Europe & Africa Market Update 29 Oct 2024

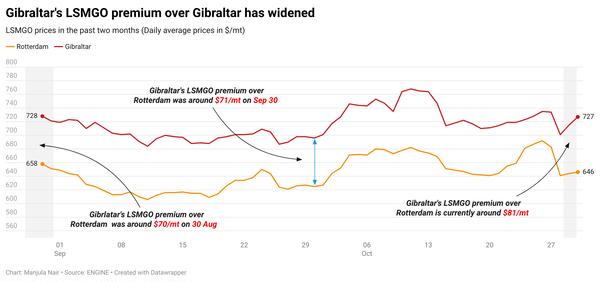

Bunker benchmarks in European and African ports have moved in mixed directions, and Rotterdam’s Hi5 spread has narrowed.

Changes on the day to 09.00 GMT today:

- VLSFO prices up in Durban ($18/mt) and Gibraltar ($7/mt), and down in Rotterdam ($13/mt)

- LSMGO prices up in Gibraltar ($5/mt) and Rotterdam ($4/mt), and down in Durban ($8/mt)

- HSFO prices up in Gibraltar ($7/mt), and down in Rotterdam ($1/mt)

- Rotterdam B30-VLSFO at a $204/mt premium over VLSFO

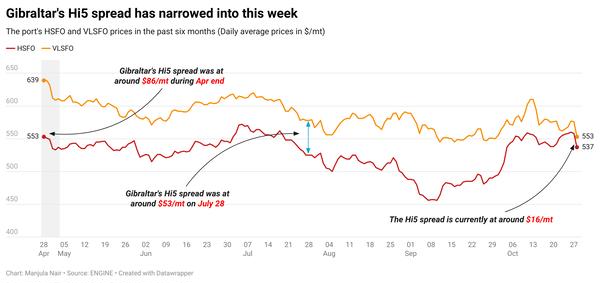

Rotterdam’s VLSFO price has fallen by a steep $13/mt in the past day, while its HSFO price has held steady. These price moves have narrowed Rotterdam’s Hi5 spread from $36/mt to $24/mt now. HSFO continues to remain tight in Rotterdam with lead times of 7–10 days advised by traders. HSFO tightness has led to the narrowing of Hi5 spread a trader told ENGINE.

Availability is normal in Gibraltar with lead times of 3–5 days advised across all grades. A calm weather forecast in the port area over the next few days has made it conducive to bunkering. In nearby Ceuta, bunkering is proceeding smoothly with four vessels due to arrive for bunkers today, according to ship agent Jose Salama & Co.

