Minimising density discrepancy to achieve bunker savings

May 10, 2021

With the rise in bunker prices, shipowners are increasingly focusing on achieving savings when buying fuel, particularly in the shipping sectors where earnings have not shown similar growth. This time we look into the importance of minimising the discrepancy between the BDN (bunker delivery note) and the tested density, also called density short lift, as well as highlight the best and the worst performing ports and discuss the options the shipowners have to manage this risk.

Higher bunker prices push to focus on savings

Bunker prices have been on the rise following the increases in Brent. This happens as oil demand continues to recover, despite the surge in the covid-19 cases in several countries.

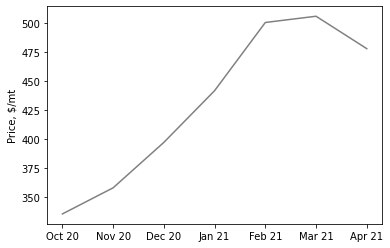

Figure 1: Average VLSFO monthly delivered price in Singapore (source: Integr8 Fuels)

As seen on Figure 1, the average VLSFO price in Singapore increased by over 40%, from around $335/mt in October to $480/mt in March, with a small correction in April, although recently Brent achieved a new multi-year high of around $70/bbl. The same pattern is seen around the ports globally.

As demand continues to recover, oil prices are likely to carry on going up, particularly as it is believed supply may not be able to react quickly to the changes in demand.

Goldman Sachs in its recent oil price forecast expect Brent to reach $80/bbl over the next six-month period, which will in turn continue pushing bunker prices higher with shipowners increasingly looking to make fuel bill savings.

In the previous articles we covered a number of ways to achieve such savings, from being flexible on the bunkering port and going beyond the main hubs to buying on calorific value and ensuring a longer lead time to avoid the prompt premiums. Another way to save money is to minimise the discrepancy between the BDN and the tested density.

Density short lift control as a way to reduce bunker bill

As bunker fuel is most often sold by metric tons, it is not only important to have the correct measurements of the volume and temperature taken before and after the transfer of the bunker fuel, but also to have the accurate density stated in the BDN as this directly impacts the metric tons bought and paid for.

Figure 2: Average difference between BDN and tested density in Jan-Apr 2021 (Source: Integr8 Fuels)

On average, as seen from Figure 2, the discrepancy between the BDN and the tested density is close to zero meaning that for a truly globally trading (or rather bunkering) fleet not much savings can be achieved here. The reality however is that a large share of the global fleet operates between or within a particular region and depending on the trade, the fleet could be exposed to buying in a limited number of ports with significant density short lifts.

Having analysed over 30,000 fuel quality tests as well as BDNs of over 4,000 stems covering the first four months of 2021, three Brazilian ports came at the top of the list, meaning that on average when buying bunkers in these ports the tested density of the fuel is higher than the density stated in the BDN, meaning a gain for the shipowner (Figure 3).

Figure 3: Top 3 and bottom 3 ports by density short lift in Jan-Apr 2021 (Source: Integr8 Fuels)

On the opposite, there was on average an over 1% density loss on the fuel bunkered in Hong Kong, Colombo, and Port Klang. In comparison, the average density discrepancy in Singapore is around 0% due to the use of mass flow meters. The fast-growing bunkering hub of Zhoushan has an average density discrepancy of -0.28%.

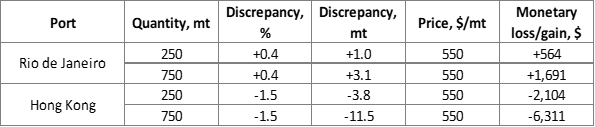

The scale of the gains and losses can be estimated through the examples shown in Figure 4.

Figure 4: Examples of density discrepancy gains and losses

In Rio de Janeiro, buying 750 mt of VLSFO at the current price would on average have resulted in an over $1,500 gain for the shipowner. While this is a somewhat extreme case, shipowners will still benefit from buying bunkers from all the other ports with positive density gains; examples would be Tenerife, Kingston, Santos, Barcelona, Lisbon, and others.

In Hong Kong a 750 mt VLSFO stem would on average result in an over $6,000 loss for the owner and this multiplied by the number of stems and vessels bunkered per year can add up substantially.

There are a number of reasons why some ports may have larger density discrepancies than others. It is often the case that a generic density is used in the BDNs across bunker deliveries, while the individual batches’ density may vary. It may also be down to lab testing or in some cases such discrepancies are simply the result of buying from the less reliable suppliers.

This is not to say that shipowners should avoid certain ports or suppliers, but to make the necessary adjustments to the quoted price with the density short lift in mind. When buying bunkers, it is often a dollar or two per mt that tips the scale in favour of a certain supplier or trader, and these could easily be “hidden” in the fuel’s density.

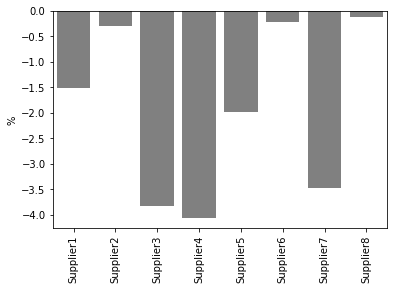

Figure 5: Suppliers in Hong Kong by average density short lift Jan-Apr 2021 (Source: Integr8 Fuels)

Even in Hong Kong, a port with a high average density short lift, shipowners should consider looking at the individual suppliers before fixing. Figure 5 shows that supplier 2, 6 and 8 are actually within the global average when it comes to the density short lift, however others may result in losses if such a difference is not reflected in the quoted price.

While it is not easy to avoid density short lift loss, there are some steps that shipowners can take to minimise it.

One way is for the shipowners to collect, structure and analyse the BDN and quality test data for their own fleet. This data could be consulted prior to enquiring or fixing a stem to see if there have been any recent cases of density discrepancy and if so, how these may affect the quoted price. Besides using the data, building trust and relationships with suppliers have been and will continue to be key.

Lastly, minimising density short lift is one out of the many solutions shipowners could use to achieve the bunker bill savings. Ideally, a combination of them should be used however this requires handing a vast amount of data and conducting continuous research and analysis, which could both be done in house or outsourced to an intermediary. Whatever the approach is, with the increasing bunker prices the desire to achieve savings will only grow stronger.

Anton Shamray, Senior Research Analyst, +44 207 4675 856

E: anton.s@integr8fuels.com

Bunker prices are back to their pre-pandemic levels; What should we look out for in the next 12 months?

April 14, 2021

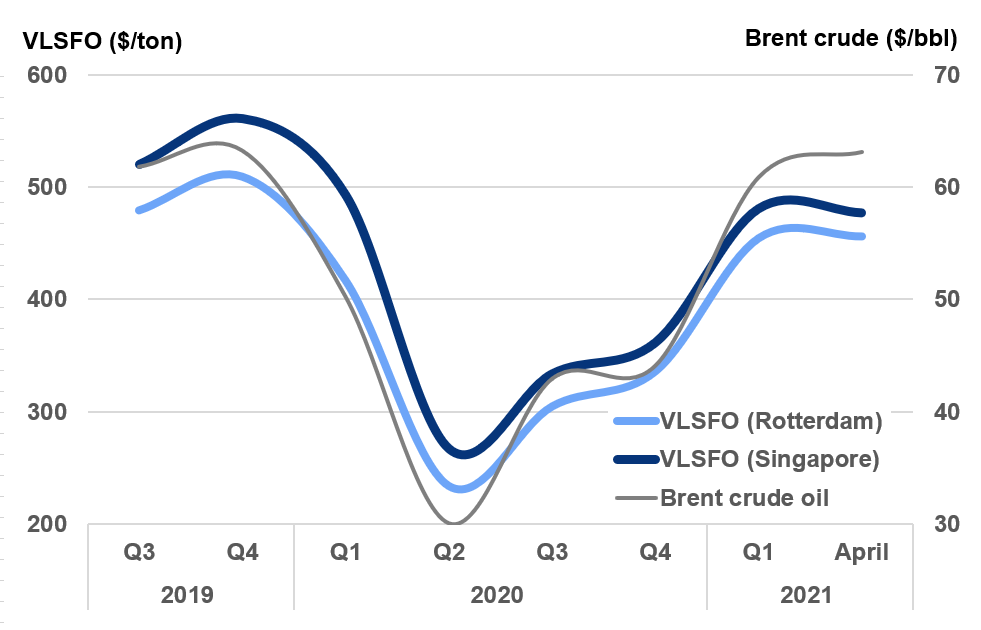

Brent crude oil prices are now back to the low $60s and where they were at the end of 2019, before the pandemic hit.

Although VLSFO price quotes are not quite back to earlier levels, part of this will be because of the market assessments and initial introduction of the VLSFO grade at end 2019/early 2020; in general terms we are back where we started.

After prices more-or-less halved in the first 3 months of 2020, the huge shifts in global oil supply & demand over the past 9-12 months have led prices back up.

