Europe & Africa Fuel Availability Outlook 30 Oct 2024

LSMGO supply is very tight in the ARA

Prompt supply is available in Piraeus

Prompt availability is tight in Port Louis  PHOTO: A container terminal in Lisbon. Getty Images

PHOTO: A container terminal in Lisbon. Getty Images

Northwest Europe

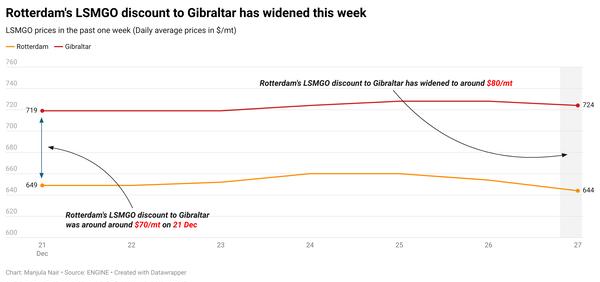

LSMGO availability in Rotterdam and across the wider ARA hub is very tight for prompt delivery dates, a trader told ENGINE. LSMGO tightness is likely to continue till mid-November, another source said, adding that this tightness is mainly due to maintenance work at one of the refineries. HSFO availability is also tight in the ARA hub with lead times of 7–10 days recommended. VLSFO availability is also tight with lead times of 5–7 days advised by traders.

The ARA’s independently held fuel oil stocks have averaged 1% higher so far this month than across September, according to Insights Global data.

The region has imported 238,000 b/d of fuel oil so far this month, a slight increase from 229,000 b/d imported in September, according to data from cargo tracker Vortexa. The ARA has imported low-sulphur fuel oil (LSFO) and HSFO in a 53/47 ratio this month, almost similar to September's 51/49 ratio.

The ARA hub has exported 185,000 b/d of fuel oil so far this month, registering a sharp decline from 250,000 b/d of fuel oil exported in September. Fuel oil cargoes have mostly departed for Spain (27%), Singapore (24%), the US (16%) and Saudi Arabia (15%).

The ARA hub’s independent gasoil inventories — which include diesel and heating oil — have come down by 9% so far this month. Inventories have declined despite higher gasoil imports this month. The region has imported 494,000 b/d of gasoil so far this month, a significant increase from 291,000 b/d of gasoil imported in September, according to Vortexa data.

Prompt supply is available in the German port of Hamburg, a trader said. The port has ample bunker fuel availability and lead times of 3–4 days are generally recommended for all grades, a trader said.

Mediterranean

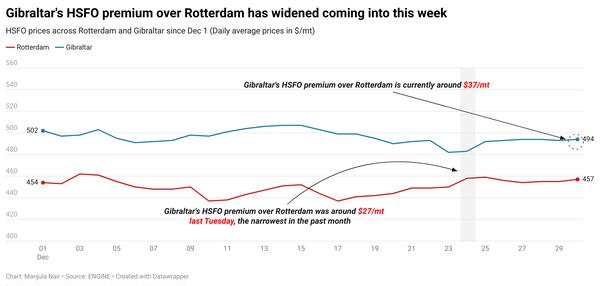

Availability is normal in Gibraltar, with prompt delivery dates available across all three bunker grades. Lead times of 3–5 days are advised for all grades, a trader said. Gibraltar is likely to face bad weather over the weekend, which could cause bunkering delays and stretch lead times there, the trader added.

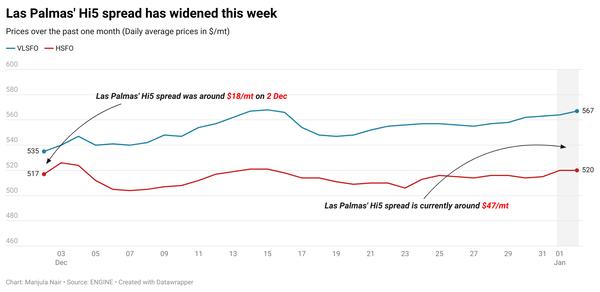

HSFO availability is still tight in the Canary Islands’ port of Las Palmas, a trader said. HSFO tightness continues amid delays in the arrival of replenishment cargoes. Prompt VLSFO and LSMGO availability are good in Las Palmas and lead times of 3–4 days are recommended.

Bunker availability in the Spanish port of Barcelona is good, but securing prompt stems may be a challenge. Lead times of 5–7 days are recommended for all three grades. Wind gusts between 23–32 knots are forecast on Wednesday and Thursday, which could impact bunkering in the port.

Demand has been moderate off Malta and in Istanbul, while demand has been negligible in Piraeus, a trader said.

Securing prompt stems is not a challenge in the Greek port of Piraeus. The port has ample availability across all grades with lead times of 3-4 days advised. Bad weather in periods this week may trigger bunkering disruptions in the port area, a source said.

Off Malta, availability of HSFO, VLSFO and LSMGO is good, a trader said. Lead times of 3–4 days are recommended for optimal coverage across all grades. Adverse weather may disrupt bunkering on Friday, a source said.

Bunker availability in the Turkish port of Istanbul is normal. Suppliers can deliver grades with lead times of 3-4 days. Weather-induced bunkering disruptions may occur in Istanbul from Wednesday to Saturday, a source said.

Africa

VLSFO remains tight in the South African ports of Durban and Richards Bay, with lead times of 7–10 days recommended by traders. LSMGO is still dry in Durban and is subject to enquiry. Bad weather on Wednesday and Friday can impact bunkering in Durban.

In Mauritius’ Port Louis, bunker availability is very tight for all three grades, a trader told ENGINE. Lead times of more than 10 days are recommended for all three grades. Some suppliers can offer bunker for prompt delivery dates, according to a source.

Bunker availability is normal in Namibia's Walvis Bay. Lead times of around 3–5 days are recommended for all three grades, a source said.

In Mozambique’s Nacala and Maputo ports, port operations and bunkering may be impacted due to a national strike to be held from 1–7 November. The demonstration has been organised in the aftermath of Mozambique’s national election results.

By Manjula Nair

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.