The Week in Alt Fuels: Ammonia’s unfinished equation

Some industry experts predict that new IMO regulations will push green ammonia to the forefront of the future bunker fuel mix by the 2040s. But with limited real-world data, its full potential remains unknown.

IMAGE: STS ammonia transfer between the gas tankers Gas Utopia and Ocean Moon in the Port of Rotterdam. Youtube of the Port of Rotterdam

IMAGE: STS ammonia transfer between the gas tankers Gas Utopia and Ocean Moon in the Port of Rotterdam. Youtube of the Port of Rotterdam

Many shipping and energy experts have long projected green and blue ammonia to lead the future fuel mix beyond the 2030s. These projections have gained renewed momentum with the IMO’s recently approved net-zero framework.

But with no commercial ammonia bunker operations, limited real-world data and critical gaps in its onboard usage, comparing ammonia to currently available fuels in the bunker fuel mix, is like comparing apples to future oranges.

Here's what we do know about ammonia, beyond its toxic properties.

First, ammonia-fuelled vessels are expected to enter operation from 2026, with engine makers including MAN Energy Solutions, WinGD and Wärtsilä developing ammonia-capable propulsion systems.

If and when it is deployed commercially, green ammonia could theoretically offer one of the lowest lifecycle emissions among alternative marine fuels.

A study commissioned by CMA CGM and conducted by French research institute IFP Energies nouvelles (IFPEN) estimates that by 2035, green ammonia could have a well-to-wake GHG intensity of around 12 gCO2eq/MJ (with an error margin of 3 gCO2eq/MJ on either side) by 2035.

The exact GHG intensity will depend on factors like its production method, location and renewable energy inputs.

But that’s only part of the picture.

Ammonia requires a pilot fuel - typically diesel - to ignite. Tests by WinGD and Wärtsilä suggest that 5% pilot ratios may be viable, but the onboard GHG intensity will depend on both the ratio and type of pilot fuel used. Fossil-based pilots like VLSFO or LSMGO could erode ammonia’s low-emission profile.

Biofuel-based pilot fuels may preserve it, but this hasn’t yet been tested on ships.

Blue ammonia is another contender. Produced through steam reforming of natural gas with carbon capture, its emissions profile is less favourable. IFPEN estimates blue ammonia’s well-to-wake GHG intensity in 2035 to be 61 gCO2eq/MJ (with an error margin of 6 gCO2eq/MJ), depending on upstream methane leakage and capture efficiency.

“Even under optimistic scenarios with reduced upstream blue hydrogen emissions, it only meets the 70% reduction threshold in 6 out of 17 regions by 2050,” IFPEN notes.

Innovation may help close some of these gaps. Korea’s Hanwha Ocean has planned ammonia gas turbines for ships to allow combustion without a pilot fuel. But the concept is currently at a pre-development stage.

On the infrastructure side, major ports like Rotterdam and Singapore have conducted ammonia pilot bunker trials and plan to allow commercial bunkering by 2026–2027.

While onshore safety protocols are being established, onboard safety and operational viability remain largely untested. Another logistical hurdle is ammonia’s low energy density. It requires around three times more fuel volume than VLSFO for the same energy output, raising space and design constraints onboard.

Cost is another major unknown. Various prices sourced by the World Shipping Council priced green ammonia at $2,037/mt by 2030 - roughly 285% over fossil LNG. While prices could drop over time, green ammonia could struggle to reach price parity with VLSFO, LNG or even bio-based alternatives without significant regulatory support.

Transport & Environment (T&E) suggests that increasing the IMO’s remedial unit price from $380/mtCO2e to $600/mtCO2e could incentivise global uptake of e-fuels like green ammonia. But without stronger regulatory support, these fuels may take a backseat to currently available low-emission alternatives, even in the future, the organisation argues.

So for now, ammonia remains a hypothetical solution with theoretical promise. Some ports are preparing, vessels are being built and marine supply chains are forming. But questions around emissions, efficiency, safety, economics and regulatory alignment still need clear answers. Projections may place ammonia at the top of the future fuel mix, but without real-world proof, the industry is still charting unknown waters with closed eyes.

In other news this week, a group of companies have partnered to develop nuclear power for ships, including strategic response vessels in remote areas. Class society Lloyd’s Register, Australian ship designer Seatransport and US-based engineering firm Deployable Energy project will use micro modular reactor (MMR) technology. This could allow a vessel to operate for 8–10 years without refuelling.

One of Mediterranean Shipping Company’s (MSC) container ships successfully trialled shore power in Hamburg. The port now has three plug-in power stations for container ships.

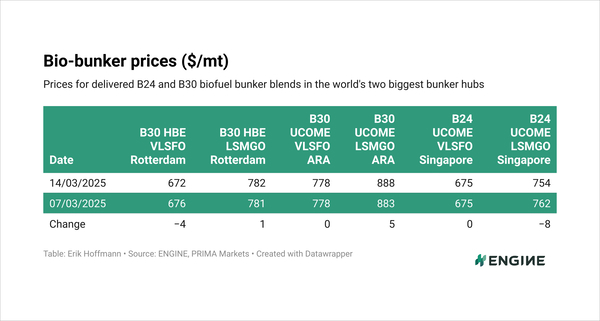

Hong Kong-based bunker fuel supplier Chimbusco Pan Nation (CPN) will offer physical deliveries of B30 biofuel blends in the port. This follows the Marine Environment Protection Committee’s (MEPC) recent approval allowing conventional bunker carriers to transport biofuel blends of up to B30, which contain a 30% bio-component.

By Konica Bhatt

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.