East of Suez Fuel Availability Outlook 12 Nov 2024

VLSFO and LSMGO availability is normal in Singapore

Bunker demand is low in Zhoushan

LSMGO availability is good in Omani ports

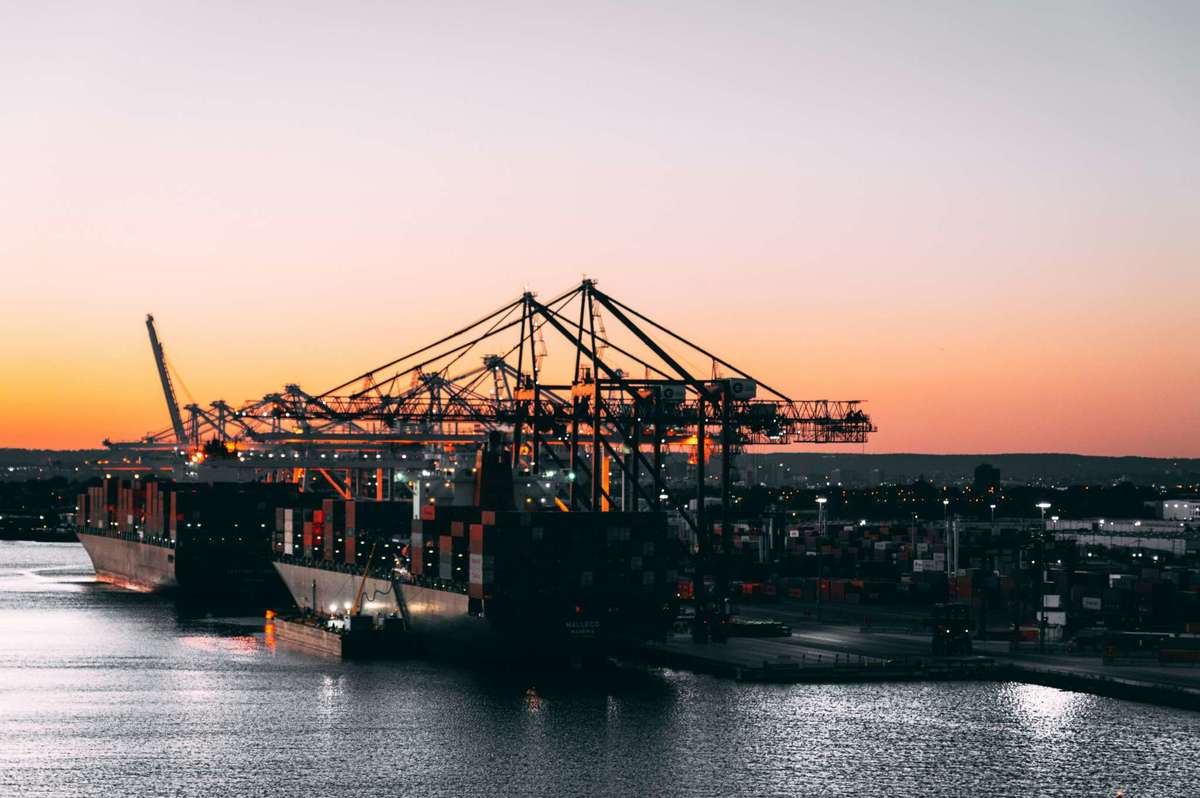

PHOTO: Container ships and gantry cranes in Port Khor Fakkan, UAE. Sharjah Ports

PHOTO: Container ships and gantry cranes in Port Khor Fakkan, UAE. Sharjah Ports

Singapore and Malaysia

Bunker demand in Singapore has increased this week, according to a source. VLSFO availability remains stable, with several suppliers now advising lead times of 2-8 days, compared to last week’s 4-7 days.

HSFO supply has also improved, with lead times reduced to 4-8 days from last week’s 5-11 days. LSMGO availability remains steady, with nearly unchanged lead times of 2-6 days.

Singapore's residual fuel oil stocks have averaged 1% higher this month compared to October, according to Enterprise Singapore’s data. The port’s fuel oil imports are down sharply, averaging 1.98 million bbls this month versus 7.55 million bbls in October, while exports have also fallen from 3.05 million bbls to 789,000 bbls. Middle distillate stocks at the port have remained steady.