Major cutbacks in crude oil production from the OPEC+ group, plus production losses because of low prices, principally in the US, have pushed prices higher. At the same time, oil demand has increased since the Q2 2020 low, although this has generally been slower than most people expected, with second and potential third waves of the virus. Nonetheless, demand is rising and the introduction of vaccination programs is supporting higher demand and higher prices.

This prompts the question: after the most turbulent 12 months in recent history, what should we be looking at for bunker price direction in the coming 12 months?

Bunker Demand & prices compared with the rest of the oil market

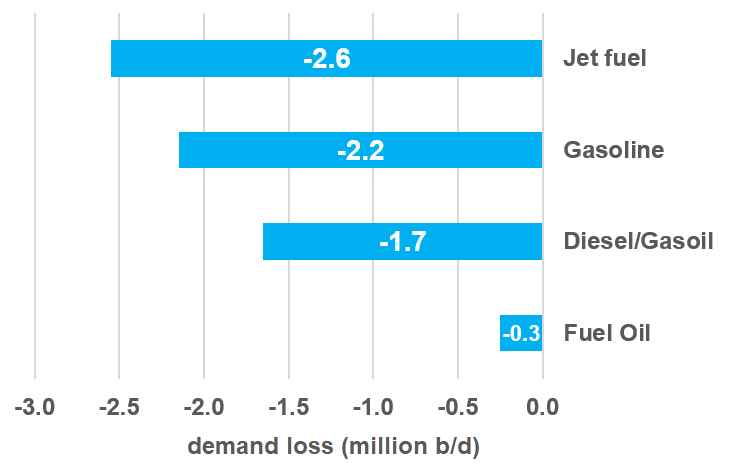

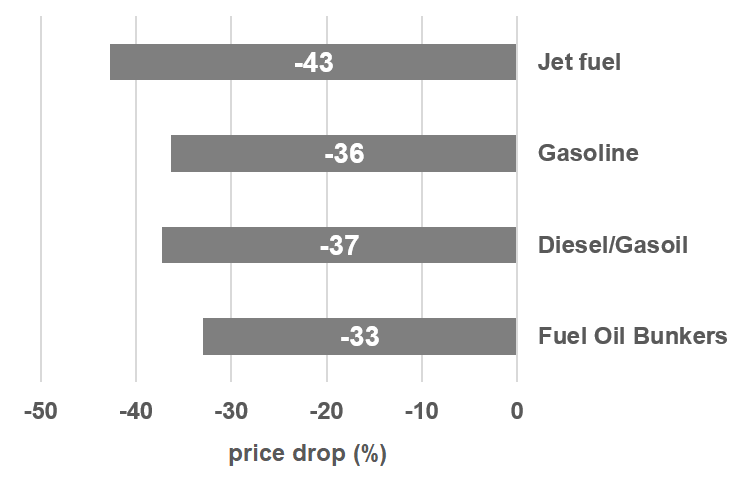

As always, the answers lie outside our markets. In fact, the bunker market has been one of the least affected sectors in terms of the demand impact from the pandemic. However, price falls for bunkers have been similar to crude oil, gasoline and diesel/gasoil, where the loss of demand has been far greater; we are not an ‘isolated’ market and it is what is happening in the other areas of the oil industry that almost entirely determine the absolute price we pay for bunkers.

Putting this in context, jet fuel has taken by far the biggest hit in demand because of the pandemic. Demand for jet in the main markets of the US, Europe and Asia was down by 2.6 million b/d (42%) in 2020. In contrast, fuel oil demand in the same area dropped by only 0.3 million b/d (7%). The volume demand impact on gasoline and diesel/gasoil lay somewhere between these two extremes.

However, these relative shifts in demand are ‘lost’ when it comes to price movements. Jet prices did fall by slightly more than other products, but price falls in the gasoline, diesel/gasoil and bunker markets were all very similar, at around 33-37% lower in 2020 than in 2019.

The inter-relationship between product prices and what happens within the refinery means prices in the bunker market are always going to reflect what is happening across the entire oil barrel.

It is worth noting that these ‘big issues’ will always be the main driver for the underlying price of bunkers, but there is also a ‘fine tuning’, with changes in the relative price of products. In fact, going forward the relative price of VLSFO could rise as gasoline demand picks up, with VGO shifted away from bunker blending to what was its typical use as a feedstock to produce gasoline.

What is happening to world oil supply?

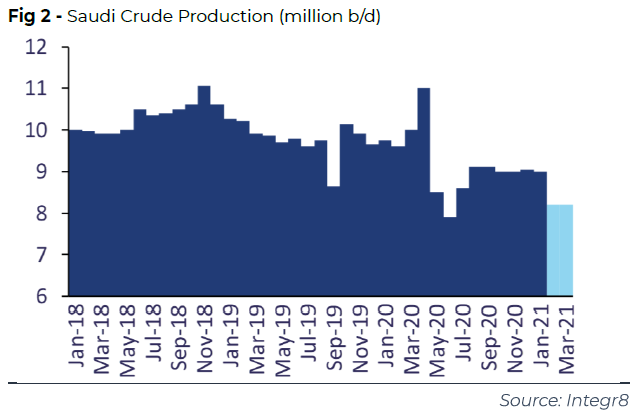

On the oil supply side, indications are that crude production will increase, at least through to July. This follows the recent OPEC+ decision at its April 1st meeting to allow a staged increase of 1.1 million b/d from the quota allocations. In addition, Saudi Arabia is easing its additional voluntary cutback of 1 million b/d over the same period. Therefore, an additional 2.1 million b/d crude production is likely within the next 3 months.

The OPEC+ group is on a planned easing of their production cutbacks. However, some industry participants were slightly surprised by the decision, given that oil prices had already eased back by $5/bbl in the 4 weeks leading up to the meeting, and that there were further concerns surrounding the demand rebound, especially with another wave of lockdowns and a slower than anticipated vaccine uptake in Europe.

There is also another potentially bearish price indication on the supply side, with the possible return of the US to the Iranian nuclear deal. This is not immediate, with preliminary, indirect talks only starting earlier this month. However, further negotiations are planned and any indication of an agreement and easing of sanctions will have a bearish sentiment on prices, with the prospects of at least another 1 million b/d of Iranian crude entering the market.

There is also a risk that this goes beyond just these incremental Iranian supplies, or that these are heavy, higher sulphur crudes, with possible political ramifications involving Saudi Arabia’s oil policies.

From the crude supply side, it does look like more volumes are coming and this could put downwards pressure on prices generally. The focus for us will be on any further OPEC+ decisions and importantly, the triangular politics between the US, Iran and Saudi Arabia and what this may mean for Iranian and Saudi crude exports.

Where is the growth in world oil demand coming from?

If supply is likely to increase, then it is down to a more positive outcome on the demand side to counter this if prices are to rise. In the past month this hasn’t really been the case and Brent crude has fallen from a (strong) peak of $70/bbl in early March to $63/bbl more recently. The same kind of drop has taken place in the bunker market, with VLSFO in Singapore down by $40/ton in the past 5 weeks.

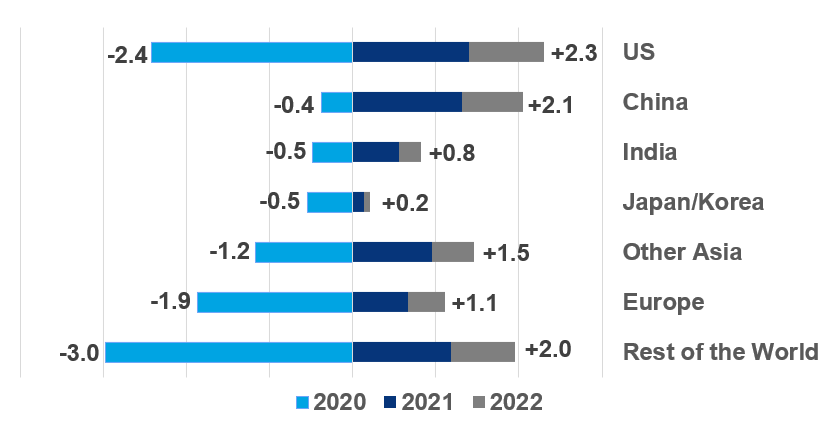

The prospects for further gains in oil demand are very much focused on a region-by-region approach. China and the US appear to be the ‘stand-out’ areas for increases in oil demand, where-as in Europe the concerns about the current surge in infections and more lockdowns make any strong demand gains here more unlikely.

In the US, the mass role out of vaccination programs, coupled with the announced $1.9 trillion fiscal stimulus policy is expected to get oil demand rising steeply. The net result is that the 2.4 million b/d loss in US oil demand in 2020 is expected to be more-or-less made up by end 2022 (+1.4 million b/d this year and another 0.9 million b/d gain in 2022). In China the market indications are even stronger, with the 0.4 million b/d demand loss last year already more than covered and the country well into ‘growth mode’.

The rest of Asia (excluding Japan and Korea) is also projected to increase its demand for oil well above the 2019 levels, although current higher infection rates in parts of India could mean a slight risk in the near term. Elsewhere, demand prospects in Japan/Korea and Europe look as though they will remain very constrained and well below pre-pandemic levels.

