East of Suez Market Update 12 Nov 2024

Most prices in East of Suez ports have moved down, and HSFO availability is tight across several South Korean ports.

Changes on the day, to 17.00 SGT (09.00 GMT) today:

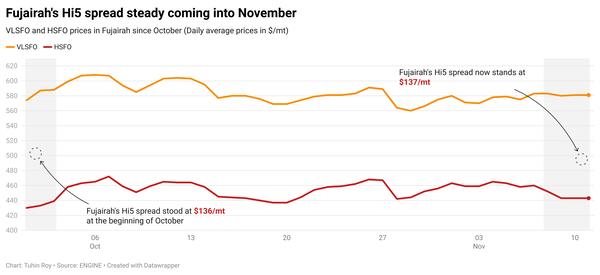

- VLSFO prices down in Fujairah ($28/mt), Zhoushan ($27/mt) and Singapore ($19/mt)

- LSMGO prices up in Singapore ($2/mt), and down in Zhoushan ($10/mt) and Fujairah ($2/mt)

- HSFO prices down in Zhoushan ($9/mt), Fujairah ($7/mt) and Singapore ($2/mt)

Most bunker benchmarks in East of Suez ports have followed Brent’s decline. Fujairah’s VLSFO price has seen the largest decrease among the three major Asian bunker ports, declining by $28/mt over the past day. Three lower-priced VLSFO deals, fixed within a $13/mt range, have contributed to this drop. Fujairah’s VLSFO is now priced $16/mt below Zhoushan’s benchmark and $12/mt below Singapore.

Prompt fuel availability in Fujairah remains tight, with lead times of around 5-7 days for all grades, consistent with last week. In Khor Fakkan, suppliers are also recommending 5-7 days for all grades.

In South Korean ports, lead times for VLSFO and LSMGO have reduced from 4-12 days last week, to 2-7 days now. However, HSFO supply has tightened further in South Korea, where most suppliers are running low on stocks amid high demand, making HSFO availability limited. Last week, suppliers recommended lead times of 8-12 days for HSFO.

Brent

The front-month ICE Brent contract has plunged by $2.02/bbl on the day, to trade at $71.97/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent’s price has found modest support from optimism spiked by OPEC’s decision to delay production hikes by another month. Besides, rising tensions in the Middle East have fuelled supply concerns.

“[Oil] investors were buoyed by OPEC’s decision to push back an anticipated production hike amid a flare up in the Middle East conflict,” ANZ Bank’s senior commodity strategist Daniel Hynes said.

OPEC will meet on 1 December to discuss oil supply quotas and production policy for the upcoming year. Brent’s price is expected to move higher if the coalition decides to extend supply cuts in 2025.

Market participants are currently awaiting monthly oil market report from the Vienna-headquartered oil producers’ group, among other reports, which will be out later today.

“There is the potential for further demand revisions from the group (OPEC),” two analysts from ING Bank said. Last month, OPEC cut its demand growth forecast by 110,000 b/d for 2024. However, the Saudi Arabia-led group still estimates demand to grow by 1.9 million b/d this year and 1.7 million b/d next year, “which is still very aggressive compared to other demand [growth] estimates, which are nearer 1m b/d [1 million b/d],” the analysts added.

Downward pressure:

Brent’s price extended losses due to strengthening of the US dollar against other currencies. A firm USD can dampen oil demand by making dollar-denominated commodities like oil costlier for non-dollar buyers.

“USD strength - an ongoing theme since the US election - has provided strong headwinds not just to the oil market but also to the broader commodities complex,” ING Bank’s analysts said.

Concerns over oil demand growth in China also kept Brent futures under pressure. The latest stimulus package announced by Chinese officials is not enough to stir demand growth, according to market analysts.

“Adding to the bearish mood were fresh concerns about demand from China,” SPI Asset Management’s managing partner Stephen Innes said.

Besides, market participants will also see if OPEC lowers demand growth in its upcoming monthly oil market report.

“Any downgrades in demand—especially from OPEC—could send Brent oil prices tumbling toward the $70 mark,” Innes said.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.