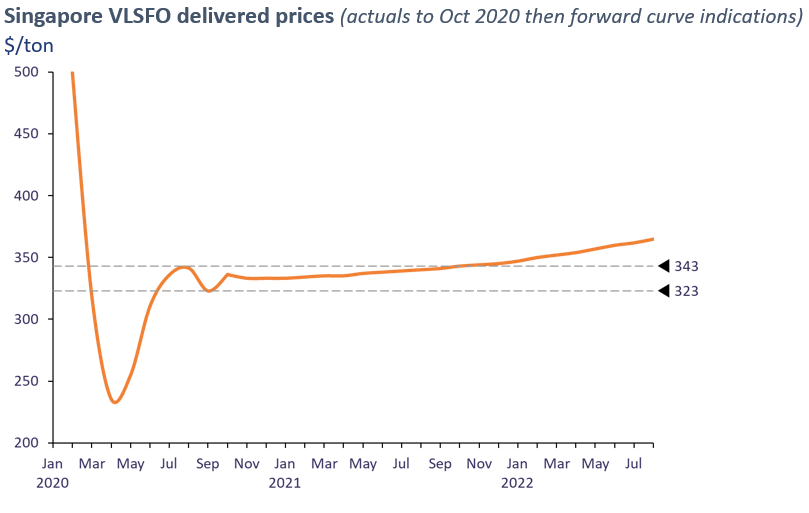

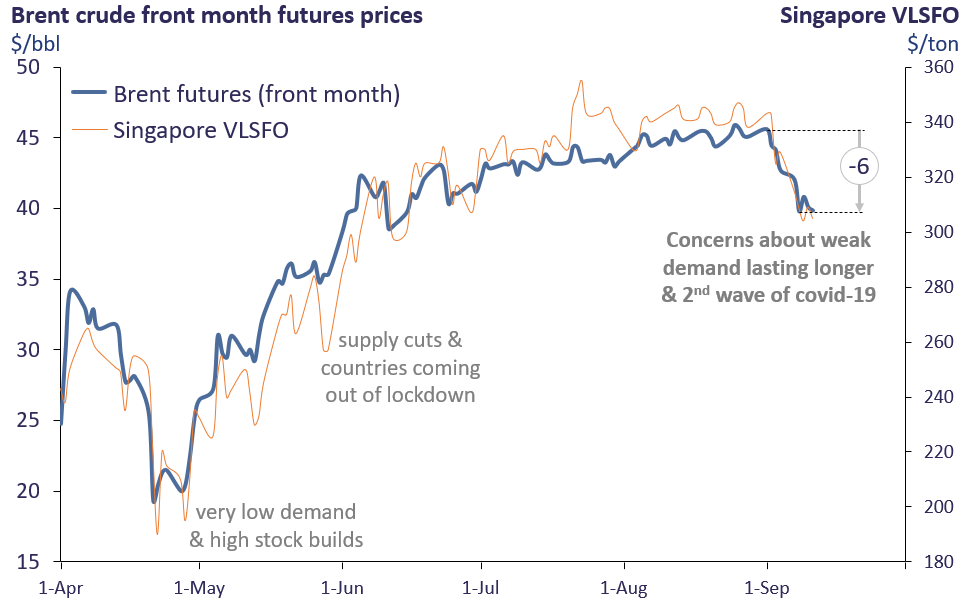

The concern in the markets two months ago about a second Covid wave and a slowing rebound in oil demand have happened. The net result has been bunkers moving in a very narrow price range, with daily VLSFO prices quotes in Singapore remaining within only a $40/ton range for the past 3 months.

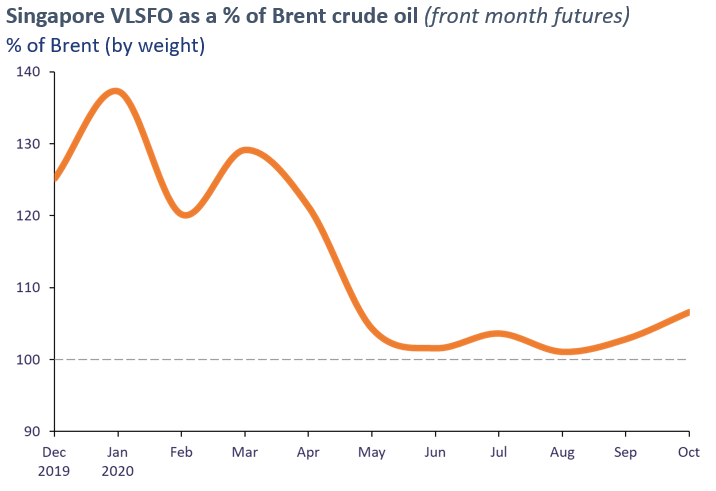

One point worth noting on relative pricing is that over the past month VLSFO has strengthened slightly against crude oil. Although it is still at very low levels versus crude, VLSFO in Singapore is now at 107% of Brent, up from a low of just 101% in August, but nowhere near the 120-130% just before the pandemic.

This slight upturn has come with some minor relative strengthening in jet and gasoil prices, which does have an underlying impact on the VLSFO ‘blend’ price (in our recent Integr8 webinar we went into detail about the inter-relationships and determining factors for VLSFO pricing). However, demand and pricing for gasoil and jet (along with gasoline and diesel) will have to rise a lot more to push this relative price of VLSFO significantly higher.

This brings the focus back to the bigger picture in oil markets. The overall fundamentals are key, and we are going through a period where oil supply has not been an issue, with the OPEC+ group doing a very good job of cutting production. All the focus is on demand, with the emergence of a second Covid wave leading to more lockdowns and constraints on the rebound in global oil demand.

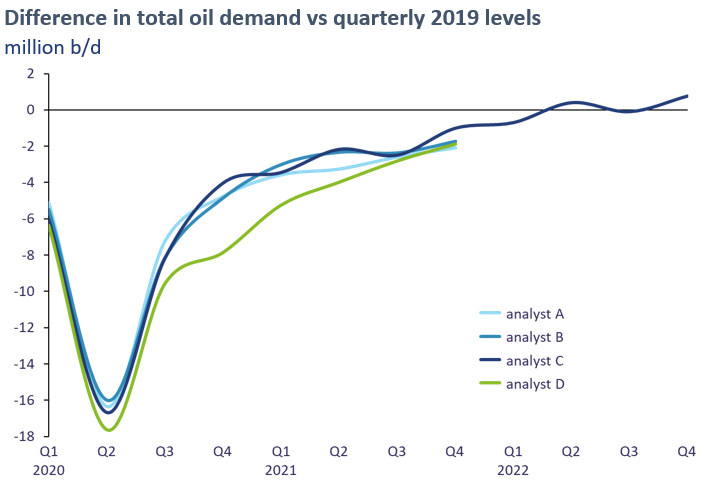

The graph below illustrates four different analysts’ views on oil demand. All measurements are against the corresponding quarter in 2019 and there is a fairly consistent view on how demand fell in Q1 and Q2 this year and how the recovery has taken place in Q3. Looking ahead through to the end of next year, three of the analysts have very similar expectations, looking at further gains in Q4 this year, but then only limited increases through all of next year, such that even by Q4 2021 global oil demand will still be 1-2 million b/d below demand in Q4 2019. One analyst is even more bearish, seeing the demand rebound falter this quarter and through the first half of next year, but then hitting similar numbers to the other three analysts for the second half of next year.

One analyst has extended their quarterly outlook into 2022 and this shows global oil demand returning to the 2019 level in Q2 2022, another 18 months away. The general expectations at this stage are that it will take until the very end of next year or the early part of 2022 before total oil demand gets back to 2019 levels. It is this view that over-arches the very flat price expectations at the moment.

The question is: what can happen to change this?

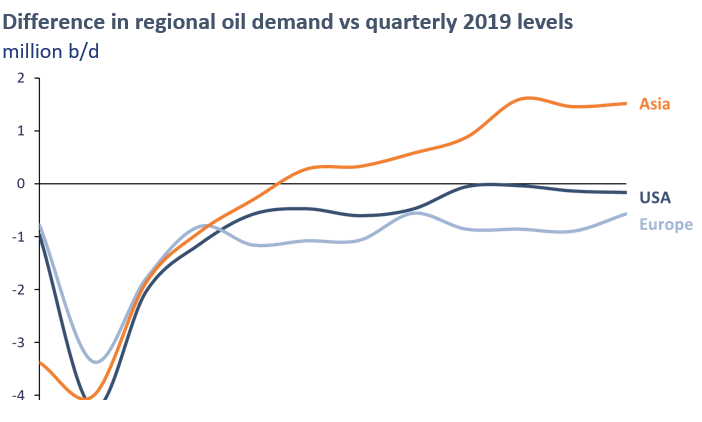

Although headline analysis is looking at the global position, there are very different developments taking place on a regional basis. Economies and oil demand have rebounded far quicker in Asia-Pacific than elsewhere. Activity in China is back close to pre-Covid levels on many levels, even including domestic airline travel. For the region as a whole, oil demand is expected to return to 2019 levels as early as Q2 next year and continue rising after this, which will support regional refining and oil markets. Any return in the US is not seen until the start of 2022, either under a Trump or Biden presidency (at the moment any political/energy policy differences between the two are seen as having a longer term impact and not in the near-term global oil markets).

Europe is looking like ‘more of a drag’ on demand than other areas and in the longer term this could have a marked impact on ‘local’ refinery closures and product pricing.

Given these current circumstances, it is difficult to see prices moving significantly higher in the very near term. The obvious trigger to prices rising steeply is the introduction of a covid-19 vaccine, or even the very strong indication that one is imminent. The increases in oil demand with the introduction of a vaccine could exceed analysts’ current views. News of a vaccine will push futures prices much higher, and with the mantra ‘buy on the rumour, sell on the fact’, the initial price hike could be high (before prices settle back down).