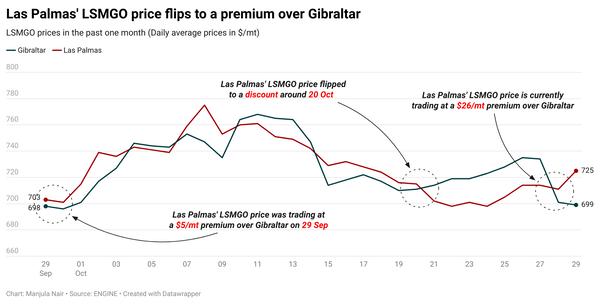

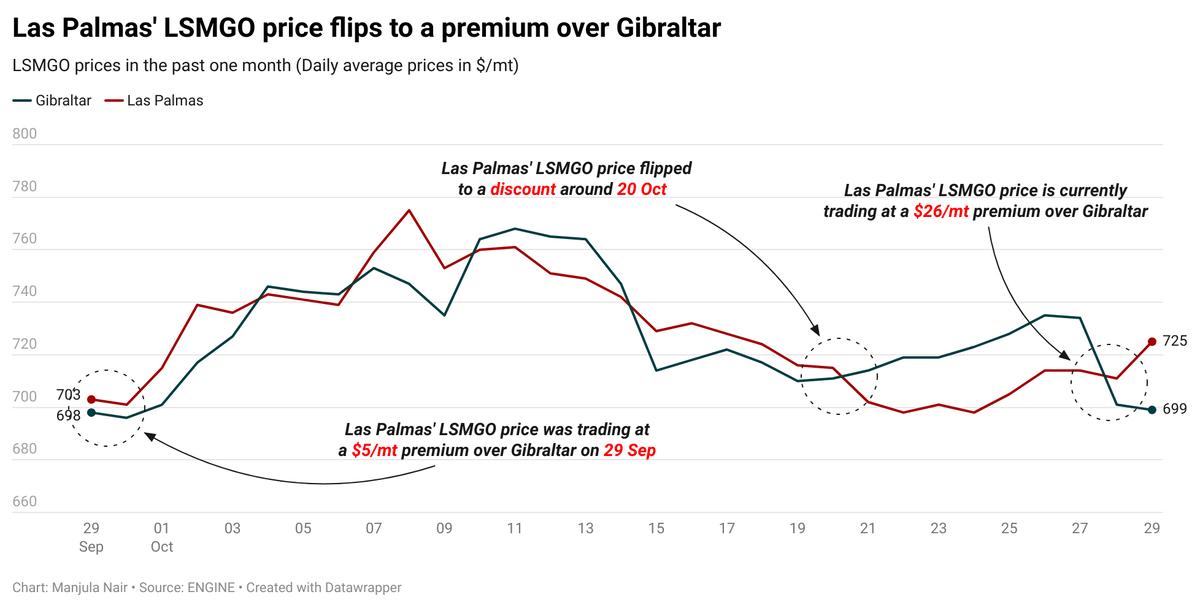

A higher-priced LSMGO stem fixed at $730/mt for 50-150 mt and booked for prompt delivery has raised Las Palmas’ LSMGO price higher in the past day. The price increase has erased Las Palmas' LSMGO discount to Gibraltar and flipped it to a premium of $26/mt now.

Availability of VLSFO and LSMGO is good in Las Palmas with lead times of 3–5 days recommended. HSFO availability is tight in the port with lead times ranging anywhere between 7–10 days.

Brent

The front-month ICE Brent contract has moved $0.65/bbl lower on the day, to trade at $71.79/bbl at 09.00 GMT.

Upward pressure:

Oil market participants have been on the edge as tensions from the impending geopolitical risks remain high, according to analysts.

There is a “tentative floor under oil prices,” as traders keep an eye out for more Israeli airstrikes as the country continues its military operations in the regions controlled by Iran-aligned Hamas and Hezbollah armed groups, SPI Asset Management’s managing partner Stephen Innes remarked.

“Some [oil] traders hedge against the possibility that Israel's initial strikes could signal the start of a broader campaign,” Innes said. “Particularly if Israel redirects its focus [towards attacking energy facilities] after addressing the immediate threats posed by Hamas and Hezbollah,” he added.

The US Department of Energy’s (DOE) Office of Petroleum Reserves announced a new solicitation to buy up to 3 million bbls of crude oil to replenish its Strategic Petroleum Reserves (SPRs).

The SPR is one of the world’s largest emergency crude oil reserves. When the US purchases crude oil to fill its SPR, significant volumes of oil are removed from the market, which could potentially tighten supply and support oil prices.

Downward pressure:

Brent’s price declined as Israel’s retaliatory strikes against Iran were not directed toward oil facilities. The geopolitical risk premium priced in by the market has slumped as the Israel Defense Forces (IDF) primarily focused on targeting Iran’s military facilities.

“Iran didn’t immediately vow to respond,” ANZ Bank’s senior commodity strategist Daniel Hynes said. “Instead, it downplayed the scale and effectiveness of the attack and suggested that its warnings, in recent weeks, against an aggressive strike had deterred Israel,” he added.

This news comes at a time when the oil market is already bracing for excess supply as OPEC+ plans to gradually unwind its production cuts, analysts said.

“[Oil] traders instead turned their attention to OPEC’s planned December increase of currently unwanted barrels,” analysts from Saxo Bank noted.

By Manjula Nair and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.