Europe & Africa Market Update 26 Nov 2024

Bunker benchmarks in European and African ports have fallen with Brent, and bunker availability is normal off Malta.

Changes on the day to 09.00 GMT today:

- VLSFO prices down in Durban ($14/mt), Gibraltar ($10/mt) and Rotterdam ($4/mt)

- LSMGO prices unchanged in Rotterdam, and down in Gibraltar ($7/mt)

- HSFO prices down in Rotterdam ($6/mt) and Gibraltar ($5/mt)

- Rotterdam B30-VLSFO at a $154/mt premium over VLSFO

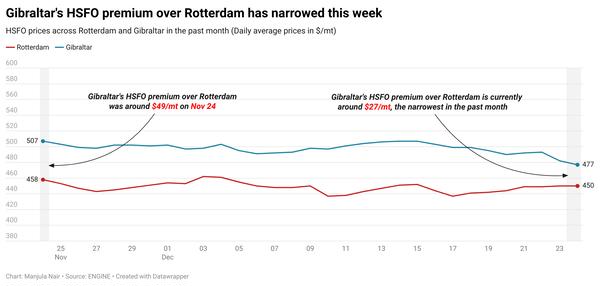

Gibraltar’s VLSFO price has dropped by $10/mt in the past day, while Rotterdam’s VLSFO price has registered a slight $4/mt dip. These price moves have narrowed Gibraltar’s VLSFO discount to Rotterdam by $6/mt to $34/mt now.

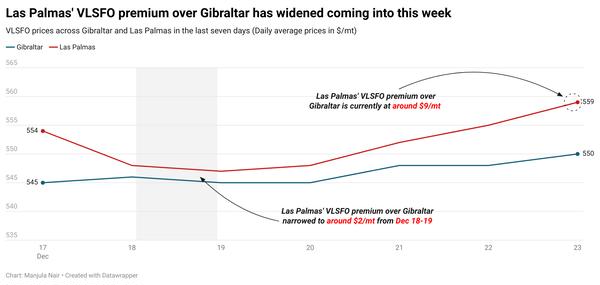

The drop in Gibraltar’s VLSFO price has also narrowed the port’s Hi5 spread from $50/mt yesterday to $45/mt now. VLSFO availability is normal in Gibraltar with lead times of 3-5 days recommended.

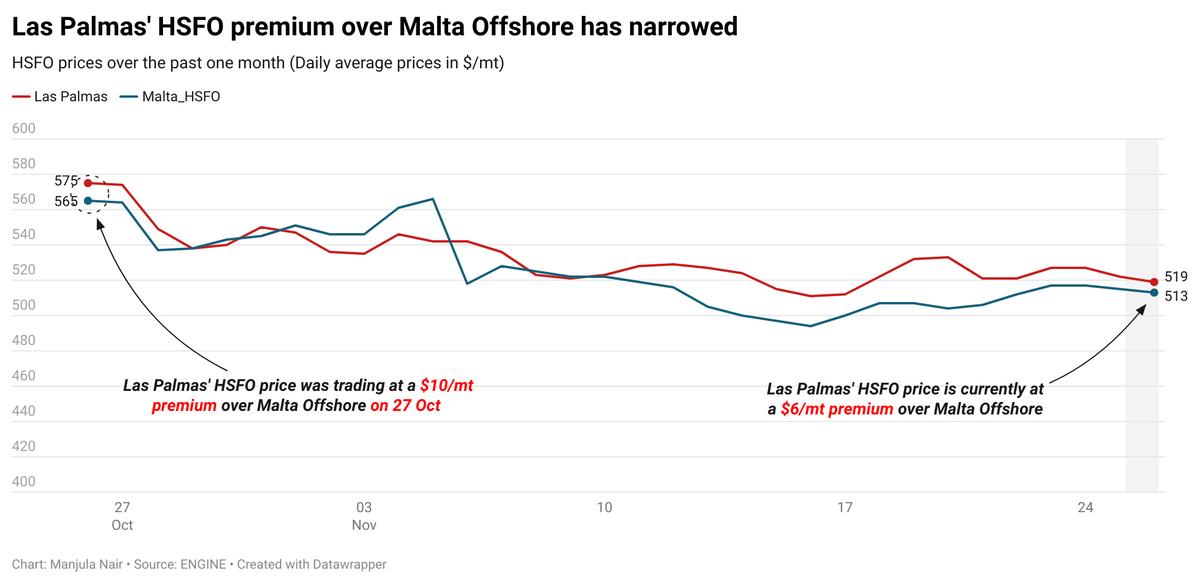

HSFO availability in Las Palmas remains tight, with lead times of 7-10 days recommended for the grade, a trader said. Las Palmas’ HSFO price is currently trading at a $6/mt premium over Malta Offshore where HSFO is subject to enquiry as only one supplier can offer the grade.

Bunker availability for VLSFO and LSMGO remains normal off Malta, unchanged in the past few weeks. Most suppliers can deliver VLSFO and LSMGO within 3-5 days. Rough weather is forecast on Friday and may disrupt bunkering in the area, a source said.

Brent

The front-month ICE Brent contract has moved $1.26/bbl lower on the day, to trade at $73.53/bbl at 09.00 GMT.

Upward pressure:

Oil market analysts and traders are on the edge, ahead of the crucial OPEC+ meeting on 1 December.

The Saudi Arabia-led oil producers’ group may consider leaving the ongoing 2.2 million b/d output cut unchanged for another month, Azerbaijan's Energy Minister Parviz Shahbazov told Reuters, as the group continues its efforts to support oil prices.

While OPEC plans to ease cuts from 1 January, many analysts expect a possible reversal of this decision.

“The market is also jumpy ahead of the OPEC+ meeting this weekend,” ANZ Bank’s senior commodity strategist Daniel Hynes said.

OPEC+ has twice postponed planned monthly increases of 180,000 b/d since October amid weaker oil prices and concerns about demand growth.

President-elect Donald Trump announced via Truth Social network that he would impose additional tariffs of 10% on Chinese imports and 25% levies on imports from Mexico and Canada after taking office.

Market analysts expect oil prices to shoot up after Trump imposes the new tariffs. “For energy markets, new tariffs could make crude oil and natural gas expensive in the US as Canada is one of the major suppliers of energy products,” two analysts from ING Bank said.

Downward pressure:

Brent’s price lost momentum as ceasefire talks between Israel and the Iran-aligned Hezbollah armed group progressed.

Israel’s ambassador to the US, Michael Herzog, expressed optimism about a deal, stating, “we are close to a deal,” though some final points need to be addressed. Bloomberg reports that Israel’s security cabinet is set to meet today, with a potential agreement “within days.”

“Crude oil prices retreated yesterday on reports of significant progress towards an Israel-Hezbollah deal,” ING Bank’s analysts said.

This news has taken geopolitical risk premiums off the oil market and eased supply concerns, thereby putting downward pressure on Brent crude’s price.

“A deal in the Middle East could also help reduce the tensions between Israel and Iran and lower the regional supply risks significantly for the oil market in immediate terms,” the analysts added.

By Manjula Nair and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.