In terms of individual products, gasoline and diesel/gasoil demand on a global level is expected to return to 2019 levels next year. It is the global jet market that is still taking the brunt of the demand loss and is not expected to fully rebound until 2023/24.

As outlined above, any loss of demand in our market has been limited and consequently there is no ‘rebound’ to take place. Total demand for bunkers is seen as relatively stable, but with the much stronger prospects in Asian economies, demand and trade, bunker demand east of Suez is likely to grow far more than west.

Can demand increases in China & the US exceed production increases in OPEC+ (and Iran)?

Bringing these fundamentals together highlights the market uncertainties we are facing. At a high level there will be a strong focus on demand prospects in the US and China countering the anticipated increases in crude production. Within these very broad parameters, how quickly (or not) the aviation industry can get flying and the US stance to the Iranian nuclear position will also have a huge bearing on price direction.

The forward curve is never a good forecast of where things are going, but it does represent a measure of sentiment at a given time and currently there is a slight bearish tinge to the curves. Even price forecasters have adopted a very cautious approach, with a number showing flat to slightly declining prices over the next 12 months.

With a number of extremely influential factors still to be determined, the key known issues to watch for are: the US economy/demand, China, OPEC+ and the ‘curved ball’ of Iranian sanctions being lifted and any potential political fallout from this, if it happens.

The current forward curve shows a gentle decline in prices over the next 12 months; looking at the factors outlined in this note, it doesn’t look like a ‘gentle’ period of pricing ahead of us.

Steve Christy

E: steve.christy@integr8fuels.com

VLSFO then, now and next

April 8, 2021

Twenty-one months ago seems an eternity given the challenges the world now faces yet I clearly recall sitting on a trading floor and hearing excited chatter that enquiries were being received for VLSFO. I have to say I gave a little sigh of relief to think that buyers were indeed proactively planning for what many of us will ultimately define as one of the biggest challenges within the industry and our careers, the IMO 2020 changeover.

Short term teething

Whenever a specification makes a step change it is quite normal for this to be accompanied by a spike in reported problems and / or claims and the IMO 2020 changeover was no different.

Trains of thought differ as to how and why this occurred, but from my perspective I would suggest this was perhaps as a result of Sulphur cross-contamination or compatibility issues either within the supply chain or even, occasionally in a continuous drop sampler resulting in false elevated Sulphur results. It was however reassuring to note that these quickly settled down and to see that suppliers were not necessarily blending to the hilt, targeting 0.47% weight instead of 0.50% weight Sulphur.

The lack of availability was also championed by many an industry voice as a major challenge, whether it be for HSFO or VLSFO depending on which camp you were stationed in.

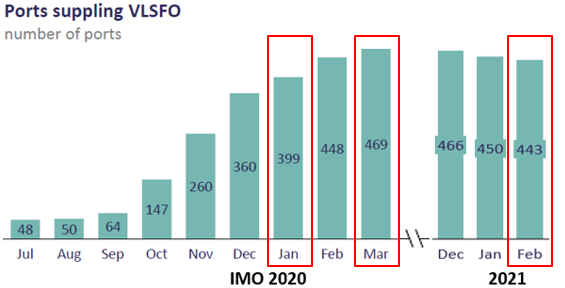

Thankfully again neither availabilities for HSFO or VLSFO were too badly affected with VLSFO ports rapidly ramping up to more than 400 globally.

As for unavailability, the simplest way of tracking this was via the IMO website and specifically the number of FONAR’s (Fuel Oil Non Availability Reports ) lodged which quickly fell away from around 50 in January 2020 to less than a handful by April 2020.

Bumps in the road

In most years we routinely face bumps in the road but in 2020 a proverbial sinkhole appeared in the shape of COVID-19.

Bad news on the Television eventually made their way into our day to day, challenging not only how we work but where we would work.

Again I can only praise the resilience of the industry in general when looking back on some of the unexpected consequences of COVID-19.

One of the first alerts raised was the possibility of vessels storing fuels for far longer than anticipated, resulting in degradation . Thankfully this did not result in too many issues from our perspective but the storage temperatures of the “goldilocks” fuels (as they have been so eloquently recently christened) remains important to carefully manage – Like the porridge in the story, not too hot, not too cold but just right.

Another consequence was the lack of demand for road fuels challenging the bunker space with VGO flowing into the marine pool rather than the catalytic cracker and as a result spiking paraffinicity and Pour Point.

As the price crack narrowed between VLSFO and MGO the residual pool unsurprisingly became a new home for distillates, this tracked by significantly lower viscosities across Q1 and Q2 of 2020, although these have since recovered.

As for Quality, Claims have been sporadic to this point mainly revolving around Stability, Sulphur non-compliance or Water content, but in early May ARA was significantly affected by TSP issues

Any Alleged difficulties onboard also generally revolved around change-over or handling practices which from experience on occasion did not move with the changing goalposts as a result of the new fuels.

Where are we now?

The sheer variance of VLSFOs from port to port continue to challenge all stakeholders across the industry, especially In addition to the well known and documented stability challenges where questions remain as to the long-term stability of VLSFO. Unfortunately this has not been helped by inconsistent cold flow advice being provided to end users which may result in further fuel degradation.

It is true VLSFOs are waxier but we must balance the temperatures of storage and purification to the animal itself and not just the waxes as we may inadvertently tip the fuel over the edge from the point of thermal stability with it falling apart as a result.

That said, the knowledge of Wax Appearance Temperature (WAT) and Wax Dissolution Temperature (WDT) are useful to know but I remain concerned too much bias is given towards them from some quarters.

After all WAT is simply the point at which, when cooling the first wax crystals detected and WDT the point waxes are last detected when heating the fuel.

Low Viscosity combined with the higher storage temperatures needed due to the waxy fuels may result in fuels becoming non-homogenous across the supply chain.

These conditions create the possibility of creating a settling tank scenario, allowing particles/water/metals etc to settle out due to the bigger density differential from VLSFO to Water 0.945 Kg/Ltr v 1.00 kg/Ltr compared to 0.99kg/Ltr v 1.00 Kg/Ltr for HSFO which could result in some very poor fuels making their way to a vessel, if for example a shore tank is on low suction – where such contaminants will concentrate.

A Silver lining however here is that from a claim’s perspective the runnier and lighter VLSFO does allow for the more efficient removal of contaminants such as elevated Aluminium and Silicon which may be a way of preventing costly and litigious Debunkering’s.

From time to time we also have our heads turned technically by what appears to be very aggressive blending.

These fuels tend to be present in more outlying ports than the blending hubs but have been noted to have Viscosity as low as 5 cSt and Pour Point at the same time being 30 Deg C.

Such fuels create an impossible position for the Chief Engineer when trying to meet Original Equipment Manufacturers (OEM) requirements for Purification or Injection (which require 20cSt and 12cSt respectfully) as the settings onboard needed to achieve the viscosities are impossible to achieve given the fuel would already resemble a candle at the corresponding temperatures required. It is arguable that the industry did not see this coming.

Where are we heading?

The industry continues to cry out for transparency across the supply chain rather than the historic opaque world of smoke and mirrors. Interestingly COVID-19 may have provided a catalyst for the industry to work more remotely and with that move with the times technically.

One such development is the use of electronic BDNs or documentation and this, combined with traceable and regulated measurements (such as in Singapore) may ultimately negate many of the safety issues associated with access and egress to vessels and barges and may also ultimately provide for efficiency savings too.

This would of course not be an overnight fix, the industry has some way to go to compete with the level of traceability that the aviation industry has for example, but I do not think we are too far away from a ‘blockchain’ type scenario where the end-to-end traceability removes many of the historic BDN inaccuracies or malpractice concerns.

Pricing and commercial factors will continue to challenge the bunker space and blend recipes as a result. Given the growing crack between MGO and VLSFO It would not be entirely unexpected to see Sulphur climbing towards the 0.50% limit with infractions creeping up nor would it be unexpected to see water content increasing.

Thankfully, we are yet to see wholesale evidence of obscure cutters making their way into the market, similar to the Houston problem – we can but hope lessons were learned in 2018.

As for the direction of travel for ISO 8217 Specifications, as already mentioned no one predicted a fuel could be sold as a 380cst RMG with a viscosity of 5cst yet it has come to pass.

Commercially there is nothing to stop this but ultimately operationally such fuels can create huge challenges. Therefore minimum viscosity specs would be a sensible addition with table 2. Of ISO 8217.

We also cannot forget that operational set ups have changed significantly with fuels no longer being purified at high temperatures (98 deg c) – due to lower viscosities, and this creates the argument that the TSP test (which uses 100 deg C) is not mirroring what we are actually doing onboard.

Ultimately however until such time that we as an industry move to a single latest specification we will never rid ourselves of the challenges that historically remain, within the almost 16 year old ISO 8217:2005 for example. Indeed driving change on this level from Refinery to the Hull of the ship, in doing so spanning bunker contracts and charter parties alike is the only way to finally resolve this situation.