The forward curve today does not reflect any step change in demand that a vaccine could offer. In fact, looking at monthly average prices, the forward curve on VLSFO in Singapore is extremely flat and still within the recent $20/ton band for another 12 months. Even going into 2022 any increase in the curve is very gradual.

There will always be some price movement, and in the very near term there are also risks to the downside, with any large-scale moves into lockdowns or issues surrounding the OPEC+ agreement and the outcome from their 30th November/1st December meetings. However, if and when there is a successful covid-19 vaccine, this is likely to push oil prices up significantly and well above the current VLSFO forward curve.

Steve Christy Strategic Communications Director, Navig8 P: +0207 4675 860

E: SteveChristy@navig8group.com

US crude exports to remain stable, but seaborne imports likely to rise

September 22, 2020

New trends in US crude trade may arise, as oil demand recovers but impacts from the Covid-19 pandemic on US oil supply linger.

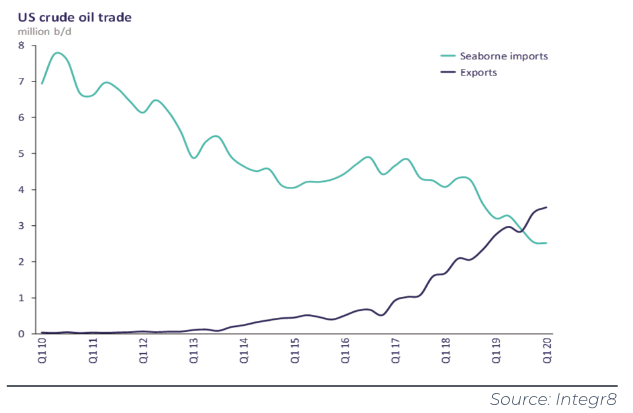

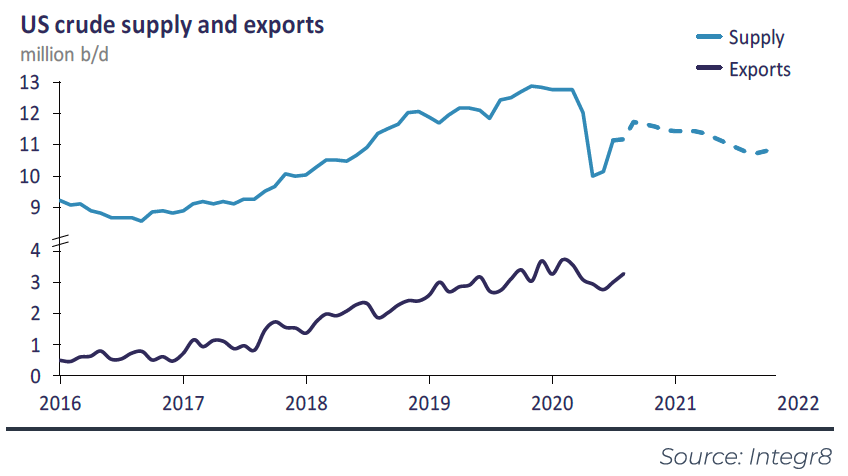

US crude exports have expanded sharply in recent years following the lifting of US oil export restrictions in December 2015, driven in large part by rising US tight oil production, which increased by 6.1 million b/d between 2012 and Q1 2020 to reach 8.3 million b/d. Shipments reached a record high of 3.5 million b/d in Q1 2020, supported by expanded pipeline infrastructure that boosted crude flows to export terminals.

On the other hand, US crude imports by sea have declined since 2010, falling 5.0 million b/d between 2010 and Q1 2020 to sit at 2.5 million b/d. Declining seaborne imports came against a backdrop of rising domestic oil supply and higher landborne imports from Canada, which doubled between 2010 and Q1 2020 to reach 4.0 million b/d.

As Q1 2020 drew to a close, fundamentals in the oil market shifted significantly. The Covid-19 pandemic caused unprecedented destruction to global oil demand, as countries imposed ‘lockdown’ restrictions and economic activity declined. Global oil demand collapsed by 15.6 million b/d y-o-y in Q2, whilst global crude throughput fell 11.4 m b/d y-o-y.

Meanwhile in April, a flood of oil entered the market as OPEC+ supply cuts ended, following the collapse of discussions in early March. Amid a massive oversupply, crude oil prices crashed, which resulted in price-sensitive US shale operators shutting-in supply. US production fell sharply, with tight oil supply dropping 2.3 million b/d in two months to 6.0 million b/d in May.

US crude exports dropped back only 0.3 million b/d q-o-q in Q2, supported by lower domestic oil consumption and inventory building in Asia. Shipments have rebounded somewhat in Q3 as global demand continued its recovery and curtailed US supply has been restored quickly.

US seaborne crude imports were initially boosted by the disruption in OPEC+ supply. Discharges of cheap Saudi crude, loaded amid Saudi Arabia’s price war with Russia, increased in May and June. However, higher imports partly offset falling US supply to maintain high crude flows into US storage, with elevated stockpiles subsequently suppressing imports into Q3.

Despite US exports not dropping as much as expected during the initial stages of the pandemic, growth in US crude exports is expected to remain limited and volumes may hold around the 3 million b/d mark into 2021.

Undermining the outlook for US crude export growth is the projection of US crude supply declines beyond September 2020, owing to reduced drilling activity, with US tight oil production declining 0.3 million b/d y-o-y in 2021. Export growth also faces headwinds outside the US from high global oil inventories, whilst persistent ‘first-wave’ and emerging ‘second-waves’ in Covid-19 affected countries could prolong economic contraction into 2021. Supply factors may also play a role, such as tapering OPEC+ cuts supporting higher OPEC+ exports, or potential shifts in Libyan, Venezuelan or Iranian crude flows.

However, there remain positive factors that could support a more optimistic outlook, including from continued gradual improvements in global oil demand. There is inherent upside risk, including from the impact of a Covid-19 vaccine ahead of end-Q1 2021, which could spur the pace of demand recovery. Meanwhile, high oil inventories in the US, likely to suppress domestic US refinery output somewhat, could push more crude to export markets.

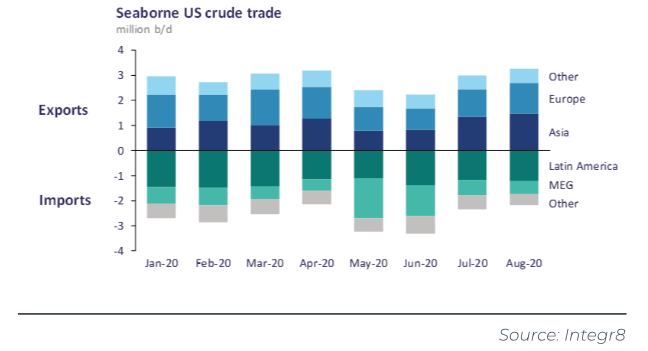

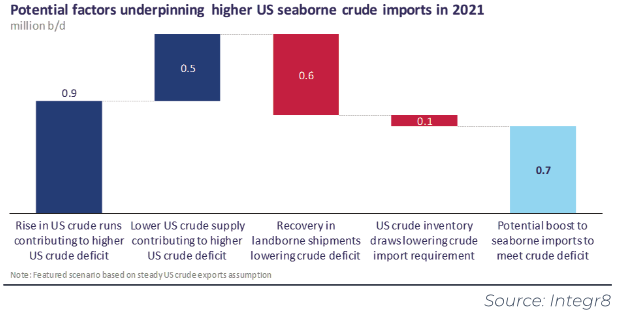

Elevated US crude stockpiles are likely to keep US seaborne imports under pressure in the near-term. However, with US crude inventories falling steeply in August to return close to the 5 year range, the outlook for rising seaborne crude shipments to the US is positive, with shipments having the potential to increase by 0.7 million b/d y-o-y in 2021.

Seaborne imports appear well positioned to benefit from a projected rise in the US crude deficit next year, as US oil demand continues to improve and domestic US oil supply eases back. However, landborne shipments are expected to largely recover, although remain limited by pipeline infrastructure and muted growth in Canadian production, whilst further draws on US crude stockpiles may also present a headwind to import growth.

VLCCs are likely to be supported next year by higher US imports of Middle Eastern crude as OPEC+ supply cuts ease, whilst Aframax demand is expected to benefit from higher US crude imports from Latin America. Meanwhile, Suezmaxes are likely to benefit from firmer US imports of both Middle Eastern and Latin American crude.

The rise in bunker prices has come to a halt and the question now is “What happens next?”

September 16, 2020

In all our previous notes and podcasts we have been relatively bullish on bunker prices rising from their extreme lows at end April, even though at some stages there was a stuttering in the upward trend.

