Europe & Africa Market Update 2 Dec 2024

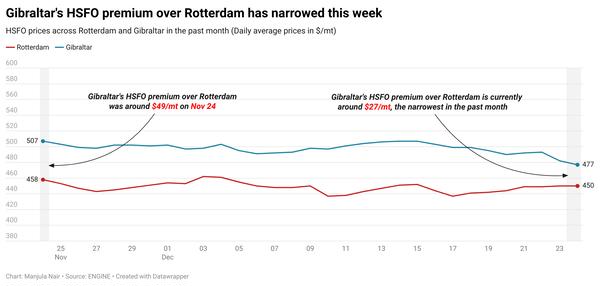

Regional bunker benchmarks have moved in mixed directions, and Rotterdam’s Hi5 spread has narrowed.

Changes on the day, from Friday to 09.00 GMT today:

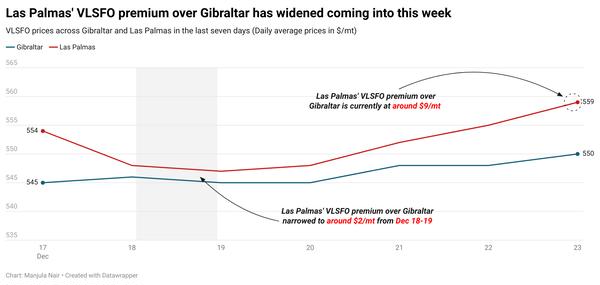

- VLSFO prices up in Gibraltar ($4/mt), Rotterdam ($2/mt) and Durban ($1/mt)

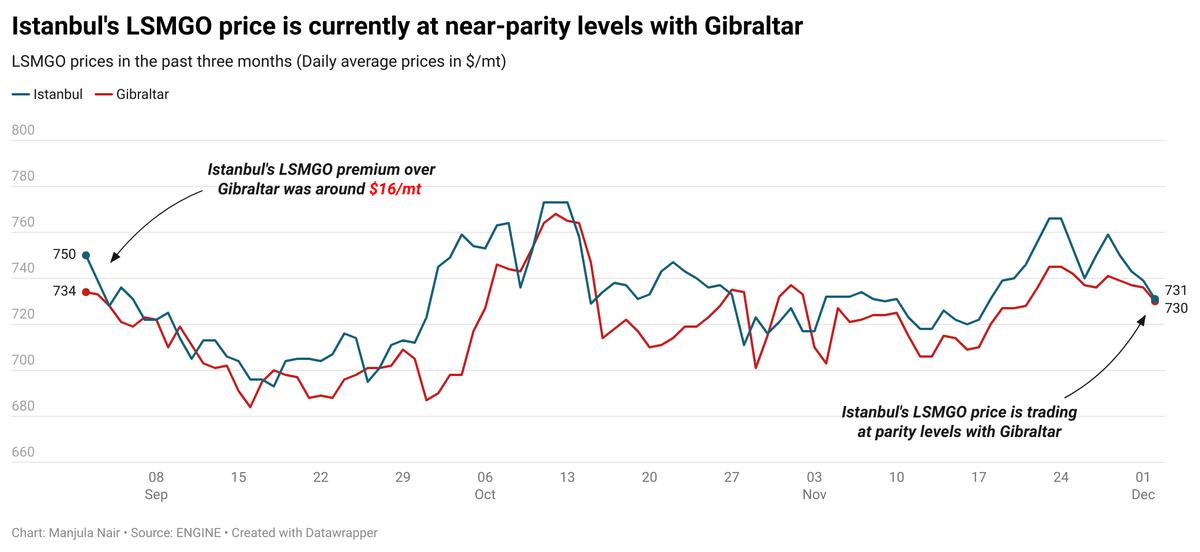

- LSMGO prices down in Gibraltar ($4/mt) and Rotterdam ($1/mt)

- HSFO prices up in Rotterdam ($8/mt) and Gibraltar ($5/mt)

- Rotterdam B30-VLSFO at a $160/mt premium over VLSFO

Rotterdam’s HSFO price has gained by a sharp $8/mt over the weekend while its VLSFO price has broadly held steady. These price moves have narrowed the port’s Hi5 spread from $47/mt on Friday to $41/mt now.

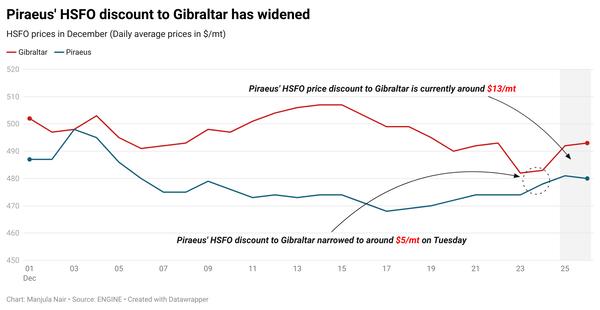

Four vessels are waiting to receive bunkers in Gibraltar today, according to a source. Calm weather is forecast in Gibraltar for most of the week, except for Wednesday when wind gusts of around 22 knots may disrupt bunkering. Currently, HSFO is a bit tight for prompt delivery dates in Gibraltar, with lead times of 5-7 days advised for optimal coverage from suppliers.

Two stems were booked in Istanbul on Friday, one each for VLSFO and LSMGO. Of these, a lower-priced LSMGO stem booked for prompt delivery has pushed the LSMGO benchmark down by $9/mt. The price drop has flipped Istanbul’s LSMGO premium over Gibraltar to near-parity level now. Bunker availability is normal in Istanbul with lead times of 3-4 days advised for full coverage from suppliers. Weather-induced bunkering disruptions may occur in Istanbul on Saturday, a source said.

Brent

The front-month ICE Brent contract has shed $0.38/bbl on the day from Friday, to trade at $72.45/bbl at 09.00 GMT.

Upward pressure:

Brent’s price gained some upward thrust as Russia and Ukraine continued to exchange airstrikes on critical energy facilities over the weekend.

A Ukrainian drone hit the Atlas oil depot in the Kamensky district of Russia’s Rostov region, the Ukrainian army’s General Staff said on its official Telegram channel.

The attack caused “at least” two fires in the energy facility, the Ukrainian army said.

Besides, oil market participants are awaiting OPEC's next move. The Saudi Arabia-led producers’ group is due to virtually meet on 5 December, to discuss its plans to gradually phase out the ongoing 2.2 million b/d voluntary production cut.

“Traders are braced for OPEC to extend its current production cuts, a decision that could keep a short-term floor under prices,” SPI Asset Management’s managing partner Stephen Innes said.

Downward pressure:

The global oil market continues to “trade in a fairly narrow range,” two analysts from ING Bank remarked, as a ceasefire deal between Israel and Iran-aligned Hezbollah armed group, “which appears to be holding, will be weighing on prices.”

The ceasefire agreement achieved last week was mediated by the US and France, the White House said in a statement. However, it mentioned that the deal did not extend to the ongoing conflict between Israel and Hamas in the Gaza Strip.

Nonetheless, the market’s focus will remain on further developments in the broader geopolitical landscape of the Middle East – a key oil-producing hub.

“[Oil] trading landscape [will remain] in a state of cautious anticipation until the next major market-moving event unfolds,” Innes said.

By Manjula Nair and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.