Americas Market Update 18 Dec 2024

Americas bunker prices have mostly gained with Brent, and bunkering is expected to be suspended in Zona Comun and GOLA again.

Changes on the day, to 07.00 CST (13.00 GMT) today:

- VLSFO prices up in Houston and Balboa ($8/mt), Los Angeles ($7/mt), New York ($6/mt) and Zona Comun ($2/mt)

- LSMGO prices up in New York ($11/mt), Los Angeles ($9/mt), Houston ($7/mt) and Balboa ($6/mt)

- HSFO prices up in Houston and Los Angeles ($9/mt), Balboa ($7/mt) and New York ($5/mt)

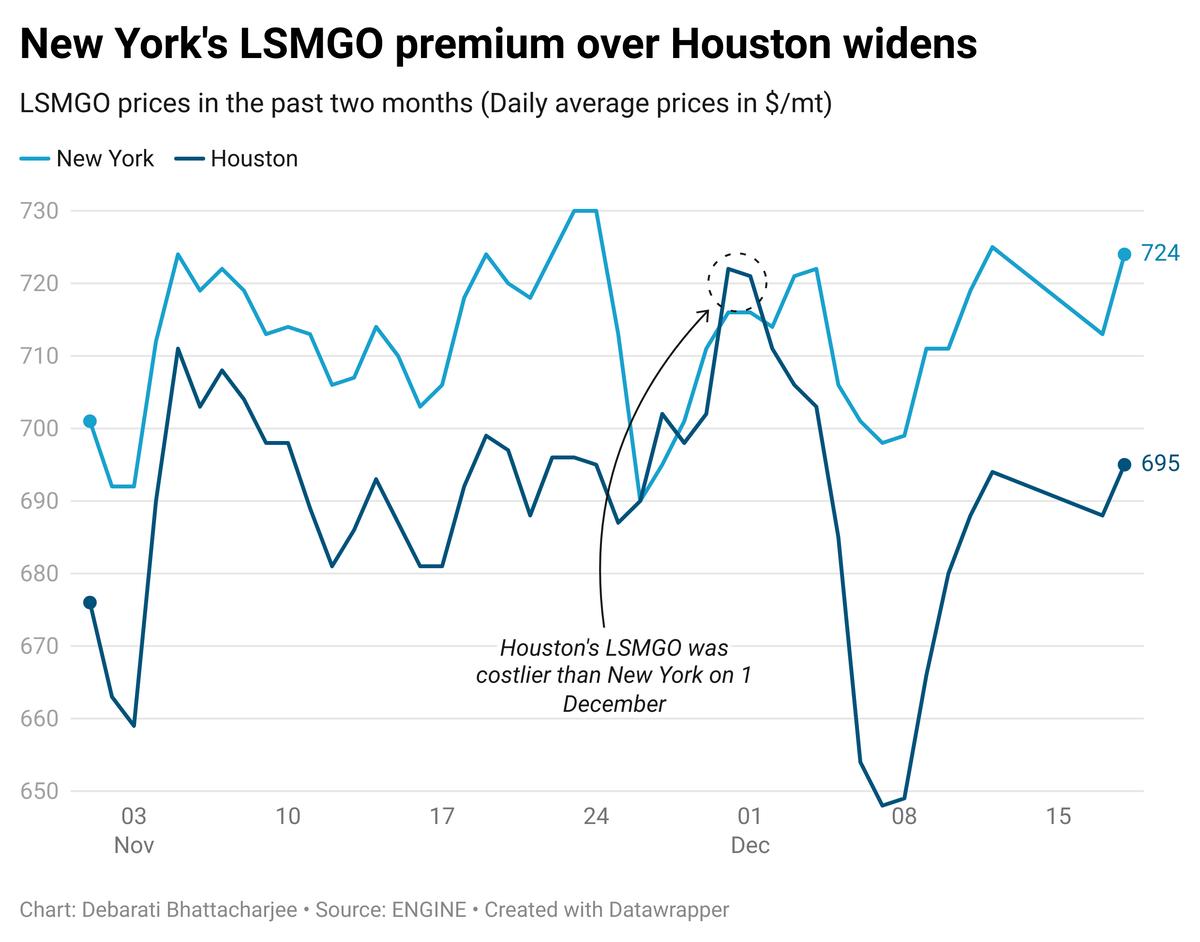

New York’s LSMGO price has gained more than New York’s LSMGO benchmark in the past day. This has widened New York’s LSMGO price premium over Houston from $25/mt yesterday, to $29/mt.

In Houston, bunker availability across all grades remains tight despite low demand over the past few days, according to a market source.

Thick fog and reduced visibility have halted all inbound and outbound vessel traffic through the Houston Ship Channel since yesterday, with conditions expected to persist throughout the week.

The offshore anchorage near Houston and Galveston is particularly affected, as dense fog prevents pilots from boarding vessels, leading to significant delays. However, vessel traffic further inland in Houston port remains less impacted, according to a source.

Bunkering has been proceeding normally in the Galveston Offshore Lightering Area (GOLA) today. But bunkering is expected to be suspended tomorrow due to a forecast of wind gusts of up to 28 knots.

Bunkering operations are expected to be suspended in Zona Comun tomorrow amid rough weather conditions. Bad weather is forecast for most of this week, which could cause prolonged delays.

Brent

The front-month ICE Brent contract has moved $0.62/bbl higher on the day, to trade at $73.81/bbl at 07.00 CST (13.00 GMT) today.

Upward pressure:

Brent’s price moved higher as the global oil market shifted its focus on today’s Federal Open Market Committee (FOMC) meeting, where the US Federal Reserve (Fed) is expected to announce another interest rate cut before the year ends.

Market analysts expect the US Fed to cut interest rates by another 25 basis points. Lower interest rates in the US can make dollar-denominated commodities like oil more affordable for holders of other currencies.

“Today's highly anticipated FOMC meeting has traders on edge, with markets already factoring in a 25bps [25 basis points] rate cut by the Federal Reserve,” SPI Asset Management’s managing partner Stephen Innes said.

The inflation rate in the US, measured by the change in the Consumer Price Index (CPI), rose to 0.3% in November, inching up from a 0.2% growth recorded in the previous month, the US Labor Department's Bureau of Labor Statistics (BLS) reported.

This has left room for one last rate cut in 2024 by the US central bank, analysts said. “This [rate cut] expectation stems from the latest inflation data, where November's CPI aligned with forecasts, showing no unexpected spikes,” Innes said.

Downward pressure:

Brent futures felt some downward pressure due to concerns about weak oil demand growth in China.

China’s National Bureau of Statistics (NBS) reported that the country’s retail sales growth came in weaker than unexpected in November, rising only by 3% year-on-year, and noting a sharp drop from the 4.8% growth achieved in October.

“Continued concerns about the demand outlook in China have otherwise been the [oil market’s] focus this week,” analysts from Saxo Bank said.

By Debarati Bhattacharjee and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.