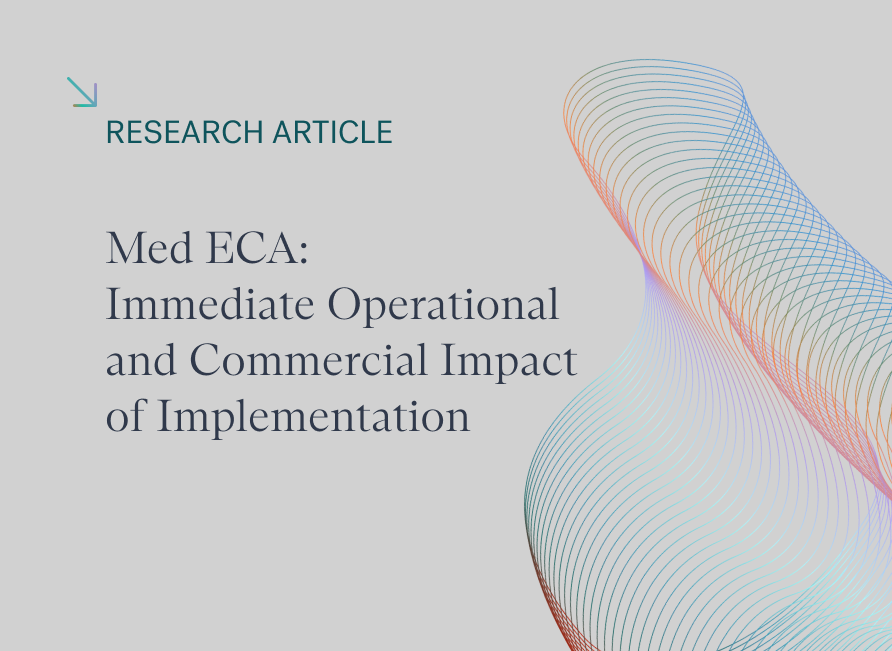

Brent rises to highest since March

Brent crude prices rose to their highest level since March in November, hitting a high of $48 on 25th November.

Oil prices trended upwards over the course of the month from a low of $39 at the start of November. The price of Brent crude closed out the month at $47.Oil prices were supported at the start of November by talk of a possible extension of OPEC+ output curbs beyond January 2021 and a steep 8 million bbls w-o-w fall in US crude stockpiles. However, uncertainty surrounding the outcome of the 3rd November US election, surging cases of coronavirus and the re-introduction of lockdown measures in Europe kept prices under pressure. Oil prices then jumped after drugmakers Pfizer and BioNTech initially said an experimental COVID-19 treatment was more than 90% effective, offsetting pressure from increasing Libyan supply. Oil prices continued to rally from mid-November, as Moderna said its experimental mRNA COVID-19 vaccine was 94.5% effective in preventing infection and AstraZeneca later said its vaccine was 62% effective under two full dosing regimens. Oil prices found further support in late November as the market eyed a US presidential transition to Joe Biden and on speculation of a three-month extension to OPEC+ supply cuts, ahead of a scheduled full OPEC+ meeting on 1st December. However, OPEC+ postponed talks until 3rd December as key players still disagreed on output policy for 2021.

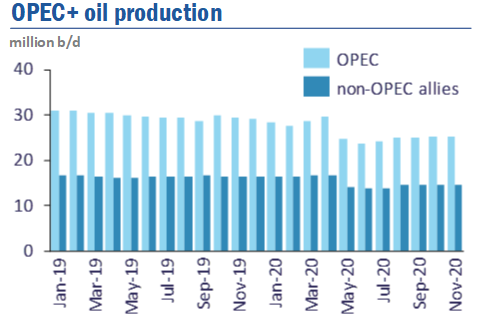

On December 3rd, OPEC and non-OPEC allies including Russia agreed to increase collective crude production by 500,000 b/d in January, but failed to come to a compromise on a broader policy for the rest of next year. Subsequent output adjustments will be decided at monthly ministerial meetings, with any further increases in output beyond January capped at 500,000 b/d each month, whilst production cuts are also possible.

Meanwhile, ministers agreed that a compensation mechanism, which requires production beyond quotas to be compensated for by additional cuts, will continue until the end of March 2021, allowing full compensation of overproduction from participating countries. Russia has cumulative overproduction of 530,000 b/d, which needs to be cut for one month to catch up with its targets, whilst Iraq has cumulative overproduction of 610,000 b/d.

Although short of a widely expected extension of existing cuts until at least March 2021, oil prices found support from this compromise to continue some cuts to production. After the OPEC+ decision, Brent crude extended gains to reach $49 during intra-day trading on 4th December.

Data on the efficacy of three COVID-19 vaccines was released in November, with vaccines ready to be submitted for regulatory approval, supporting hopes of a swifter recovery in the global economy and oil demand.

The first announcement by Pfizer and BioNTech on 9th November initially showed a 90% success rate. On 16th November, Moderna said its experimental mRNA vaccine was 94.5% effective and remains stable under standard refrigeration for 30 days. Both vaccines were shown to work equally well across age groups, ethnicities and genders.

On 23rd November, AstraZeneca said its vaccine was 62% effective under two full doses and can be stored under standard refrigeration for at least six months. Concerns were later raised about the robustness of results for a sub-group of trial participants under 55 years old who received a half-dose regimen with 90% efficacy. However, efficacy of 62% for two full doses is well above the 50% efficacy required by US regulators, whilst Europe’s drug regulator has said it will not set a minimum efficacy level for potential vaccines. US healthcare workers recommended that the first COVID-19 inoculations could start within days of regulatory consent in December.

The latest OECD projection sees global GDP returning to pre-pandemic levels by end 2021, aided by vaccine rollouts and accommodative fiscal monetary policies.

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.