East of Suez Market Update 11 Nov 2024

Prices in East of Suez ports have moved in mixed directions, and availability of all grades remains good in Zhoushan.

Changes on the day from Friday, to 17.00 SGT (09.00 GMT) today:

- VLSFO prices unchanged in Fujairah and Zhoushan, and down in Singapore ($5/mt)

- LSMGO prices up in Zhoushan ($8/mt), and down in Singapore ($9/mt) and Fujairah ($8/mt)

- HSFO prices up in Singapore ($5/mt), and down in Fujairah ($9/mt) and Zhoushan ($3/mt)

VLSFO benchmarks in East of Suez ports have held steady over the weekend, showing no significant changes. Zhoushan continues to price its VLSFO higher than Fujairah and Singapore, with premiums of $15/mt and $12/mt, respectively.

Availability of all bunker fuel grades remains stable in Zhoushan amid low demand, with suppliers recommending lead times of 5–7 days, the same as last week.

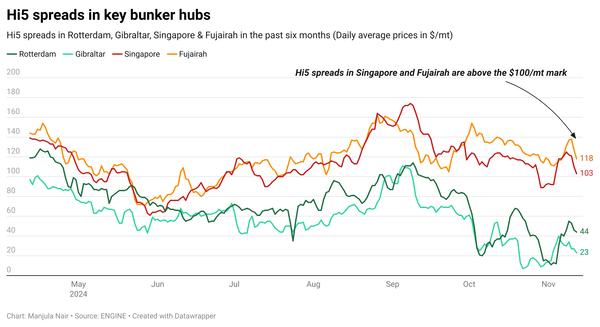

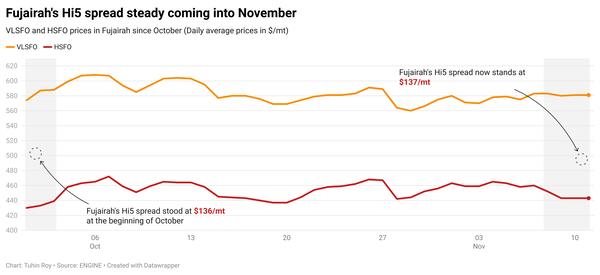

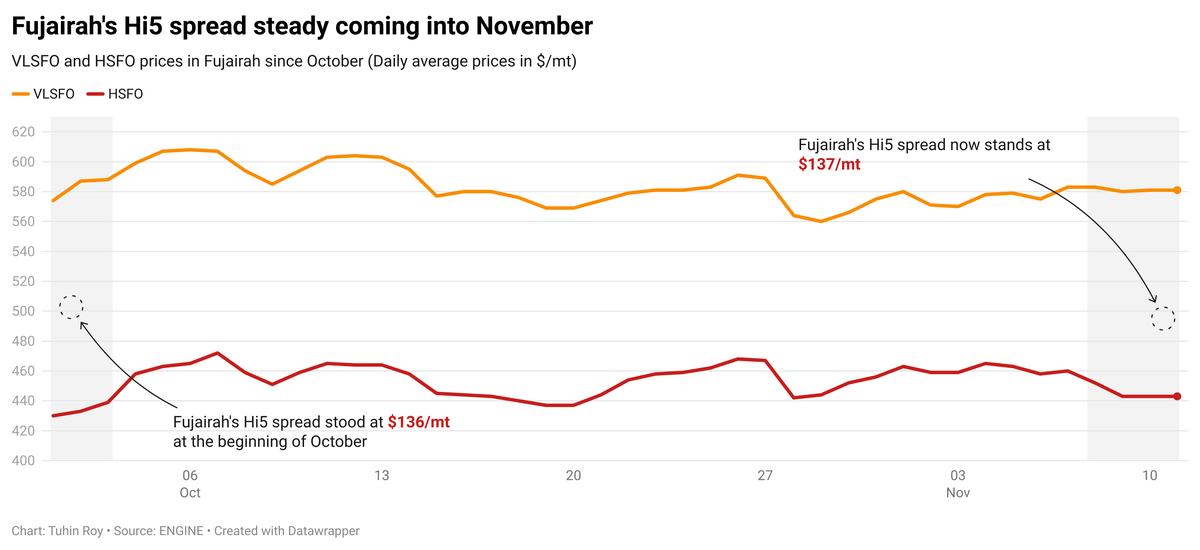

In Fujairah, the HSFO price has come down over the weekend, while VLSFO has remained stable, widening the port’s Hi5 spread from $128/mt to $137/mt today. This spread is now wider than Zhoushan’s $119/mt and Singapore’s $115/mt.

Prompt fuel availability is tight in Fujairah, with recommended lead times of around 5-7 days for all grades, consistent with last week.

Brent

The front-month ICE Brent contract has traded $0.52/bbl lower on the day from Friday, to trade at $73.99/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

The re-election of Donald Trump as the 47th President of the US has jittered global markets and put some upward pressure on Brent’s price. This will be Trump’s second term as the elected head of the US.

Oil market traders anticipate that the new government in the US will intensify its crackdown on Iran with stricter sanctions, which in turn could heighten supply concerns and escalate tensions in the Middle East.

“Investors have increased bullish bets on oil amid increasing supply uncertainty,” ANZ Bank’s senior commodity strategist Daniel Hynes said.

Downward pressure:

China announced its latest economic stimulus package at the National People's Congress (NPC) standing committee meeting on Friday, Reuters reported. The country unveiled a 10 trillion yuan ($1.40 trillion) debt package last week, to support economic growth, but it was not enough to stir a positive market reaction.

China is also bracing for Trump’s administration and its impact on the US-China relations. “Crude oil slumped… amid concerns over China’s outlook, which supported the general weak demand focus,” analysts from Saxo Bank remarked.

Supply disruption issues due to Hurricane Rafael in the US also eased over the weekend, pushing Brent’s price lower.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.