East of Suez Market Update 26 Dec 2024

Prices in East of Suez ports have remained broadly stable, and availability of all grades remains tight in several Japanese ports.

Changes on the day, to 17.00 SGT (09.00 GMT) today:

- VLSFO prices up in Zhoushan ($2/mt) and Singapore ($1/mt), and unchanged in Fujairah

- LSMGO prices up in Zhoushan ($2/mt), and unchanged in Singapore and Fujairah

- HSFO prices up in Fujairah ($5/mt), Singapore ($2/mt) and Zhoushan ($1/mt)

Prices in East of Suez ports have remained largely stable over the past day, with no significant changes. Singapore’s VLSFO price is at a notable discount of $37/mt compared to Zhoushan and carries a slight premium of $8/mt over Fujairah.

VLSFO availability in Singapore remains tight, with standard lead times of 10 days, though expedited deliveries within four days are available at higher costs. HSFO lead times range between 9-15 days, while LSMGO lead times are steady at 3-7 days.

In Malaysia's Port Klang, VLSFO and LSMGO grades are readily available, with prompt small-quantity deliveries possible, but HSFO supply remains limited.

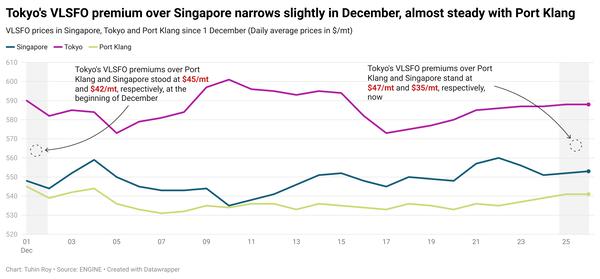

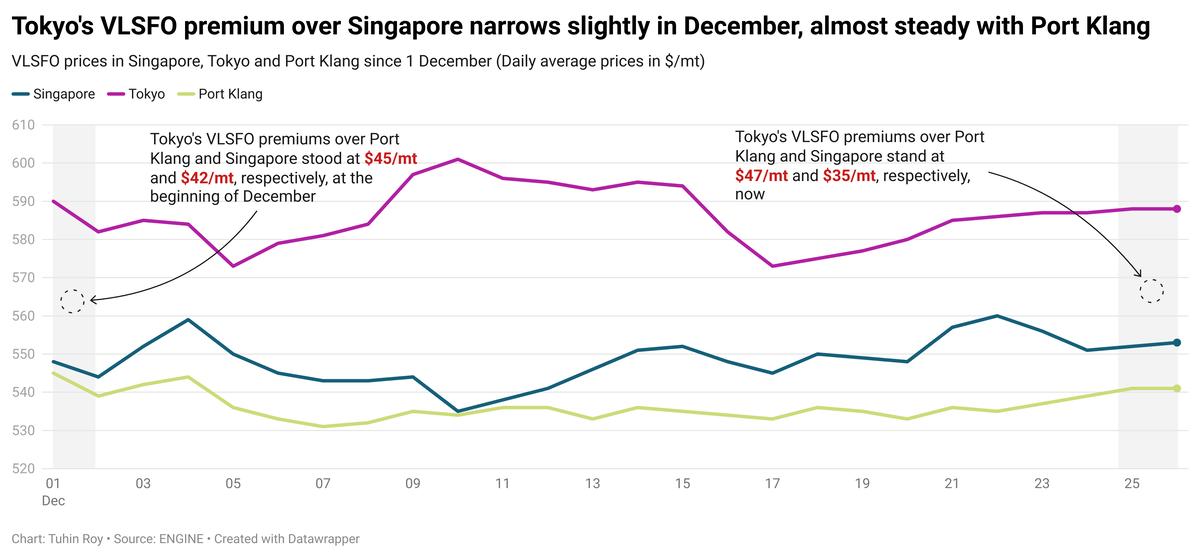

Meanwhile, in Japan, Tokyo's VLSFO is at premiums of $47/mt and $35/mt over Port Klang and Singapore, respectively.

Across Japan's major ports—Tokyo, Chiba, Yokohama, Kawasaki, Osaka, Kobe, Sakai, Nagoya, Yokkaichi, Mizushima and Oita—availability of all fuel grades remains tight.

Brent

The front-month ICE Brent contract has risen $0.72/bbl from Tuesday, to trade at $73.88/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Oil prices rose on optimism about additional fiscal stimulus in China, the world's largest oil importer.

China plans to enhance fiscal support for consumption next year by increasing pensions, medical insurance subsidies, and expanding trade-in programs for consumer goods, according to a finance ministry announcement reported by Reuters.

China's trade-in programs for consumer goods refer to a series of measures to boost domestic sales.

Expectations of a decline in US crude inventories also supported Brent futures, analysts said.

Downward pressure:

Libya's National Oil Corporation (NOC) announced on Wednesday that the country's average crude production in 2024 surpassed its target of approximately 1.4 million b/d, Reuters reported. This exerted some downward pressure on Brent futures.

By Tuhin Roy

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.