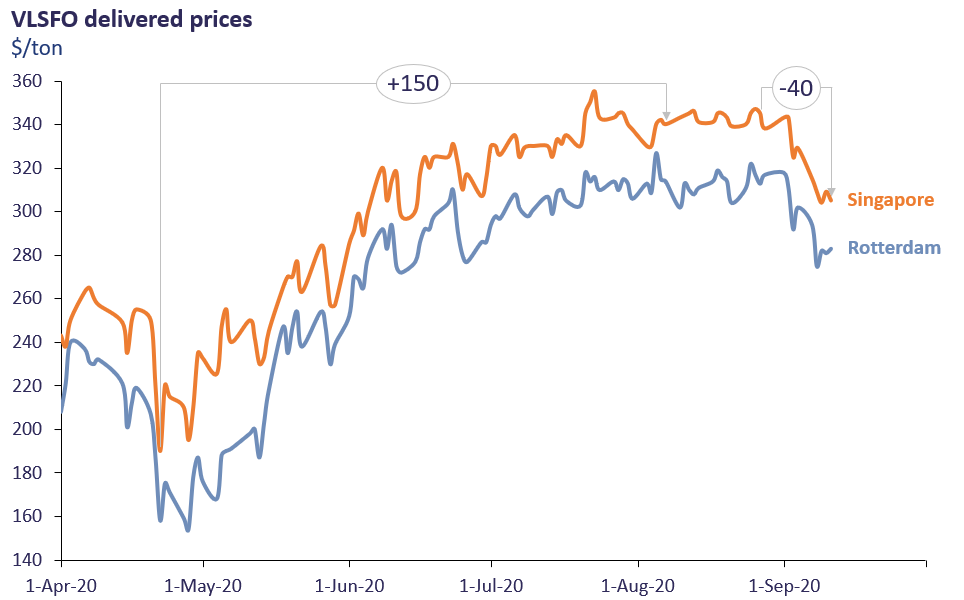

The sentiment was driven by tightening oil fundamentals; demand began to rebound and OPEC+ made major cuts to oil production. But these signals have taken a turn. In our Integr8 podcast 3 weeks ago we did take a more nervous approach to any further short term rises in price, but bunker prices have taken more of a hit and have dropped $40/ton (for VLSFO in Singapore) in the past 14 days.

Looking at oil fundamentals at the moment, there are far fewer concerns about oil supply, with the OPEC+ countries producing at close to the agreed levels; it is much more about demand now. The reversal in crude prices has come from a far greater concern about the ‘rebound’ in total oil demand, with the emerging threat of a second Covid-19 wave and the associated lockdowns taking place.

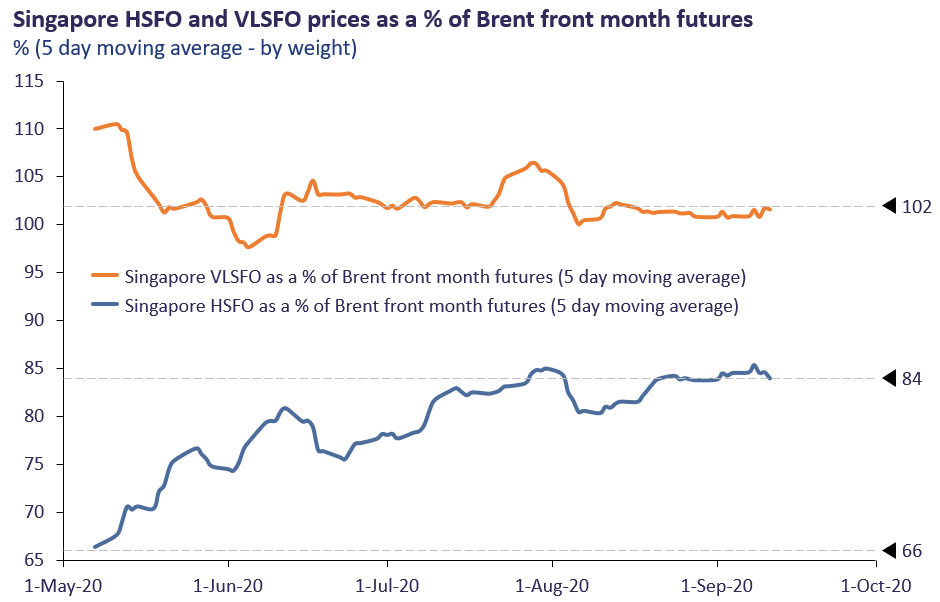

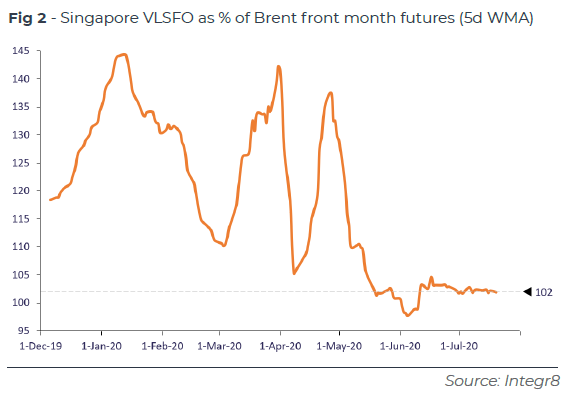

Since mid-May VLSFO prices have closely tracked the price movements in Brent futures, with Singapore prices very close to 102% of the Brent price throughout the period (on a weight basis). So, as the crude price has moved up or down, this has led VLSFO up or down by a similar amount.

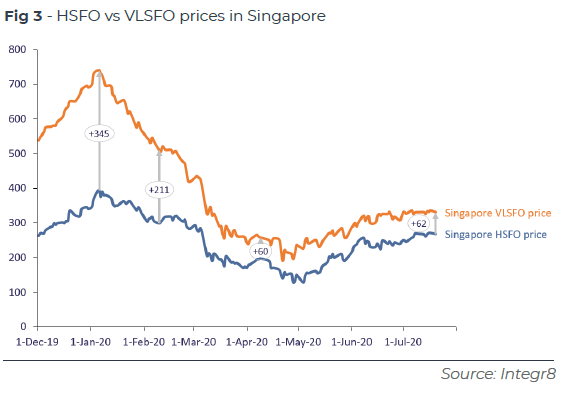

Although VLSFO prices have closely tracked movements in the Brent price for the past 4 months, this is not the case for HSFO. The price of HSFO has strengthened considerably against crude (and so VLSFO), going from 66% of the Brent price in early May to 84% currently. The drivers here are that demand for HSFO has been relatively flat and one of the least affected products from covid-19, and at the same time refinery runs have fallen and the OPEC+ production cuts have focused on heavier, higher sulphur crude grades; all this has led to a ‘constrained’ supply of high sulphur fuel oil.

Between early May and now the price of HSFO in Singapore has risen by around $100/ton, with $55/ton of this accounted for by the underlying rise in crude prices, but a further $45/ton gain because of the relative strength in HSFO. It is these dynamics that have squeezed the VLSFO/HSFO differential over the past 3½ months.

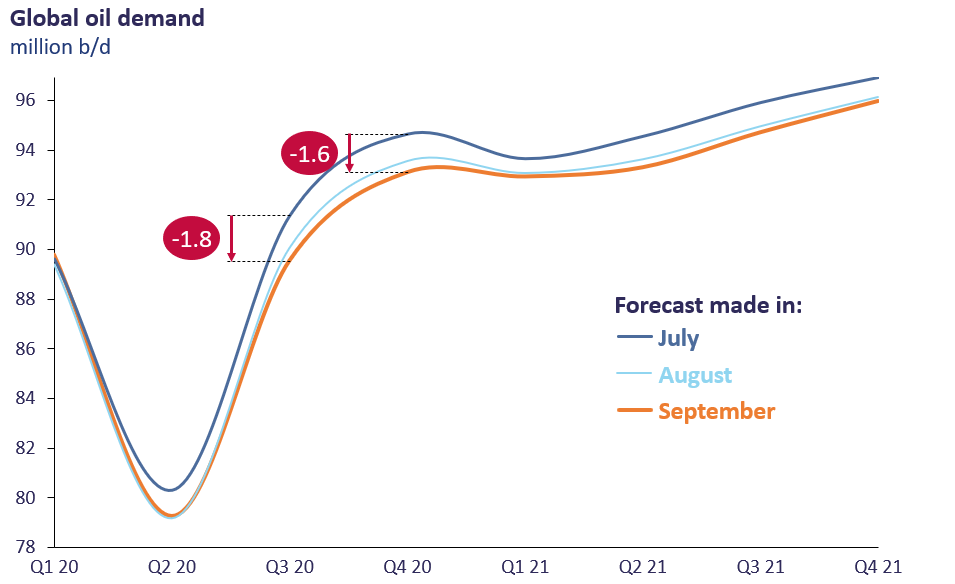

The very recent drop in oil prices reflects the changing perspective of how fast oil demand can recover and how long the covid-19 impact could last. Over the past few months most analysts have downgraded their views on future oil demand, with for instance demand estimates for the third and fourth quarters this year reduced by 1.6-1.8 million b/d since July. Also, expectations for next year are relatively flat and 1 million b/d below levels projected in July. The current demand position is ‘the rapid rebound has come to an end and any future increase will be far more muted’. Hence, the drop in oil prices over the past 2 weeks.

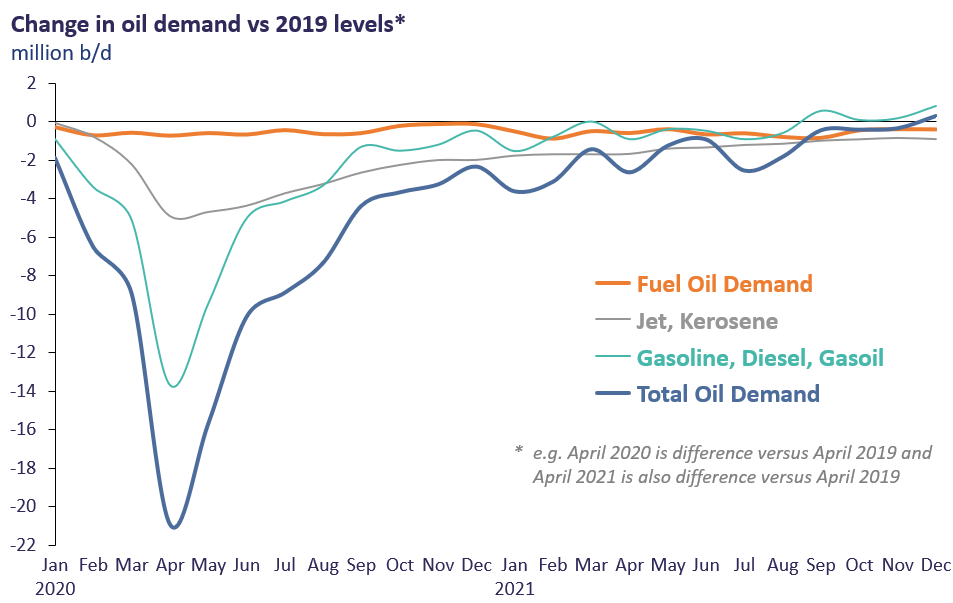

Looking at different oil products, it is clear the demand impact on the bunker market has been far less than for other sectors. In the graph below the orange line represents the change in total fuel oil demand on a monthly basis vs the corresponding month in 2019. This shows fuel oil demand running at around 0.5 million b/d below 2019 levels throughout this year and next year.