And last but not least, We cannot forget the drive for the industry to reduce Carbon Emissions, one of which Is Bio-fuels and with these in mind I want to raise awareness of the likely increase of biofuels in certain tonnages going forwards.

This may be particularly relevant for the older tonnage as they pave the way to meet Carbon Reduction targets without expensive retrofits (ammonia/methanol etc) and ultimately prolong the lifespan of the ship.

This will however again need wholesale changes, including specifications and tact in the industry in general given some of the recent GCMS alerts raised are for exactly the components we will inevitably be blending.

Until the next time, stay safe.

Chris Turner Manager – Bunker Quality and Claims P: +65 6622 0042

E: chris.t@integr8fuels.com

Australian refinery closures are evidence of a new wave of industry consolidation

March 25, 2021

Covid-19 has left refiners in a precarious position, but the impact of Australian closures is positive for product tankers.

The COVID 19 pandemic has resulted in one of the worst years refiners have ever faced. The catastrophic loss of nearly 10 million b/d of global oil demand has led to many refiners idling until economic conditions improve. That alongside a structural oversupply in refining capacity means the industry faces continued tough times for the next few years.

And with the continued addition of complex, integrated refining and petrochemical complexes in China and the Middle East, it is the marginal refiners that are less complex, located in Asia, Australasia and the Atlantic basin that will lose out. In addition to a recent spate of closures in Australia, the Marsden Point refinery in New Zealand has been operating at reduced rates and could be converted into an import terminal. Being the only refinery in the country, this leaves another isolated country in the region with a reliance on fuel imports. Closures in Europe also contribute to forecasts from the IEA that indicate 3.6 million b/d of refining capacity will shut between 2020 and 2026.

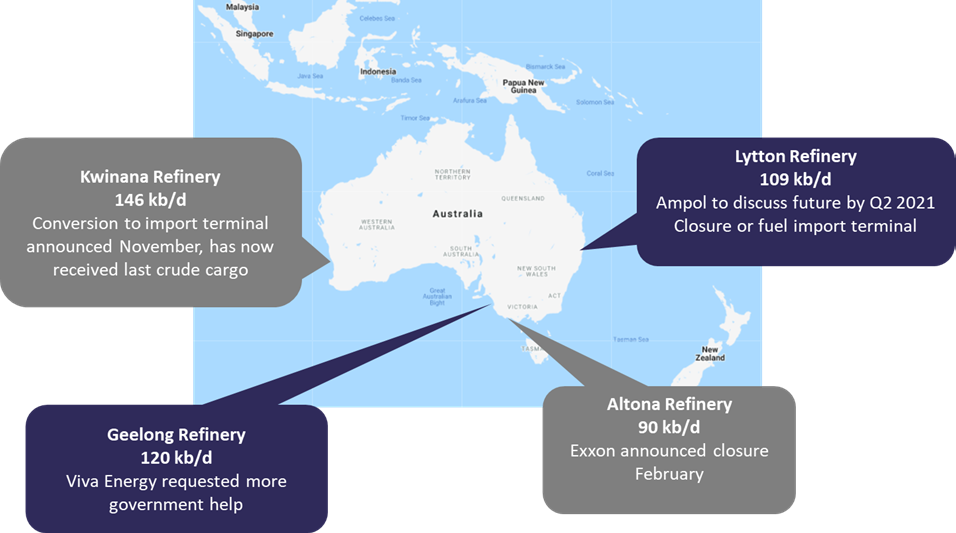

Australian closures leaves just two refineries

Last month ExxonMobil announced it would shut its 86,000 b/d Altona refinery in Australia. This followed news in November of BP closing and converting the Kwinana refinery in Western Australia into a fuel import terminal.

These two closures leave just two refineries in Australia. The Geelong refinery in Melbourne in the state of Victoria, which at 128,000 b/d will be the country’s largest remaining refinery. And then the Lytton refinery in Brisbane on the East coast with a capacity of 109,000 b/d.

Viva Energy, the company running the Geelong refinery, expect trading conditions to remain challenging this year and have accepted a governmental subsidy but has not ruled out closing Geelong. With the company planning to “resolve the refinery’s business for the long term this year”. Meanwhile, Ampol aim to discuss the future of the Lytton refinery by the end of Q2 2021. It remains to be seen whether these remaining two refineries will keep operating, although potentially the Australian government could be forced to step in with more generous subsidies to protect security of supply.

Why are Australian refiners facing closure?

These aren’t the first two refineries to close in Australia, and in fact follow a decade of closures which shows that in a globally integrated oil and refining market there is clear fundamental weakness in the economics of the Australian refineries.

One of the principal reasons is that the refineries are importing around 70% of their crude, and some of that from long distances. This high crude delivery cost will make them disadvantaged compared to US Gulf coast or Middle Eastern refiners that have a readily available supply of local cheap crude accessible via pipeline.

There is also the high cost of the crude slate, because as relatively simple refineries in Australia they are purchasing lighter, sweet crude which comes at a premium to heavier sour crudes. Despite the light-heavy differential reducing due to OPEC cuts, it is forecast to widen again, and so place simpler refiners at a disadvantage once again.

Furthermore, refineries will also be forced to spend money to upgrade their processing in the next few years to meet new tighter aromatic specifications in gasoline for the Australian market. In addition, operating expenses are also relatively high due to the lack of large economies of scale, and comparatively high labor costs.

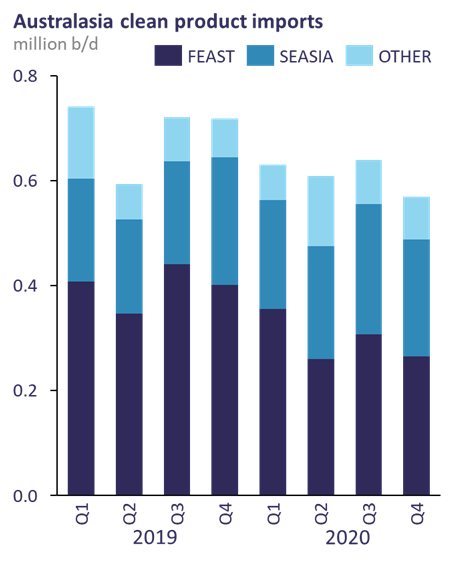

Closures set to provide a boost for product tanker demand East of Suez

The big benefit to shipping will come from the need to increase fuel imports into the country. It is estimated that by the end of 2021 imports will increase by 300,000 b/d from 2020 levels, as demand returns to normal levels and the shortfall of supply from the refineries comes into effect.

This is a big positive for product tankers East of Suez. This product will come from the Middle East and India, and North Asia. Locations that have complex refineries where the economics are better. They will also receive product from the regional hub of Singapore. While trade from Singapore will be on MRs, journeys from the Middle East, and the Far East will attract LR2 and LR1 as well as MR tankers.

There is also a potential additional benefit for the LR2s in that with less aframax going into Western Australia, they might be able to take the Northwest shelf condensates on a valuable back-haul cargo which was previously an aframax trade.

We have calculated that for every 100,000 b/d of refining capacity lost in Australia, the market needs an additional 5 LR2 tanker equivalents. So, for the two refineries that are shutting down you would need around 12 additional LR2 equivalents, but obviously that is going to be spread between the MR, LR2 and LR1s.

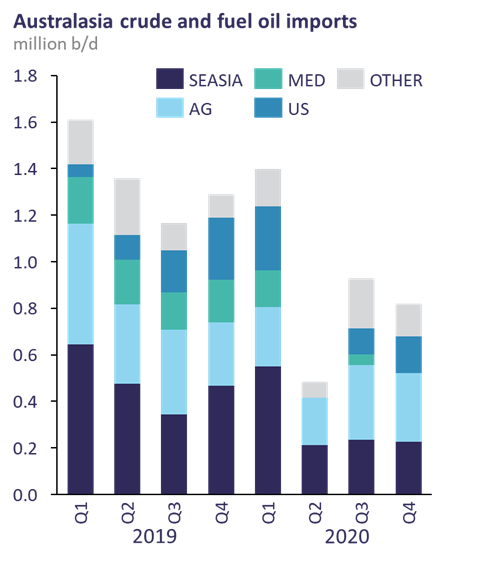

The positive shift for product tankers is balanced with the negatives on the crude side

The swing side is that things are looking less good for crude imports. Imports in 2020 were already 500,000 b/d down y-o-y due to lower utilization and they are not likely to see much of a recovery. The local source of barrels is Malaysia so this is a reasonably short-haul trade on an Aframax. But the big loss will be the long-distance routes of supply including the USA and North Africa. Losing these will be a blow to tonne-mile demand for the Aframax, and also Suezmax tankers.

