Bunker prices have remained in a narrow range for the past 3 months; When will this change?

Since our Integr8 notes and podcasts in late August we have taken a far more cautious approach on potential near-term gains in bunker prices. As we have (too) often outlined, absolute prices in our markets are driven by what is happening in the overall oil market, with some variations as relative crude and product prices shift.

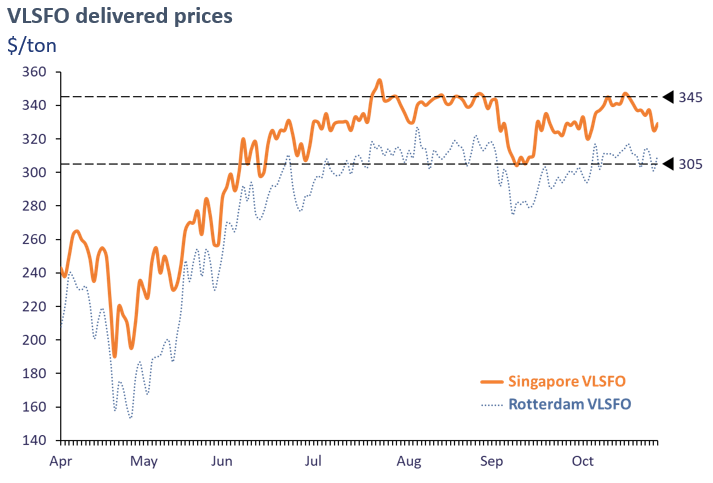

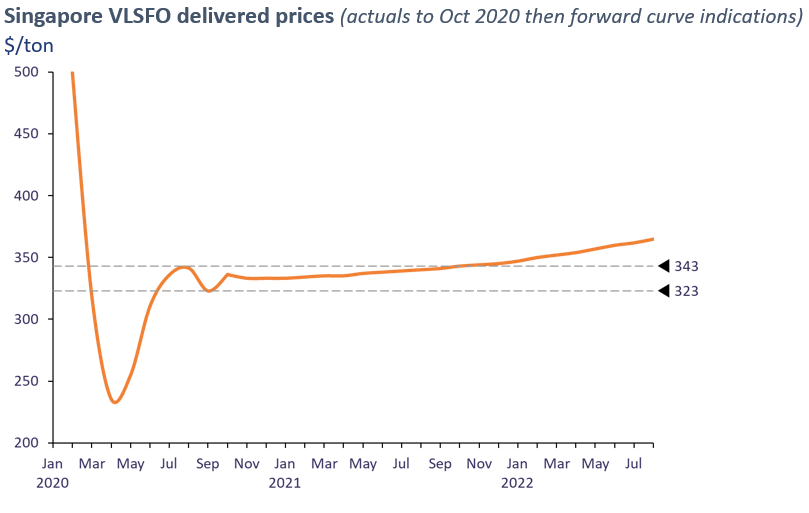

The concern in the markets two months ago about a second Covid wave and a slowing rebound in oil demand have happened. The net result has been bunkers moving in a very narrow price range, with daily VLSFO prices quotes in Singapore remaining within only a $40/ton range for the past 3 months.

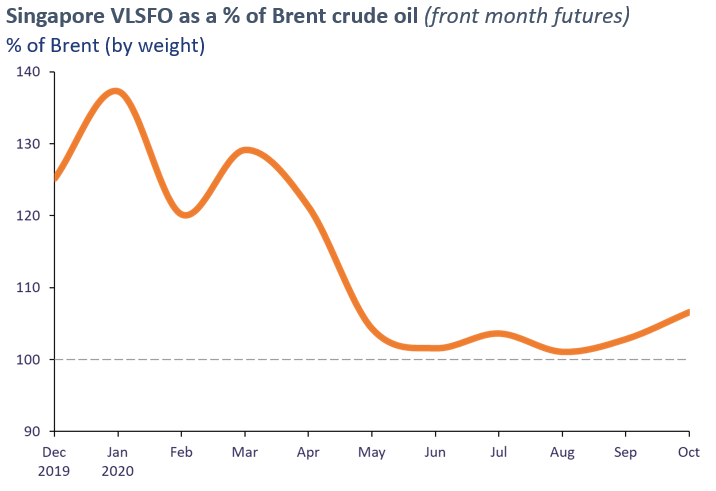

One point worth noting on relative pricing is that over the past month VLSFO has strengthened slightly against crude oil. Although it is still at very low levels versus crude, VLSFO in Singapore is now at 107% of Brent, up from a low of just 101% in August, but nowhere near the 120-130% just before the pandemic.

This slight upturn has come with some minor relative strengthening in jet and gasoil prices, which does have an underlying impact on the VLSFO ‘blend’ price (in our recent Integr8 webinar we went into detail about the inter-relationships and determining factors for VLSFO pricing). However, demand and pricing for gasoil and jet (along with gasoline and diesel) will have to rise a lot more to push this relative price of VLSFO significantly higher.

This brings the focus back to the bigger picture in oil markets. The overall fundamentals are key, and we are going through a period where oil supply has not been an issue, with the OPEC+ group doing a very good job of cutting production. All the focus is on demand, with the emergence of a second Covid wave leading to more lockdowns and constraints on the rebound in global oil demand.

