Europe & Africa Market Update 2 Jan 2025

Regional bunker benchmarks have shown mixed market directions, and LSMGO remains dry in Durban.

Changes on the day to 09.00 GMT today:

- VLSFO prices up in Rotterdam, Gibraltar and Durban ($1/mt)

- LSMGO prices unchanged in Gibraltar, and down in Rotterdam ($9/mt)

- HSFO prices unchanged in Rotterdam and Gibraltar

- Rotterdam B30-VLSFO at a $186/mt premium over VLSFO

Rotterdam’s LSMGO price has plunged by $9/mt in the past day, while Gibraltar's LSMGO price held steady. A lower-priced 150-500 mt LSMGO stem fixed at $645/mt in Rotterdam has exerted downward pressure on the benchmark.

These price moves have widened Gibraltar’s LSMGO price premium over Rotterdam by $9/mt to $87/mt now.

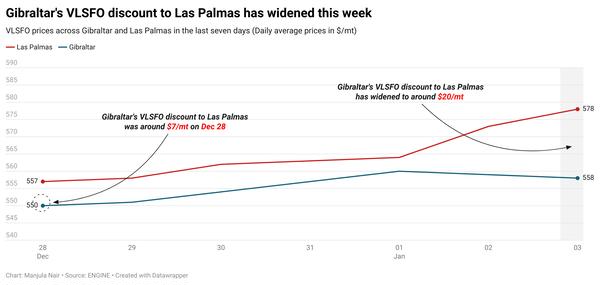

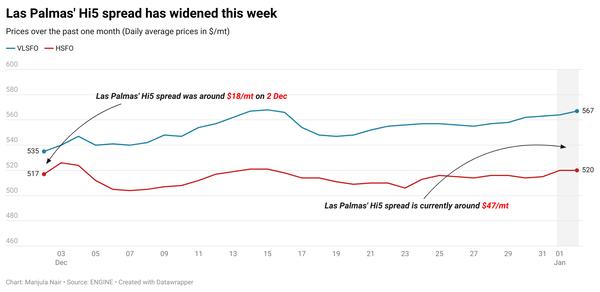

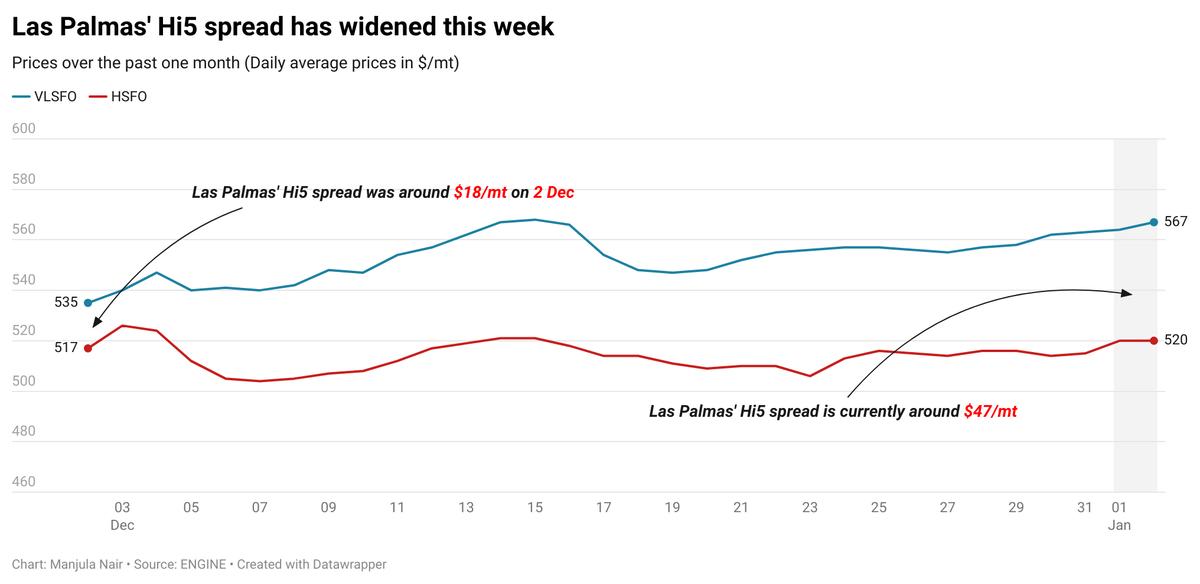

In Las Palmas, a higher-priced VLSFO stem booked at $571/mt for 500-1,500 mt for prompt delivery in the past day has put upward pressure on the benchmark. The price movement has widened the port's Hi5 spread to around $47/mt today. Las Palmas’ VLSFO price is currently trading at a $10/mt premium over Gibraltar.

LSMGO continues to be dry in the South African port of Durban, a trader told ENGINE. Rough weather may impact bunkering in Durban on Friday when wind gusts of up to 23 knots are forecast in the port.

Brent

The front-month ICE Brent contract has gained $0.32/bbl on the day from Tuesday, to trade at $74.92/bbl at 09.00 GMT.

Upward pressure:

Brent crude price has risen on the first trading day of 2025, supported by the gradual return of market participants after the Christmas holiday season.

According to SPI Asset Management's managing partner, Stephen Innes, the trajectory of oil prices in 2025 “hinges critically on OPEC+'s next moves."

The Saudi Arabia-led oil producers’ group has sought to prevent a surplus in 2025 by delaying the planned 2.2 million b/d production increases by three more months through March 2025.

Other global factors influencing Brent's price include geopolitical tensions in the Middle East, potential trade tariff hikes and stricter sanctions under Trump 2.0, Innes remarked.

“As we vault into the new year, the oil market is poised on the brink of significant upheaval,” he added.

Downward pressure:

Brent’s price felt some downward pressure as fresh economic data from China missed analysts’ expectations and renewed demand growth concerns in the world’s second-largest oil consumer.

China's manufacturing purchasing managers' index (PMI) came in at 50.1% in December, noting a small decline from 50.3% achieved in November, data from the National Bureau of Statistics (NBS) showed.

A decline in the PMI reading typically indicates a contraction in the manufacturing sector. This also raises concerns about demand growth, which negatively impacts the prices of commodities such as oil.

“China’s official data Tuesday showed December manufacturing Purchasing Managers’ Index at 50.1, missing analyst expectations and softer than November’s 50.3 reading,” VANDA Insights’ founder and analyst Vandana Hari said.

Oil market participants currently await tomorrow’s US December manufacturing data, which will be key for oil price movements, according to analysts.

By Manjula Nair and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.