Brent rally pauses amid lockdowns and virus mutations

February 4, 2021

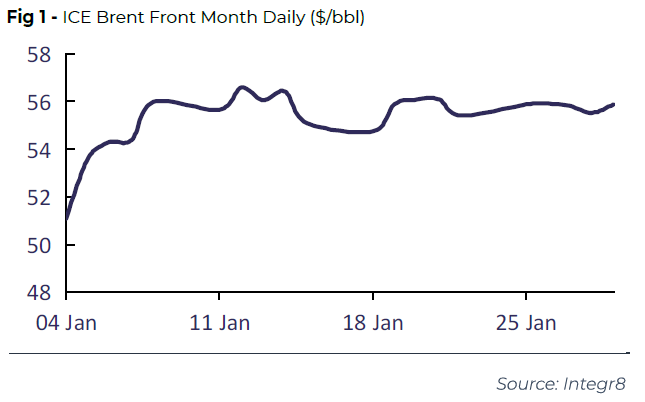

The price of Brent crude increased in the first half of January, rising from a low of $51 at the start of the month to reach a high of $56 on 12th January, as supply constraints came into focus. Oil prices then remained rangebound in the second half of the month, with the price of Brent holding at around $55 as the near-term demand outlook came under pressure.

Oil prices rose to an 11-month high in early January, following Saudi Arabia’s announcement of a unilateral cut of 1 million b/d to crude production in February and March, draws to US crude stockpiles and a weaker US dollar. However, gains were capped by concerns over near-term oil demand amid lockdowns and the emergence of virus mutations that could prompt tighter mobility restrictions. Restrictions were expanded or extended in the US and Europe amid rising COVID-19 cases and hospitalizations. Meanwhile, the UK and South Africa imposed strict lockdowns to combat new highly transmissible virus variants. Restrictions were also introduced or extended in Asia, the region which has led the global oil demand recovery. In the second half of the month oil prices found some support from a proposed $1.9 trillion US stimulus package announced before the 20th January inauguration of US President Biden, and as US crude stockpiles plunged 9.9 million bbls in the week to 22nd January to reach their lowest level since March 2020 .

Saudi Arabia commits to extra supply cut

On 5th January, Saudi Arabia unexpectedly committed to a unilateral cut of 1 million b/d to crude production in February and March, helping to offset worries that rising COVID-19 cases globally and new variants would curtail fuel demand. This is in addition to its existing January quota and gives the Kingdom a target crude supply of 8.12 million b/d for February and March. Meanwhile, most other OPEC+ producers agreed to hold production steady over February and March in the face of new coronavirus restrictions, although Russia and Kazakhstan are allowed to raise output by a combined 75,000 b/d in February and a further 75,000 b/d in March. Higher quotas for Russia and Kazakhstan came as cuts to operations of their mature wells and fields would create lasting damage to production capacity. Overall, this means OPEC+ production cuts are set at 8.13 million b/d for February and 8.05 million b/d for March, instead of the January level of 7.2 million b/d. The group will reconvene in early March to discuss April output.

Decarbonisation to transform shipping and bunkering

January 18, 2021

Last year was tough and the spread of Covid-19 has had a massive impact on all industries, including shipping. As we are seeing the light at the end of the pandemic tunnel with the vaccination programmes being rolled out, the focus is shifting towards what happens next. Clean energy and decarbonisation are again in the headlines with the governments increasing spending, announcing new projects and bringing ambitious environmental targets forward. This poses a number of questions for shipping – what technology to use and what fuel to burn as well as in what shape and form energy will be shipped in what looks like the not so distant future.

Cleaning up shipping

Despite not being the fastest industry to transform and adapt, a major change happened in shipping just over a year ago. The IMO2020 legislation introduced a much lower limit on the amount of sulphur in the bunker fuel that ships can burn. While there are plans to reduce NOx emissions that ships produce, shipping is now facing an ever-increasing pressure to contribute to the global push for decarbonisation.

While the car industry is already embracing the new technology, in the form of electric vehicles powered by batteries and increasingly looking into fuel cells, shipping remains in limbo and has not “decided” on the technology that will take it forward. The main question is what type of technology will be able to fit into the limited space on a ship, provide for a good range and not impair a ship’s carrying capacity. While traditional power plants can be replaced with hectares of solar panels or wind farms to generate the equivalent energy, this cannot be achieved on a vessel. Below is an overview of the potential solutions for shipping and how they may transform bunkering.

Carbon footprint offset / carbon capture and storage

Offsetting emissions or using carbon capture would mean that shipping may continue using the current fuels (with further abatement technology but with the ever growing pressure to change) or transition to the next generation of fuels, which could have lower SOx, NOx, and CO2 emissions. These fuels could be LNG (10-20% less carbon emissions), which is already gradually taking off and methanol. Both have lower energy density than conventional fuels and require certain handling conditions.

Offsetting carbon emissions could potentially be done by either buying carbon credits from other businesses, using alternative “green” investments such as carbon capture or by planting trees although calculations suggest that offsetting a single voyage requires planting and growing hundreds of thousands of trees.

Carbon capture and storage (CCS) is a solution similar to planting trees, although the emitted carbon will not be captured by the trees but rather by the CCS facilities. There are a number of projects being developed whereby salt caverns and decommissioned oil and gas fields will be used to store carbon dioxide.

If this is the preferred way going forward, then bunkering is unlikely to change dramatically. Bunker fuel will still likely be delivered by a tanker barge, truck or pipeline.

Ammonia

Ammonia is a gas that could be a good solution as it doesn’t produce any carbon when burnt. While currently most of ammonia is produced using hydrogen from natural gas, ammonia projects using “green” hydrogen obtained by electrolysis also exist meaning the entire chain could potentially be carbon neutral. Ammonia has lower energy density, so it requires either more frequent refuelling or more storage capacity on board compared to fuel oil. It also needs certain storage conditions and generally is not pleasant to handle due to its pungent smell.

Bunkering ammonia would not look very different from taking on LNG as it is typically carried by LPG/ammonia tankers.

Batteries

This is already a viable option for road vehicles, and we are seeing faster than expected uptake. While batteries may be a viable option for short-haul shipping, including ferries and small craft, this technology is unlikely to be able to produce enough energy to power a seagoing vessel in the near future. There is hope that solid state batteries may change this situation at some point in a more distant future.

A pioneering electric ferry

Should battery technology develop to allow them to be installed on seagoing vessels, bunkering may look very different to what it looks now. Ship’s batteries could be recharged by a floating charging barge or at the jetty or potentially swapped to allow a quicker turnaround.

Fuel Cells

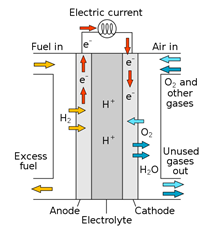

Fuel cells were invented almost 2 centuries ago, although until now their application has been mostly limited to power generation, space and military. However, they are increasingly being used in the automotive industry and several JVs have been concluded to extend its application to marine technology.

Fuel cells can reach 80-90% efficiency, although most currently rely on hydrogen storage and supply. Storing hydrogen can be tricky as it is prone to leakages and is very explosive. Fuel cells can also be developed to use LNG, methanol, ammonia and other fuels as the source of hydrogen. To achieve the maximum reduction in carbon dioxide emissions all these fuels will also have to come from “green” sources.

The diagram of a fuel cell

A ship equipped with fuel cells in the future will likely be supplied by a tanker carrying hydrogen, LNG, ammonia, methanol or other fuels or from the jetty.

Nuclear

Fitting ships with nuclear reactors can, with correct maintenance and servicing, deliver enormous amounts of power and provide an almost limitless range. This technology has primarily been used by the military, although a small number of nuclear-powered merchant vessels have also been built. Concerns about safety and the long-term cost of deactivating and storing spent nuclear fuel have outweighed the benefits.

Russian nuclear ice-breaker

Nuclear powered ships do not need to “bunker” frequently, however they also require the offloading of used nuclear fuel for recycling. Had ships made a switch to nuclear power, the bunkering industry would likely not exist in the current form. It is possible that only a handful of suppliers would be allowed to operate in the market, either run by or under a very tight supervision from the international agencies.

Energy transportation by sea may not be the same

Decarbonisation will not only affect the type of fuel ships use but also how energy is moved around the globe.

As the share of wind and solar energy generation continues to increase, it increases the need for storing excessive energy. Batteries are one way to do it. Another way is to convert the electric energy into fuels, for example by separating hydrogen from water using electrolysis or going even further by reacting hydrogen with nitrogen (from the atmosphere) to produce ammonia. Hydrogen and ammonia can then be loaded and transported by gas carries.

Out of the other two fuels mentioned in the article, LNG will continue to be transported by gas (LNG) carriers, and only methanol is transported in the liquid form and will require tankers. Should batteries dominate, it will likely require specialist carriers or be transported as a container good.

It goes without saying that new technologies and fuels, besides having technical feasibility, also need to make sense economically. There is no doubt that governments will increasingly support the green fuels initiatives, introduce legislation, provide subsidies and the current capital inflows will help make these technologies cheaper and ready for mass implementation.

This is a time of a great change, but also great opportunity. The change in the energy landscape will no doubt transform shipping and bunkering, and we may have no other choice but to embrace this transformation and be part of it.

