Europe & Africa Market Update 20 Dec 2024

Bunker prices in most European and African ports have decreased, and prompt supply of VLSFO remains tight in Durban.

Changes on the day to 09.00 GMT today:

- VLSFO prices unchanged in Gibraltar, and down in Durban ($3/mt) and Rotterdam ($2/mt)

- LSMGO prices down in Gibraltar ($9/mt) and Rotterdam ($1/mt)

- HSFO prices unchanged in Rotterdam, and down in Gibraltar ($11/mt)

- Rotterdam B30-VLSFO at a $177/mt premium over VLSFO

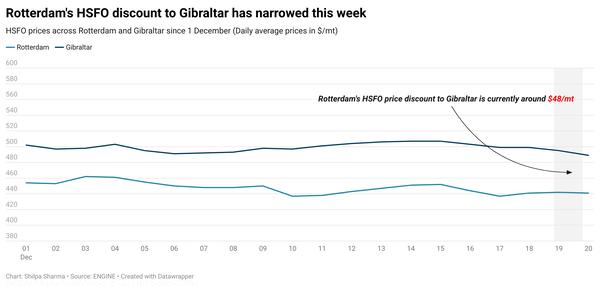

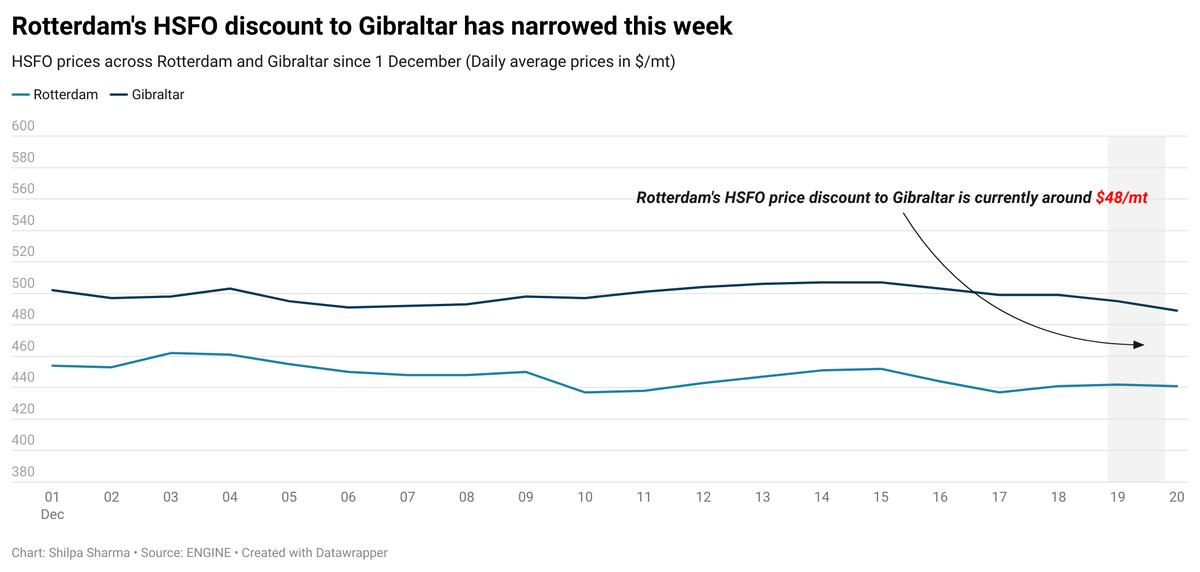

Most regional bunker benchmarks have come down. Gibraltar’s HSFO price has dropped by $11/mt, while the grade’s price in Rotterdam has held steady. A lower-priced HSFO stem fixed in Gibraltar at $487/mt in the past day has contributed to drag the benchmark down. The diverging price moves have narrowed Rotterdam’s HSFO discount to Gibraltar by $11/mt to around $48/mt now.

Supply of all bunker fuel grades remains normal in Gibraltar, with recommended lead times of 3-5 days. Meanwhile, securing prompt supply of HSFO can be slightly difficult in Rotterdam, according to a trader.

In South Africa’s Durban, the VLSFO price has decreased some, while availability of the grade remains tight for prompt delivery dates. Lead times of 7-10 days are advised for full coverage from suppliers. Prompt supply of LSMGO is under pressure as well, requiring lead times of 7-10 days.

Brent

The front-month ICE Brent contract has moved $0.77/bbl lower on the day, to trade at $72.34/bbl at 09.00 GMT.

Upward pressure:

Brent’s price has gained some support as market participants braced for news of further oil supply tightness.

In a move that could cut more supply from the global oil market, the G7 group of developed countries is considering stricter ways to strengthen the price cap on Russian crude oil, including an outright ban, Bloomberg reports.

Russia’s alleged ‘shadow fleet’ has circumvented the $60/bbl price cap set on its crude and oil products.

By assembling a shadow fleet of poorly maintained vessels that are used to circumvent sanctions meant to restrict the movement of Russian crude oil, Russia has been effectively trading outside the imposed price cap.

Downward pressure:

Brent's price lost momentum after the US dollar climbed to a two-year high on Thursday.

The dollar climbed higher after the US Federal Reserve hinted at a more cautious outlook for interest rate cuts in 2025, Reuters reports. A stronger dollar makes commodities like oil more expensive against other major currencies.

The commodities market crushed “after the Fed raised its dot plot and took interest rate cuts off the table for the foreseeable future,” Price Futures Group’s senior market analyst Phil Flynn said.

Brent’s price felt additional pressure due to growing concerns about China’s oil demand in 2025. Chinese officials recently met to discuss more economic stimulus to be introduced in the country next year. However, the news did not provide much support to oil, analysts said.

Chinese state-owned refiner Sinopec said in its annual energy outlook that China's crude oil imports could peak as soon as 2025 and the country's oil consumption would peak by 2027 as demand weakens and EV sales grow, Reuters reports.

“The [demand] growth rate is underwhelming for China from historical standards but at the same time, to achieve that rate consistently China is going to have to do a lot more on the stimulus front,” Flynn added.

By Shilpa Sharma and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.