At Malaysia's Port Klang, VLSFO and LSMGO supplies are abundant, with some suppliers offering prompt deliveries for smaller volumes, while HSFO availability remains limited.

East Asia

Availability in Zhoushan remains stable amid low bunker demand, with suppliers recommending lead times of 5–7 days, consistent with last week.

In Northern China, Dalian and Qingdao ports have sufficient supplies of VLSFO and LSMGO, although Qingdao has limited HSFO. Tianjin is experiencing tight supplies of HSFO and LSMGO, but VLSFO availability is adequate. In Shanghai, LSMGO is easily available, while VLSFO and HSFO are scarce. Fuzhou has strong stocks of both VLSFO and LSMGO, while Xiamen has limited LSMGO despite good VLSFO supply. Prompt availability of both grades remains limited in Yangpu and Guangzhou.

In Hong Kong, lead times for all bunker grades remain steady at seven days. Strong winds of 24-31 knots and swells over two meters are expected on Wednesday and Thursday, which may disrupt bunkering.

The Hong Kong Observatory (HKO) has issued a standby alert for Tuesday due to the potential impact of Tropical Storm Toraji, which was located about 630 km southeast of Hong Kong on Tuesday morning.

The storm is forecast to move west-northwest across the northern South China Sea, and the HKO will reassess the situation and issue higher warning signals if needed, according to GAC Hot Port News.

In Taiwan’s ports—Hualien, Kaohsiung, and Keelung—VLSFO and LSMGO remain readily available with consistent lead times of two days, the same as last week. In Taichung, lead times for both grades are around four days.

In South Korean ports, lead times for VLSFO and LSMGO have shortened from 4-12 days last week to 2-7 days now. However, HSFO supply has tightened further, with most suppliers running low on stocks due to high demand, making HSFO availability limited. Last week, suppliers recommended lead times of 8-12 days for HSFO.

Adverse weather is expected to disrupt bunker operations intermittently at Ulsan, Onsan, Busan, and Yeosu ports from 13-17 November, with potential interruptions at Daesan and Taean between 16-17 November.

VLSFO supply is generally stable at Japanese ports, although prompt deliveries are limited in Oita. HSFO availability is tight for prompt delivery at most ports, while LSMGO is readily available at major ports such as Tokyo, Chiba, Yokohama, Kawasaki, Osaka, Kobe, Sakai, Nagoya, Yokkaichi, Mizushima, and Oita.

Oceania

A bunker barge has been in dry dock since September, limiting VLSFO availability by barge at Fremantle and Kwinana ports until mid-November. LSMGO remains available at berth. Port Kembla, however, remains unaffected, with bunkering available by truck and ex-pipe.

In New South Wales, Sydney has sufficient LSMGO, though HSFO may require longer lead times. Melbourne and Geelong in Victoria have ample VLSFO and LSMGO, but prompt HSFO deliveries may be challenging.

In Queensland, Brisbane and Gladstone report adequate VLSFO and LSMGO with 7-8 day lead times, although HSFO availability in Brisbane is limited.

In New Zealand, Tauranga and Auckland have good VLSFO supplies, with Auckland also well-stocked in LSMGO. However, rough weather in Tauranga on Thursday and Friday could disrupt bunker operations.

South Asia

VLSFO and LSMGO availability remains tight at several Indian ports, including Kandla, Mumbai, Tuticorin, Chennai, and Cochin, consistent with recent weeks. In Visakhapatnam, Paradip, and Haldia, both grades are subject to availability.

Meanwhile, Sri Lanka's ports of Colombo and Hambantota have ample supplies of VLSFO, LSMGO and HSFO, with prompt lead times available.

Middle East

Prompt fuel availability in Fujairah remains tight, with lead times of around 5-7 days for all grades, consistent with last week. In Khor Fakkan, suppliers are also recommending 5-7 days for all grades.

In Basrah, Iraq, VLSFO and LSMGO are readily available, while both grades are nearly depleted in Ras Laffan, Qatar. Jeddah has a good supply of LSMGO, but VLSFO is limited. Djibouti is facing tight supplies of both VLSFO and LSMGO.

Omani ports, including Sohar, Salalah, Muscat, and Duqm, have ample LSMGO for prompt availability.

By Tuhin Roy

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.