East of Suez Market Update 17 Apr 2025

Prices in East of Suez ports have moved up, and VLSFO supply is tight in Singapore.

Changes on the day, to 17.00 SGT (09.00 GMT) today:

- VLSFO prices up in Singapore ($18/mt), Fujairah ($16/mt) and Zhoushan ($14/mt)

- LSMGO prices up in Fujairah ($25/mt), Zhoushan ($19/mt) and Singapore ($18/mt)

- HSFO prices up in Fujairah ($16/mt), Zhoushan ($15/mt) and Singapore ($11/mt)

- B24-VLSFO at a $222/mt premium over VLSFO in Singapore

- B24-VLSFO at a $243/mt premium over VLSFO in Fujairah

Singapore’s VLSFO price has risen by $18/mt—the steepest increase among the three major Asian bunker ports. Despite the sharp rise, VLSFO in Singapore is still priced at a $13/mt discount to Zhoushan and is near parity with Fujairah.

Lead times for VLSFO in Singapore have widened to 8–12 days, up from 7–10 days last week. In contrast, HSFO lead times have shortened to 5–9 days from 7–11 days. LSMGO availability remains steady, with recommended lead times of 2–7 days.

At Malaysia’s Port Klang, VLSFO and LSMGO remain readily available, with prompt deliveries possible for smaller quantities, though HSFO supply continues to be limited.

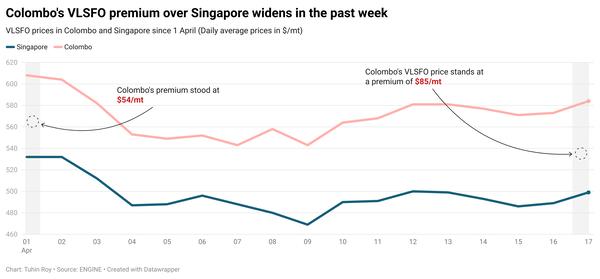

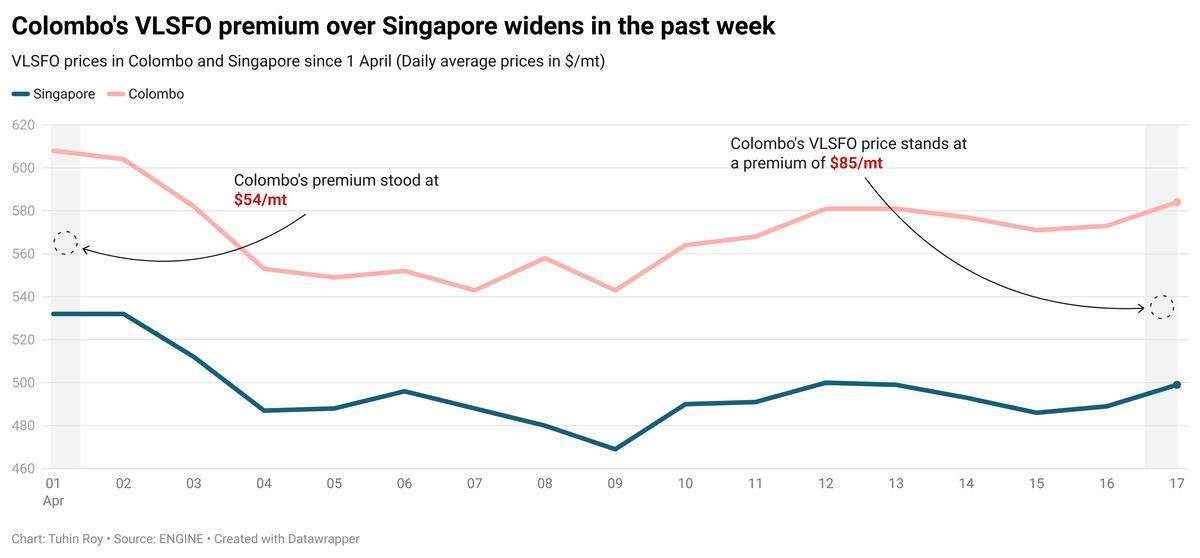

Meanwhile, Sri Lanka's Colombo port continues to price its VLSFO at a notable premium of $85/mt over Singapore. A supplier there recommends lead times of around eight days for all fuel grades in key ports such as Colombo and Hambantota.

Brent

The front-month ICE Brent contract has moved $1.15/bbl higher on the day, to trade at $66.40/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent crude’s price moved higher after the US administration announced stricter sanctions on Chinese buyers of Iranian crude oil.

The US Department of the Treasury’s Office of Foreign Assets Control (OFAC) has sanctioned several companies and vessels responsible for facilitating Iranian oil shipments to China, which are a part of Iran’s shadow fleet.

The news was aided by further supply-side issues as OPEC revealed revised compensation plans from seven members, aiming to make deeper cuts in the upcoming months through June 2026 for previous overproduction.

“Iraq said it will cut its oil exports this month after it faces pressure to adhere to its OPEC+ production target,” ANZ Bank’s senior commodity strategist Daniel Hynes remarked.

The seven OPEC+ members will collectively cut production by a total of 4.6 million b/d through June 2026, the coalition has announced.

Downward pressure:

Brent’s price felt some downward pressure after the US Energy Information Administration (EIA) reported a small rise in US crude stocks.

Commercial US crude oil inventories gained by 515,000 bbls to touch 443 million bbls for the week ending 11 April, according to data from the EIA.

A buildup in inventories typically signals weaker oil demand, which can put downward pressure on Brent's price.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.