Anton Shamray Senior Analyst P: +44 207 4675 856

E: Anton.S@navig8group.com

Brent rises to highest since March

December 10, 2020

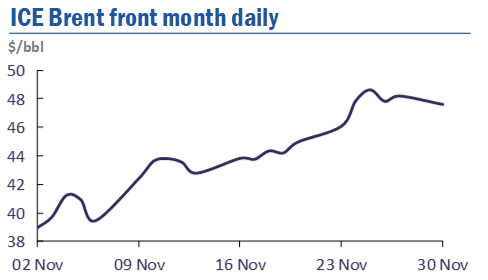

Brent crude prices rose to their highest level since March in November, hitting a high of $48 on 25th November.

Oil prices trended upwards over the course of the month from a low of $39 at the start of November. The price of Brent crude closed out the month at $47.Oil prices were supported at the start of November by talk of a possible extension of OPEC+ output curbs beyond January 2021 and a steep 8 million bbls w-o-w fall in US crude stockpiles. However, uncertainty surrounding the outcome of the 3rd November US election, surging cases of coronavirus and the re-introduction of lockdown measures in Europe kept prices under pressure. Oil prices then jumped after drugmakers Pfizer and BioNTech initially said an experimental COVID-19 treatment was more than 90% effective, offsetting pressure from increasing Libyan supply. Oil prices continued to rally from mid-November, as Moderna said its experimental mRNA COVID-19 vaccine was 94.5% effective in preventing infection and AstraZeneca later said its vaccine was 62% effective under two full dosing regimens. Oil prices found further support in late November as the market eyed a US presidential transition to Joe Biden and on speculation of a three-month extension to OPEC+ supply cuts, ahead of a scheduled full OPEC+ meeting on 1st December. However, OPEC+ postponed talks until 3rd December as key players still disagreed on output policy for 2021.

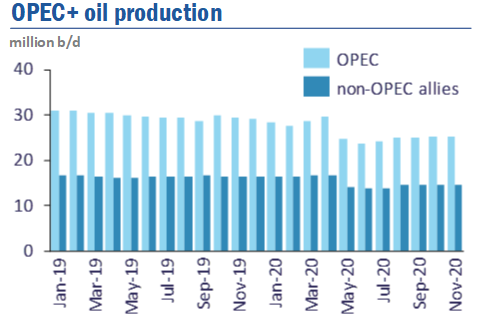

On December 3rd, OPEC and non-OPEC allies including Russia agreed to increase collective crude production by 500,000 b/d in January, but failed to come to a compromise on a broader policy for the rest of next year. Subsequent output adjustments will be decided at monthly ministerial meetings, with any further increases in output beyond January capped at 500,000 b/d each month, whilst production cuts are also possible.

Meanwhile, ministers agreed that a compensation mechanism, which requires production beyond quotas to be compensated for by additional cuts, will continue until the end of March 2021, allowing full compensation of overproduction from participating countries. Russia has cumulative overproduction of 530,000 b/d, which needs to be cut for one month to catch up with its targets, whilst Iraq has cumulative overproduction of 610,000 b/d.

Although short of a widely expected extension of existing cuts until at least March 2021, oil prices found support from this compromise to continue some cuts to production. After the OPEC+ decision, Brent crude extended gains to reach $49 during intra-day trading on 4th December.

Data on the efficacy of three COVID-19 vaccines was released in November, with vaccines ready to be submitted for regulatory approval, supporting hopes of a swifter recovery in the global economy and oil demand.

The first announcement by Pfizer and BioNTech on 9th November initially showed a 90% success rate. On 16th November, Moderna said its experimental mRNA vaccine was 94.5% effective and remains stable under standard refrigeration for 30 days. Both vaccines were shown to work equally well across age groups, ethnicities and genders.

On 23rd November, AstraZeneca said its vaccine was 62% effective under two full doses and can be stored under standard refrigeration for at least six months. Concerns were later raised about the robustness of results for a sub-group of trial participants under 55 years old who received a half-dose regimen with 90% efficacy. However, efficacy of 62% for two full doses is well above the 50% efficacy required by US regulators, whilst Europe’s drug regulator has said it will not set a minimum efficacy level for potential vaccines. US healthcare workers recommended that the first COVID-19 inoculations could start within days of regulatory consent in December.

The latest OECD projection sees global GDP returning to pre-pandemic levels by end 2021, aided by vaccine rollouts and accommodative fiscal monetary policies.

Bunker prices up 25% in just 30 days on the back of Covid-19 Vaccines and support from OPEC+

December 3, 2020

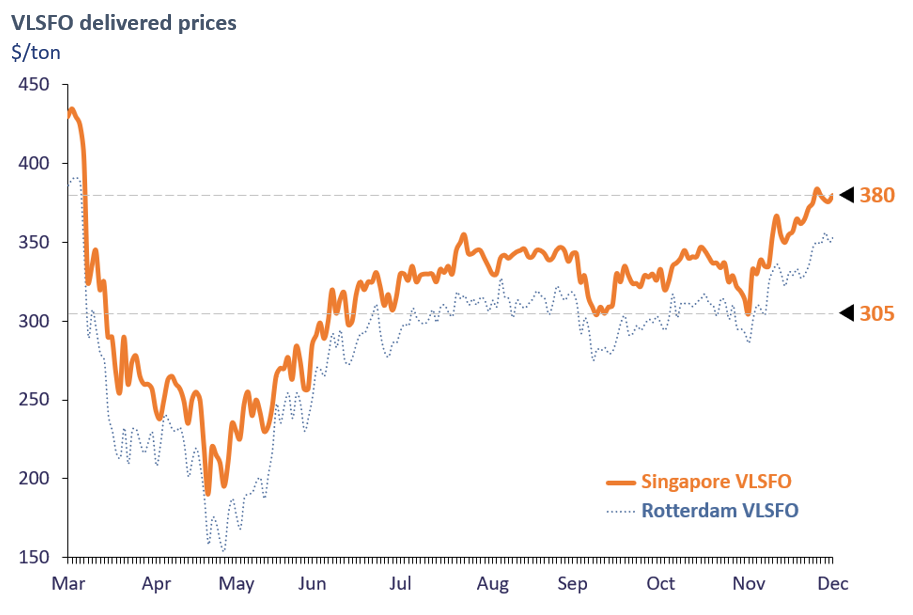

VLSFO prices have risen by $75/ton in just 30 days; the previous talk about a Covid-19 vaccine and a corresponding sharp rise in oil prices has now become a reality. In the past few weeks, we have had the very big news of 3 successful Covid-19 vaccine trials, with the corresponding jump in prices. There has been further price support with positive comments on the OPEC+ group extending their current cutbacks into 2021, and this has now finally been agreed with only a 0.5 million b/d increase in January (the original plan was to raise production quotas by 2 million b/d from January 2021).

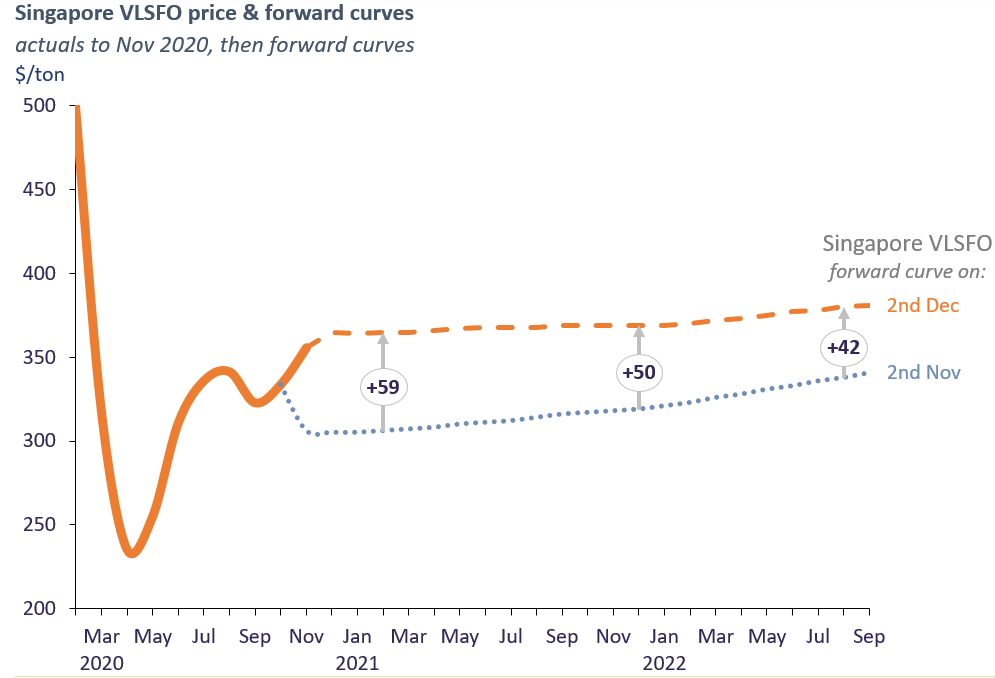

The net result is that in past 30 days we have moved from a bearish position, when a second Covid wave was dominating the news, to now, where the ‘imminent’ implementation of vaccine programs is seen as the path to significant gains in oil demand. This has seen VLSFO prices hit levels not seen since in early March, and in Singapore rise from $305/ton to around $380/ton (up 25%) in this very short period.

