Europe & Africa Market Update 3 Jan 2025

Regional bunker benchmarks have risen with Brent values, and Gibraltar continues to face severe congestion.

Changes on the day to 09.00 GMT today:

- VLSFO prices up in Rotterdam ($5/mt) and Durban ($4/mt), and down in Gibraltar ($3/mt)

- LSMGO prices up in Rotterdam ($10/mt) and Gibraltar ($8/mt)

- HSFO prices up in Rotterdam ($5/mt) and Gibraltar ($1/mt)

- Rotterdam B30-VLSFO at a $187/mt premium over VLSFO

Rotterdam’s LSMGO price has gained the most compared to other key regional benchmarks. LSMGO and VLSFO grades are well stocked in the ARA hub, with recommended lead times of 3-5 days. HSFO availability is still tight for very prompt delivery dates in the ARA hub, requiring lead times of 5-7 days, according to a trader.

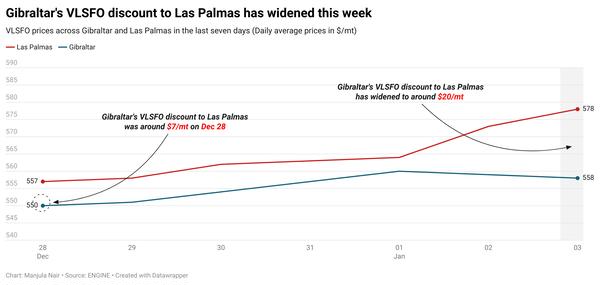

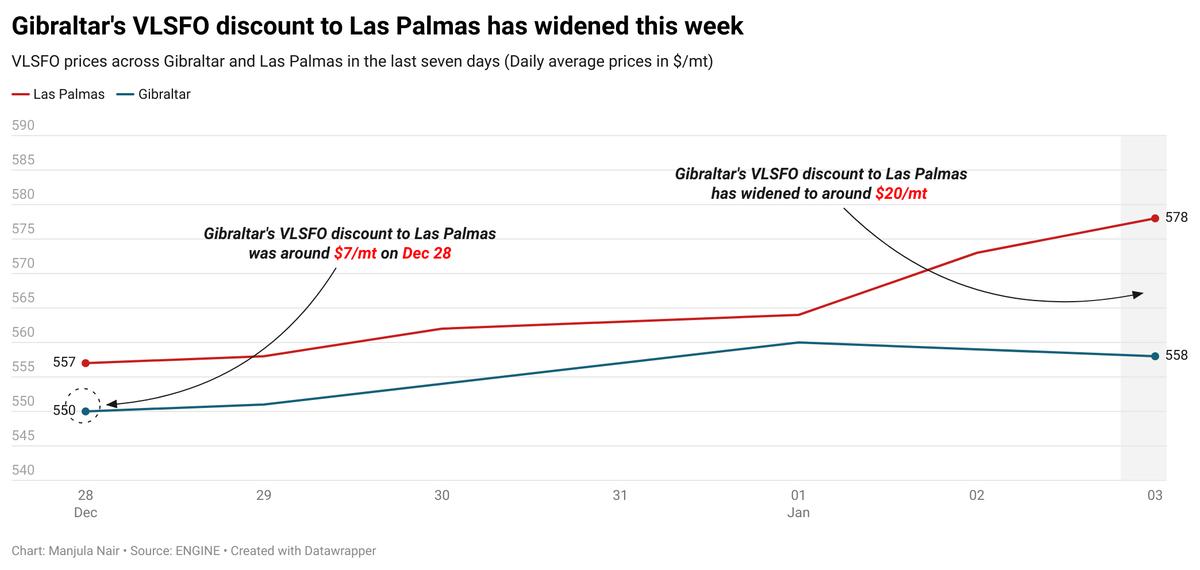

Gibraltar’s VLSFO price has countered Brent’s upward pull and has declined in the past day. A lower-priced VLSFO stem fixed at $553/mt for 150-500 mt has contributed to drag the benchmark down. The price drop has widened Gibraltar's VLSFO discount to Las Palmas by around $9/mt to around $20/mt now.

Gibraltar continues to face congestion today. Currently, 11 vessels are waiting for bunkers in the port, up from nine vessels yesterday, according to a source. Adverse weather conditions are forecast in Gibraltar over the weekend and into the next week, which may lead to bunkering disruptions. Strong wind gusts of 24-29 knots are forecast to hit Gibraltar on Sunday and escalate up to 37 knots on Monday.

Brent

The front-month ICE Brent contract has moved $0.93/bbl higher on the day, to trade at $75.85/bbl at 09.00 GMT.

Upward pressure:

Brent’s price has increased by around $1/bbl on strong hopes of oil demand growth in 2025, as US President-elect Donald Trump, a vocal advocate for expanding domestic oil production, prepares to take office later this month.

Commercial crude oil inventories in the US declined by 1.2 million bbls to touch 415 million bbls for the week ending 27 December, according to data from the US Energy Information Administration (EIA).

A drop in US crude stocks indicates oil demand growth, which could support Brent's price.

Brent’s price has gained “amid expectations of a surge in energy use,” VANDA Insights’ founder and analyst Vandana Hari said.

Downward pressure:

Brent futures felt some downward pressure due to resurfacing demand growth concerns from China.

China's manufacturing purchasing managers' index (PMI) came in at 50.1% in December, noting a decline from 50.3% achieved in November, data from the National Bureau of Statistics (NBS) showed.

A decline in the PMI reading has raised concerns about demand growth in the country, ultimately weighing down on prices of commodities like oil.

The US December manufacturing data, which will be key for oil price movements, will be out later today.

By Manjula Nair and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.