Europe & Africa Market Update 3 Dec 2024

Bunker benchmarks in most European and African ports have shown mixed market directions, and adverse weather may impact bunkering in Gibraltar tomorrow.

Changes on the day to 09.00 GMT today:

- VLSFO prices up in Rotterdam ($8/mt) and Durban ($5/mt), and down in Gibraltar ($1/mt)

- LSMGO prices down in Rotterdam ($5/mt) and Gibraltar ($4/mt)

- HSFO prices up in Rotterdam ($9/mt), and down in Gibraltar ($9/mt)

- Rotterdam B30-VLSFO at a $172/mt premium over VLSFO

In Rotterdam, one 150-500 mt lower-priced LSMGO stem fixed at $639/mt for prompt delivery has pulled the benchmark lower in the past day. LSMGO availability is normal in the ARA hub with suppliers able to offer the grade for prompt delivery dates, a trader said. Lead times of 3-5 days are advised for LSMGO in Rotterdam and across the wider ARA hub.

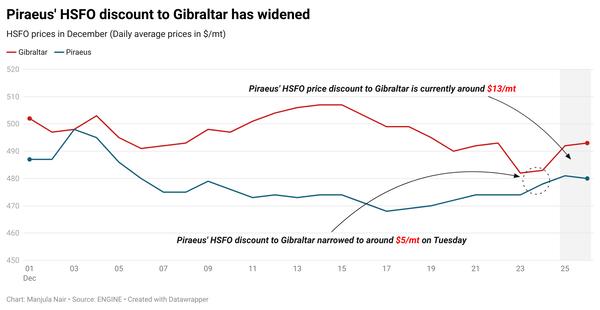

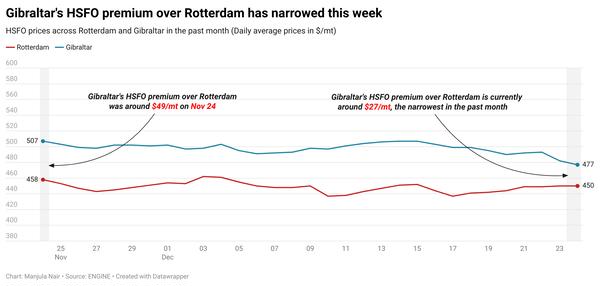

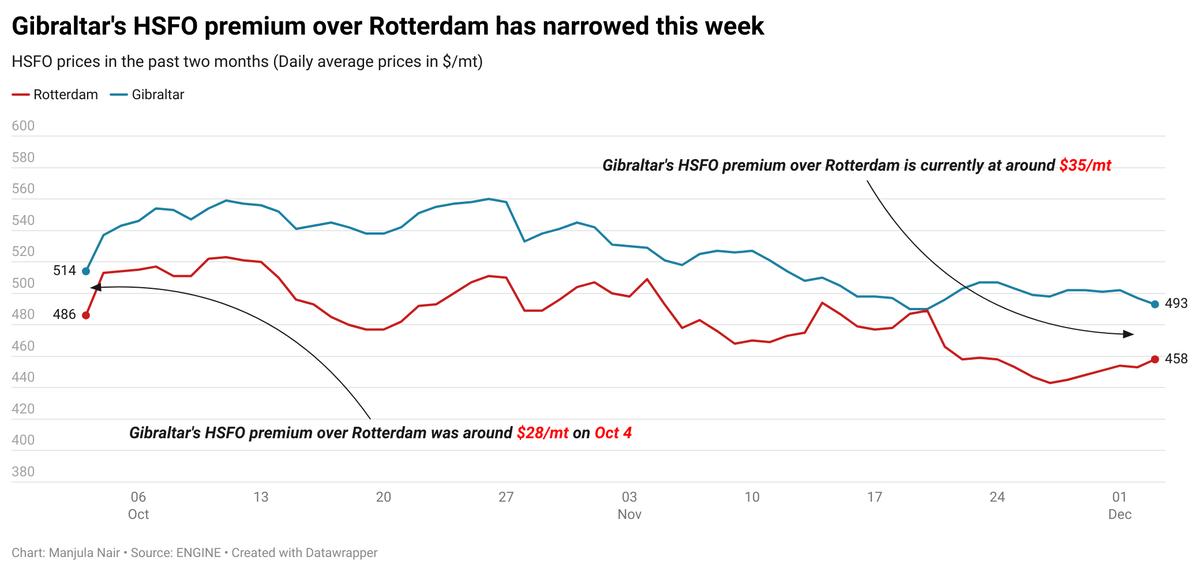

Gibraltar’s HSFO price has dropped by a sharp $9/mt in the past day. A lower-priced prompt delivery HSFO stem fixed at $494/mt for around 1,500 mt has put downward pressure on the benchmark. The port’s VLSFO price has broadly held steady. These price moves have widened Gibraltar’s Hi5 spread from $35/mt yesterday to $43/mt now. Gibraltar’s HSFO premium over Rotterdam has also narrowed by $18/mt and is currently around $35/mt.

Bunkering is proceeding smoothly in Gibraltar, with two vessels waiting for bunkers today, down from four yesterday, according to a source. Bunkering disruptions may occur tomorrow when wind gusts of up to 24 knots are forecast in the port area.

Brent

The front-month ICE Brent contract has moved $0.20/bbl higher on the day, to trade at $72.65/bbl at 09.00 GMT.

Upward pressure:

Brent’s price found some support as the geopolitical conflict in the Middle East intensified. The crucial ceasefire deal between Israel and Iran-aligned Hezbollah militants appears to be in a delicate condition, following cross-border strikes from both sides.

The Israel Defense Forces (IDF) said that the Lebanon-based militant group launched projectiles into Israeli territory on Monday, violating the terms of the ceasefire agreement between the two countries.

“Geopolitical risk is still high as the Israeli cease fire in Lebanon broke down,” Price Futures Group’s senior market analyst Phil Flynn said.

Analysts and traders also await OPEC’s ministerial meeting on Thursday where the group is expected to extend the ongoing production cut.

The eight members collectively cutting output by 2.2 million b/d are likely to continue through the first quarter of 2025, according to a Reuters report.

Downward pressure:

The crude oil supply outlook remains uncertain, with market analysts anticipating that the upcoming OPEC+ meeting will be crucial in determining price direction.

While the Saudi Arabia-led group had initially planned to gradually reverse the 2.2 million b/d production cut in October, it opted instead to extend the cuts through the end of the year to bolster oil prices.

OPEC+ has rescheduled its meeting to discuss the 2025 output policy. Originally planned for 1 December, the meeting will now be held virtually on 5 December.

“The oil balance does not need this additional supply as it will push the market into a large surplus,” two analysts from ING Bank said. “The challenge is that the group needs to find a balance between trying to support the market and limiting its loss in market share,” they added.

By Manjula Nair and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.