East of Suez Fuel Availability Outlook 15 Apr 2025

VLSFO availability is tight in Singapore

Bunker demand low in Fujairah

Prompt HSFO supply is tight across several Japanese ports

PHOTO: Aerial daytime view of Tokyo port, Japan. Getty Images

PHOTO: Aerial daytime view of Tokyo port, Japan. Getty Images

Singapore and Malaysia

VLSFO lead times in Singapore have widened to 8–12 days, up from 7–10 days last week. In contrast, HSFO lead times have shortened to 5–9 days, compared to the previous 7–11 days. LSMGO availability remains steady, with recommended lead times ranging from 2-7 days.

According to the latest data from Enterprise Singapore, the port’s residual fuel oil stocks have averaged 15% higher so far this month than in March. Fuel oil imports have surged by 29%, increasing by 1.64 million bbls. This rise has far outpaced the 432,000-bbl increase in exports, resulting in a notable buildup of stock levels. On the other hand, middle distillate inventories at the port have dropped by 9% this month to 9.35 million bbls—the lowest level since January.

At Malaysia’s Port Klang, VLSFO and LSMGO remain readily available, with prompt deliveries possible for smaller volumes. However, HSFO supply continues to be limited.

East Asia

Availability has improved across all grades in Zhoushan, where most suppliers now recommend lead times of 4–6 days, down from 5–7 days previously.

In northern China, Dalian and Qingdao have healthy stocks of VLSFO and LSMGO, although HSFO remains limited in Qingdao. Tight supply conditions persist in Tianjin for both VLSFO and HSFO, while LSMGO availability remains steady.

In Shanghai, VLSFO and HSFO are also under supply pressure, but LSMGO continues to be readily available. Further south, Fuzhou has strong availability of both VLSFO and LSMGO. Xiamen has good VLSFO supply but limited LSMGO.

Prompt deliveries of VLSFO and LSMGO remain difficult to secure in Yangpu and Guangzhou.

In Hong Kong, lead times for all fuel grades remain stable at around seven days, unchanged from recent weeks.

In Taiwan, VLSFO and LSMGO supplies remain stable in Hualien and Keelung, with lead times holding steady at around two days, the same as last week. In Kaohsiung and Taichung, deliveries of both grades require lead times of approximately three days.

Lead times for all fuel grades at several South Korean ports have shortened from 3–10 days last week to 3–6 days currently.

However, bunker operations are expected to face disruptions due to high waves and strong winds in Ulsan, Onsan, and Busan from 16–21 April, in Daesan and Taean from 16–19 April, and in Yeosu from 19–21 April.

Prompt VLSFO supply remains tight across several Japanese ports, including Tokyo, Chiba, Yokohama, Kawasaki, Osaka, Kobe, Sakai, Nagoya, Yokkaichi and Mizushima.

LSMGO availability is generally stable, although prompt deliveries can be difficult to secure in Osaka, Kobe, Sakai, Nagoya, Yokkaichi and Mizushima. Similarly, prompt HSFO supply remains constrained across many Japanese ports. In Oita, availability of all fuel grades is subject to enquiry.

Oceania

In Western Australia, Kwinana, Fremantle, and Kembla have strong supplies of VLSFO and LSMGO, with recommended lead times of 7–8 days. In New South Wales, Sydney has ample LSMGO availability, though securing prompt HSFO deliveries remains challenging.

In Victoria, both Melbourne and Geelong report abundant VLSFO and LSMGO stocks, but prompt HSFO stems are difficult to obtain. Queensland ports—Brisbane and Gladstone—also maintain sufficient VLSFO and LSMGO supplies, with lead times of 7–8 days. However, HSFO availability in Brisbane remains limited.

In New Zealand, Tauranga and Auckland have adequate VLSFO stocks, and suppliers in Auckland can provide prompt LSMGO deliveries. Bunker operations in Tauranga, however, may face intermittent disruptions due to rough weather expected throughout the week.

South Asia

VLSFO continues to be in tight supply at several Indian ports—Mundra, Kandla, Mumbai, Tuticorin, Chennai, Visakhapatnam, Cochin, and Haldia—reflecting conditions seen in recent weeks. LSMGO availability at most Indian ports remains subject to inquiry.

Adverse weather is expected to disrupt bunker deliveries at Kandla and Sikka from 16–19 April, and at Visakhapatnam from 17–19 April.

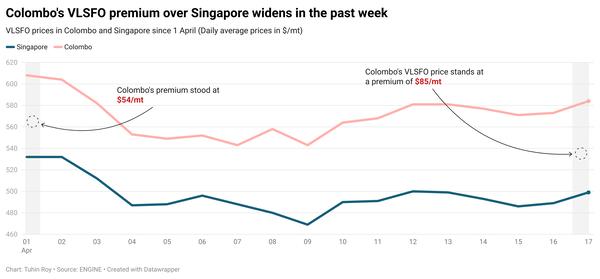

In Sri Lanka, a supplier recommends lead times of approximately eight days for all grades at ports including Colombo and Hambantota.

Middle East

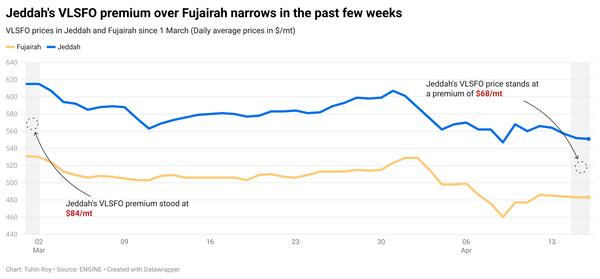

In Fujairah, prompt availability remains tight despite low demand, with lead times for all grades steady at 5–7 days, the same as last week. Suppliers in Khor Fakkan report similar lead times.

In Jeddah, VLSFO supply continues to be limited, while LSMGO is sufficiently available. In Djibouti, bunker supply is under pressure, with both VLSFO and LSMGO running low.

At Omani ports—including Sohar, Salalah, Muscat, and Duqm—LSMGO supply remains ample.

By Tuhin Roy

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.