Americas Market Update 19 Dec 2024

Bunker fuel prices have moved in both directions across grades in key Americas ports, and rough weather can trigger bunker suspensions in Zona Comun tomorrow.

Changes on the day, to 07.00 CST (13.00 GMT) today:

- VLSFO prices up in Los Angeles ($3/mt), and down in Houston, New York, Balboa and Zona Comun ($5/mt)

- LSMGO prices down in Houston ($6/mt), Los Angeles, Balboa ($4/mt) and New York ($3/mt)

- HSFO prices up in Los Angeles ($1/mt), and down in Houston ($5/mt), New York ($4/mt) and Balboa ($1/mt)

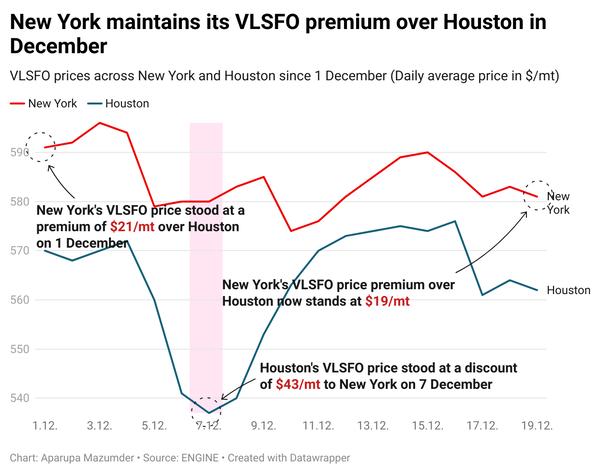

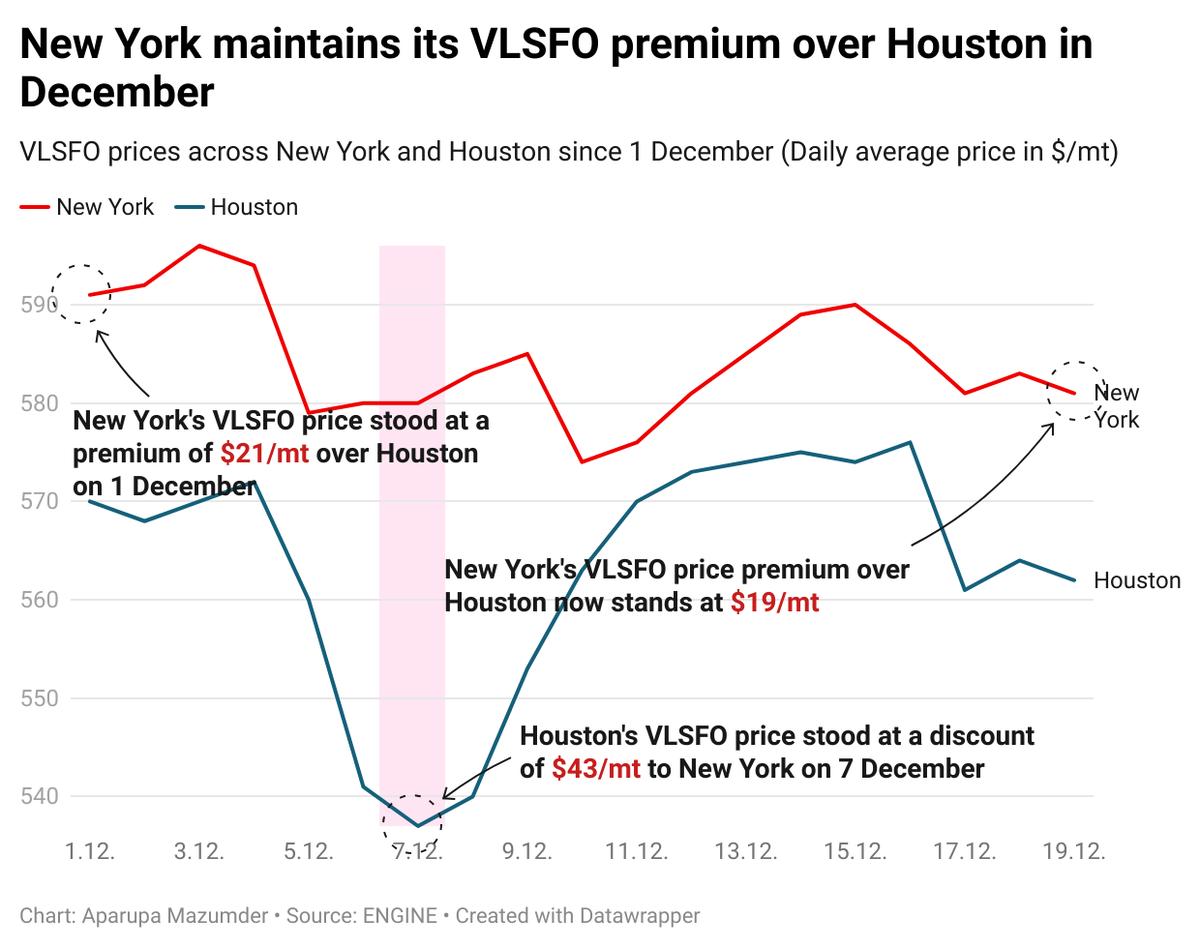

VLSFO prices in major Americas ports have mostly tracked Brent crude’s downward move, except in Los Angeles, where it has inched up. Houston and New York’s VLSFO prices have both lost $5/mt. New York currently prices its VLSFO at a $19/mt premium over Houston, which is similar to where the premium was at the beginning of the month.

Prompt VLSFO availability is tight in Houston. The situation is expected to remain the same until the year-end, according to a source. Bunker operations in the port are also facing delays due to dense fog in the Houston Ship Channel.

Bunker deliveries at Argentina’s Zona Comun anchorage could be suspended between 20-23 December due to high wind guts, a source says.

Suppliers in the Galveston Offshore Lightering Area (GOLA) can also face bunkering issues this week as weather-related issues persist, a source says.

Brent

The front-month ICE Brent contract has moved $0.56/bbl lower on the day, to trade at $73.11/bbl at 09.00 GMT.

Upward pressure:

Brent’s price gained as supply-related concerns escalated with Israel launching airstrikes on ports and energy infrastructures in Houthi-controlled areas of Yemen, Reuters reported.

