Europe & Africa Market Update 4 Dec 2024

Regional bunker benchmarks have tracked Brent’s upward movement, and demand has picked up in Gibraltar.

Changes on the day to 09.00 GMT today:

- VLSFO prices up in Gibraltar ($4/mt), Rotterdam and Durban ($2/mt)

- LSMGO prices up in Rotterdam ($8/mt) and Gibraltar ($1/mt)

- HSFO prices up in Gibraltar ($8/mt), and unchanged in Rotterdam

- Rotterdam B30-VLSFO at a $197/mt premium over VLSFO

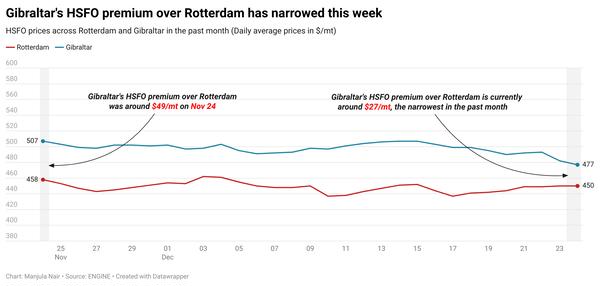

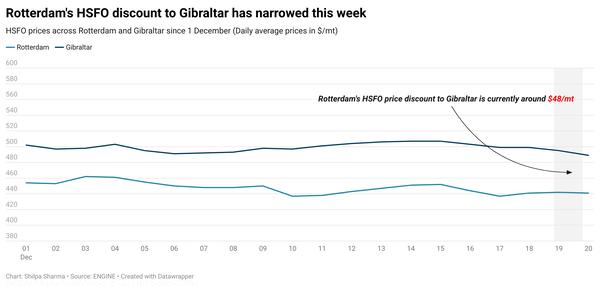

Gibraltar’s HSFO price has gained by a steep $8/mt in the past day, while Rotterdam’s HSFO price has held steady. These price moves have widened Gibraltar’s HSFO premium over Rotterdam by $8/mt to $42/mt now.

Gibraltar is witnessing adverse weather today, with wind gusts of 23 knots in the port area. Demand has spiked in the port, which has contributed to push delivery lead times further this week, according to a source.

Lead times of up to 11 days are advised for HSFO in Gibraltar and 7-8 days for VLSFO. LSMGO can be delivered with shorter lead times of around 5-7 days. Five vessels are waiting to receive bunkers in Gibraltar today, up from two yesterday, a source said.

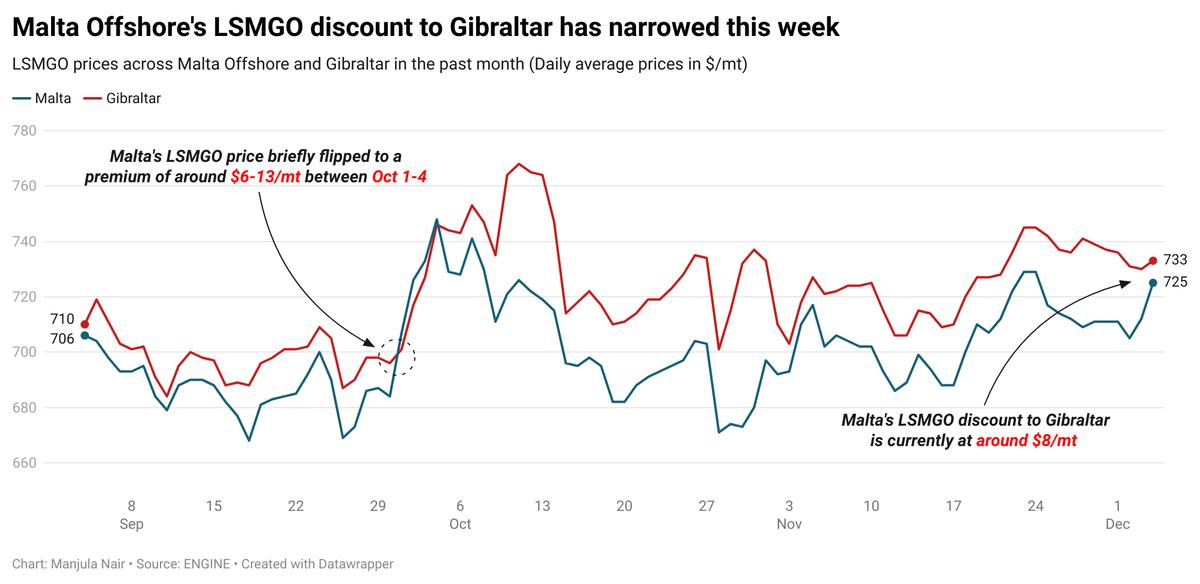

A higher-priced prompt delivery LSMGO stem fixed at $717/mt for 150-500 mt off Malta has pushed its LSMGO benchmark up by $15/mt to $723/mt. The price increase has narrowed Malta’s LSMGO discount to Gibraltar by $14/mt to just $8/mt now.

Bunker availability off Malta has improved this week, after being tight last week. HSFO and VLSFO now require 4-5 days of lead time, while LSMGO is plentiful, with 2-5 days recommended, a trader said.

Brent

The front-month ICE Brent contract has gained $1.17/bbl on the day, to trade at $73.82/bbl at 09.00 GMT.

Upward pressure:

The ceasefire deal between Israel and Iran-backed Hezbollah militants, coupled with renewed geopolitical conflicts rising in other parts of the world has collectively lent support to Brent’s price today.

The Israel Defense Forces (IDF) warned of resuming the conflict with Hezbollah if the ceasefire collapses. This news comes as rebel groups from Syria have threatened to unite with other armed factions in neighbouring oil-producing nations.

“The freshly-erupted internal war in Syria continued to fester… while Israel and the Hezbollah militants exchanged attacks in violation of their ceasefire,” VANDA Insights’ founder and analyst Vandana Hari remarked.

South Korea’s President Yoon Suk Yeol declared martial law in the country yesterday, following internal issues within the parliament. The martial law was immediately lifted on Wednesday following a bipartisan parliamentary vote that rejected the martial law. Growing political tensions in the country could impact the country's refining capability or imports.

Brent’s price also found support as anticipation grew around the upcoming OPEC+ meeting. The eight members cutting output by 2.2 million b/d are now expected to extend production cuts through the first quarter of 2025, Reuters reported citing sources.

“Oil prices are rising on reports that suggest that OPEC-plus will extend its production cuts until the end of the first quarter of next year,” Price Futures Group’s senior market analyst Phil Flynn said.

Downward pressure:

Brent’s price felt some downward pressure after the American Petroleum Institute (API) reported a rise in US crude stocks.

Crude oil inventories in the US rose by 1.2 million bbls in the week that ended 29 November, according to API estimates. The weekly inventory rise contradicted market expectations of a 2.06 million-bbl fall during the week.

A surge in US crude stocks indicates a slowdown in oil demand growth, which can lower Brent's price.

The broadly followed US government data on crude oil stockpiles from the US Energy Information Administration (EIA) is due later today.

By Manjula Nair and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.