Europe & Africa Market Update 28 Nov 2024

Bunker benchmarks have mostly followed Brent’s downward movement, and LSMGO supply has resumed in Durban.

Changes on the day to 09.00 GMT today:

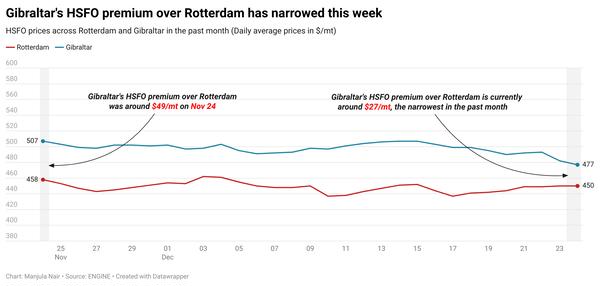

- VLSFO prices down in Durban ($10/mt), Rotterdam and Gibraltar ($4/mt)

- LSMGO prices up in Gibraltar ($1/mt), and down in Rotterdam ($2/mt)

- HSFO prices up in Gibraltar ($3/mt), and down in Rotterdam ($1/mt)

- Rotterdam B30-VLSFO at a $167/mt premium over VLSFO

Durban’s VLSFO price has dropped by $10/mt in the past day, marking the steepest drop among the three ports. Availability of VLSFO is tight in South Africa’s Durban and Richards Bay, a trader said. Lead times of 7-10 days are recommended for both grades in both ports.

LSMGO supply has resumed in South Africa’s Durban, but prompt availability of the grade is tight, a source told ENGINE. The grade was briefly unavailable last week. Lead times of 7-10 days are recommended for LSMGO. Rough weather is forecast from Wednesday to Friday, with wind gusts expected—ranging from 21-31 knots on Thursday, and 19-22 knots on Friday, the source added.

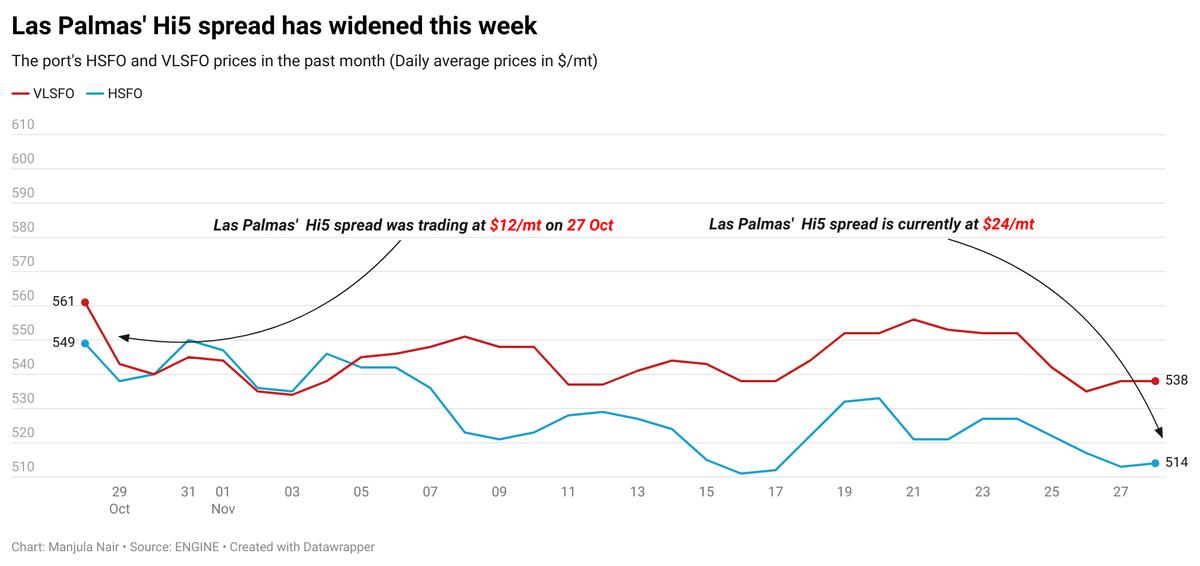

A lower-priced prompt HSFO stem has pushed Las Palmas’ HSFO price down in the past day. The port’s VLSFO price has mostly held steady. These price moves have widened Las Palmas’ Hi5 spread to around $24/mt now. HSFO tightness persists at the Canary Islands' Port of Las Palmas. Lead times of 7-10 days are recommended for the high-sulphur grade. LSMGO supply is relatively more stable, with shorter lead times of 5-7 days. VLSFO availability is ample, with most suppliers offering delivery within 3-5 days.

Brent

The front-month ICE Brent contract has moved $0.51/bbl lower on the day, to trade at $72.53/bbl at 09.00 GMT.

Upward pressure:

OPEC has postponed its highly anticipated output policy meeting to 5 December to avoid overlapping with another key event. As anticipation around the meeting builds, oil prices have found marginal support.

Market analysts expect the Saudi Arabia-led consortium to keep output policy unchanged at the upcoming meeting, deferring from earlier plans to gradually start unwinding the 2.2 million b/d cut from January 2025.

“OPEC+ is expected to delay increasing production to address potential oversupply concerns next year,” analysts from Saxo Bank said.

Earlier on Wednesday, Saudi Arabia’s Energy Minister Prince Abdulaziz bin Salman, the de-facto head of the group spoke with Russian Deputy Prime Minister Alexander Novak and Kazakhstan’s Energy Minister Almasadam Satkaliyev to discuss OPEC’s plans, Reuters reported. Meanwhile, Iraq, Saudi Arabia, and Russia held talks in Baghdad on Tuesday.

“[OPEC] Delegates are said to be concerned they can go ahead with the 180kb/d [180,000 b/d] increase amid signs of a global oversupply in the oil market,” ANZ Bank’s senior commodity strategist Daniel Hynes said.

Downward pressure:

Brent crude oil price has continued to move lower on the back of easing supply disruption concerns in the Middle East and Eastern Europe.

Analysts noted that the geopolitical risk premiums on oil supply have diminished slightly, as no significant developments occurred in the Russia-Ukraine conflict over the past week.

Besides, the ceasefire deal achieved in Lebanon has also pulled Brent’s price lower.

Earlier this week, US President Joe Biden announced a ceasefire deal between Israel and the Iran-aligned Hezbollah armed group in Lebanon. Israel’s war cabinet approved the ceasefire agreement, which took effect on Wednesday across the Lebanon-Israel border.

“[Oil] prices are somewhat subdued due to eased tensions in the Middle East,” SPI Asset Management’s managing partner Stephen Innes said.

China's oil demand growth continues to trend lower, adding to the downward pressure on Brent. October saw a 5.4% month-on-month drop in Chinese oil consumption, with refiners processing 59.54 million mt of crude oil last month, according to data from the National Bureau of Statistics (NBS).

“Oil prices have been hovering within a confined range, caught in the perpetual tug-of-war between geopolitical shifts and classic supply-and-demand dynamics,” Innes said.

By Manjula Nair and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.