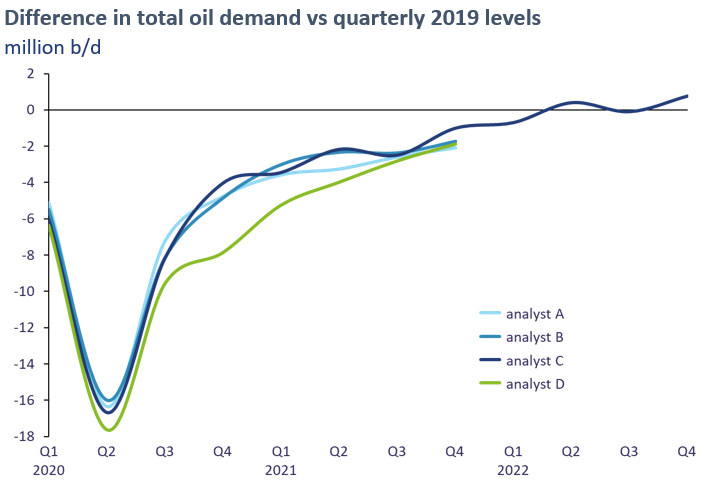

The graph below illustrates four different analysts’ views on oil demand. All measurements are against the corresponding quarter in 2019 and there is a fairly consistent view on how demand fell in Q1 and Q2 this year and how the recovery has taken place in Q3. Looking ahead through to the end of next year, three of the analysts have very similar expectations, looking at further gains in Q4 this year, but then only limited increases through all of next year, such that even by Q4 2021 global oil demand will still be 1-2 million b/d below demand in Q4 2019. One analyst is even more bearish, seeing the demand rebound falter this quarter and through the first half of next year, but then hitting similar numbers to the other three analysts for the second half of next year.

One analyst has extended their quarterly outlook into 2022 and this shows global oil demand returning to the 2019 level in Q2 2022, another 18 months away. The general expectations at this stage are that it will take until the very end of next year or the early part of 2022 before total oil demand gets back to 2019 levels. It is this view that over-arches the very flat price expectations at the moment.

The question is: what can happen to change this?

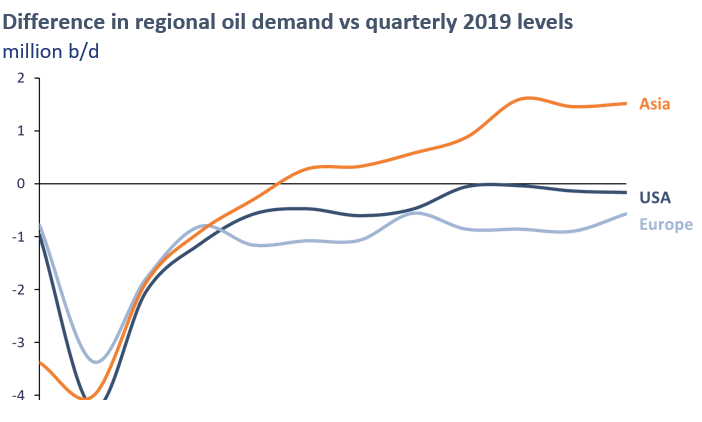

Although headline analysis is looking at the global position, there are very different developments taking place on a regional basis. Economies and oil demand have rebounded far quicker in Asia-Pacific than elsewhere. Activity in China is back close to pre-Covid levels on many levels, even including domestic airline travel. For the region as a whole, oil demand is expected to return to 2019 levels as early as Q2 next year and continue rising after this, which will support regional refining and oil markets. Any return in the US is not seen until the start of 2022, either under a Trump or Biden presidency (at the moment any political/energy policy differences between the two are seen as having a longer term impact and not in the near-term global oil markets).

Europe is looking like ‘more of a drag’ on demand than other areas and in the longer term this could have a marked impact on ‘local’ refinery closures and product pricing.

Given these current circumstances, it is difficult to see prices moving significantly higher in the very near term. The obvious trigger to prices rising steeply is the introduction of a covid-19 vaccine, or even the very strong indication that one is imminent. The increases in oil demand with the introduction of a vaccine could exceed analysts’ current views. News of a vaccine will push futures prices much higher, and with the mantra ‘buy on the rumour, sell on the fact’, the initial price hike could be high (before prices settle back down).

The forward curve today does not reflect any step change in demand that a vaccine could offer. In fact, looking at monthly average prices, the forward curve on VLSFO in Singapore is extremely flat and still within the recent $20/ton band for another 12 months. Even going into 2022 any increase in the curve is very gradual.

There will always be some price movement, and in the very near term there are also risks to the downside, with any large-scale moves into lockdowns or issues surrounding the OPEC+ agreement and the outcome from their 30th November/1st December meetings. However, if and when there is a successful covid-19 vaccine, this is likely to push oil prices up significantly and well above the current VLSFO forward curve.

Steve Christy Strategic Communications Director, Navig8 P: +0207 4675 860

E: SteveChristy@navig8group.com

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.