Americas Fuel Availability Outlook 19 Dec 2024

Fog season to impact US Gulf Coast bunkering

Tight availability in West Coast ports

Bad weather disrupts bunkering in Zona Comun

PHOTO: A cargo ship being moved by tugboats in the Port of Galveston, Texas. Getty Images

PHOTO: A cargo ship being moved by tugboats in the Port of Galveston, Texas. Getty Images

North America

Bunker fuel availability in Houston remains tight across all grades, despite low demand in recent days, according to a source. Suppliers generally require lead times of 7-9 days for VLSFO and LSMGO deliveries, while HSFO could take more than nine days.

A source noted that demand could pick up early next week as some buyers may finalise orders. “A few are just watching the market, or many vessels haven’t fully fixed, which makes them wait on stemming fuel,” the source said.

Fog and reduced visibility halted vessel traffic through the Houston Ship Channel on Tuesday and Wednesday, adding to intermittent closures over the past two weeks. The offshore anchorage near Houston and Galveston has been particularly impacted, with pilots unable to board vessels. However, traffic further inland towards the port of Houston has been less affected.

As of Thursday morning, vessel movements in the Houston Ship Channel had resumed in both directions, but adverse weather conditions could return over the weekend.

At the New Orleans Outer Anchorage (NOLA), a cold front on Wednesday caused fog-related disruptions similar to in Houston. Fog conditions in the region depend heavily on wind directions. Southerly winds from the Gulf typically result in fog, while colder, northerly winds keep visibility clear.

Bunkering proceeded normally at the Galveston Offshore Lightering Area (GOLA) on Thursday, though high wind gusts could cause delays in the coming days.

On the West Coast, prompt bunker availability in Los Angeles and Long Beach remains tight, with suppliers recommending lead times of 8-10 days for VLSFO and LSMGO This situation coincides with the end of the year, when suppliers often adjust inventory levels.

The ad valorem tax, a value-based tax system, can influence bunker fuel operations, particularly at the year-end. Suppliers may delay fuel deliveries until the new year to shift their tax liabilities, creating tighter availability as they manage their inventory.

Moreover, the tax is calculated based on the market value of the fuel, which could lead to price increases. Receiving vessels may also time their refueling, to either avoid higher taxes by topping up well before the year ends, or to take advantage of lower taxes in the new year. This can, in turn, affect demand and potentially cause short-term supply constraints.

California also differs from Texas in its approach to taxing international vessels. In Texas, vessels departing for international destinations are exempt from taxes. In California, however, taxes are levied on fuel burned from the time it is loaded until the vessel docks at its next port outside the state.

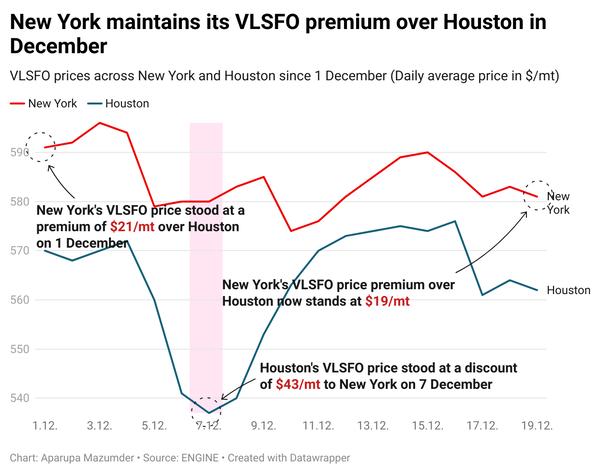

On the East Coast, bunker availability for VLSFO and LSMGO is stable in New York, but demand has been slow so far this week.

Caribbean and Latin America

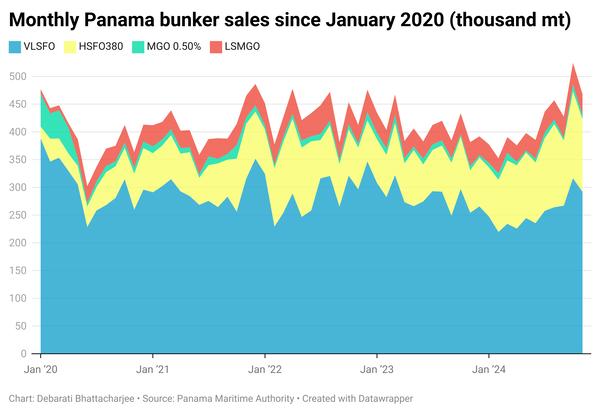

The Panamanian ports of Balboa and Cristobal have seen more demand this week, tightening availability. Suppliers require lead times of more than seven days to secure stems. The surge is typical of end-of-year trends, when vessels aim to refuel ahead of the holidays.

Bunker operations at Argentina’s Zona Común anchorage are expected to be suspended on Friday afternoon due to rough weather, with wind gusts of up to 30 knots forecast over the weekend. Prolonged delays are likely, a source says.

In Argentina's Bahía Blanca, YPF’s bunker barge Stratis Sky is undergoing maintenance in a dry dock, temporarily reducing supply capacity. Bahía Blanca, a major wheat export hub, is facing sluggish exports and reduced barge availability, adding pressure to the bunker market. Some vessels may seek alternative refueling options in Buenos Aires or Necochea.

Meanwhile, suppliers in Brazilian ports reported strong demand this week, with ample availability across most grades. Some suppliers offered fuel at lower prices to attract business, a source said.

By Debarati Bhattacharjee

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.