Red Sea diversions push Rotterdam's HSFO sales higher

Ships have been taking bigger HSFO stems in the Port of Rotterdam to complete longer voyages around Africa, multiple sources told ENGINE.

The ongoing Red Sea crisis has led ships to bunker bigger HSFO volumes in Rotterdam, as they opt for the longer Cape of Good Hope route instead of transiting through the shorter Suez Canal, Global Risk Management's chief analyst and head of research Arne Lohmann Rasmussen told ENGINE. Global Risk Management is part of the Bunker Holdings conglomerate.

An ARA-based trader also told ENGINE that several ships on these extended African routes have been taking on bigger HSFO quantities in Rotterdam. This has boosted HSFO demand in Rotterdam.

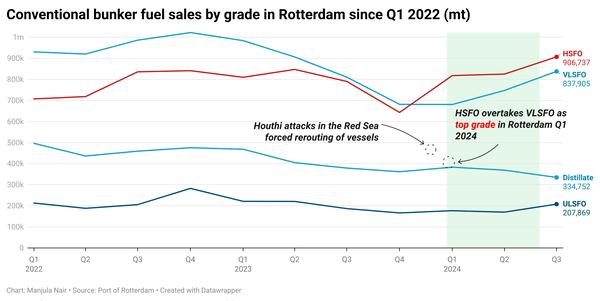

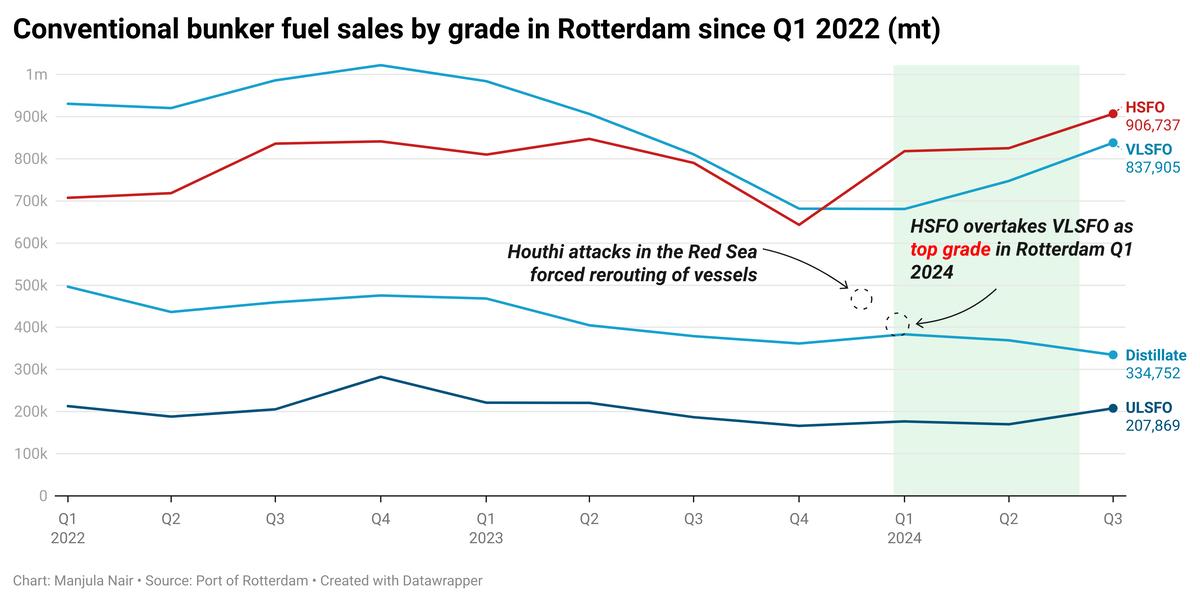

The Houthi attacks on commercial ships in the Red Sea began in November 2023, and shipping firms started rerouting vessels around mid-December. Commercial vessels avoided the Suez Canal transits and instead opted for the longer route around the Cape of Good Hope.

HSFO prices in Rotterdam were among the lowest globally over the past few months, while tight supplies drove prices up in Singapore and Fujairah. This price advantage resulted in a significant uptick in vessels bunkering HSFO in Rotterdam, another trader claims.

Rotterdam's HSFO price has now risen to a premium over Fujairah and Singapore as supply has tightened in Rotterdam.

Port of Rotterdam’s HSFO sales have remained robust throughout 2024, with 818,000 mt sold in Q1, rising slightly to 825,000 mt in Q2. But Q3 saw a new high of 906,000 mt—the highest since the 2020 IMO 0.5% sulphur cap—affirming HSFO as the port's leading bunker fuel grade.

The strong HSFO sales figures also reflect an increase in scrubber-fitted vessels calling Rotterdam. “Typically larger vessels are more often equipped with scrubbers and they choose to bunker in Rotterdam as it is the biggest port in Northern Europe,” Rasmussen said.

DNV data shows that the global fleet of scrubber-fitted vessels increased from 4,789 in 2022 to 5,111 in 2023. Projections indicate further growth to 5,340 ships by the end of this year, with a steady rise expected to reach 5,451 by 2027.

By Manjula Nair

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.