Europe & Africa Market Update 28 Oct 2024

Regional bunker benchmarks have declined with Brent, and bunker availability has improved in the ARA hub.

Changes on the day, from Friday to 09.00 GMT today:

- VLSFO prices down in Rotterdam ($14/mt), Durban ($12/mt) and Gibraltar ($11/mt)

- LSMGO prices down in Durban ($46/mt), Rotterdam ($35/mt) and Gibraltar ($16/mt)

- HSFO prices down in Gibraltar ($18/mt) and Rotterdam ($12/mt)

- Rotterdam B30-VLSFO at a $196/mt premium over VLSFO

Bunker availability has improved in Rotterdam and across the wider ARA hub, a trader said. All three grades had experienced tightness due to barge loading delays in recent weeks. This tightness has now eased with lead times coming down from 7–10 days to 5–7 days now.

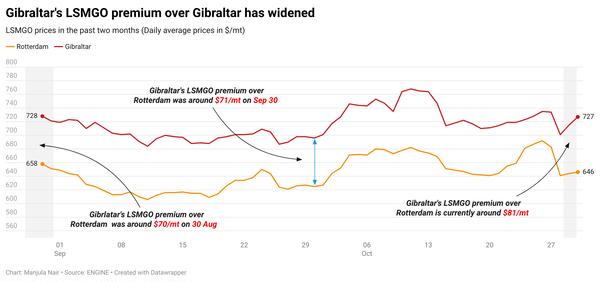

Rotterdam’s LSMGO price has experienced a steep fall over the weekend, outpacing Gibraltar’s LMSGO price drop of $16/mt. These price moves have widened Rotterdam’s LSMGO discount to Gibraltar by $19/mt to $61/mt now.

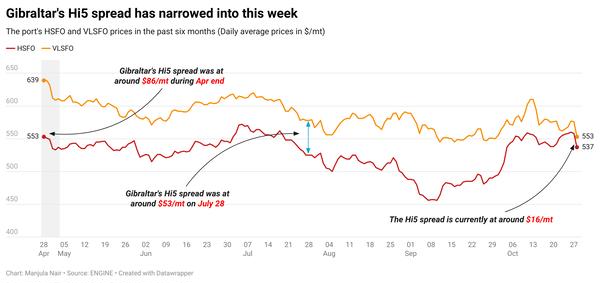

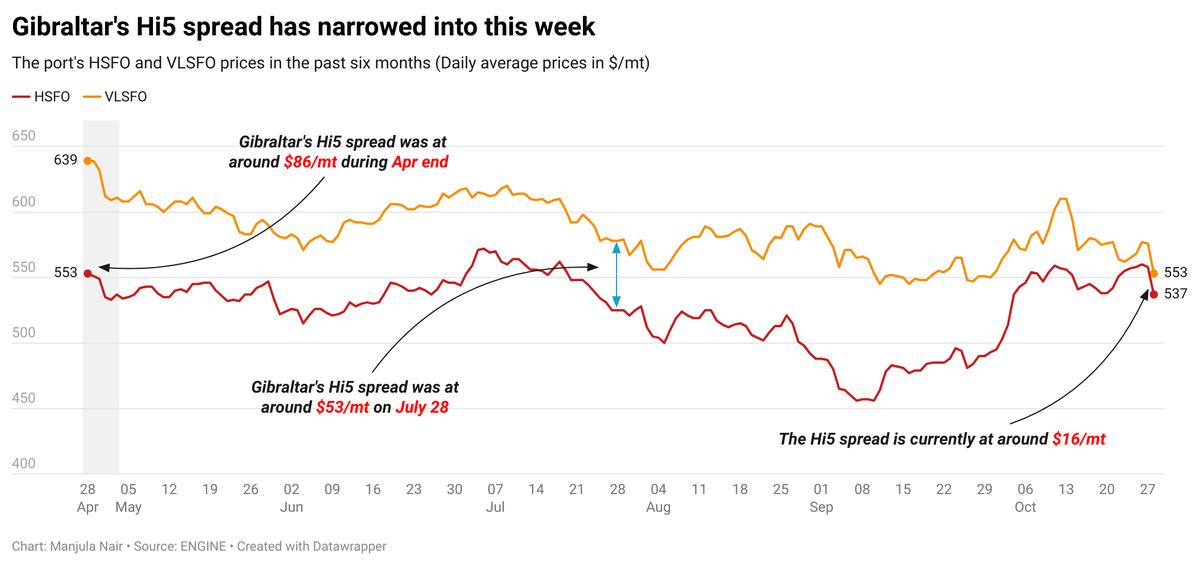

Gibraltar’s HSFO price decline has outpaced its VLSFO price decrease over the weekend. As a result, Gibraltar’s Hi5 spread has widened from $8/mt on Friday to around $16/mt now.

Vessel traffic in the Bosphorus Strait will be suspended tomorrow from 07.00-14.00 GMT due to Republic Day. Bunkering will remain unaffected and continue as per schedule, a bunker trader said. Bunker availability is good in Turkey’s Istanbul port. Suppliers can offer prompt delivery dates in Istanbul. Availability across all three grades is good in the port with lead times of 3–4 days are recommended for all three grades.

Brent

The front-month ICE Brent contract has declined by $2.05/bbl on the day from Friday, to trade at $72.44/bbl at 09.00 GMT.

Upward pressure:

Brent’s price found some support as tensions in the Middle East heightened following Israel’s attack on Iran over the weekend.

“Over 100 fighter planes targeted only military targets across Iran,” ANZ Bank’s senior commodity strategist Daniel Hynes said.

Last week, the Israel Defense Forces (IDF) killed prominent Hamas and Hezbollah leaders, according to statements on its official social media platform X (formerly Twitter).

"Israel's targets [in Iran] for any retaliatory attack have been the focus, with concerns they would include nuclear facilities and energy infrastructure,” Hynes added.

Downward pressure:

Despite growing concerns about supply disruptions in the Middle East, weak oil demand growth forecasts, especially in the US and China, the world’s top oil consumers, have continued to put downward pressure on oil prices.

Commercial US crude oil inventories increased by 5.5 million bbls to touch 426 million bbls in the week ending 18 October, the US Energy Information Administration (EIA) reported.

Brent's price came under additional pressure as Israel's latest round of attack did not target Iran’s oil infrastructure directly, according to market analysts. It is expected to decline further if the geopolitical risk premium priced into oil markets eases in the coming days.

“Crude oil futures plunged… as Israel’s much-anticipated airstrikes on Iran swerved away from critical oil infrastructure, deflating the geopolitical risk premium that’s been holding up oil prices,” SPI Asset Management’s managing partner Stephen Innes remarked.

By Manjula Nair and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.