At the same time forward curves have jumped higher, although they remain extremely flat through the next 18 months. The Singapore VLSFO curve at the start of November was a clear reflection of the near-term bearish concerns from the second covid-19 wave, showing a drop in December and only a gradual uplift through the outlook period. The recent news on vaccines had an immediate bullish impact on prices and now for the earlier part of next year, the VLSFO forward curve in Singapore is almost $60/ton higher than it was four weeks ago. Even looking as far out as 2022, the curve is still more than $40/ton above what it was showing at the start of November.

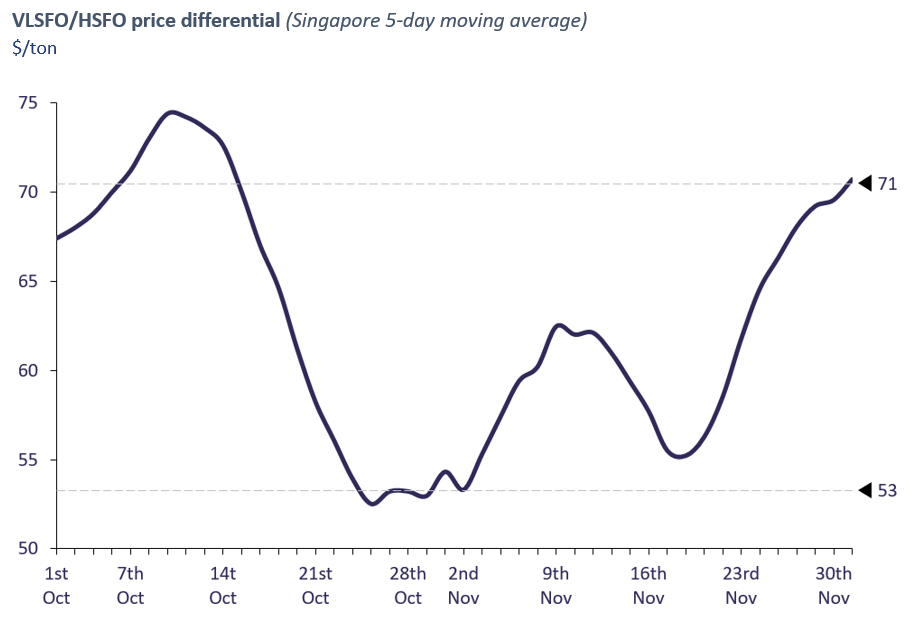

Another aspect to the price rise has been a widening in the VLSFO/HSFO spread. Differentials tend to widen as prices rise (and narrow as prices fall), and this has happened with this latest price increase. Although the differential between the two bunker grades is still very narrow by historical standards, the VLSFO/HSFO spread in Singapore is now around $70/ton compared with only $53/ton at the start of November.

General developments in the oil markets would indicate a further widening in this spread, based on the relative weakening of HSFO prices and relative strengthening of VLSFO as:

- Demand for fuel oil into the power-generation sector eases; Saudi Arabian demand is down after the summer peak aircon demand and Pakistan has decided not to go ahead with a 500,000 ton HSFO tender for December delivery, although LSFO demand in South Korea is up in December by around 100,000 tons as utilities move to replace coal-fired capacity that has been shut-in because of winter air-pollution issues.

- and at the same time, relative VLSFO prices strengthen with improving margins for gasoil, gasoline and jet fuel margins as product demand in Asia rises (and product supply in Europe is reduced because of cuts in refinery runs).

Any further increases in oil prices are likely to add to these general widening pressures on the VLSFO/HSFO spread, lending further support to scrubber economics.

We have always referred to the underlying movements in bunker prices being led by crude oil, and of course it is the same this time around. VLSFO has largely tracked changes in the hugely traded Brent and WTI crude futures markets, and will continue to respond to the current big stories of vaccines, the prospects for oil demand and OPEC+ outcomes.

Steve Christy Strategic Communications Director P: +44 207 4675 860

E: SteveChristy@navig8group.com

A year on: better VLSFO quality but watch HSFO

November 16, 2020

This time a year ago the market was talking about the upcoming IMO2020 sulphur regulations change. The operators of the non-scrubber tonnage were in the process of putting together the switch-over plans from HSFO to VLSFO and starting to purchase the compliant fuel, while bunker fuel producers worked tirelessly on the different recipes for the VLSFO blends.

In October 2019, Integr8 Fuels started collecting VLSFO sample test data and one year later managed to accumulate over 75,000 test results. Marking the anniversary, this article looks at the key fuel quality developments comparing VLSFO and HSFO. Despite the drop in the HSFO demand and testing, over 15,000 HSFO test results formed part of this analysis.

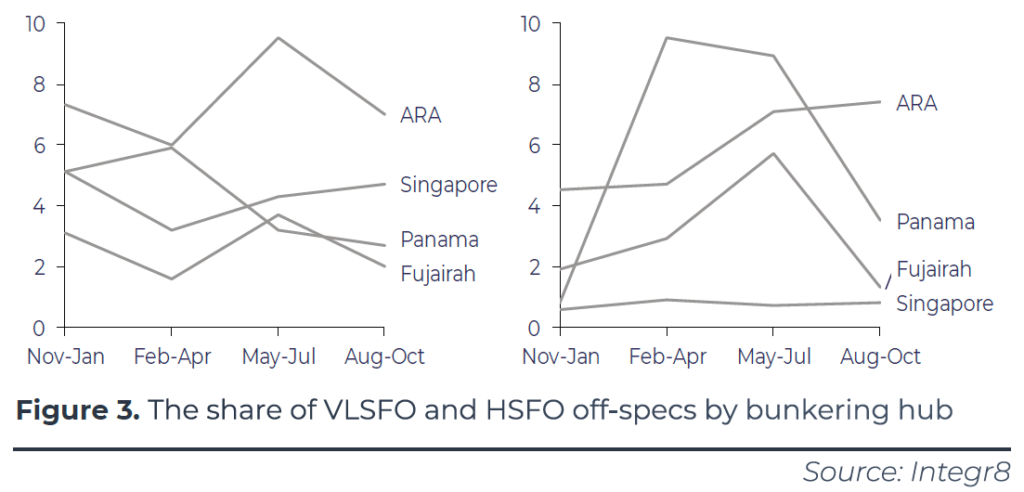

The data shows that in the past year the share of HSFO off-specs increased, overtaking VLSFO, which in turn saw a decrease. The severity of VLSFO off-specs also decreased, while increasing for HSFO. Out of the four bunker hubs analysed, currently ARA has the highest probability of VLSFO and HSFO off-specs.

VLSFO: fewer off-specs than HSFO

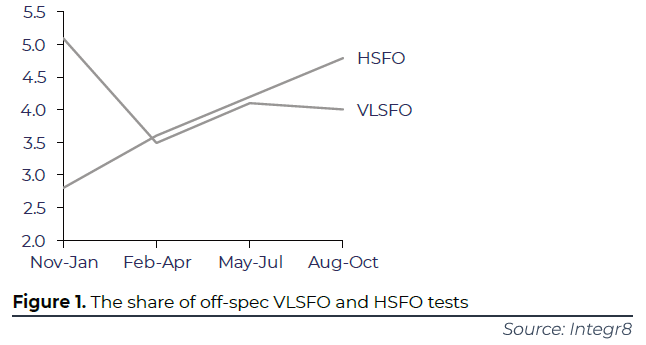

Prior to the IMO2020 switch, it was widely expected that VLSFO would turn out to be more problematic than HSFO and this was indeed the case early in the transition. Given that VLSFO producers had to hone their blending recipes, the share of VLSFO off-specs stood at 5.1% on average between November 2019 and January 2020, almost double the HSFO share (Figure 1).

As the year went by and producers gained more experience with VLSFO, the reduction in the share of off-specs followed. On the other hand, and quite unexpectedly, the share of HSFO off-specs steadily increased, currently standing higher than VLSFO.

This development shows that while previously HSFO was considered an “easier” fuel to buy compared with VLSFO, this is no longer the case. The bunker buyer is encouraged to exercise the same due diligence when buying HSFO given the increase in the share of off-specs.

Off-spec severity lower in VLSFO, higher in HSFO

Fuel quality data shows that it is not only the share of VLSFO off-specs that decreased but also the severity.