In contrast jet/kerosene demand collapsed in April and even by the end of next year is still expected to be below 2019 levels (the airline industry is looking at 2024 to stand a chance of getting back to earlier demand). It is then the road transportation sector where the biggest swings in absolute demand are taking place. Gasoline, diesel, gasoil has accounted for the biggest part of the demand loss and the biggest rebound since April. However, only minor gains are forecast between now and the end of 2021. The possible second Covid-19 wave is hanging heavily over this and economies generally.

Putting all these demand developments together, total oil demand is not expected to get above 2019 levels until the end of next year, or possibly into 2022. Hence the bearish sentiment in today’s market.

In past notes, we have looked at changes in US oil stocks as an early indicator of how well oil demand is doing. This will remain an influence, but low refinery margins and higher Covid-19 infection rates and lockdowns have had a bigger (negative) impact.

It could be the case that prices fluctuate around recent levels, but for the next major leap upwards in price there has to be the sign and confidence of a successful Covid-19 vaccine. Mixed into the recent news was a halt in one of the key, advanced, vaccine trials (which is typical for such trials) and this has been taken as a bearish signal in the oil markets.

So, in addition to all the other oil indicators we have highlighted before, we must add pharmaceutical developments to the list. There are close to 200 Covid-19 vaccine trials currently underway and 9 of these are in their final phase large-scale trial before possible approval. Some analysts are suggesting Q1 next year as a potential time-frame for a vaccine to hit the market. This may be the case, but this is an area where those carrying out the clinical trials and those in a position to approve (or not) a vaccine are far better placed to know than the rest of us.

As before, headline news on US oil stocks, refinery margins and US/China/Russia/Saudi Arabia politics will all steer oil prices, but the current signal for any big hike in bunker prices (and oil prices generally) is likely to be the emergence of a Covid-19 vaccine.

Steve Christy Strategic Communications Director P: +44 207 467 5860

E: SteveChristy@navig8group.com

Never underestimate the importance of accurate sampling during supply

September 3, 2020

In recent times, we have written as to the importance of having an open mind when it comes to claims investigations when assessing the bunker stems against issues experienced onboard but what is equally important, is that we have a solid base for a claim against the fuel in the first place.

Indeed the most basic hurdles to overcome are whether we are basing the claim on a sample representative of the bunker contract and are we confident as the sample’s provenance, in other words, how, where, when it was drawn and is it fully representative of the supply?

At the end of the day, you will not be surprised that as a former laboratory chemist, that for years I have been heard preaching the same mantra in that “any laboratory is only as good as the quality of the sample provided”.

So how do we address one of the biggest variable of them all?

Prior to supply

Proactively buyers should always look to clarify means of delivery and the location of the sampler used to produce the binding contractual samples. Singapore is a notable exception in that SS600 and SS 648 mandate that samples which form the BDN are drawn from the vessels manifold but many areas have no such control with samples being drawn from the barge manifold unless agreed in writing prior to supply.

Truck and ex pipe deliveries require special attention in order to define how and from where samples are drawn which ultimately will be listed on the BDN and are inevitably the binding samples in the case of a dispute.

It is also important to understand access limitations given the continued Covid-19 challenges. Clarification must be sought early as to whether crew members can attend a barge or shore installation to witness samples being drawn and/or can barge crew attend the vessel as given the importance of samples the mobilization of surveyors would always be recommended.

Recently we have identified that some suppliers list these Covid limitations in their calling instructions, so all stakeholders should be sure to read them thoroughly as this document may give you the “heads up” needed to appoint a surveyor in advance to protect your interests.

Time of delivery

At the end of the day, if you don’t raise concerns at the time as to the provenance of samples or any deviation from sampling protocols then you have little recourse in the future.

Indeed it would not be the first time that the representative (and contractually binding sample) does not bear any resemblance to other samples presented which of course could expose you to the full weight of the claim.

Therefore any deviation or issue should be documented in a Statement Of Fact (SOF) or Letter Of Protest (LOP) at the time of supply and should this be refused or not accepted to be signed by the supplier, then urgent communications should be made to the relevant counter-parties in order to document the occurrence.

Common deviations include:

• Lack of continuous drip sampler on board the barge resulting in “SPOT ONE SHOT” samples forming the BDN.

• Continuous drip sampler not started at commencement of delivery.

• Cubitainer seen to be full prior to delivery completion.

Post delivery

Particularly if time is of the essence on completion, it can be a bad habit to ignore the samples and concentrate on the ullaging – which of course would render all previous attention potentially useless. It is essential that the entire sampling process is covered from the moment the cubitainer is connected to the continuous drip sampler until the last sample has been sealed and accurately documented on the BDN and both the BDN and the sample labels have been signed off by all parties.

Conclusion

So to conclude, I would argue that given some of the quality challenges and the issues with barge accessibility for the crew given Covid-19 concerns, it is almost essential to employ a barge based surveyor to protect buyers interests even in a relatively low flat price world as we have at present.

This allows any deviations relating to Quantity and Sampling to be noted, documented and dealt with at the time and gives you peace of mind in the event a claim occurs further down the line.

Remember the adage, the laboratory is only as good as the sample provided – you are wise to always employ a gold standard ISO 17025 accredited laboratory for your testing but if the sample is not representative then it is irrelevant and is a recipe for disaster.

Chris Turner Manager – Bunker Quality & Claims P: +65 662 200 42

E: chris.t@integr8fuels.com

To see where bunker prices are going, we have to look at the bigger oil picture

August 20, 2020

Bunkers are a relatively small part of the overall oil market, accounting for just over 6%. It is what is happening elsewhere in the industry that sets the underlying price in our market, but of course with a number of factors that determine if VLFSO, HSFO or MGO prices are relatively strong or relatively weak in comparison with crude oil and other product prices.

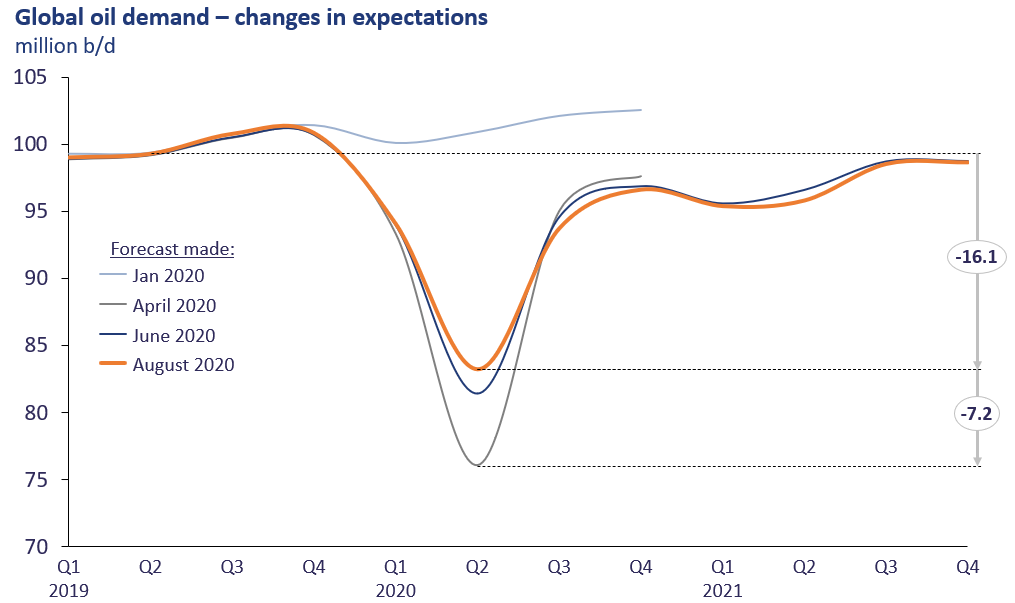

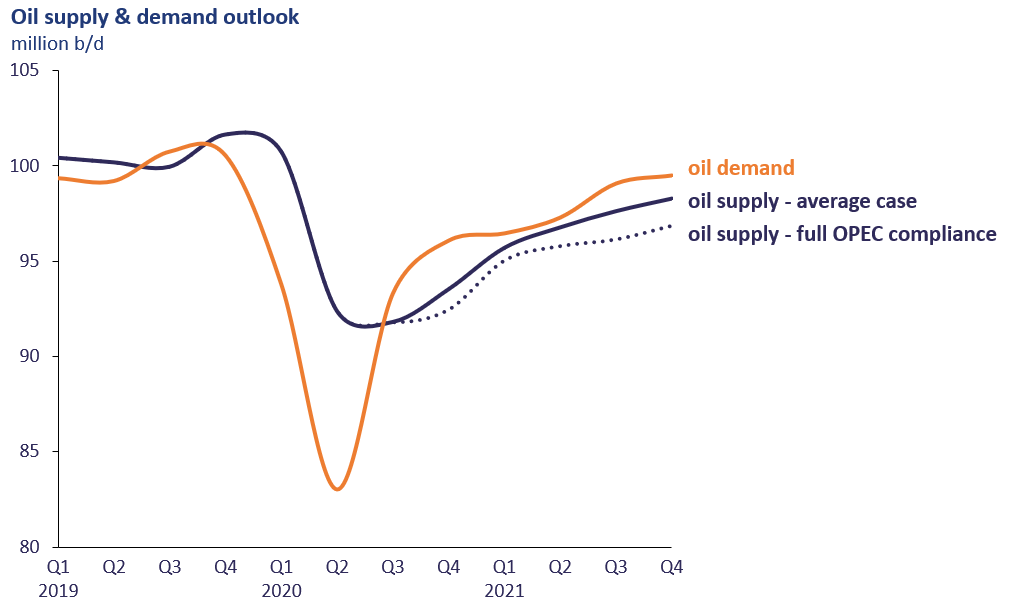

This report is an update of our end June look at the oil industry fundamental outlook and the drivers behind prices in the bunker market. To summarise, the collapse in oil demand has been huge, but not as big as first thought. However, expectations now are the Covid-19 impact will last longer than originally forecast. Back in April, when the realization of what was happening became apparent, the drop in total oil demand in the second quarter was expected to be just over 23 million b/d, now that estimate is close to 16 million b/d (still incredibly big though). Demand is forecast to continue to rise, but figures for next year are still below the 2019 levels; it is not until 2022 that total oil demand is expected to get back to the 2019 levels.

