East of Suez Market Update 6 Nov 2024

Prices in East of Suez ports have moved down, and VLSFO and LSMGO availability remains good across several Taiwanese ports.

Changes on the day, to 17.00 SGT (09.00 GMT) today:

- VLSFO prices down in Zhoushan ($6/mt), Singapore and Fujairah ($5/mt)

- LSMGO prices down in Zhoushan ($8/mt), Singapore ($7/mt) and Fujairah ($5/mt)

- HSFO prices down in Fujairah ($5/mt), Singapore and Zhoushan ($4/mt)

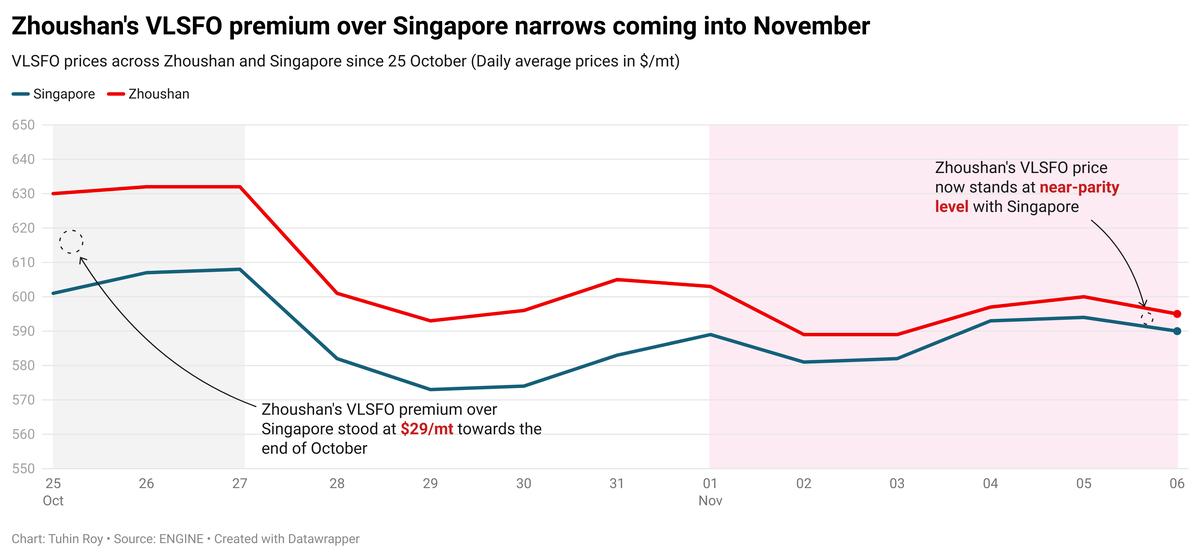

VLSFO benchmarks in East of Suez ports have held steady over the past day with minimal changes. Zhoushan's VLSFO is at a substantial premium of $20/mt over Fujairah, while remaining near parity level with Singapore's price.

VLSFO and LSMGO supplies are stable in Zhoushan amid low demand, with suppliers advising lead times of 5–8 days, unchanged from last week. HSFO supply has seen some improvement, with lead times reducing to 5–8 days from 7–10 days last week.

In Singapore, availability of VLSFO grade has improved amid subdued demand, shortening lead times to 4–7 days from around 11 days last week. HSFO supply has also strengthened, with recommended lead times of 5–11 days, down from 7–14 days last week. LSMGO lead times are stable at 2–7 days.

In Taiwan’s ports—Hualien, Kaohsiung, Taichung and Keelung—VLSFO and LSMGO remain readily available with steady lead times of two days, consistent with last week.

Brent

The front-month ICE Brent contract has lost $0.97/bbl on the day, to trade at $74.35/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent crude faces some upward pressure as global markets focus on the high-stakes 2024 US elections. As the US elections ballot counting continues, market participants brace for a Republican sweep, according to analysts.

“Oil prices have held relatively steady as markets await the outcome of the US election, in what is expected to be a very close race,” two analysts from ING Bank remarked.

For supply fundamentals, a victory for Republican candidate Donald Trump could see “stricter sanction enforcement” against Iran and support Brent’s price gains, ING Bank’s analysts said.

“If Trump becomes president, his policies are likely to be neutral to slightly bullish for the oil market,” ANZ Bank’s senior commodity strategist Daniel Hynes said.

Downward pressure:

Brent moved lower following the API projection of a bigger crude stock build in the US. Crude oil inventories in the US rose by 3.13 million bbls in the week that ended 1 November, according to the American Petroleum Institute (API) estimates.

The API projection exceeded market expectations of a 1.8 million bbls rise during the week.

A rise in US crude stocks indicates a possible slowdown in oil demand growth, which can put downward pressure on Brent’s price. The broadly followed US government data on crude oil stockpiles from the US Energy Information Administration (EIA) is due later today.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.