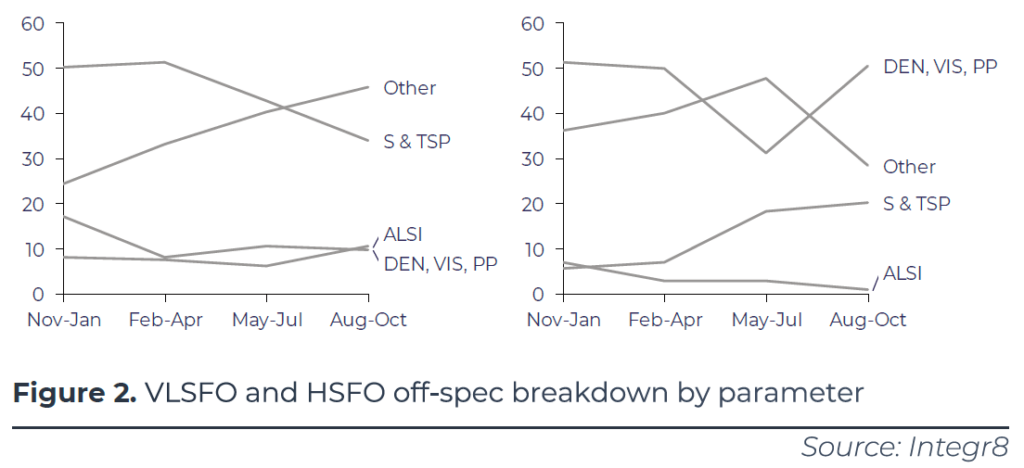

Figure 2 breaks down the off-specs by parameter, which for simplicity have been put into four groups. The ‘Other’ group contains the parameters that cause less severe quality issues if found to be off-spec comprising of ash, water, sodium and others.

In VLSFO there has been a steady reduction in the prevalence of sulphur and TSP (a measure of fuel stability) off-specs, which are critical quality parameters, while the occurrence of off-specs in the ‘Other’ group has increased with sodium in particular causing some issues in a number of ports in Asia.

HSFO shows a very different trend. Both sulphur and TSP off-specs are on the rise, mostly driven by TSP. This may potentially indicate a change in the composition of HSFO, whereby the formulations are becoming more “complex”.

While the above changes are good news for the VLSFO users, HSFO buyers should be aware of the rising TSP off-specs.

Watch out for VLSFO and HSFO quality issues in ARA

Looking at the global quality averages can help understand the general direction, although when it comes to bunkering vessels, individual ports, which collectively make up the global trend, should also be looked into. Figure 3 shows the breakdown of VLSFO and HSFO off-specs in four key global bunkering hubs.

The share of VLSFO off-specs in ARA, despite a drop in August – October, remains much higher than in the other ports and above the global average. The picture is similar for HSFO, with the share of ARA off-specs rising to the highest in August – October, while Panama and Fujairah seem to have dealt with the past quality issues. Singapore on the contrary remains one of the best ports for HSFO quality where less than 1 in 100 HSFO stems are tested off-spec, compared with almost 8 in 100 in ARA.

Looking at the severity of VLSFO off-specs in ARA, it is a mixture of sulphur and TSP issues, despite the reduction of these in the global trend. On the other hand, the HSFO issues here are mostly related to density (also with a sharp increase in St. Petersburg) and viscosity, which are less critical and can often be handled well on board the vessel.

Overall, it has been an interesting year when it comes to bunker fuel quality and despite the initial concerns the IMO2020 transition generally went well. However, monitoring fuel quality data remains important and Integr8 Fuels will continue highlighting any significant fuel quality trends going forward.

Anton Shamray Senior Research Analyst P: +44 207 4675 856

E: Anton.S@integr8fuels.com

The annual cold flow conundrum

November 9, 2020

Well it’s that time of the year again, the overcoats are being thrown on in the Northern Hemisphere and the clocks have changed and in the world of Bunkering this means only one thing, it’s time to consider Cold Flow properties again.

Why is this so concerning? Winter comes once a year and Cold Flow is nothing new, but the idiosyncrasies of the Bunker Industry allow fuel blenders to thrive within the ‘grey areas’ with regard quality.

Which other industry allows fuels to be sold on multiple and sometimes obsolete International standards or even local specifications?. Indeed 16 years since the 2005 specification was released we still see this being sold, despite 2010, 2012 and the latest 2017 versions being published.

Worryingly, even the latest 2017 specification does not provide adequate protection for cold flow properties with only the winter specification requiring the seller to report Cloud and Cold Filter Plugging Point rather than specifying a hard limit.

Furthermore it is quite remarkable that even Charter Parties have not been adjusted to the latest specifications and that they don’t mandate the use of winter grade fuels only specifying fit for purpose, a statement no supplier will ever warrant.

So what are the grey areas and how can we prevent these issues impacting the end user?

Issues

In short, not only are things not what they seem, they are not even what they are called!

This statement certainly applies for DMA distillates across a large swathe of North West Europe and the epicenter of ARA ports where blenders have for some years now pushed the envelope using additives to masquerade a summer grade fuel as a winter specification. Indeed whilst there generally are warning signs that we can use to detect such fuels there are exceptions and therefore you cannot assume simply on a pour point result that a fuel is a winter grade which will give you adequate protection.

In understanding the effect of the additives we need first to understand the effects of cooling on a distillate fuel such as DMA.

The Cooling Process

As a distillate cools down the first point of note is what is known as the Cloud Point, this is the temperature under laboratory conditions at which wax crystals in the fuel become visible by way of the first wisps of a cloud.

Beyond the cloud point, the fuel becomes almost jelly like until such a point, again under laboratory conditions that the fuel blocks a 45 Micron filter, its Cold Filter Plugging Point.

Finally the fuel will reach its Pour Point, in other words it will solidify, stop pouring etc.

Under normal circumstances from point to point, i.e. cloud to CFPP, a delta of 2 to 5 degrees Celsius is standard. It is when these ranges vary beyond 5 degrees when it can be assumed that additives are in play.

Additive Use

As mentioned earlier, one weapon in the armoury of a fuel blender is additives in order to improve the performance of a fuel, one type of which is a middle distillate flow improver (MDFI). These MDFI additives work to improve operability at colder temperatures by depressing both the CFPP and the Pour Point. Cloud Point however is unaffected.

Additives can be added proactively or re-actively and have varying effects depending on the fuel and dosing rate and their effects generally lessen with larger quantities of additive.

So armed with the routine behavior of unadditized fuels when cooling it is feasible to identify fuels with far wider temperature variances from Cloud Point to Pour Point.

Current Position

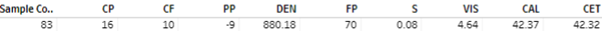

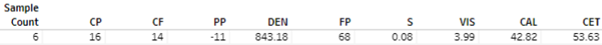

Recent data available to Integr8 fuels suggests that a large proportion in ARA, North West Europe and ports replenished from this area have a Cloud Point above 10 Deg C and a delta from Cloud to Pour Point of 16 Deg C which takes us to the Winter grade Limit for Pour Point (-6 Deg C). See Diagram below.

The DMA fuels that exhibit such properties are usually identifiable by their higher densities (0.87 to 0.89 Kg/Ltr) as can be seen from the data below, whereby the average delta for such fuels from Cloud to Pour Point is 25 Deg C.

Skaw on the other hand worryingly bucks that trend with fuels with similar poor cold flow operability as ARA exhibiting far lower Densities (0.843 Kg/Ltr) and far better combustion characteristics (54 Cetane Index v 42 in ARA). This results in the specter of even the most eagle-eyed technical manager not spotting what lurks behind the mask.

Therefore both examples would in the eyes of ISO 8217: 2005/10/12 meet the winter grade specification but in real terms could create significant operational challenges onboard the vessel.

Control Measures

So proactively what can be done to minimise risk to the vessel and the end user?

Firstly it is essential to understand the vessel, its uses for distillate fuels, its limitations and its upcoming voyage. Some vessels are more sensitive to cold flow properties than others, for example those with cranes such as a Geared Bulk Carrier or Heavy lift vessel given we would be concerned about ambient air temperatures (& wind chill) rather than simply the sea temperatures.

Secondly it is obvious that this is more of a concern if a vessel is headed to colder climes, for example the Baltic in the middle of winter. Planning is therefore essential to consider whether for example a summer grade fuel picked up in Singapore is fit for purpose in the Baltic in January, I very much doubt it would be.

Finally, and most importantly should risks be identified during procurement then a data driven process of risk mitigation should follow.

Buyers must check during enquiry that:

• Their expectations are clearly passed to their counterparty, for example Cloud Point 0 Deg C Maximum.

• Fuel is guaranteed to 2017 Winter Grade wherever possible which mandates the reporting of Cloud Point and CFPP..

• If the fuel is not guaranteed to 2017 then a Certificate of Quality should be obtained for the batch in question with

Cloud Point or CFPP data provided which meets the requirements.

Inevitably such demands may result in a premium being charged by the supplier, however given the circumstances it is a price worth paying to swerve such fuels.

Conclusion

So to conclude until such time that adequate protection is provided within ISO 8217 it is essential that buyers understand the risk of such fuels and put suitable buffers in place to protect them from issues.

Control measures may be able to be utilized post issue such as more additive or a small amount of heating (which may be possible given some vessels have converted old fuel oil tanks into distillate tanks) but it by no means guarantees a resolution.

The best bet is to plan, purchase smartly and if necessary accept a price premium given the challenges these masquerading fuels bring.

Chris Turner Manager – Bunker Quality and Claims P: +65 6622 0042

E: chris.t@integr8fuels.com