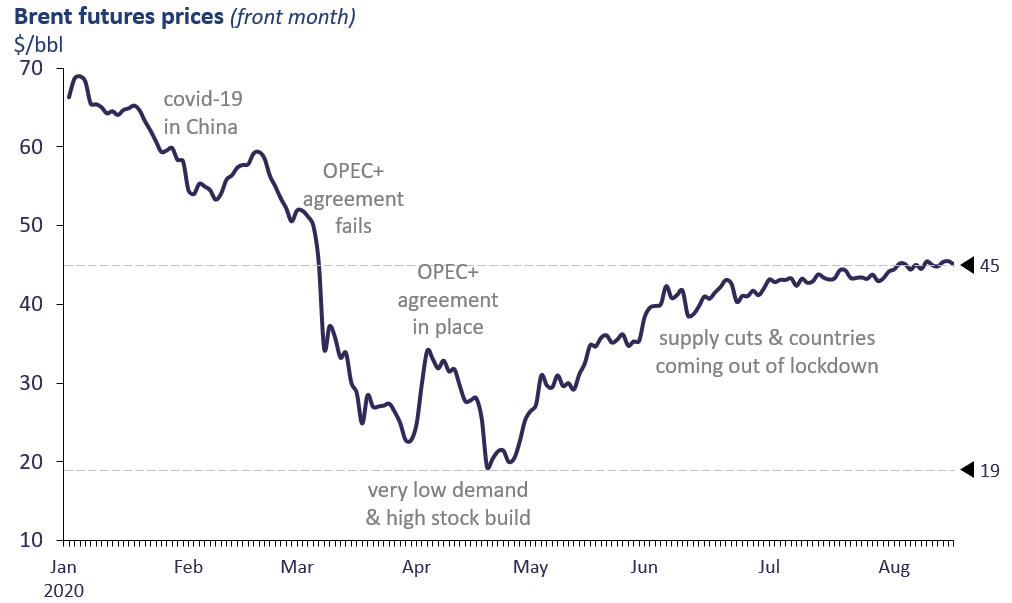

This suggests that demand is rising but is going to take more than 18 months to ‘recover’. Also, we have already seen a number of setbacks, with local and regional lockdowns being introduced. On this basis we can expect demand contributions towards higher prices, but not on a straight-line basis. We have already seen this over the past 7 weeks as crude oil prices have only edged higher in a relatively narrow range of $43-45/bbl for Brent front month futures. This is shown in the graph below, following the collapse in Brent prices from $70/bbl at the start of the year to a low of $20/bbl at the end of April.

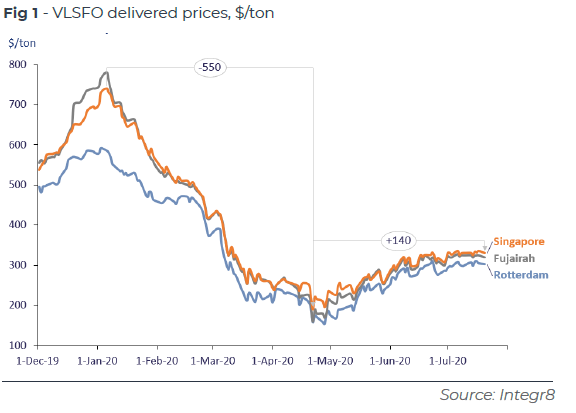

The shape of price developments in the bunker sector has followed a similar pattern, a collapse from January through to late April and a gradual rebound since then, but with prices still well below those at the start of the year.

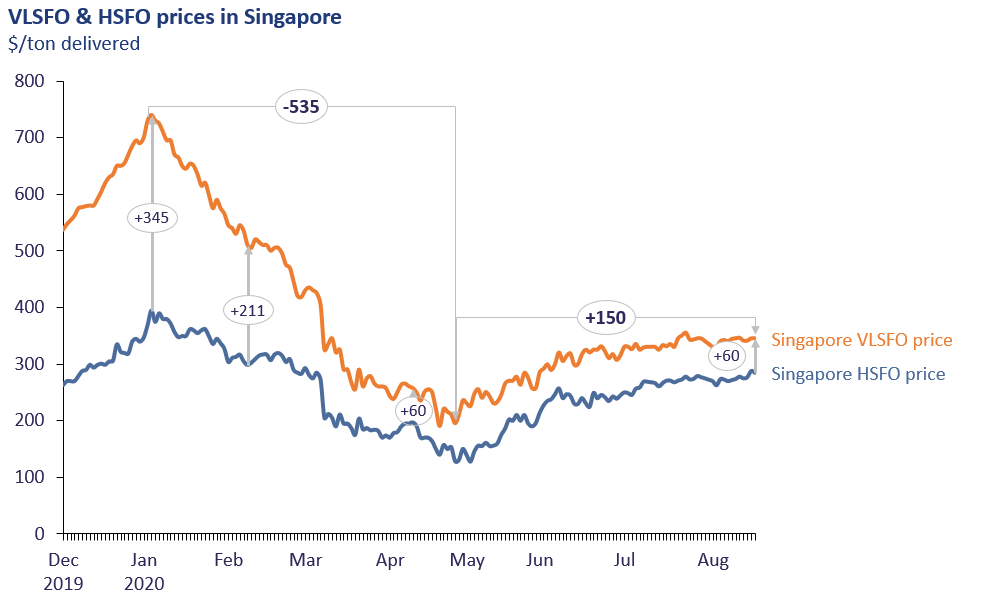

The graph above also illustrates the narrow position of the VLSFO/HSFO differential over the past 4 months, partly a reflection of ‘smaller differentials a lower prices’, but also a reflection of more specific developments in the oil markets. VLSFO is currently relatively weak within the price structure because it is typically a blended product and component prices are weak from the ‘hit’ in distillate/gasoline demand. Conversely, HSFO prices are relatively strong because demand has been less affected in this market than others and also the OPEC+ crude production cuts have largely centred on more heavy, higher sulphur crudes, so constraining the supply of HSFO.

It is the balance between total oil supply and total oil demand that will determine how overall prices respond going forward. If the analysts are correct, and we gradually move to higher demand over the next 18 months, then the question is: what happens to supply at the same time? This means a key focus on the OPEC+ agreement and how this is working, and more specifically the positions of Saudi Arabia and Russia within the agreement.

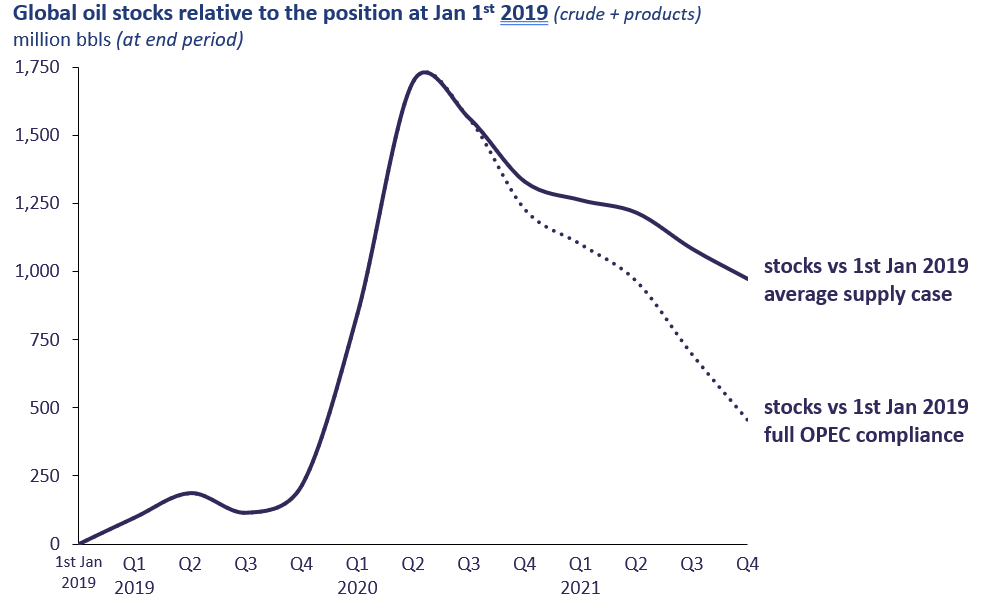

The market has seen a massive drop in demand over the first half of this year and a position where supply was much higher than demand, i.e. a period of huge stock build. The general outlook for the next 18 months is an increase in demand to levels just above supply, i.e. a gradual stock draw. Forecasts tend to show OPEC+ producers moving above quotas during next year, but If OPEC can maintain full compliance to the existing agreement, then the stock draw would be greater and so prices likely to be higher.

