East of Suez Market Update 24 Dec 2024

Prices in East of Suez ports have moved in mixed directions, and HSFO supply has improved across several South Korean ports.

Changes on the day, to 17.00 SGT (09.00 GMT) today:

- VLSFO prices up in Fujairah ($2/mt), and down in Singapore ($15/mt) and Zhoushan ($6/mt)

- LSMGO prices up in Fujairah ($6/mt), and down in Singapore ($15/mt) and Zhoushan ($6/mt)

- HSFO prices up in Singapore ($2/mt), and down in Zhoushan ($7/mt) and Fujairah ($6/mt)

Singapore's VLSFO price has dropped by $15/mt over the past day, while prices in Fujairah and Zhoushan have remained largely stable. Four lower-priced VLSFO stems, fixed in a wide range of $18/mt, have contributed to pull the benchmark down. This price drop has shifted Singapore's VLSFO from a premium over Fujairah to a near-parity level.

VLSFO availability in Singapore remains tight, with lead times of 10 days, unchanged from last week. Some suppliers can deliver within four days, but such expedited deliveries come at higher prices. HSFO supply is also constrained, with lead times ranging from 9-15 days. LSMGO lead times remain steady at 3-7 days.

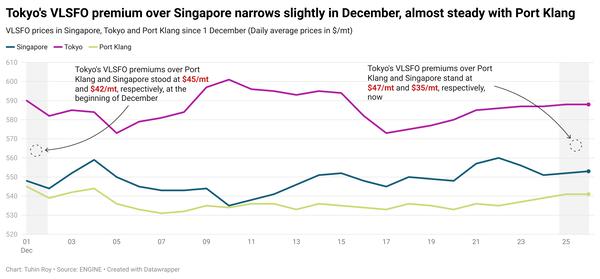

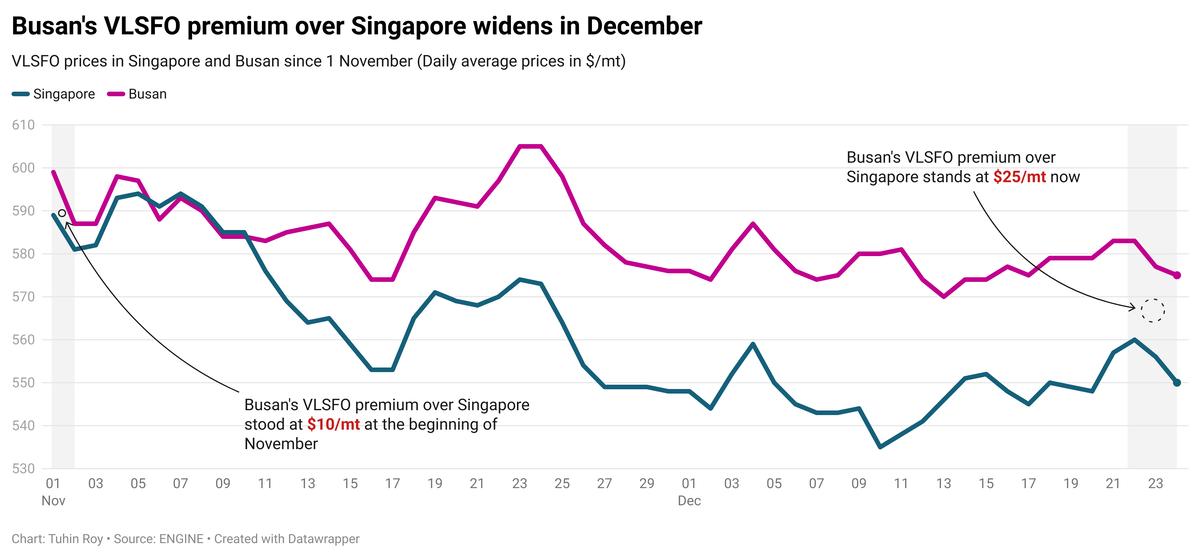

In South Korea's Busan, the VLSFO price is at a $25/mt premium over Singapore. In southern South Korean ports, VLSFO and LSMGO lead times range from 3-11 days, while 6-11 days are recommended for deliveries in western ports. Last week, lead times of 4-9 days were advised across South Korea for both grades.

Meanwhile, HSFO supply has improved in South Korea, with most suppliers now advising lead times of around six days across all ports, compared to last week's 4-9 days.

Brent

The front-month ICE Brent contract has inched $0.05/bbl lower on the day, to trade at $73.16/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Oil prices gained some upward thrust after the US Department of Commerce revised its GDP estimate upward for the third quarter.

The US gross domestic product (GDP), a key indicator of demand growth and consumer spending activity, increased at an annualised rate of 3.1% in the third quarter of this year, up from the initial estimate of 2.8%, the US Commerce Department’s Bureau of Economic Analysis (BEA) said.

The upward revision has shown resilience in the country's economic growth in the third quarter of this year, as it was better than previously estimated. It has supported demand growth expectations in the global oil market, according to analysts.

Oil market analysts and traders are now waiting to factor in the potential changes in the US economy when US President-elect Donald Trump takes office on 20 January 2025.

The oil market is in a “wait-and-watch mode for what 2025 brings,” VANDA Insights’ founder and analyst Vandana Hari said.

Downward pressure:

Brent’s price inched marginally lower in pre-Christmas trade as global financial markets held largely stable during the year-end holiday season.

Brent has felt some downward pressure due to concerns about the slowdown in Chinese oil demand, according to analysts.

Oil demand in the world’s second-largest consumer is expected to peak around 2027, market intelligence provider JLC reported citing Chinese state-owned oil company Sinopec.

Chinese officials have pledged to roll out a new stimulus package next year to revive the country’s economy. However, oil market analysts remain cautious, tempering expectations of a significant boost to oil demand from these measures.

The country will likely consume about 750 million mt and 770 million mt of crude oil this year and in 2025, respectively, Sinopec said in its report.

“Oil stays locked in a boring trading range a coming cold blast,” Price Futures Group’s senior market analyst Phil Flynn said.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.