The Israel Defense Forces (IDF) has threatened with more attacks against the Iran-aligned armed group, raising further concerns of a spillover of the conflict into neighbouring oil-rich areas, analysts said.

Meanwhile, oil demand growth found some support after the US Energy Information Administration (EIA) reported a slump in US crude stocks.

Commercial crude oil inventories in the US declined by 934,000 bbls to touch 421 million bbls for the week ending 13 December, according to data from EIA.

A drop in US crude stocks indicates oil demand growth in the world’s largest oil-consuming country.

Downward pressure:

Brent lost momentum after the US Federal Reserve (Fed) hinted at a softer approach to interest rate cuts next year.

Despite cutting interest rates for the final time in 2024, oil prices and the broader commodities market reacted negatively to the US central bank’s “hawkish” stance on economic and monetary policies next year, oil market analysts said.

“Crude futures were inching lower… as the US Federal Reserve’s signal of a slower and shallower path of interest rate cuts in 2025 dampened the mood in the financial markets,” VANDA Insights’ founder and analyst Vandana Hari said.

Higher interest rates in the US can make oil and other dollar-denominated commodities costlier for holders of other currencies and weigh on demand.

Brent continues to see headway from a slowdown in oil demand growth and a lack of efficient economic policies in China, the world’s second largest crude-consuming nation.

China's National Bureau of Statistics (NBS) reported that the country’s retail sales growth came in weaker than unexpected in November, rising by only 3% year-on-year, and noting a sharp drop from the 4.8% growth achieved in October.

“Weak economic data in China also sort of weighed on [oil market] sentiment,” Price Futures Group senior market analyst Phil Flynn said.

By Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.