The final graph illustrates how global oil stock levels could react after the massive build we have seen during the first half of this year, where by June 2020 stocks were around 1.7 billion bbls higher than at 1st January 2019. Given the two supply scenarios, stock levels at the end of next year could be around 1 billion bbls above 1st Jan 2019 based on an OPEC ‘over-production’, or just 0.5 billion bbls higher if OPEC stick to the agreement.

Current forward curves for crude oil prices show a very flat profile for next year, rising by only $3.50/bbl by end 2021 for Brent. The curve for VLSFO is slightly steeper than for crude, at $42/ton higher at end 2021, which is also a reflection of a shift away from the current relative weakness in VLSFO pricing.

The implications from the graph above are not a return to prices at the start of this year, but a rise in prices and the extent dependent on how OPEC responds and how quickly demand can recover. Analysts’ expectations for oil demand plus full OPEC compliance suggests a higher price than the current forward curve. Within this, bunker prices will follow suit, along with more subtleties surrounding the VLSFO/HSFO price differential. We will continue to analyse and report on these industry fundamentals.

Steve Christy Strategic Communications Director P: +44 207 467 5860

E: SteveChristy@navig8group.com

Monitoring bunker price changes and buying on weighted average price can save you money

August 14, 2020

In the past couple of months, it has been a somewhat quieter period in the bunker industry, particularly with regard to VLSFO and LSMGO, with relatively low prices and abundant supply generally……..

There is clearly a lot of uncertainty about whether oil demand will carry on recovering given the rise in the Covid-19 cases in a number of countries and what the OPEC+ countries will do with the crude oil cuts going forward.

For now, we have mostly seen bunker prices trailing Brent, although there has been a number of ports where pricing changed in bunker buyer’s favour or against it.

Given the low freight environment in many shipping sectors, opportunities to buy smart and pay less should not be missed an one of the approaches would be to utilise the volume weighted price average calculation when fixing multiple fuel stems.

VLSFO pricing: a somewhat unexpected outsider

Selecting ten major bunker ports for the price analysis and ranking them by VLSFO price we found that Singapore, and for some buyers rather unexpectedly, appeared to be at the bottom of the table in the past couple of months meaning it is the most expensive port out of the ten for lifting VLSFO bunkers.

In general, it appears that the ports in the West have cheaper VLSFO bunkers than the ports in the East, however in both regions a number of changes occurred between June and August despite the somewhat muted activity in the market.

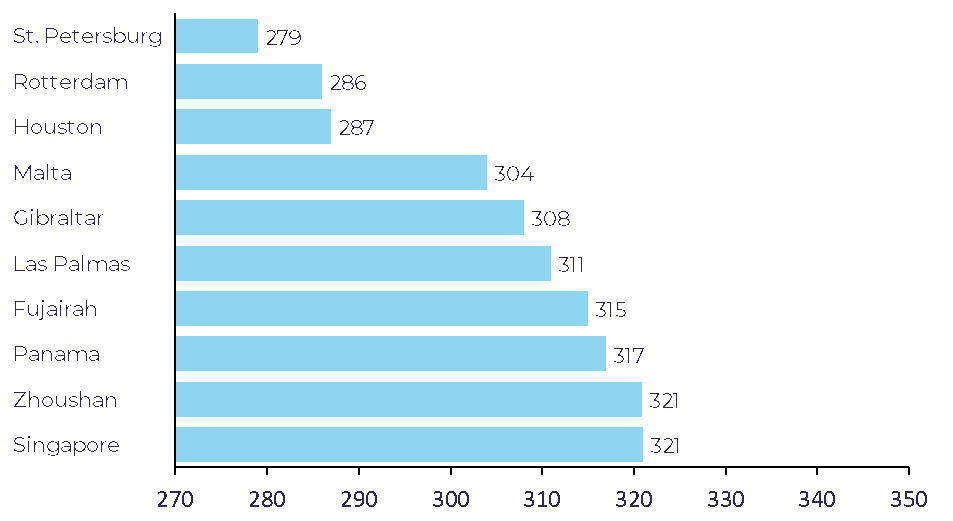

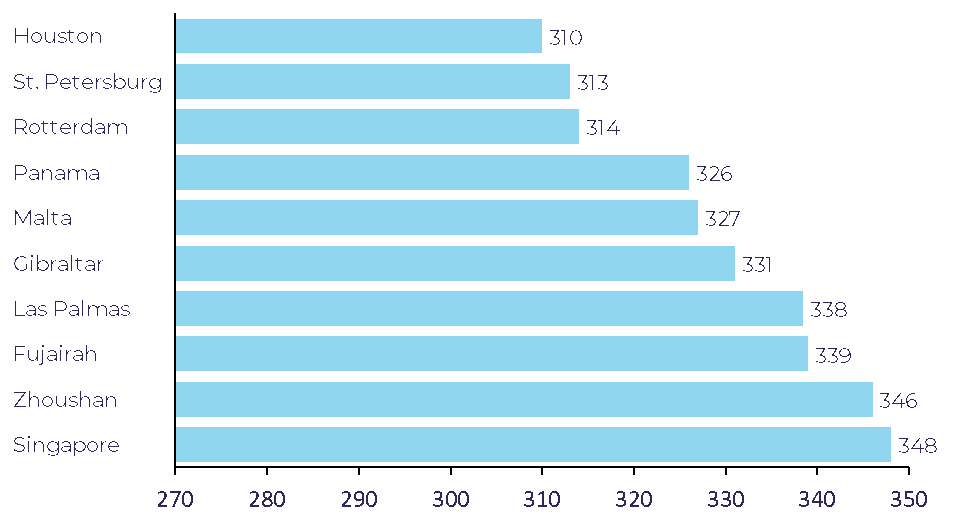

Looking back to June, of the ten selected ports, NW European and USG ports including Houston, Rotterdamand St. Petersburg, were the cheapest, while Singapore and Zhoushan had the most expensive VLSFO (Figure 1 below).

While the difference between the cheapest and the most expensive port shrank from around $200/mt in January to $40/mt in August, the decrease in freight rates emphasizes the importance of every little saving achieved.

Figure 2 shows the same ports ranked by VLSFO price in August to date.

Again, Singapore remains at the bottom of the ranking.While it may not be possible for vessels trading regionally to sail West to pick up cheaper bunkers, for vessels operating globally deviating from the usual buying patters may result in savings.

For example, before for a ship sailing West to East, Singapore was a natural stop for a bunker only call, while now it is worth checking whether a bunker load can be taken elsewhere on the route. Moreover, a rise in the number of quality issues has recently been recorded in Singapore, which is another reason to potentially look at the alternative ports for comparison on price and quality.

St.Petersburg appears to have lost its VLSFO price advantage over Rotterdam in August.While it used to be quite common for a vessel discharging in Rotterdam to lift bunkers in St.Petersburg if this was the next port, currently Rotterdam can provide a good alternative. Lifting in Rotterdam could also protect the buyer should the voyage orders change and the vessel is no longer heading to the Baltic.

The other location is Panama, which in June was in the top-3 of the most expensive VLSFO ports and by August became one of the cheapest making it more competitive with Houston.

Even in a quiet market, such changes happen on a weekly and even daily basis so keeping your options open and assessing prices not only in alternative regional ports but also on the other end of your voyage could result in savings.

While VLSFO by far is the main fuel these days, a large number of stems bought are actually dual fuel and in the case of a non-scrubber vessel that would be VLSFO and LSMGO, while for a scrubber fitted vessel that would most likely be HSFO and LSMGO.

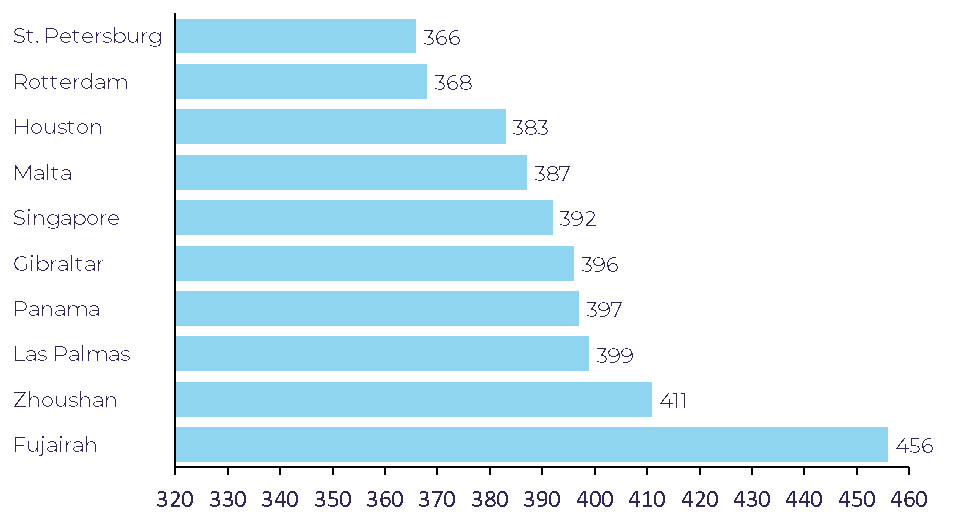

LSMGO pricing: do not get caught with expensive gasoil

Taking the same ten ports and raking them by the price of LSMGO, the picture is somewhat different (Figure 3 below).While the cheapest ports are still in NW Europe, Fujairah is by far the most expensive, and with Singapore being somewhat in the middle.

It is also worth noting that since June there has been little change in the port ranking based on the LSMGO price, which indicates that LSMGO price changes are less extreme.

While Fujairah may be almost $10/mt cheaper than Singapore on VLSFO, it is a whooping $60/mt more expensive on LSMGO. These differences should be taken into account when buying bunkers and they show the importance of calculating the volume weighted average price of the bunker fuel bought.

