East of Suez Market Update 16 Apr 2025

Prices in East of Suez ports have moved up, and VLSFO supply is constrained in the Middle Eastern ports of Jeddah and Djibouti.

Changes on the day, to 17.00 SGT (09.00 GMT) today:

- VLSFO prices up in Fujairah ($10/mt), Singapore ($9/mt) and Zhoushan ($8/mt)

- LSMGO prices up in Singapore ($20/mt), Fujairah ($14/mt) and Zhoushan ($12/mt)

- HSFO prices up in Singapore ($16/mt), Zhoushan ($12/mt) and Fujairah ($9/mt)

- B24-VLSFO at a $237/mt premium over VLSFO in Singapore

- B24-VLSFO at a $217/mt premium over VLSFO in Fujairah

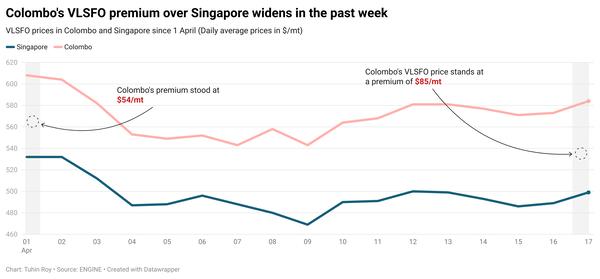

VLSFO benchmarks in East of Suez ports have increased by $8–10/mt over the past day, with Fujairah at the upper end of that range. Fujairah’s VLSFO is now priced nearly on par with Singapore and carries a slight discount of $9/mt compared to Zhoushan.

In Fujairah, prompt availability remains tight despite subdued demand, with lead times for all grades holding steady at 5–7 days, unchanged from last week. Suppliers in Khor Fakkan report similar lead times.

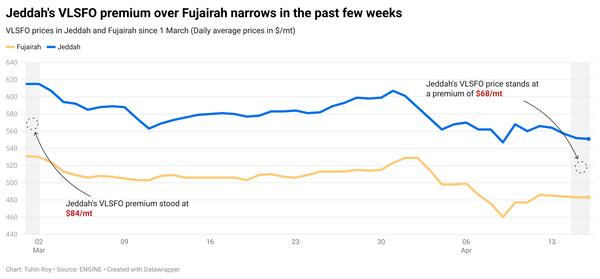

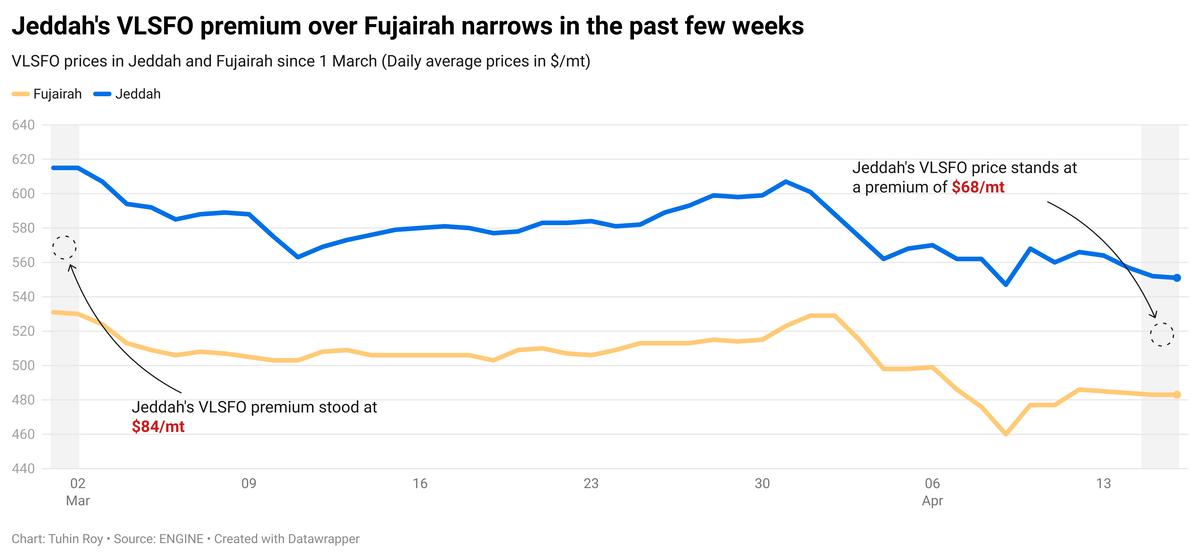

Meanwhile, Jeddah in Saudi Arabia continues to price its VLSFO significantly higher than Fujairah, with a notable premium of $68/mt.

VLSFO supply in Jeddah remains limited, while LSMGO is readily available. In Djibouti, bunker availability is under strain, with both VLSFO and LSMGO in short supply.

Brent

The front-month ICE Brent contract has gained by $0.43/bbl on the day, to trade at $65.25/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent’s price moved higher as global investors found some relief after the US administration temporarily paused some tariffs for 90 days.

While there are no significant upward pressures on Brent’s price at the moment, easing tariff-related concerns have helped prevent a further decline.

Market participants are now waiting to see the outcomes of trade negotiations between the US and its trading partners during the 90-day pause period.

Downward pressure:

Brent’s price felt some downward pressure after the American Petroleum Institute (API) reported a surge in US crude stocks. US crude oil inventories gained by 2.4 million bbls in the week ending 11 April, according to API estimates.

A buildup in inventories typically signals weaker oil demand, which can put downward pressure on Brent's price. “The demand picture for oil looks anything but rosy,” SPI Asset Management managing partner Stephen Innes remarked.

Additionally, the Paris-based International Energy Agency (IEA) now sees global oil demand to grow by 730,000 b/d in 2025, about 300,000 b/d lower than its previous estimate. This news has also capped Brent’s price gains.

“Traders are looking past the surface print and zeroing in on the soft underbelly: bloated inventories, sluggish demand recovery, and a tariff war that’s morphing into a slow bleed for global trade flows,” Innes added.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.