BDN’s in the spotlight: The hidden risks and losses associated with omissions or inaccuracies

There has been a lot of peering into the rear-view mirror in recent months as to IMO 2020 but what has remained constant has been the continuing spectre of Bunker Delivery Notes being found to be inaccurate or non-compliant.

In this article we will address the main issues we have found in our trading experience, the key implications and, of course, some advice on how to prevent this from affecting our bunker procurement.

The Problem

You could debate long and hard as to the reasonings why these vital documents often don’t stand up to scrutiny, the lack of regulation of suppliers at PSC level in many ports, the lack of awareness across stakeholders and worse still, a worrying lack of knowledge with respect to what fuel is actually being delivered – all of which may manifest into serious issues and losses for the end user.

Firstly with regard compliance to Marpol Annex VI , the latest amendments to Appendix V has been in place for well over a year and yet there remain examples where formats have not been updated to meet the new requirements and even when this has occurred it is frequently noted that neither the barge or vessel crew appear able to ensure the BDN is completed correctly by ticking the correct box or something as simple ensuring a Marpol sample seal is documented.

We must assume that enforcement will gather speed once COVID19 restrictions ease and as a result incomplete and non compliant BDNs will undoubtedly cause owners issues in the coming months, particularly if they have not raised the issue at the time by means of an LOP and reported deviations to flag state.

Secondly the accuracy of data within BDNs continues to result in technical and commercial challenges and at worse losses. Indeed just at the time the industry is crying out for data transparency we have as much opacity as ever.

What data shows

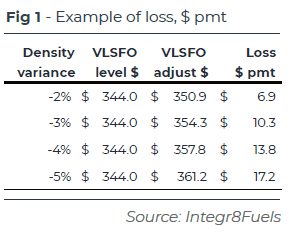

For example, a recent study by Integr8 fuels covering over 10,000 samples suggested that hotspots exist when it comes to BDN inaccuracies. Density in VLSFOs for example in Hong Kong is routinely found to be 2% higher on average than the owners analysis. Under current market conditions this can easily account for $7 to $9 and in extreme cases a quite eye watering $18 to $20 per tonne which as a buyer cannot be ignored when comparing prices across ports and suppliers.

Inaccurate Densities can also result in intake issues onboard vessels with miscalculations entirely possible with larger stems resulting in at best a less than stemmed delivery or at worse the possibility of a tank overfill.

It has also been well published in recent months that other key parameters of VLSFOs are very different to that of HSFO. Viscosity for example is averaging less than 100cSt but from time to time we still see an arbitrary 380cSt recorded on the BDN. This can result in conventional purifiers not being set up correctly resulting in a loss of efficiency during purification and possibly damage to equipment onboard as a result.

Indeed Pour Point, one of the key variables in VLSFO is only routinely recorded on BDNs in Singapore. This is particularly important given the paraffinic nature of VLSFO and the need to maintain a fuel at least 10

deg C above its pour point.

Absent owners test results we recommend the fuel is maintained onboard at the delivery temperature until such time it can be confirmed.

Finally we cannot underestimate the need to request Certificates of Quality prior to delivery and cross compare against BDN data. The vessels crew are the first line of defence and if tasked correctly can be a very effective one.

Conclusion

In closing we cannot underestimate the need to request Certificates of Quality prior to delivery and cross compare against BDN data. The vessels crew are the first line of defence and if tasked correctly can be a very effective one.

However in order for the crew to do this we have to collectively give them the tools to complete the job, namely training and awareness.

From the buying perspective the issues highlighted only go to reinforce the need to use data to buy smartly in this highly challenging and complex environment.

Chris Turner Global Manager for Quality and Claims

P: +65 6622 0042

E: chris.t@integr8fuels.com

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.