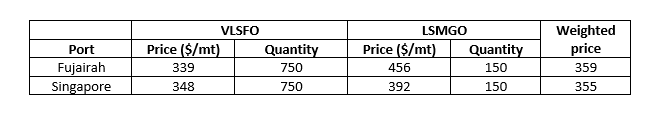

The importance of the weighted price average

For the dual fuel stems it is of great importance to calculate the average volume weighted price to ensure the cheapest bunker port is identified.We have seen on a number of occasions bunker buyers getting caught with buying one fuel cheap and then overpaying on the other and this is currently the case in a number of ports globally.

Figure 4 shows the comparison between Fujairah and Singapore and while VLSFO in Fujairah can be bought almost $10/mt cheaper than in Singapore, LSMGO in Fujairah ismore than $60/mt more expensive.

For a rather typical stemcomprising of 750mt of VLSFO and 150mt of LSMGO, Singapore would still be the cheapest port given the high LSMGO pricing in Fujairah, saving the buyer $4 on every ton bought, which in this case adds up to savings in the region of $3,000.

Granted that in the current bunker market environment where the price spreads between different ports are often in single digits, this may not seem like great savings, however when oil prices rise (and eventually they will), these spreads may start widening and so increase the potential to either lose or save money depending on the buying approach taken.

Anton Shamray Senior Analyst P: +44 207 467 5856

E: anton.s@integr8fuels.com

We have finally seen some stability in bunker prices, but there is still a lot happening out there…….

July 27, 2020

Following on from our earlier Integr8 notes on developments in bunker prices, oil prices and the supply/demand fundamentals behind the oil industry, here we give an update on bunker pricing and some of the possible next moves in the market.

Introduction

After the extreme turmoil in the market in the first half of this year, we have just seen a 6-week period of relative calm. Oil prices have generally stabilized, with Brent just above $40/bbl and VLSFO in the $300-330/ton range (in Singapore), as seen in Fig 1. We are in that phase where oil demand is recovering, but there is no straight line out of this, and at the same time the OPEC+ group have successfully made huge reductions in oil production. These factors have lifted prices from their end-April lows and meant we have seen these past 6 weeks of near consistent pricing.

But this is by no means the end of the road. As we have outlined in previous notes, the overall oil supply/demand fundamentals will have the biggest bearing on prices in our markets and there is still a lot of uncertainty here. Total oil demand is rising, and this will push prices higher, but it’s a ‘bumpy road’ and it seems we are in for more localized or regional lock downs in many countries. Clearly the US, as the biggest consumer, will create the biggest headlines and is likely to have the biggest impact on price movements, either up or down.

Other factors putting an upwards spin on prices are the indications of successful vaccines being developed and the huge government and EU stimulus programs being put in place. Any combination of higher oil demand and any/all of these other factors will push oil prices above the low $40s we have seen for Brent in the past 6 weeks.

VLSFO and HSFO dynamics

The other side of the equation is oil supply. We have seen major OPEC+ production cutbacks, originally announced for May/June and then extended into July, but these are coming to an end and there is every indication that the group will increase output by around 2 million b/d from the 1st August. However, this is not a surprise and is largely already factored into current/futures prices. As long as Saudi Arabia and Russia appear to be co-operating, oil prices are likely to be supported.

Watching these oil demand and covid-19 factors, along with OPEC+ developments, will give the key indications for absolute oil prices. However, what is happening with oil demand is likely to have the biggest influence and this is most immediately visible through oil stocks data; this is why the US weekly oil stock levels are watched so closely and have so much price influence.

Over-and-above these key developments in absolute oil prices, there will be specific issues that will have a further impact on our market and bunker prices. The relative price for VLSFO against crude has moved to extremes. At the start of the year there was a huge VLSFO premium as IMO 2020 kicked-in, and it was trading up to 45% above crude (Brent). As the VLSFO market settled, this relationship eased to 110% of crude in late February. The enormous volatility in March and April stemmed from the impact of Covid-19 and the very weak position of crude, with a brief interlude in early April as crude strengthened temporarily ahead of Saudi Arabia and Russia finding an agreement to cut production from May 1st. It has been since these production cutbacks took place in May that crude has strengthened to the point where for the past 6 weeks VLSFO pricing relative to crude has been very low, at only 102%, as shown in Fig 2.

The nature of VLSFO typically as a blend means that as demand for gasoil/diesel, jet and gasoline increases, so the price of these products relative to crude will rise and this will also ‘pull-up’ the relative price of VLSFO to crude. So as oil demand increases and crude prices move higher, we could expect VLSFO prices to increase by even more, not back to the 130% plus levels to Brent, but certainly higher than the present 102%.

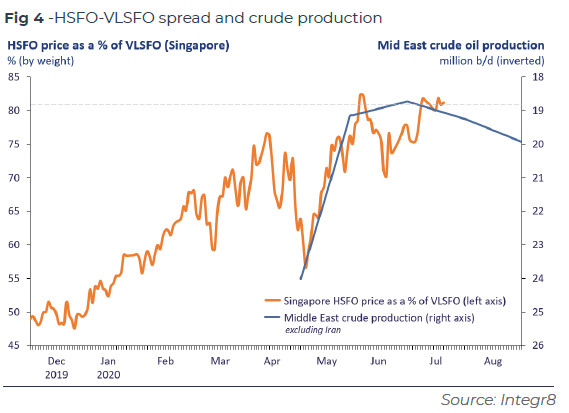

These factors that have ‘squeezed’ the relative price of VLSFO to crude are not as apparent in the HSFO market. It is the opposite here, and HSFO prices relative to crude are currently strong; this largely stems from the cutbacks in OPEC+ production, where a high proportion are heavier, high sulphur crudes from the Middle East, and this has meant a subsequent drop in HSFO supply.

This means we have been in a period where VLSFO prices are relatively weak and HSFO prices relatively strong. Hence, the differential between the two bunker products has narrowed considerably over the past few months, to only around $60-70/ton.

Focusing on the next 1-2 months, as some of the OPEC+ cuts are reversed from 1st August, so more heavy, high sulphur crudes will enter the market and the price of HSFO should ease relative to crude.

Fig 3 illustrates the HSFO price relationship to VLSFO in Singapore since late last year (the orange line & left axis) and how HSFO has moved from 50-60% of the VLSFO price to more than 80% of the VLSFO price today.

As outlined above, the cutbacks in OPEC+ production since 1st May will have supported HSFO prices and the blue line (right axis and inverted from high to low) shows Middle East crude production falling from 24 million b/d in April to only 19 million b/d by June at the same time as HSFO moved from around 55% of VLSFO to just above 80% of VLSFO (Fig 4).

The increase in Middle East production to around 20 million b/d next month is expected to reverse this relationship between VLSFO and HSFO.

Going forward

So, looking ahead over the short term we could expect this VLSFO/ HSFO differential to widen, as:

- VLSFO prices rise relative to crude as demand for all transportation fuels increase; and

- The relative price of HSFO to crude falls with the hike in heavy/ sour crude production from the Middle East (and other OPEC+ countries).

The VLSFO/HSFO spread is not going back to the $300 plus seen at the start of the year, but certainly wider than current levels. The forward curves for this spread are trading at close to $90/ton by the end of this year, and although this is never a forecast, it does illustrate the current market thinking that we are at a low in terms of this VLSFO/HSFO spread. Analysing the oil fundamentals is important, and we continue to monitor the extent of stronger oil demand and/or OPEC+ production levels, which in-turn will determine the absolute level of prices in the bunker market and also where the VLSFO/HSFO spread goes.

Steve Christy Director of Strategic Communications P: +44 207 467 5860

E: SteveChristy@navig8group.com

Are bunkers too easy a target when problems alleged onboard vessels?

July 22, 2020

Prior to IMO 2020 there was a lot of conjecture mingled with a fair spattering of trepidation as to the perceived level of quality issues we would see with many stakeholders suggesting significant problems were on the horizon using analogies of our old foe 1% Sulphur LSFO and the relatively recent Houston problem among others.

Overview

As it happened and as widely reported many of these gloomy predictions did not come to pass, Q1 2020 passed with all stakeholders relatively unscathed despite the new world of a patchwork quilt of VLSFO qualities. Things have changed more recently however with ARA being thrust into the spotlight as a result of high TSPs and an increase in the prevalence of Estonian Shale Oil in VLSFO blends.

Circumstances of high TSP of course allow the buyer to lodge a claim against the seller given the value exceeds a maximum contractual guarantee however what has become apparent is an increasing frequency of fuels that appear on specification to Table 2 parameters of ISO 8217 yet have been alleged to have caused fuel management related issues as well as equipment component damage.

Curiously still,many of these fuels when examined forensically have been found not to contain any sinister contaminants and do not correlate with a “problem” fuel according to testing experts.

Food for thought

It would of course be remiss of us to not acknowledge that problem fuels do exist and can result in difficulties or damage onboard vessels, however it is important to make the point that without adequate precautions even an on specification VLSFO has the potential to cause damage.

This is nothing new, indeed HSFO routinely contained 30 to 60mg/kg of Aluminium and Silicon (cat fines). Even these levels of abrasive catfines would have to be removed to below 15mg/kg by purification and of course if this was not efficient or effective then harmful particles could reach the engine resulting in catastrophic damage to cylinder liners etc.

Indeed whilst catfines are generally lower in VLSFOs almost a quarter of all VLSFOs however in Singapore for example still have catfines of greater than 40mg/kg and still require extensive purification.

This should not be too difficult a task given the lower density and viscosity of VLSFOs when comparing to HSFO but it is vital to remember that purifiers still need to be set up correctly considering the pour point of the fuel as well as its density and viscosity.

It is also entirely possible that the reason for a chocked purifier may be as a result of mixing with previous ROB, not in the storage tank – as this is hardly ever noted these days – but in the settling tank itself.

