East of Suez Market Update 7 Nov 2024

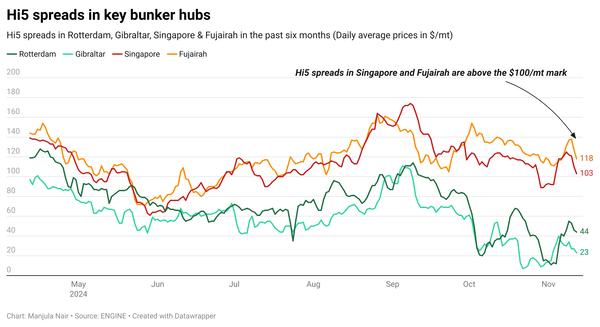

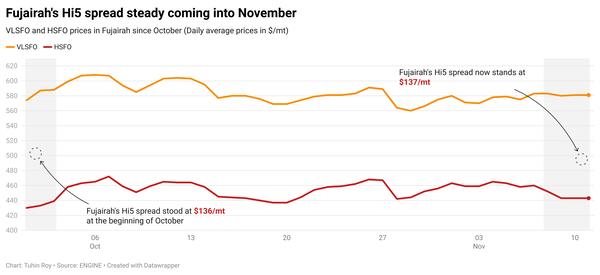

Prices in East of Suez ports have moved up, and prompt availability of all grades remains tight in Fujairah.

Changes on the day, to 17.00 SGT (09.00 GMT) today:

- VLSFO prices up in Zhoushan ($10/mt), Fujairah ($6/mt) and Singapore ($4/mt)

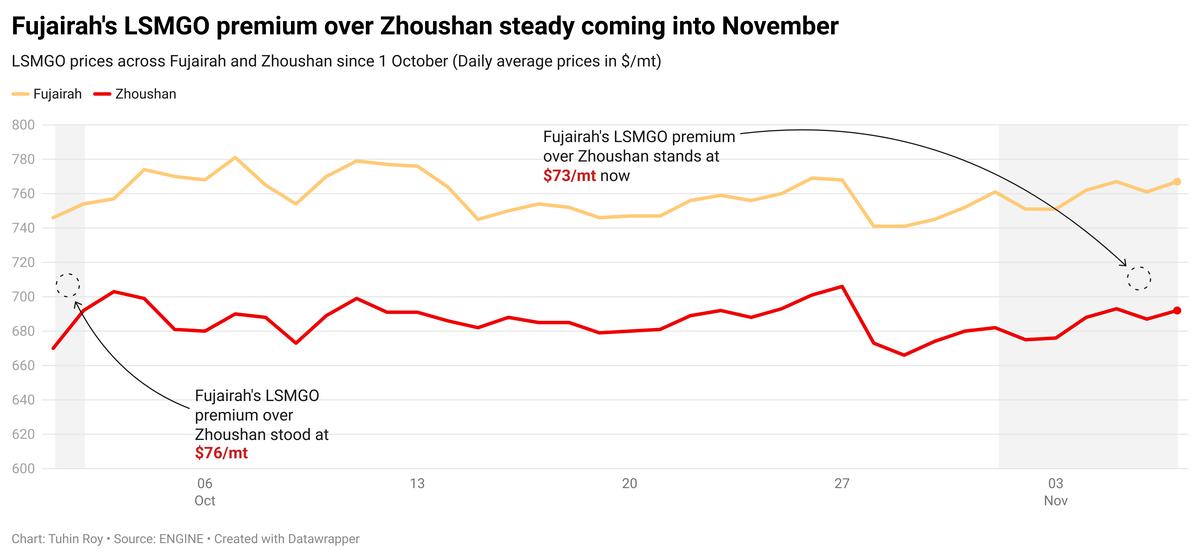

- LSMGO prices up in Zhoushan ($5/mt) and Fujairah ($4/mt), and down in Singapore ($1/mt)

- HSFO prices up in Singapore ($4/mt), Zhoushan ($2/mt) and Fujairah ($1/mt)

VLSFO benchmarks in East of Suez ports have tracked Brent’s upward movement. Zhoushan’s VLSFO price has risen by $10/mt, marking the steepest increase among the three major Asian bunker ports. A higher-priced VLSFO stem fixed in Zhoushan has supported this price rise. Zhoushan's VLSFO premiums over Fujairah and Singapore are currently at $24/mt and $11/mt, respectively.

VLSFO and LSMGO supplies remain stable in Zhoushan amid low demand, with suppliers advising lead times of 5–8 days, unchanged from last week. HSFO supply has improved, with lead times reducing to 5–8 days from 7–10 days last week.

LSMGO prices in the three major Asian bunker ports have stayed mostly within the same range over the past day. Fujairah continues to price its LSMGO at premiums over Singapore and Zhoushan, with respective differences of $90/mt and $73/mt.

Prompt availability of all fuel grades remains tight in Fujairah, with recommended lead times of around 5–7 days, consistent with last week. In Khor Fakkan, suppliers recommend lead times of 5–7 days for all grades.

Brent

The front-month ICE Brent contract has traded $0.52/bbl higher on the day, to trade at $74.87/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent's price gained after the global oil market factored in Donald Trump’s pivotal victory in the high-stakes 2024 US election.

Trump’s return to the White House can have several implications for the global oil market, according to market analysts. His government could bring stringent sanctions on Iran, which could be a major blow to the crude oil supply.

“[Trump’s] his foreign policies could stoke supply disruptions,” ANZ Bank’s senior commodity strategist Daniel Hynes remarked. “Overall, we expect a Trump White House to be neutral to slightly bullish for the oil market,” he added.

Brent’s price also increased as US producers shut operations due to Hurricane Rafael. According to the US Bureau of Safety and Environmental Enforcement (BSEE), about 17.4% of the current oil production in the US Gulf of Mexico has been halted due to the hurricane.

“Hurricane Rafael in the US Gulf of Mexico continues to put oil and gas supply at risk,” two analysts from ING Bank said.

Downward pressure:

Brent’s price felt some downward pressure after the US Energy Information Administration (EIA) reported a surge in US crude stocks. Commercial crude oil inventories in the US rose by 2.15 million bbls to touch 428 million bbls in the week ending 1 November, according to the EIA.

“The EIA report was bearish on both the stocks and fuel demand fronts,” VANDA Insights’ founder and analyst Vandana Hari said.

A rise in US crude stocks indicates a possible slowdown in oil demand growth, which can put downward pressure on Brent’s price.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.