Biofuel Bunker Snapshot: Slight bio price gains countered by fossil declines

Broadly steady bio-bunker prices

Singapore biofuel bunker sales hit new highs

IMO framework could favour crop-based biofuels

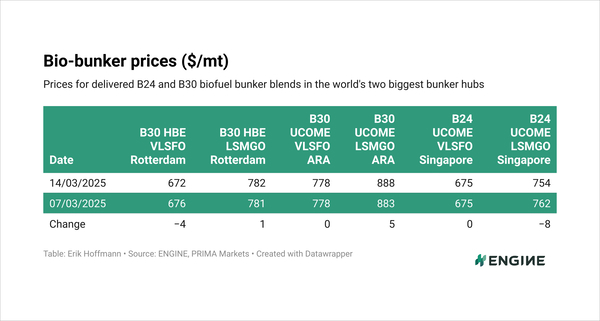

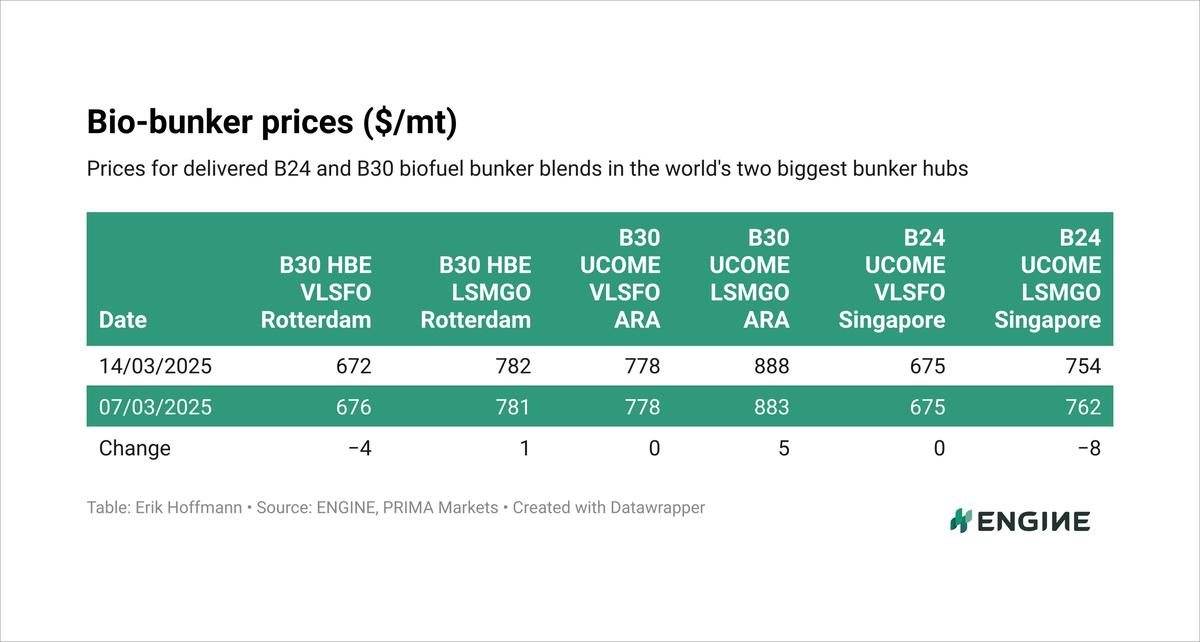

Rotterdam

The price of B30-VLSFO HBE is down by $4/mt on the week in Rotterdam, amid a $6/mt drop for pure VLSFO and a $4/mt greater HBE rebate for qualifying B30 blends. The B30 benchmark has been under some downward pressure from a $12/mt rise in POMEME CIF ARA barges, assessed by PRIMA Markets.

B30-VLSFO HBE’s premium over pure VLSFO has edged up by $2/mt to $229/mt, which does not include the higher cost of burning VLSFO under the EU ETS and FuelEU Maritime regulations.

B100 HBE keeps being offered in a wide price range between various Dutch suppliers. The grade has been priced from a low of around $850/mt to a high of around $1,200/mt. Pricing can depend on feedstocks, which include palm oil methyl ester (POME), residue from fatty acid methyl ester (FAME) production, forest residue and food waste.

Rotterdam’s B30-VLSFO UCOME ARA price has been steady on the week and is about $100/mt higher than the HBE-rebated version. A $12/mt gain in PRIMA’s UCOME FOB ARA barge price was offset by a $6/mt drop in pure VLSFO.

Singapore

B24-VLSFO UCOME is priced at the same level as a week ago in Singapore. Steady levels for both UCOME FOB China cargo and a relevant China-Singapore freight rate of $16.25/mt has kept the B24 price in check. Singapore’s pure VLSFO price edged $1/mt lower on the week.

The premium of B24-VLSFO UCOME over conventional VLSFO has widened by $1/mt to $187/mt – without any emission costs for EU-linked voyages included.

Biofuel bunker sales reached new highs in Singapore last month. Around 4,700 mt/day was sold, up from 3,800 mt/day in February. At 145,600 mt, sales just about topped the previous 145,500 mt record from October last year. Only bio-VLSFO (64%) and bio-HSFO (36%) featured in the sales. B100 sales dropped from 3,800 mt in February to nothing in March.

Other bio-bunker news

The newly approved draft IMO Net-Zero Framework is projected to favour biofuels, but not necessarily the sustainable kind. There are no provisions on which biofuel feedstocks will qualify, unlike FuelEU Maritime, which excludes food- and feed crop feedstocks like palm, soy and rapeseed. The greenhouse gas (GHG) intensity reduction targets could end up promoting “forest-destroying first generation biofuels,” warned Faïg Abbasov, shipping programme director at Transport & Environment.

Chimbusco Pan Nation has started supplying B30 blends in Hong Kong, upping its blend ratio from B24. This follows a recent decision by Singapore’s port authority to allow oil tankers to supply B30 blends. B30 bunkering could soon spread to other ports where B24 is still the standard grade.

Coral Marine delivered a first biofuel stem in Greece. It was blended biofuel produced from used cooking oil by Motor Oil and supplied to a cruise ship in the Port of Lavrio.

By Erik Hoffmann

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.