VLSFO’s also require to be injected at the correct viscosity, generally speaking most OEMs require a viscosity of 12cSt at the engine inlet. Indeed it may be that in extreme cases of low viscosity that this may not be possible to achieve without a cooler being employed or without being in close proximity of the pour point if it is waxy.

Finally, an increasingly new and important area of focus is engine lubrication and an increase in engine wear which may result should this not be optimized to the new fuels.

Prior to IMO 2020 It was well publicized that as an Industry we would have to move to a lower Base Number (BN) Cylinder Lubrication Oils (CLOs) given prolonged running on 0.5% Sulphur fuels however what appears to have developed is a pattern of vessels sufferingmajor engine damage since switching to VLSFO despite also all switching to BN 40 CLOs and all fuels meeting the ISO 8217 specification.

Evidence has been published of red tinged piston tops and abrasion as a results of calcium deposits which have not been removed due to the reduced detergency of BN 40 CLO’s.

Indeed you could argue that some of these issues were foreseen as early as March 2018 when MAN indeed recommended the introduction of Cermet (Chromium) coated piston rings at next overhaul given their experiences with ULSFOs. MAN have also issued a number of service letters in recent months describing the benefits including providing a “seizure resistant surface against the liner.. avoiding micro seizures and lowering scuffing risks”

Conclusion

Therefore all things considered, whilst it is absolutely prudent to put the fuel supplier on notice of alleged damage at the earliest opportunity so as to avoid the robust time bar clauses in the bunker contract we must not lose sight of the fact that these issues may well be as a result of other factors rather than the fuel itself.

It is therefore important to go into every investigation with an open mind, work on fact and not assumption, collate and document evidence which would survive robust cross examination and more importantly do so in a transparent manner.

Chris Turner Global Manager for Quality and Claims

P: +65 6622 0042

E: chris.t@integr8fuels.com

BDN’s in the spotlight: The hidden risks and losses associated with omissions or inaccuracies

July 15, 2020

There has been a lot of peering into the rear-view mirror in recent months as to IMO 2020 but what has remained constant has been the continuing spectre of Bunker Delivery Notes being found to be inaccurate or non-compliant.

In this article we will address the main issues we have found in our trading experience, the key implications and, of course, some advice on how to prevent this from affecting our bunker procurement.

The Problem

You could debate long and hard as to the reasonings why these vital documents often don’t stand up to scrutiny, the lack of regulation of suppliers at PSC level in many ports, the lack of awareness across stakeholders and worse still, a worrying lack of knowledge with respect to what fuel is actually being delivered – all of which may manifest into serious issues and losses for the end user.

Firstly with regard compliance to Marpol Annex VI , the latest amendments to Appendix V has been in place for well over a year and yet there remain examples where formats have not been updated to meet the new requirements and even when this has occurred it is frequently noted that neither the barge or vessel crew appear able to ensure the BDN is completed correctly by ticking the correct box or something as simple ensuring a Marpol sample seal is documented.

We must assume that enforcement will gather speed once COVID19 restrictions ease and as a result incomplete and non compliant BDNs will undoubtedly cause owners issues in the coming months, particularly if they have not raised the issue at the time by means of an LOP and reported deviations to flag state.

Secondly the accuracy of data within BDNs continues to result in technical and commercial challenges and at worse losses. Indeed just at the time the industry is crying out for data transparency we have as much opacity as ever.

What data shows

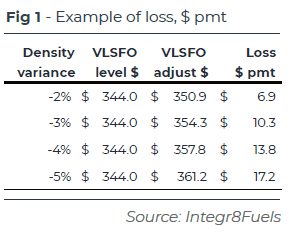

For example, a recent study by Integr8 fuels covering over 10,000 samples suggested that hotspots exist when it comes to BDN inaccuracies. Density in VLSFOs for example in Hong Kong is routinely found to be 2% higher on average than the owners analysis. Under current market conditions this can easily account for $7 to $9 and in extreme cases a quite eye watering $18 to $20 per tonne which as a buyer cannot be ignored when comparing prices across ports and suppliers.

Inaccurate Densities can also result in intake issues onboard vessels with miscalculations entirely possible with larger stems resulting in at best a less than stemmed delivery or at worse the possibility of a tank overfill.

It has also been well published in recent months that other key parameters of VLSFOs are very different to that of HSFO. Viscosity for example is averaging less than 100cSt but from time to time we still see an arbitrary 380cSt recorded on the BDN. This can result in conventional purifiers not being set up correctly resulting in a loss of efficiency during purification and possibly damage to equipment onboard as a result.

Indeed Pour Point, one of the key variables in VLSFO is only routinely recorded on BDNs in Singapore. This is particularly important given the paraffinic nature of VLSFO and the need to maintain a fuel at least 10

deg C above its pour point.

Absent owners test results we recommend the fuel is maintained onboard at the delivery temperature until such time it can be confirmed.

Finally we cannot underestimate the need to request Certificates of Quality prior to delivery and cross compare against BDN data. The vessels crew are the first line of defence and if tasked correctly can be a very effective one.

Conclusion

In closing we cannot underestimate the need to request Certificates of Quality prior to delivery and cross compare against BDN data. The vessels crew are the first line of defence and if tasked correctly can be a very effective one.

However in order for the crew to do this we have to collectively give them the tools to complete the job, namely training and awareness.

From the buying perspective the issues highlighted only go to reinforce the need to use data to buy smartly in this highly challenging and complex environment.

Chris Turner Global Manager for Quality and Claims

P: +65 6622 0042

E: chris.t@integr8fuels.com

Fuel oil tightness means shipowners pay more for bunkers in ARA

July 7, 2020

This year so far has been full of events which have affected many global markets, including the bunker market. While the spread of Covid-19 reduced crude oil demand, the production cuts changed not only the supply of crude oil but also its composition.

As a result and driven by the changes in pricing, some refiners started to purchase more light crude yielding little residual output, which goes into HSFO and VLSFO production. Bunker prices have already reacted, particularly in ARA, where the HSFO and VLSFO discount to other ports seems to be narrowing giving suppliers in other locations a chance to compete on the price.

OPEC+ cuts affecting fuel oil supply

Crude oil demand fell sharply on the back of the Covid-19 lockdowns and prices followed, at some point down to low teens.

For many oil producing states such low prices were a major blow to the budget so to rescue the situation the OPEC+ countries cut production with the majority of these cuts being for medium and heavy crudes, rich in fuel oil.

Elsewhere, medium and heavy crude oil production fell naturally, while the production of light crude dropped less significantly changing the global crude oil composition. Crude oil prices reacted accordingly.

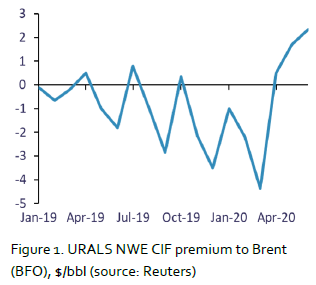

A good example is Russian URALS (which is a medium grade) that is now selling to North West Europe (NWE) at a significant premium over Brent (Figure 1).

Paying more for crude affects refining margins, so some refiners in North West Europe started to purchase more light crude from the US and West Africa and subsequently produce less fuel oil.

Fuel oil bunker discount narrowing in ARA

The shortage of fuel oil is already visible in bunker pricing in ARA and in an increase in imports. While Russia remains the main supplier into the region, a number of rare fuel oil cargoes are expected to arrive from the Americas.

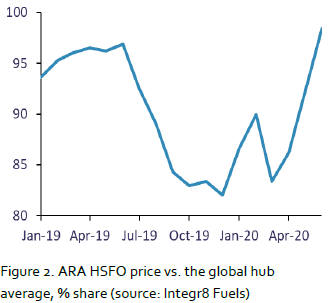

The tight fuel oil supply is affecting ARA bunker prices, particularly for HSFO which have recently increased and are now at parity with the other hubs (Figure 2) .

While HSFO constitutes a small proportion of the global bunker demand, there is evidence that VLSFO prices are also affected, although to a smaller extent.

The reason for VLSFO being less affected is that generally it is a blended product meaning many different streams go into production. These could be residual, distillate and others. However, when residual components become relatively more expensive, some producers may start looking for cheaper alternatives with the potential impact on quality and an increase in off-specs.

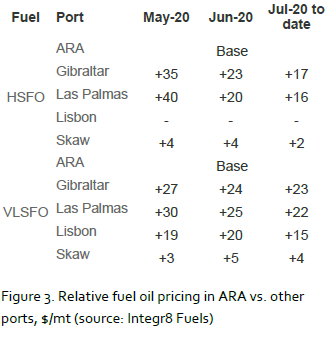

The ARA fuel oil tightness also means owners may have to pay more in relative terms for their bunkers. Figure 3 (below) shows the narrowing discount for residual bunker fuels in ARA compared with some other and often competing ports.

The HSFO discount to Gibraltar and Las Palmas more than halved between May and early July. The VLSFO discount has also declined.

The table shows the average prices which do not reflect the variance between suppliers meaning that should this trend continue, there is a higher likelihood of suppliers elsewhere potentially able to offer competitive prices vs. ARA.

Previously, for vessels going to a port in ARA the bunker buyer would not normally consider bunkering elsewhere (unless for operational reasons), however currently we recommend checking the price in alternative ports.

Fuel oil tightness expected to reverse longer-term

While it is possible that the current fuel oil tightness lasts for a number of months, the expectation is that it may reverse afterwards. As OPEC+ is expected to gradually reduce the crude oil cuts pushing more medium and heavy crudes to the market, the US light crude oil production may see further declines given the sharp contraction in new oil well drilling.

Therefore, it is likely that in the near term fuel oil tightness may occur in other locations, just like it is happening in ARA, so keeping an eye on pricing and being open-minded about where to bunker can save shipowners money.

Anton Shamray Senior Research Analyst

P: +44 207 467 5856

E: anton.s@integr8fuels.com